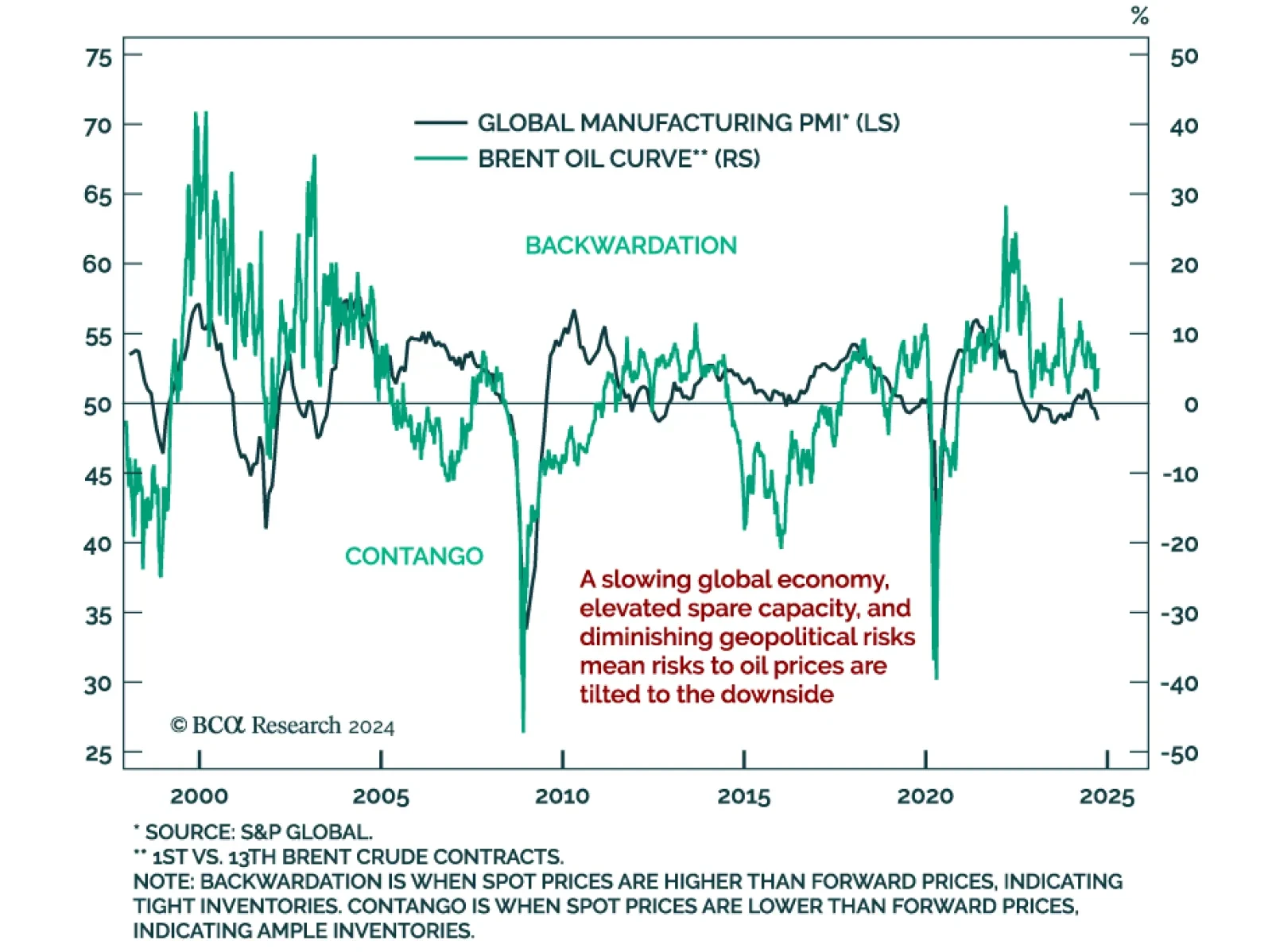

Crude prices have been trendless but volatile in 2024. Oil’s choppy price action illustrates the demand and supply tug-o-war in the market. Our bias is for crude prices to weaken on a six-to-nine months horizon. Good…

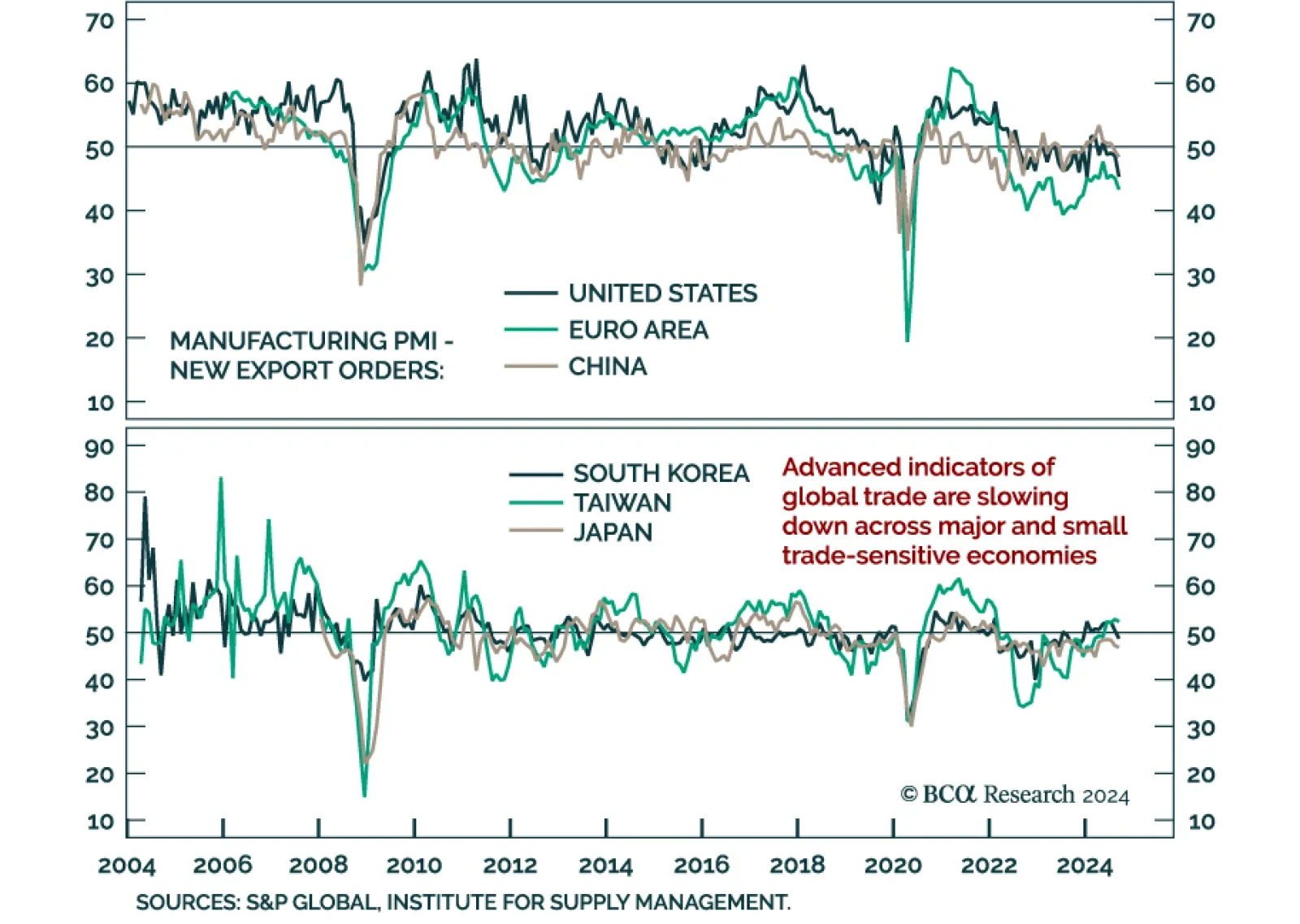

September numbers for East Asian trade disappointed across the board. Japanese exports dropped 1.7% year-on-year (YoY) after rising 5.5% in August, and Singapore’s non-oil domestic exports decelerated to 2.7%YoY after…

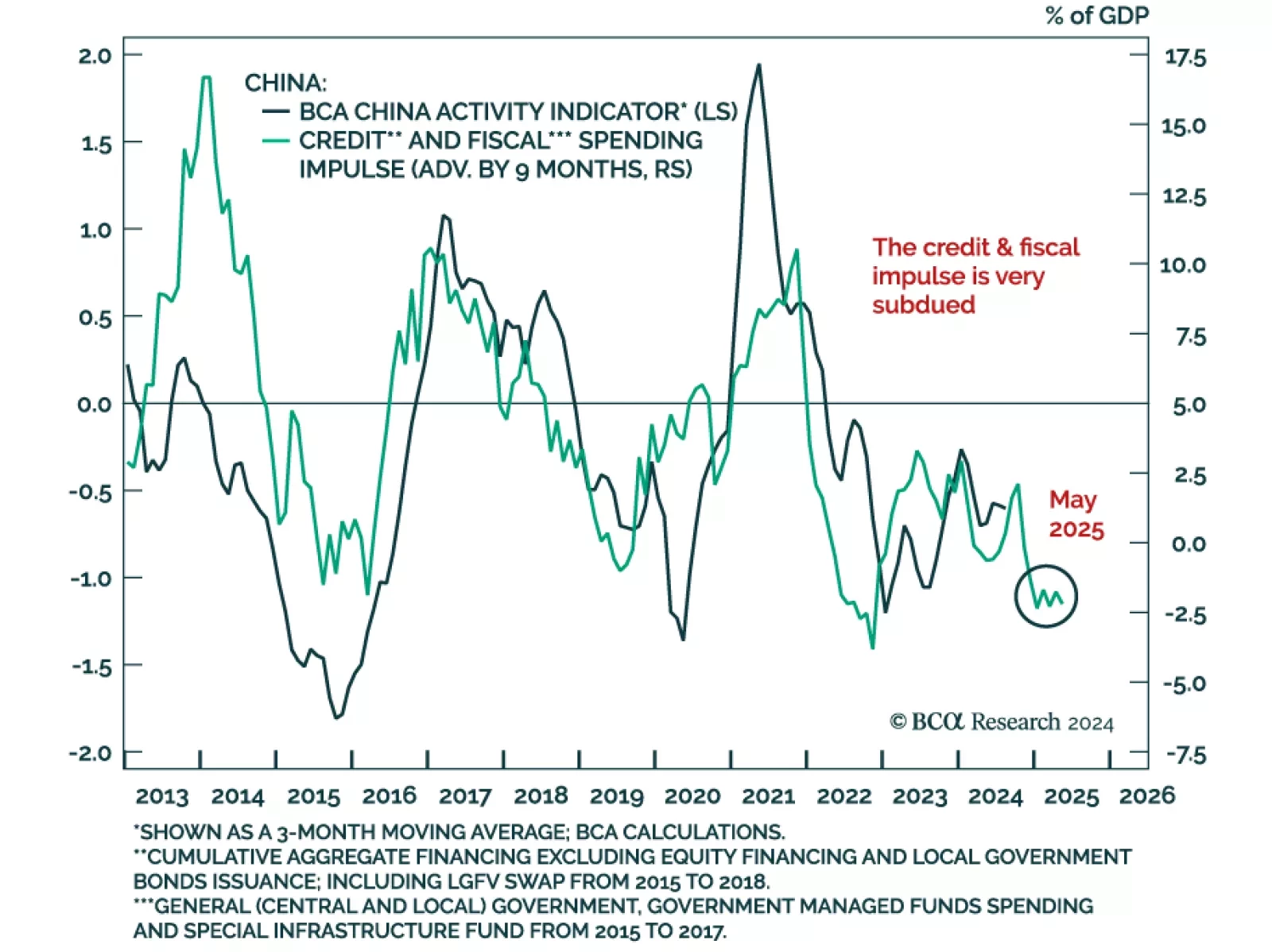

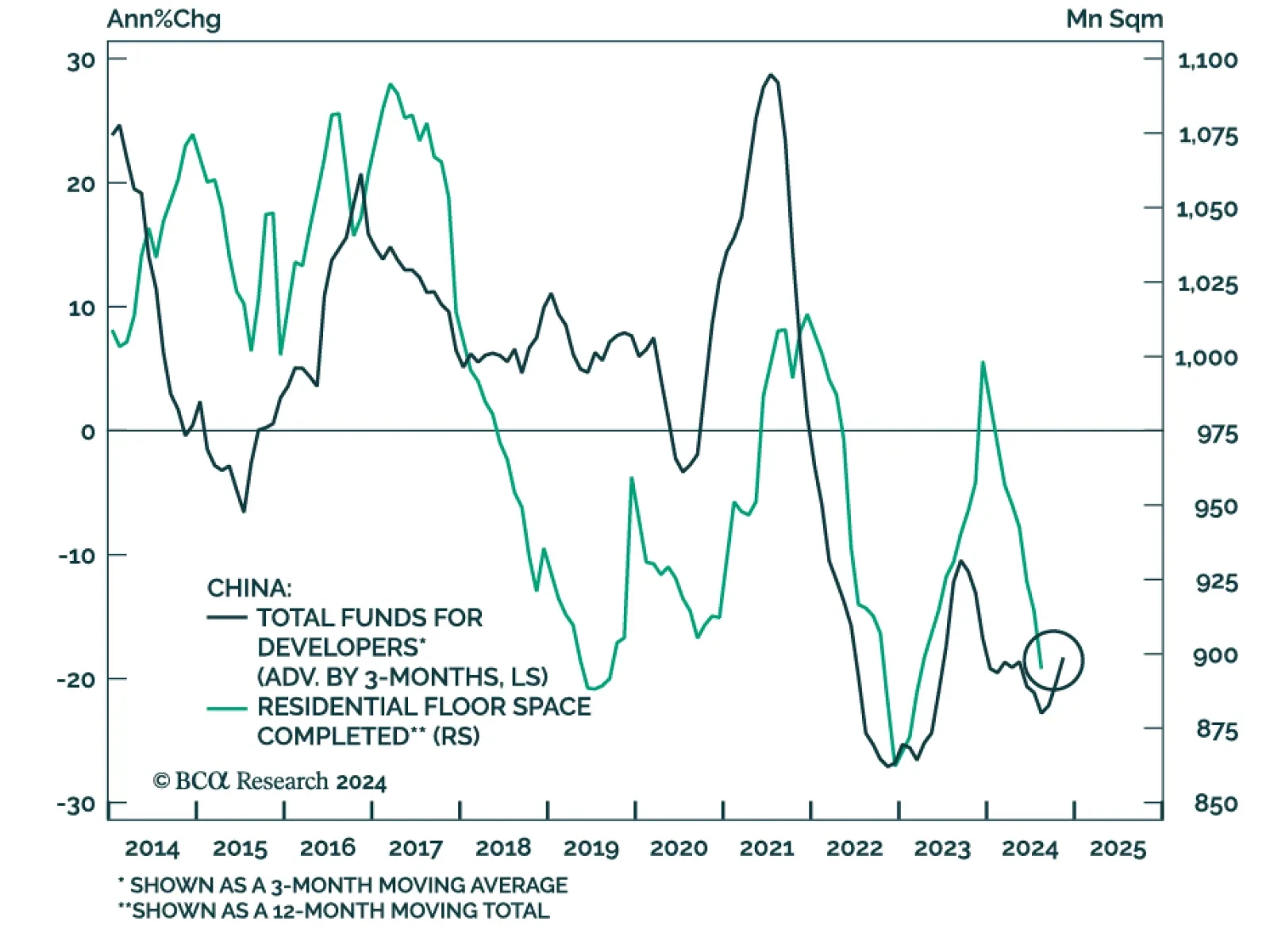

Chinese activity data met expectations, with Q3 GDP printing at 4.6% year-on-year, decelerating from 4.7% in Q2 but below the 5% 2024 growth target. Other metrics such as industrial production and retail sales beat expectations…

US housing starts and building permits eased below expectations in September. Permits, a proxy for future construction, dropped 2.9% after rising 4.6% in August. New construction fell 0.5% after rising 7.8% a month prior. These…

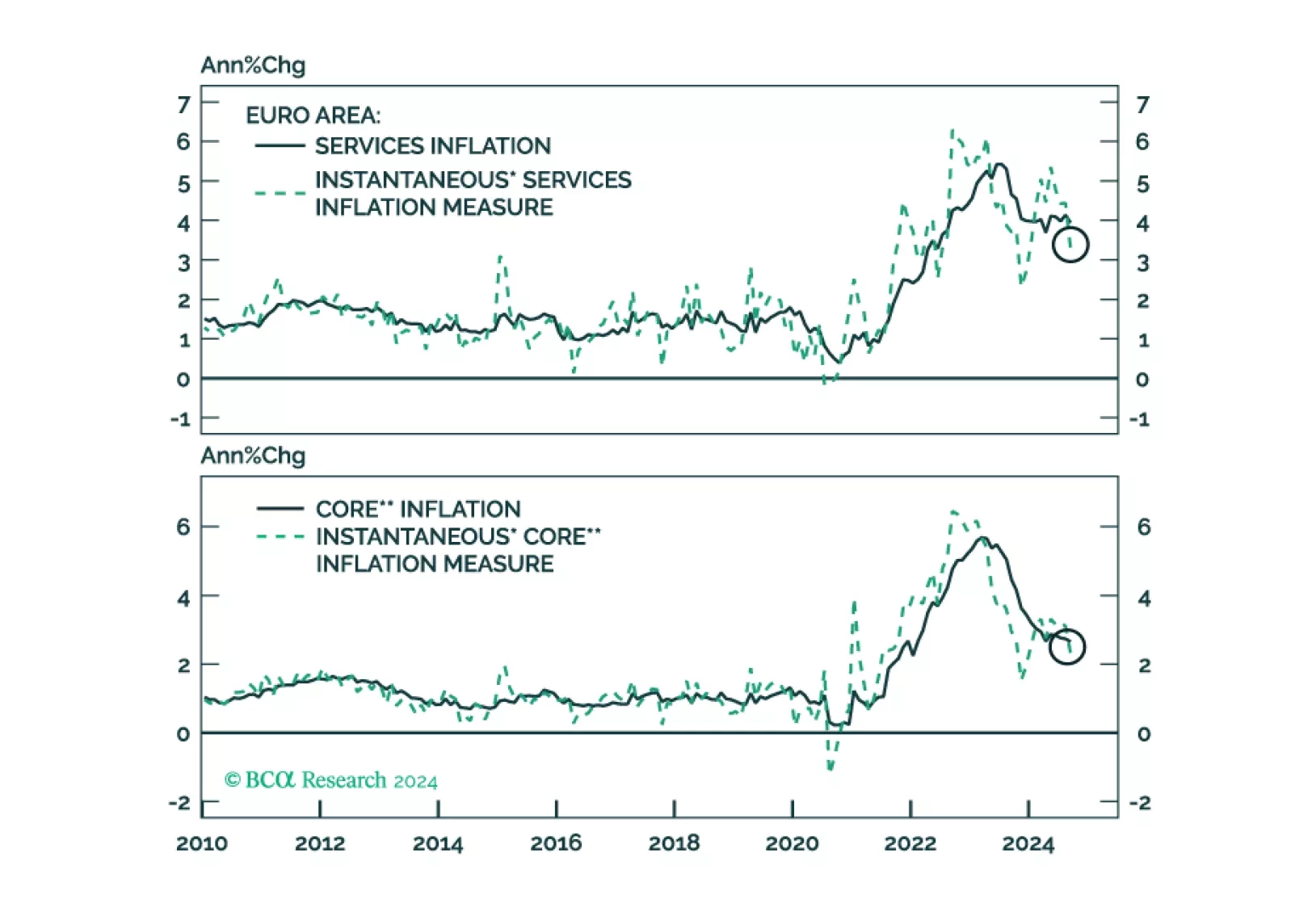

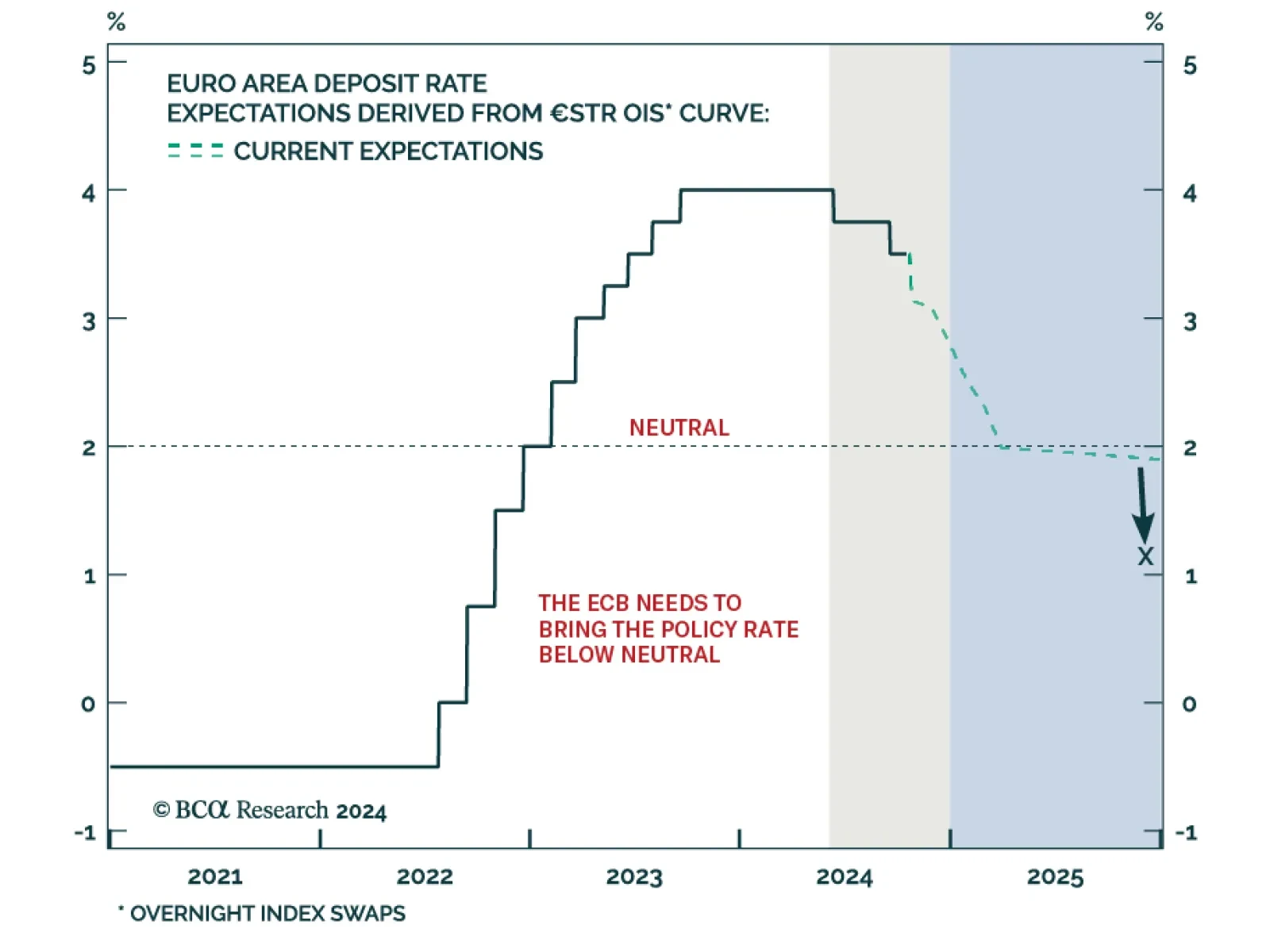

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

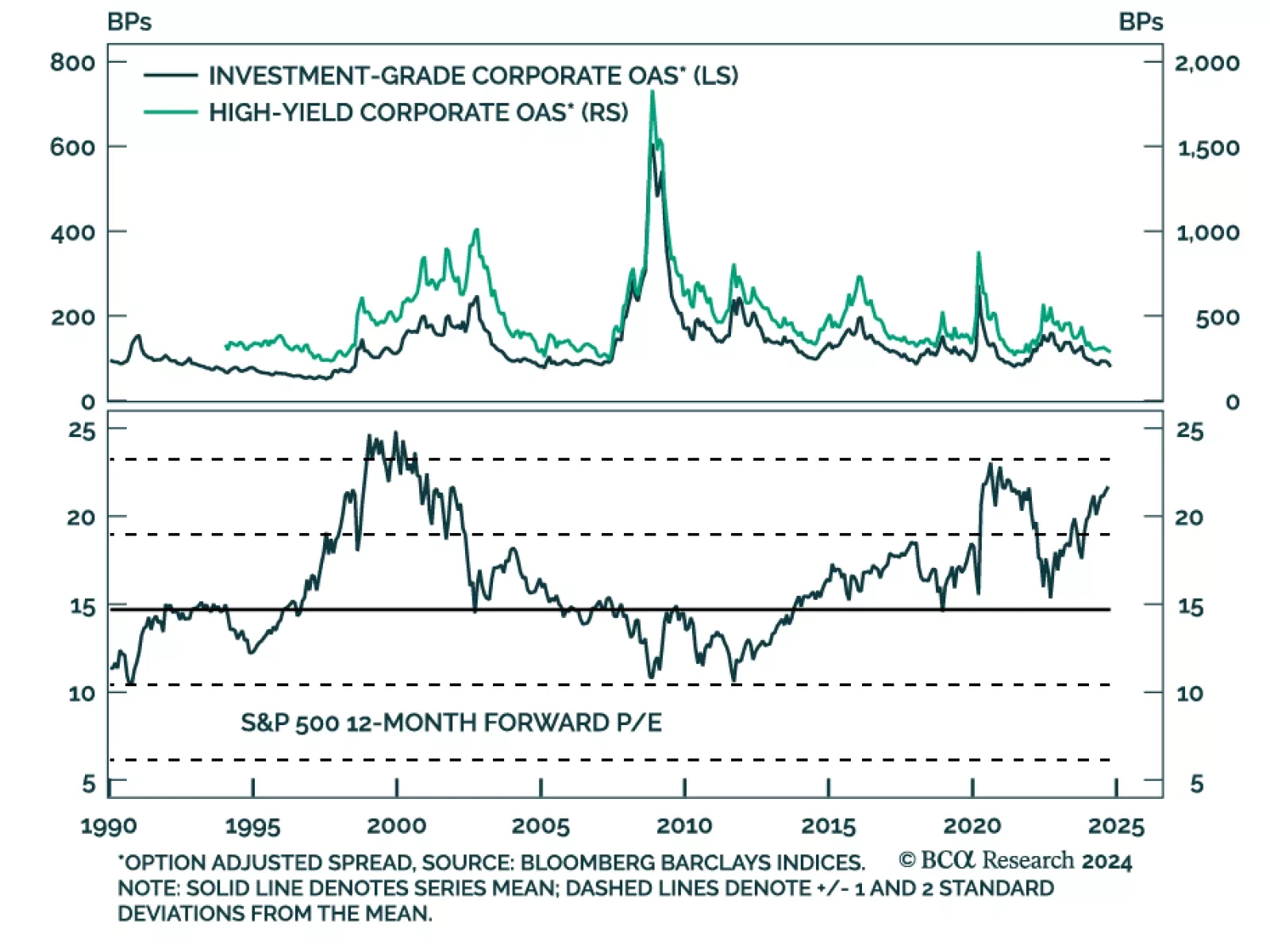

Recent economic data surprises drove equities and bond yields higher, putting our US Investment Strategy team’s bearish views to the test. They recently published a piece assessing their views considering these bullish…

China’s Housing Administration Chief held a press conference yesterday to unveil two property-sector stimulus plans. According to our China strategists, the details were underwhelming and led to a decline in Chinese…

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…

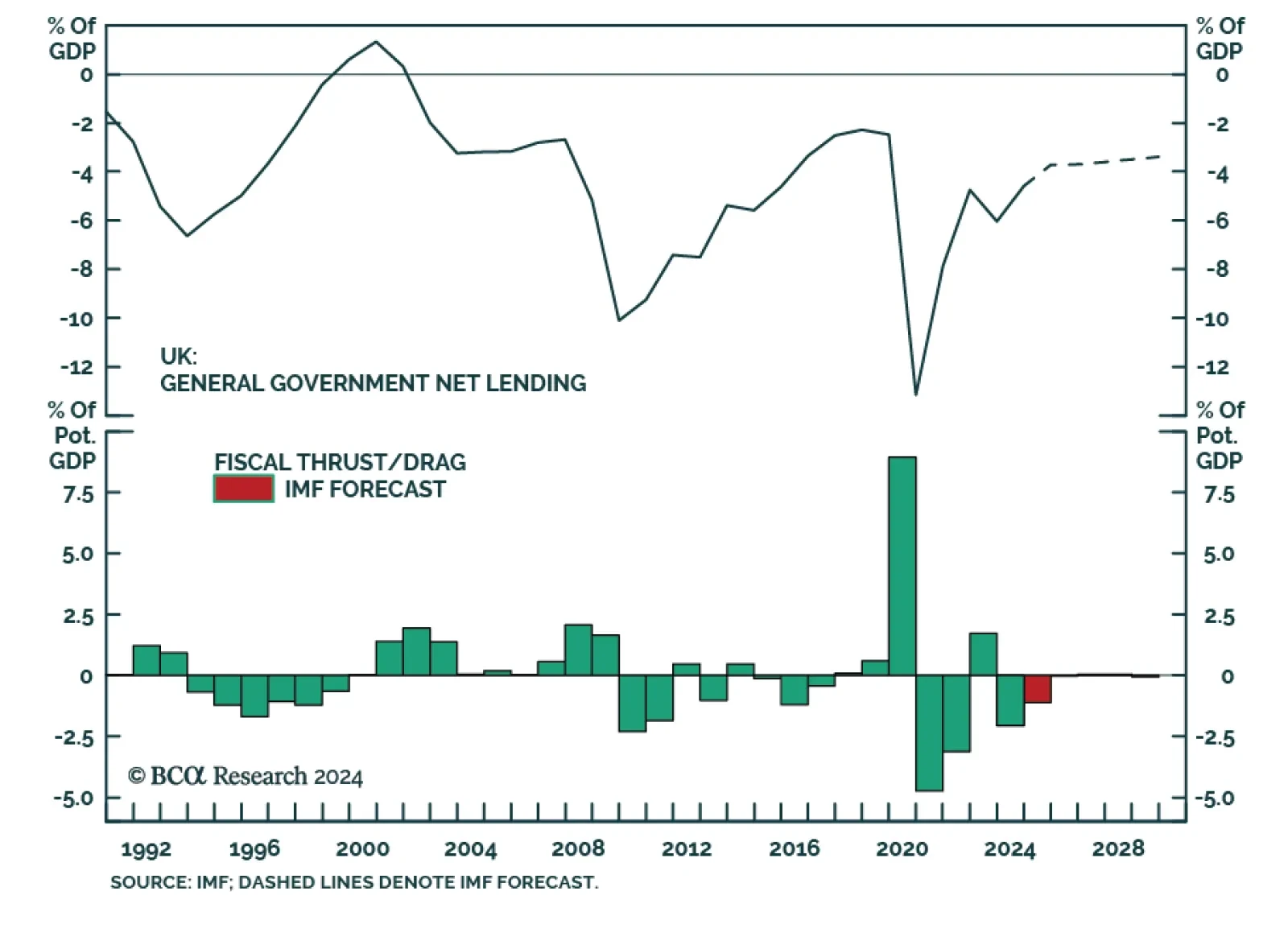

The UK August employment report was in line with recent data showing an economy humming at a decent pace. The unemployment rate decreased 0.1pp to 4% after peaking at 4.4% before the summer. The BoE will look kindly to the…

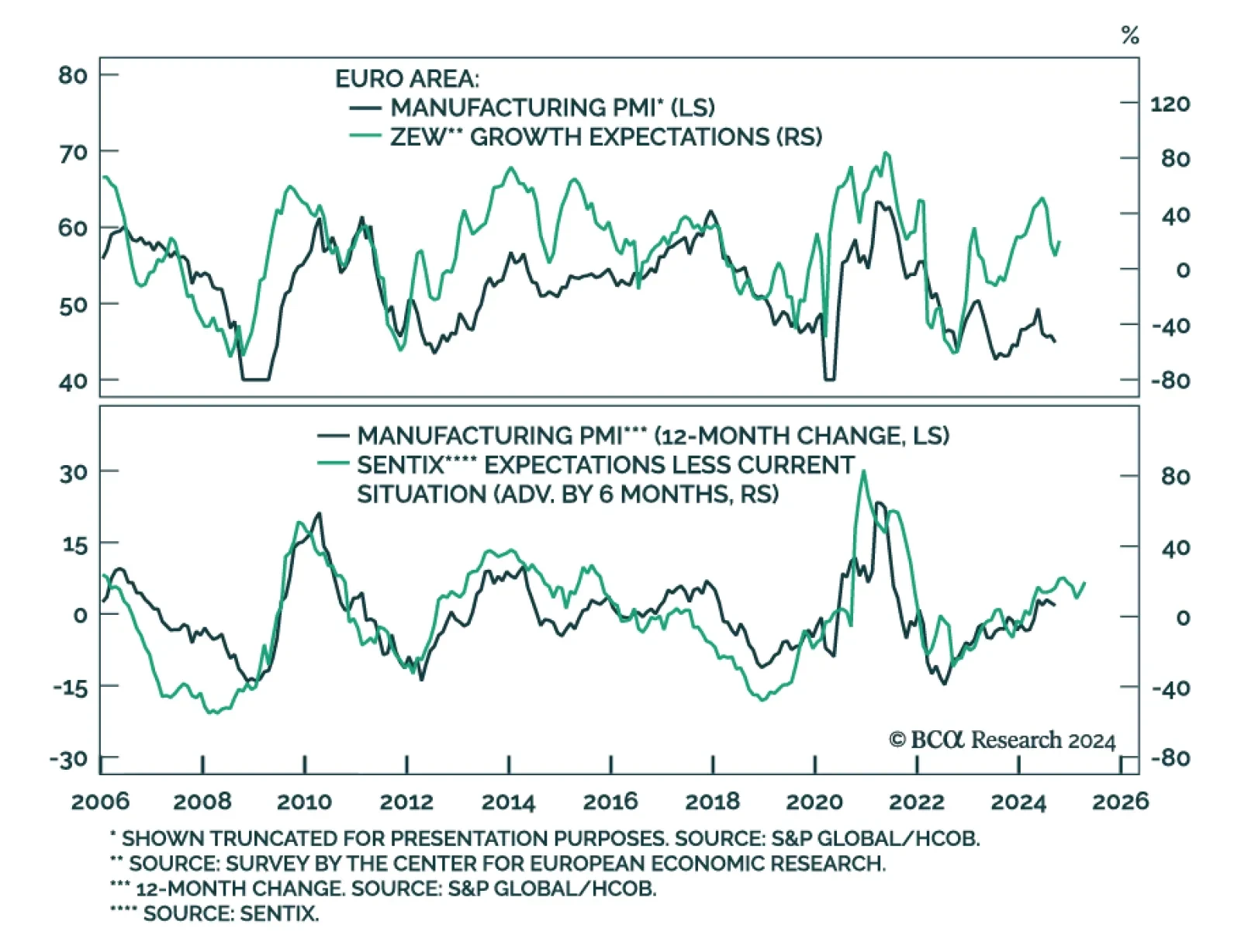

Economic expectations for the both Germany and the Eurozone ticked up in October and surprised positively for the first time since they collapsed this summer. The assessment of current conditions however worsened, going from -84.…