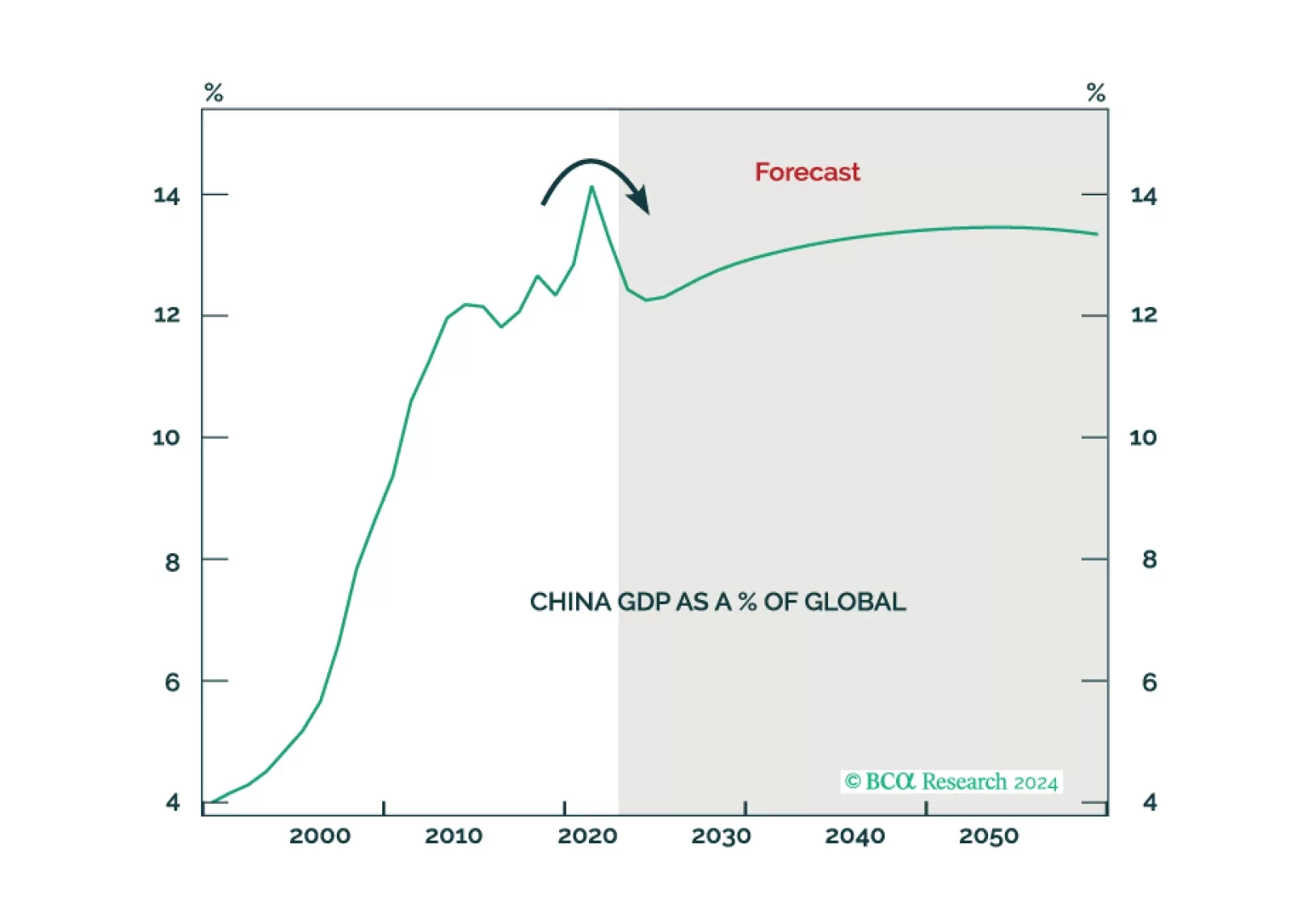

"There's no supply chain in the world that's more critical to us than China." — Tim Cook, CEO of Apple, March 2024 According to BCA Research’s China Investment Strategy and Emerging Market…

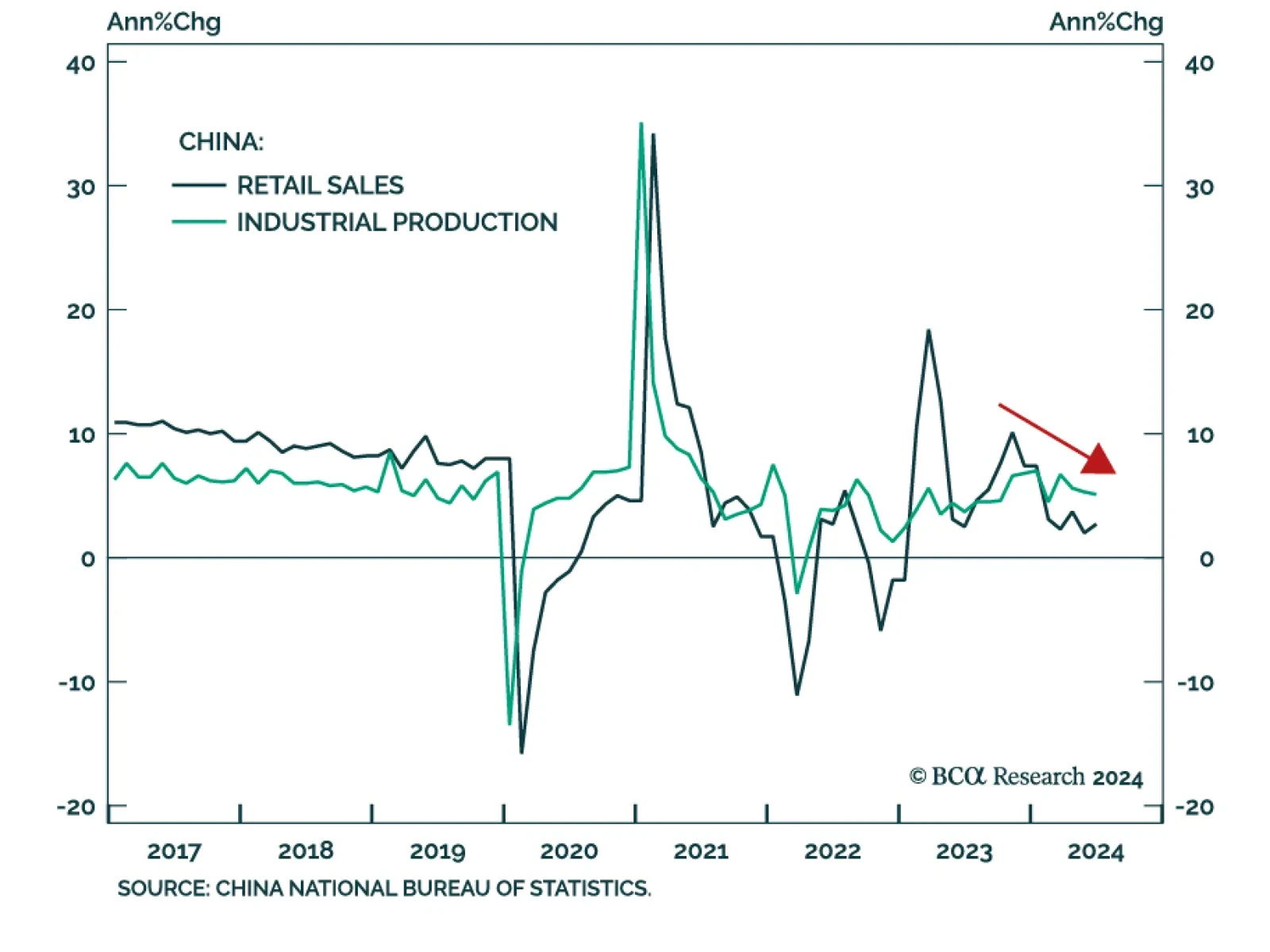

China’s economic malaise extended through the month of July. The contraction in property investment worsened (-10.2% YTD y/y) and disappointed expectations of a slower pace of decline. Residential property sales remained…

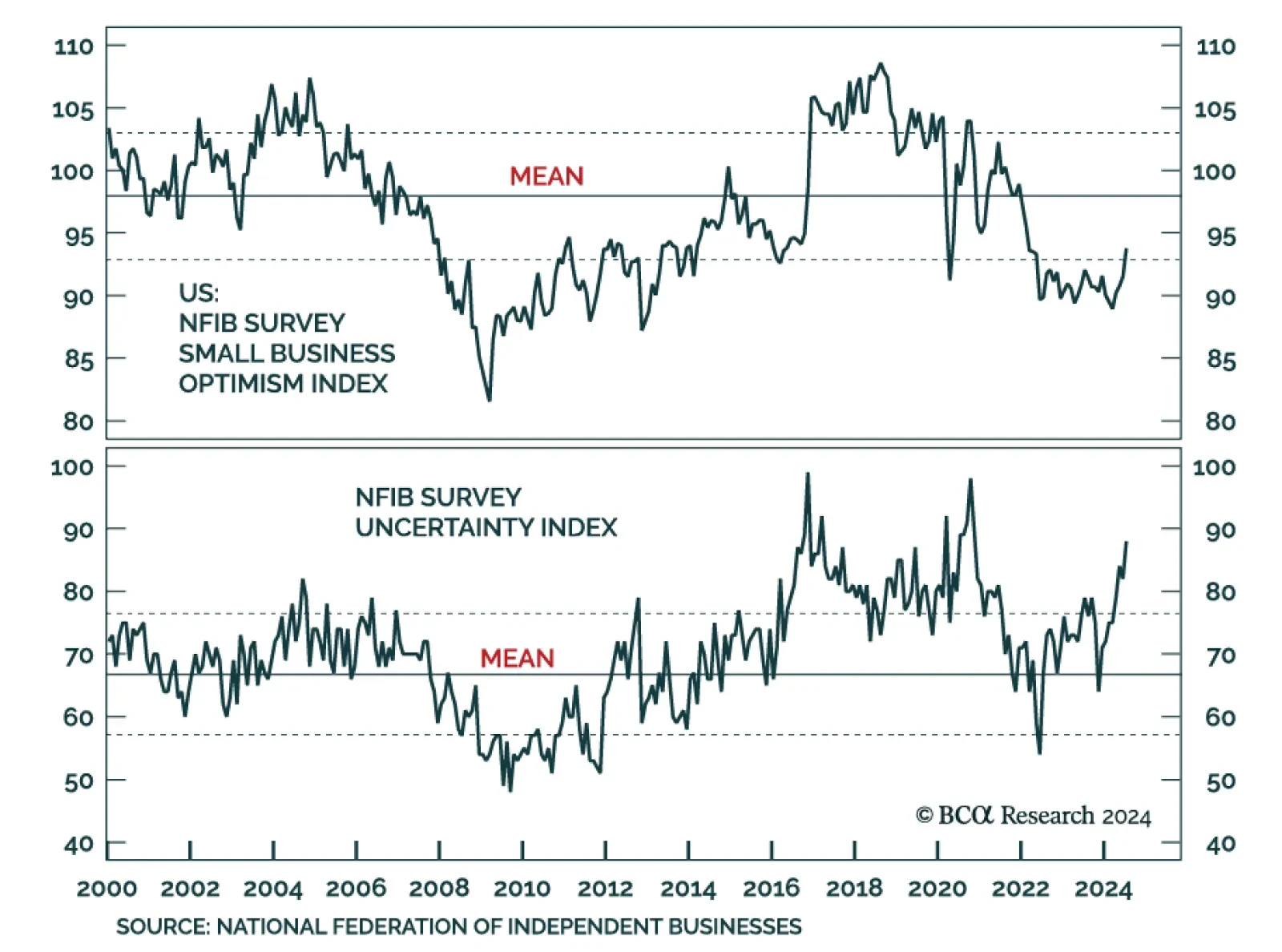

Tuesday morning’s NFIB Small Business Survey release surprised to the upside. The Small Business Optimism Index increased to 93.7 from 91.5, above expectations of remaining flat. The July reading was the highest since…

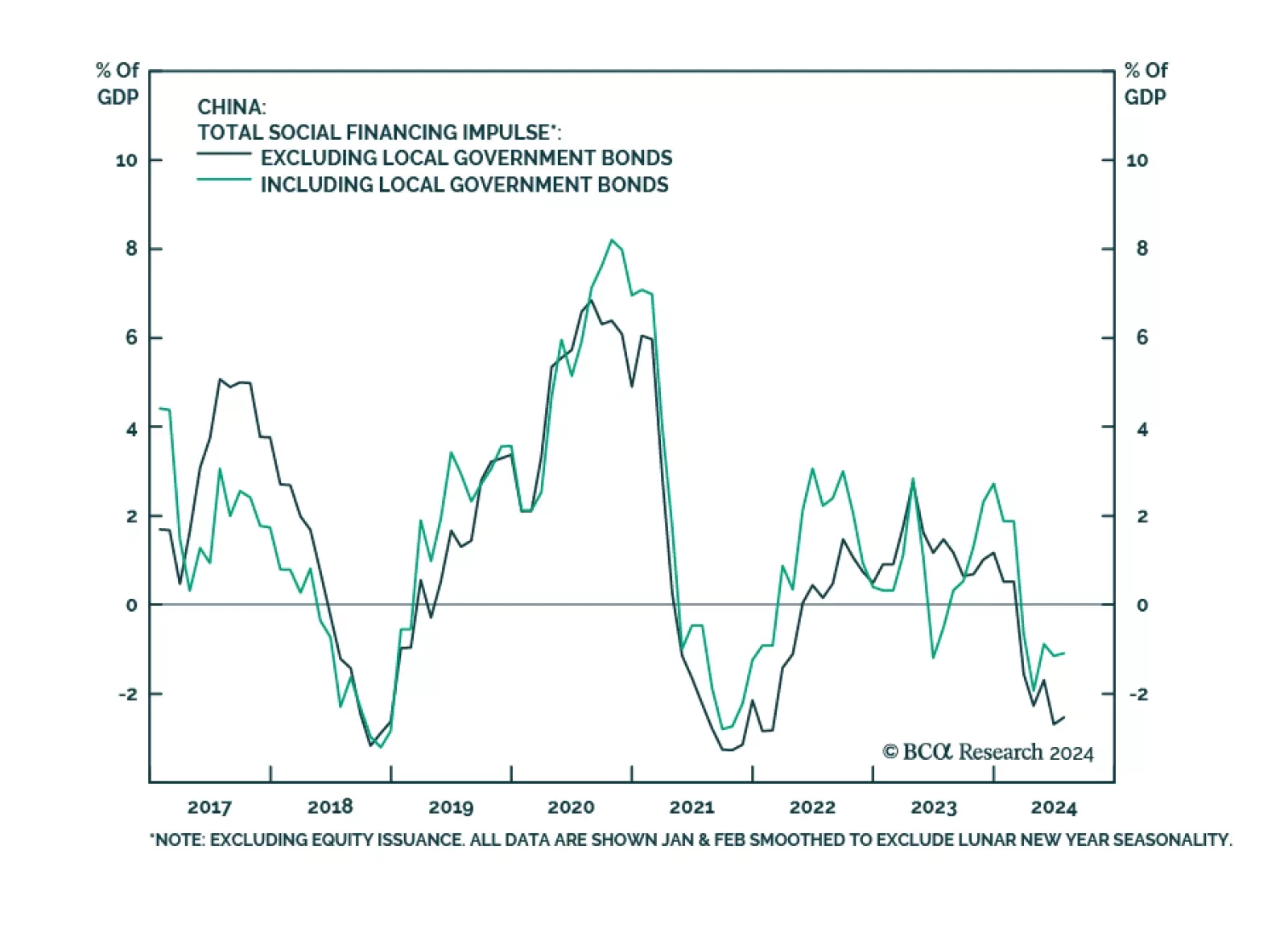

Subdued demand for credit among Chinese private-sector businesses and households persisted through July. Aggregate financing missed expectations, growing CNY 0.8bn to CNY 18.9bn in July on a YTD basis. New loans grew CNY 0.2bn…

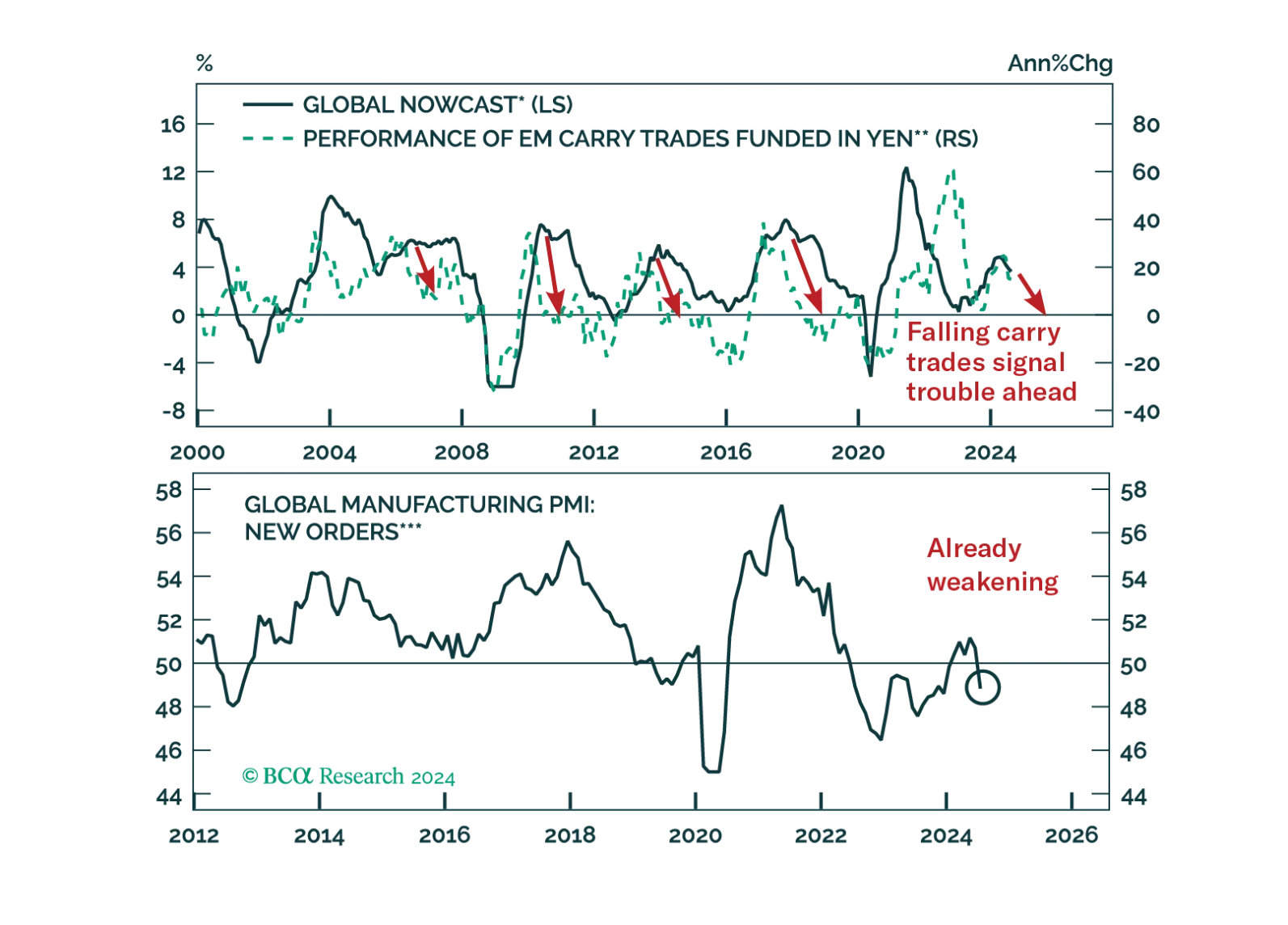

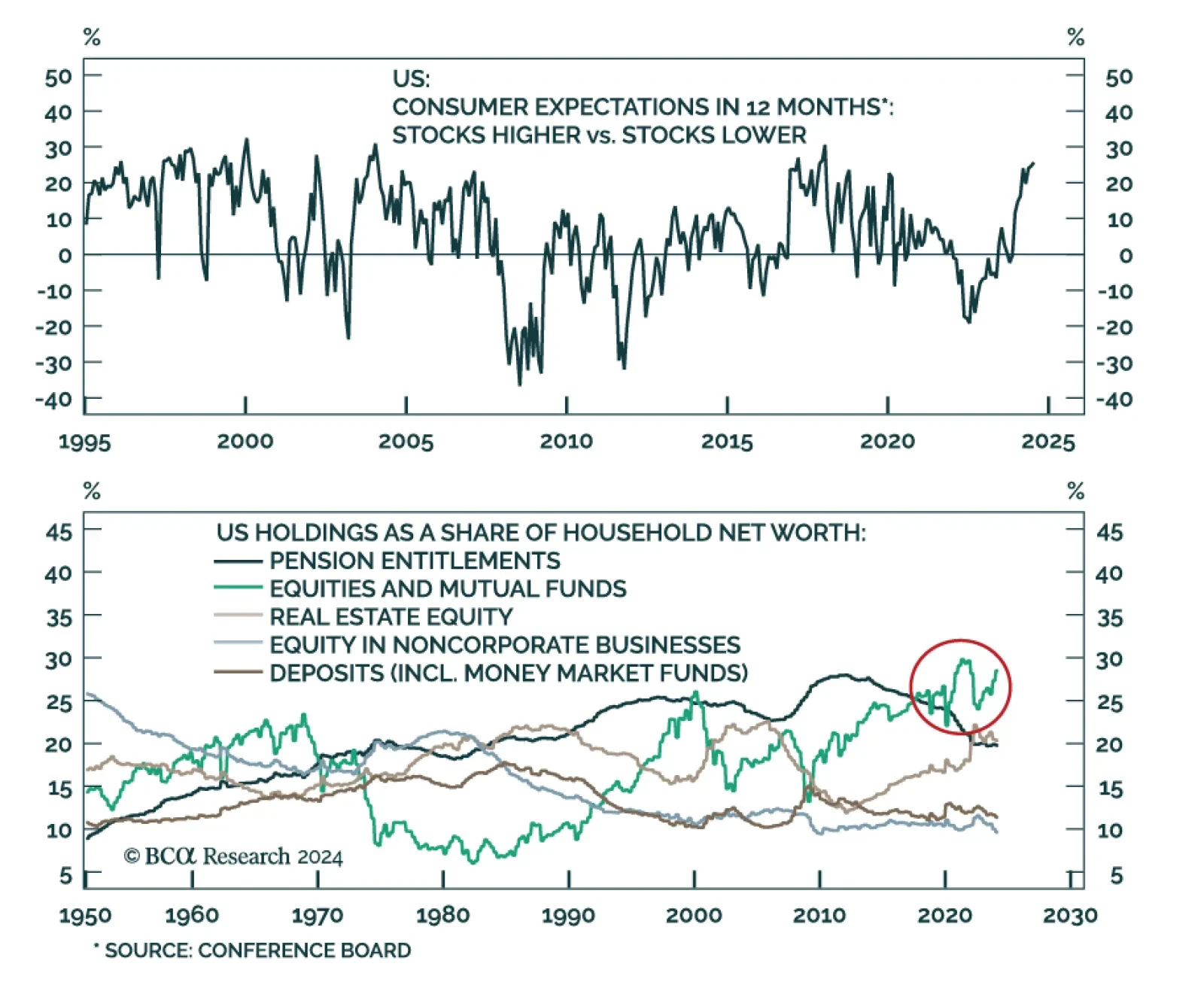

Regular readers are familiar with our expectation that the stabilization in global growth this year will be fleeting. The US has been the main source of demand in this cycle. We view the latest string of US employment data as…

The unwind of yen carry trades caused violent tremors across the globe. Was this shock a one-off event or the prelude to more troubles?

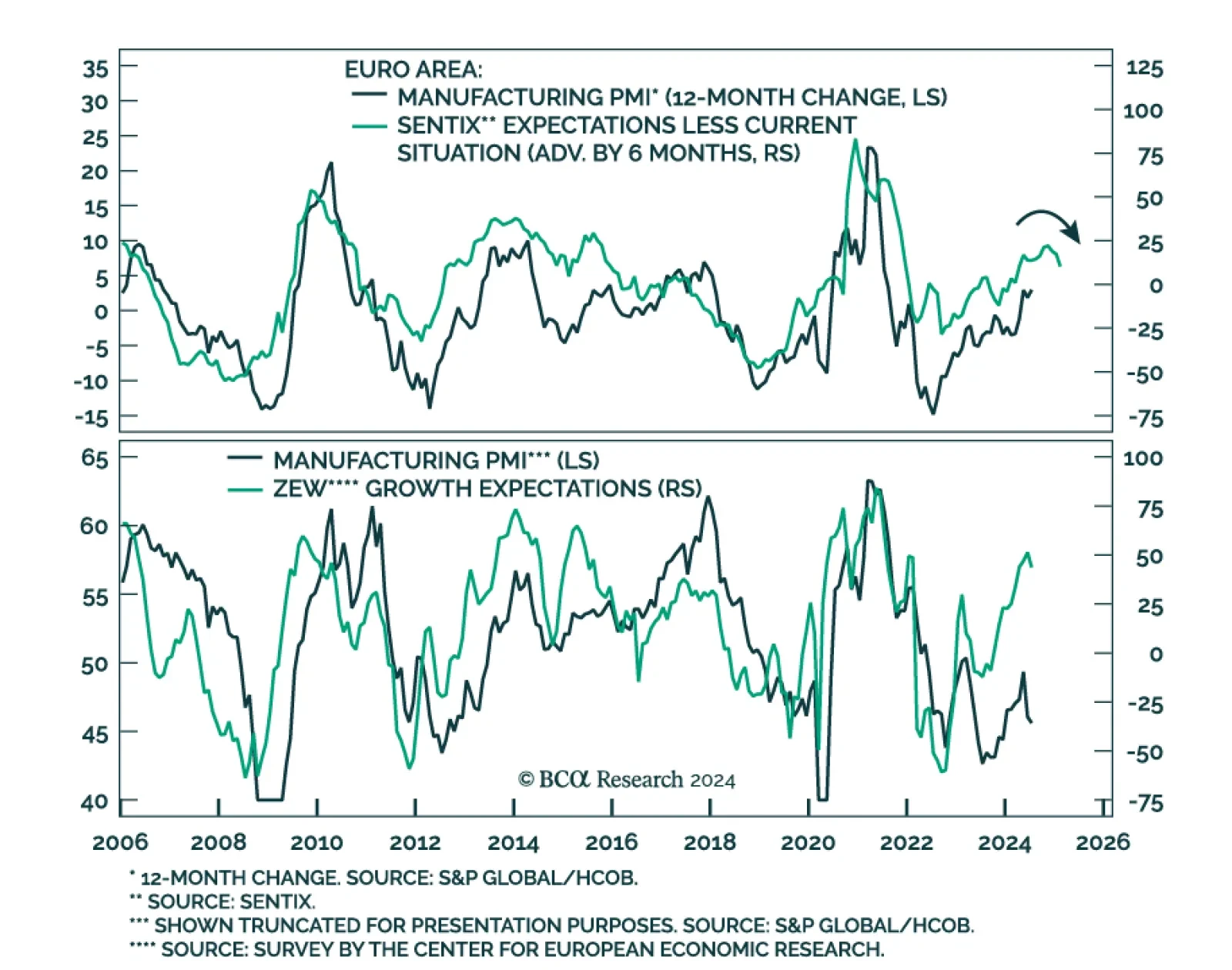

After briefly breaking a 27-month streak of negative sentiment back in June, the Eurozone Sentix Economic index disappointed in August. The overall index worsened from July’s negative reading to -13.9, below expectations…

The latest Conference Board measure of consumer confidence suggested that consumers were increasingly downbeat about current economic conditions. Notably, their fading optimism about labor market conditions drove the jobs-…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.