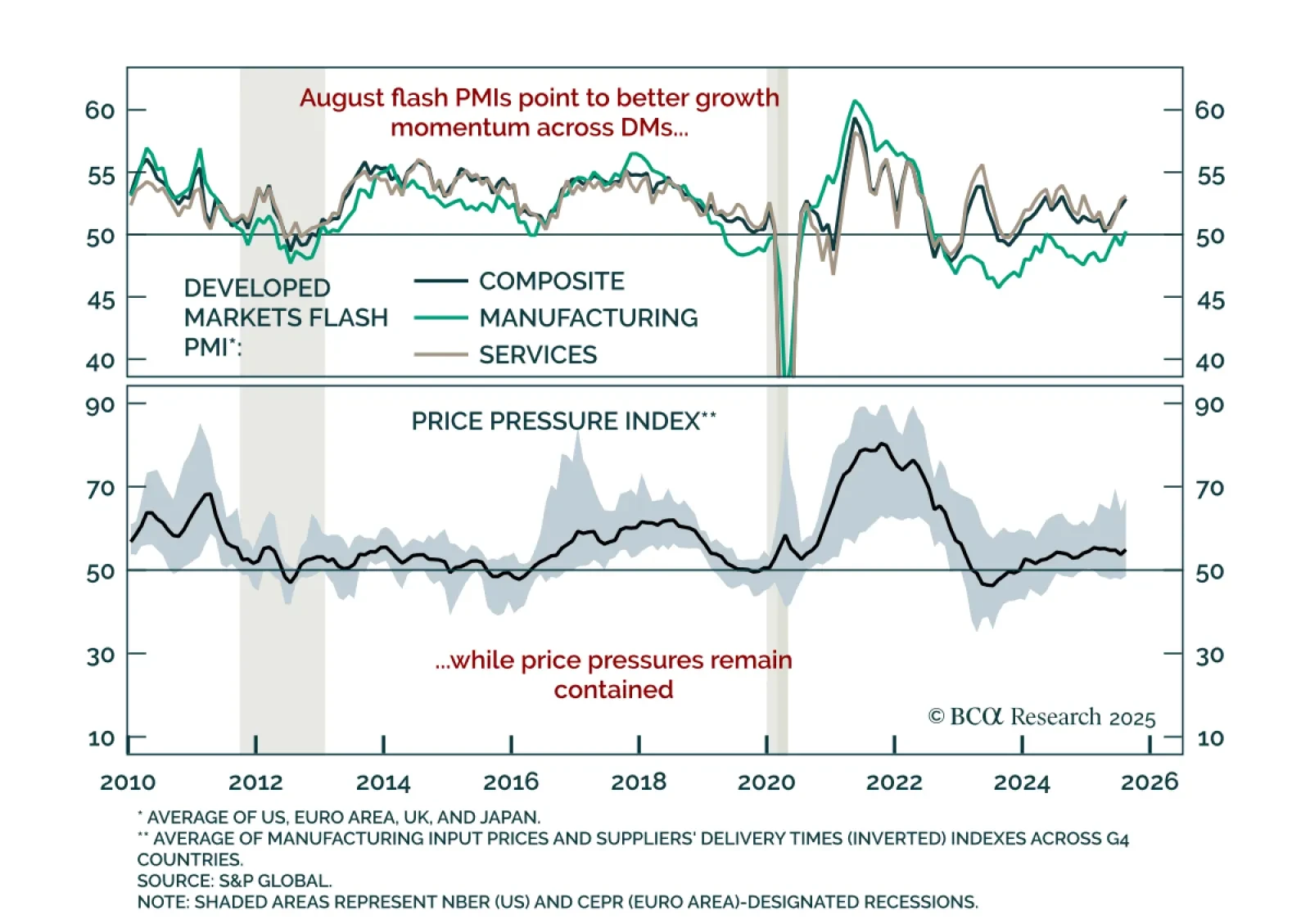

Flash August PMIs show tentative global momentum yet growth remains weak. The composite PMI improved in both the US (55.4 vs. 55.1) and euro area (51.1 vs. 50.9), with manufacturing moving into expansion for the first time in 18…

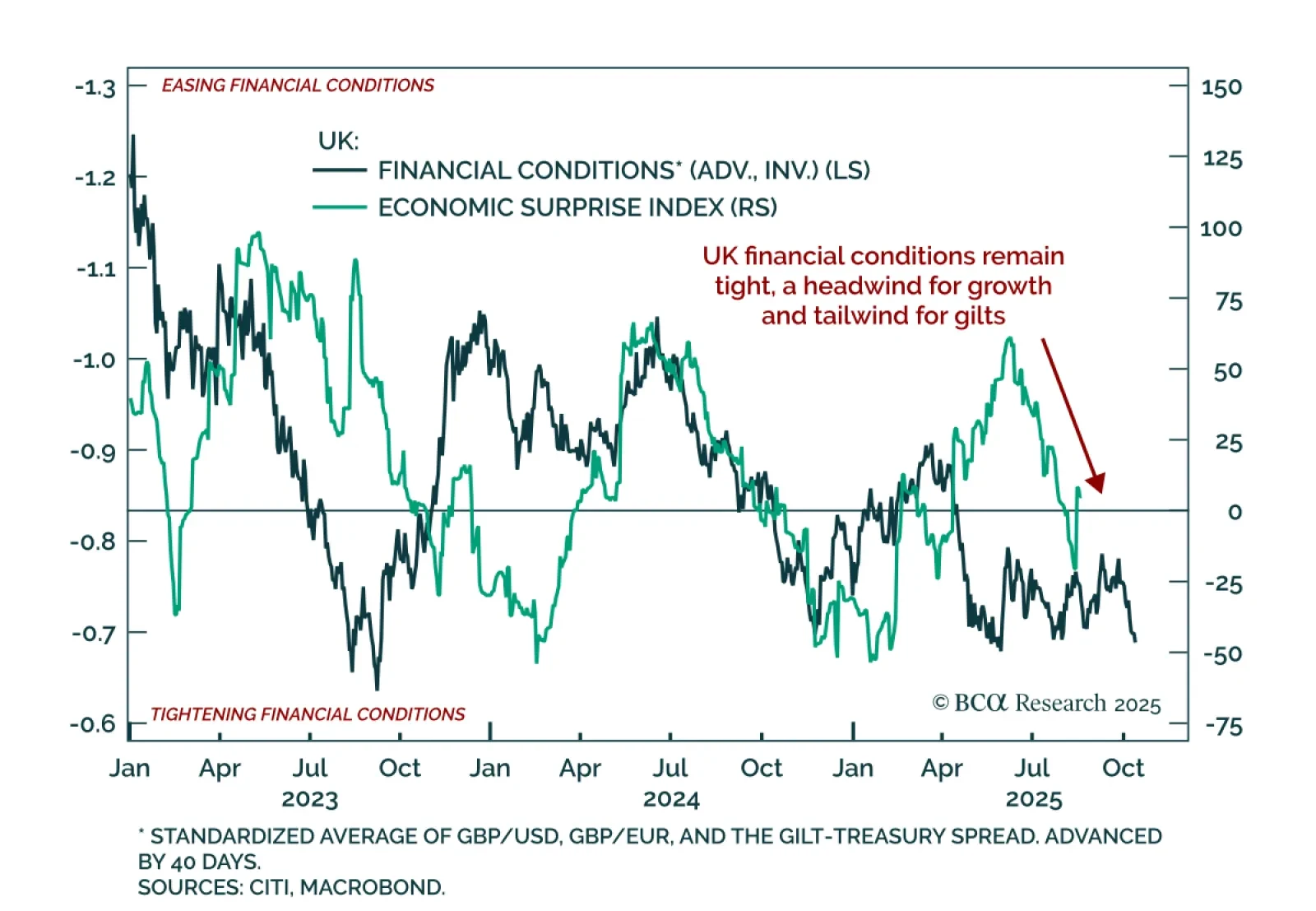

UK data momentum is fading, keeping Gilts attractive and GBP vulnerable. At 5.60%, 30-year Gilts trade at their highest yields since the late 1990s, reflecting persistent pressure on the long end across DMs. The Bank of England…

US housing data remain weak, reinforcing a fragile growth backdrop and the need for equity downside protection. July housing starts rose 5.2% m/m (annualized), but building permits fell 2.8% following a small June decline. The…

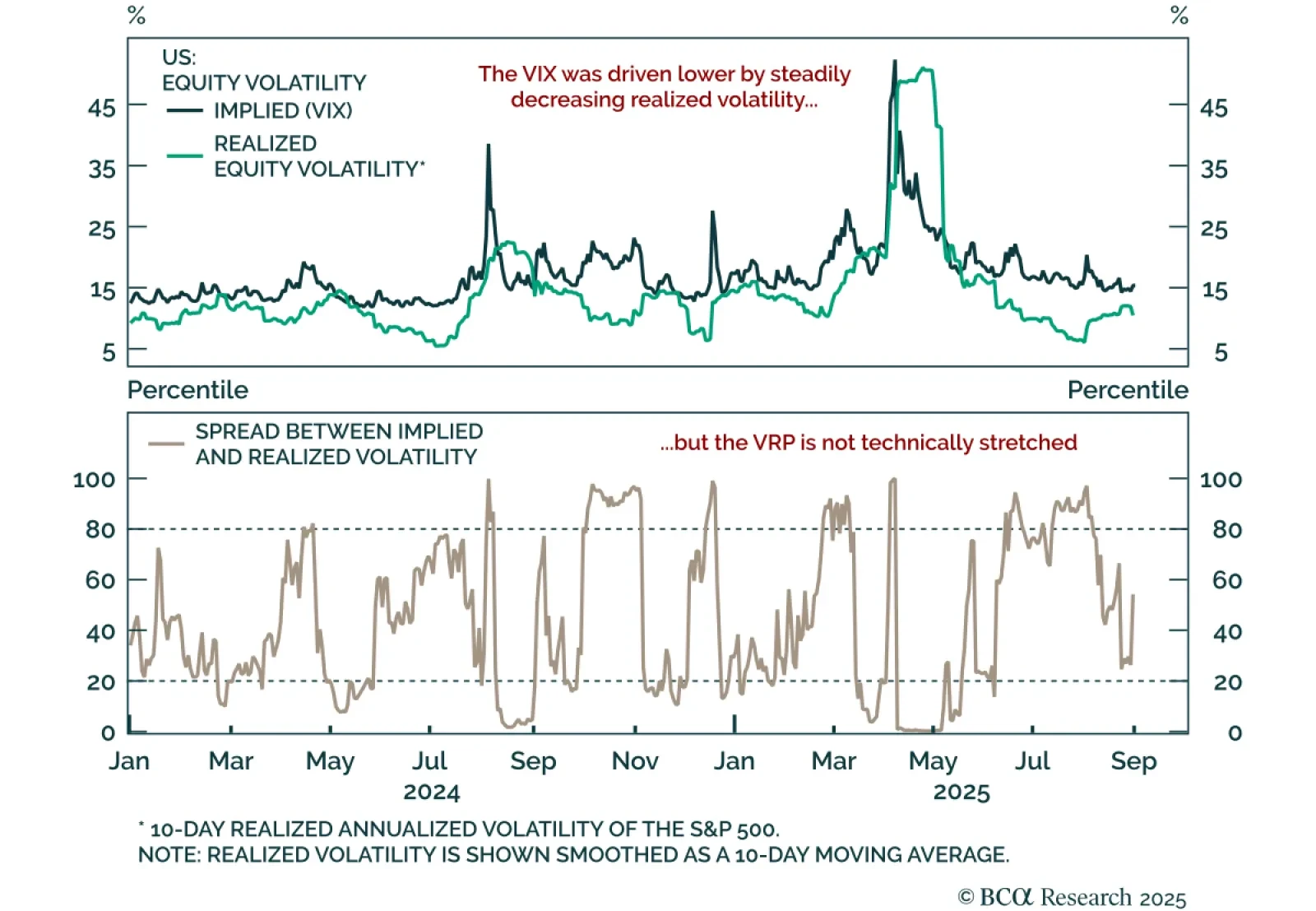

A smooth S&P 500 rally has crushed volatility, but stretched signals argue for buying protection. The index has climbed back to all-time highs with almost no drawdown, producing a steady decline in realized volatility. This…

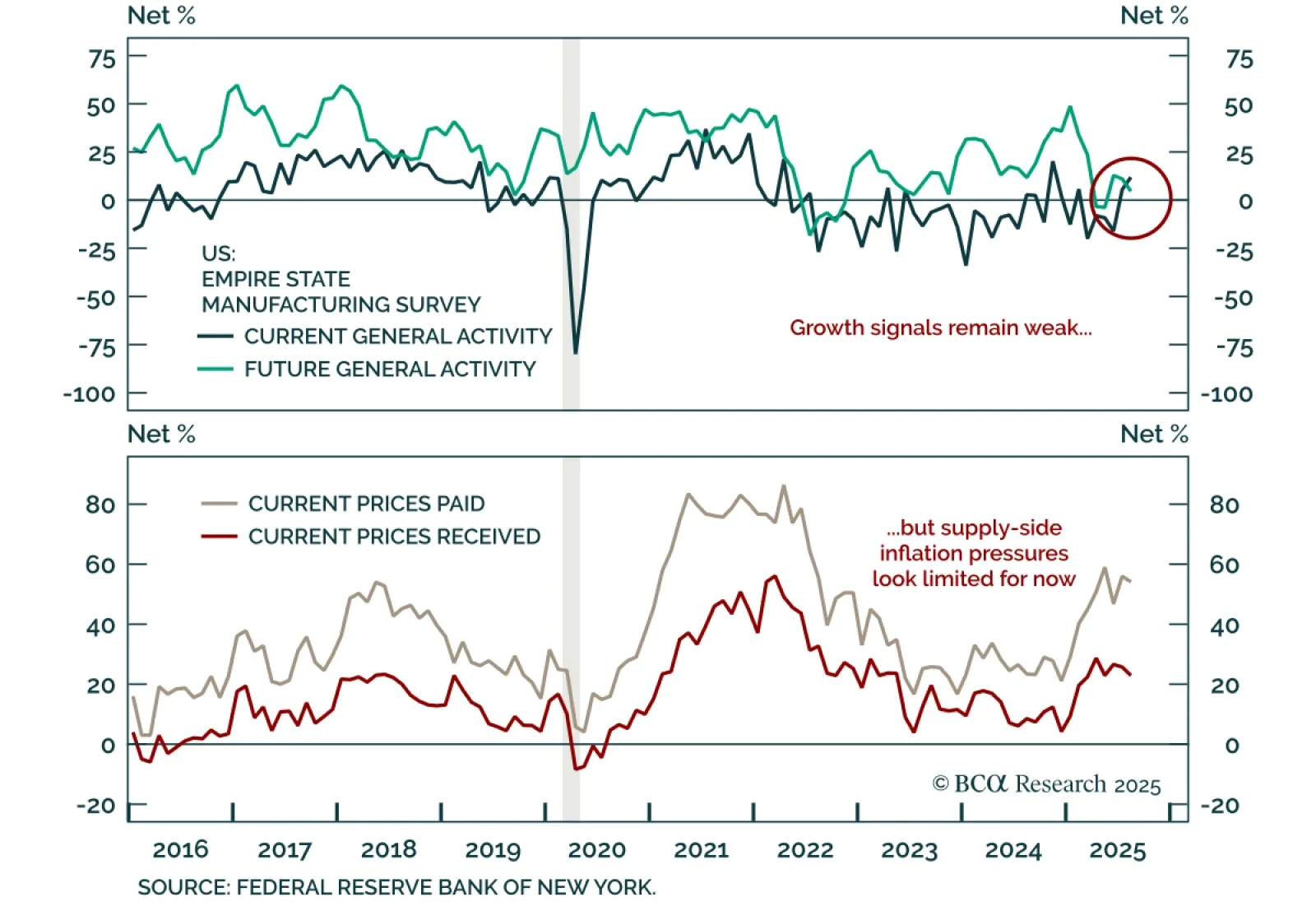

The surprisingly positive August Empire State Manufacturing survey conceals growth headwinds. The headline index rose to 11.9 in August from 5.5 in July, well above estimates. But the report showed a split between current…

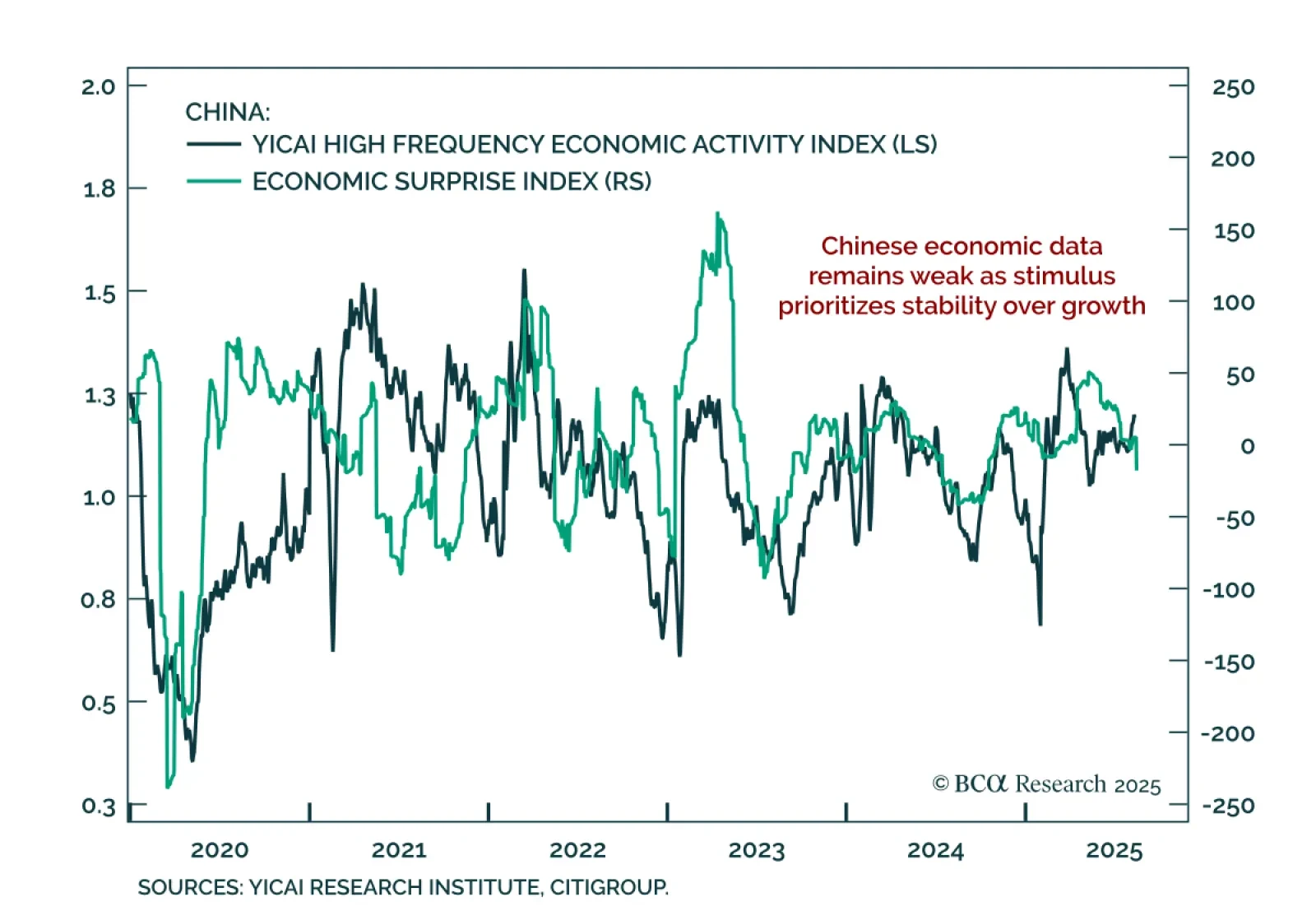

July data confirm China’s weak growth, with no near-term shift toward meaningful stimulus. New home prices fell 0.31% m/m, retail sales slowed to 3.7% y/y from 4.8%, and industrial production eased. Flooding in July disrupted…

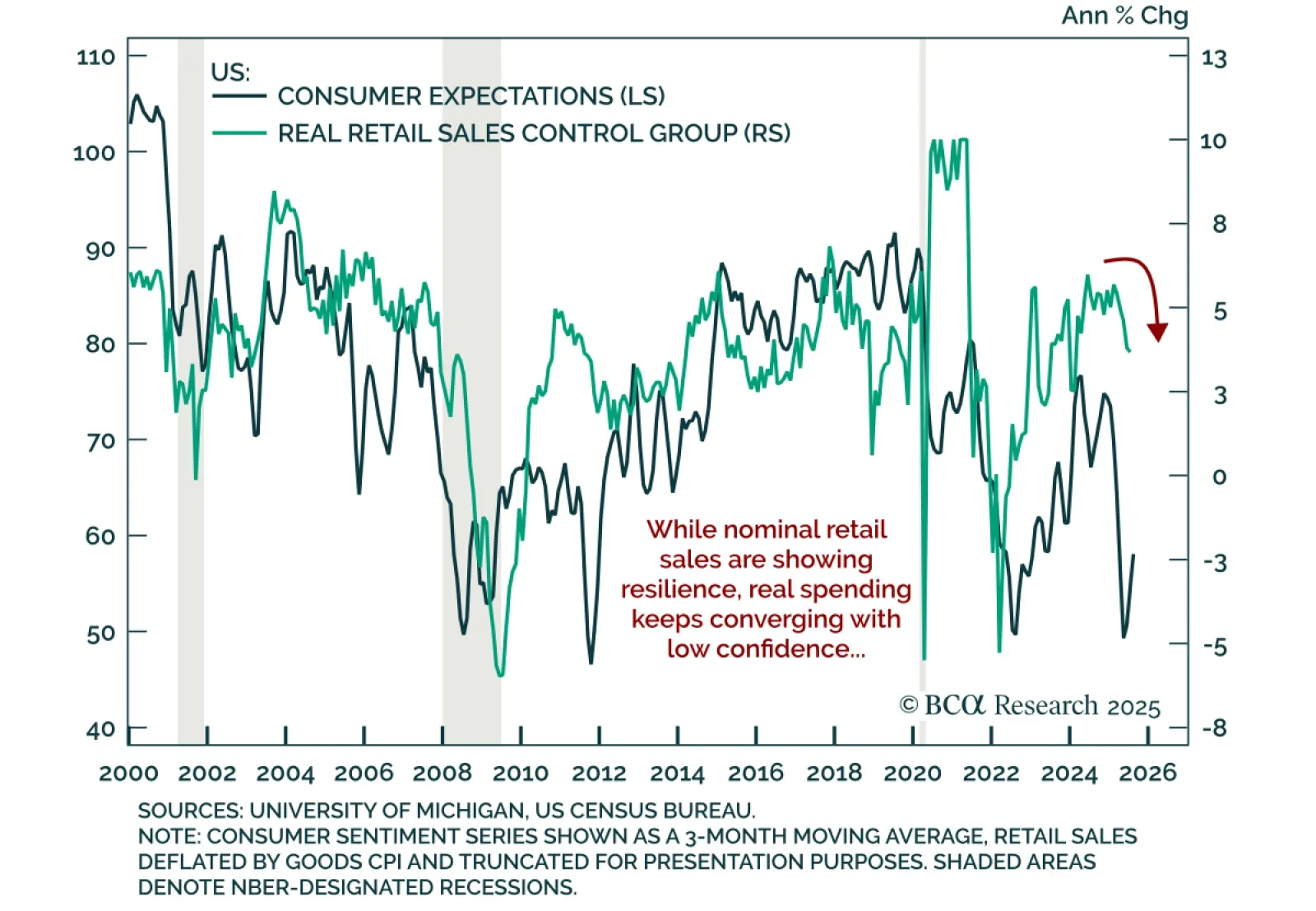

Retail sales and consumer sentiment data point to slowing underlying momentum despite headline resilience. Retail sales rose 0.5% m/m in July, below estimates and decelerating from 0.9% in June. The control group beat estimates…

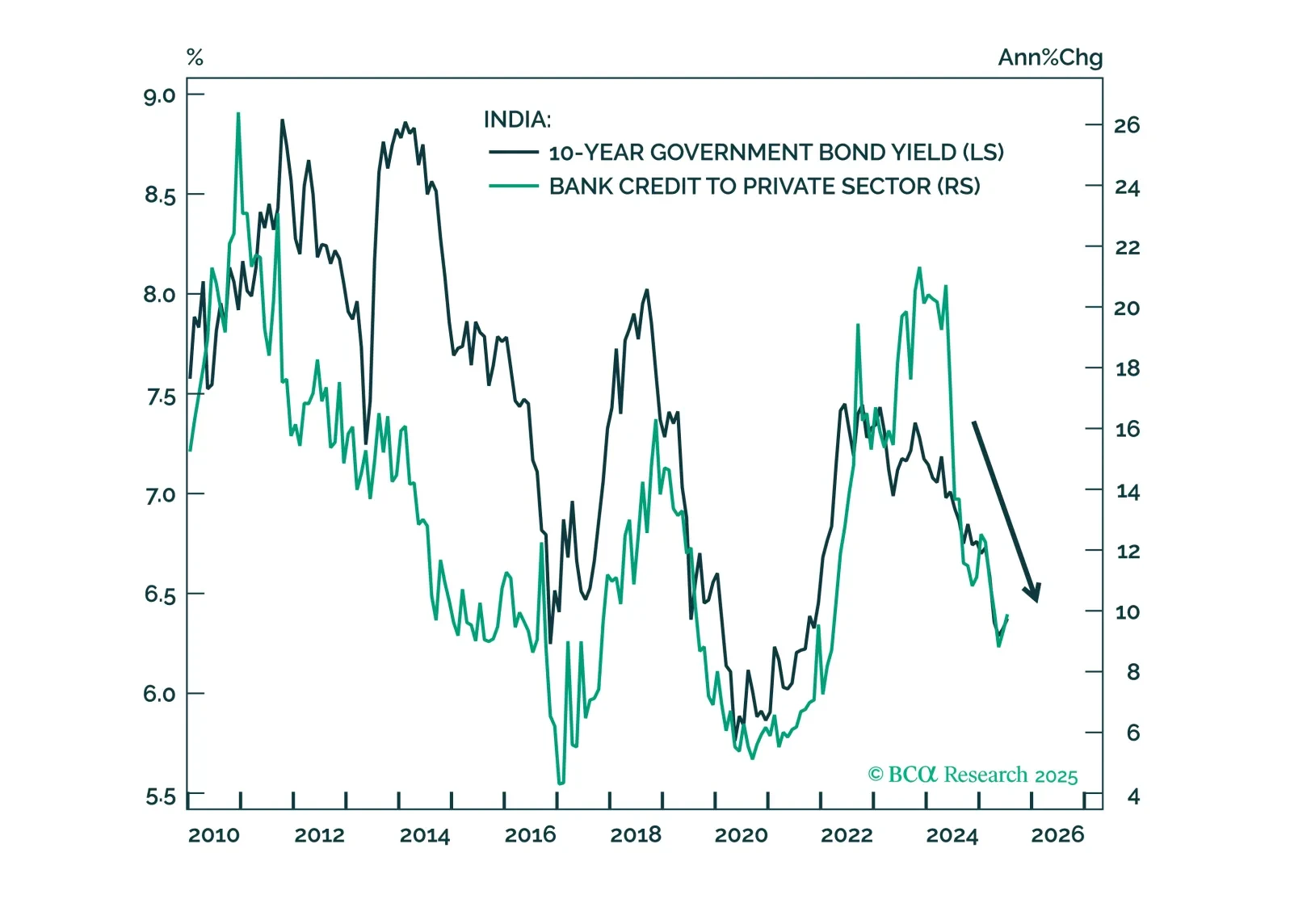

The Indian rupee remains vulnerable to further depreciation amid slowing growth, tight domestic policy, and fragile capital flows. Trade risks and a weakening external balance will likely keep INR underperforming EM Asia peers.…

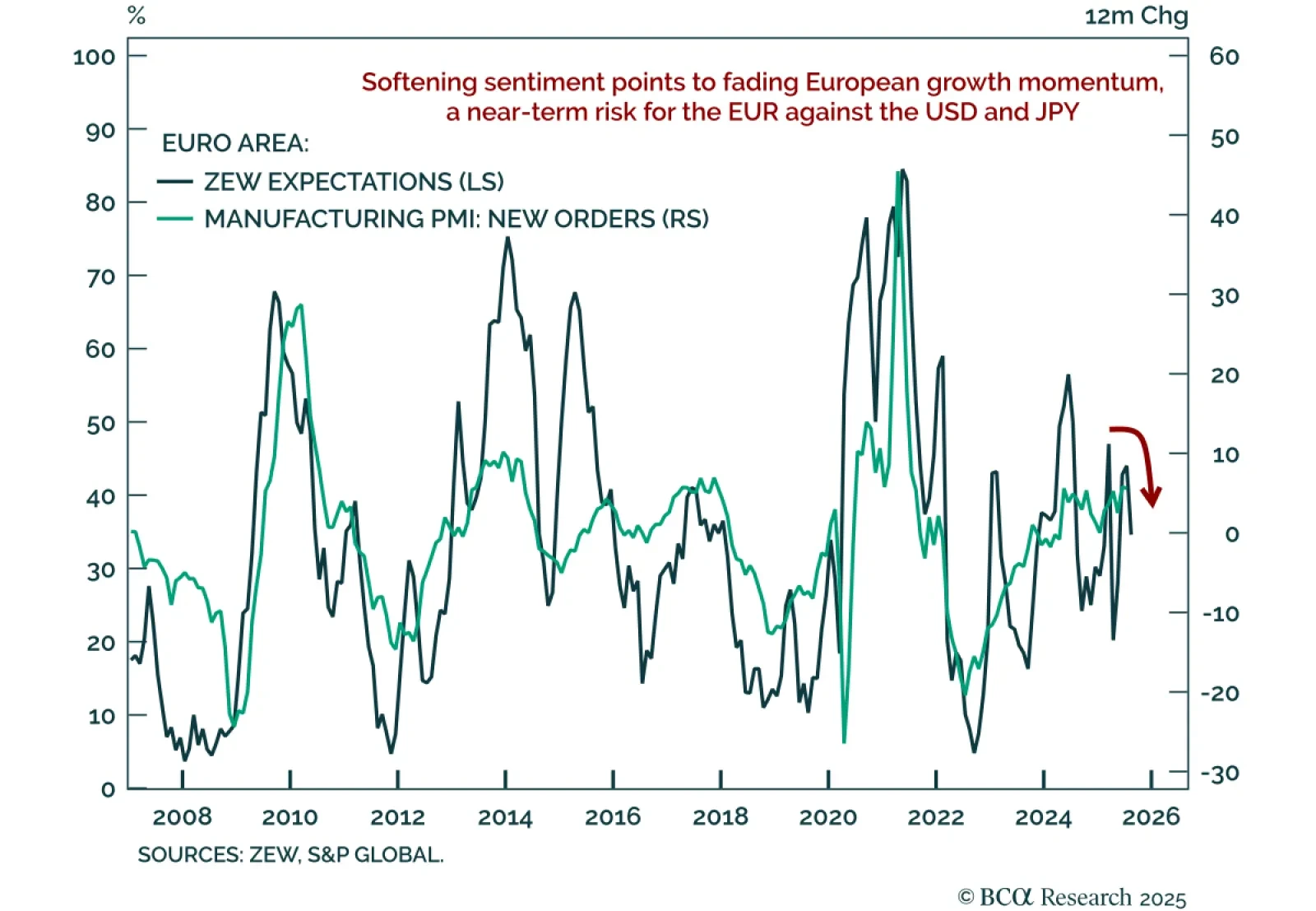

European sentiment has moderated, pointing to near-term downside risk for a technically-stretched Euro. The August Eurozone ZEW Expectations index fell to 25.1 from 36.1, with Germany’s reading missing estimates, dropping sharply to…

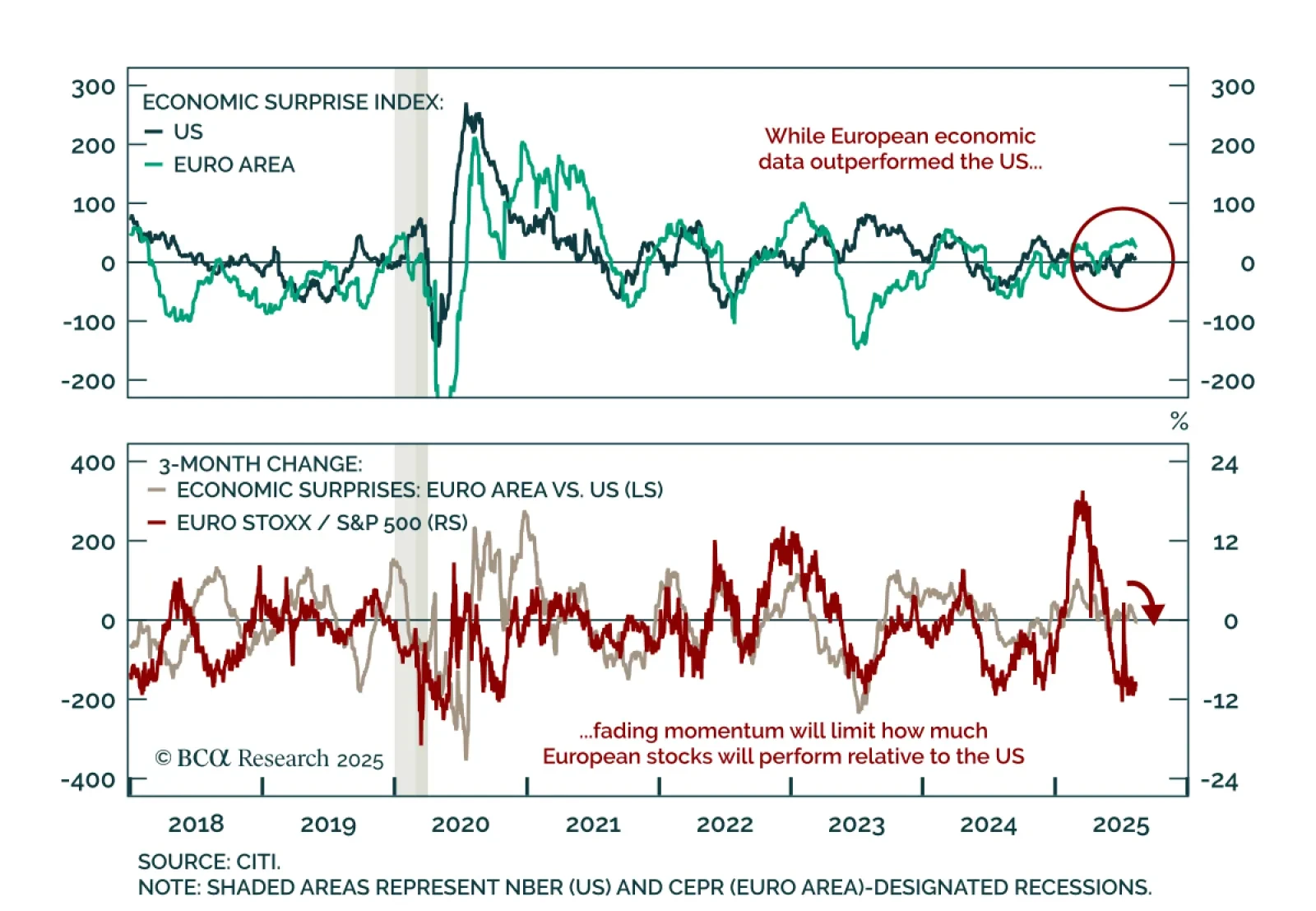

US equities are set for tactical outperformance versus Europe, but dips or underperformance in European assets remain entry points for long-term investors. European stocks have stalled below prior highs, while the S&P 500 has…