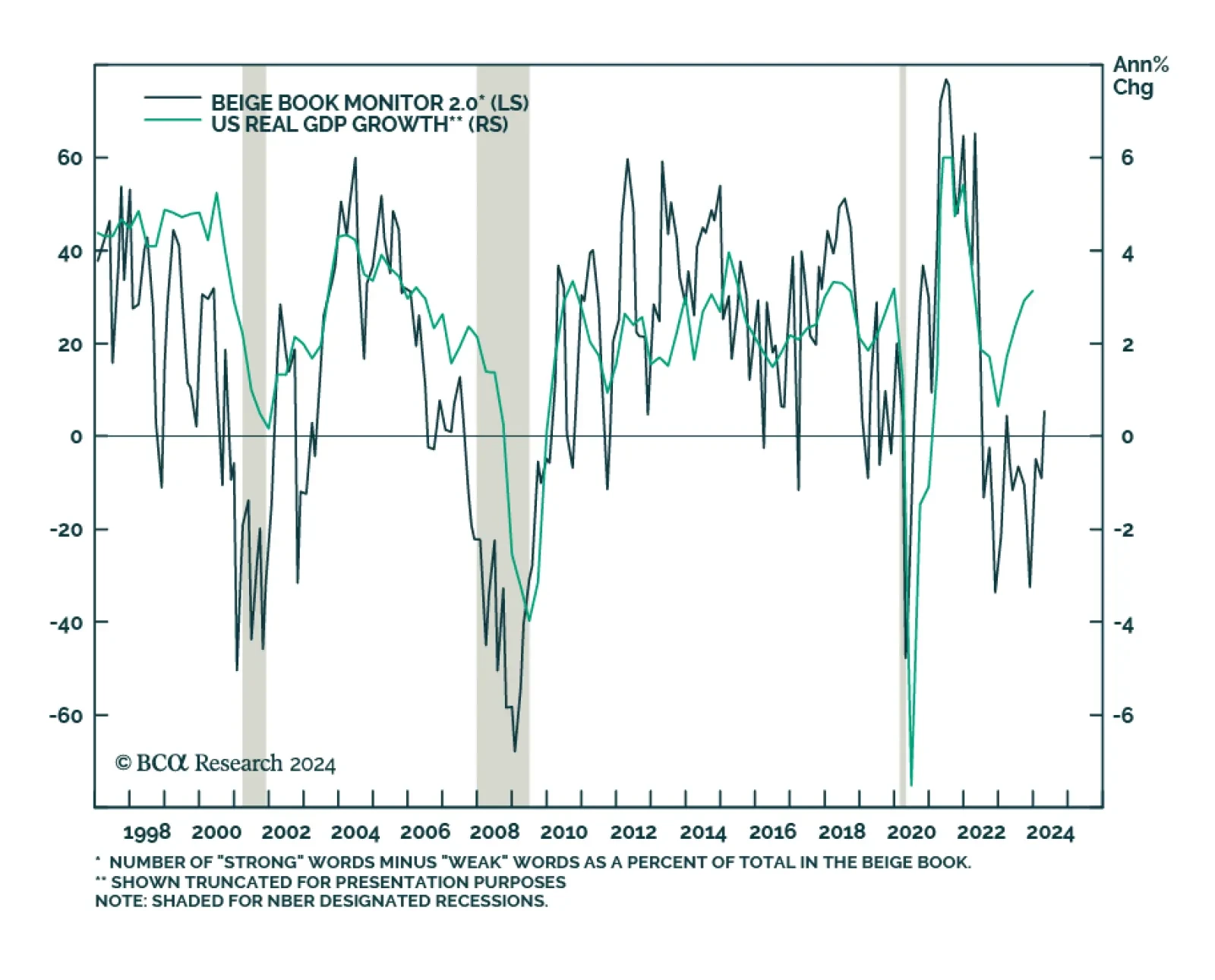

BCA’s US Beige Book Monitor – an indicator we use to gauge changes in the language of the Fed’s Beige Book report and which historically tracks US GDP growth – has improved in April. Nevertheless…

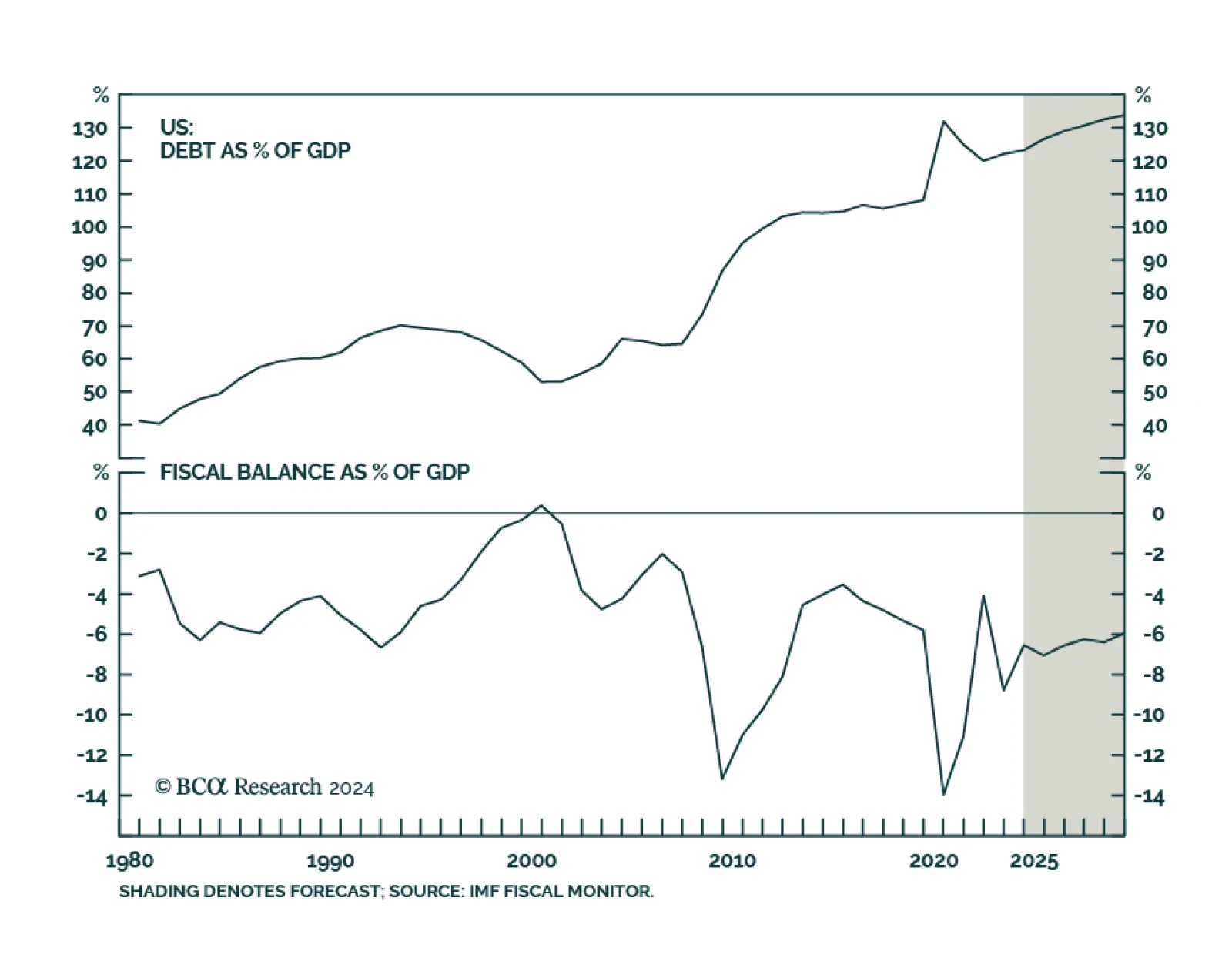

The IMF’s latest fiscal monitor report highlighted the dangers that rising sovereign debt alongside rising deficits pose to advanced economies. The United States, in particular, is at risk. The IMF projects that fiscal…

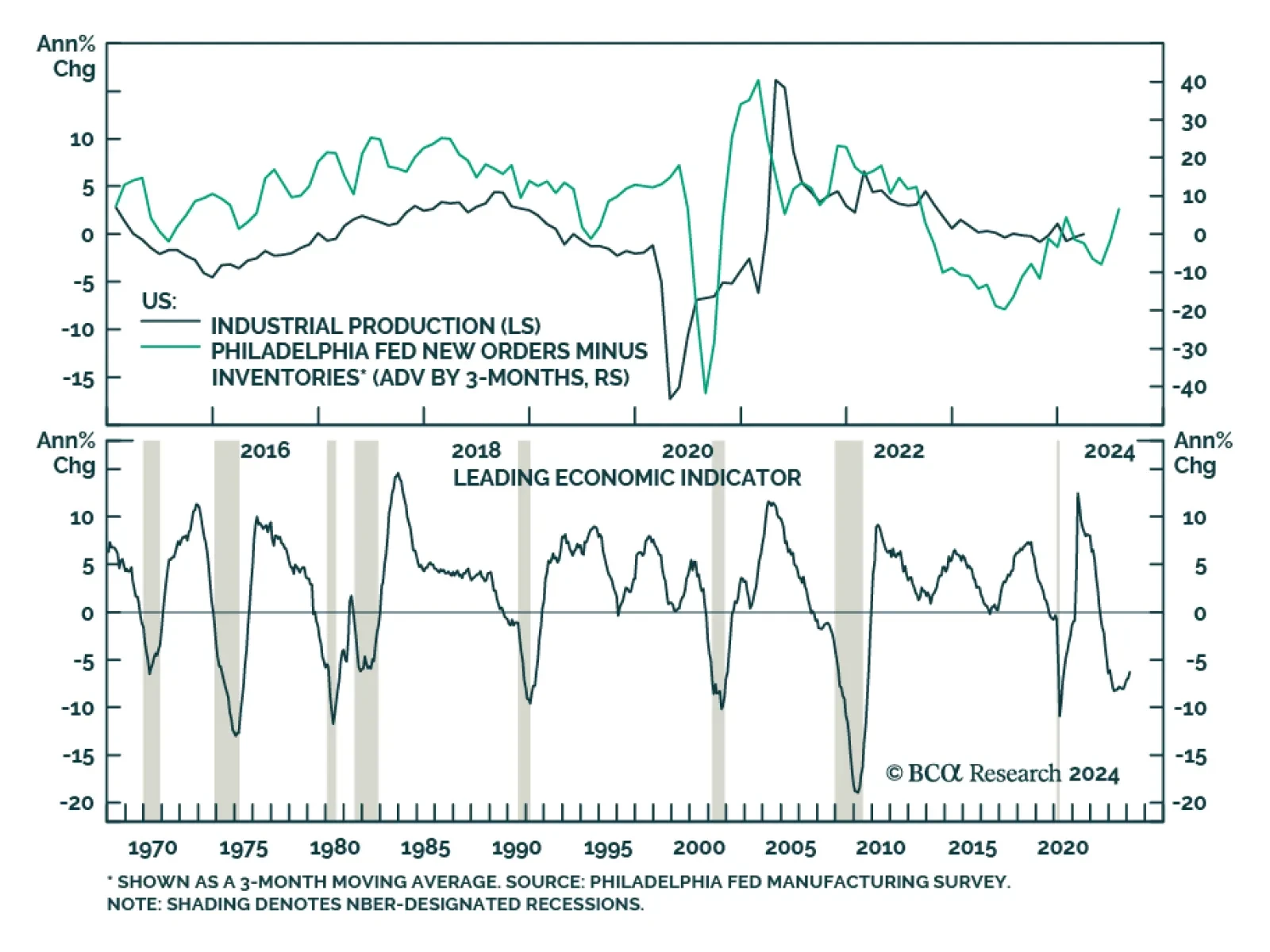

The headline Philadelphia Fed manufacturing survey for April delivered a positive surprise on Thursday, increasing from 3.2 to a twelve-month high of 15.5 and beating expectations it would soften to 2.0. Measures of demand…

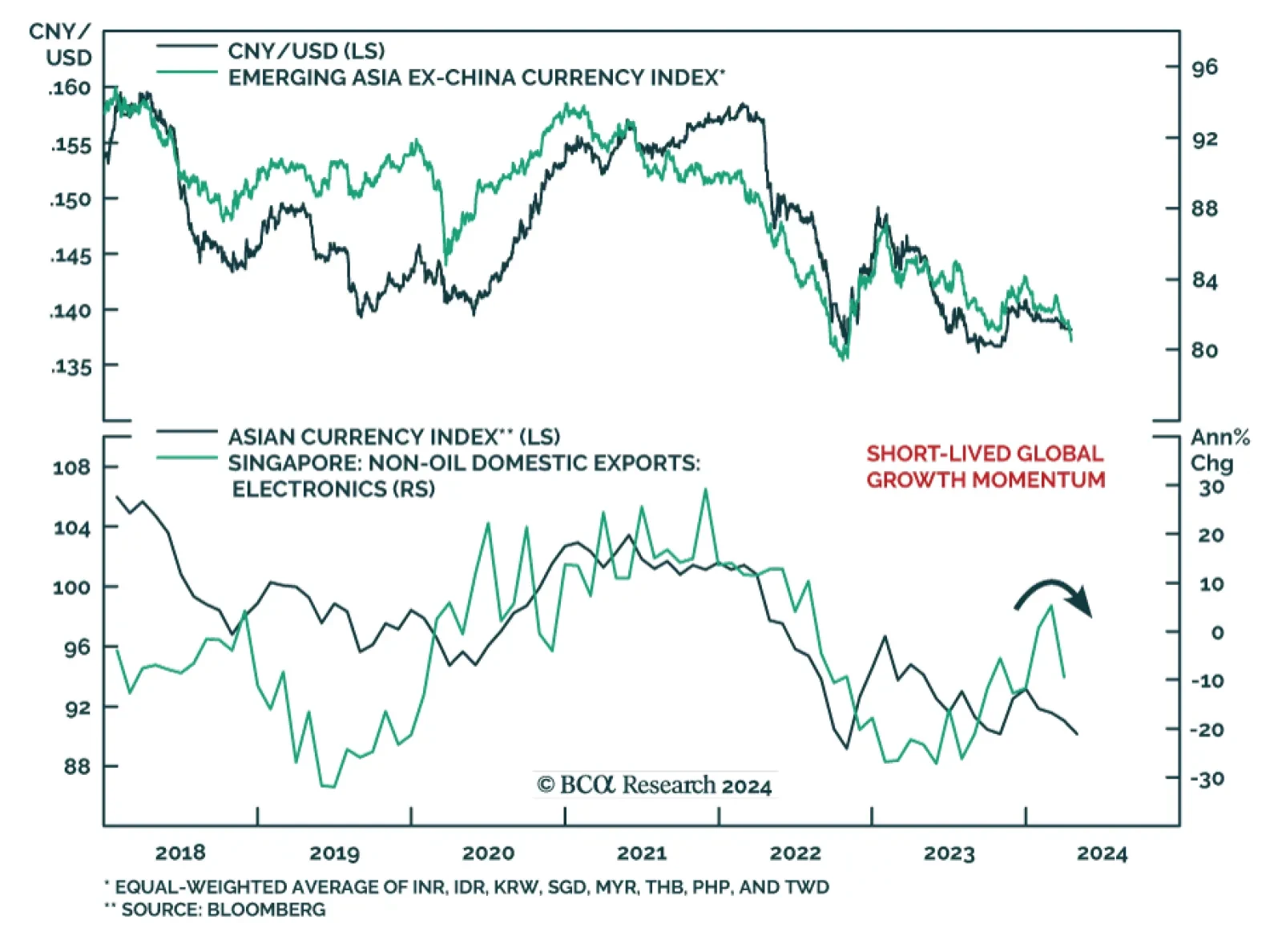

The Asian currency index posted the largest negative post-GFC abnormal returns (z-score) among the major financial markets we tracked in March. Indeed, Asian currencies have been on a general downtrend since early 2023, and more…

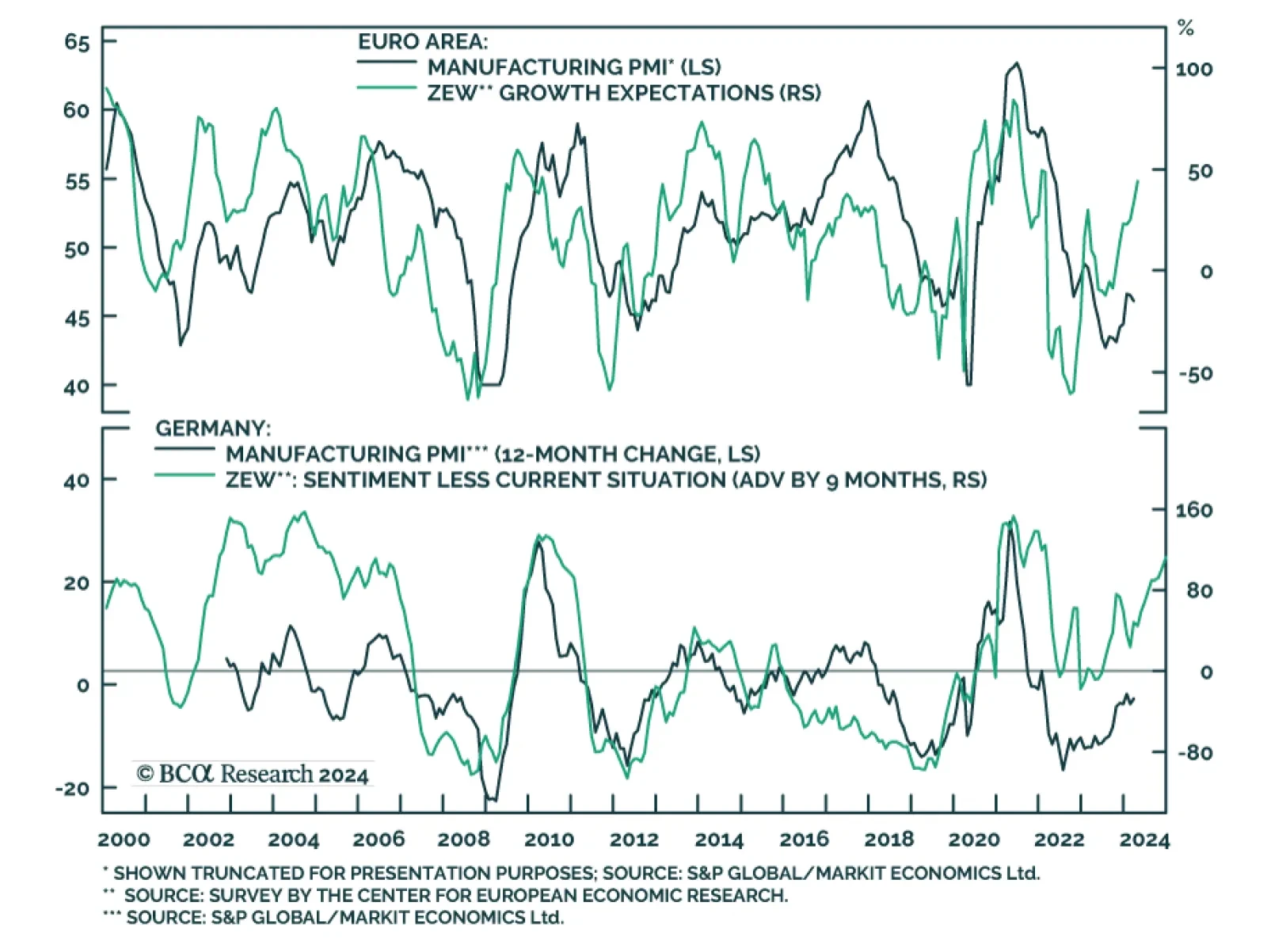

Optimism about the future continues to boost investor confidence in the Euro Area. The ZEW Expectations series for the Eurozone (+10.4 to 43.9) and Germany (+11.2 to 42.9) surged and are now both at their highest in 26…

Chinese economic data releases painted a mixed picture of domestic conditions on Tuesday. Chinese real GDP growth accelerated from 5.2% y/y to 5.3% y/y in Q1 2024, beating expectations of 4.8% and suggesting that economic…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

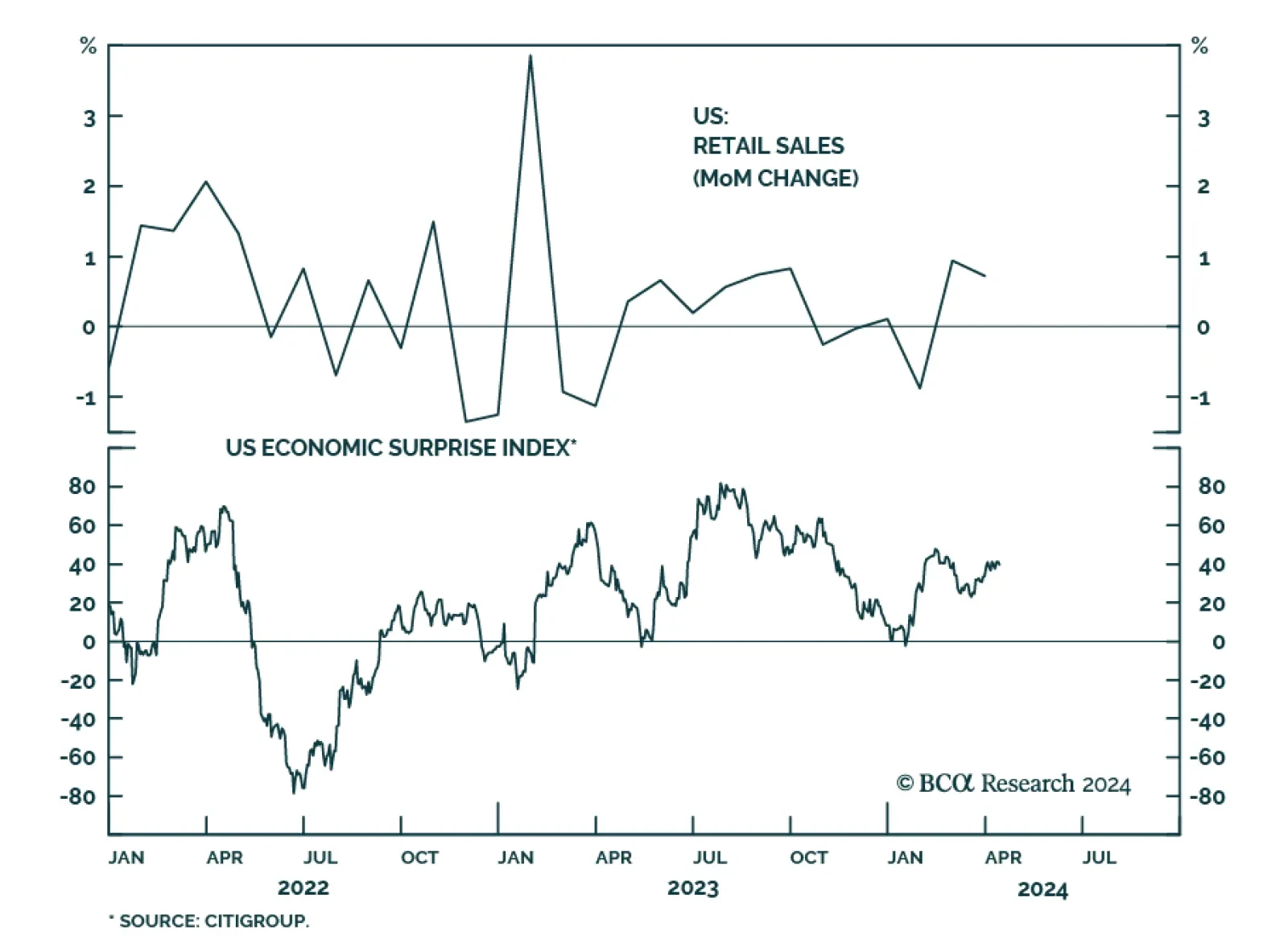

Advanced estimates for retail sales in the US grew by 0.7% m/m in March, down from an upwardly revised 0.9% m/m in February, but meaningfully outperforming expectations of 0.3% m/m. Retail sales ex autos also surprised to the…

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

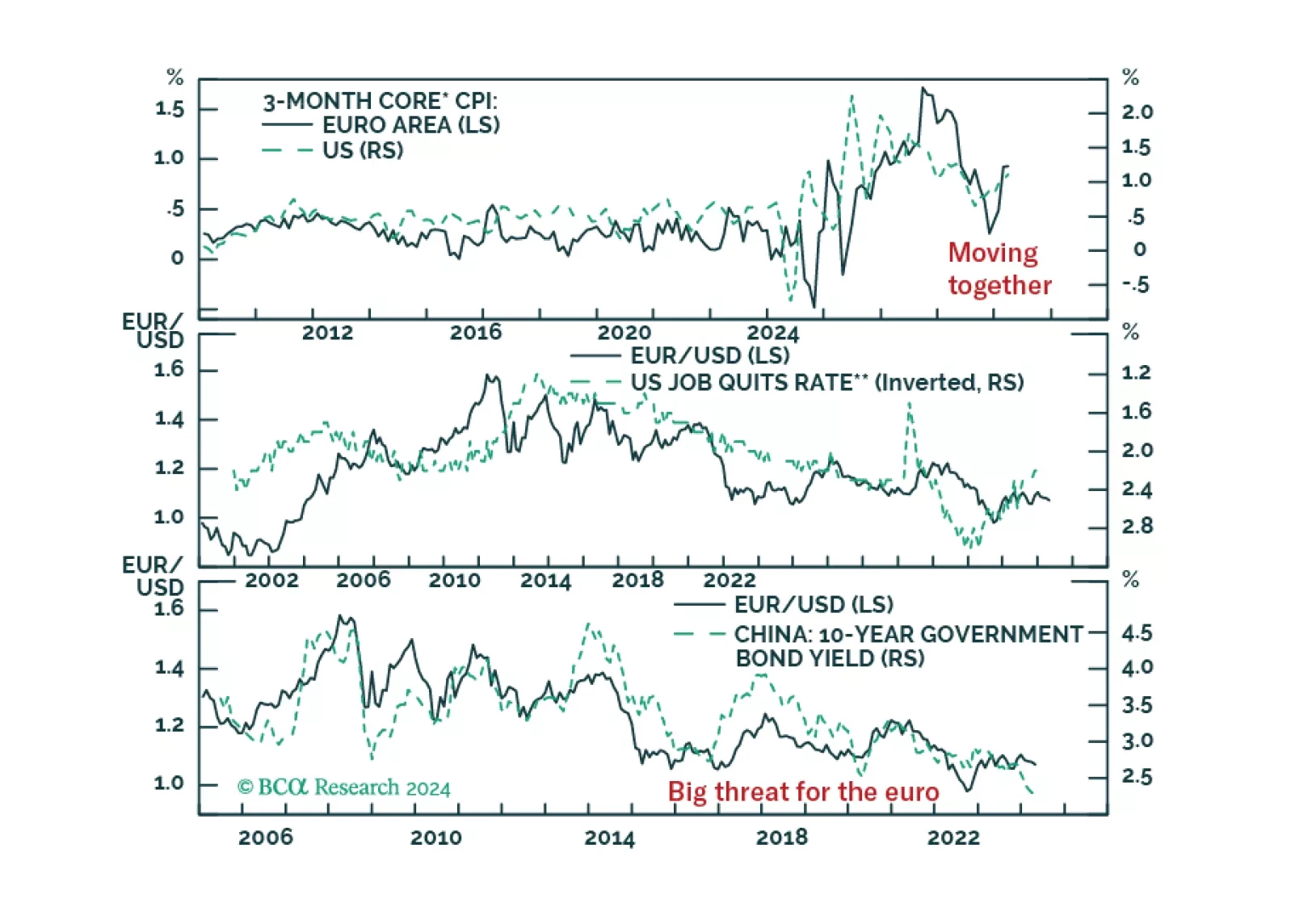

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?