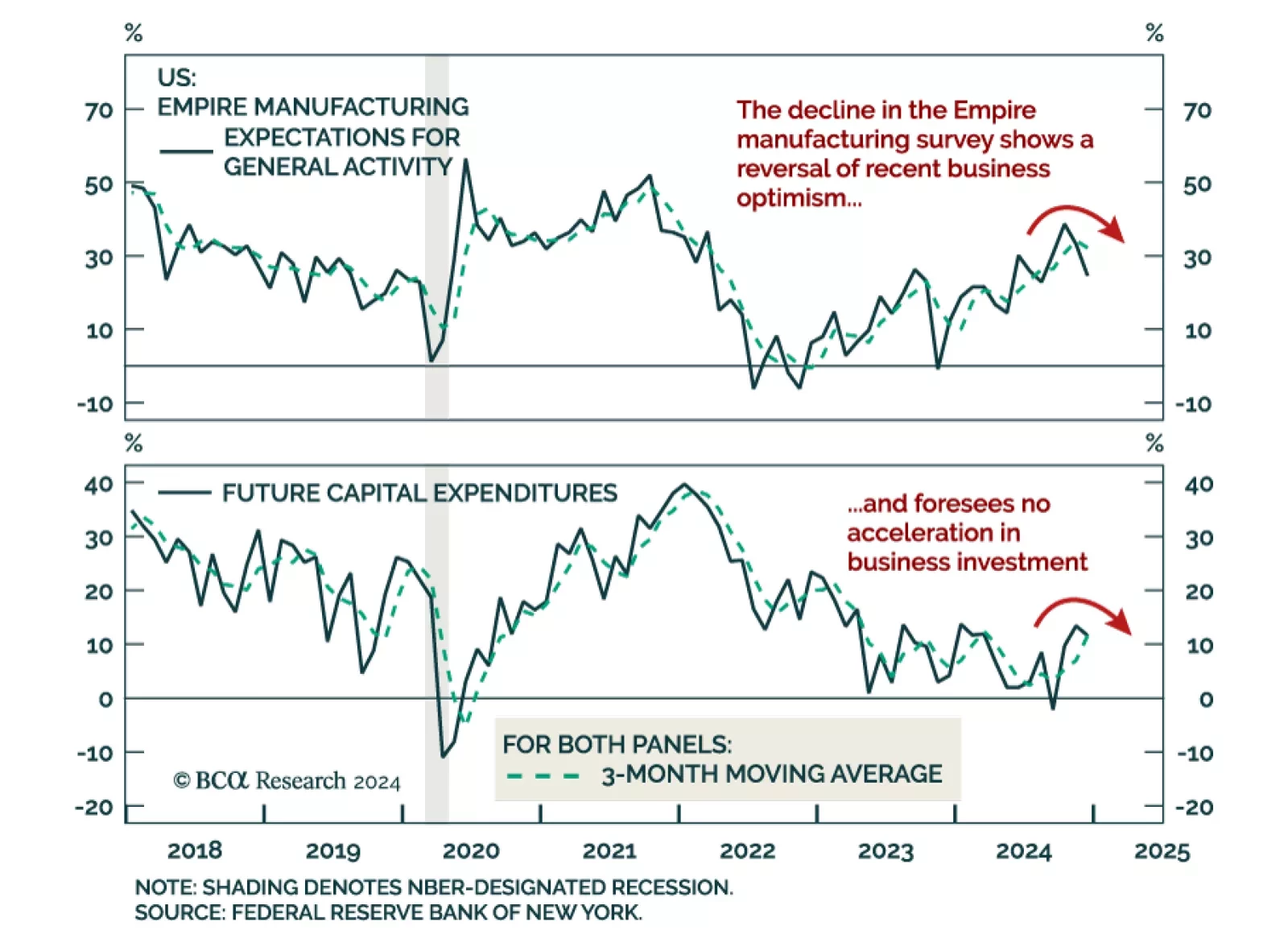

The December Empire Manufacturing index missed expectations, slowing to 0.2 from 31.2 in November. Most cyclical components eased, suggesting last month's surge was a post-election blip. The new orders subcomponent…

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

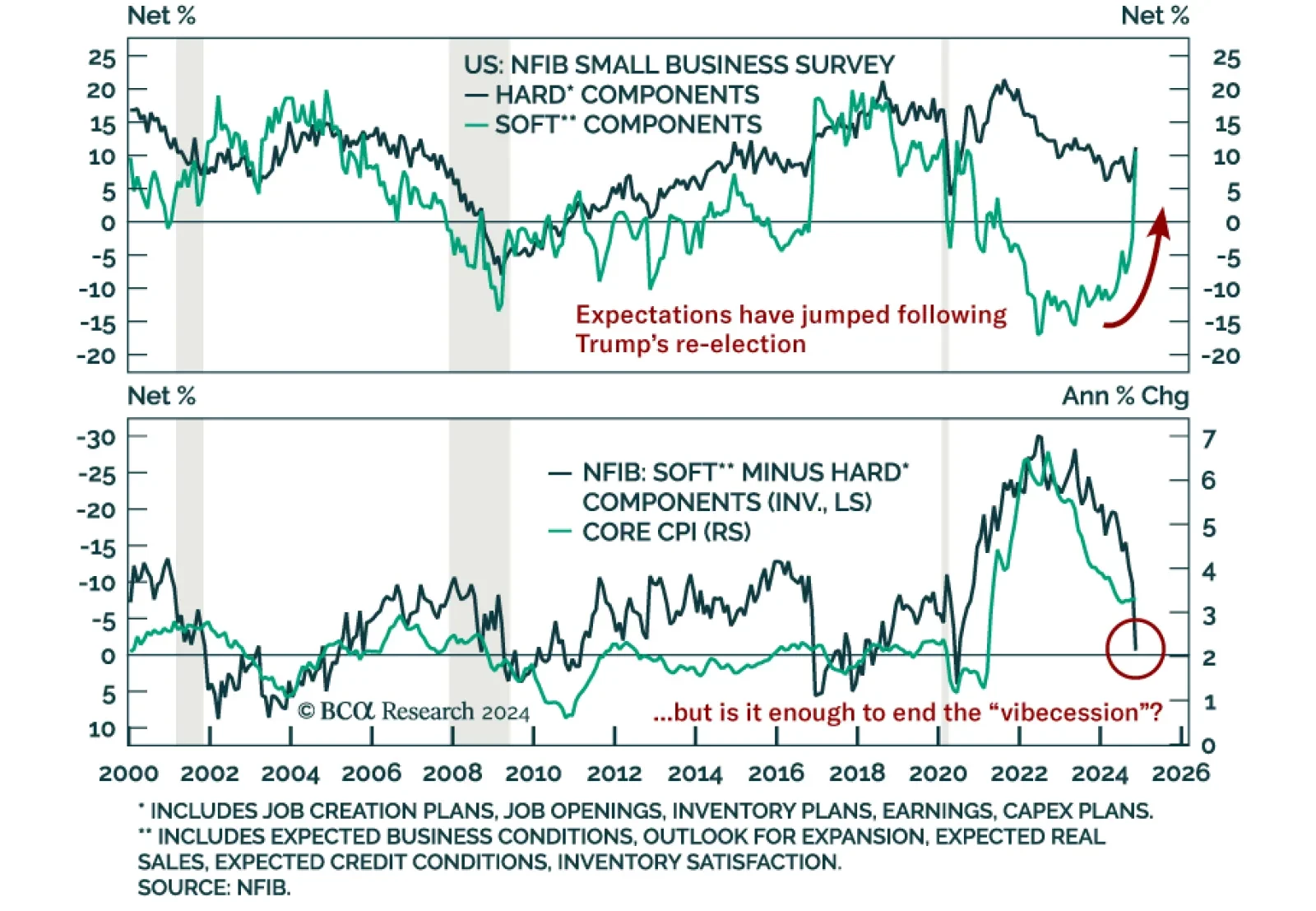

The post-COVID US recovery was different from previous cycles. Despite an ebullient economy, US consumers and firms have just not been feeling it, as reflected by the depressed signals from so-called soft, survey-based indicators…

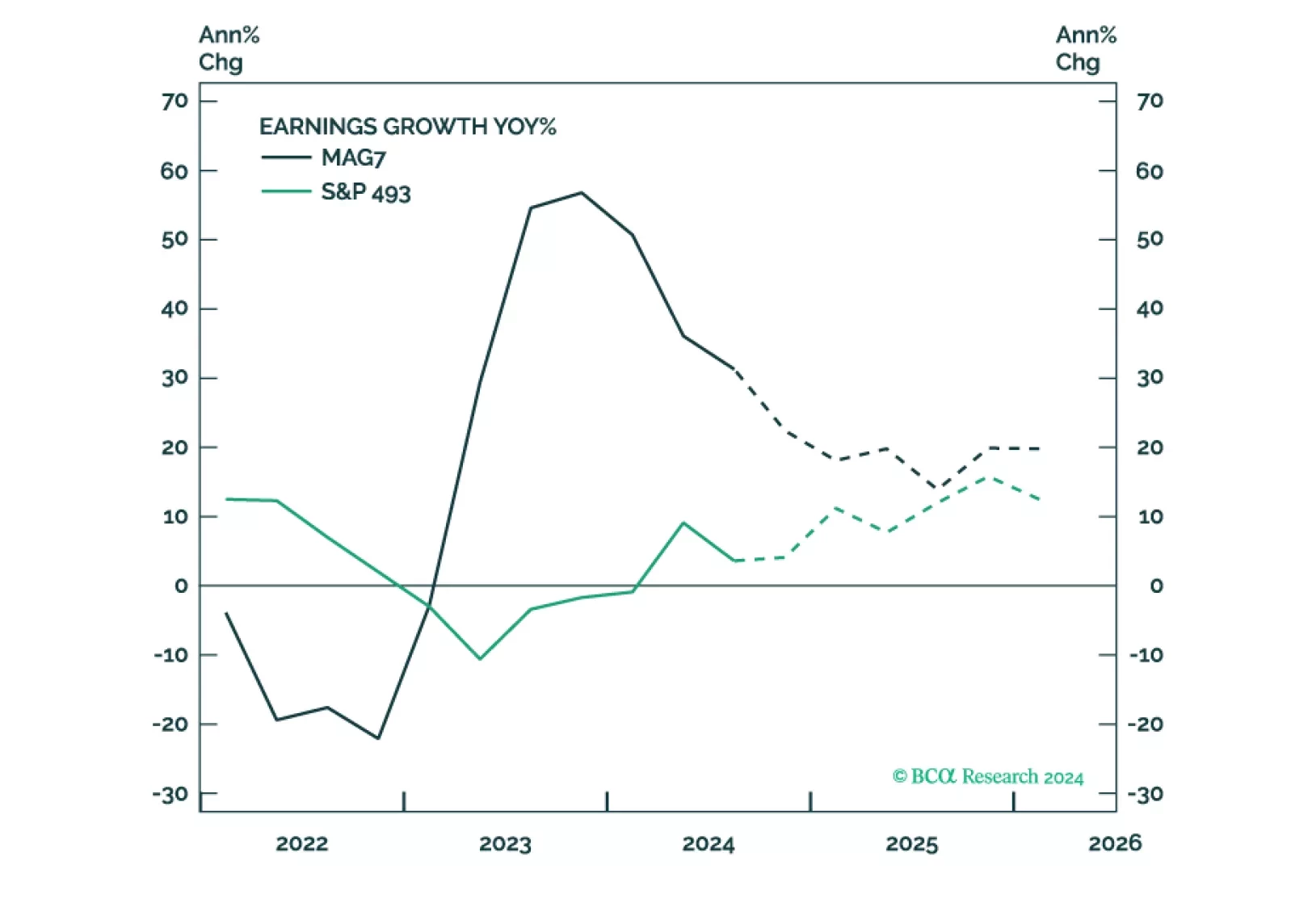

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

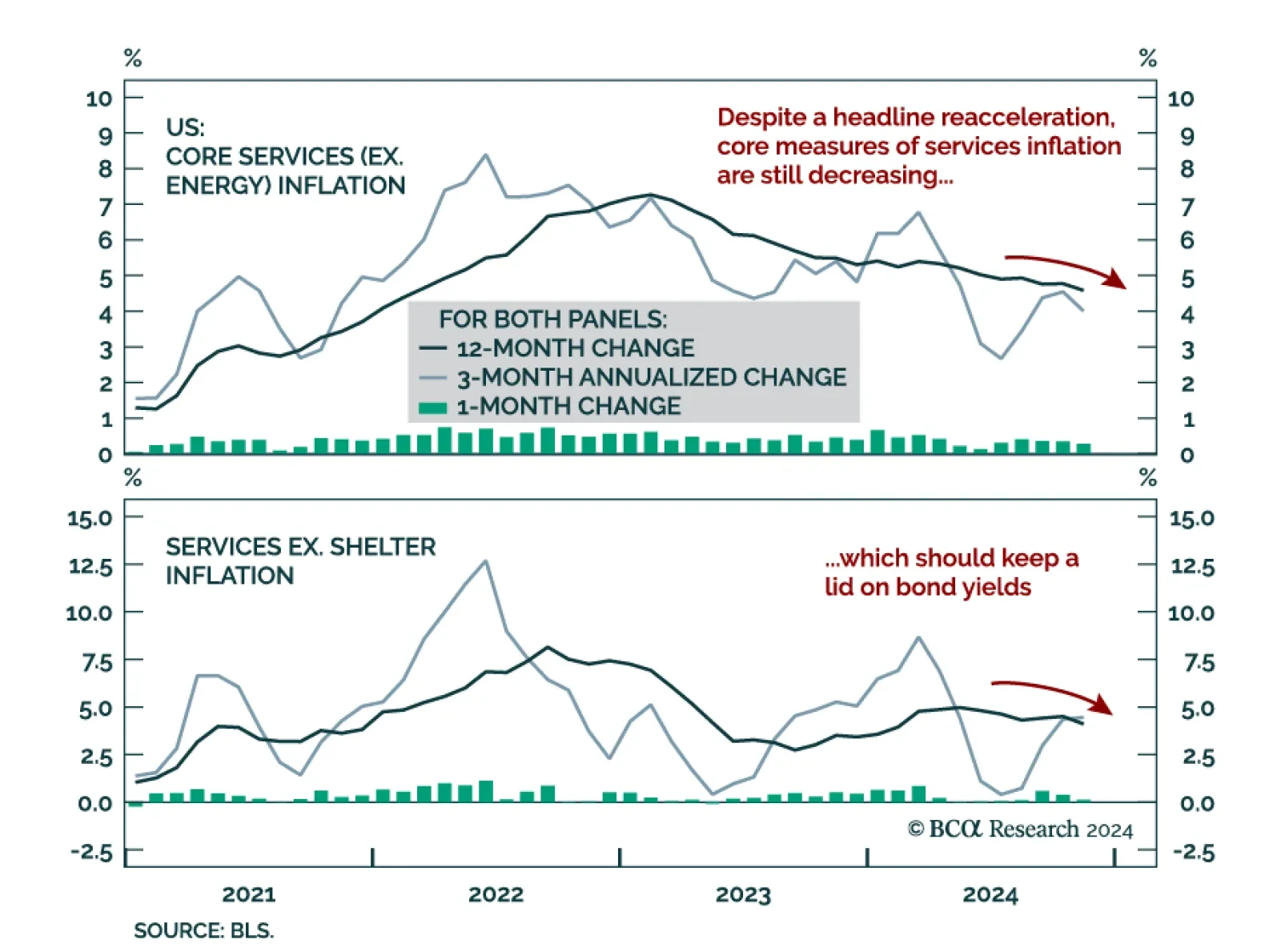

The November CPI came in line with expectations, accelerating to 0.3% m/m (2.7% y/y) from 0.2% (2.6% y/y) in October. Core also printed at 0.3% m/m, the same as October and remaining at 3.3% y/y. The acceleration was mainly…

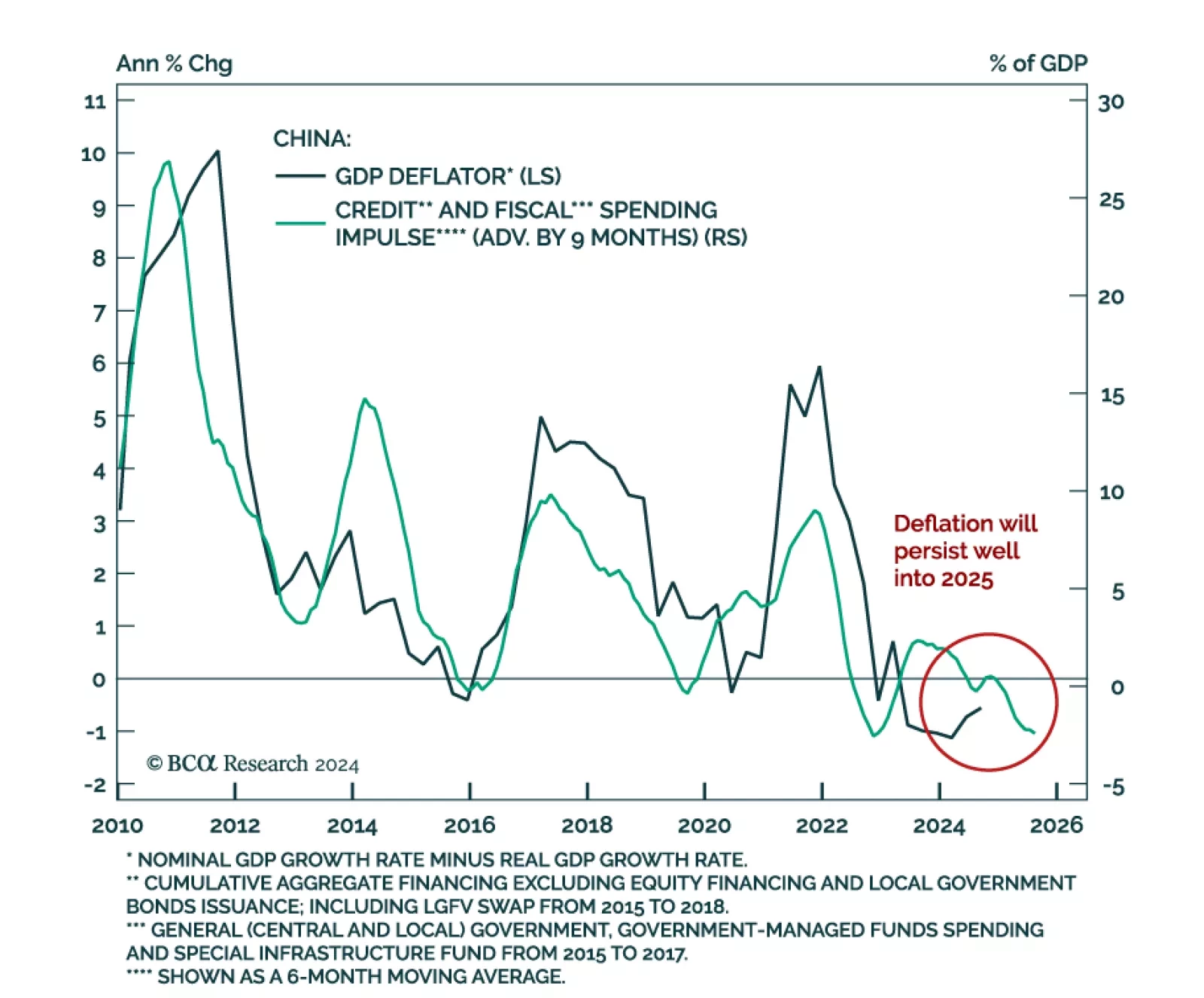

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

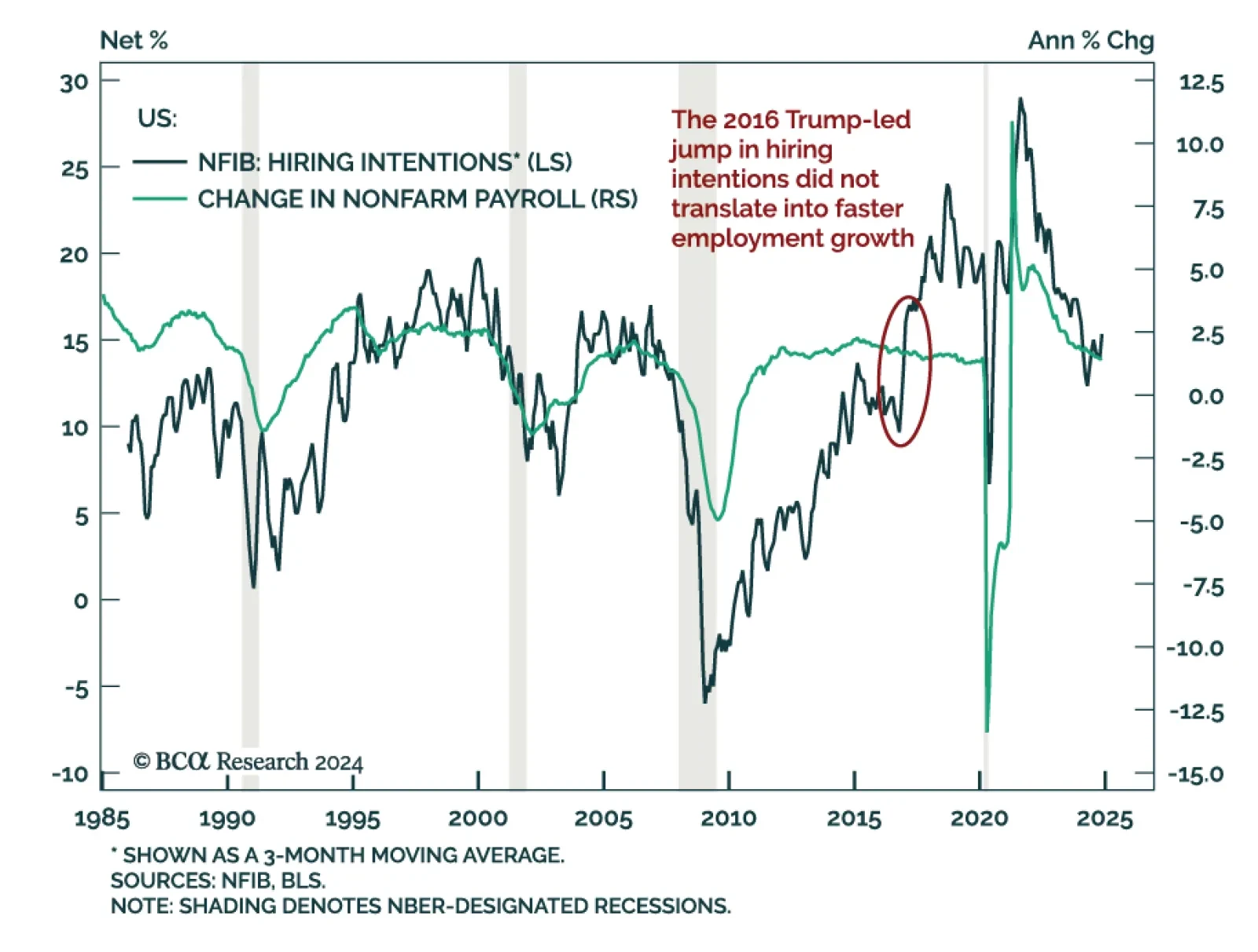

The November NFIB Small Business Optimism index beat expectations, jumping to 101.7 from 93.7 in October. Outside of inventory satisfaction, which was flat, all index subcomponents increased, led by measures of expectations. The…

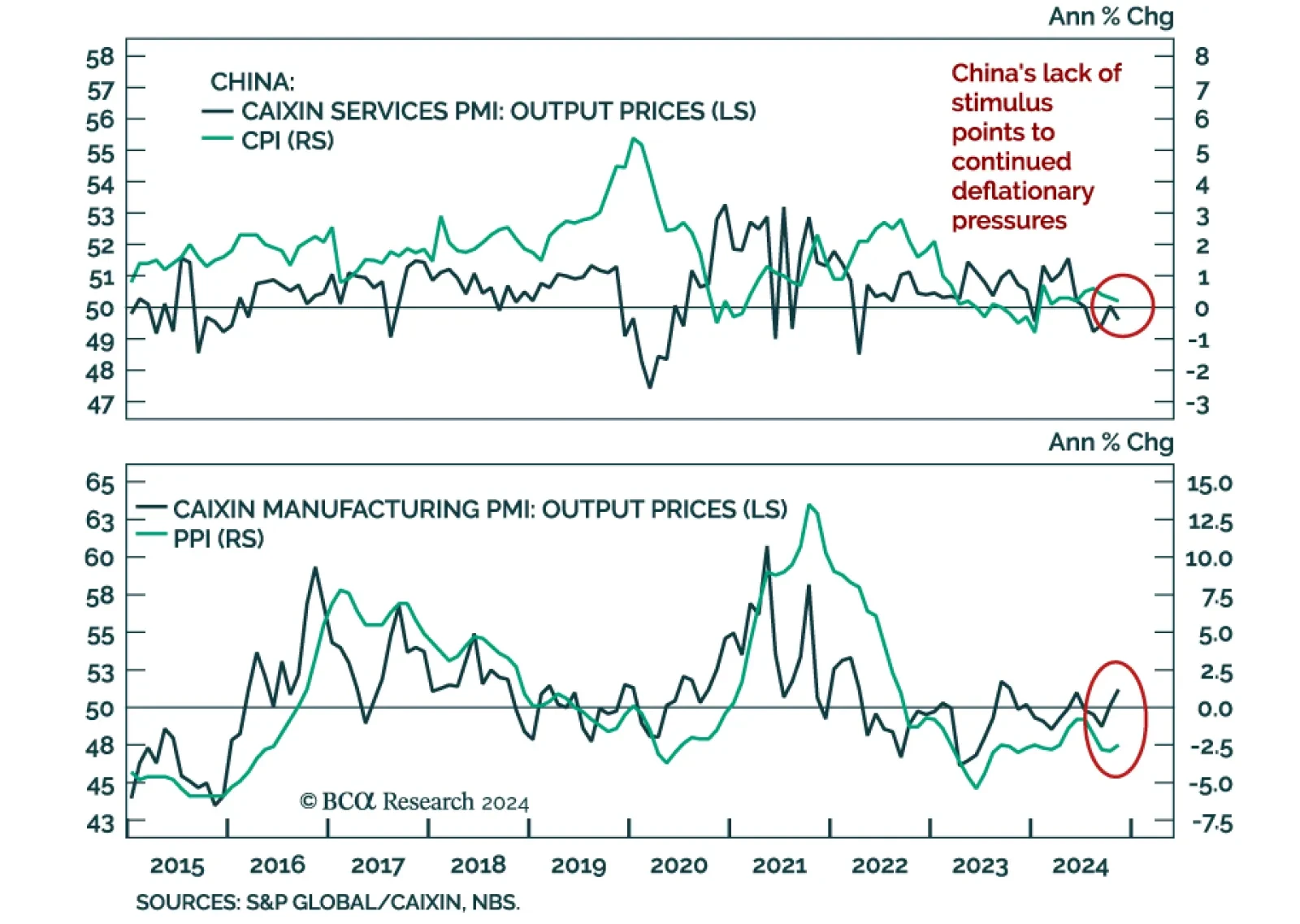

Chinese deflationary pressures intensified in November, with CPI ticking down to 0.2% y/y from 0.3% in October. Producer prices deflation eased, with prices falling 2.5% y/y, less than -2.9% y/y a month prior. The weak data…

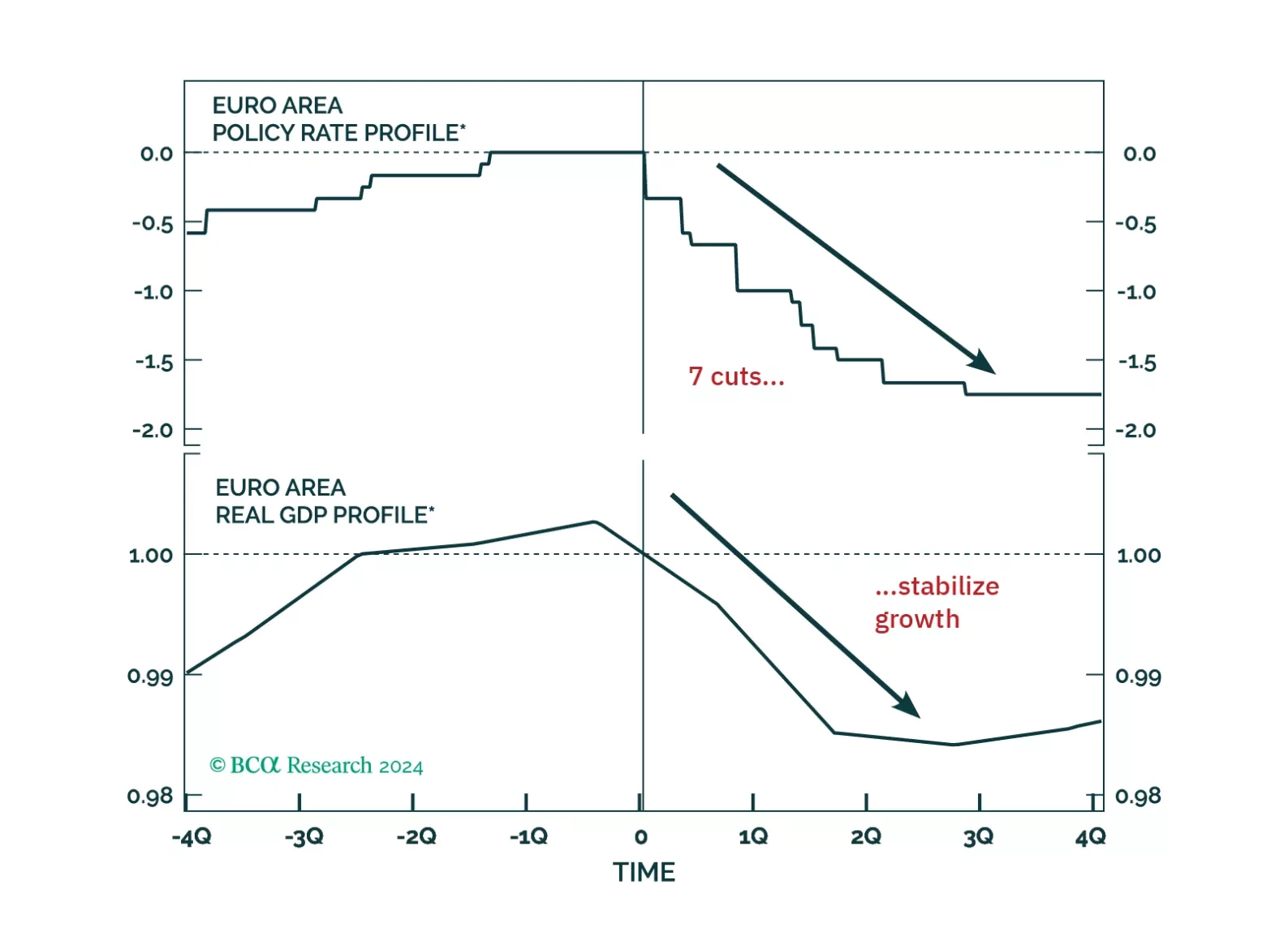

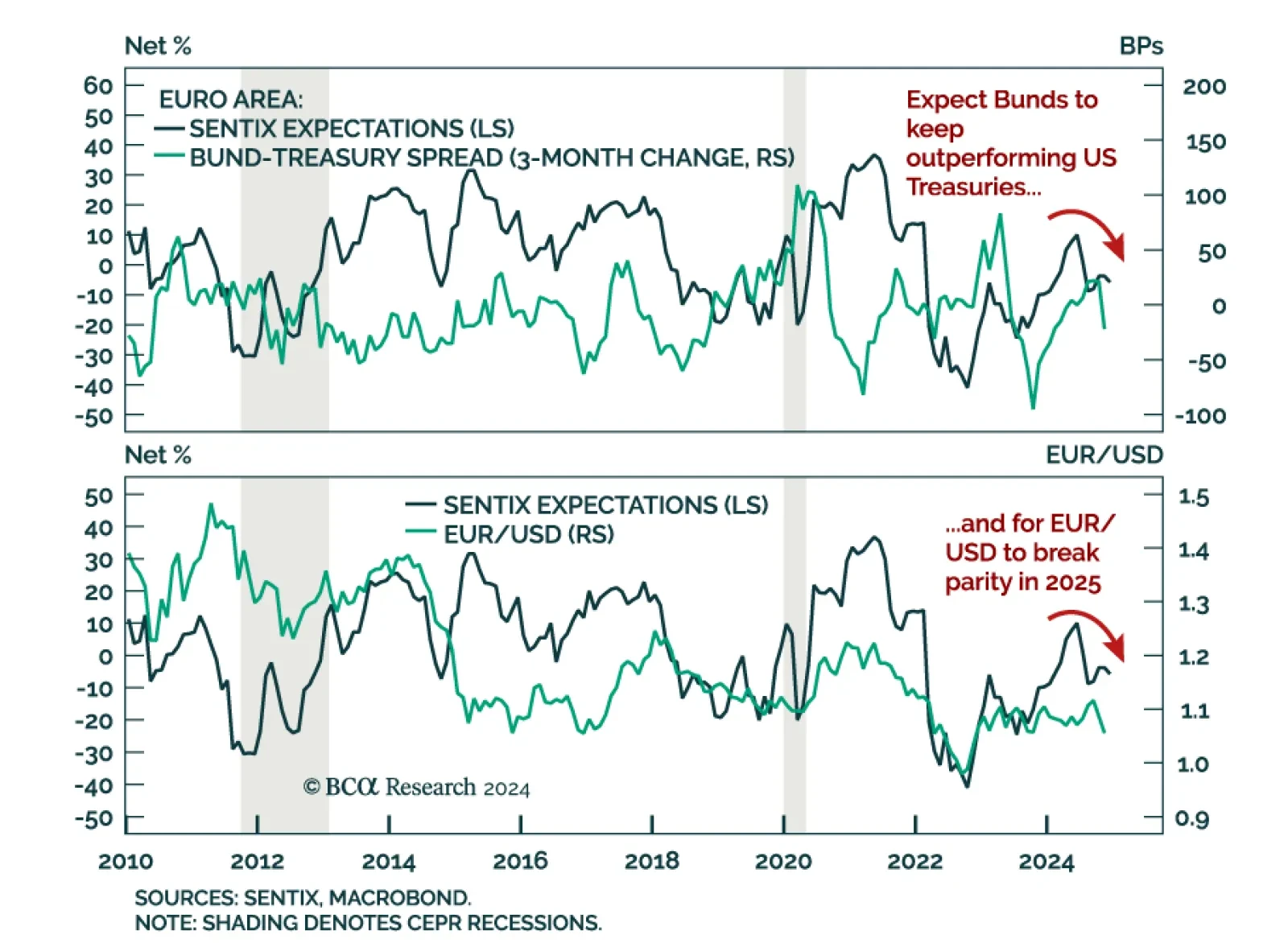

The December Sentix Economic Index for the Euro Area missed expectations, declining to -17.5 vs. -12.8 in November. Both the current situation and expectations components declined. As the first sentiment indicator for…