As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

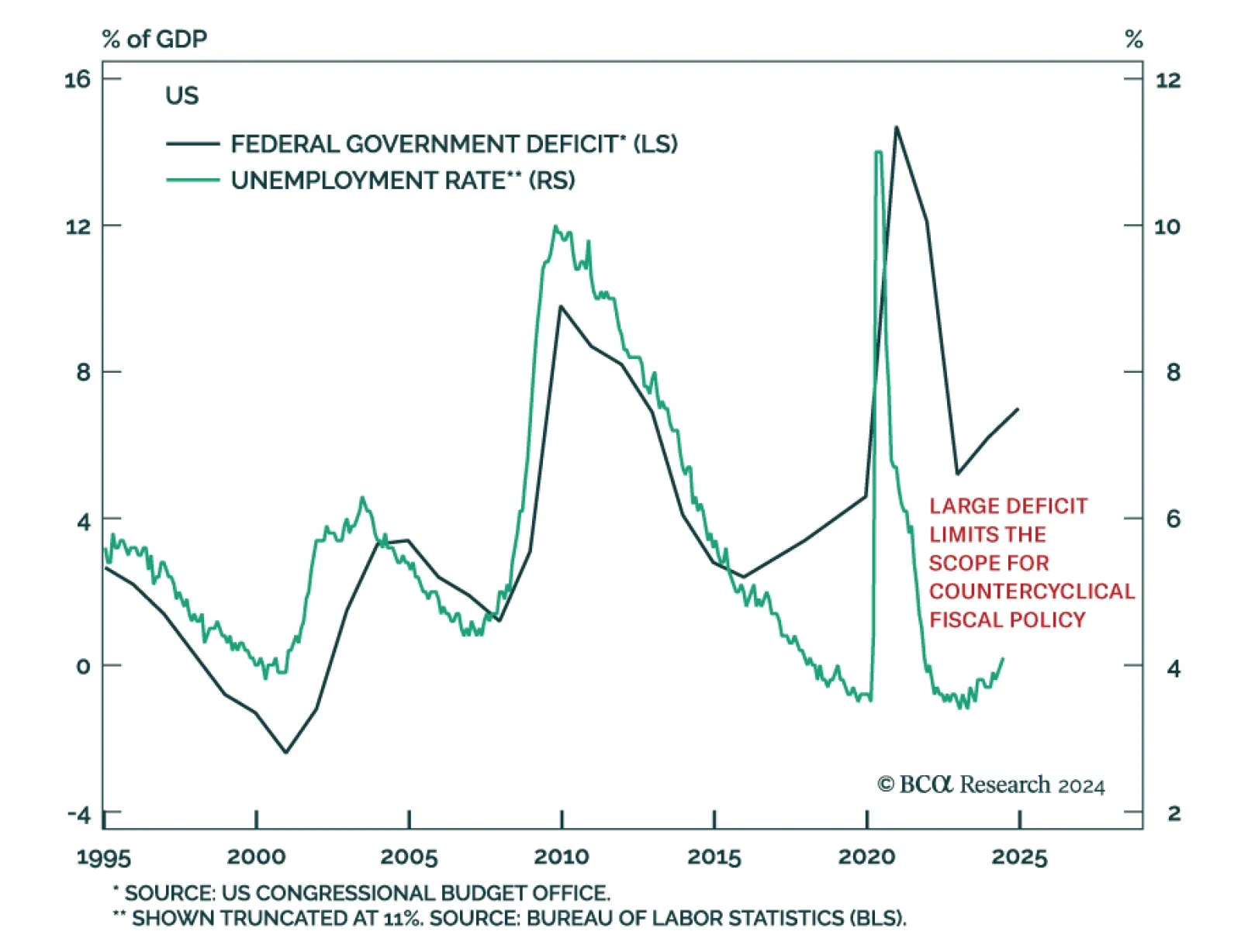

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

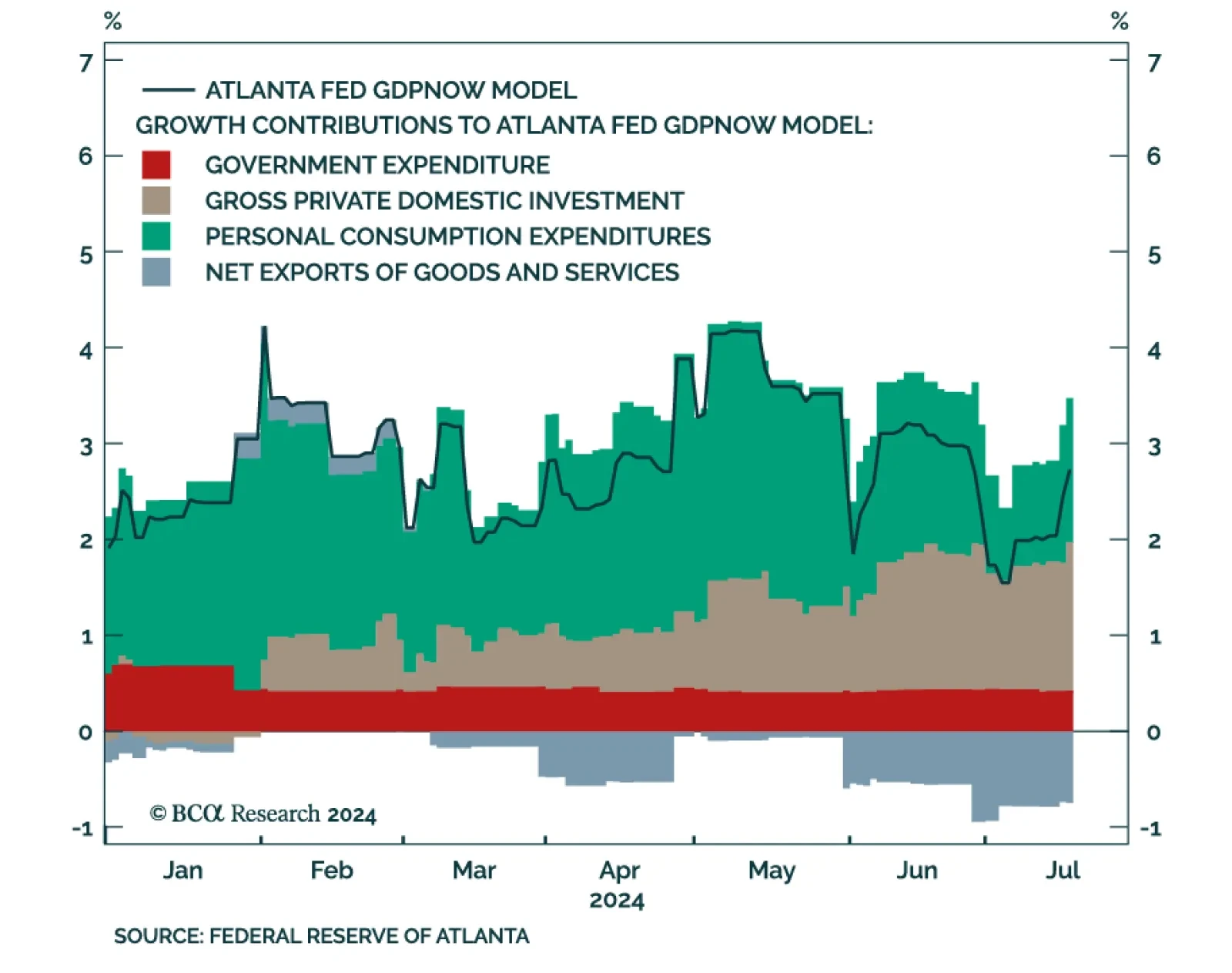

BCA Research has been writing extensively on how consumption fueled by excess savings has been propping up the US economy and prevented a recession in 2023. Now, many estimates of pandemic-era excess savings show that they have…

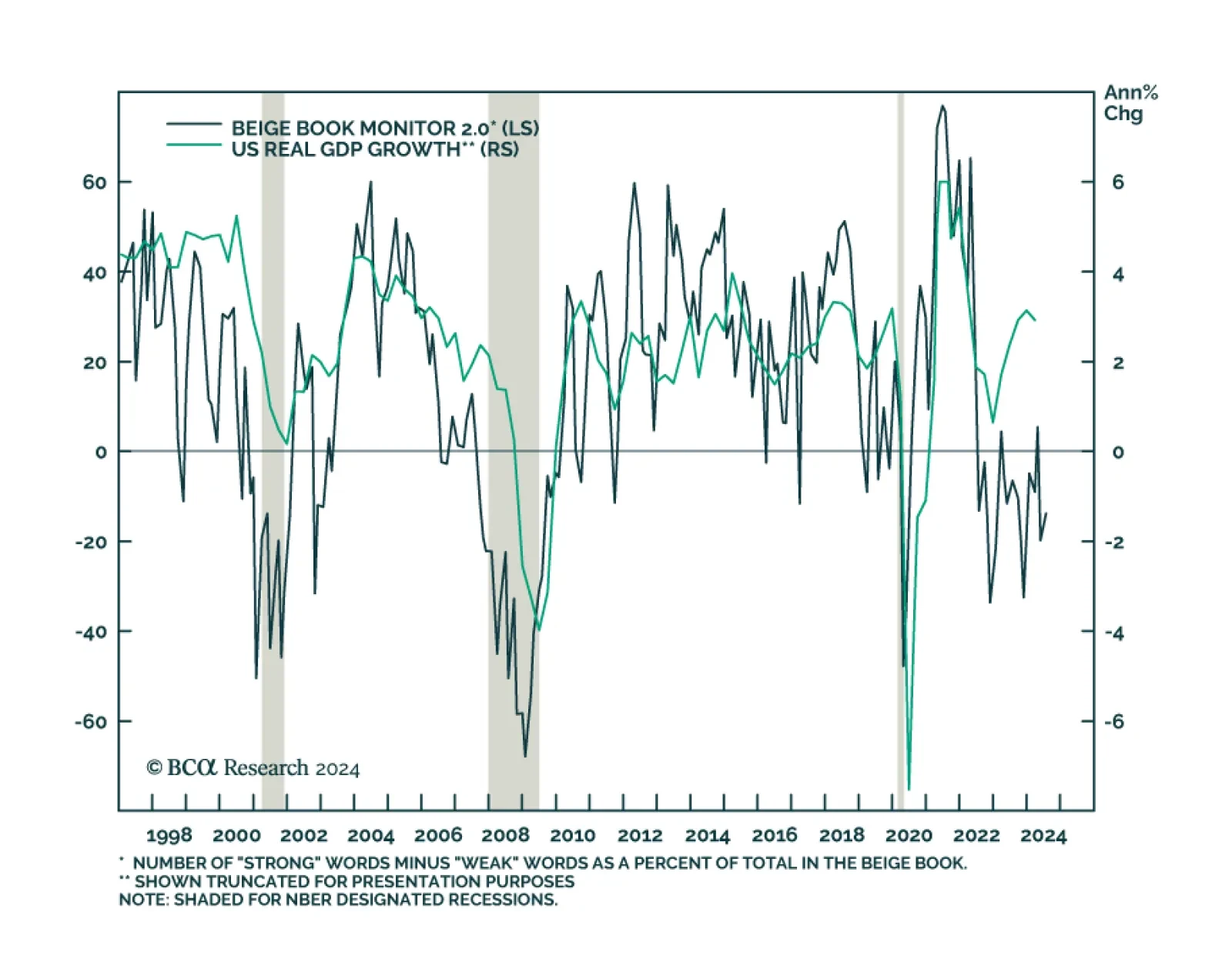

The latest iteration of the Fed’s Beige Book, a compilation of qualitative input sourced from business and other organizational contacts in each of its twelve Districts, was released Wednesday afternoon. The Beige Book…

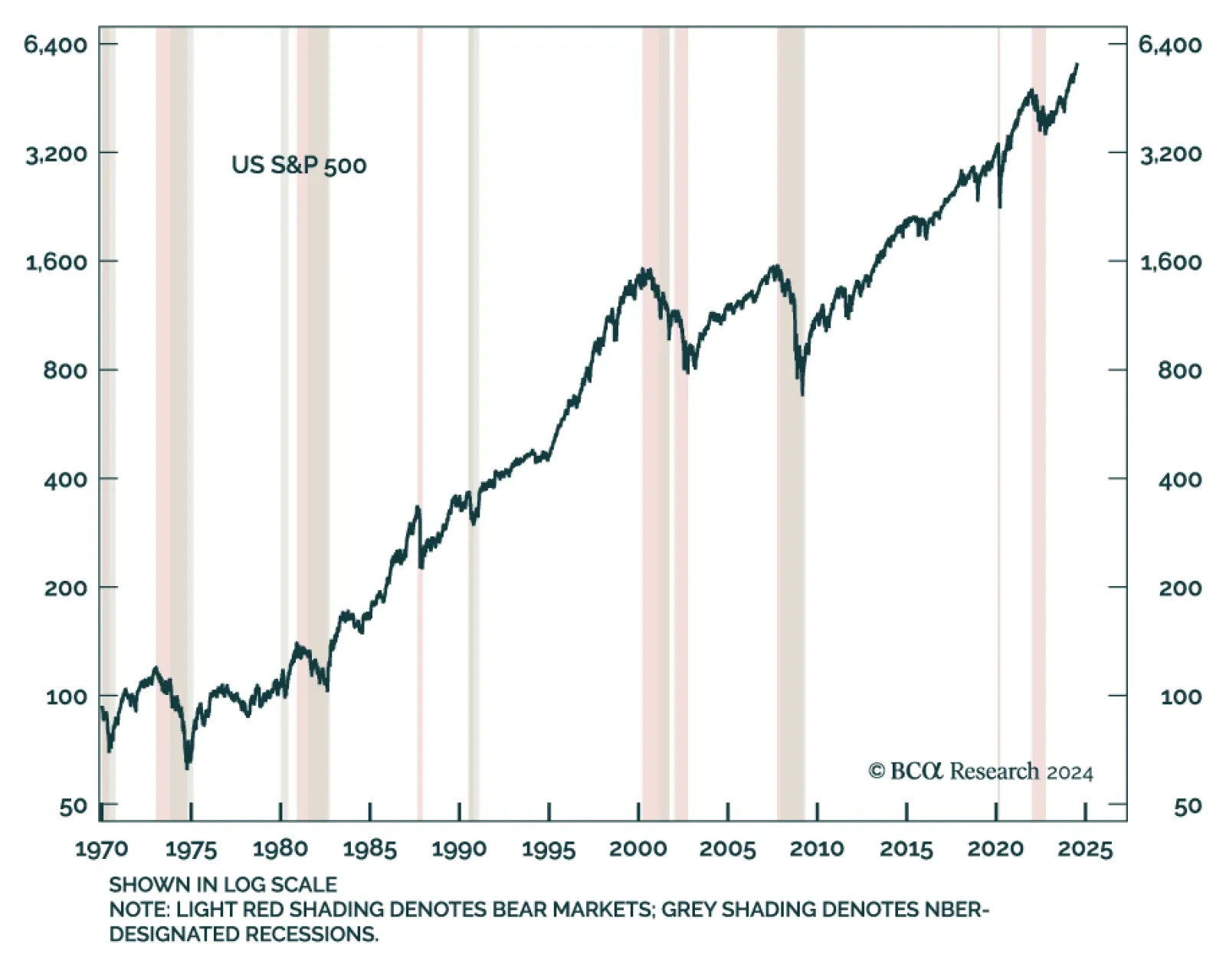

Way back in the 1970s and 1980s, before investment returns were assessed in relation to benchmarks and return of capital had the upper hand over return on capital, BCA researchers were invited to consider the following thought…

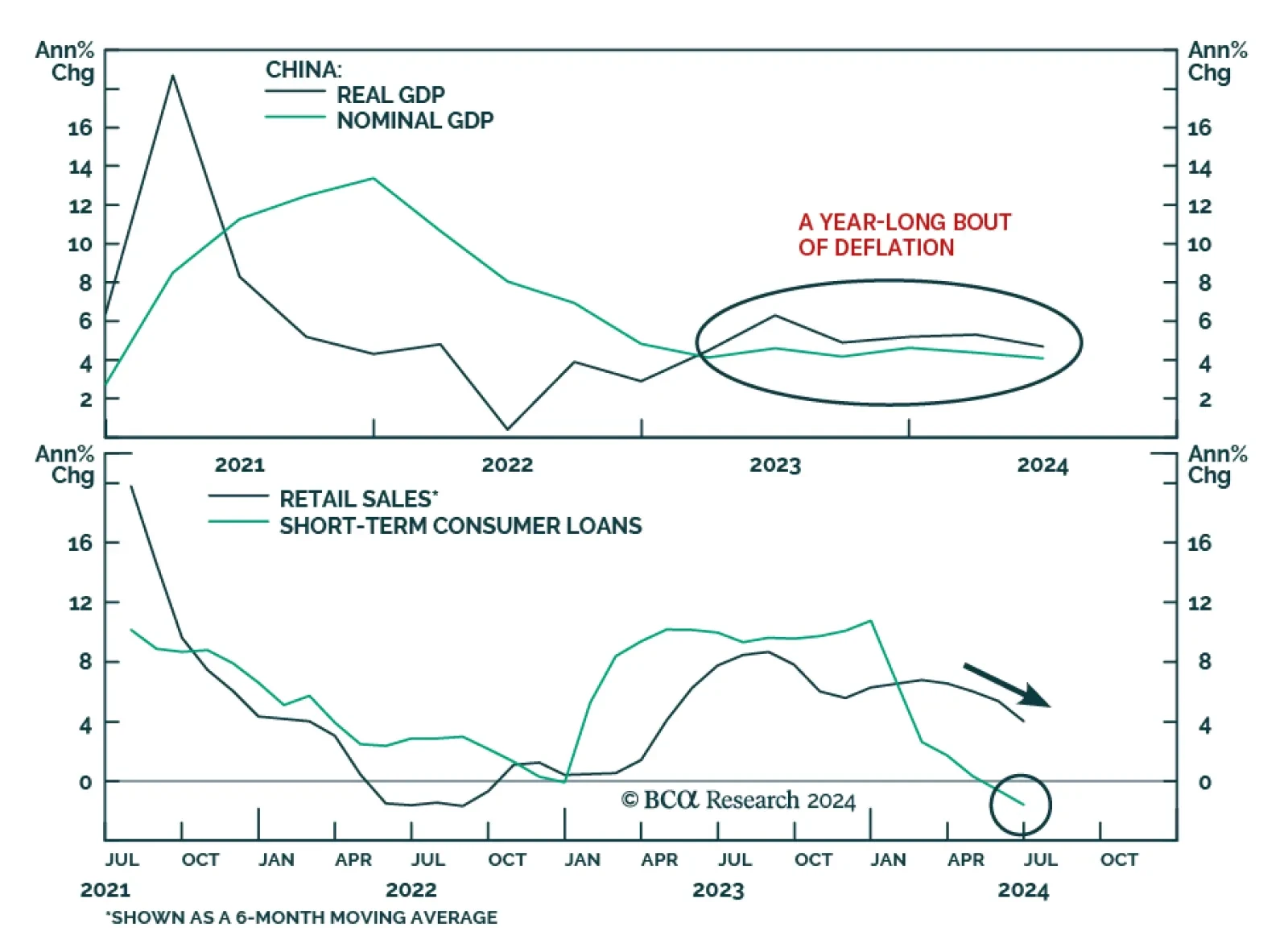

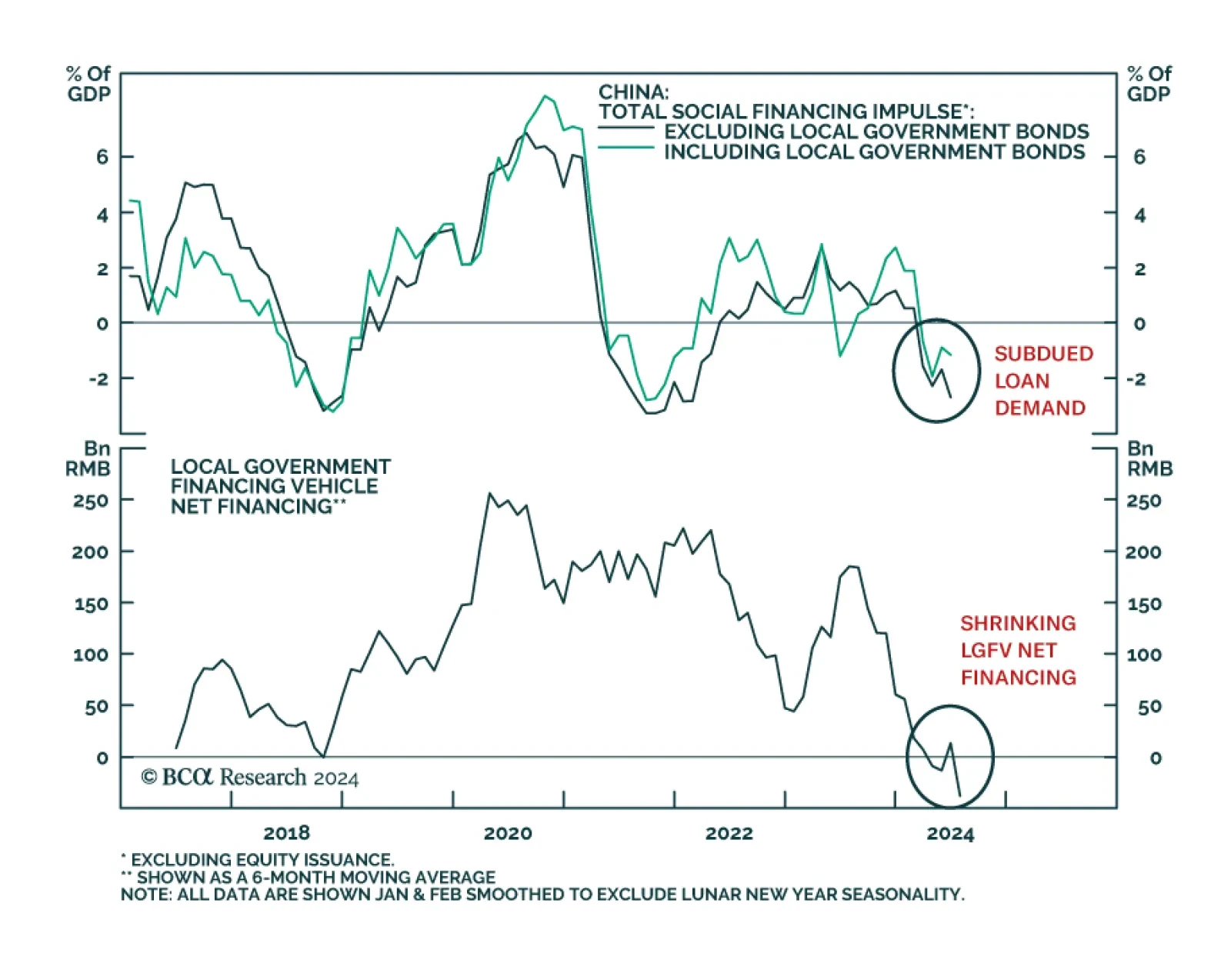

China's real GDP growth decelerated to 4.7% y/y in Q2, down from 5.3% in Q1 and below the consensus forecast of 5.1%. Domestic demand weakened, with retail sales growth sliding to 2% y/y in June, down from 3.7% in the…

GeoMacro’s monthly Beta Report will typically perform deep dives into the most pressing macro topics of the moment. For its debut, however, it turns the microscope on its own process, explaining the team’s framework…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

Subdued demand for credit among Chinese private-sector businesses and households persisted through June. The stock of outstanding bank loans grew by 8.3% year-on-year, marking the slowest pace since records began in 2003.…

According to BCA Research’s Global Investment Strategy service, investors are overstating the degree to which bond yields will rise under a Trump presidency. For one thing, the team expects the US to fall into recession…