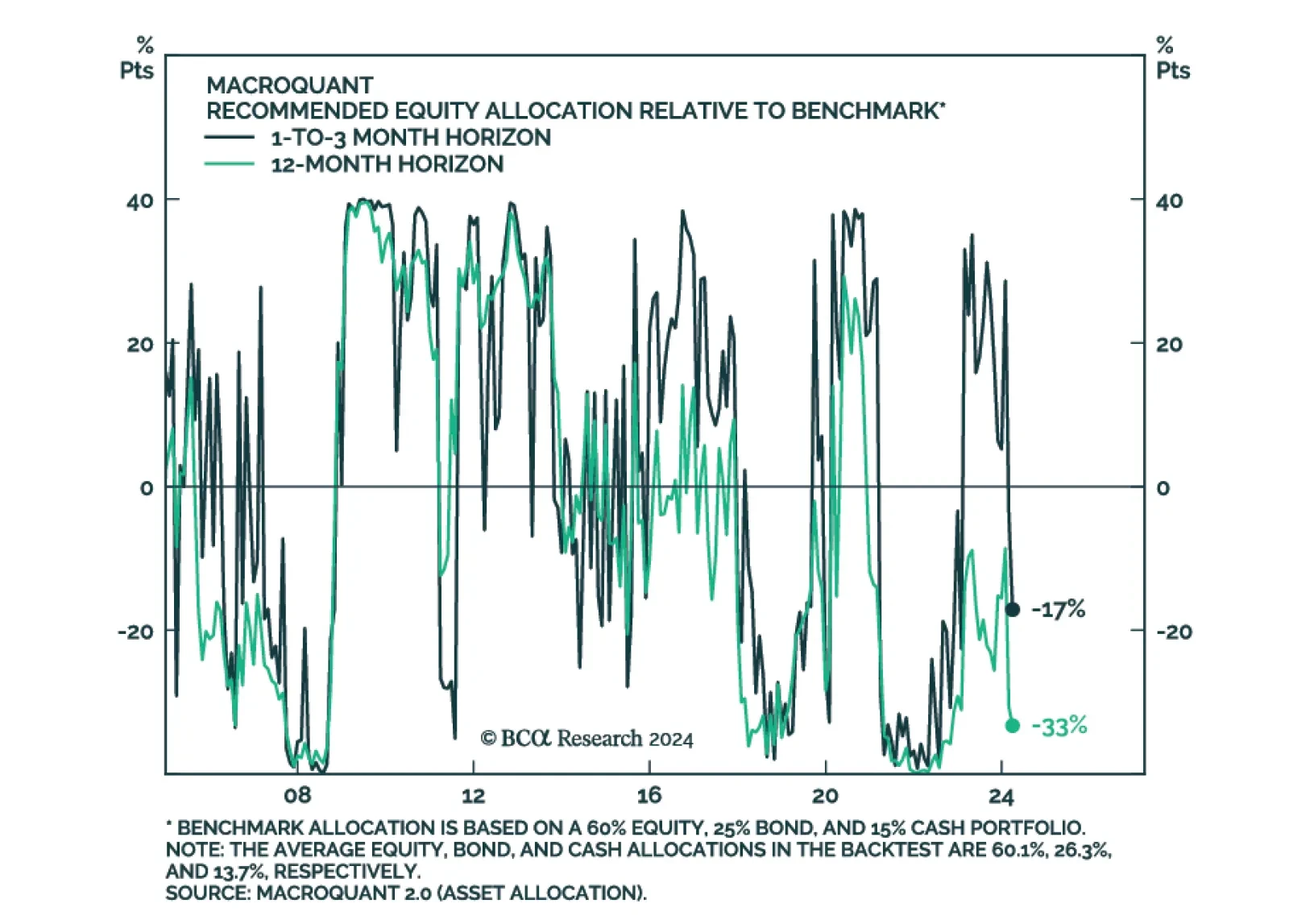

In its latest report, BCA Research’s Global Investment Strategy service provides an update on its MacroQuant model. The overall equity score declined in April, finishing the month at the 29th percentile, which is enough to…

Central banks are in a dilemma whether to prioritize supporting growth or bringing inflation back to target. This is unlikely to end well. Investors should be defensively positioned.

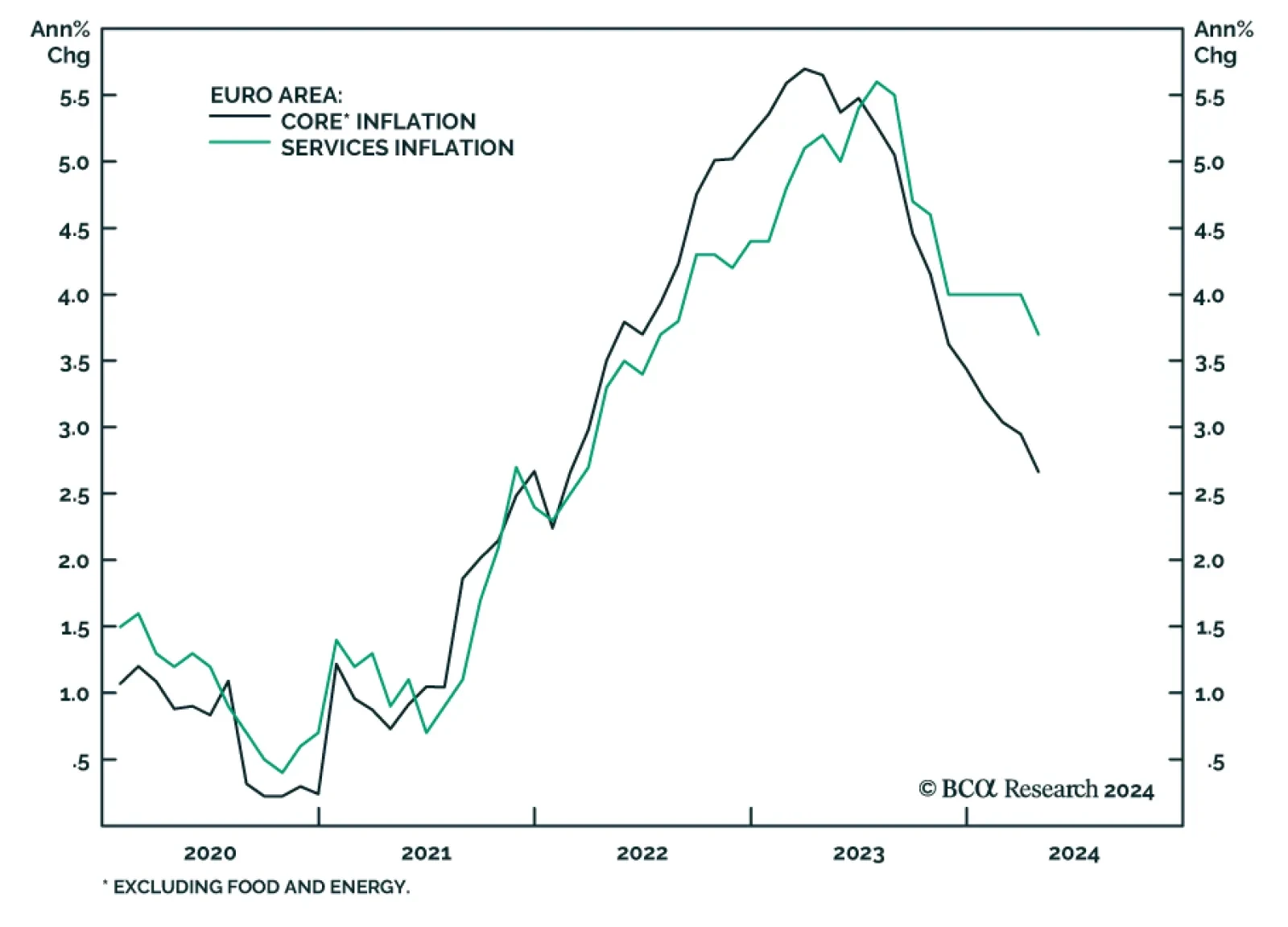

Euro area inflation and GDP numbers were released on Tuesday. The preliminary harmonized core consumer price index came in at 0.7% on a month-on-month basis, a decrease from 1.1% in March. The preliminary year-on-year core CPI…

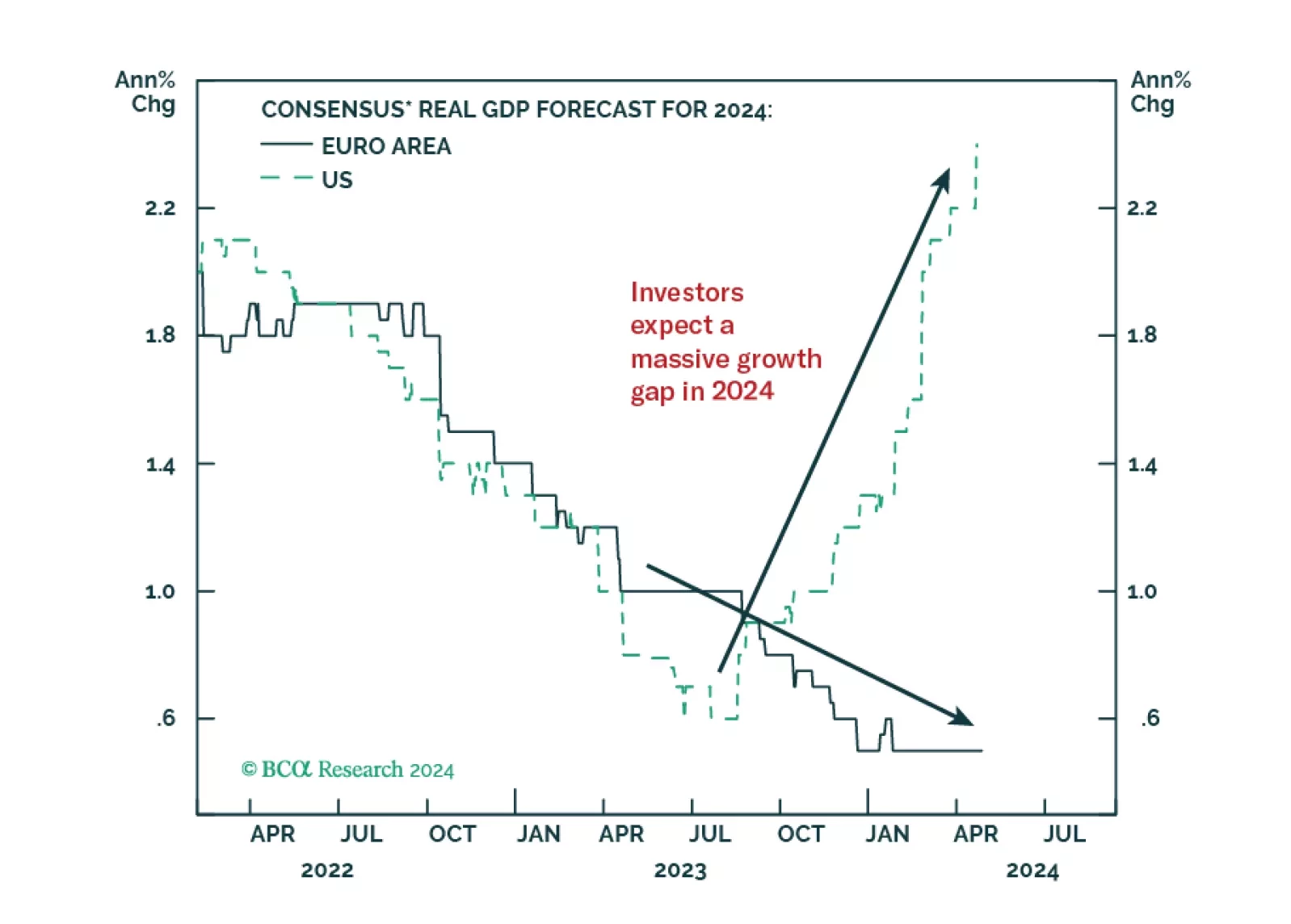

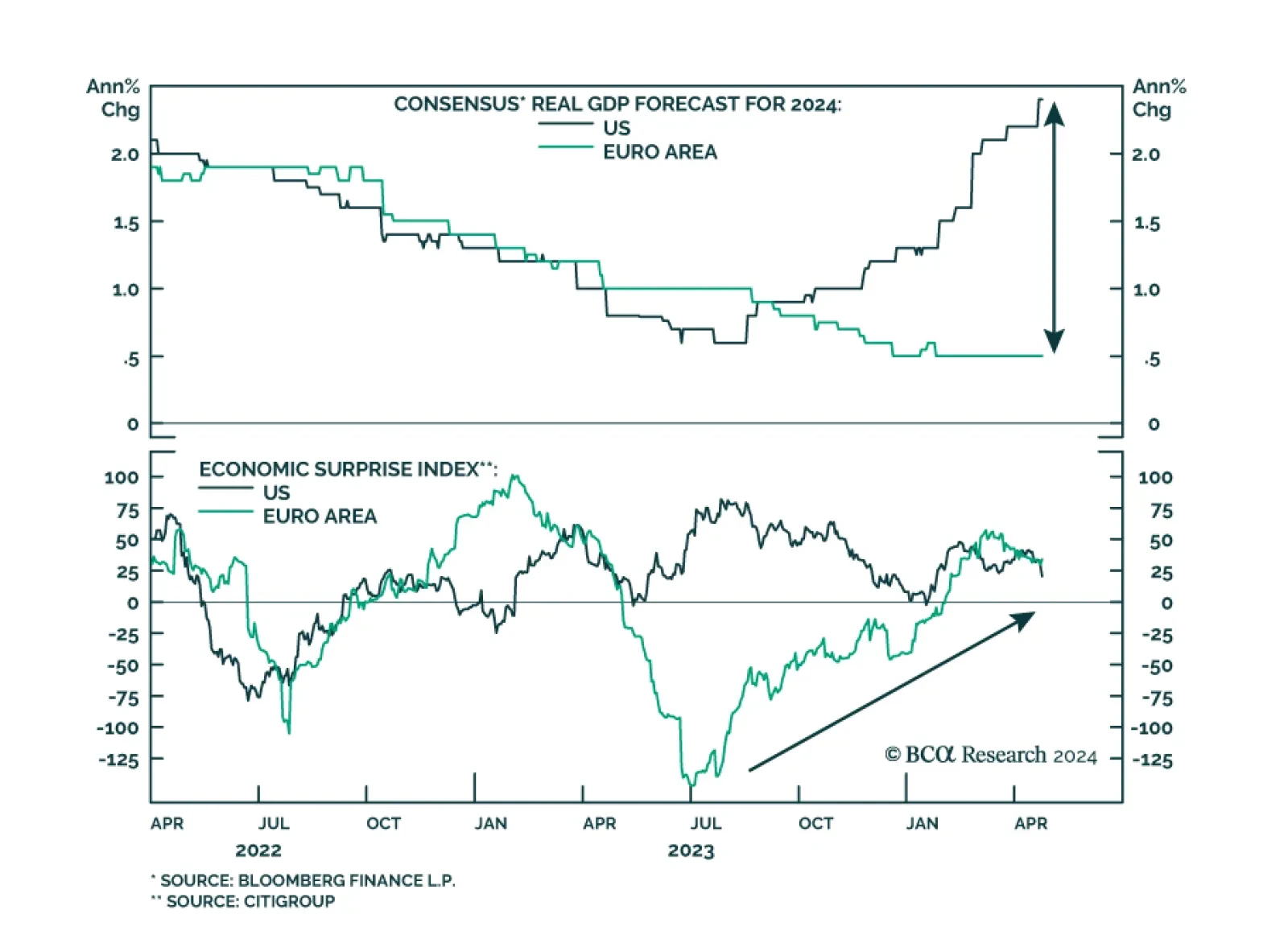

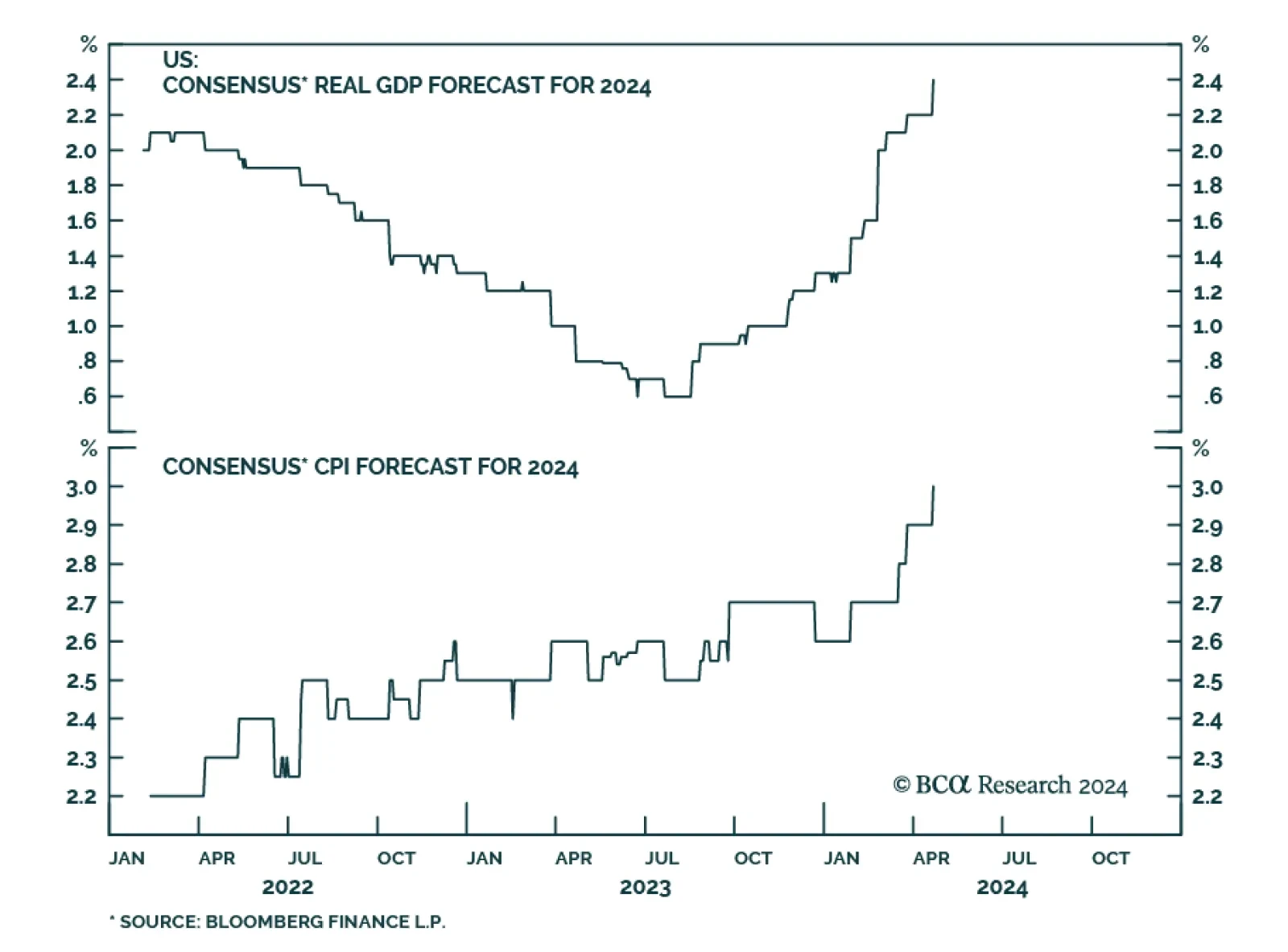

Investors anticipate a record growth gap between the US and the Eurozone in 2024. Does this skewed expectation create market opportunities?

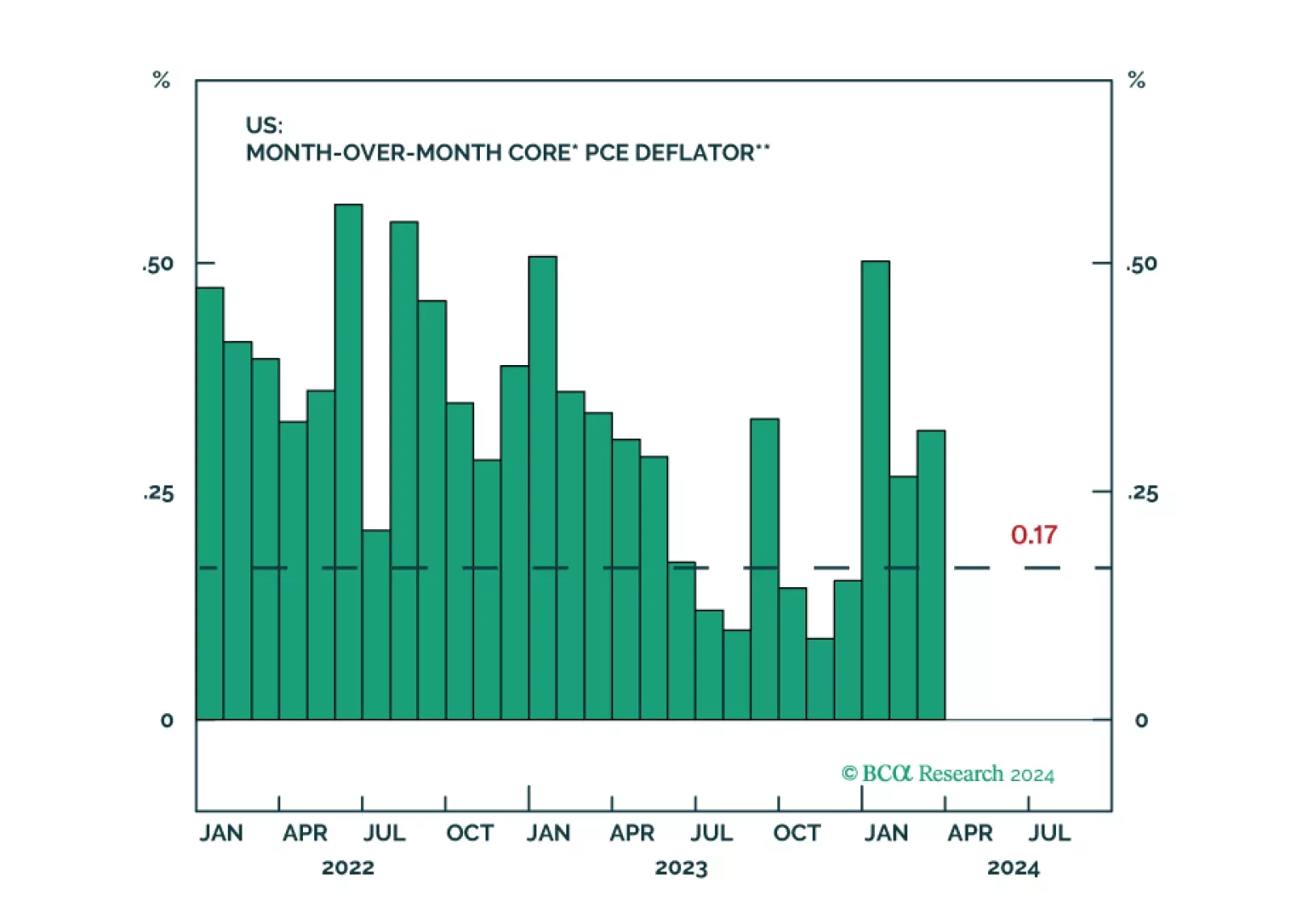

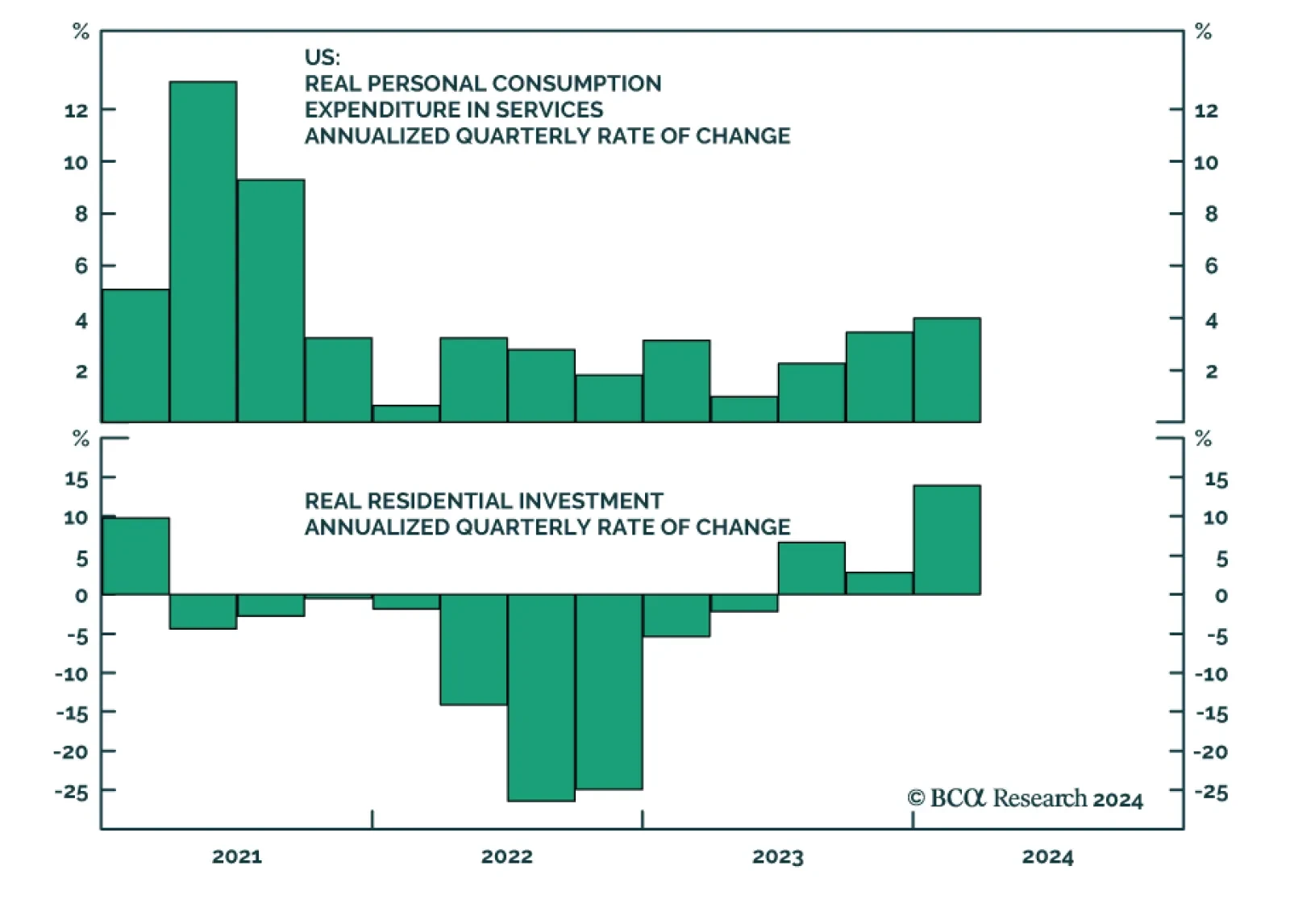

The advanced estimates for US real GDP suggest that economic growth slowed meaningfully from 3.4% in Q4 2023 to 1.6% in Q1 2024 on an annualized basis, significantly below expectations of 2.5%. That said, the details of the…

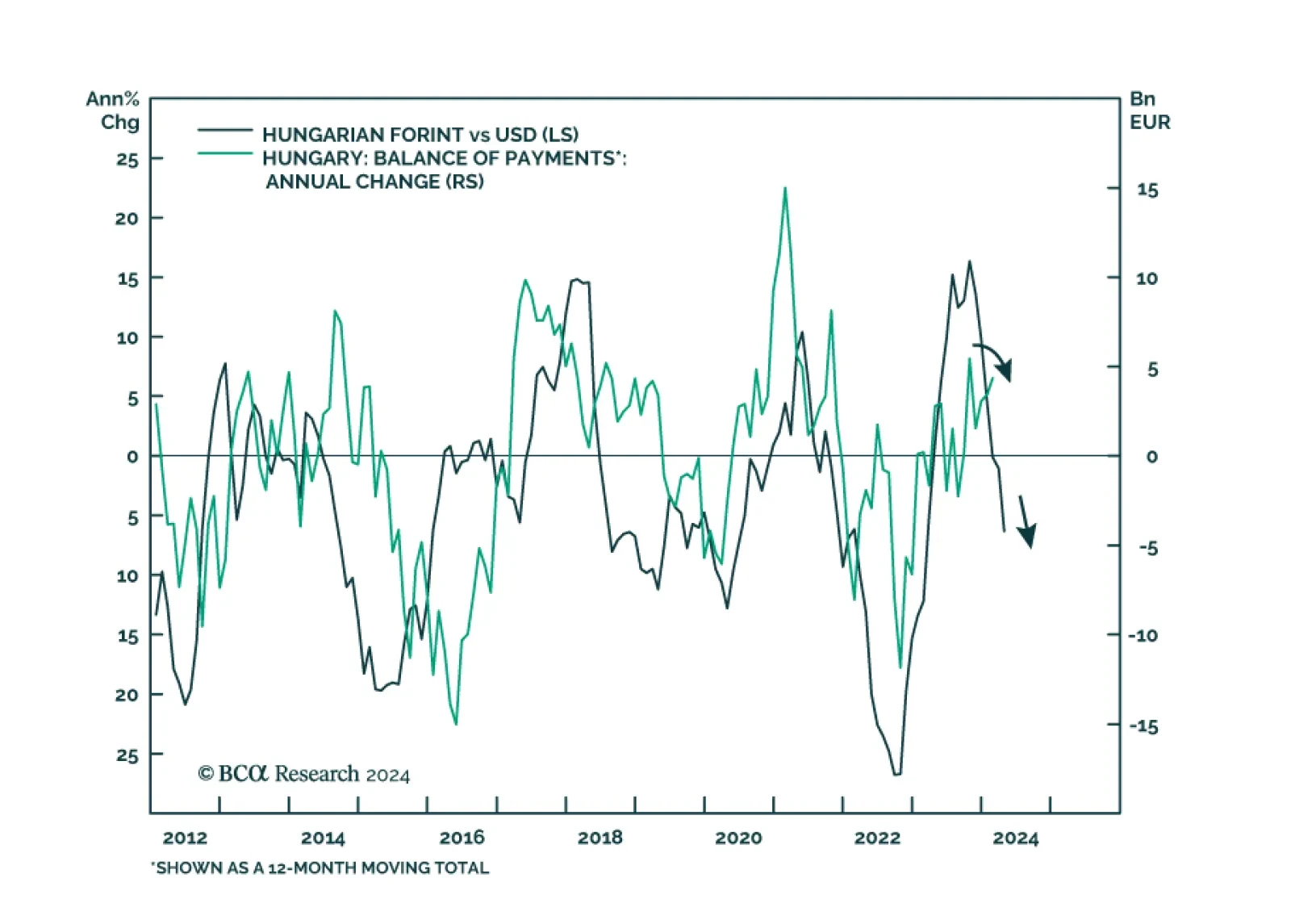

BCA Research’s Emerging Markets Strategy service concludes that among the CE3 currencies, the zloty and the koruna will be the relative winners, while the forint will likely be the worst performer of the three. That said,…

The resilience of the US economy has led economists to consistently revise up their consensus real GDP growth forecast for 2024, which now stands at 2.4%, up from 0.6% in July 2023. Conversely, the 2024 consensus Eurozone growth…

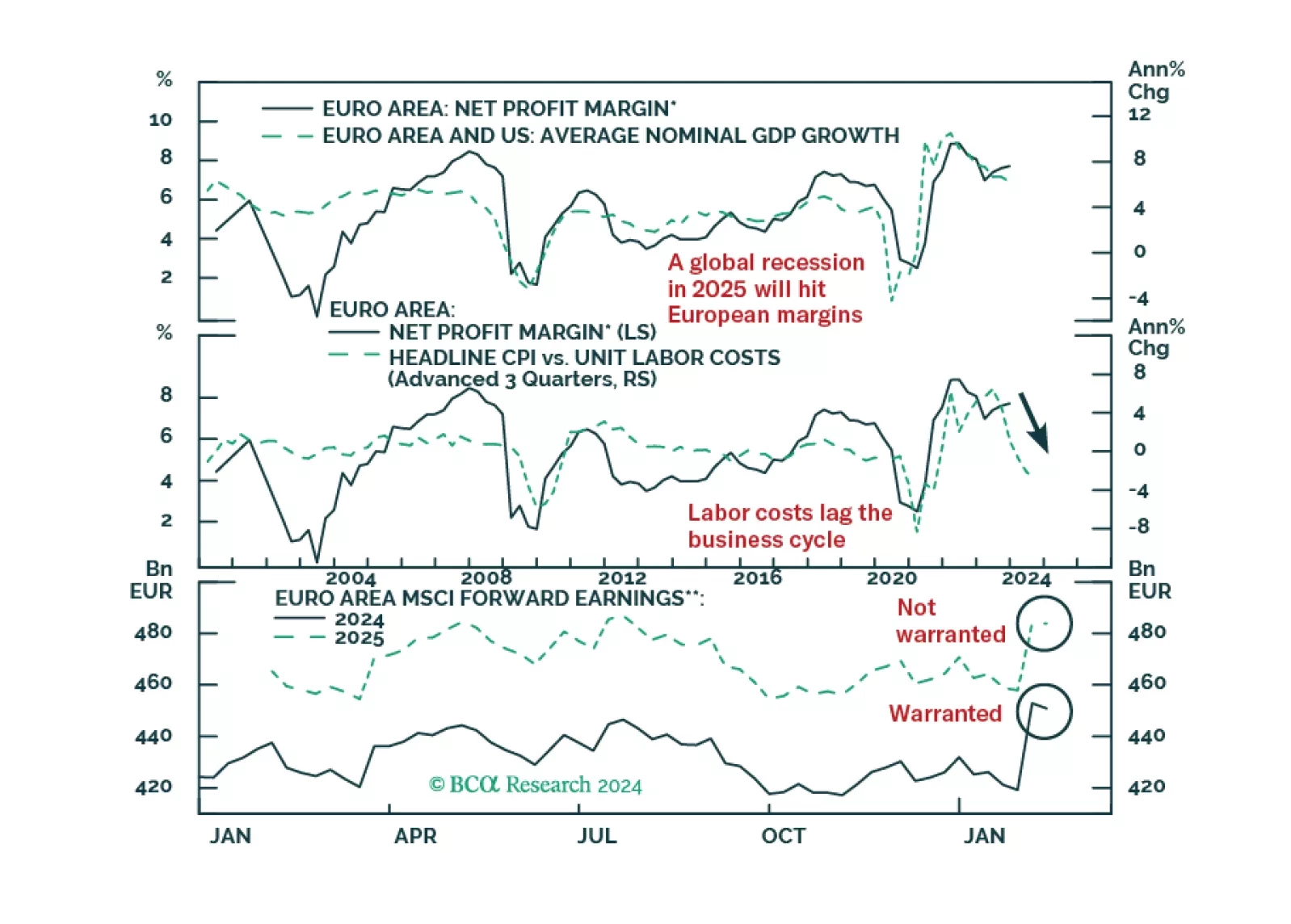

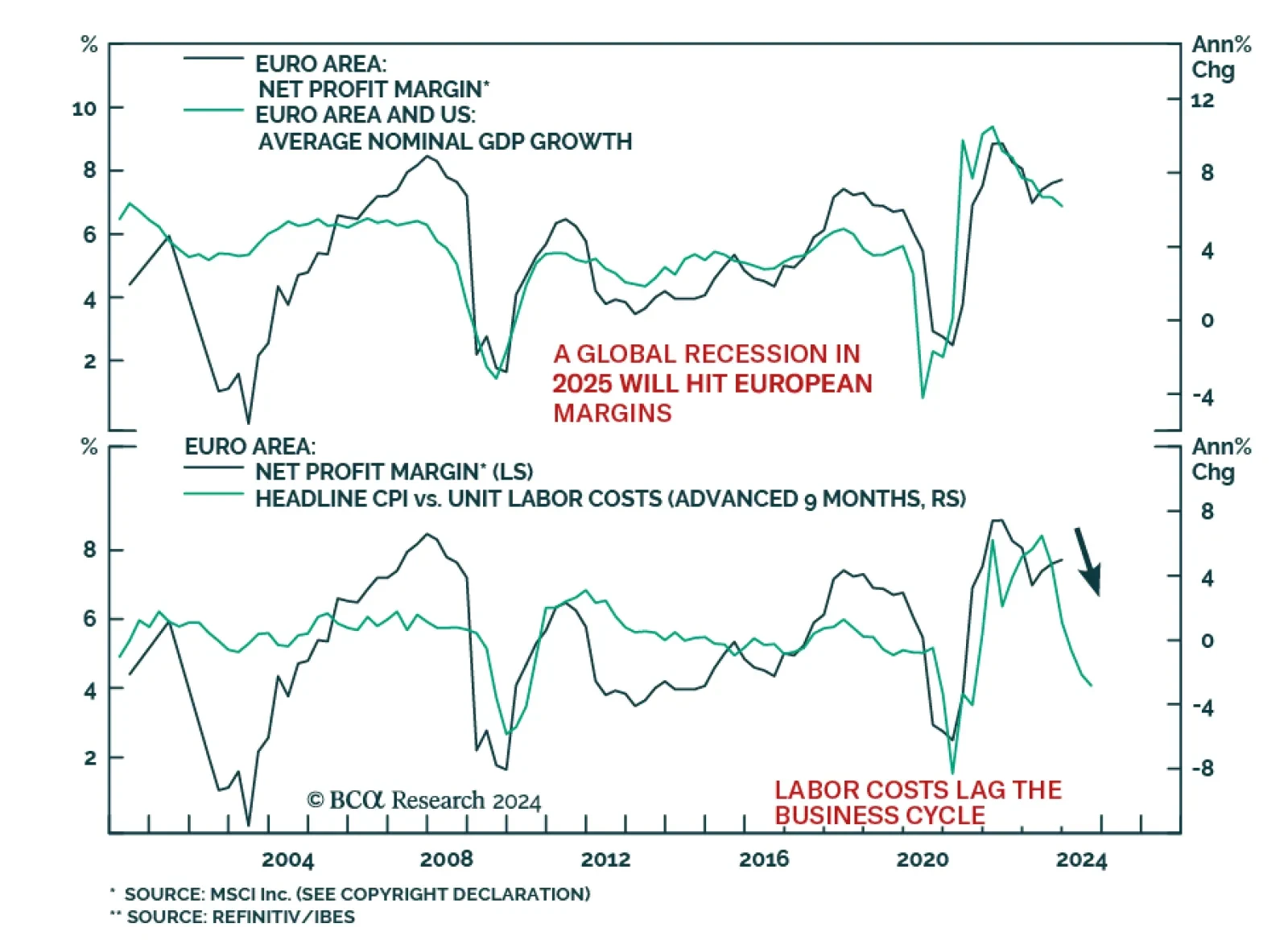

According to BCA Research's European Investment Strategy service, European profit margins have downside because they are both elevated and procyclical. European net margins stand at 7.7% above their long-term average…

By the end of 2023, the “soft landing” scenario became the dominant narrative in financial markets. Following the regional banking scare in March of last year, market participants slowly came around to the view that…

European profits margins are elevated. Will a mild recession be enough to bring them down?