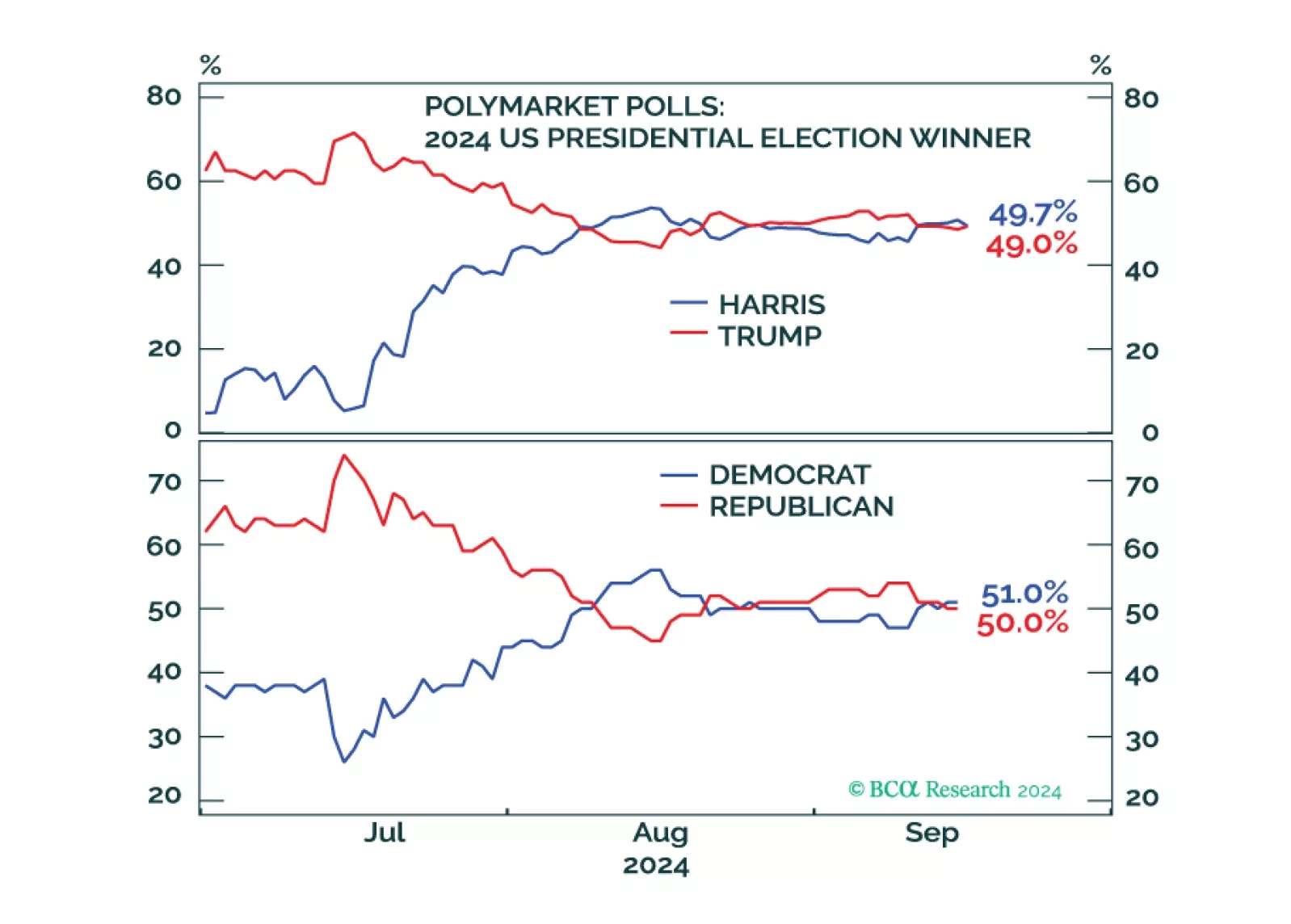

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

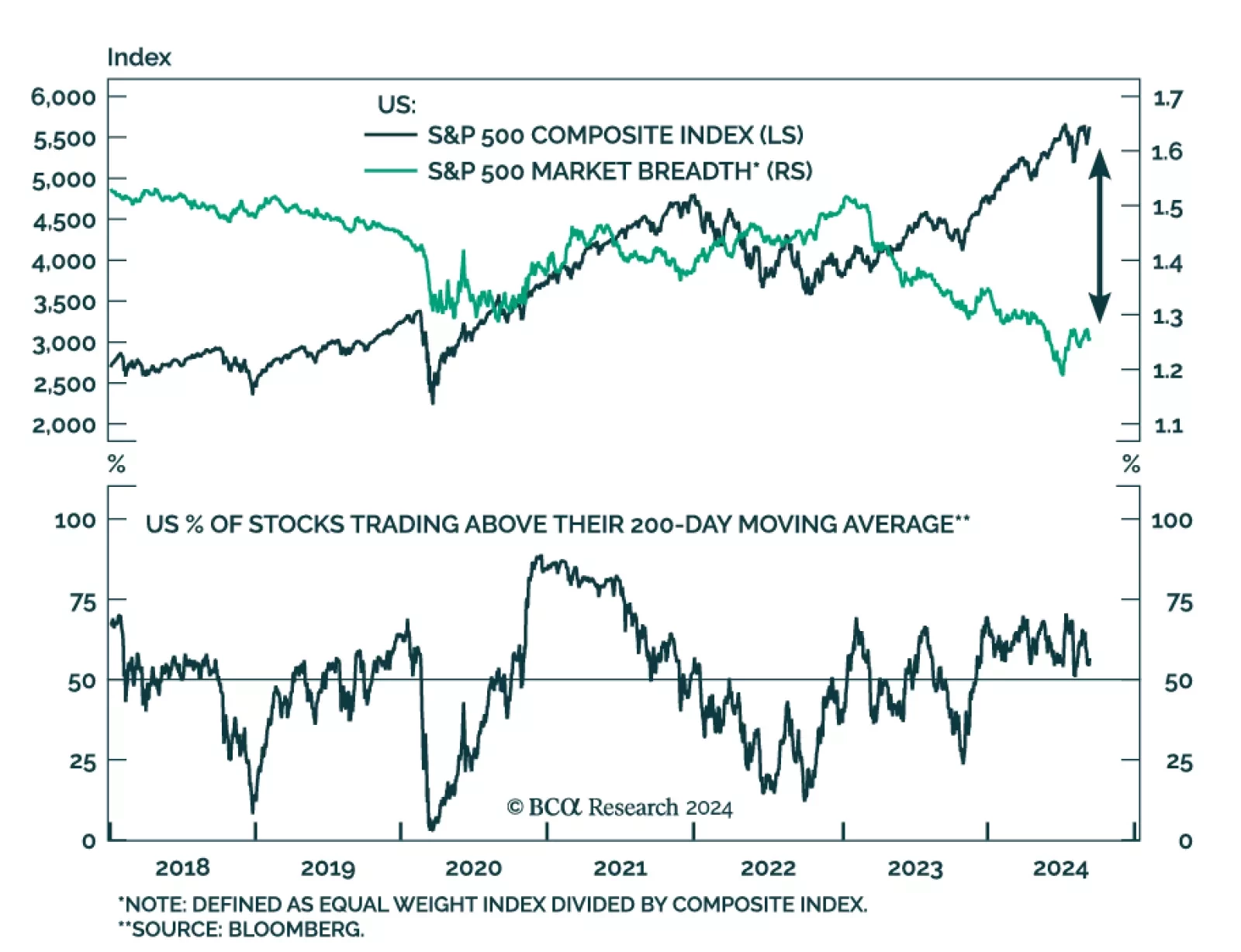

Investors are pricing in a soft landing in the US. Notably, we noted that pro-cyclical assets topped the performance ranking in August. At the same time, the S&P 500 is currently trading only 1% below its all-time highs.…

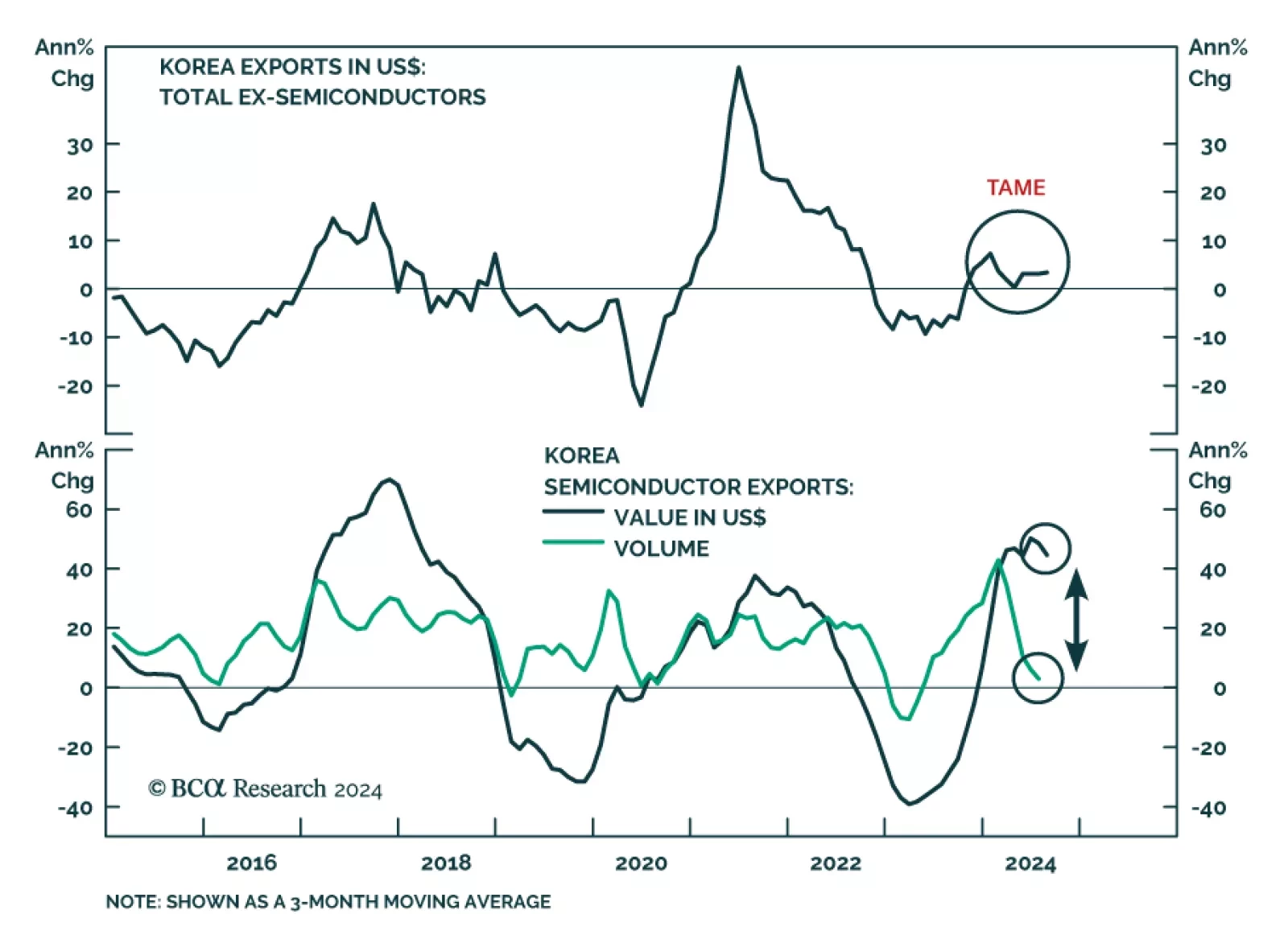

Trade data from small open economies act as a bellwether for global growth developments. In August, Korean exports expanded by 11.4% y/y in USD and 5.7% y/y in KRW terms, marking their eleventh and eighth consecutive month of…

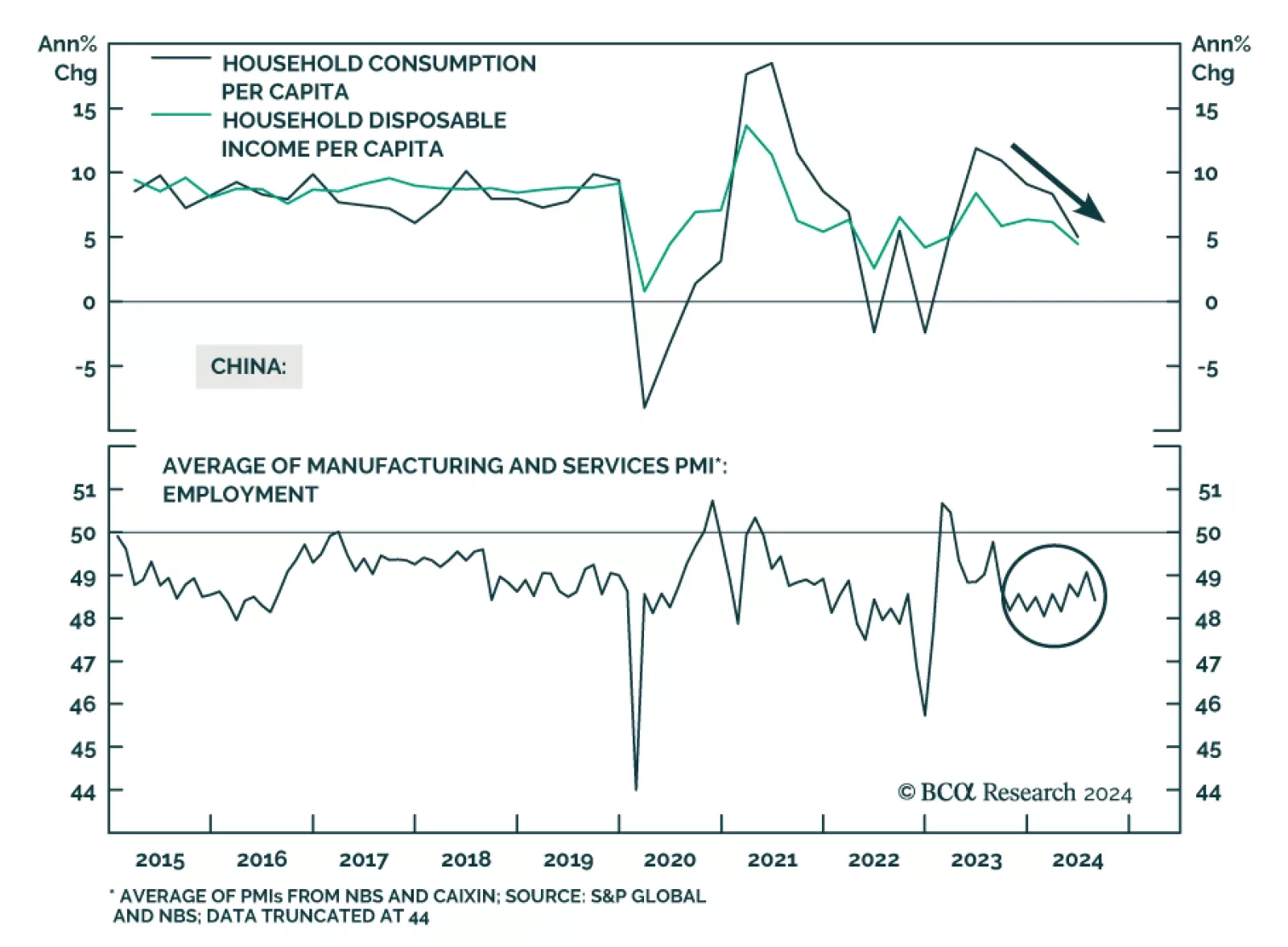

The Chinese economic data in its totality was uninspiring in August. Industrial production and retail sales growth decelerated year-on-year and corroborate the message from August’s import and credit growth data that…

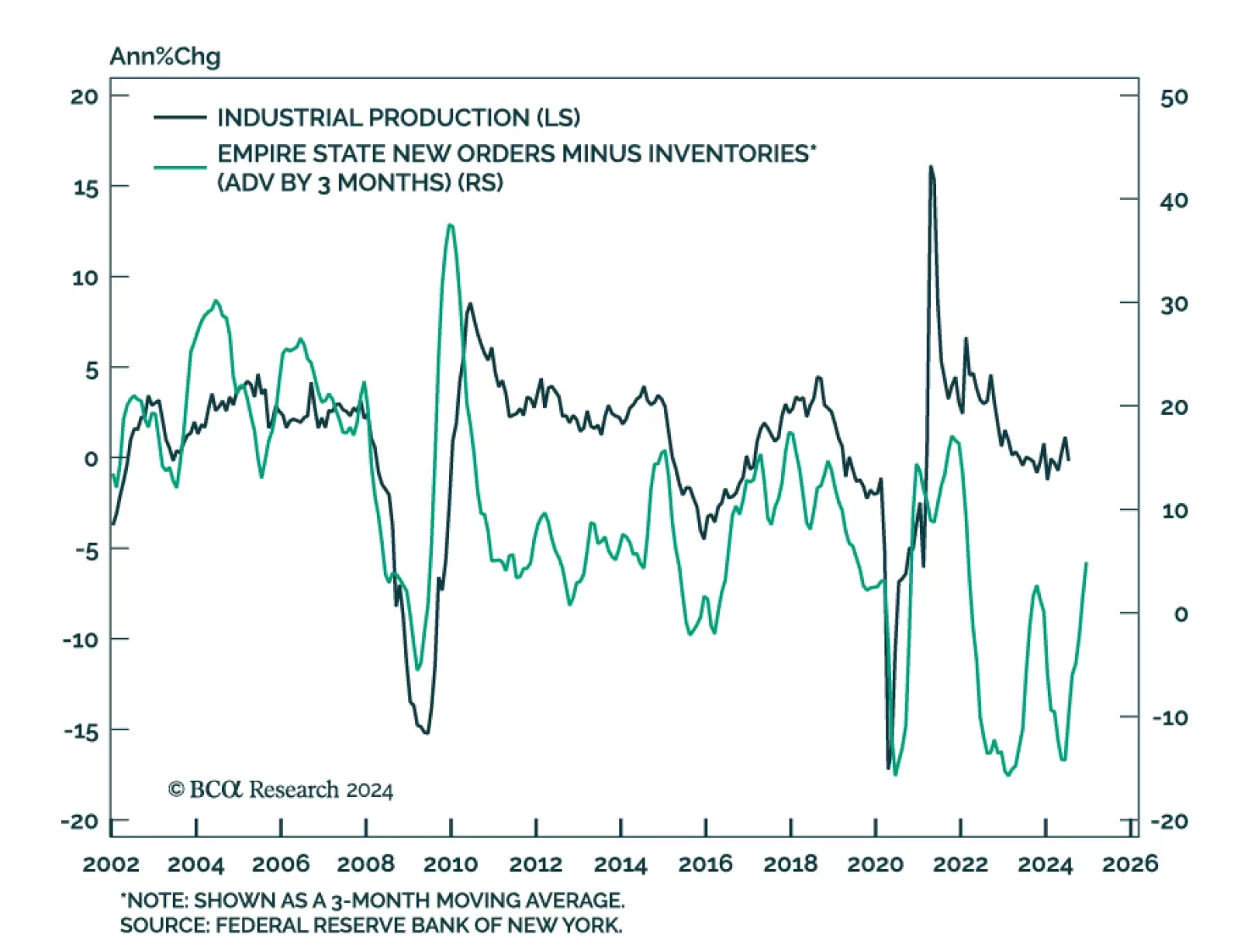

The timeliest of the regional Fed manufacturing surveys sent a positive signal about the state of US manufacturing activity in September. The Empire State manufacturing general business conditions index surprised positively.…

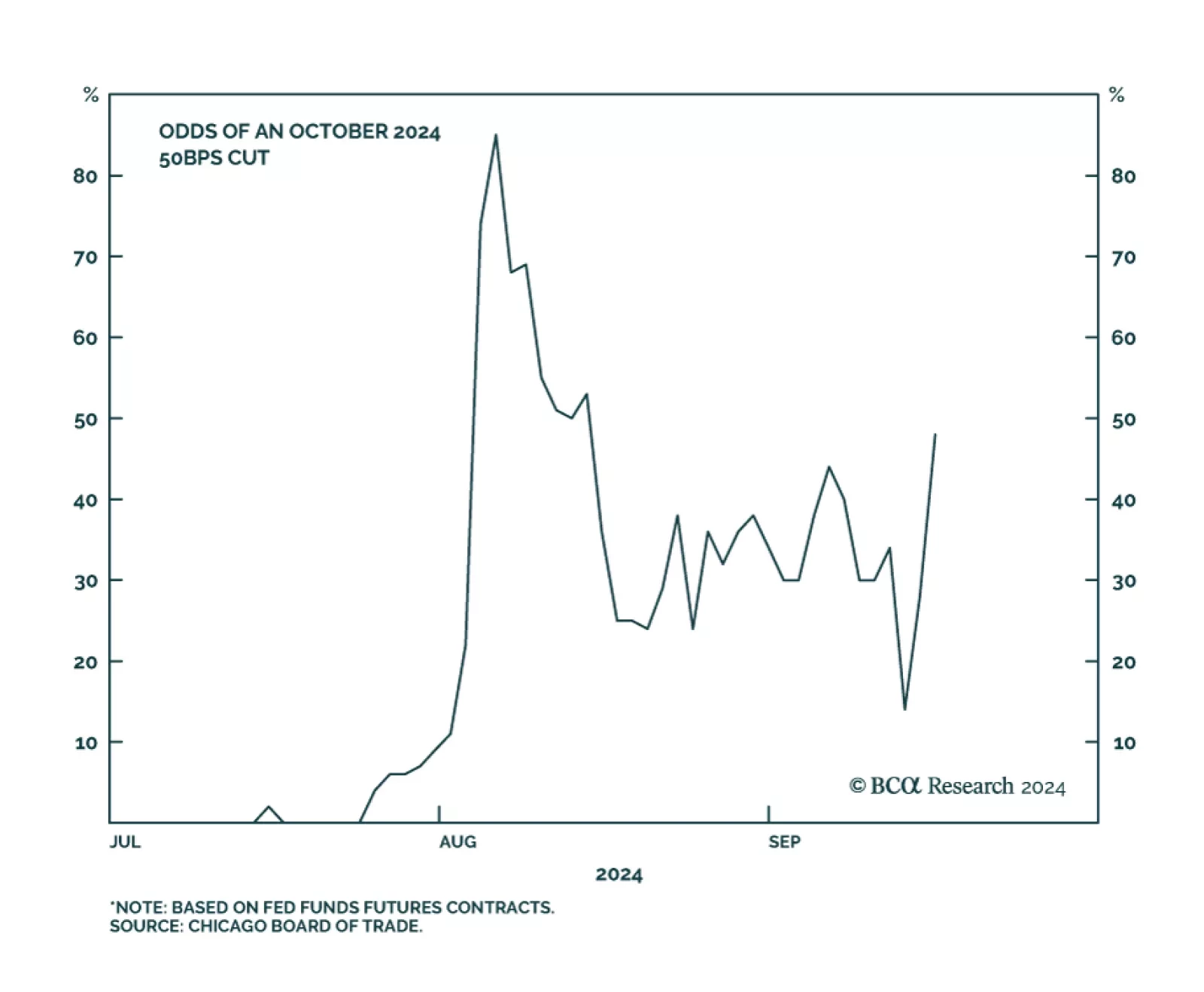

We noted earlier this month that the Fed would be unlikely to deliver a jumbo rate cut without telegraphing it first. President Williams' and Governor Waller’s September 6 speeches offered policymakers one last chance…

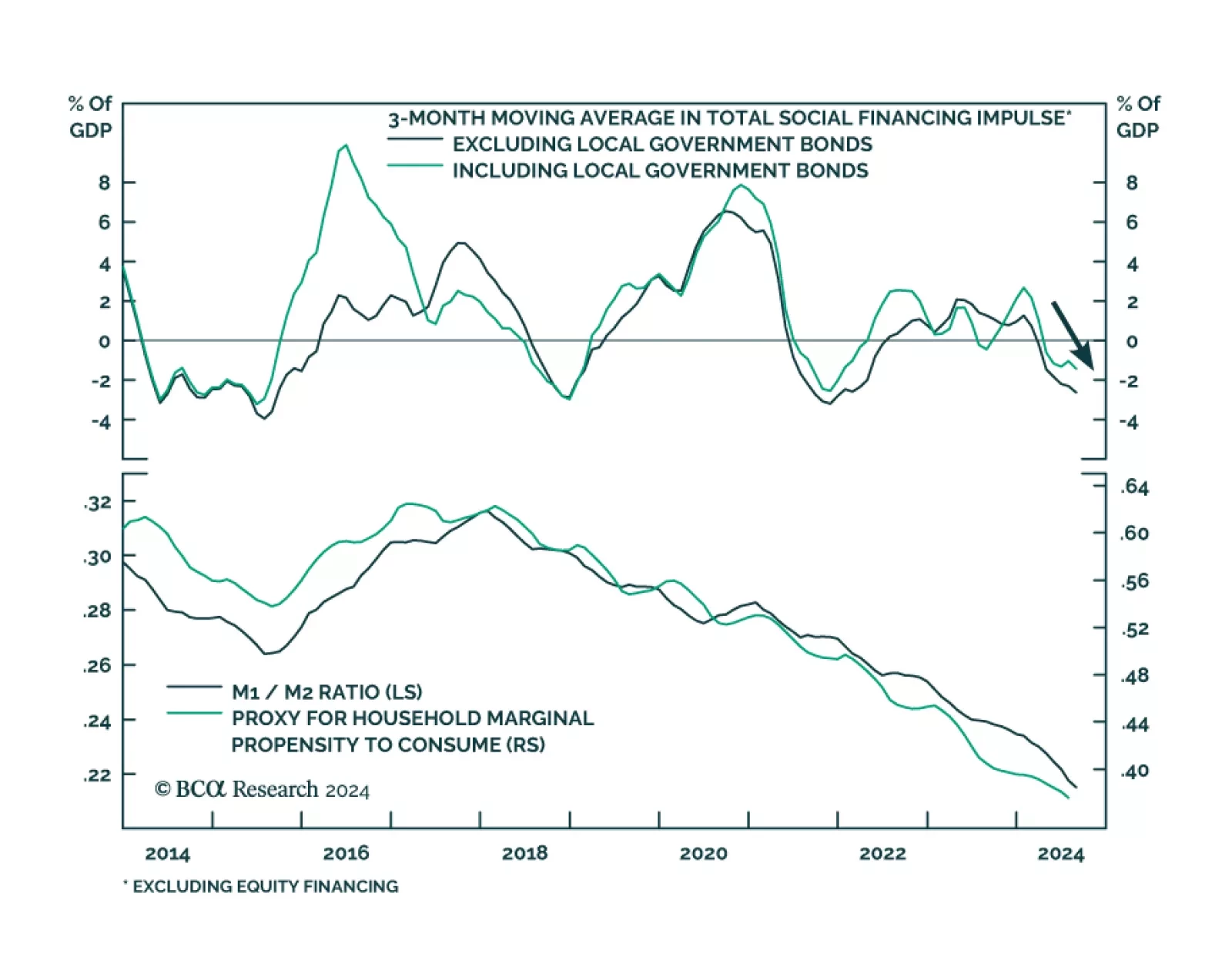

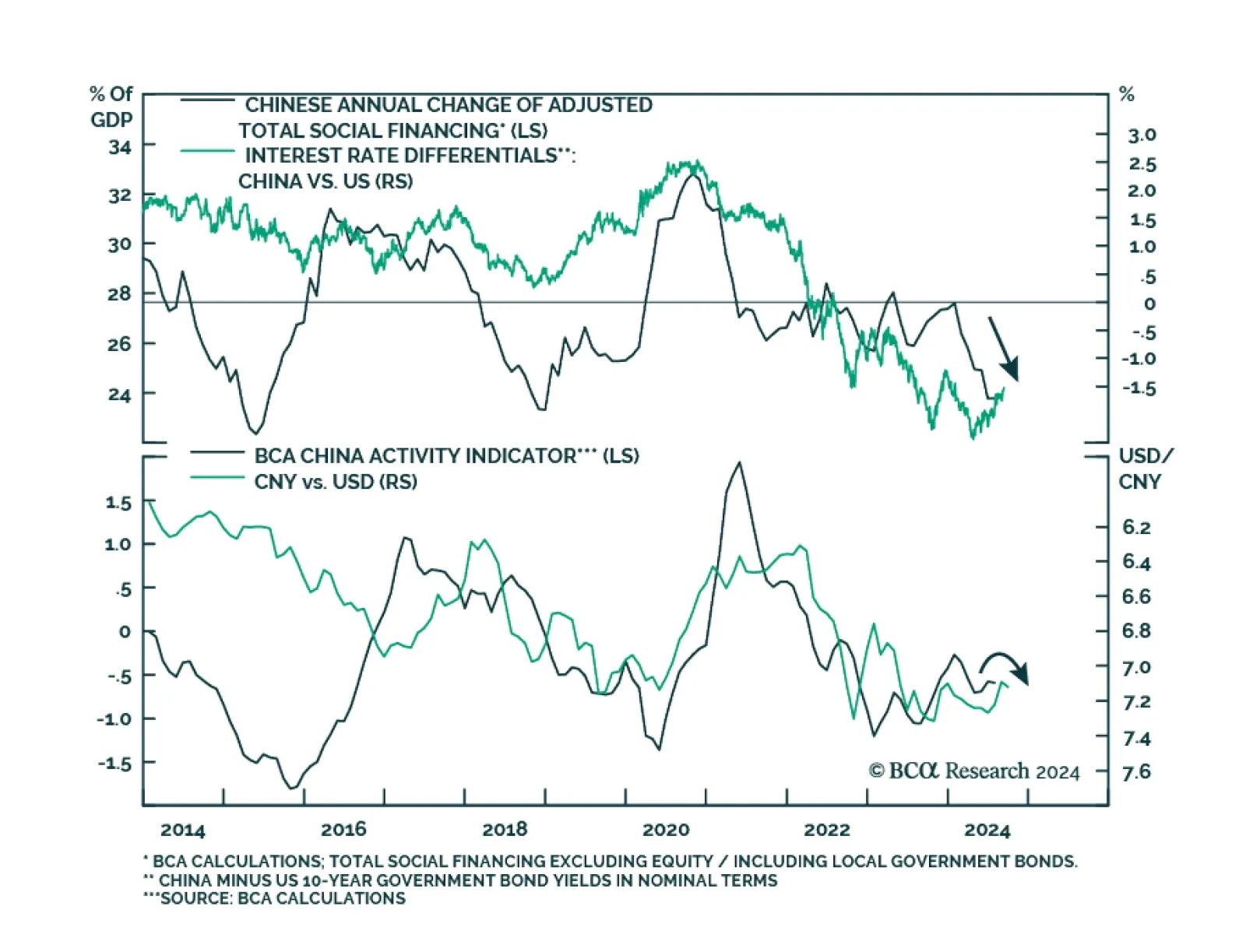

Subdued demand for credit among Chinese private-sector businesses and households persisted through August. Outstanding loan growth decelerated from 8.7% y/y to 8.5%. Moreover, M1’s contraction deepened, from 6.6% to 7.…

According to BCA Research’s China Investment Strategy service, the Fed’s upcoming rate cut will temporarily alleviate some of the downward pressure on the RMB, but beyond the short term the USD will likely rebound in…

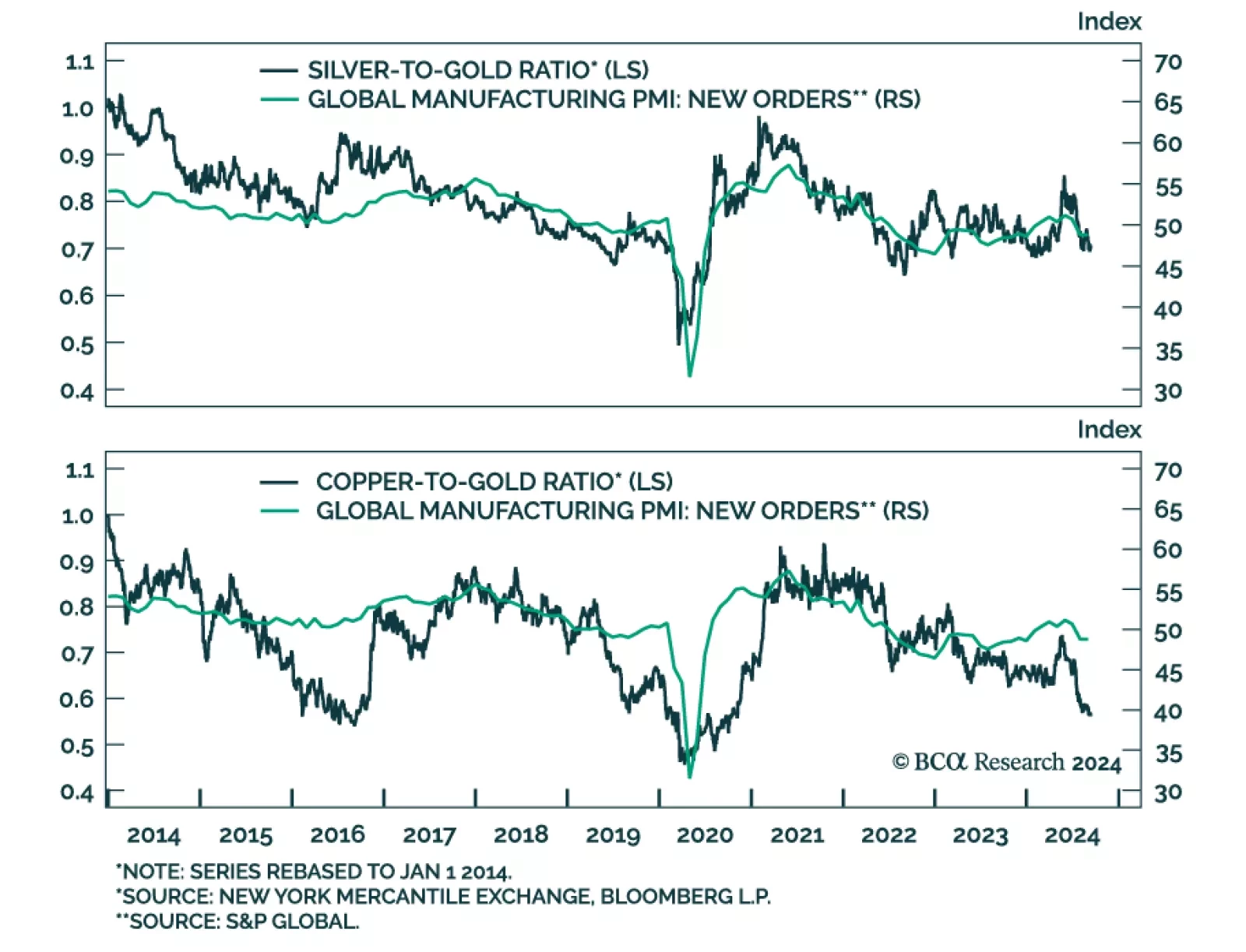

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…