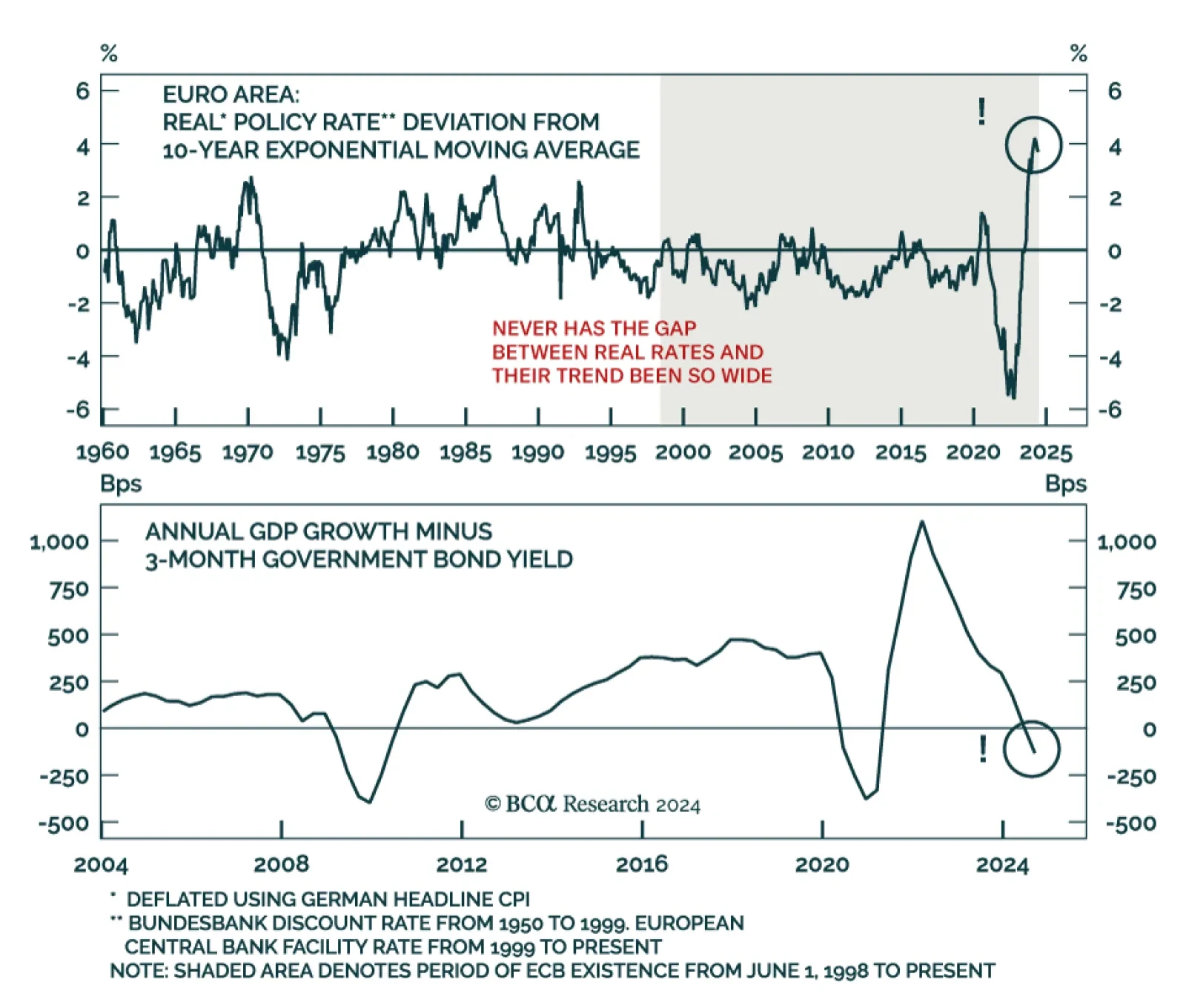

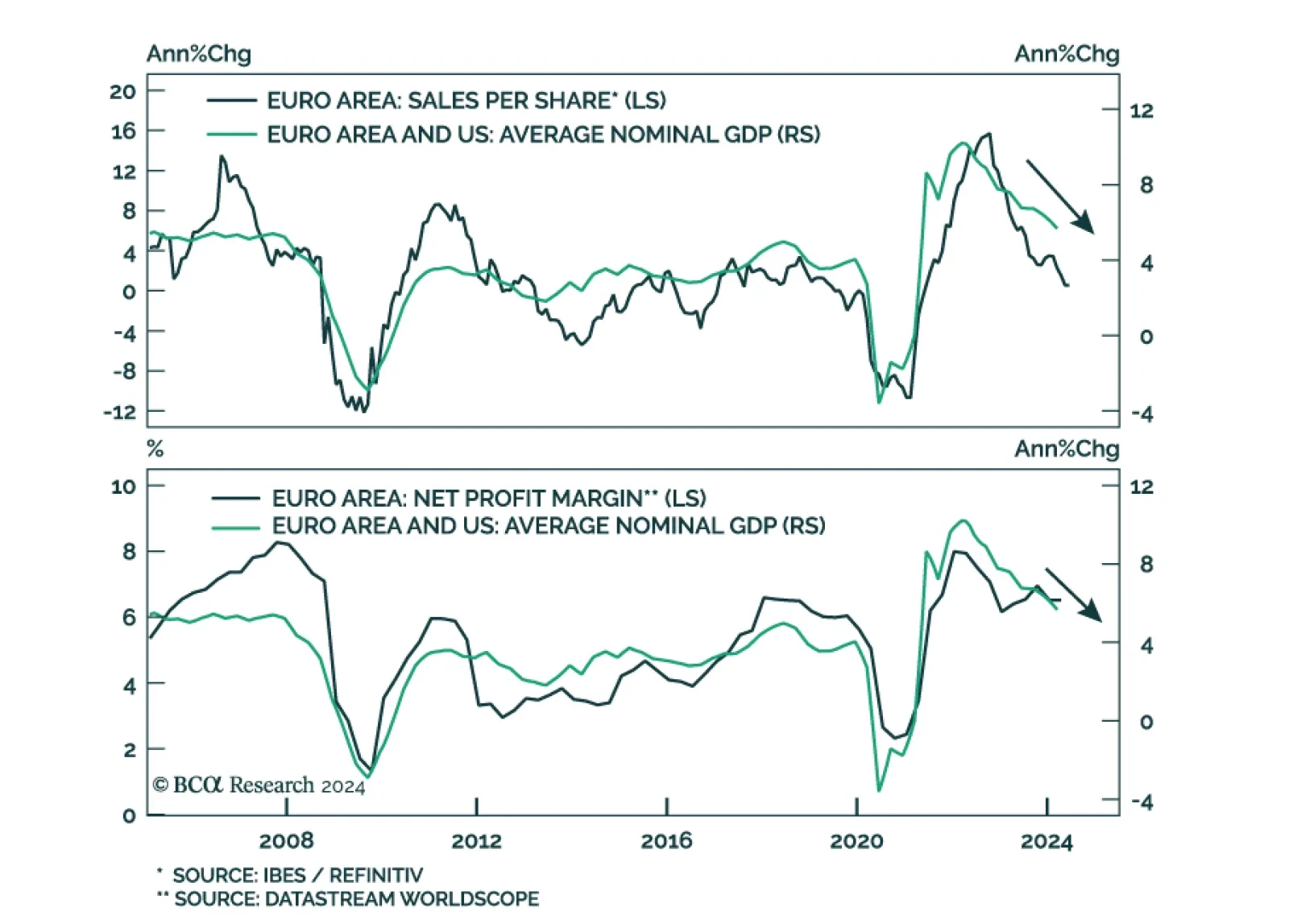

According to BCA Research’s European Investment Strategy service, a foreign shock is likely to tip the Eurozone economy into a recession because important vulnerabilities have emerged domestically. Policy is restrictive…

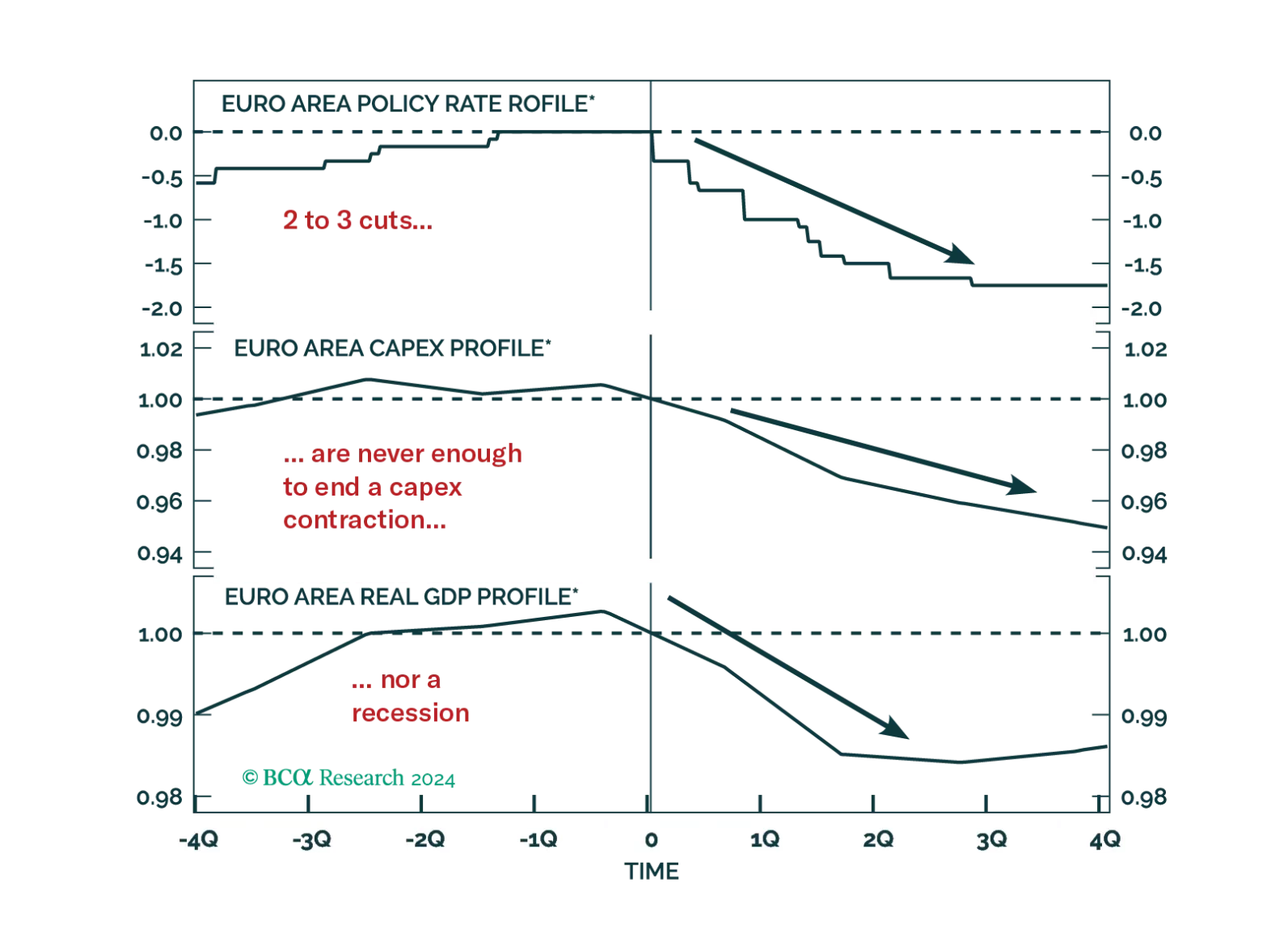

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

This report takes a look at bond and FX market technical indicators and calibrates the decision to increase portfolio duration and get long the US dollar.

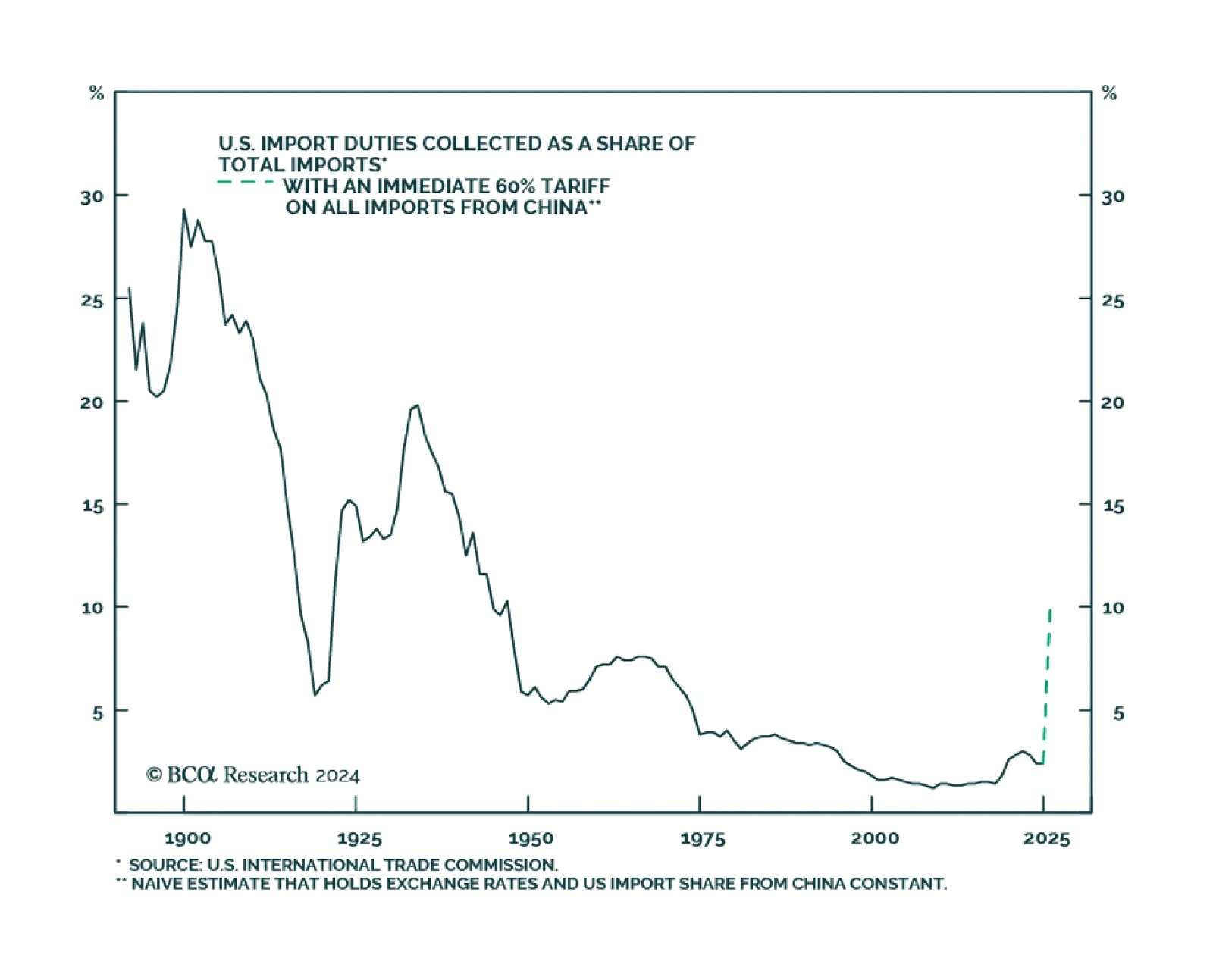

According to BCA Research’s Bank Credit Analyst service, trade policy under a second Trump presidency represents one of the greatest cyclical risks to investors. A key question for investors is whether tariffs are…

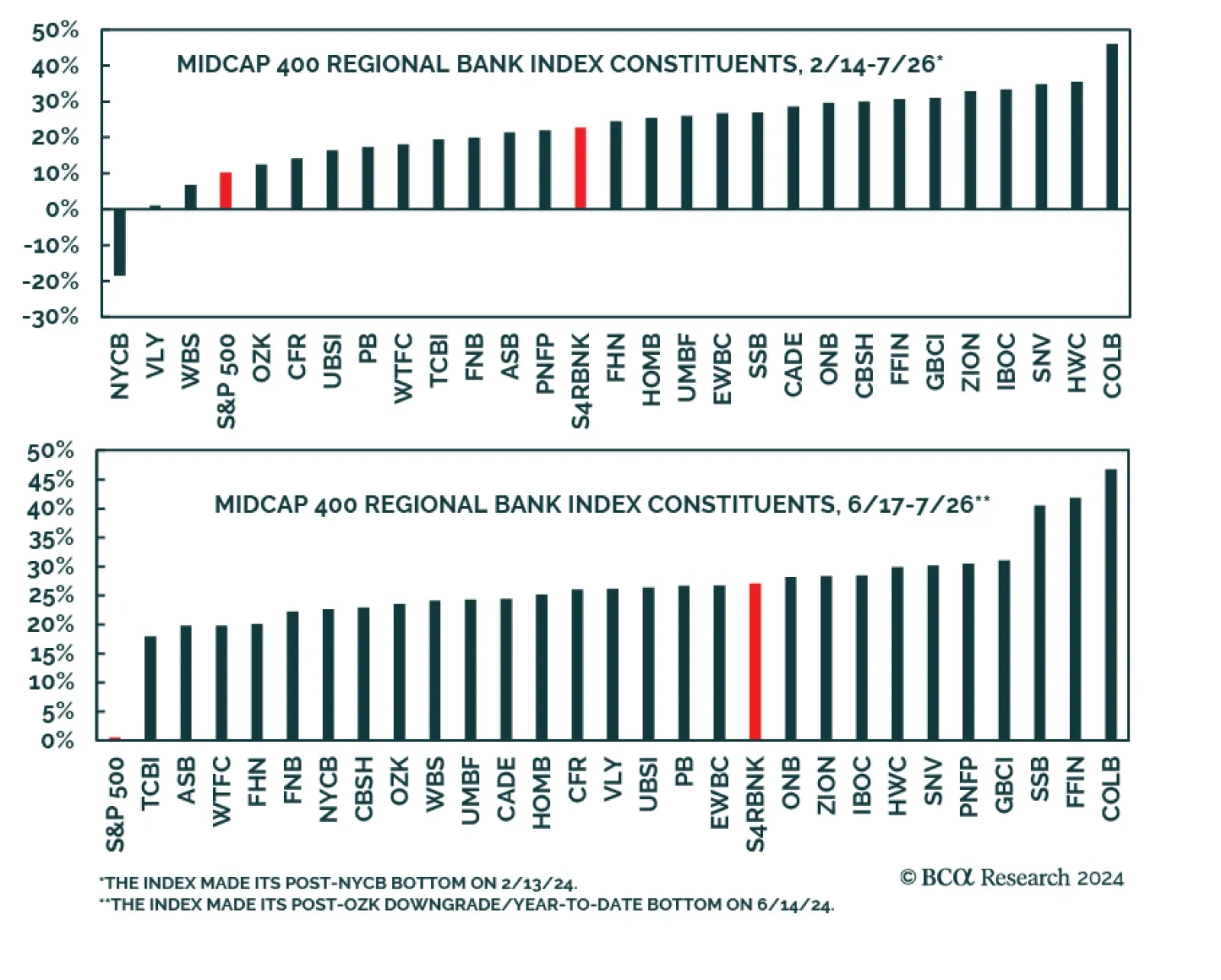

Equity investors have been skittish about mid-cap banks ever since Silicon Valley Bank failed in March 2023. The S&P MidCap 400 Regional Banks Index remains 4% below its February 2023 high while the S&P 500 Diversified…

We assign high odds that the US will tip into a recession by year-end or early 2025. Given it has been the largest driver of global demand in this cycle, a US recession will morph into a global downturn. The procyclical…

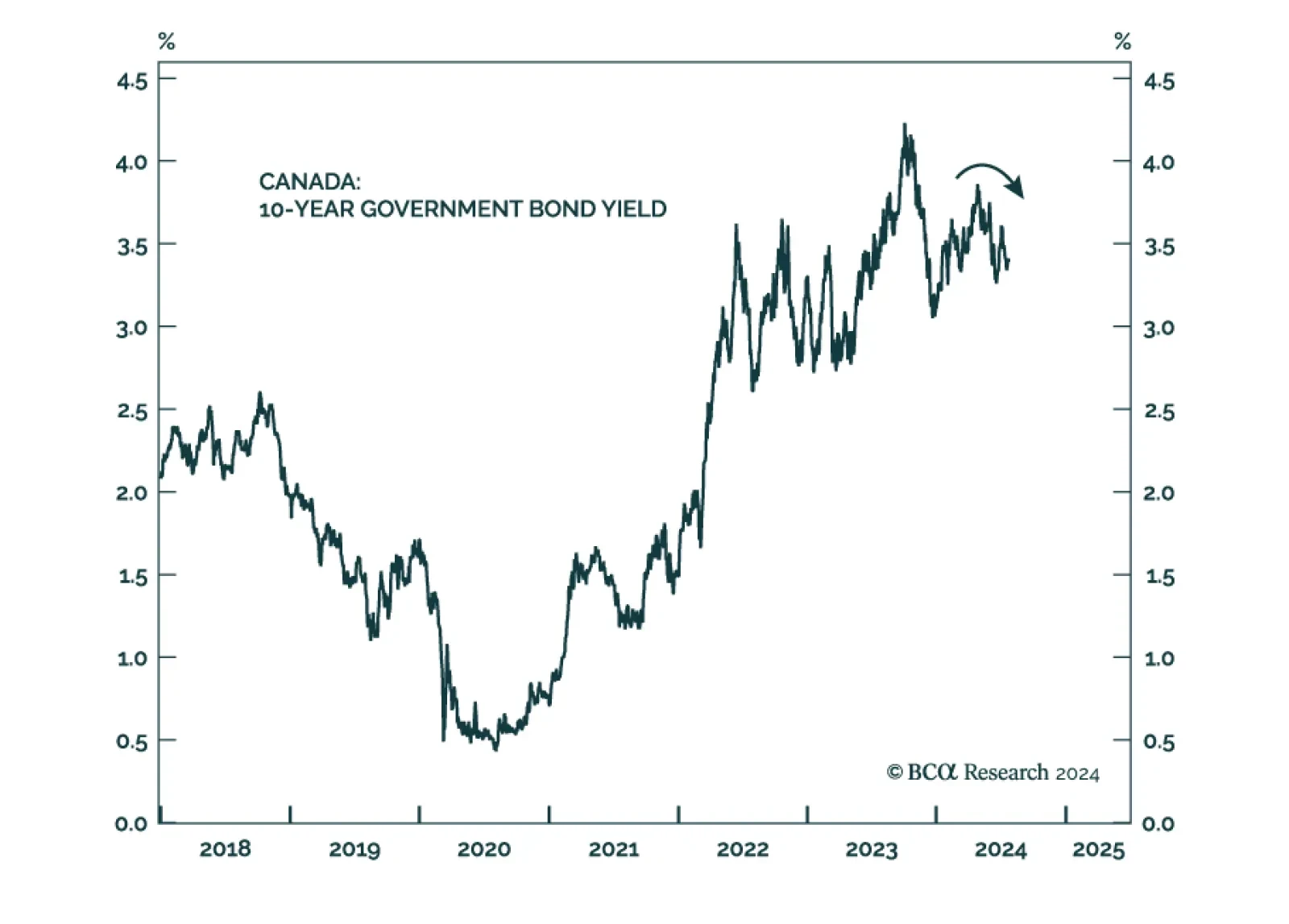

The Bank of Canada (BoC) reduced its policy rate by 25bps for the second meeting in a row on Wednesday. We highlighted in a recent Insight that the soft June inflation print and weakening labor market increased the odds of more…

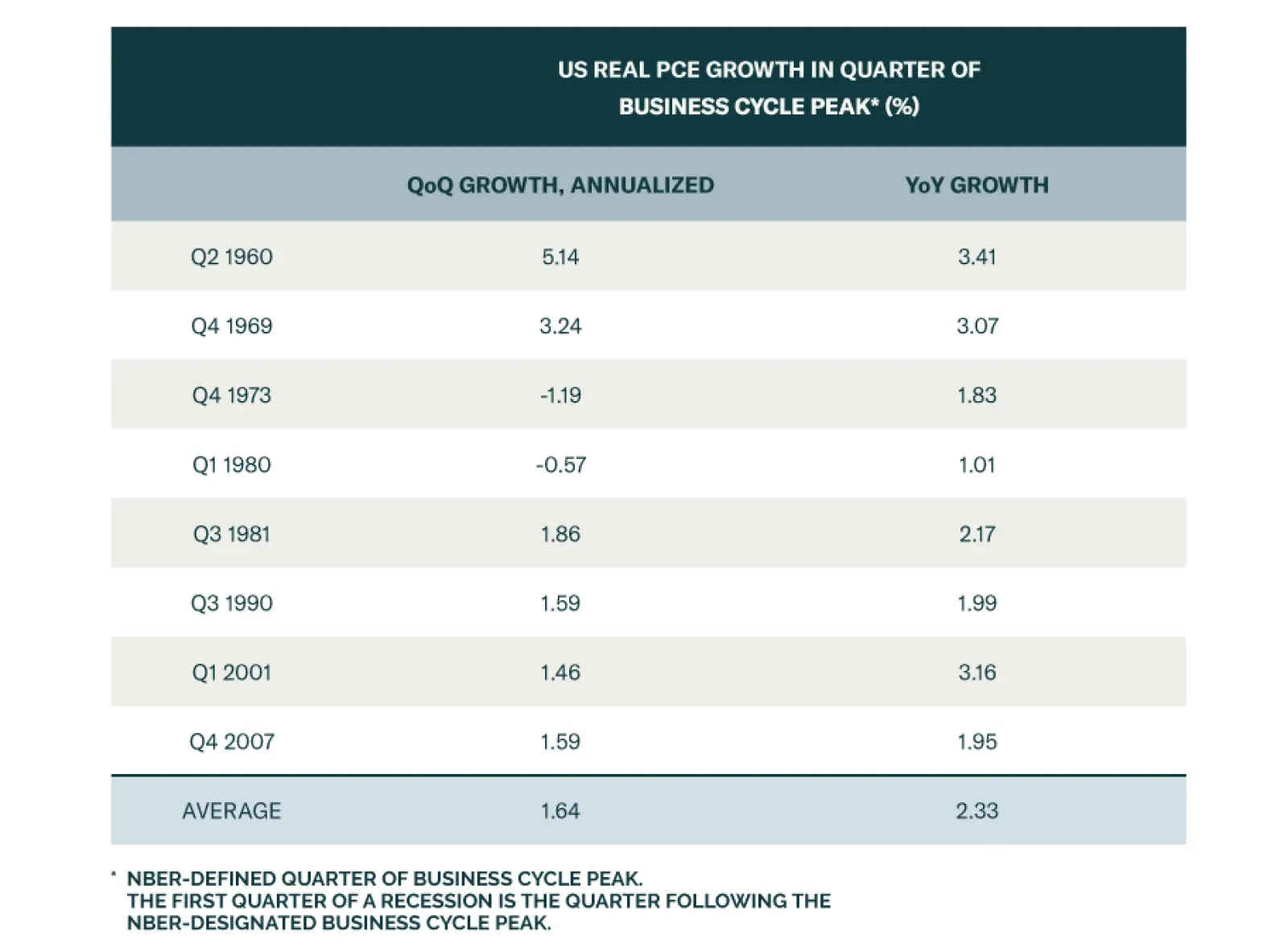

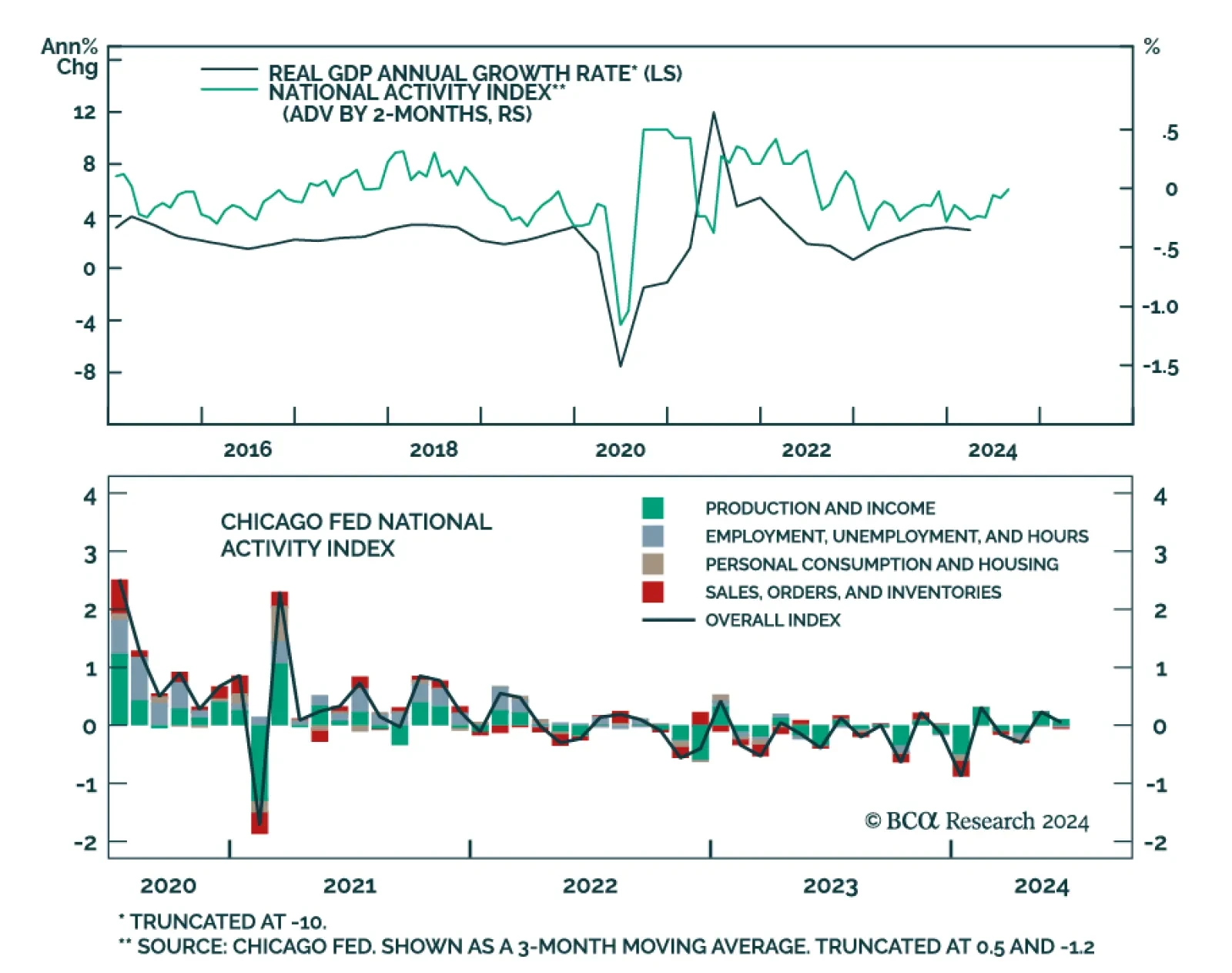

The US economy has clearly cooled from its above-trend pace of growth in 2023. The consensus view among BCA Research’s strategists project that this deceleration will eventually culminate in a recession by year-end or early…

The Chicago Fed National Activity Index (CFNAI) – a summary statistic of US economic data releases – decreased to 0.05 from 0.23, suggesting that the US economy cooled in June. Although the headline index surpassed…