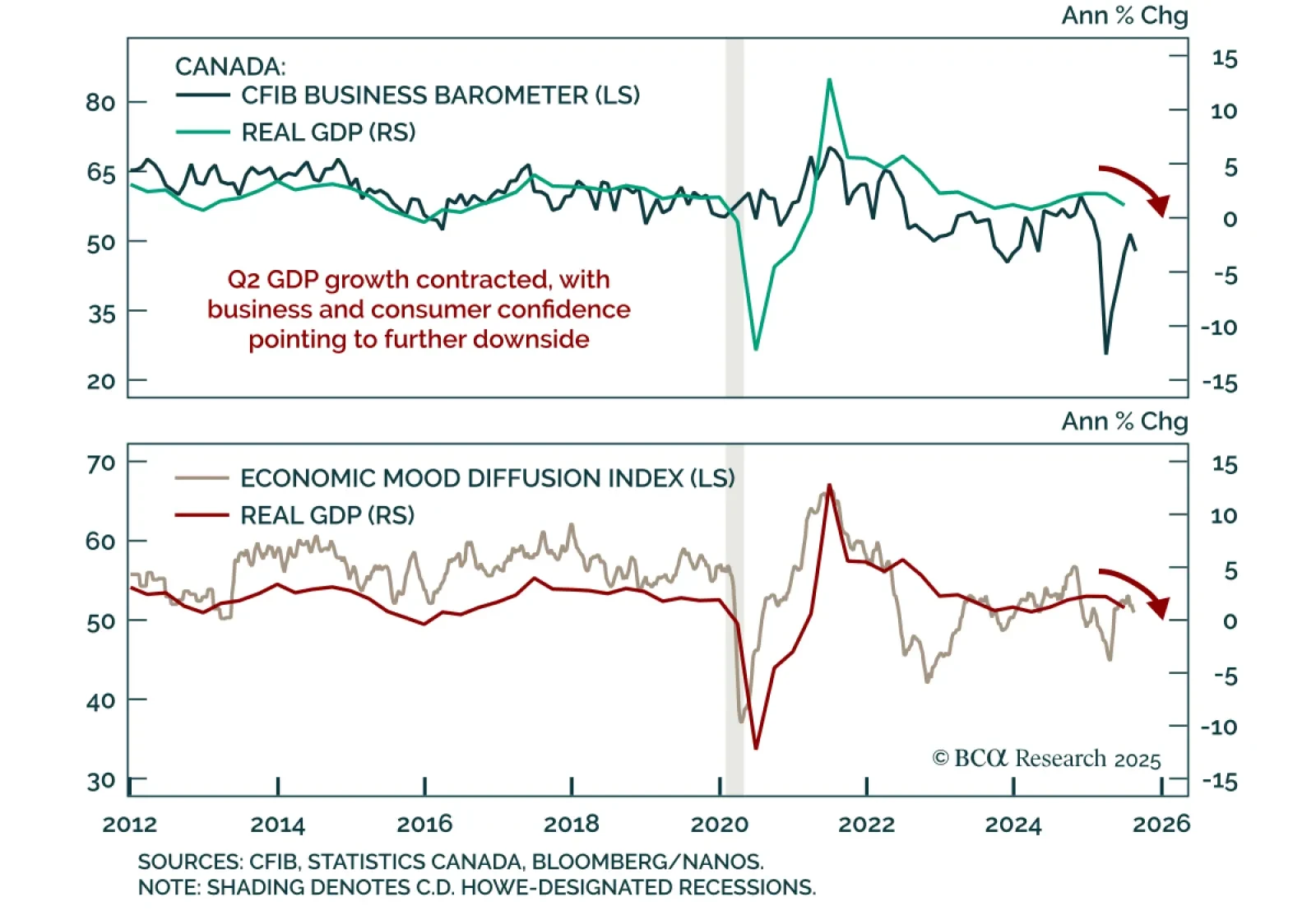

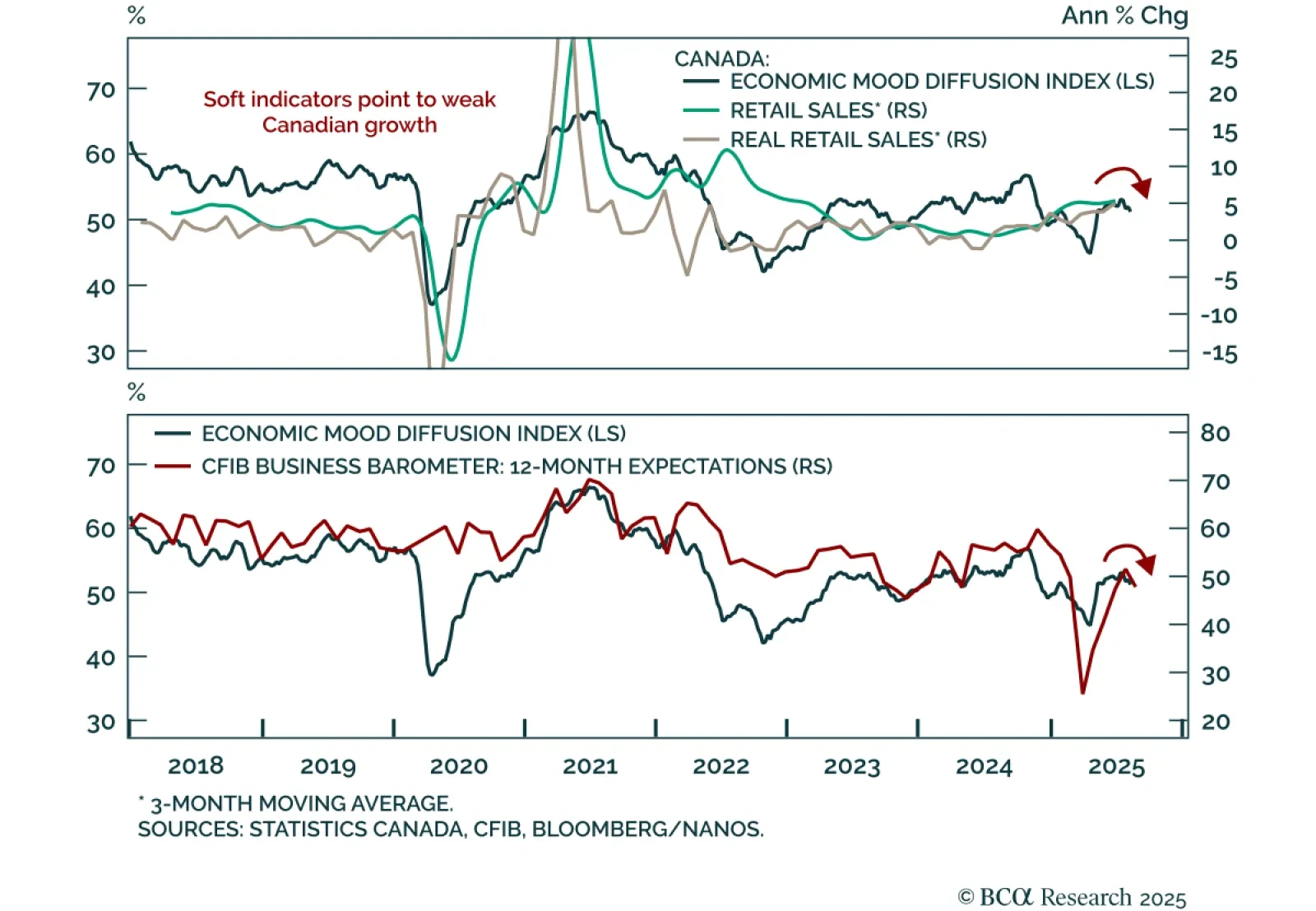

Canada’s Q2 GDP contraction underscores a fragile backdrop where growth risks will outweigh inflation, supporting further BoC easing. Real GDP contracted at an annualized 1.6% after expanding 2.2% in Q1, consistent with survey data…

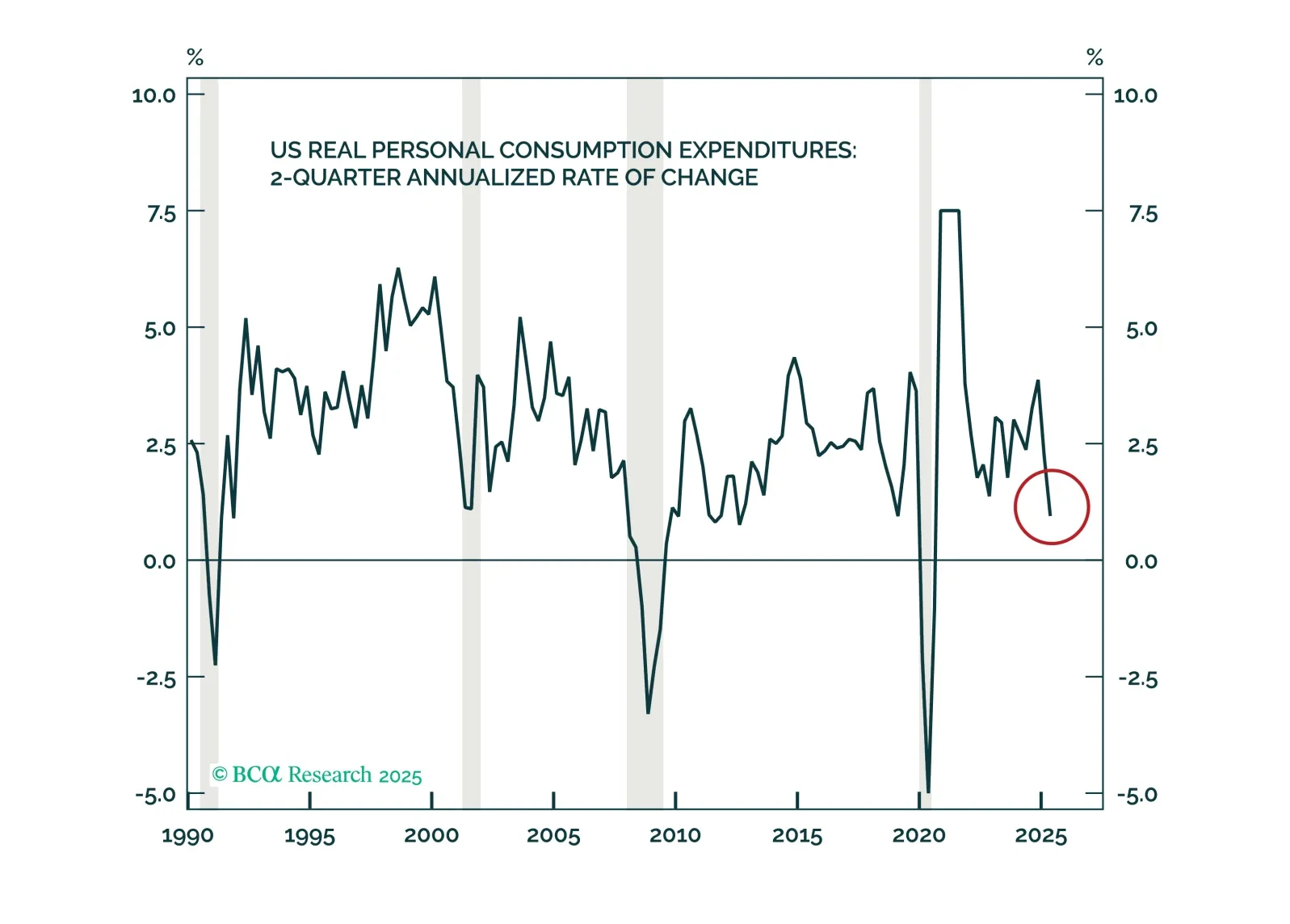

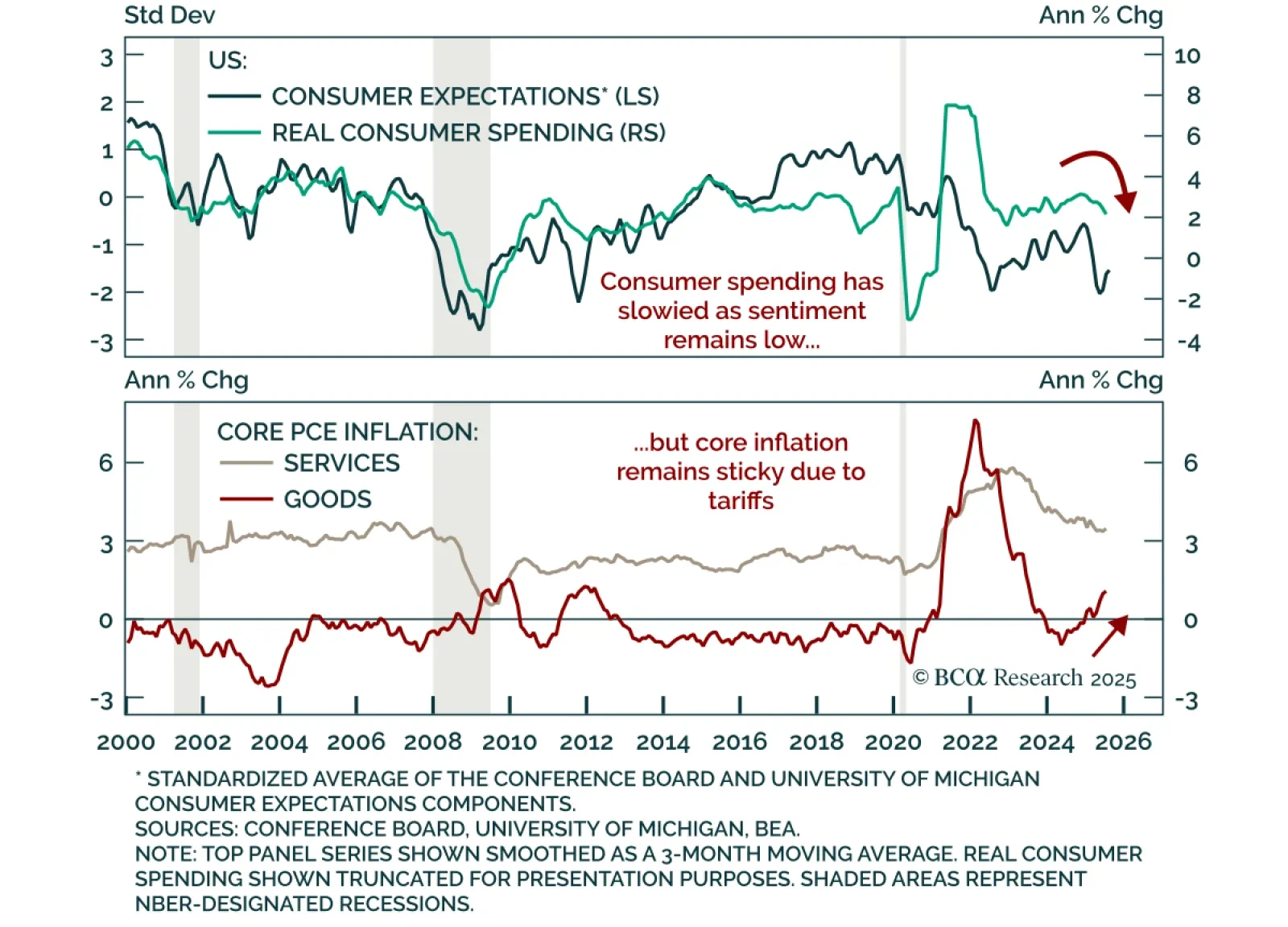

July income and spending data confirmed resilient consumption and sticky inflation, however, slowing labor momentum keeps us defensive. Real personal spending increased 0.3% m/m. Personal income rose 0.4% m/m, with real income…

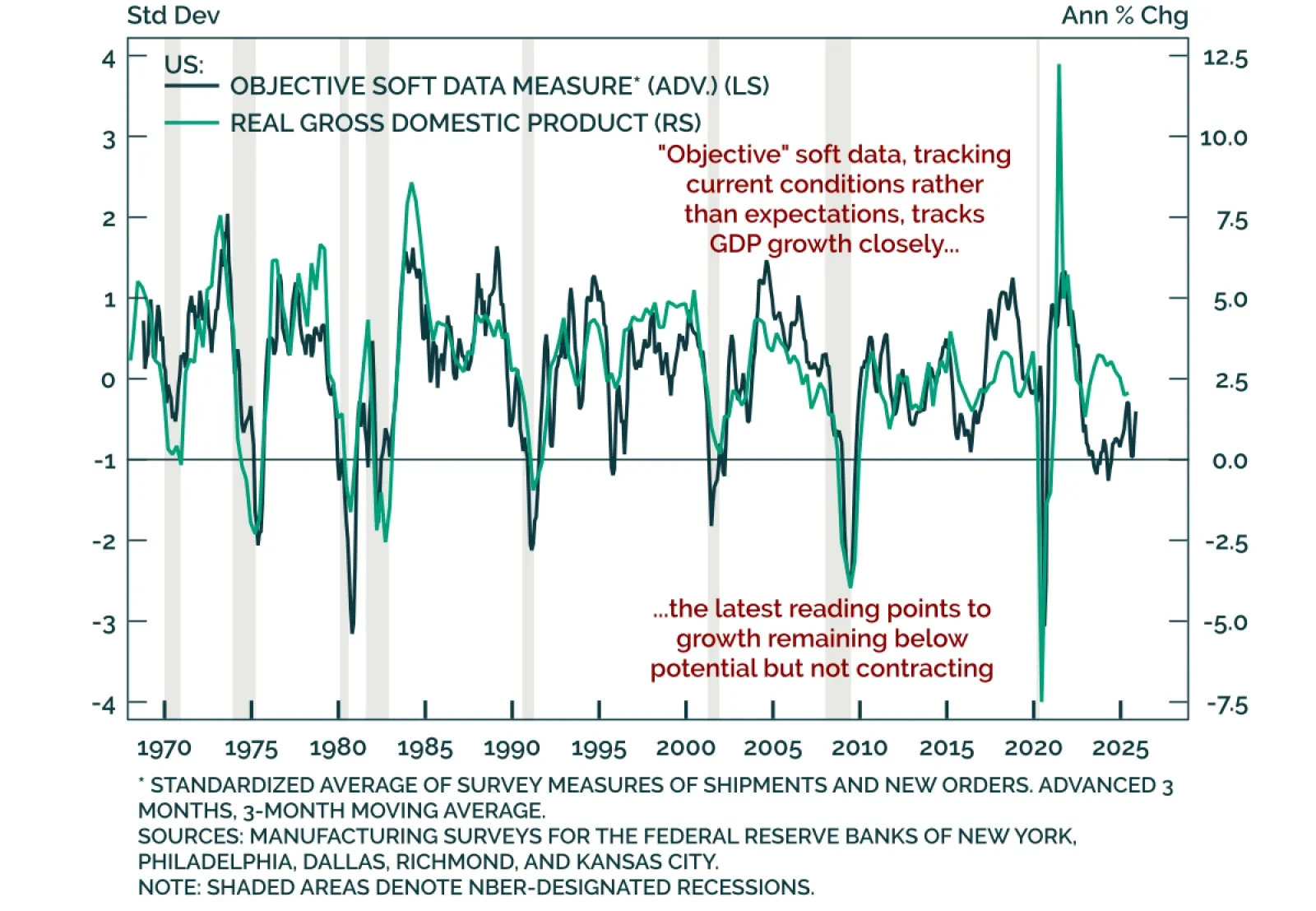

Regional Fed surveys point to low GDP growth, not an outright recession, which tactically supports low growth plays such as duration and tech. These timely surveys provide a snapshot of current month activity, combining “…

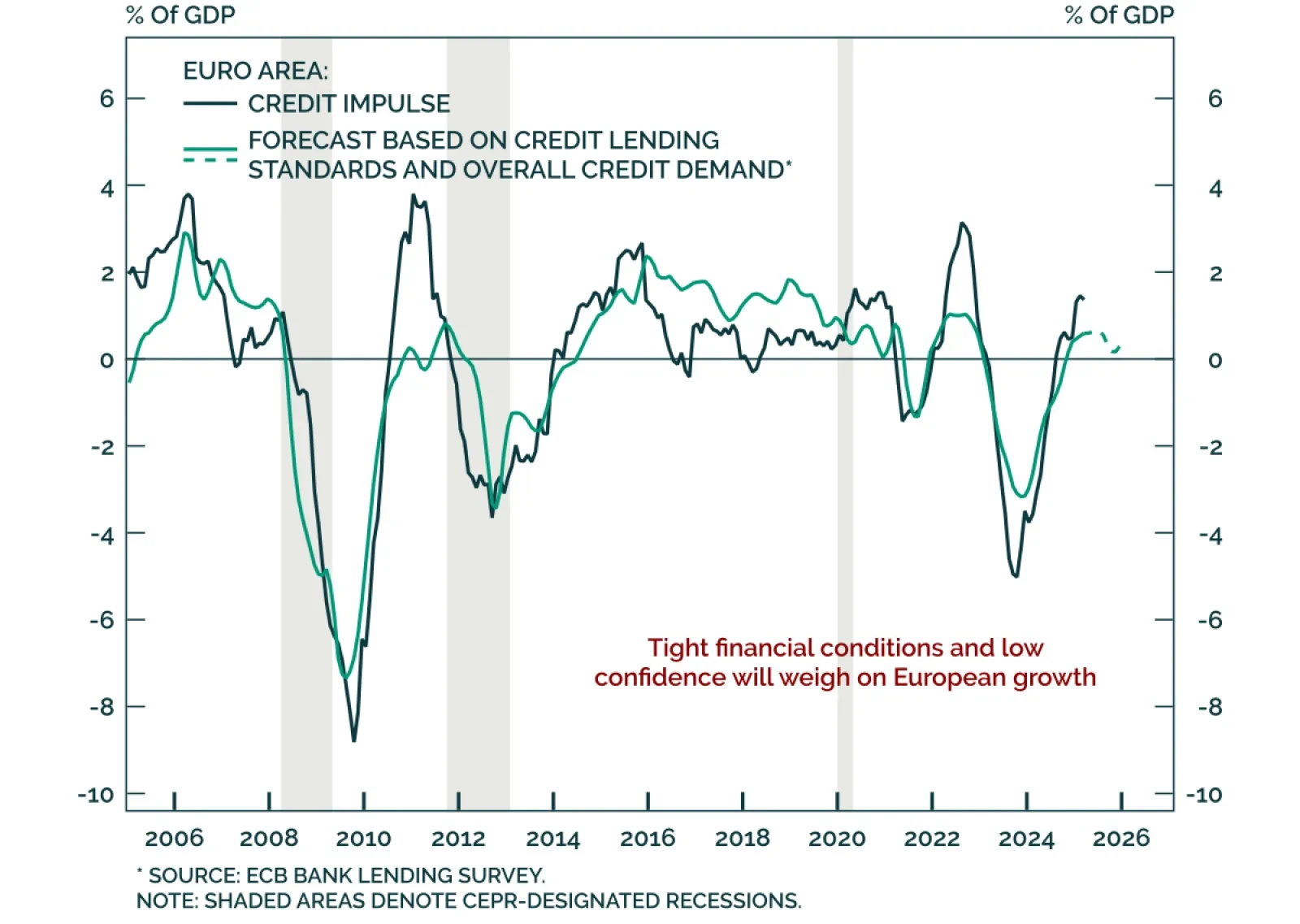

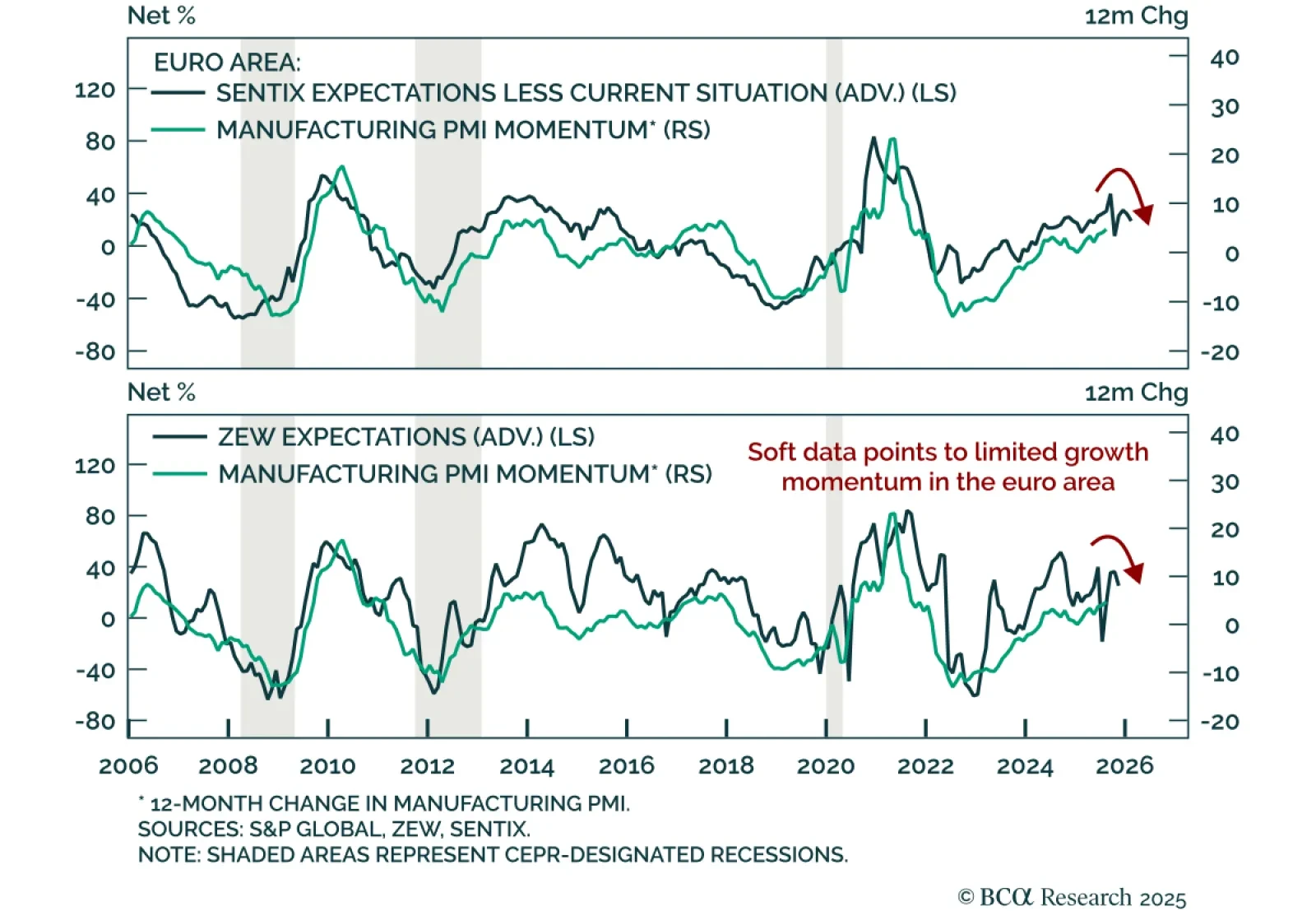

Weak Euro Area sentiment data and tight financial conditions support the case for a tactical US outperformance over Europe. July monetary data came in slightly below expectations, with M3 growth only edging up to 3.4% y/y from 3…

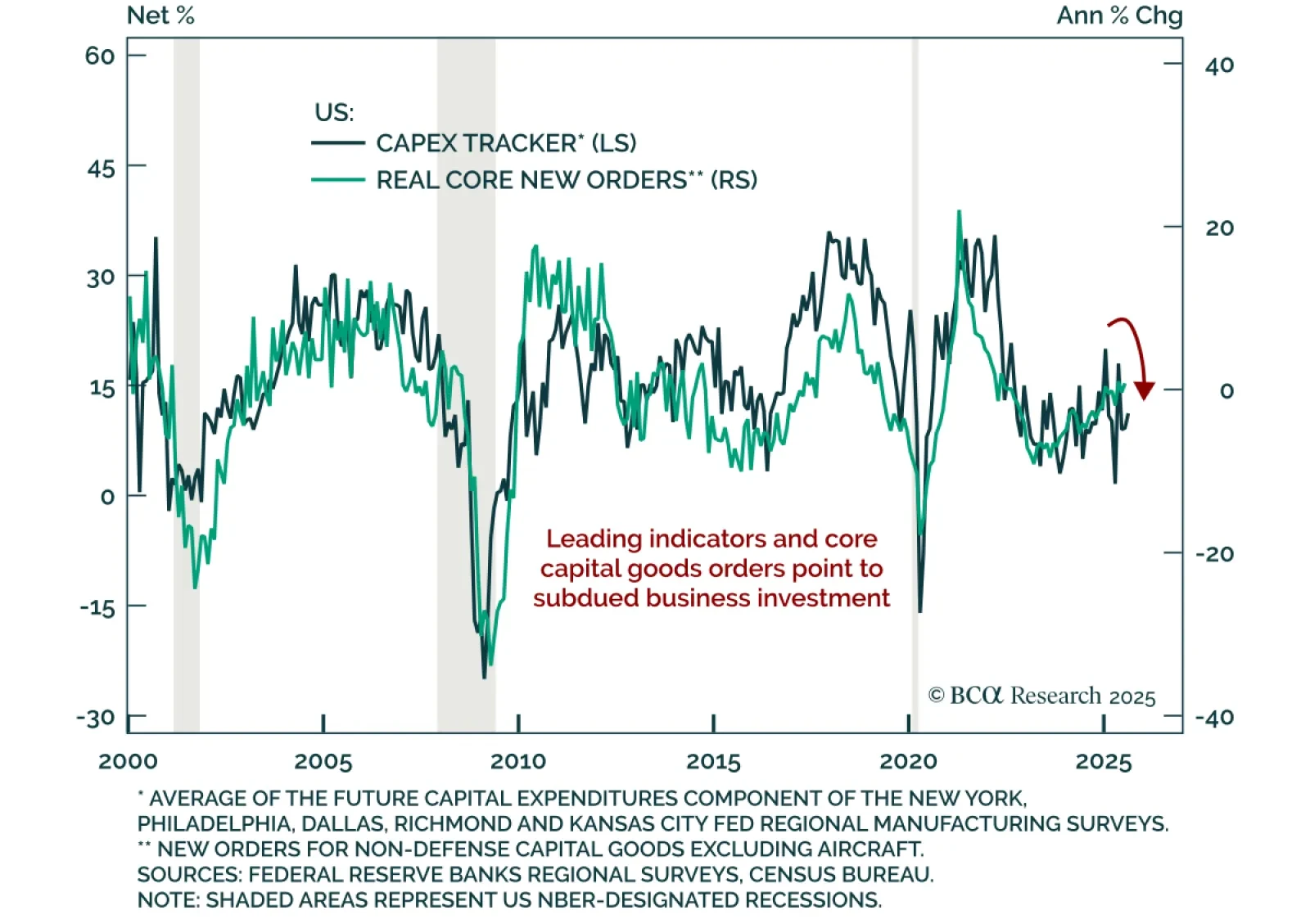

July US durable goods orders rebounded, but investment signals remain subdued and favor duration and tech. Orders fell 2.8% m/m after a 9.4% June drop, better than expected. Core measures excluding volatile components were…

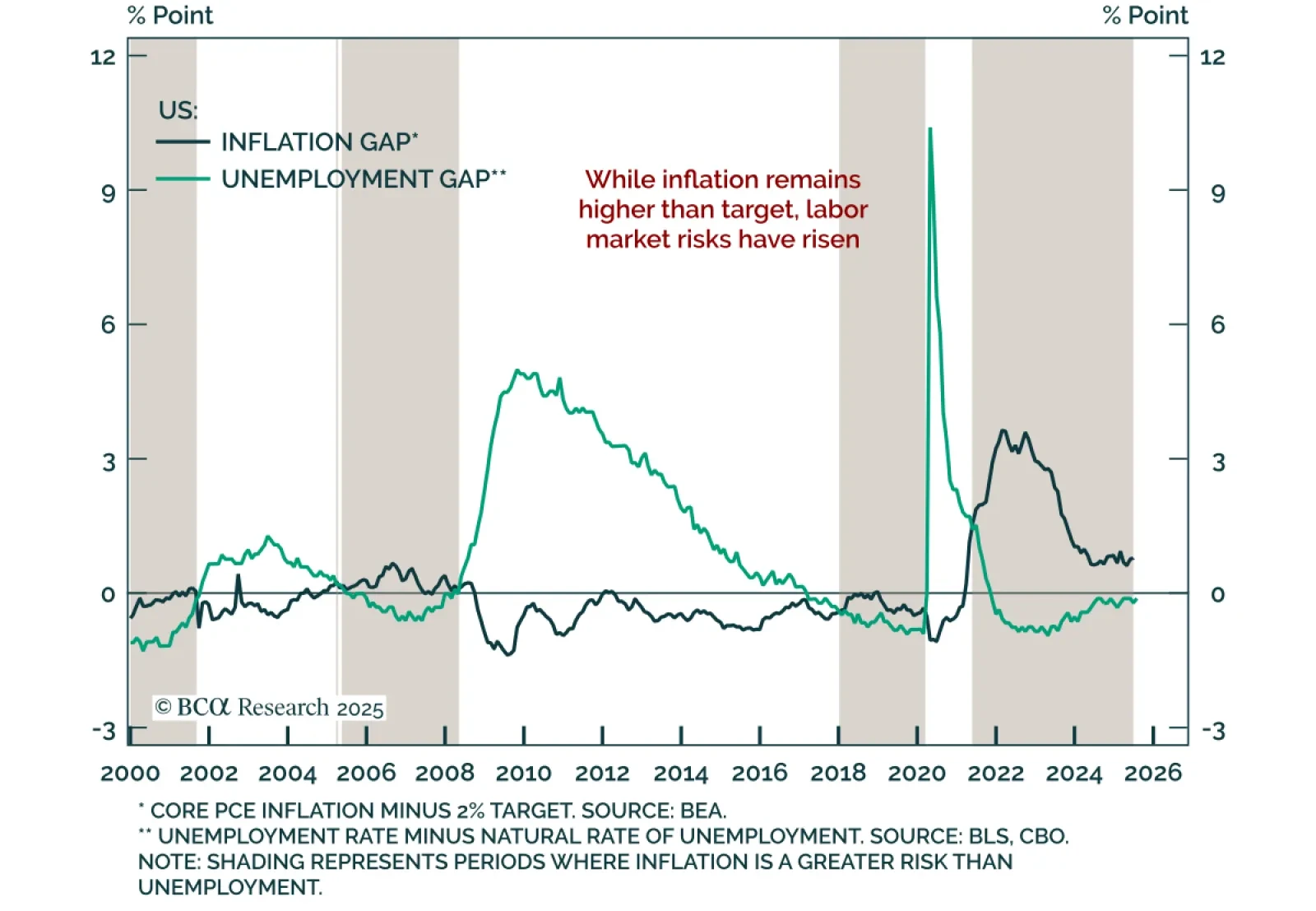

Powell’s Jackson Hole speech was misread, and points to cautious dovishness. Some commentators called it hawkish, others suggested the Fed abandoned its 2% target. Neither is accurate. Central bank communication is rarely…

Canada’s fragile growth backdrop reinforces the case for more BoC easing than markets price. June retail sales rose 1.5% m/m, in line with expectations. Excluding autos, sales were stronger at 1.9%. However, the advance estimate…

Economic activity plainly slowed in the first half, led by decelerating consumption and payrolls growth, but financial markets didn’t care. If the next two weeks of data don’t indicate that the May-June slowdown stretched into July…

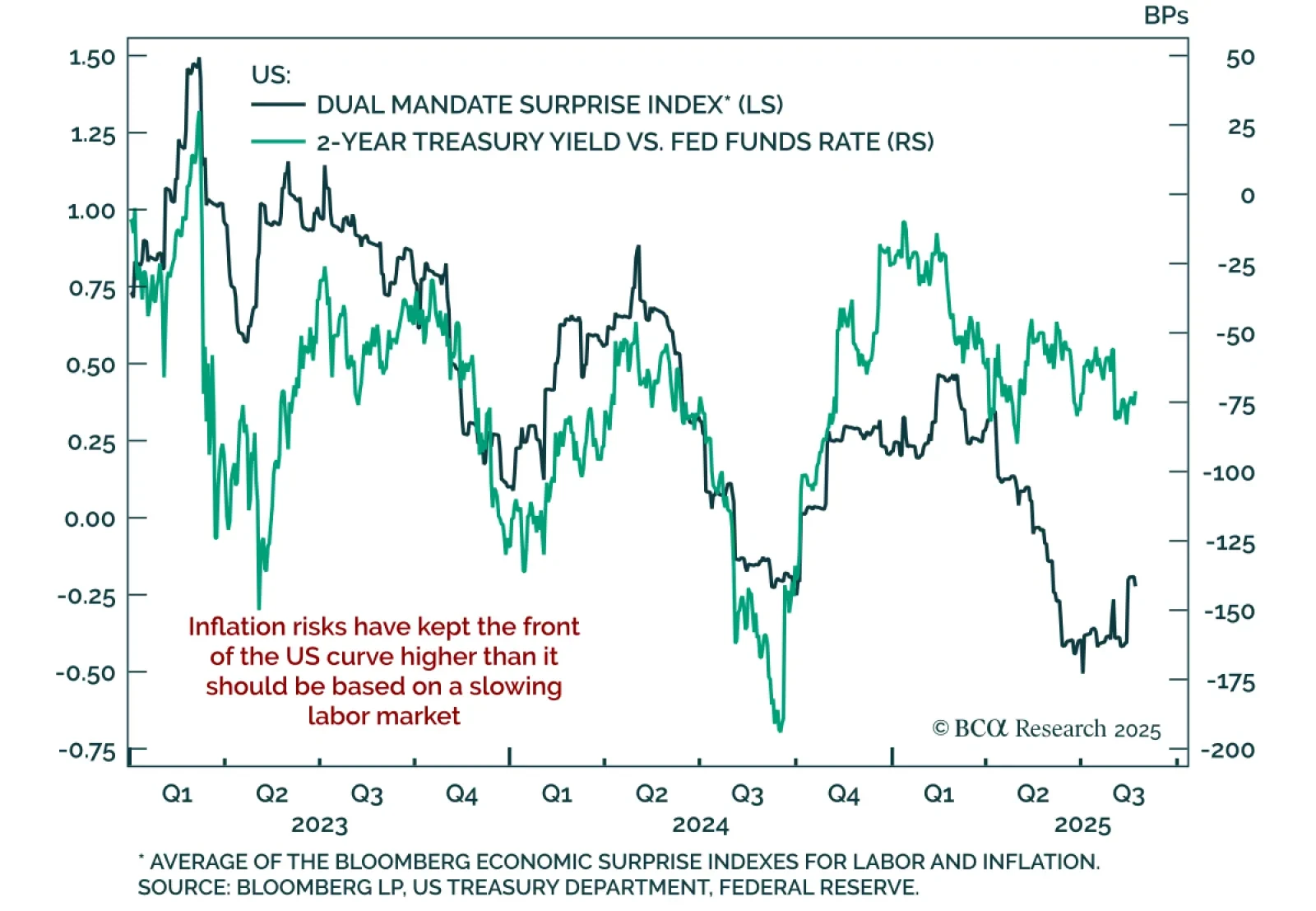

Powell’s final Jackson Hole speech signaled a dovish tilt, opening the door to a September cut. The Fed is under pressure to balance unemployment and inflation risks, with the FOMC split between “proactive” doves and “reactive” hawks…

Although Euro area PMIs beat expectations in August, the growth outlook remains weak. The composite index rose to 51.1, driven by manufacturing returning to expansion at 50.5 from 49.8. Meanwhile the services PMI slipped 0.3…