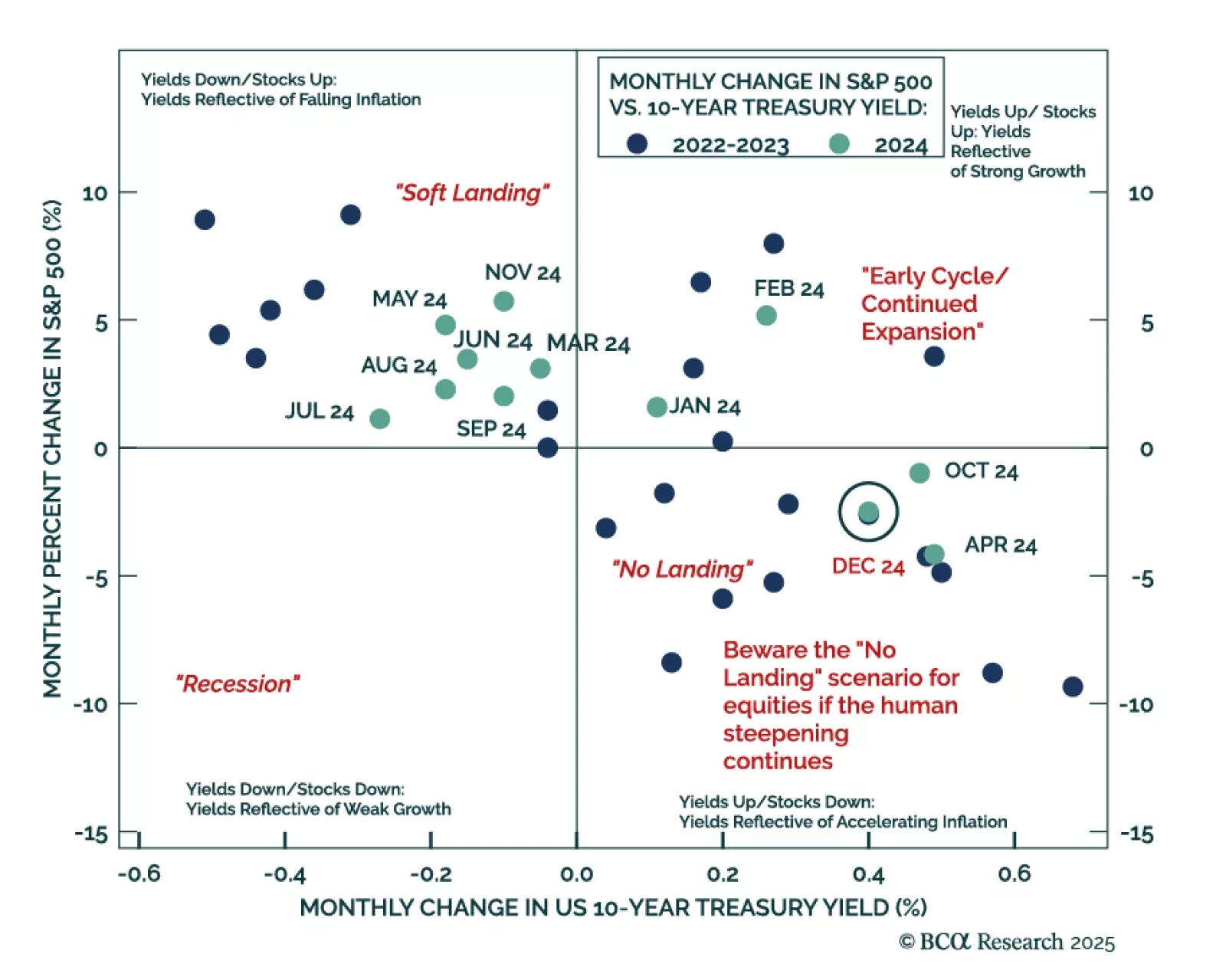

Our GeoMacro strategists published their Alpha Report, outlining their view that President Trump will have to pare back his fiscal ambitions to avoid a bond market riot. The long end of the US bond market continues to sell off,…

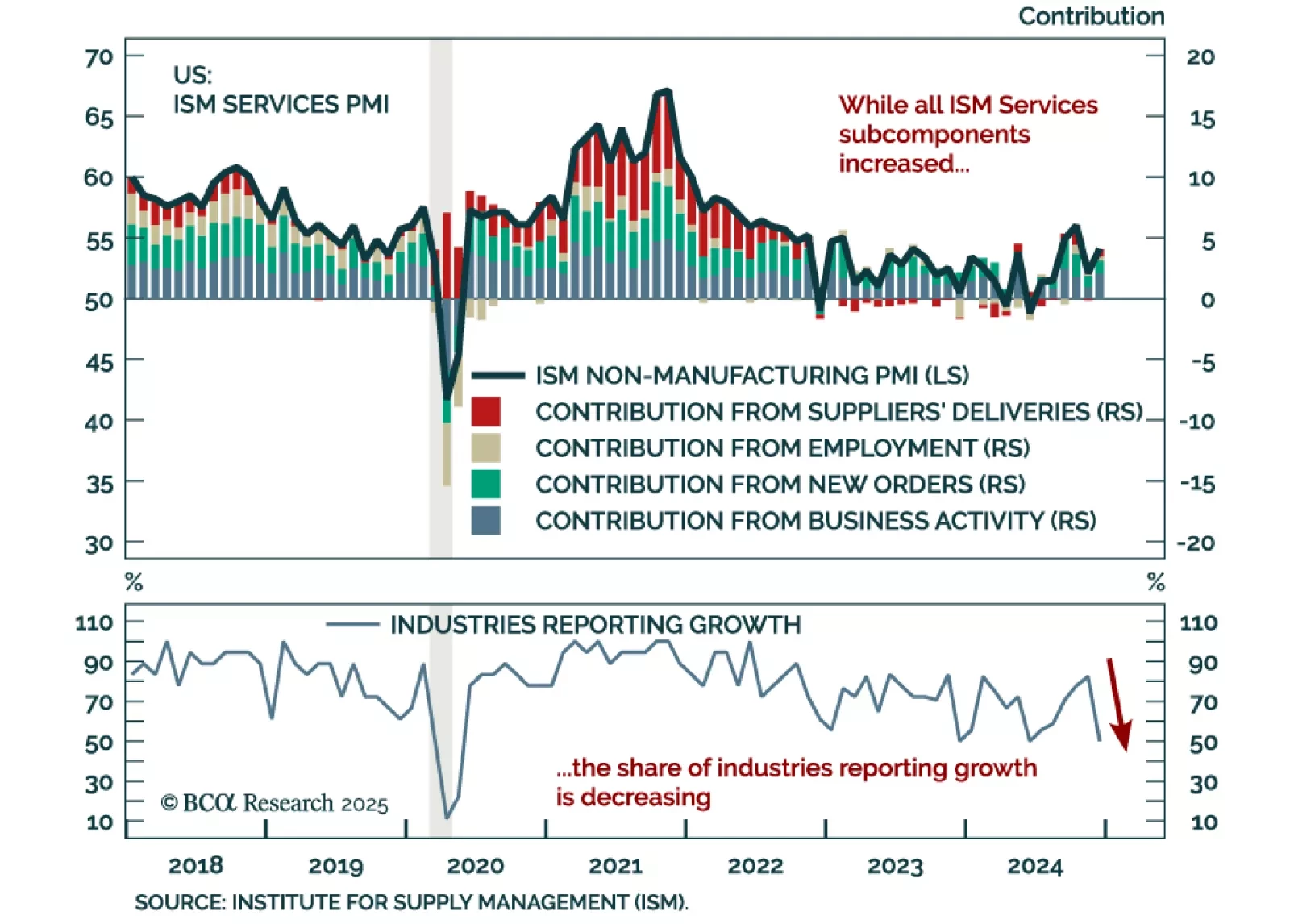

The December ISM Services PMI beat estimates, increasing to 54.1 from 52.1 in November. All subcomponents increased except for employment, which nonetheless remains in expansion. The prices paid component was especially strong,…

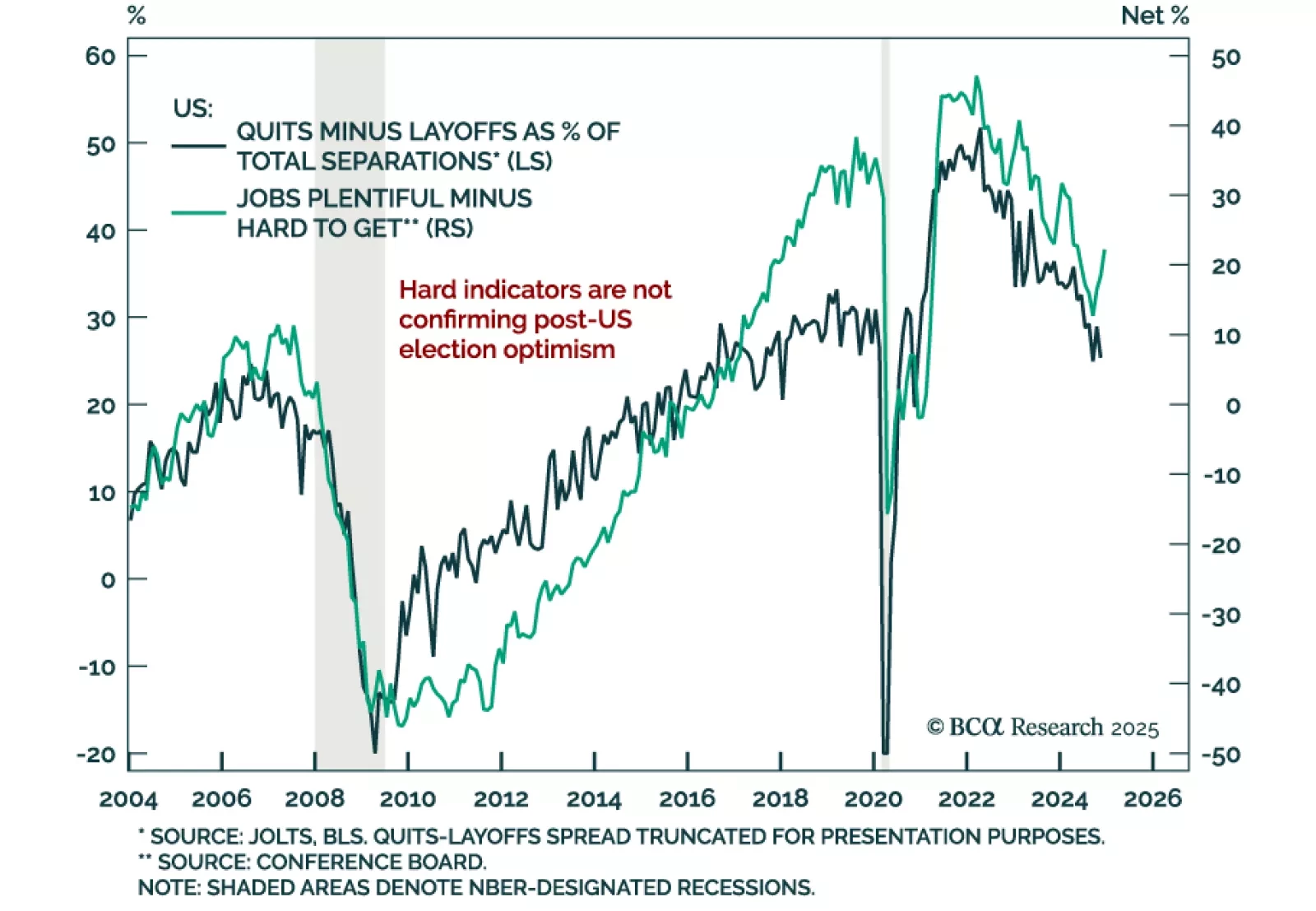

Job openings once again beat expectations in November, increasing to 8.1m from 7.8m in October. However, hires and quits decreased and layoffs increased. The gap between quits and layoffs, a leading indicator of labor market demand,…

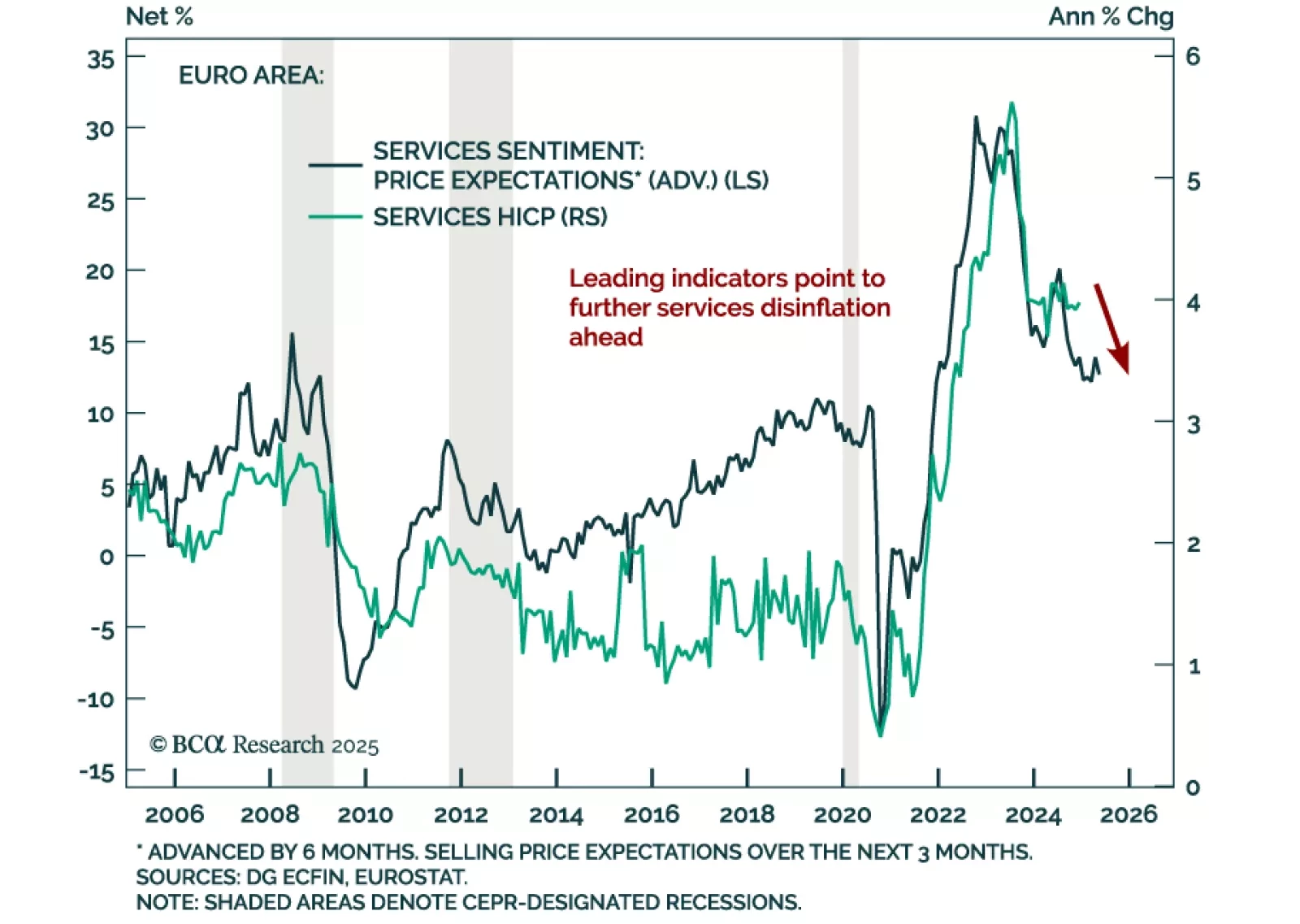

December euro area inflation met expectations, with headline HICP printing at 2.4% y/y from 2.2% in November, and core steady at 2.7%, above the ECB’s target. Services inflation remains elevated at 4.0% y/y, up from 3.9% a month…

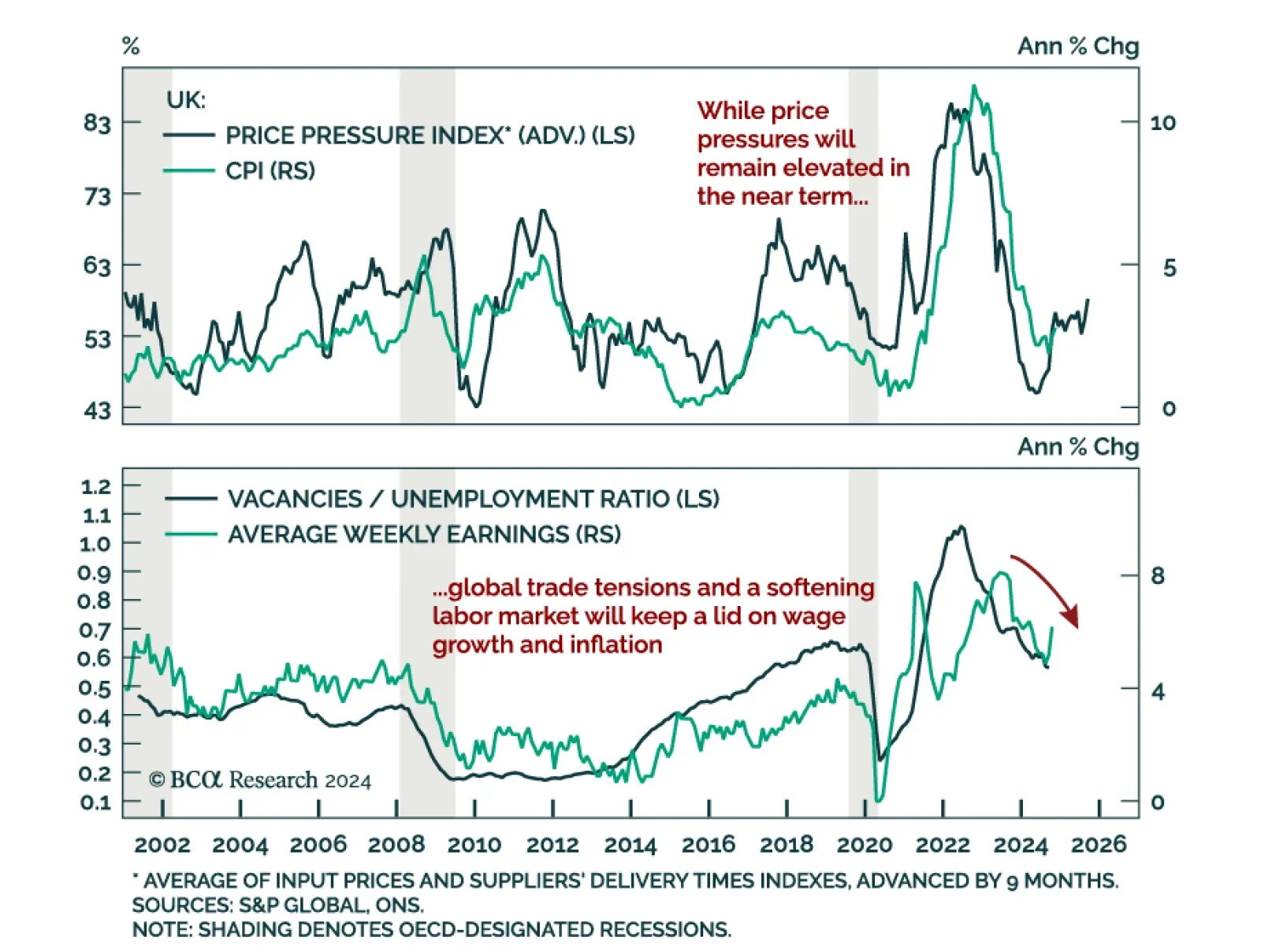

The November UK CPI, in line with estimates, hit an eight-month high, accelerating from 2.3% y/y to 2.6%. Core and services inflation were also strong at 3.5% (vs. 3.3% in October) and 5.0% (flat from October), respectively.…

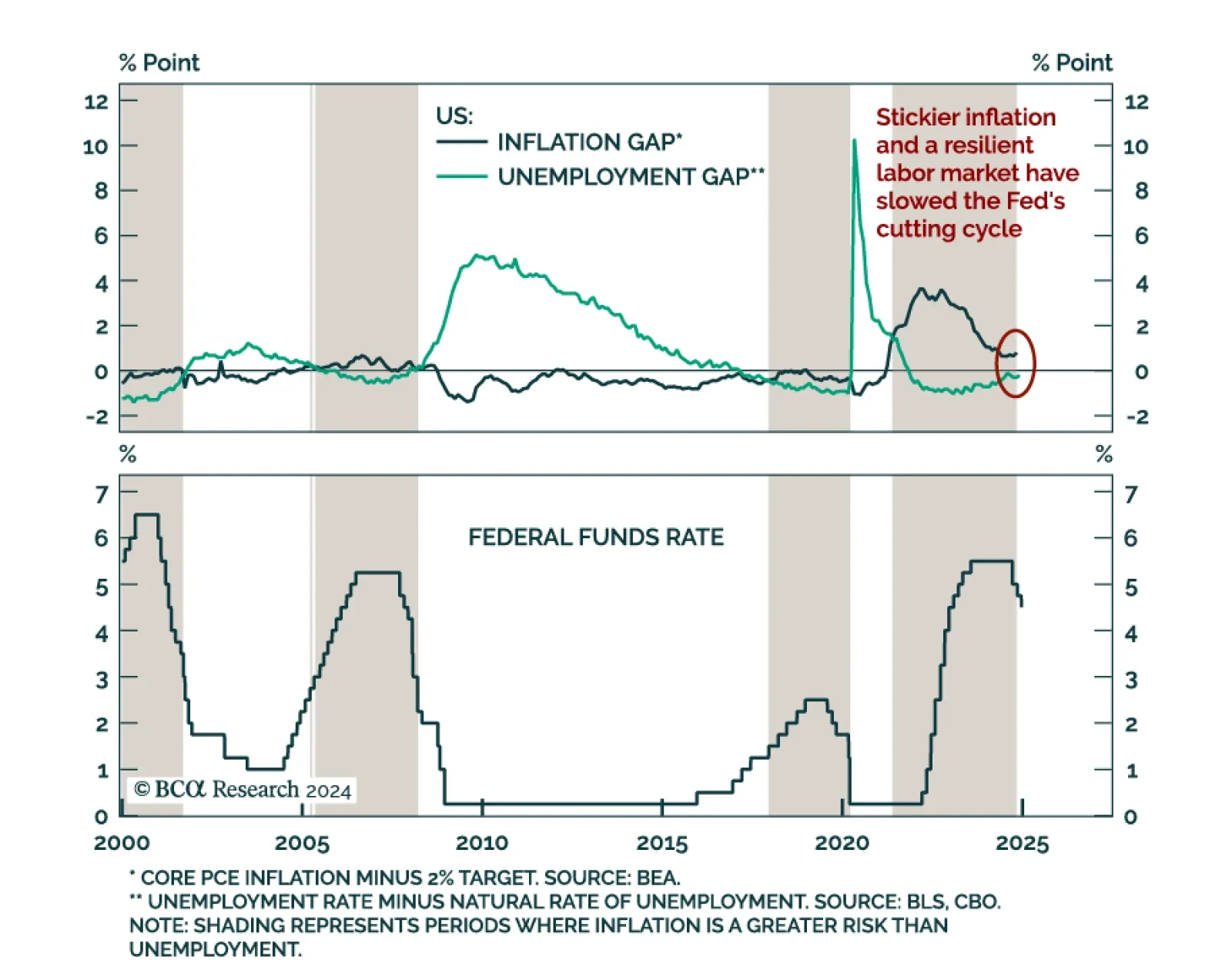

The Federal Reserve cut the fed funds rate by 25 bps to a 4.25%-4.5% range, as expected. However, it was a “hawkish cut”; the FOMC signaled a slower pace of easing ahead. The statement signalled less urgency, saying…

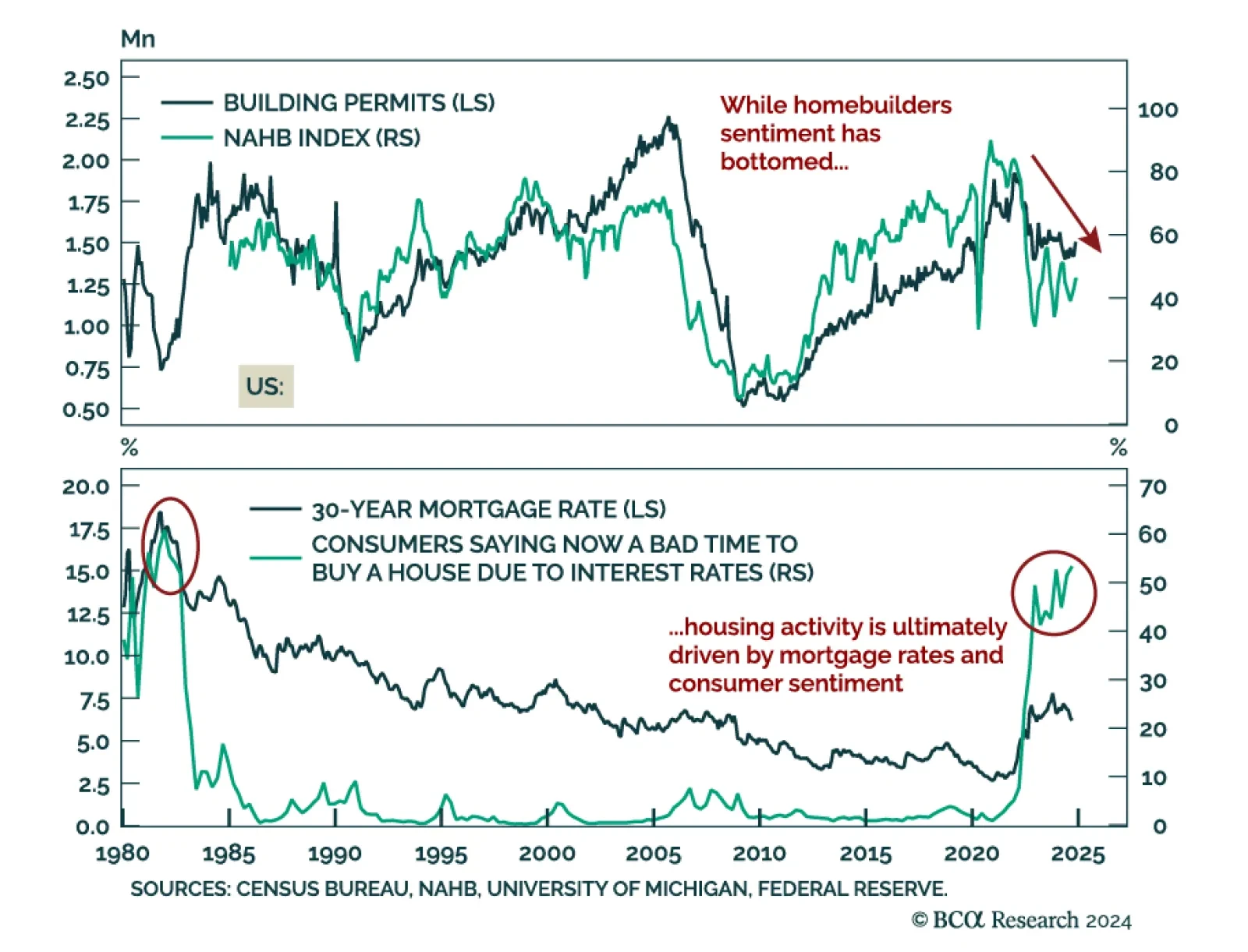

US November housing data was mixed, but still reflected a weak picture. Housing starts were down 1.8% m/m, below expectations of a 2.6% increase. However, building permits were stronger than expected, increasing 6.1%. Units under…

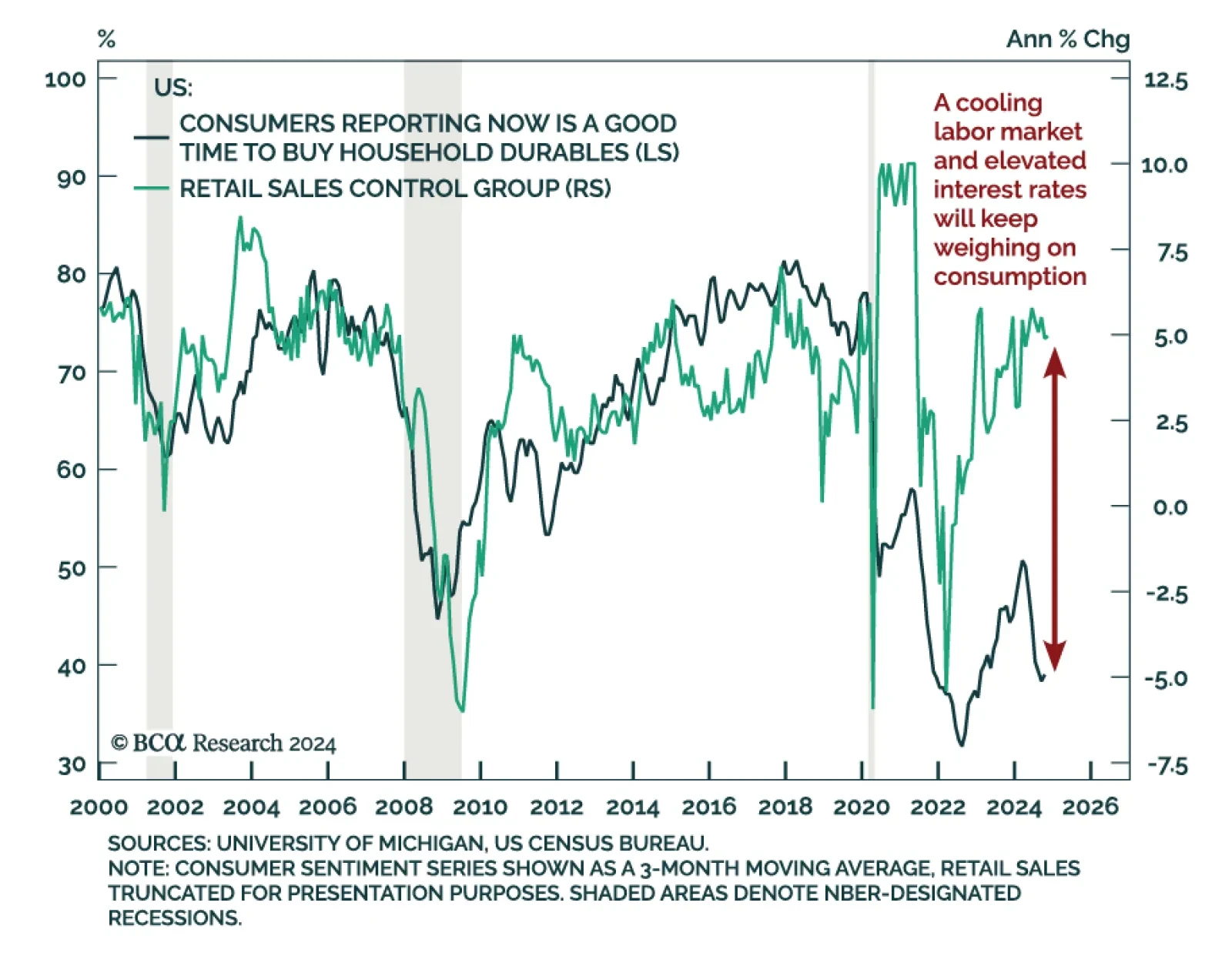

November retail sales were roughly in line with expectations, with headline growth at 0.7% m/m vs. 0.4% in October. Vehicle sales were solid. Excluding auto and gas, sales rose a more modest 0.2% m/m, below expectations. The…

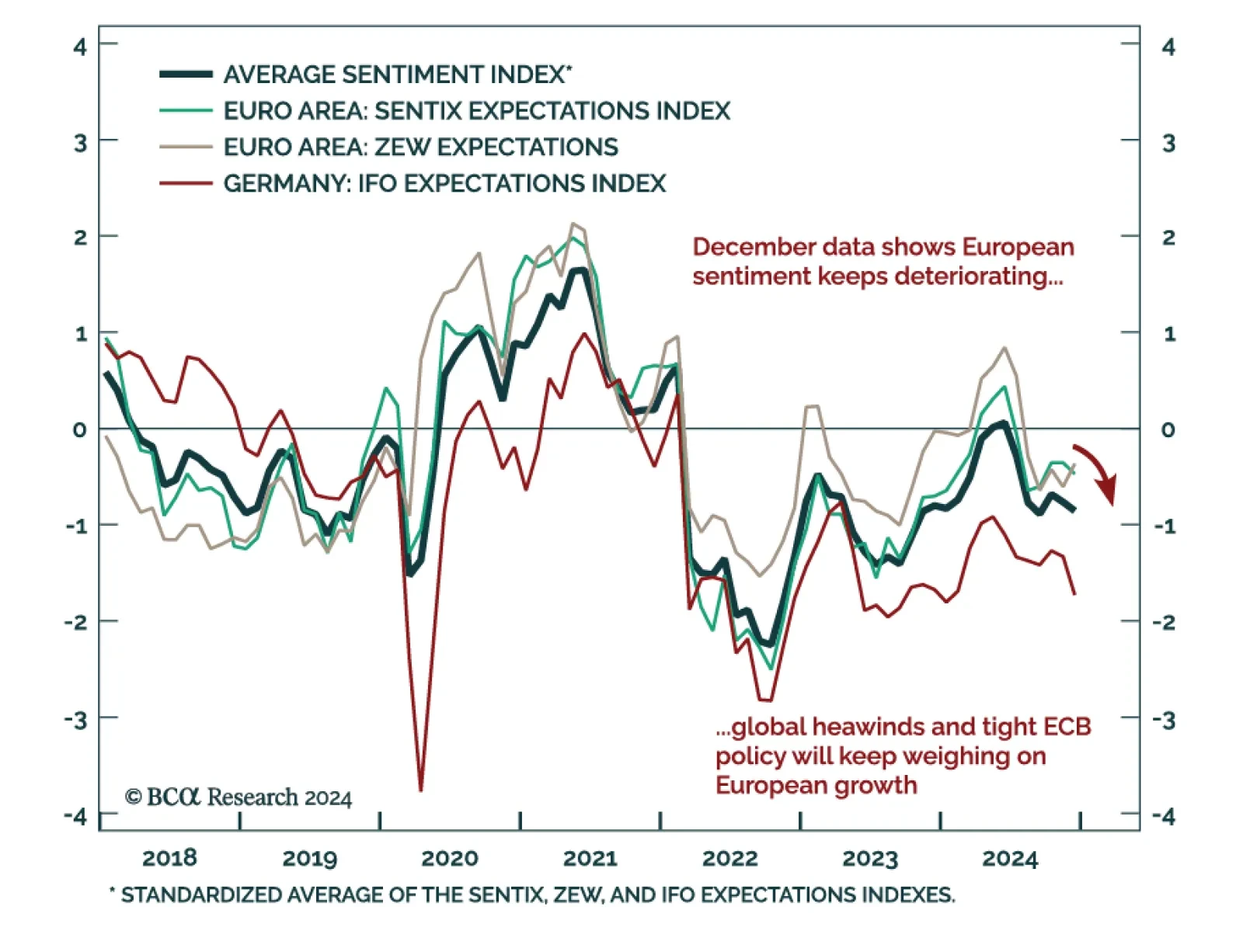

European sentiment data was mixed. The December Ifo Business Climate index for Germany missed estimates and was down 1 point to 84.7 from November. The decrease came from its expectations component, which fell to 84.4 from 87.2.…

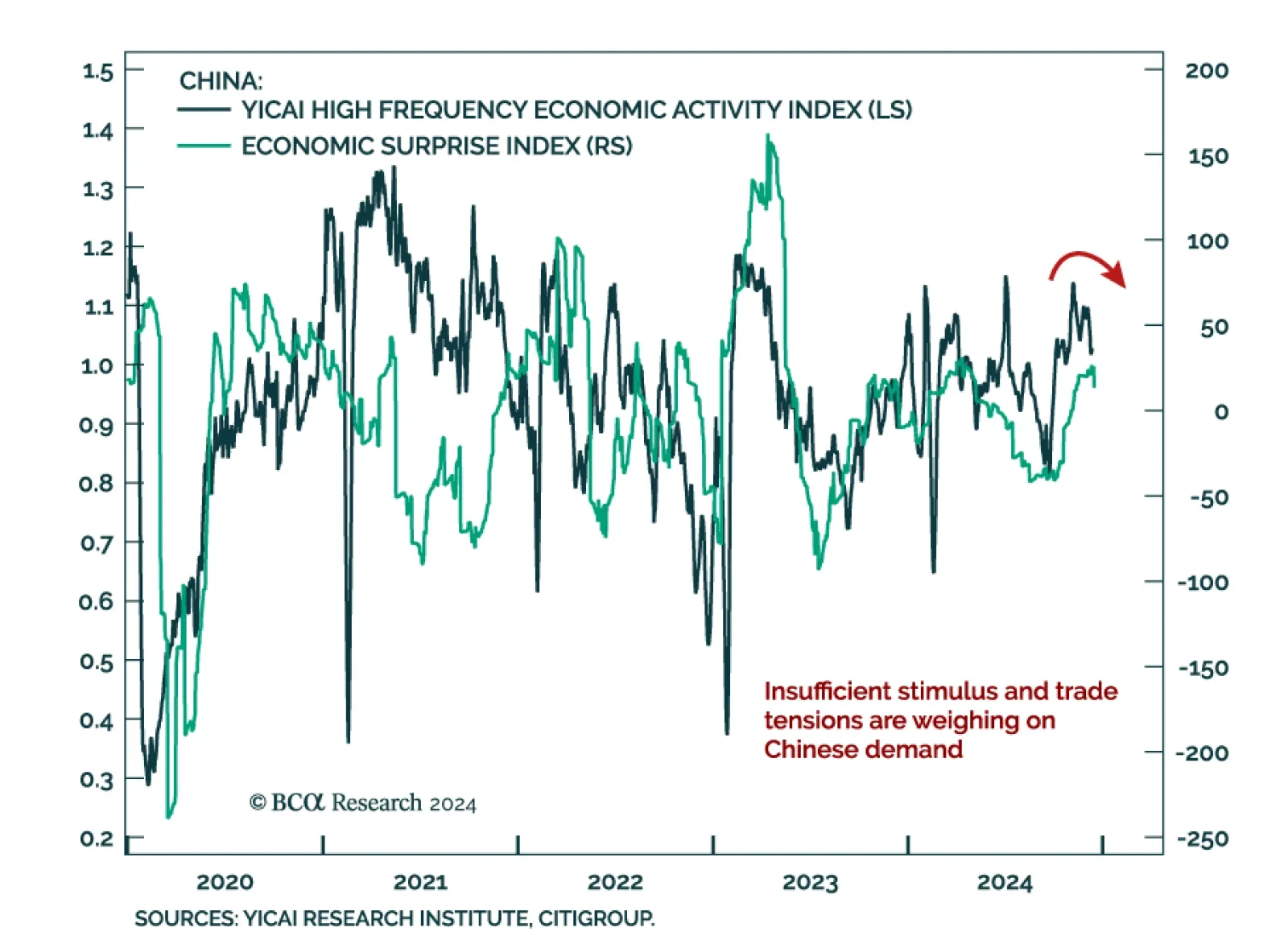

Chinese activity indicators were mixed in November, reflecting the dynamic of a resilient supply side coupled with weak demand. Industrial production growth was roughly flat at 5.4% y/y vs. 5.3% in October, while retail sales…