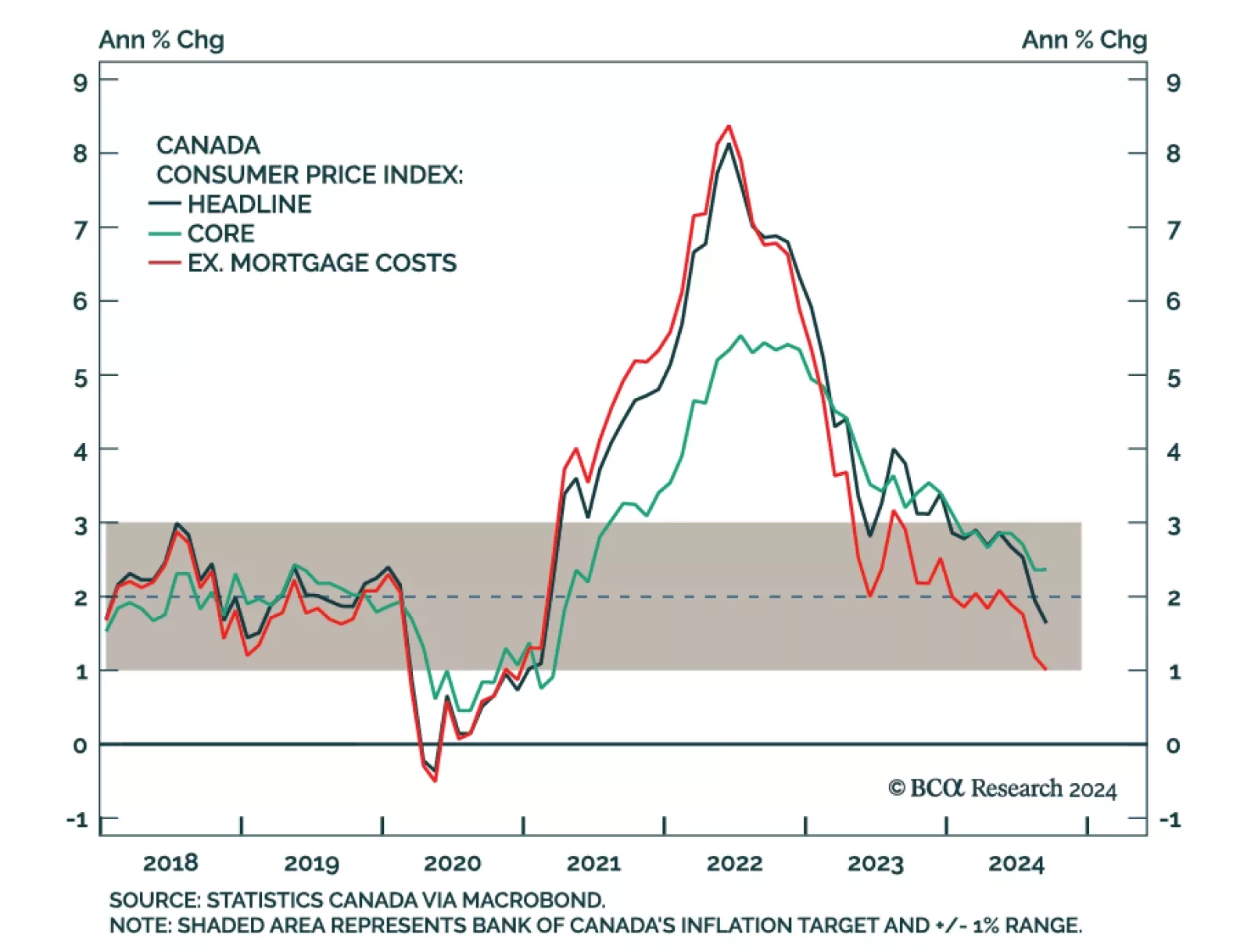

Canadian headline inflation rose 1.6% year-over-year in September, lower than the expected 1.8% and down from 2.0% in August. This was also its slowest pace since February 2021. The decrease was mainly driven by gasoline prices,…

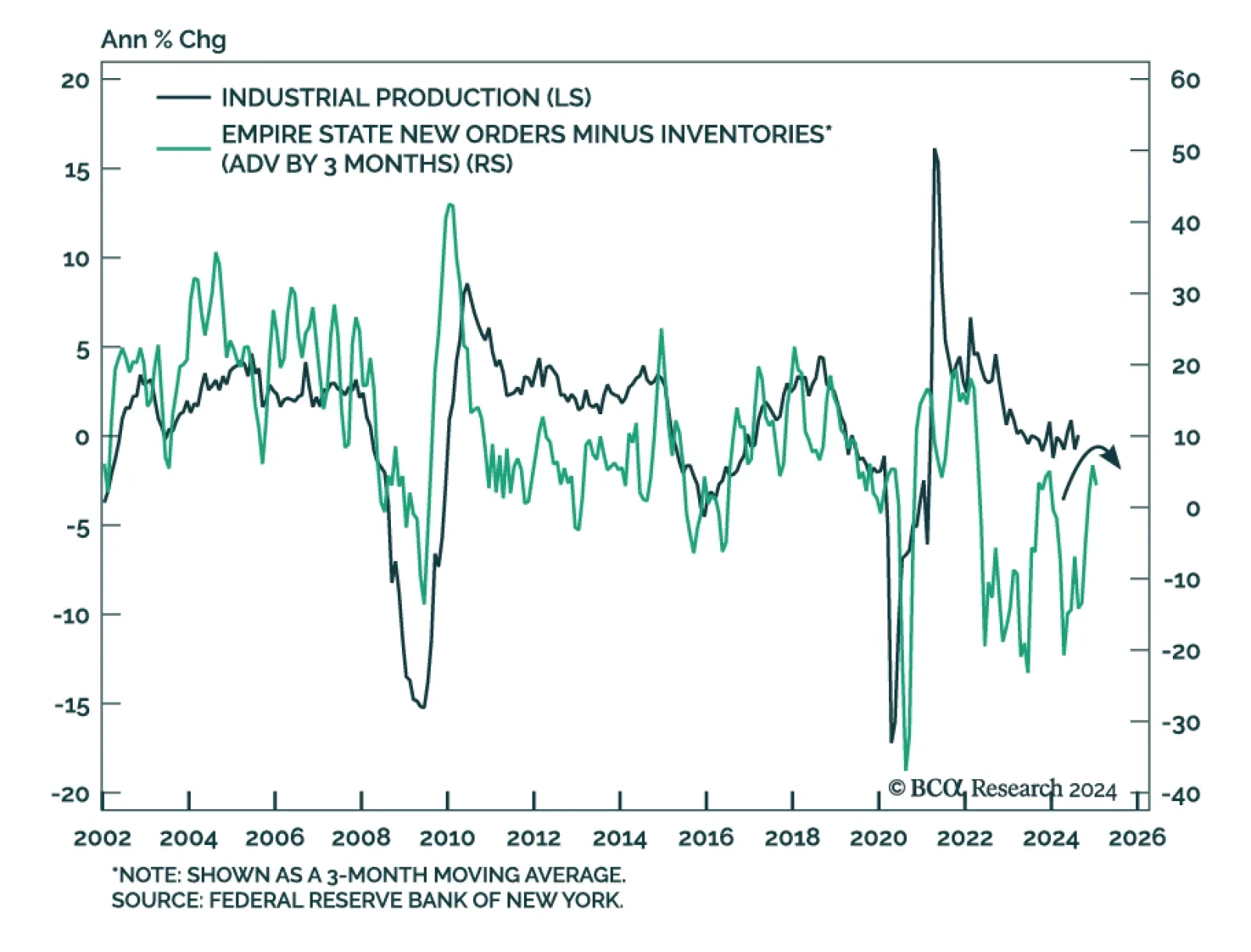

After improving throughout the summer, the October release of the first monthly regional Fed manufacturing survey sent a negative signal about US manufacturing activity. General business conditions from the Empire State…

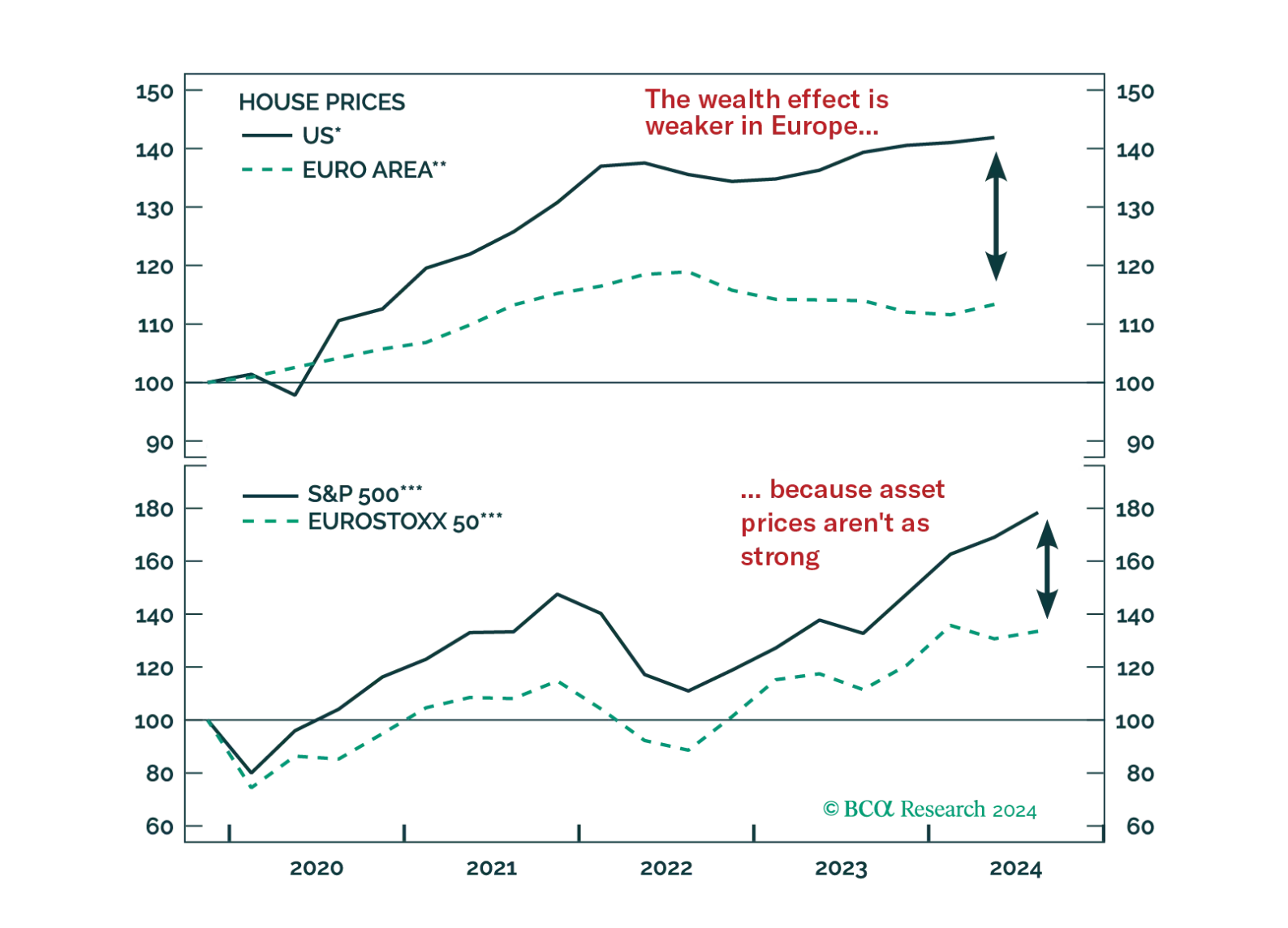

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

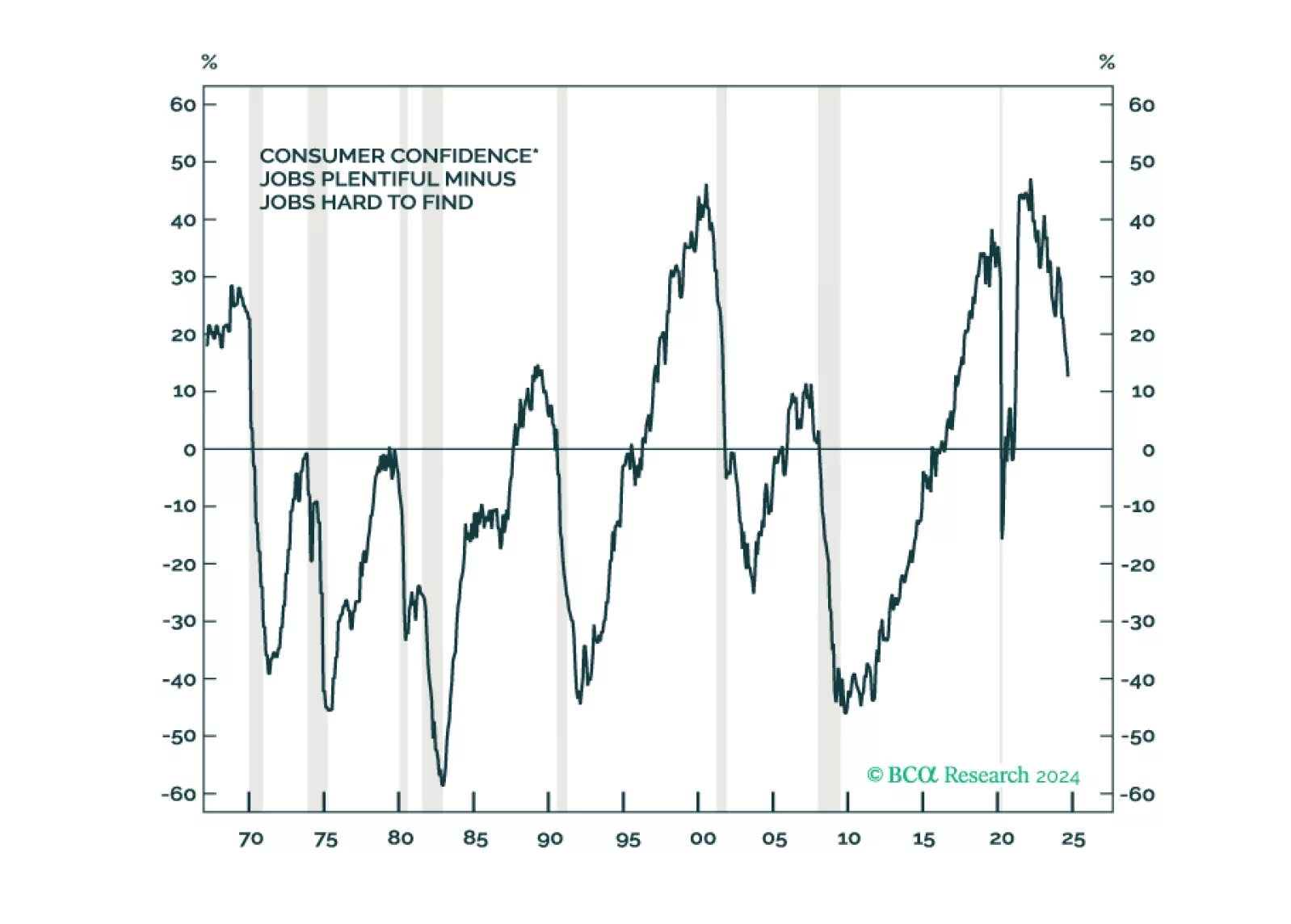

Rising stock prices and improving economic data have us re-examining our bearish thesis, but we still see deterioration in leading labor market indicators and expect it will eventually culminate in a recession. We reiterate our…

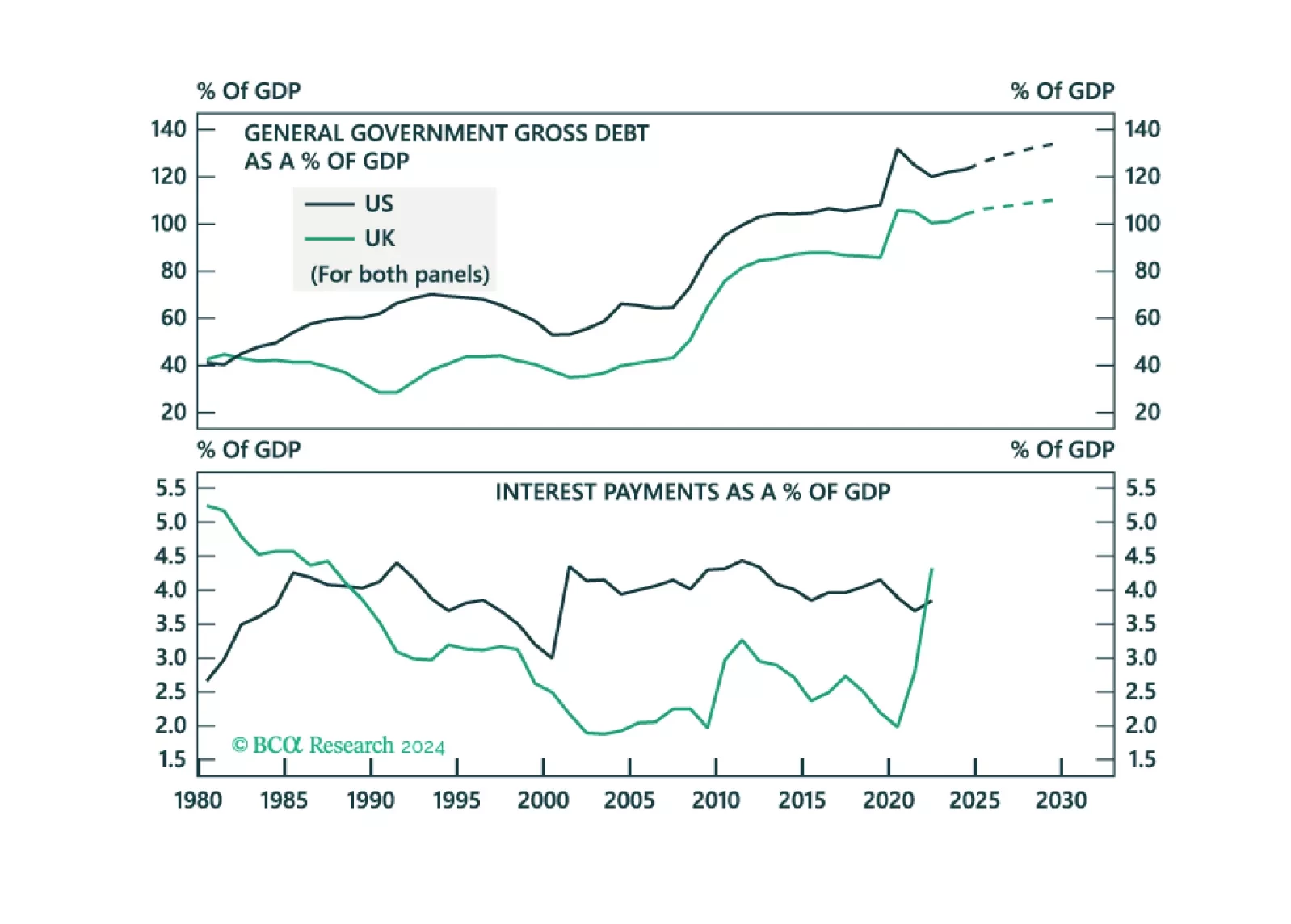

In this Insight, we assess whether investors should expect fiscal turbulence in the UK, that will drive UK yields higher and the pound lower.

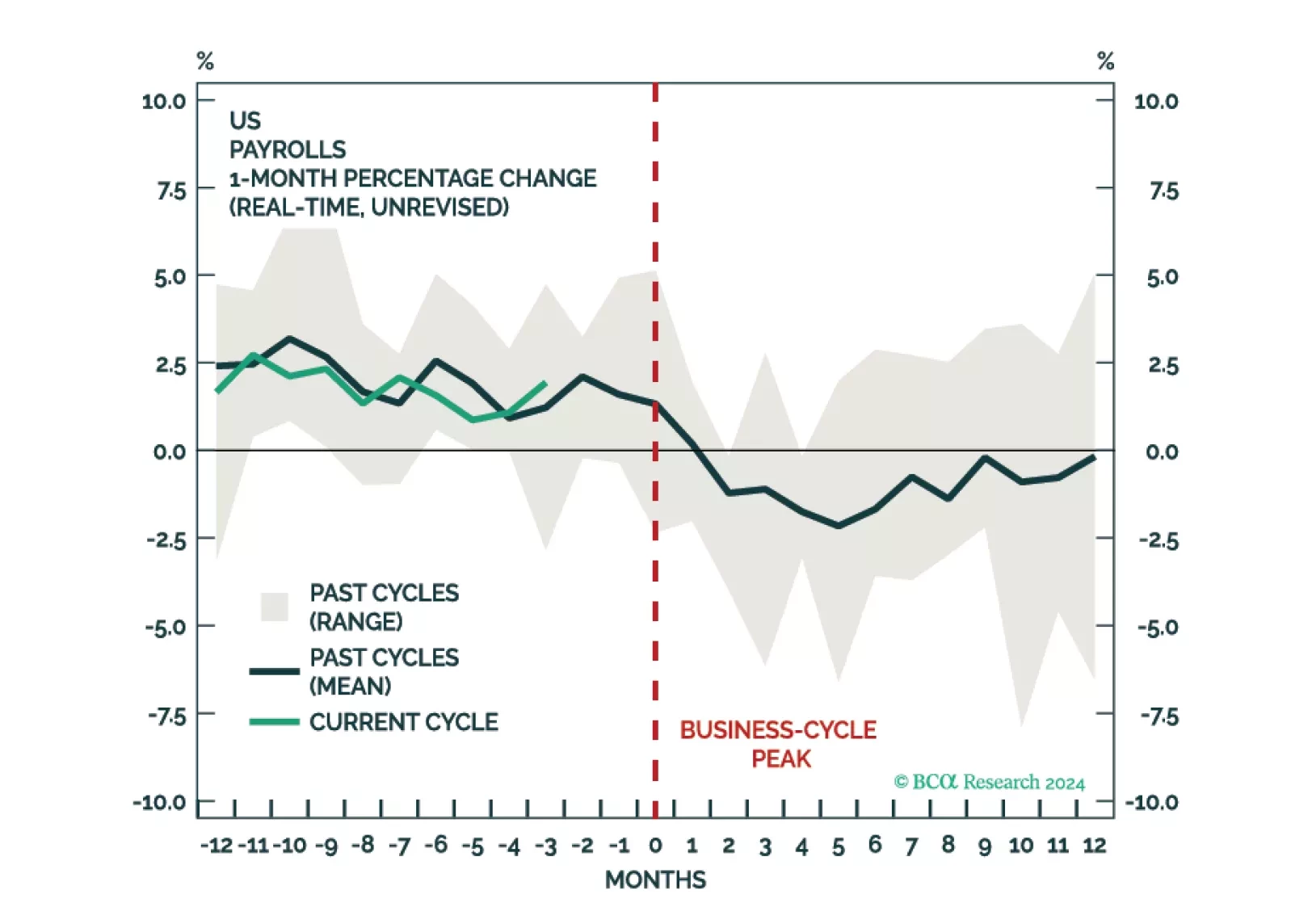

It is too early to say that the US labor market has turned the corner. We assign a 60% chance that the US will enter a recession over the next 12 months, with the downturn likely to begin in the first half of 2025. Accordingly,…

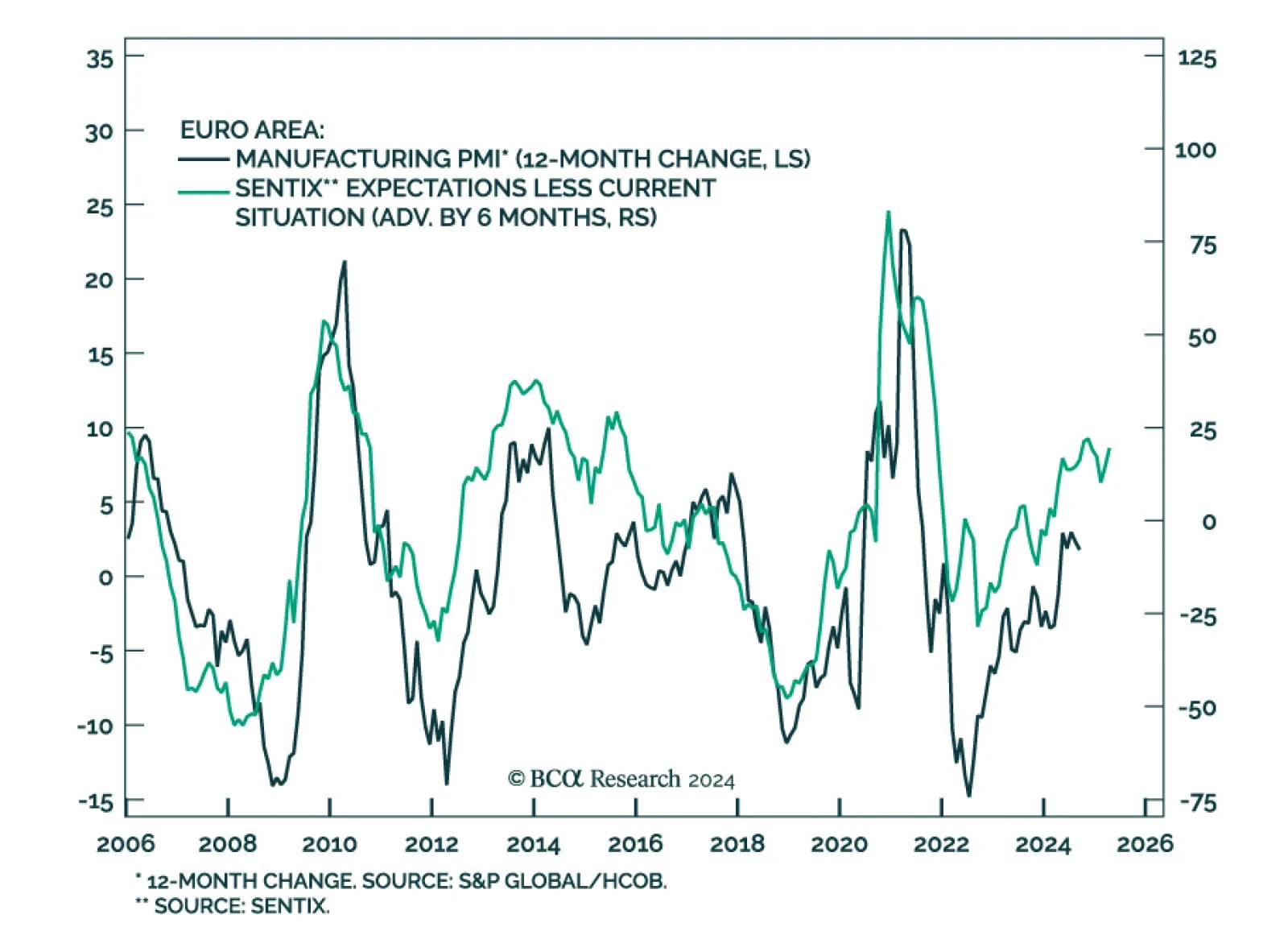

The Sentix Investor Confidence index unexpectedly improved in October from -15.4 to -13.8. A notable improvement in Expectations (from -8.0 to -3.8) drove the overall index higher, while the Current Situation subcomponent…

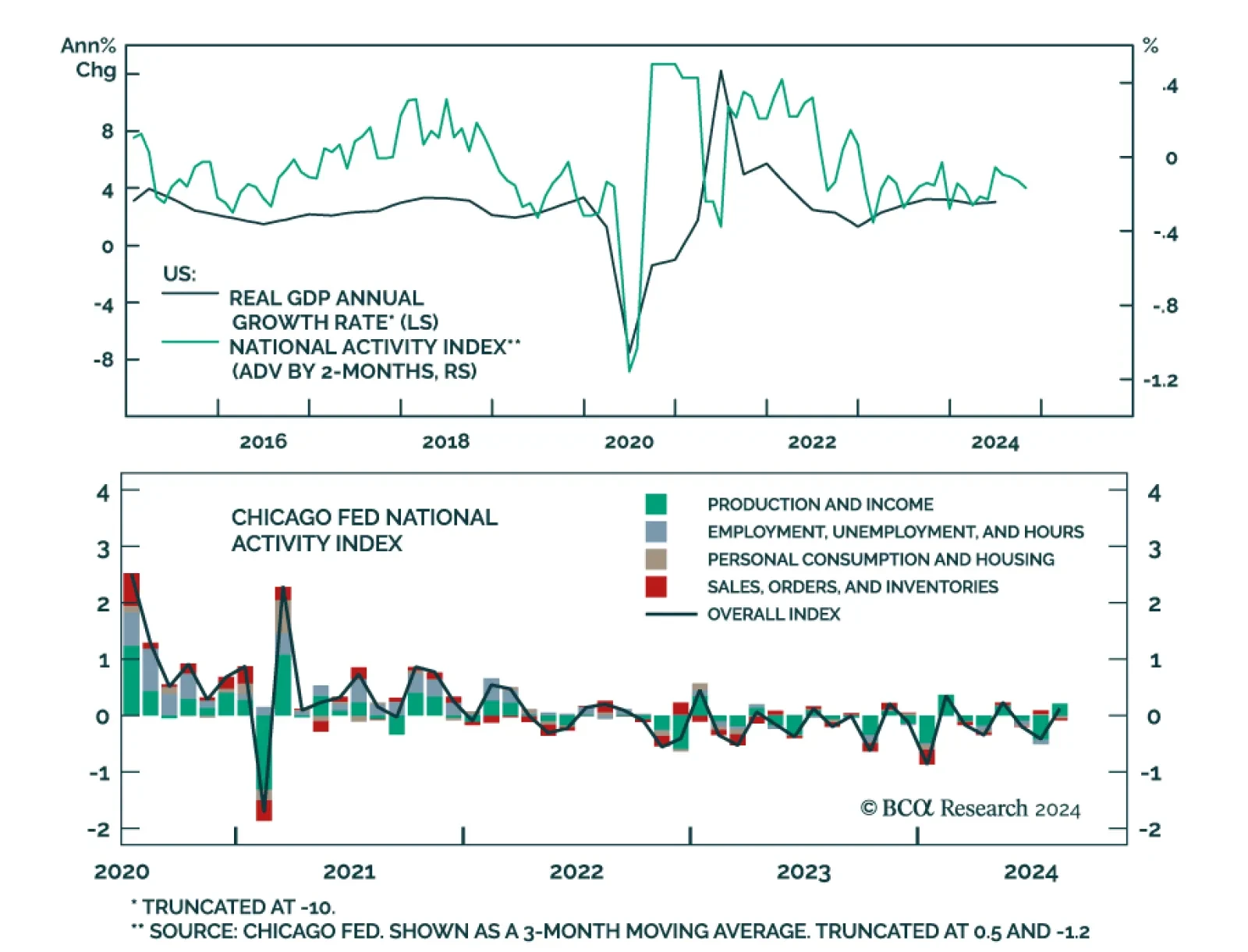

The Chicago Fed National Activity Index (CFNAI) – a summary statistic of US economic data releases – increased to 0.12 from -0.42, suggesting that the US economy improved in August. Details, however, do not point to a…

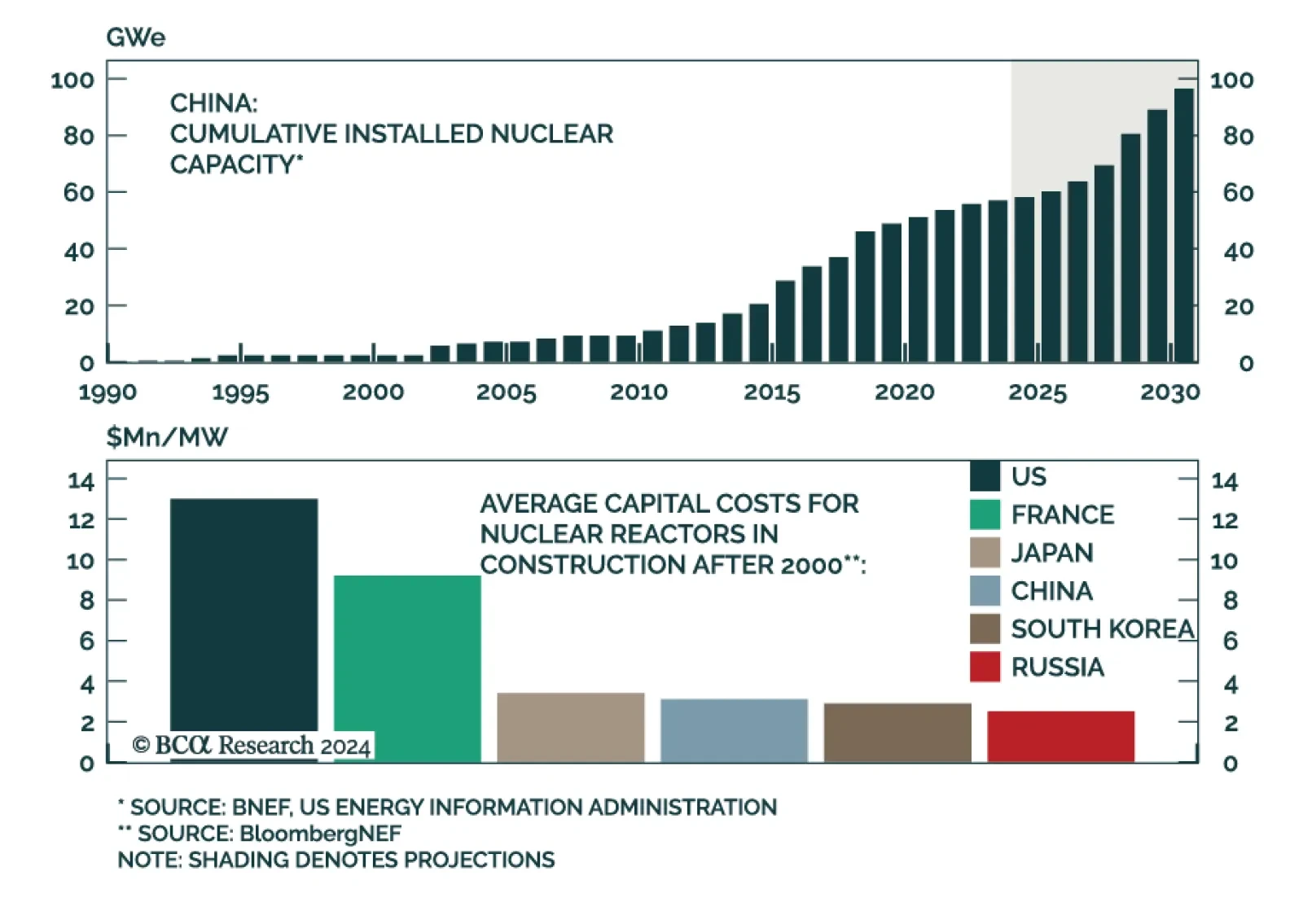

In the fifth installment of a BCA Special Report series on nuclear energy, our colleagues argue that US nuclear energy dominance is decaying. Though still the world’s leader in generation and capacity, the US will not hold…

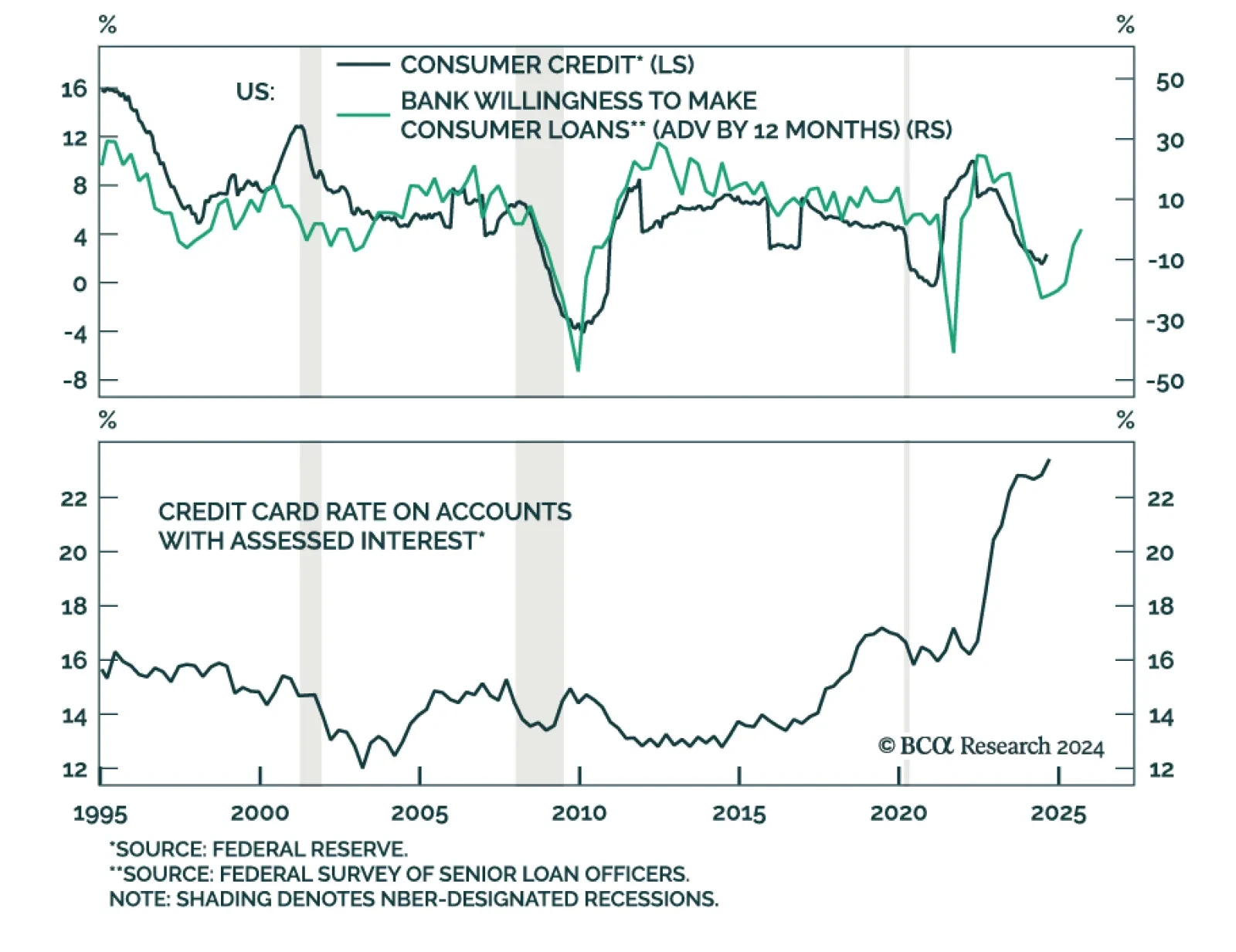

Consumer credit growth slowed in August, rising by USD 8.9 bn (to USD 5,097.6 bn outstanding) from USD 26.6 bn, disappointing expectations of a USD 12 bn monthly increase. Notably, revolving credit (which includes credit cards)…