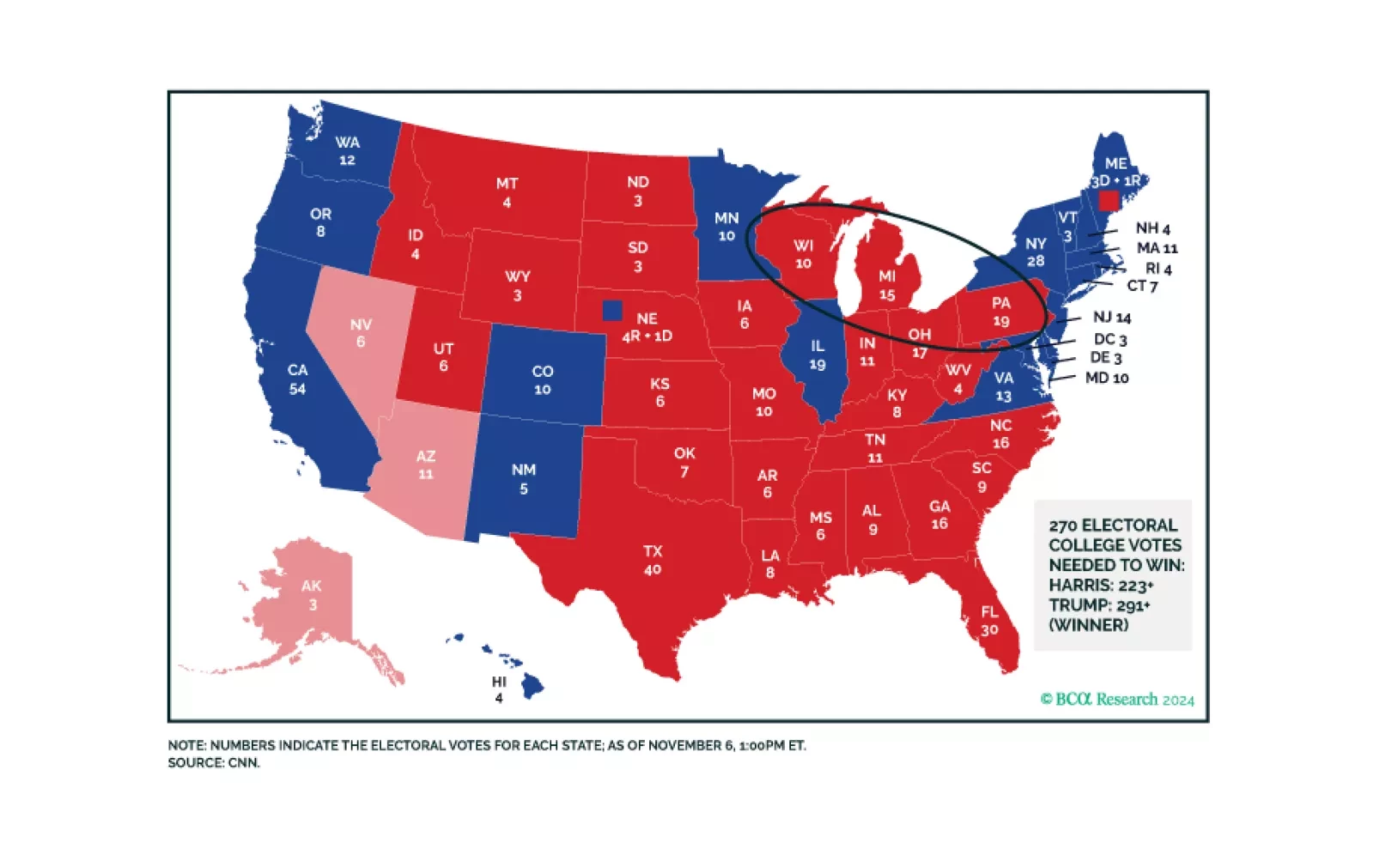

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

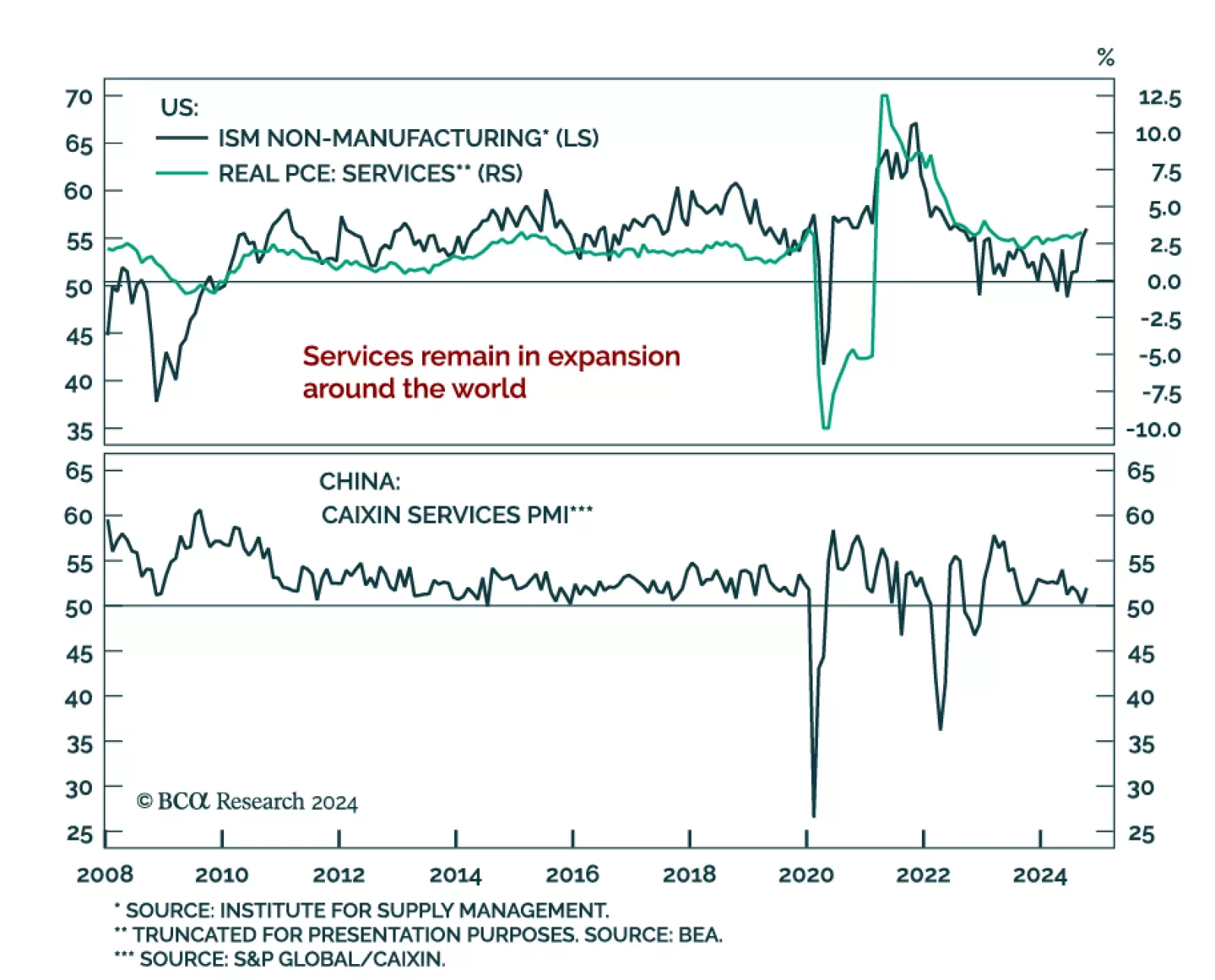

The October ISM non-manufacturing PMI beat expectations, rising to 56 from 54.9 in September, up from a sub-50 low in June. Most components indicate an expansion, but the only significant increase came from employment. New orders…

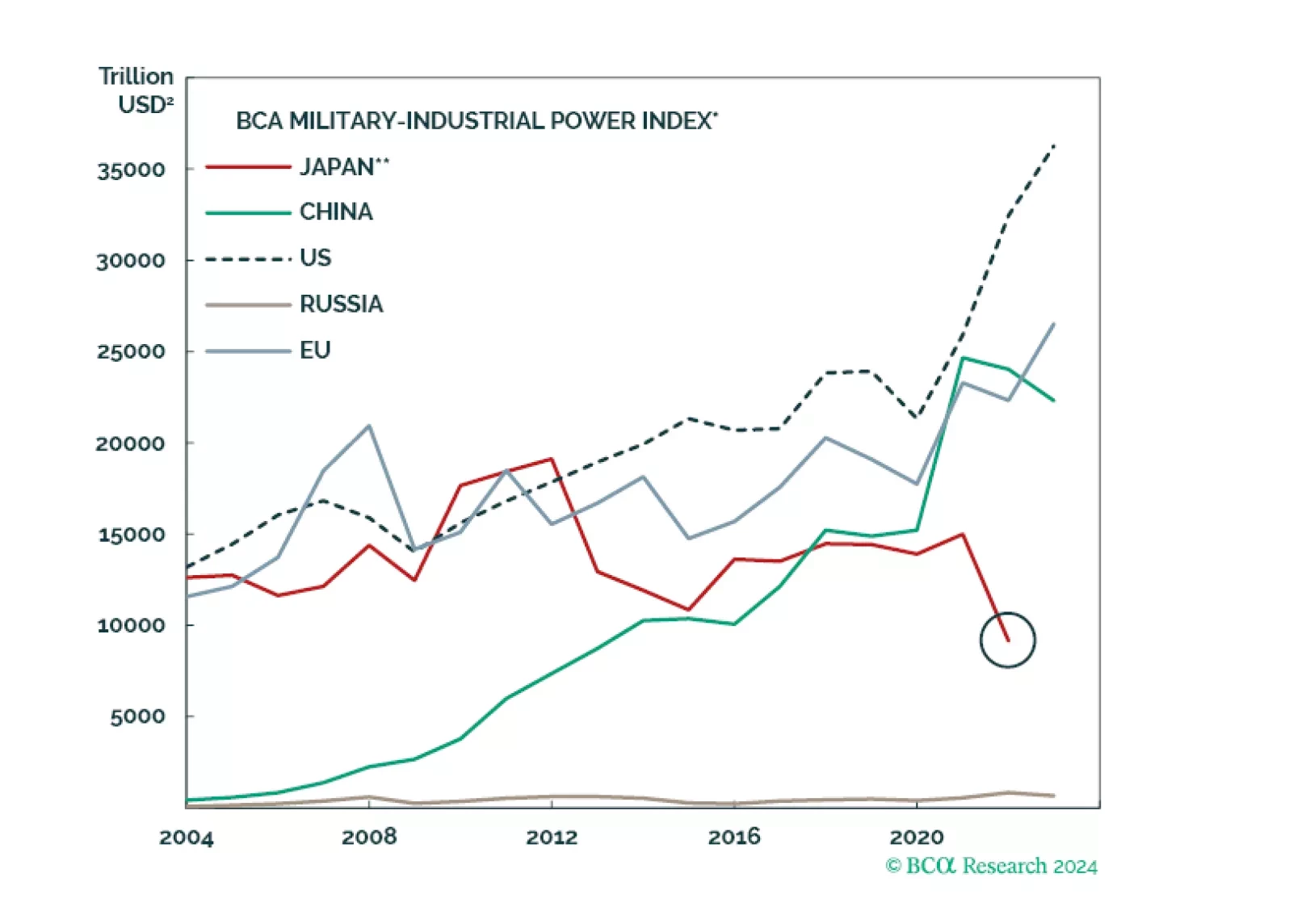

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

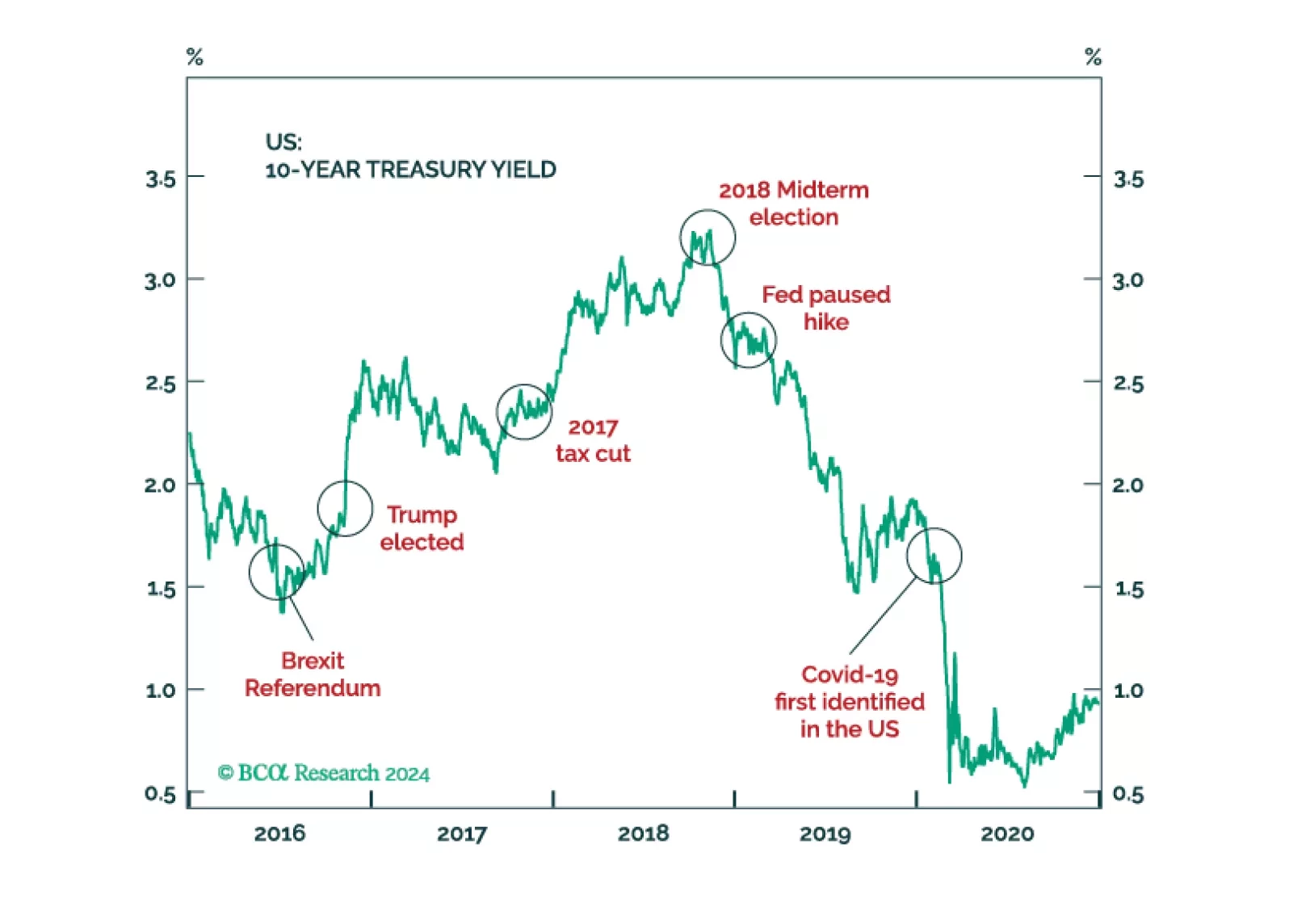

Our Global Asset Allocation Strategy colleagues argue in their monthly report that while a soft landing is a possibility, it is already reflected in asset pricing. A Trump victory would be a threat to this scenario. Inflation…

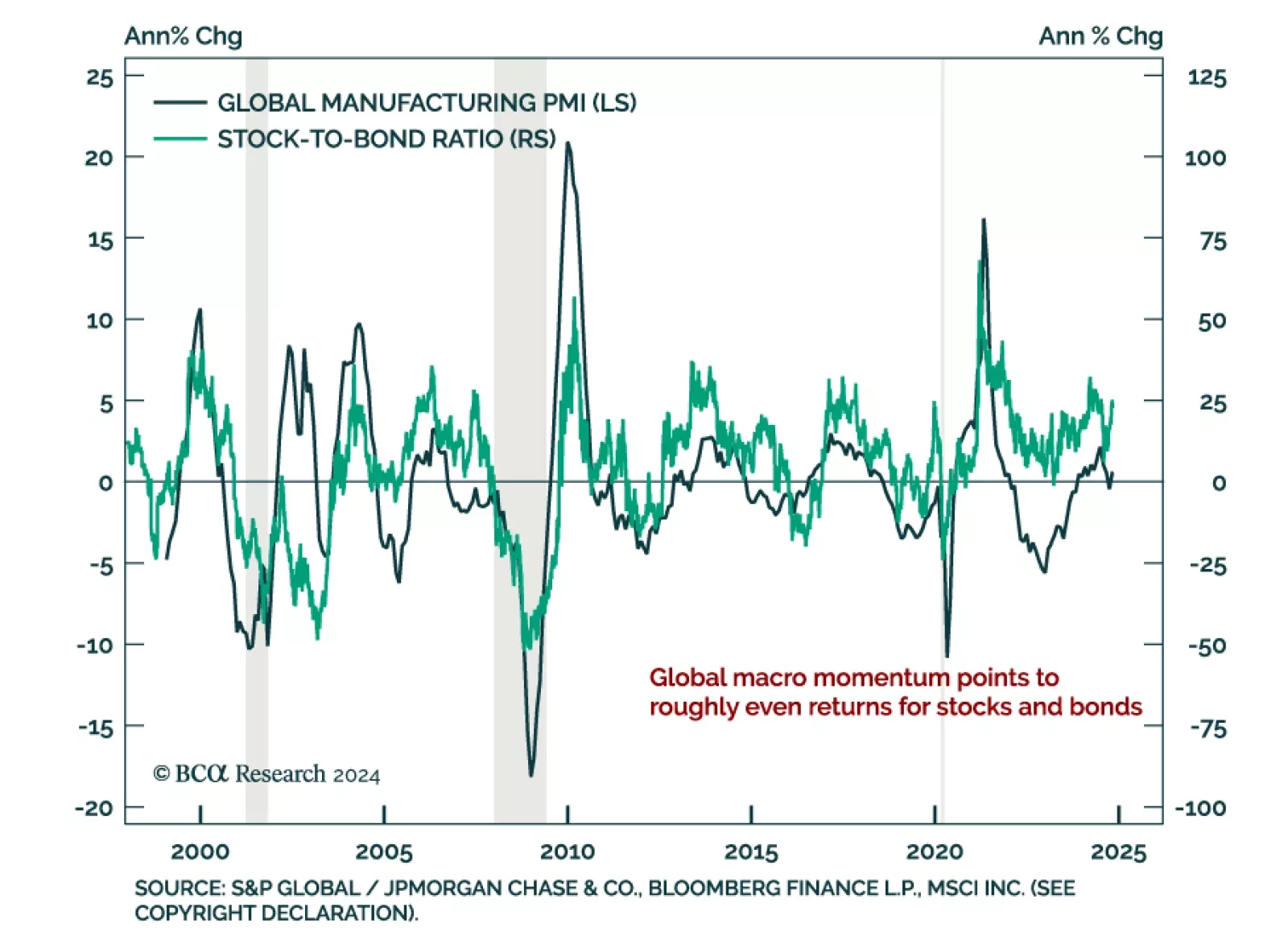

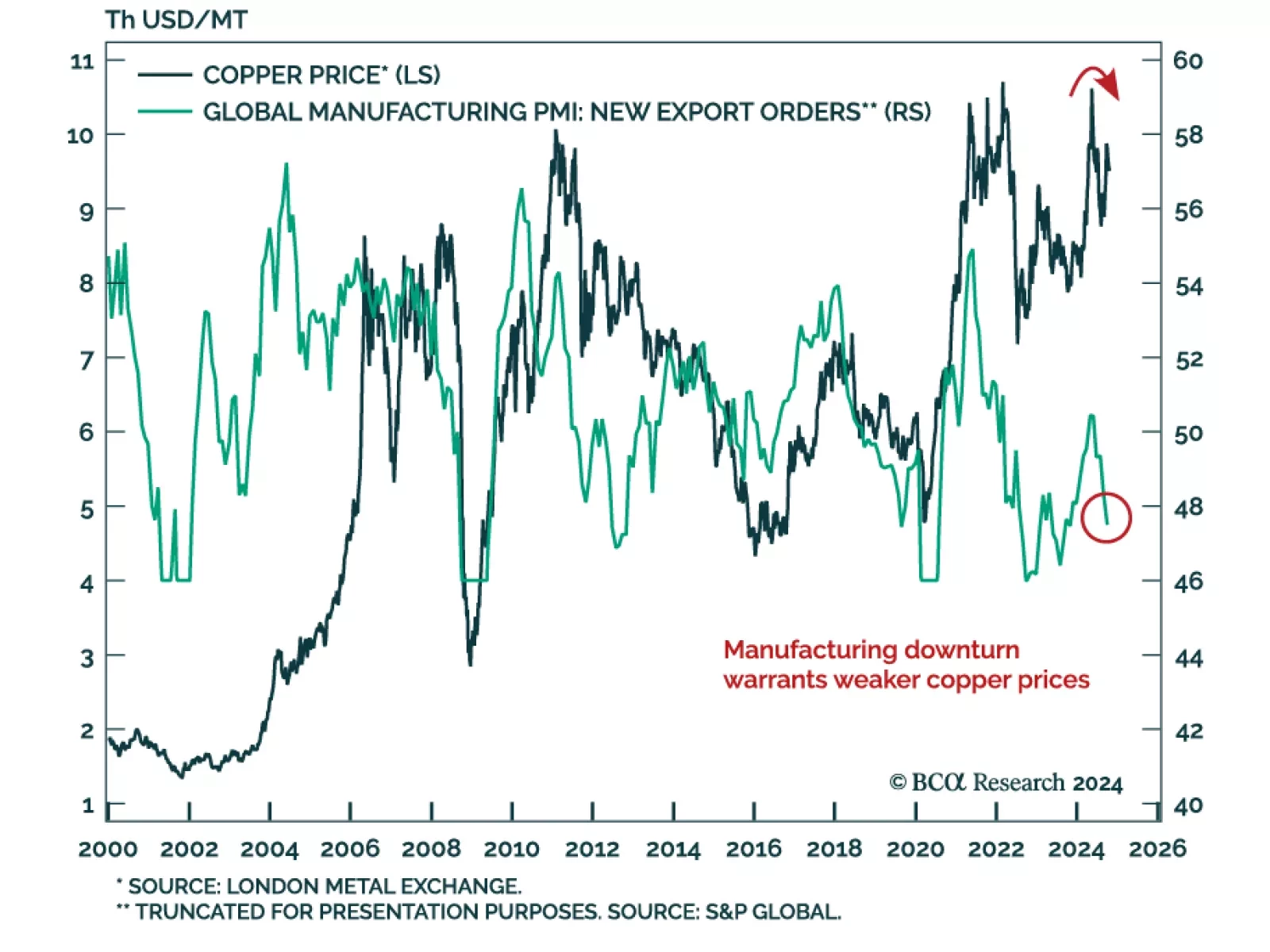

The October global manufacturing PMI printed at 49.4, up from 48.7 in September but still in contractionary territory. While output stabilized at 50.1, new orders (48.8) and new export orders (48.3) remain in contraction, as is…

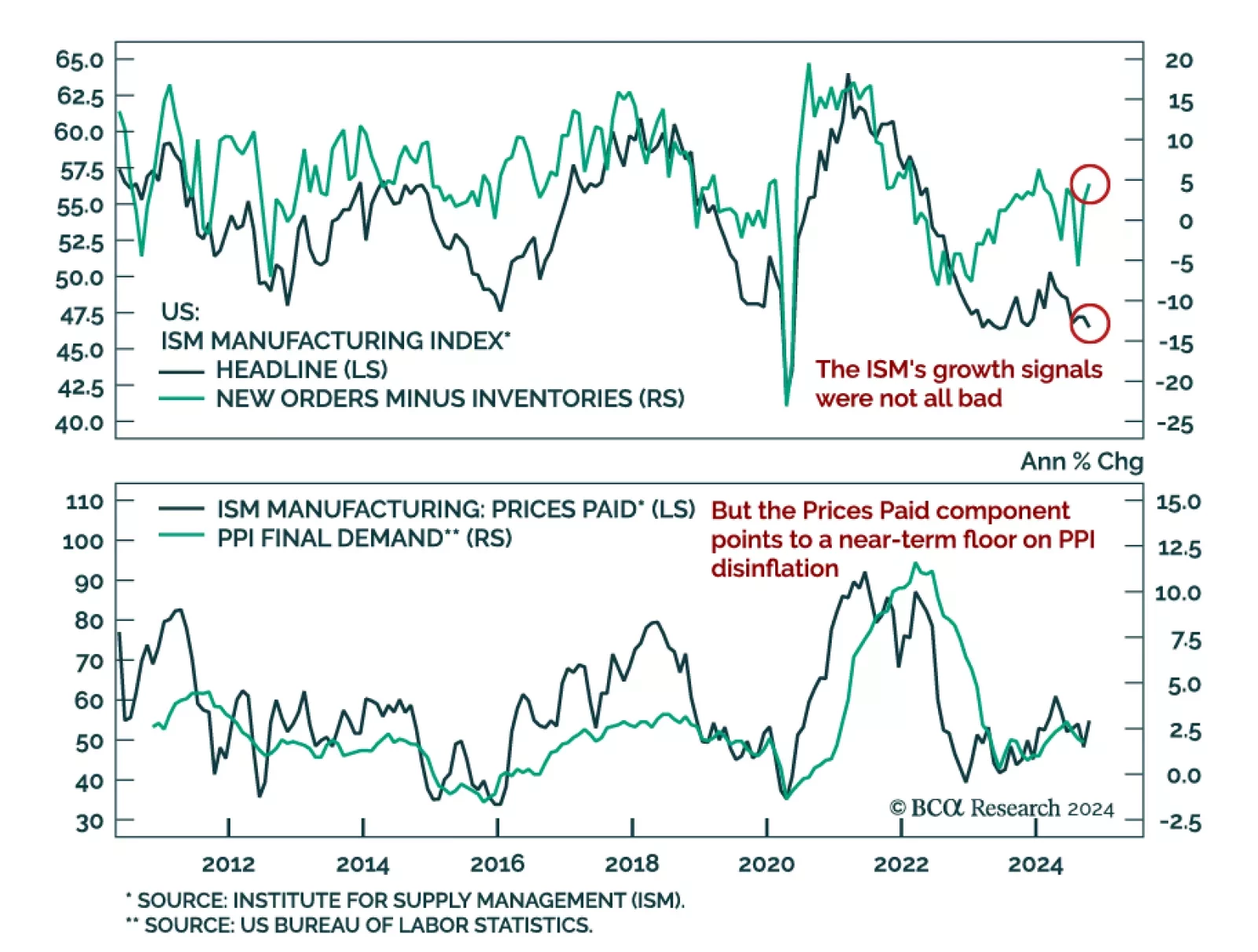

The October ISM Manufacturing missed expectations, decreasing to 46.5 from 47.2 in September. The Prices Paid component jumped, rising to 54.8 from 48.3 the month prior. New Orders showed a small upside surprise at 47.1, up 1…

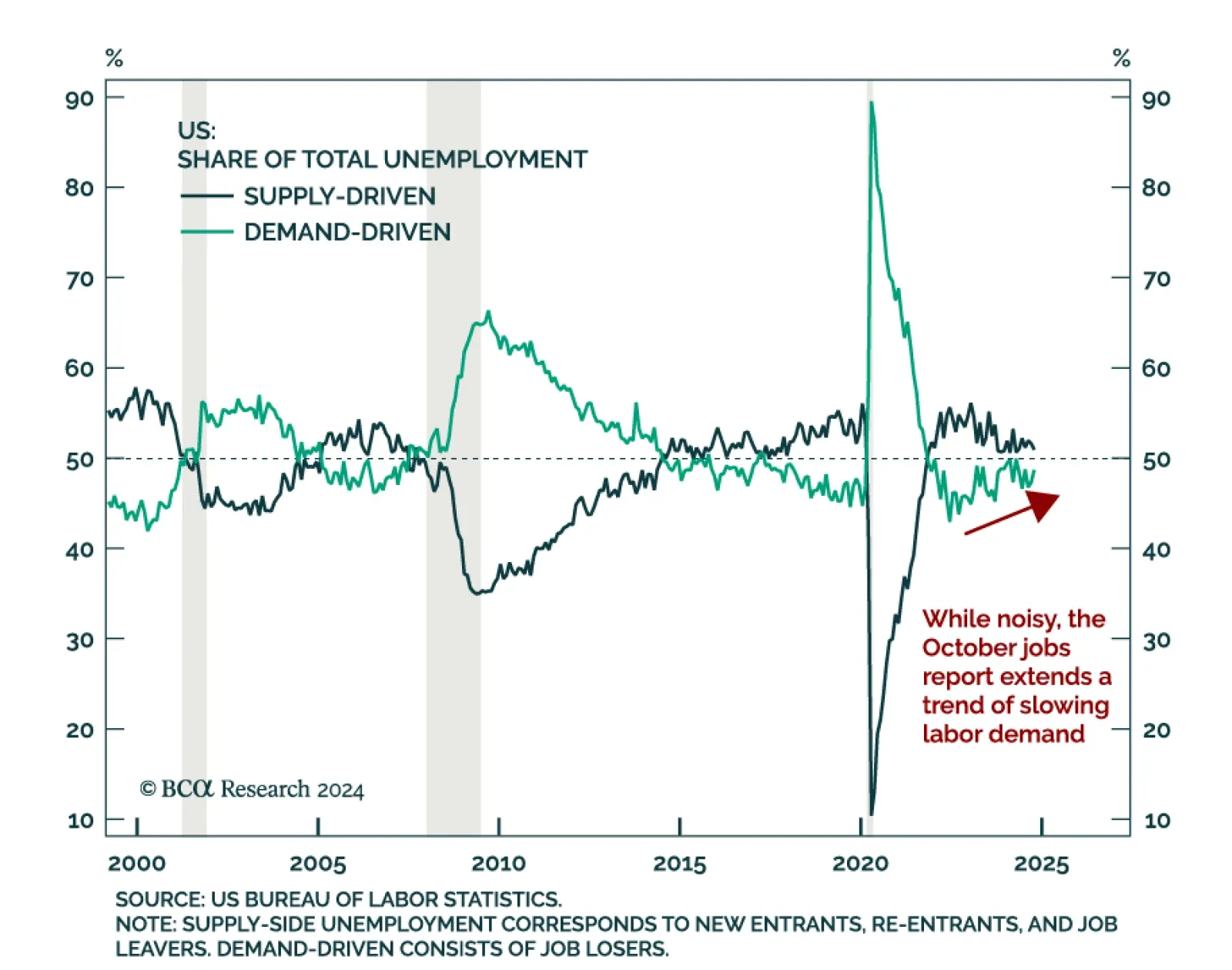

The October US jobs report had mixed signals and was skewed by hurricanes and industrial strikes. Unemployment met expectations by staying unchanged at 4.1%, although it rose nearly 0.1 percentage point on an unrounded basis.…

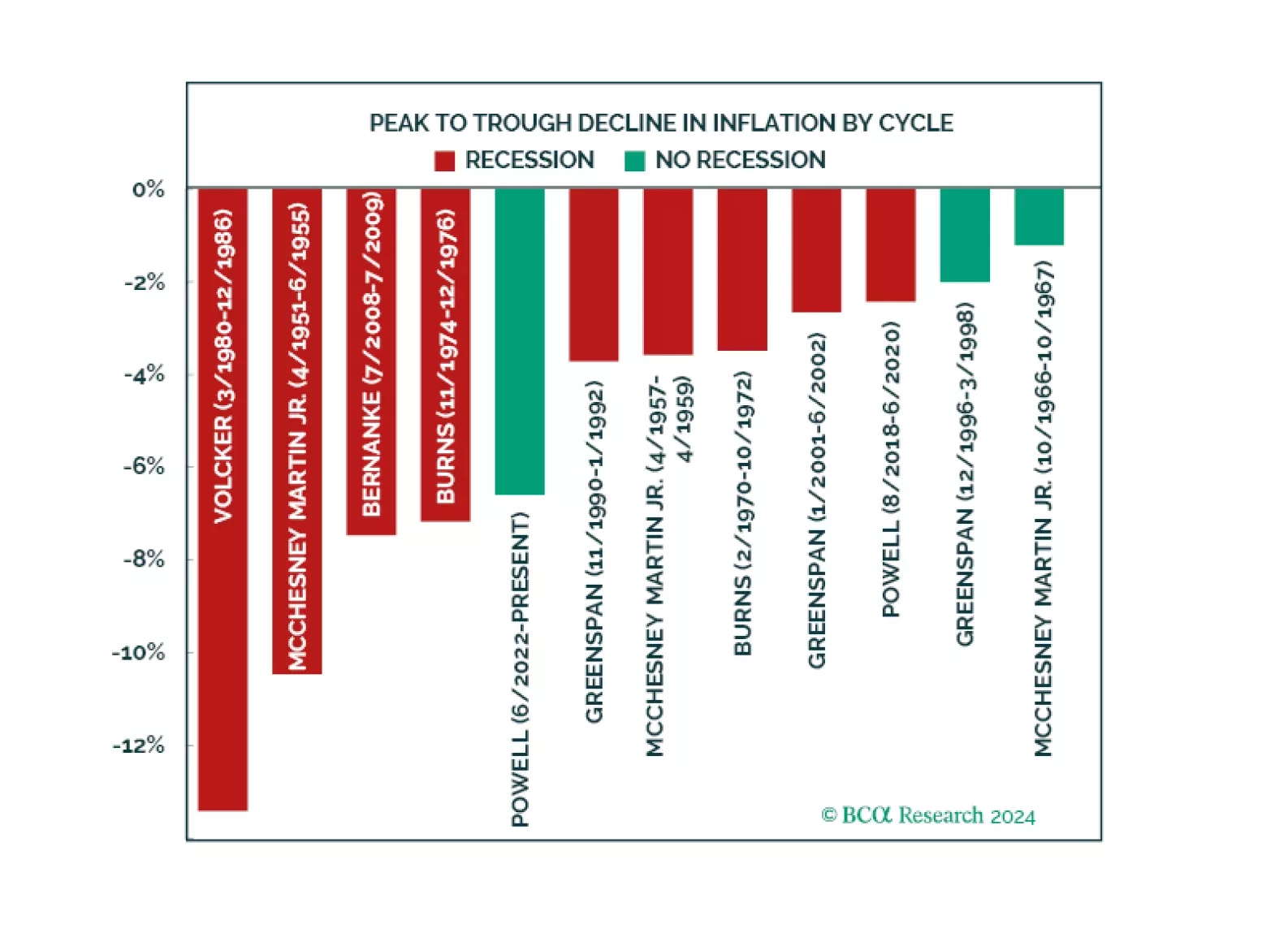

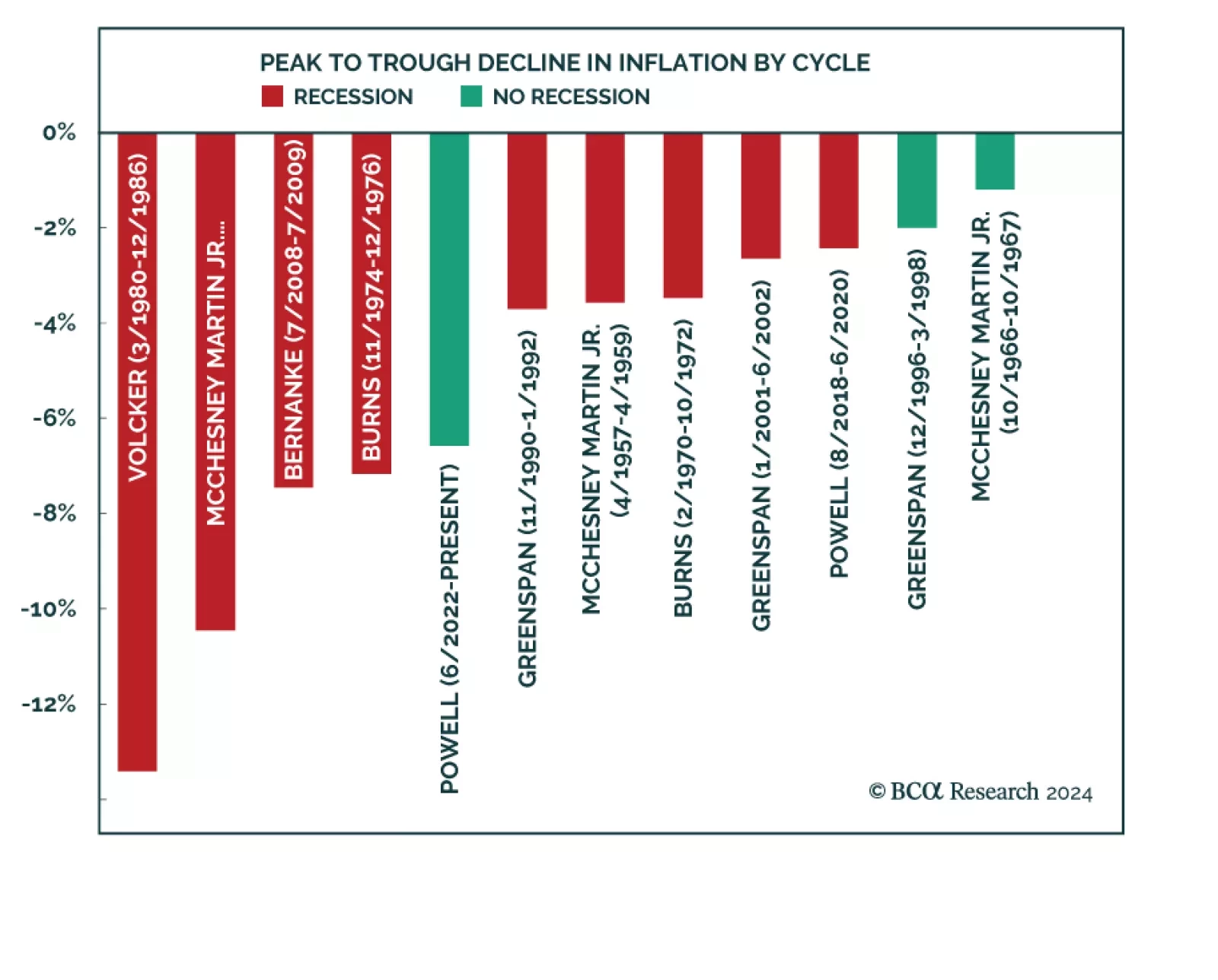

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…