In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

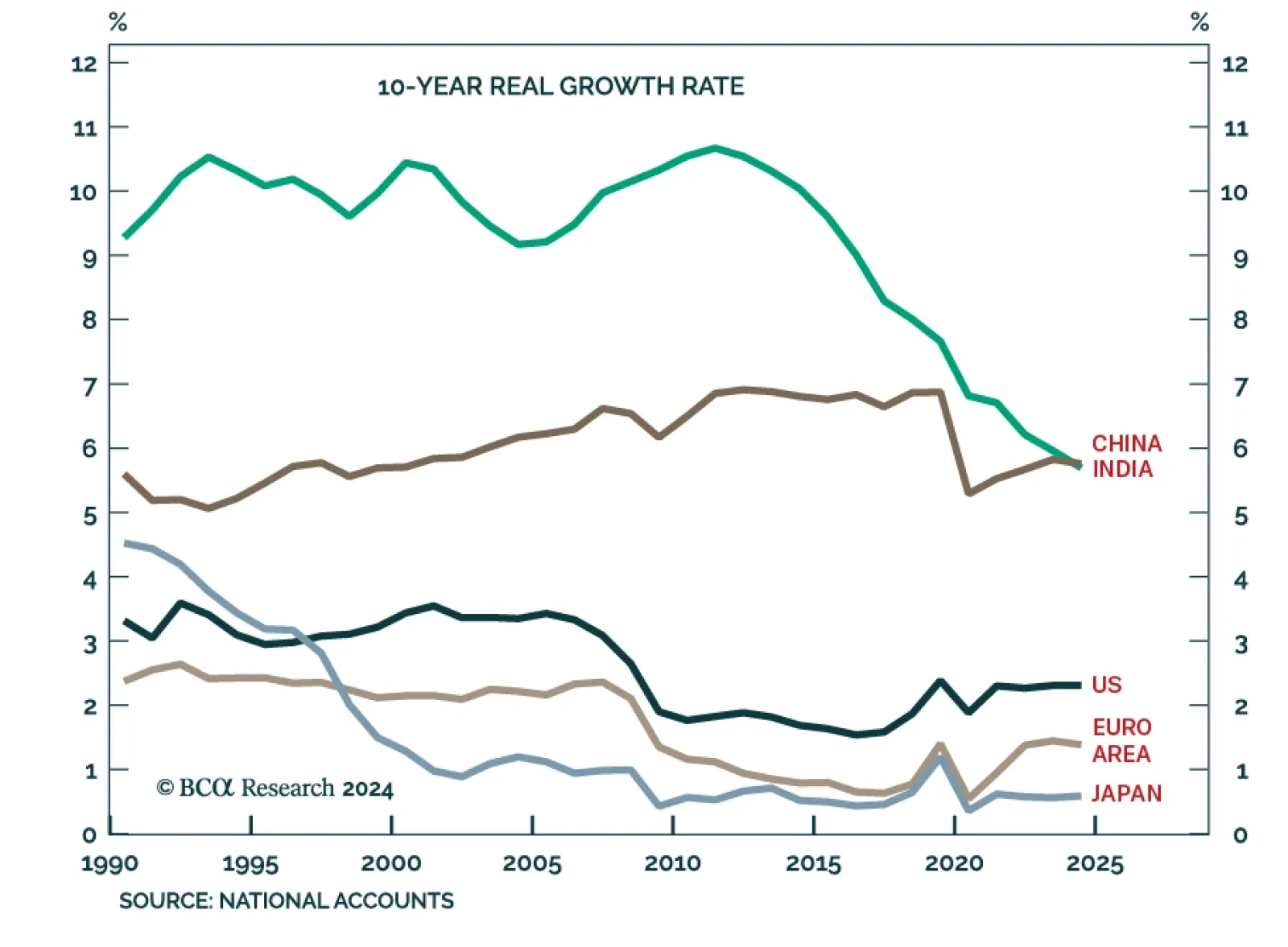

According to BCA Research’s Counterpoint service, absent China’s exponential credit growth, China’s trend growth rate will fall to 4 percent and the world’s trend growth rate will fall to sub-3 percent.…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

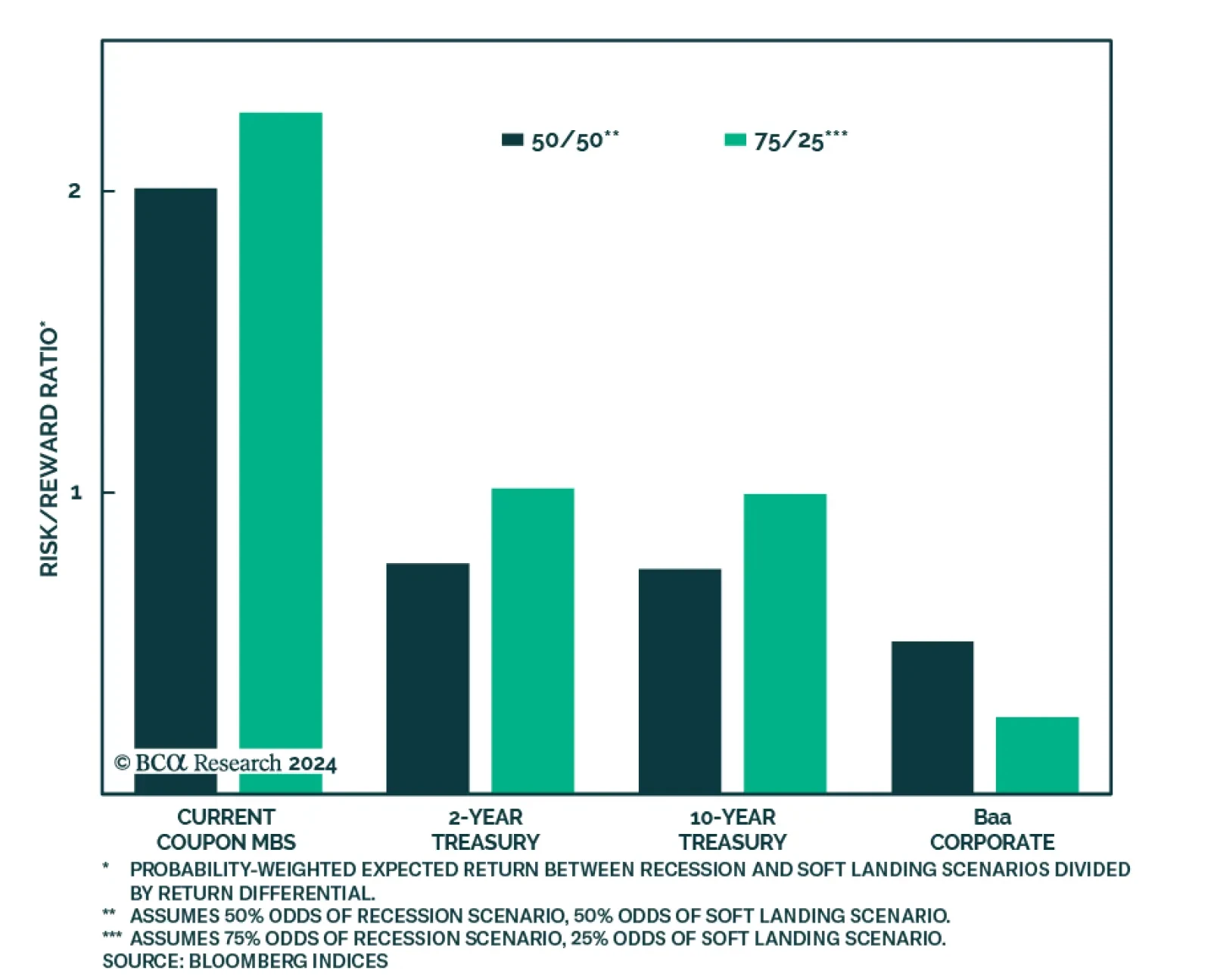

In its latest Special Report, BCA Research’s US Bond Strategy service considers the relative merits of four different fixed income investments in the current economic environment: 2-year Treasuries, 10-year Treasuries, Baa-…

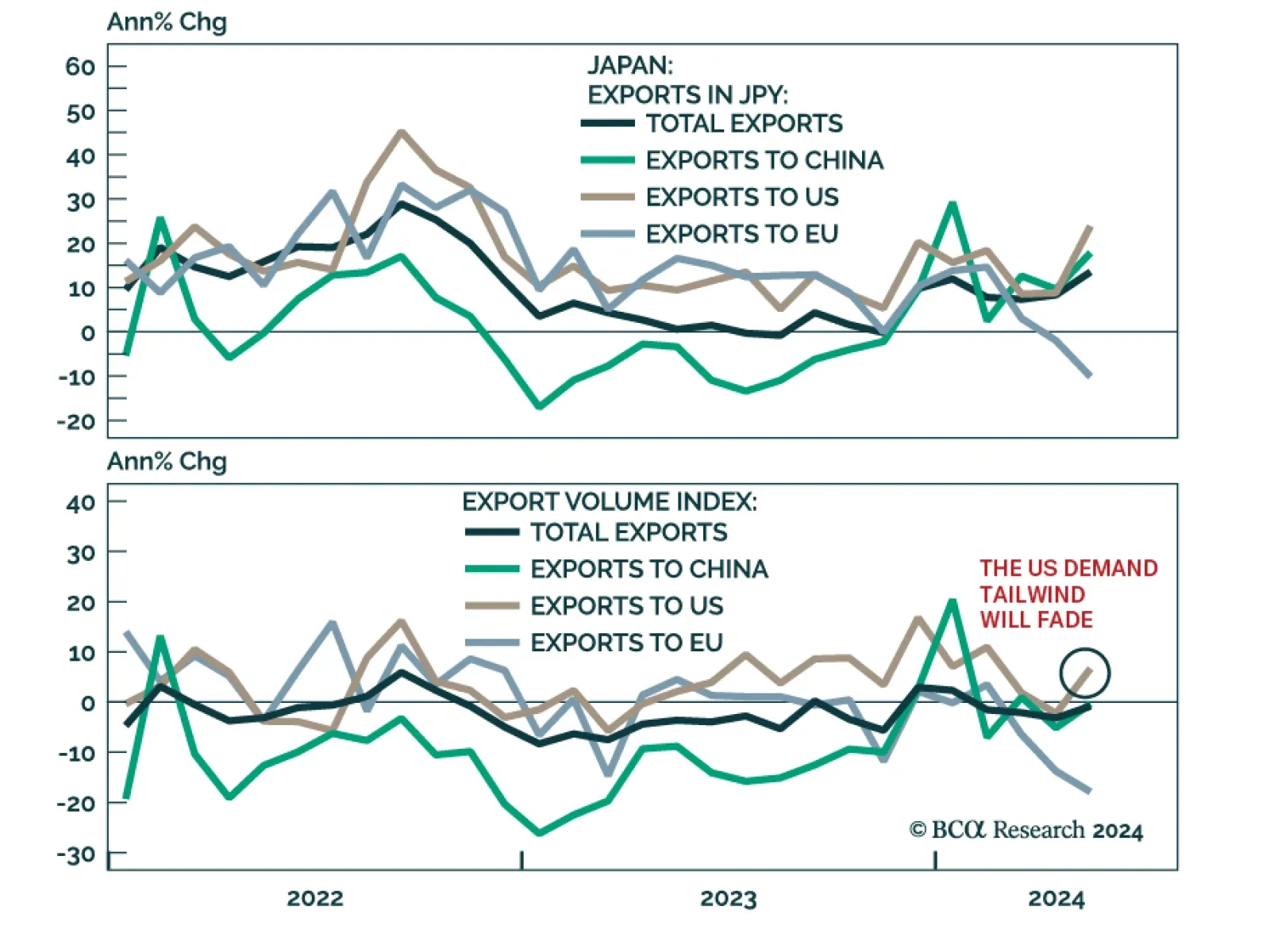

Japanese exports in JPY increased from 8.3% y/y to 13.5% in May, surpassing expectations of 12.7%. 23.9% and 17.8% y/y growth in exports to the US and China, respectively, led the overall surge. Trade data from Asian export-…

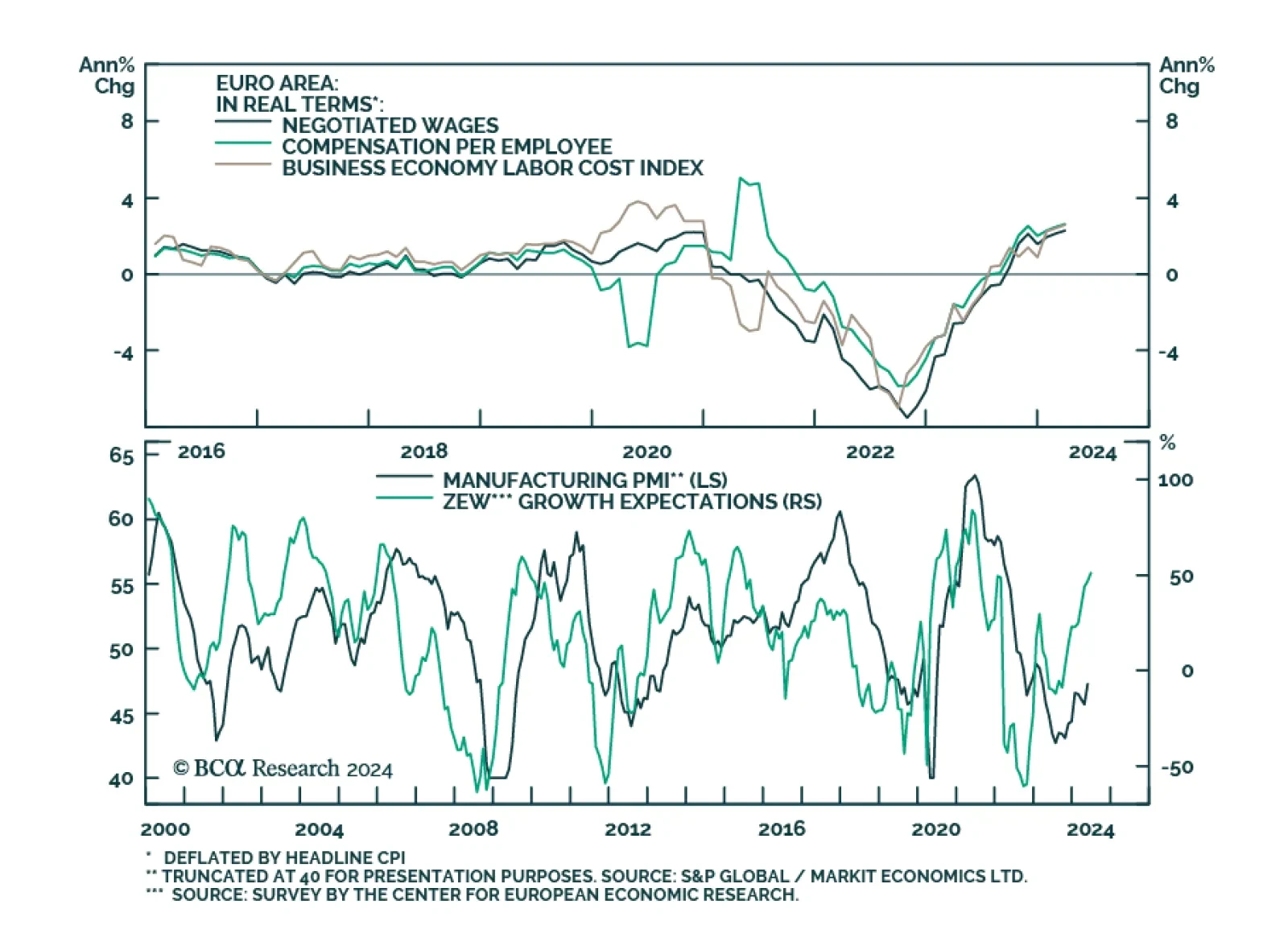

The ECB delivered its first rate cut in June, moderating the degree of restriction rather than pivoting outright to easy monetary policy settings. Indeed, the rate cut was accompanied by an upward revision of inflation and growth…

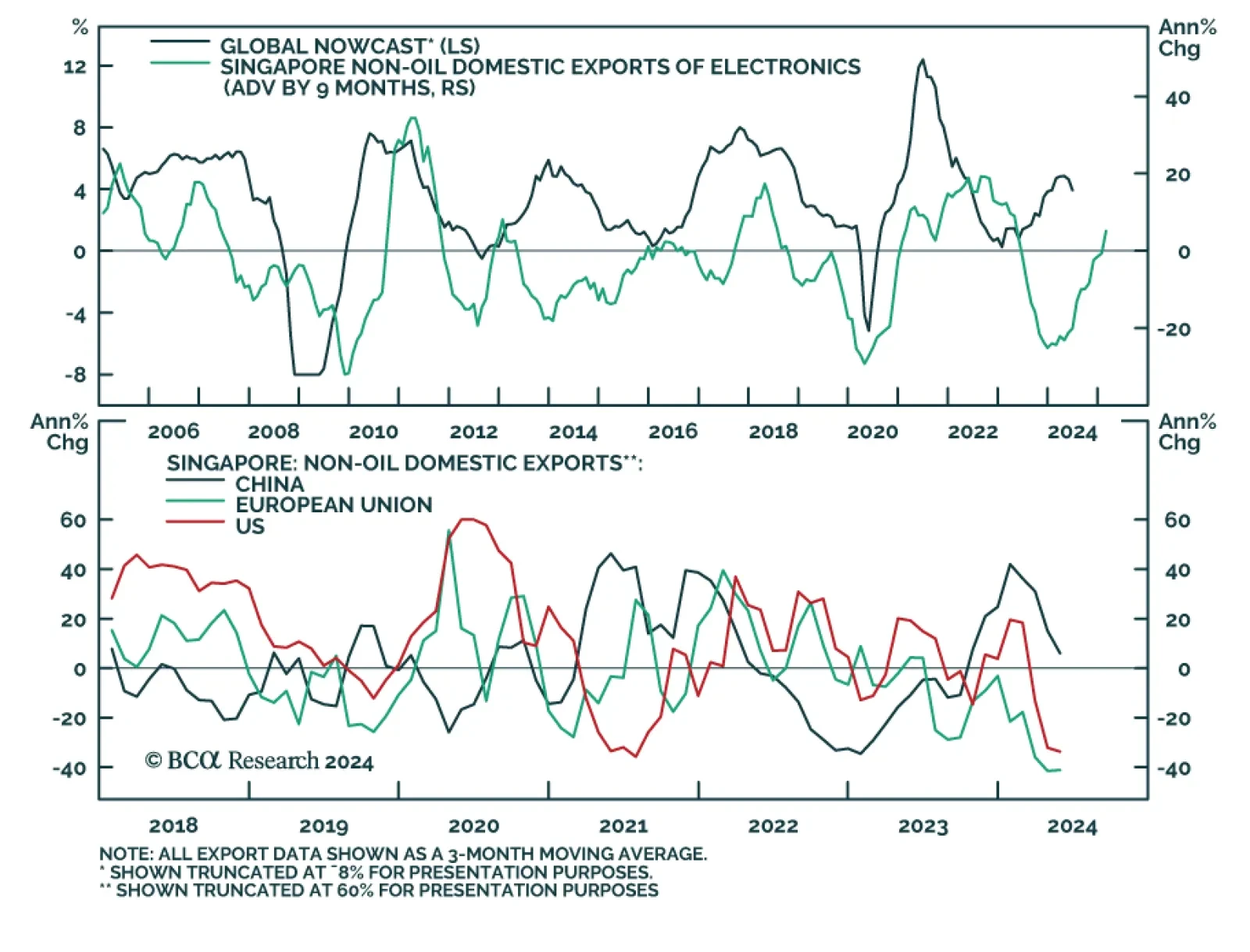

Singapore is a small open economy sensitive to global trade dynamics. Its non-oil exports (NODX) are thus a good bellwether for global growth conditions and they surprised to the upside in May. Notably, electronics exports, which…

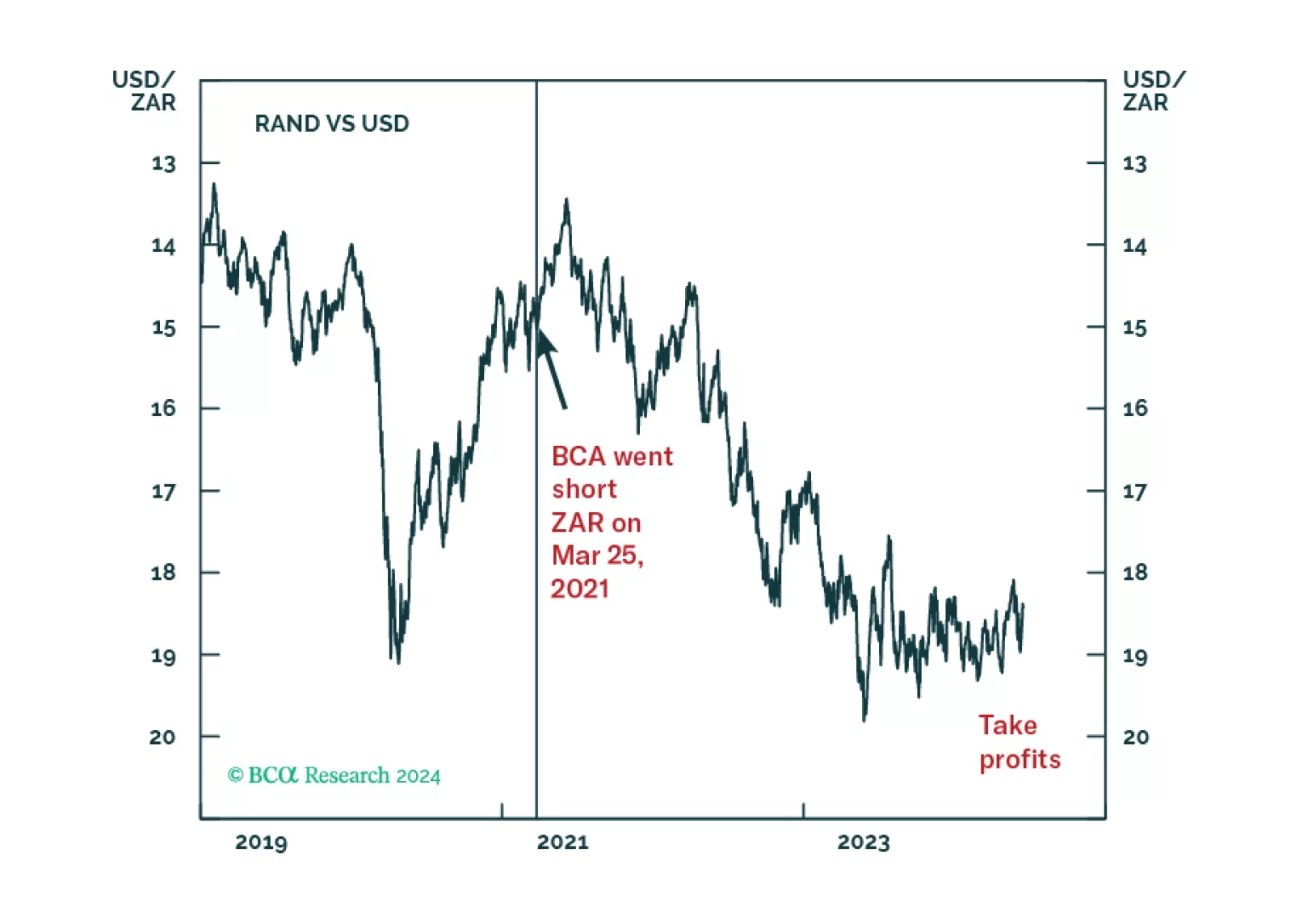

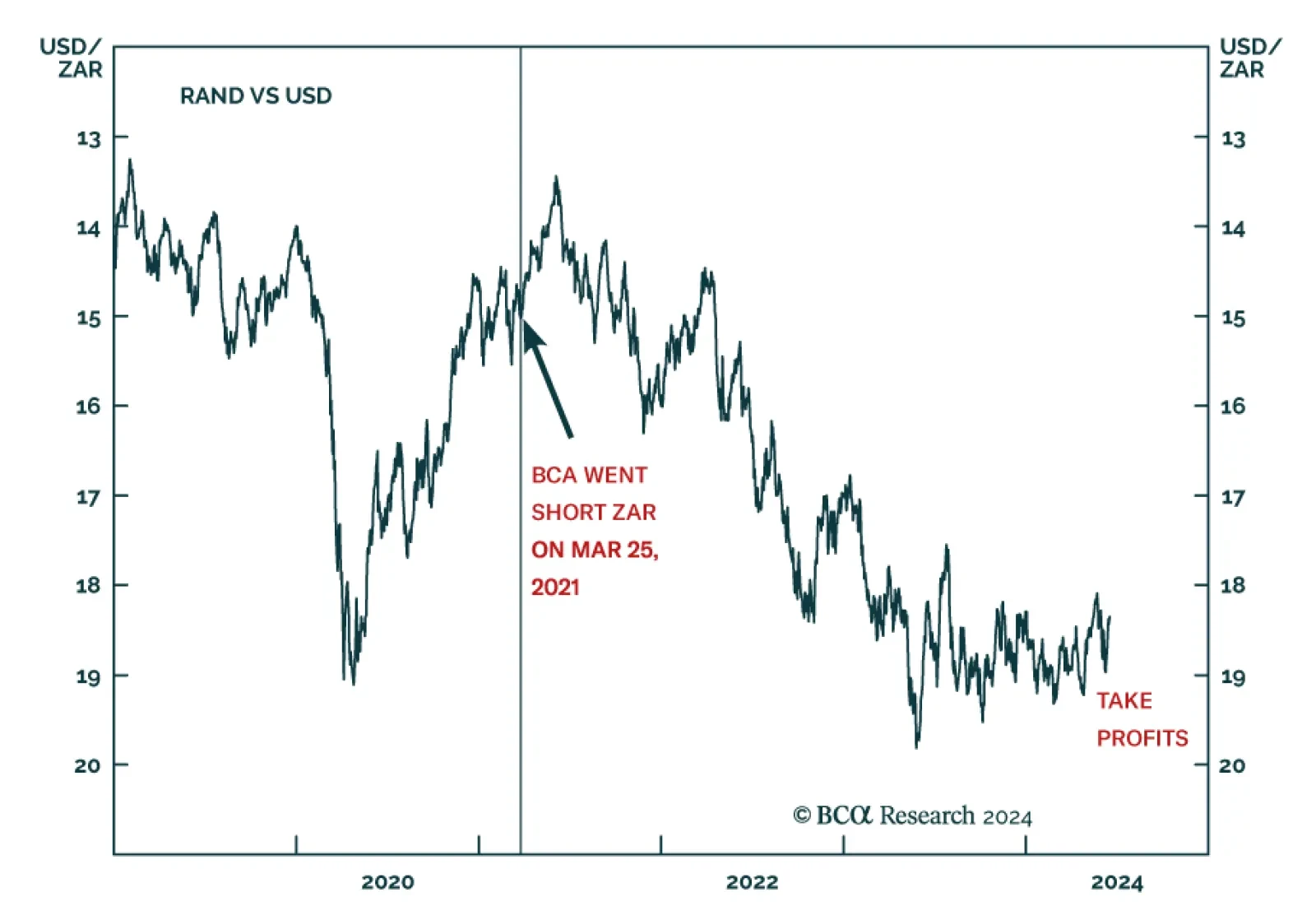

According to BCA Research’s Geopolitical Strategy service, the South African election presents a window of opportunity for productivity-boosting structural reforms, such as privatization, to coincide with monetary and…