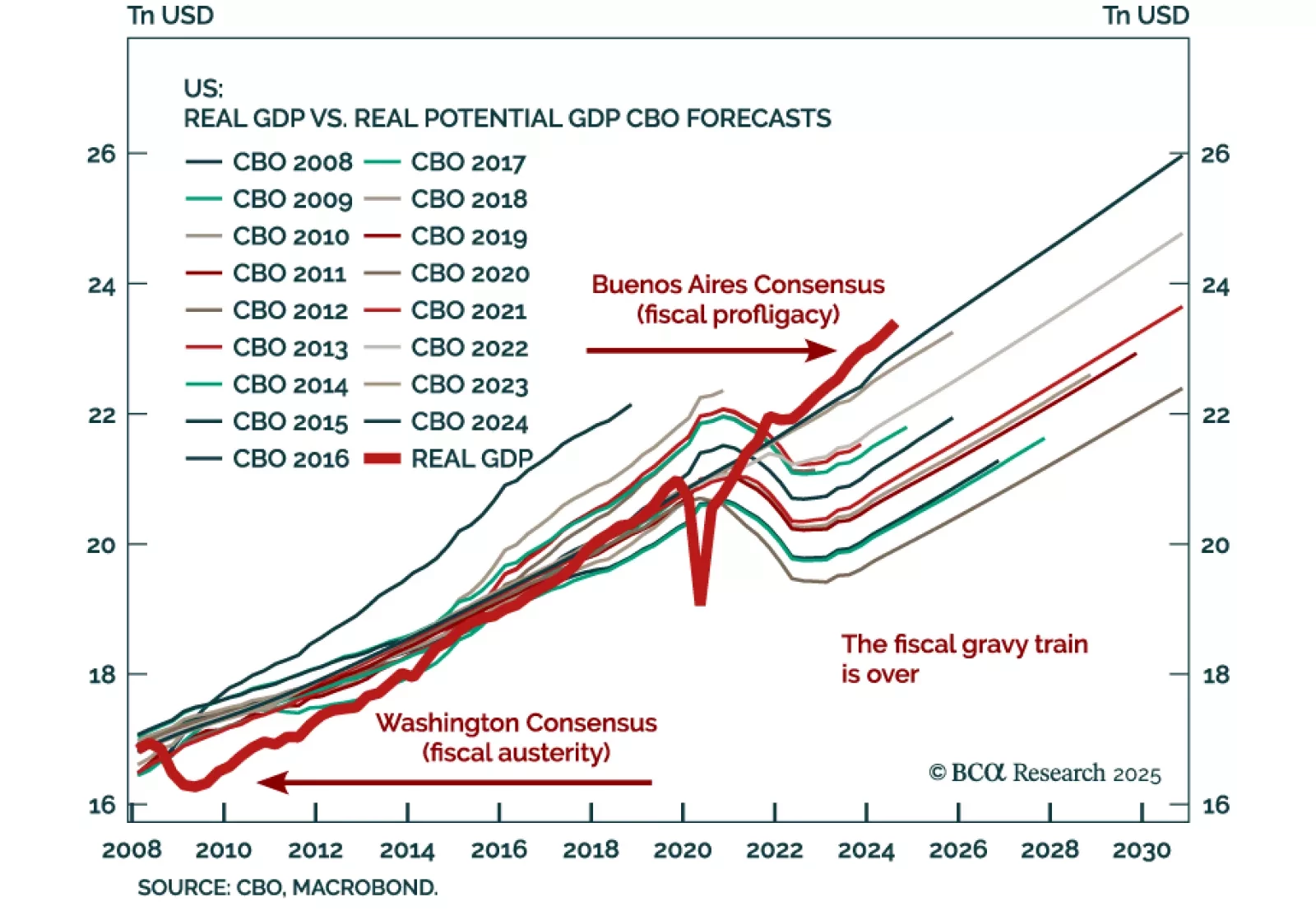

Our Chart Of The Week comes from Marko Papic, Chief Strategist of our GeoMacro Strategy service. Marko has argued that the most important macro story over the past decade has been the transition from the Washington Consensus,…

Our Emerging Markets strategists just published a report on Singapore stocks after a significant rally over the past year. Singapore’s manufacturing sector faces headwinds from contracting global new orders, which signals that a…

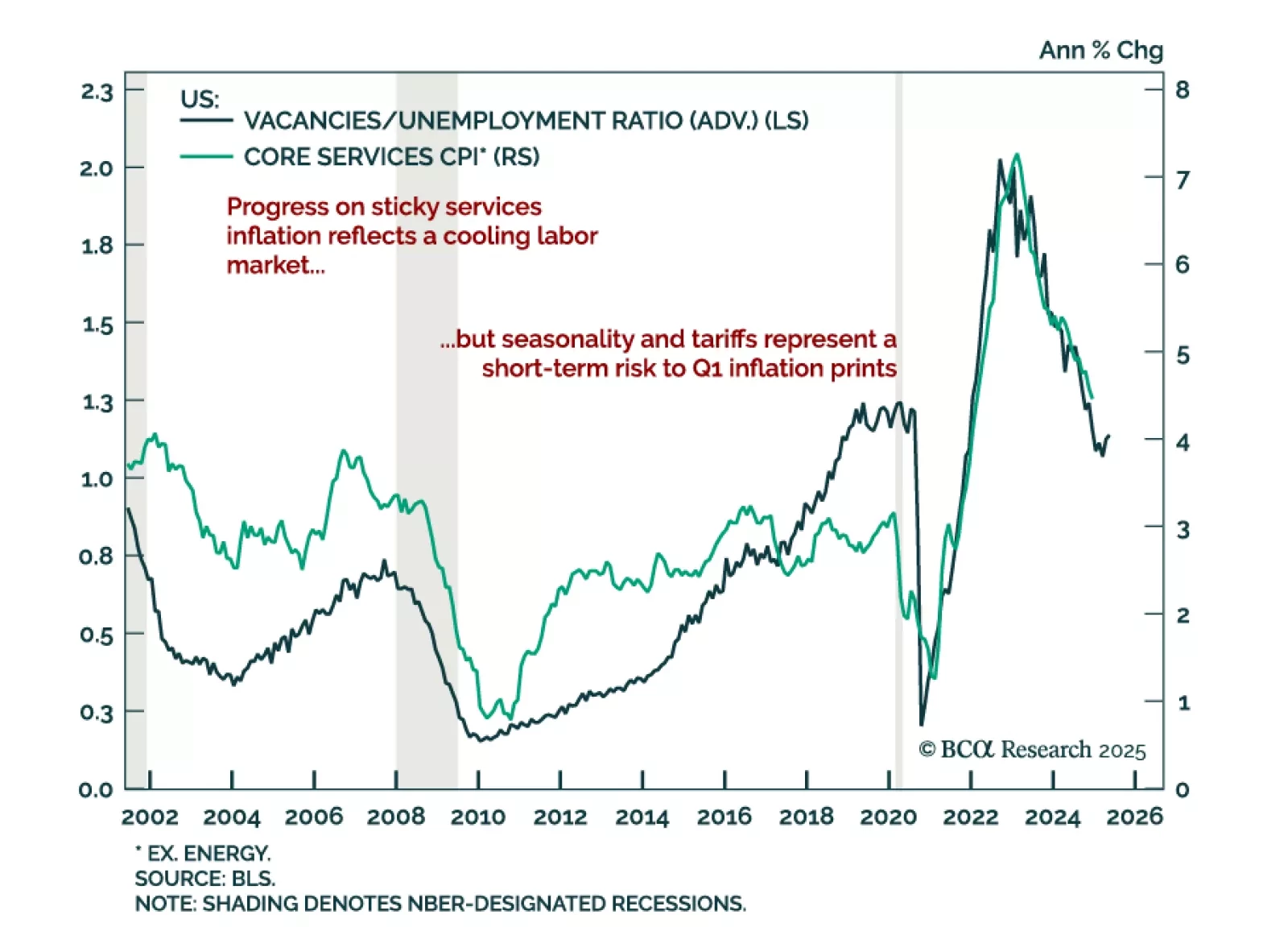

The December US CPI came in better than expected. While headline CPI met estimates of 0.4% m/m (2.9% y/y), core surprised to the downside at 0.2% m/m, decelerating to 3.2% y/y from 3.3%. Moderation in core annual inflation was driven…

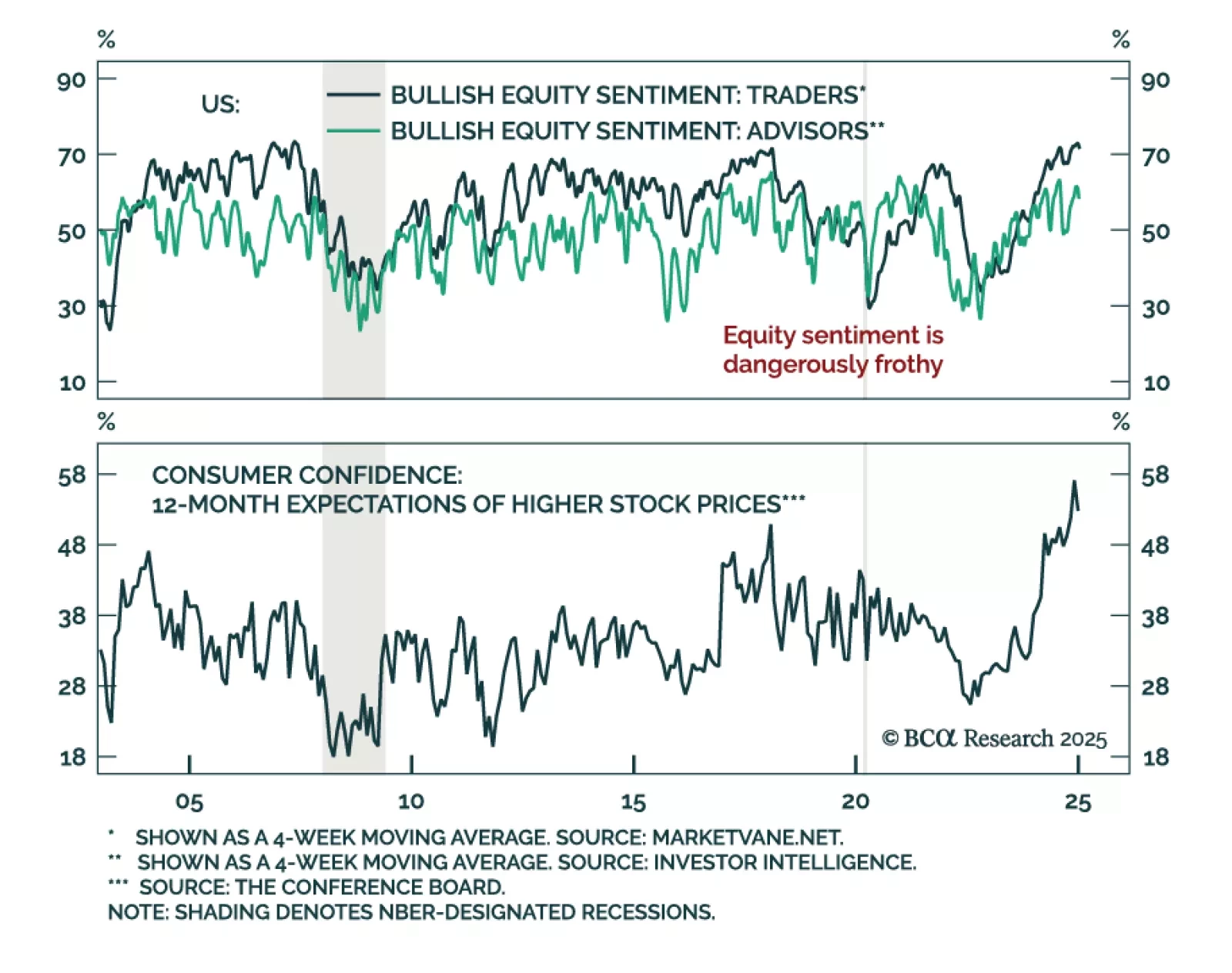

Our Global Investment Strategy (GIS) team believes the US economy is not as strong as commonly believed, and that equity valuations offer little buffer given the risk of incoming macro shocks. The US economy is more fragile than…

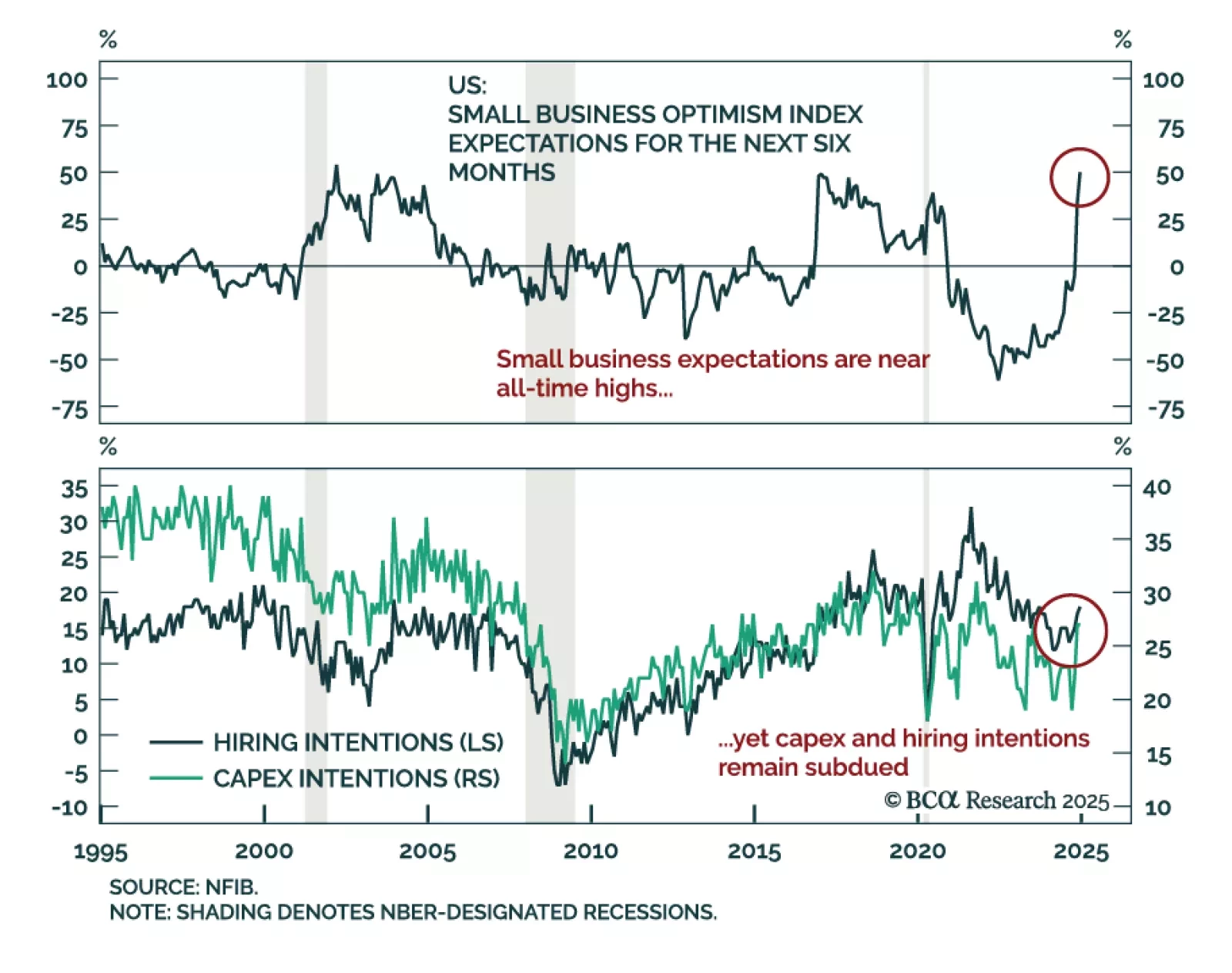

The December NFIB Small Business Optimism Index beat expectations, jumping to 105.1 from 101.7 in November. Most index subcomponents increased, led by measure of expectations, notably for the state of the economy and real sales.…

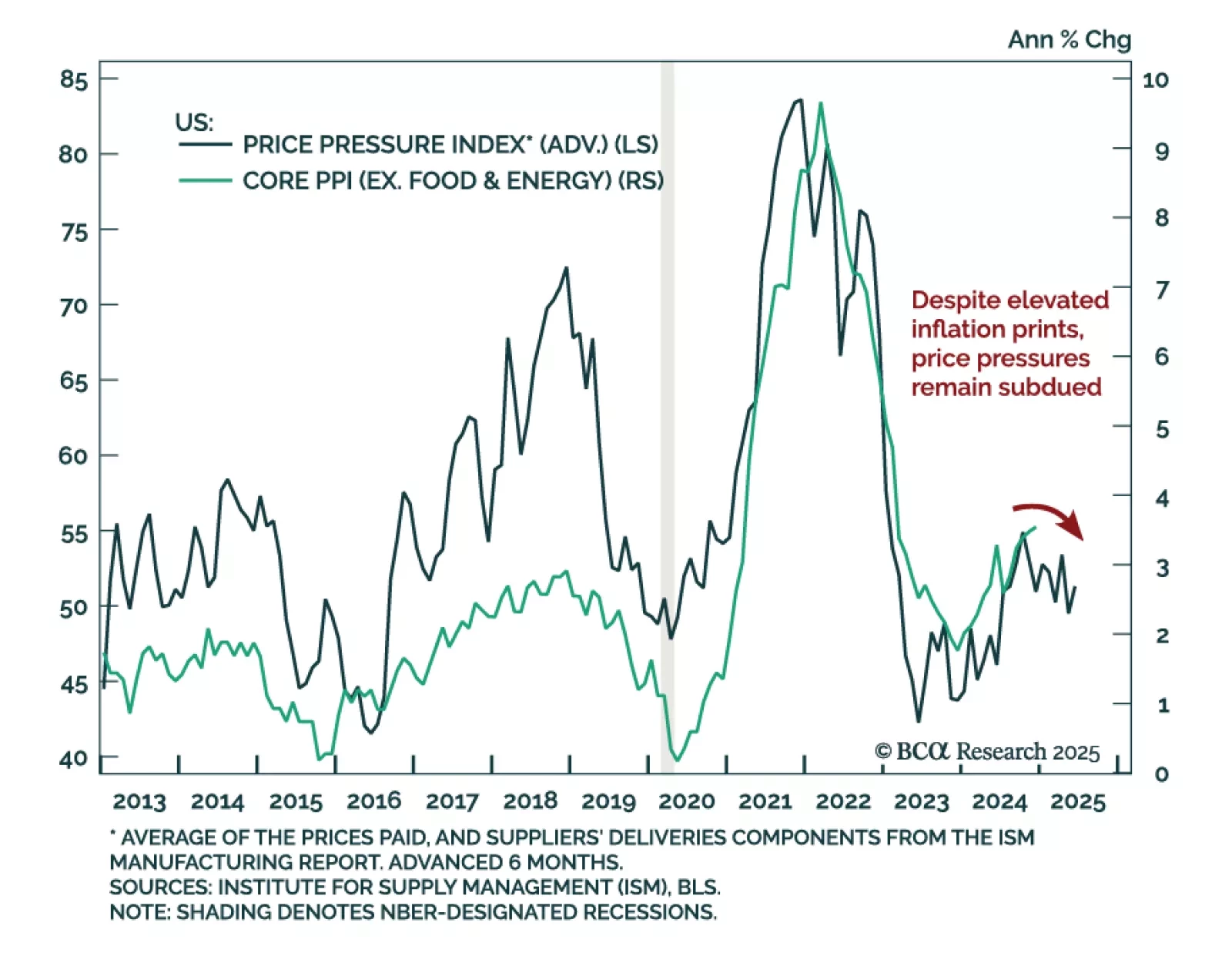

The December US Producer Price Index came in cooler than expected, increasing 0.2% m/m, a deceleration from 0.4% in November. Core PPI, excluding food and energy, was flat after increasing 0.2% a month prior. Inflation is…

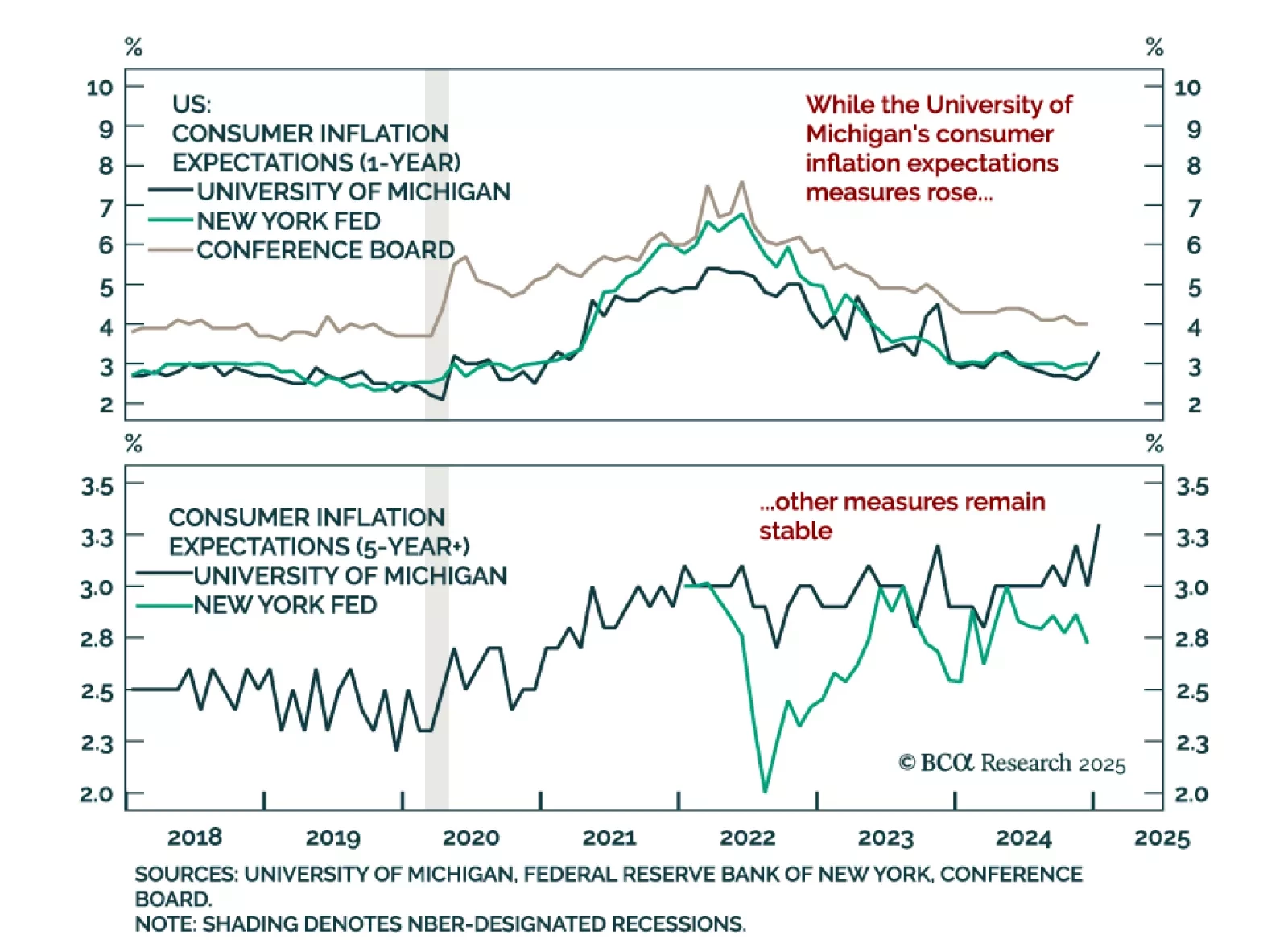

The preliminary January University of Michigan Consumer Sentiment Index missed estimates on Friday, driven by a cooling of consumer expectations. Worryingly, both the 1-year and 5-to-10 year inflation expectations ticked up to 3.3%…

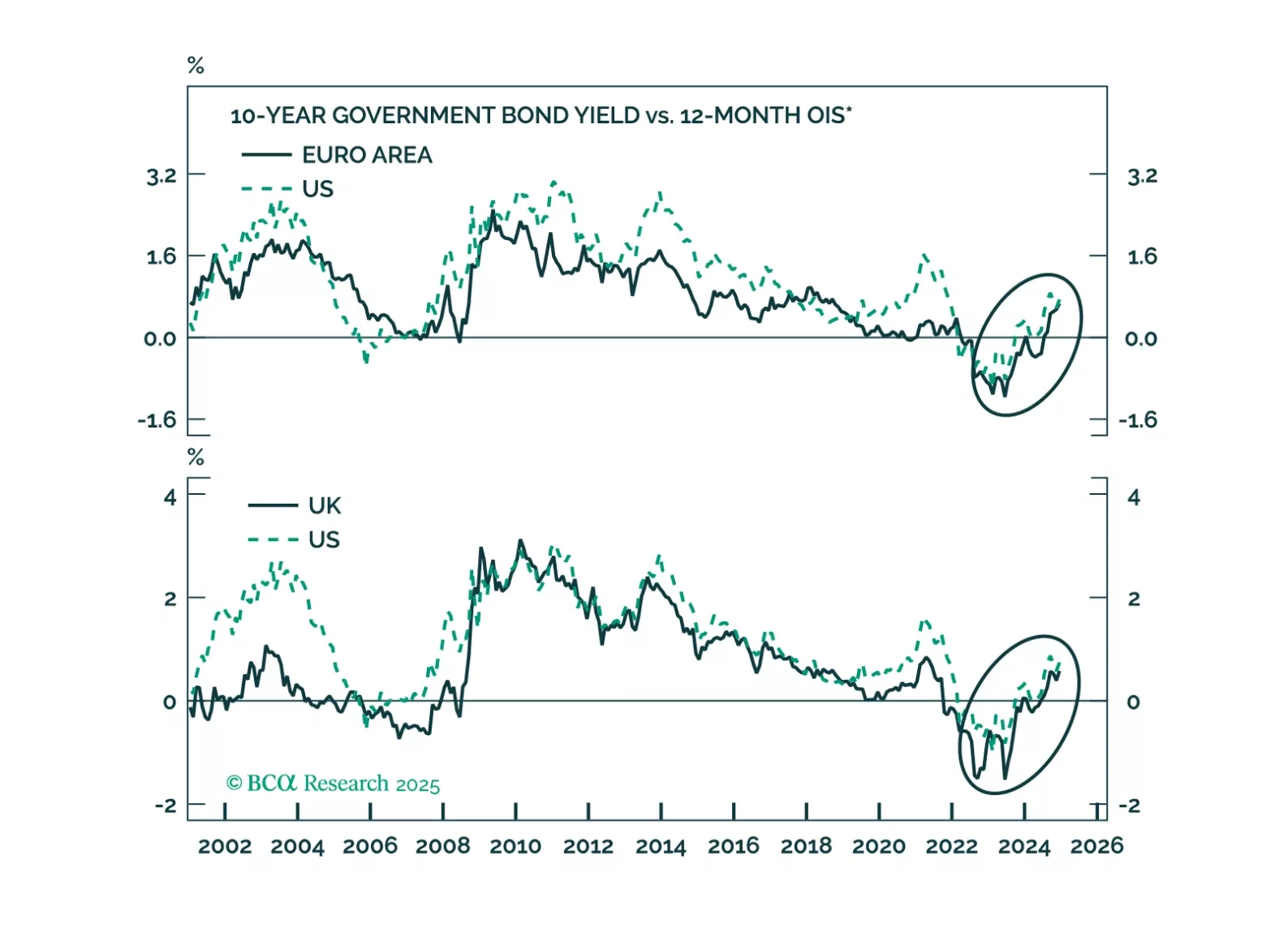

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

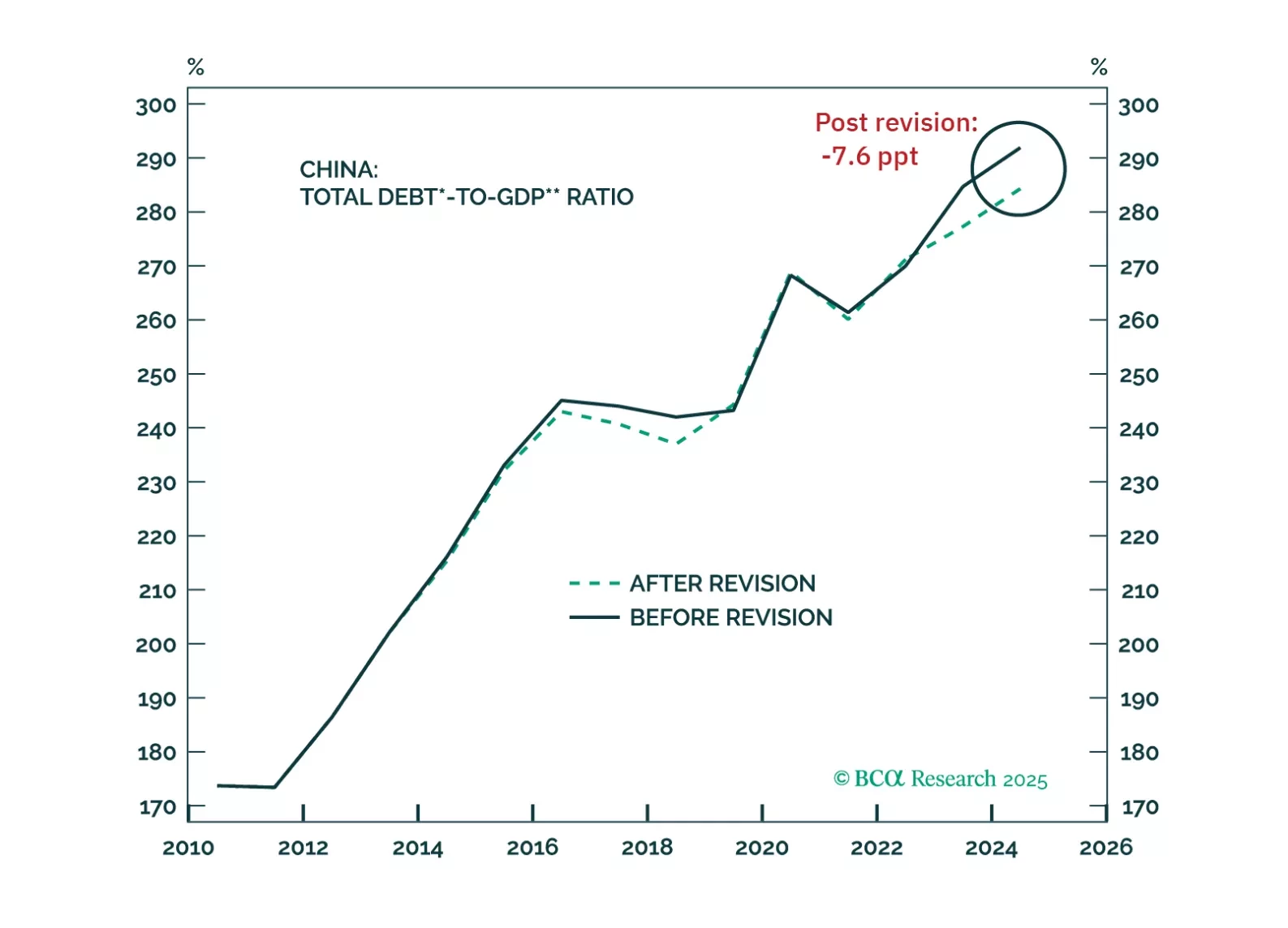

In this week’s report, we present our key takeaways from China's two notable adjustments recently implemented: an upward revision to its 2023 GDP and the reduction of the USD weighting in the RMB Exchange Rate Index.

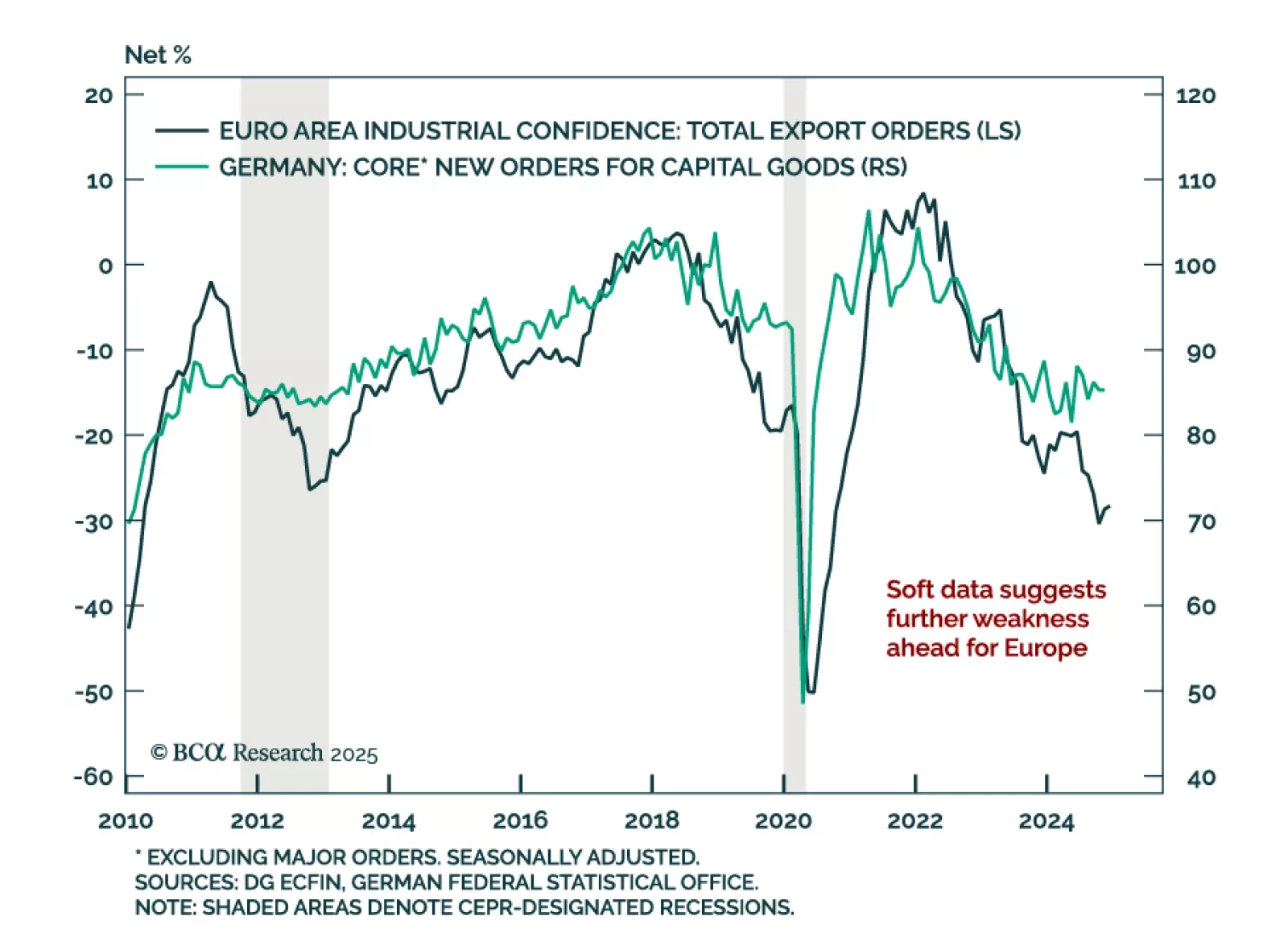

November factory orders in Germany widely missed estimates, falling by 5.4% m/m, worsening the 1.5% October decline. Excluding major orders, which often distort the overall picture, core new orders fell 1.7% y/y after growing 5.7% in…