The January Ifo Business Climate index for Germany beat estimates, increasing to 85.1 vs. 84.7 in December. The increase came from the survey’s current assessment component, which increased a full point, as the expectations component…

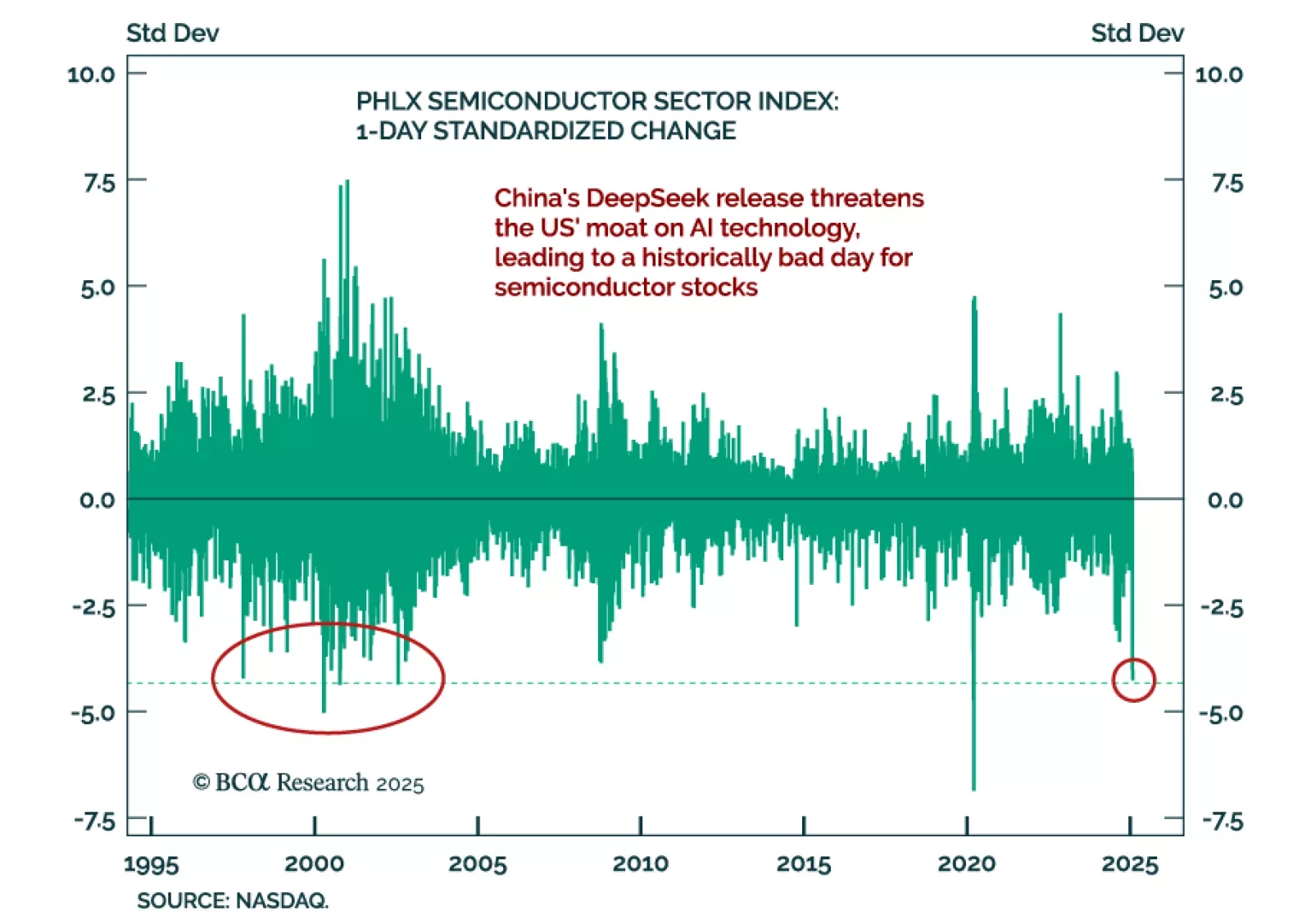

News of a cheaper Chinese-developed AI model sent a tremor through markets, with a selloff in the S&P 500, NASDAQ, and leading tech names associated with AI. The narrative on Monday was that the eye-watering sums spent on AI…

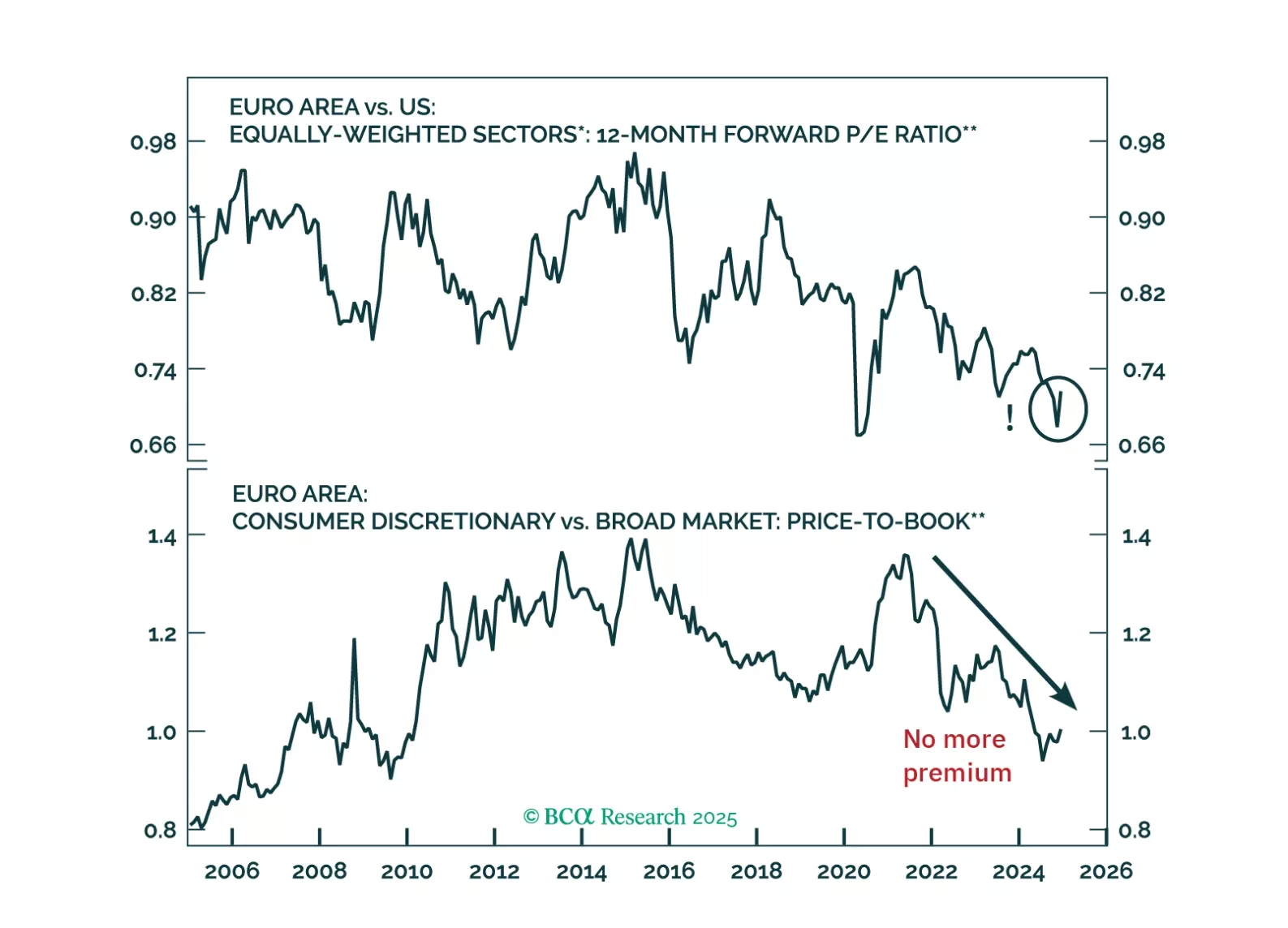

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

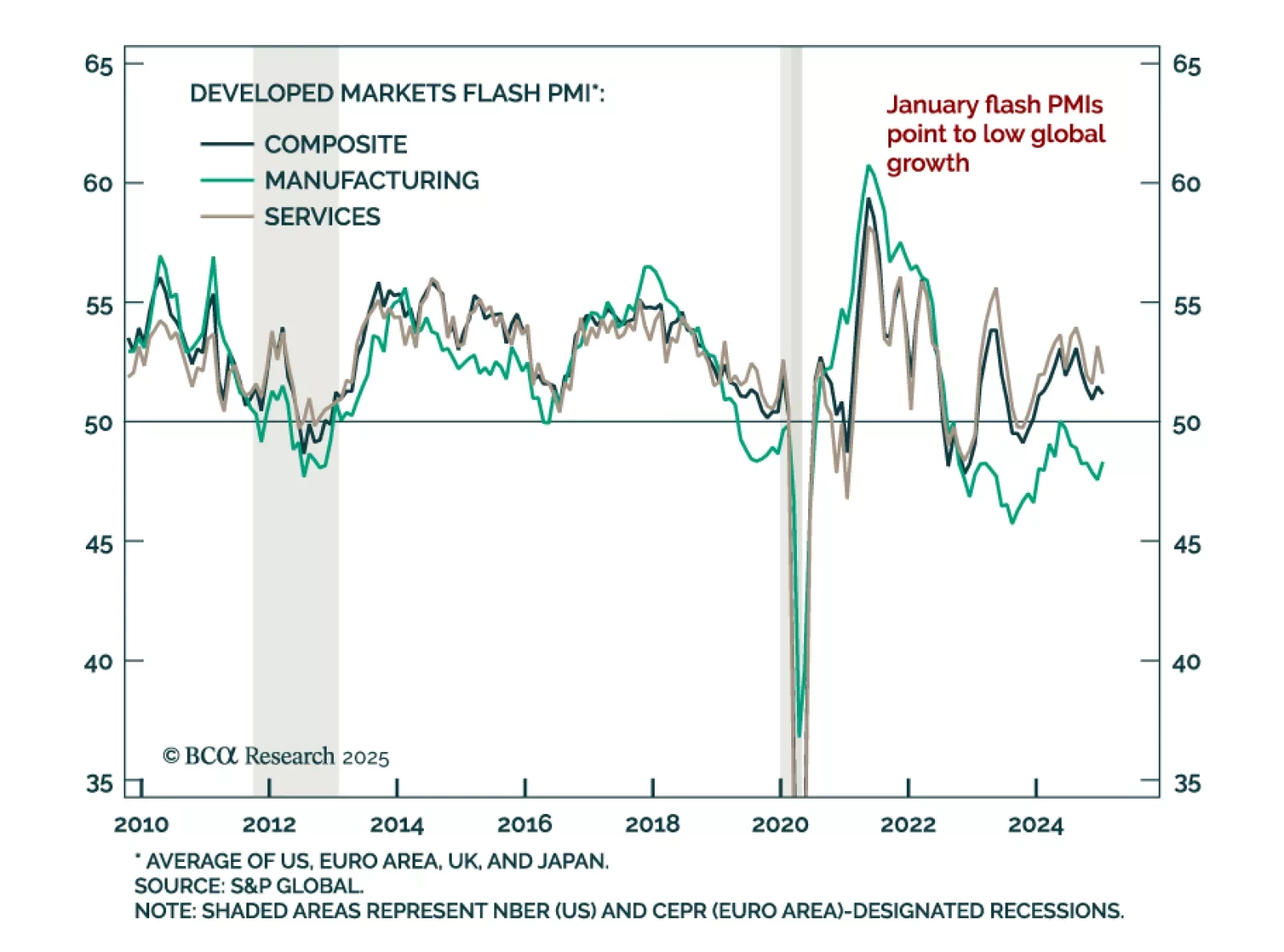

January’s flash PMIs for the major developed markets showed that manufacturing contracted at a slower pace and service activity continues to display significant regional differences. Moreover, the performance gap between the US and…

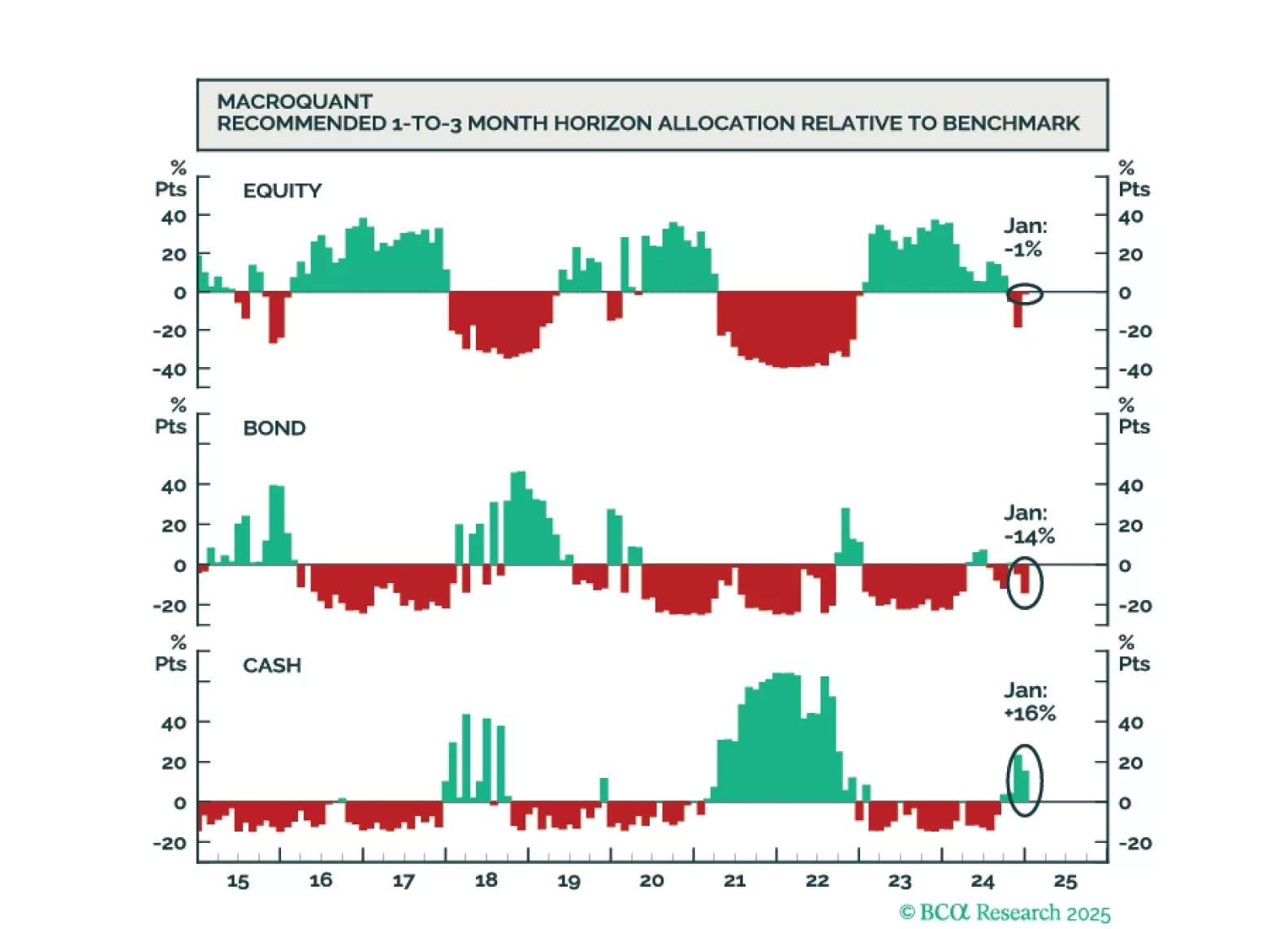

While the US economy could remain upright on the tightrope for a while longer, it will inevitably fall, leading to a major bear market in stocks. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

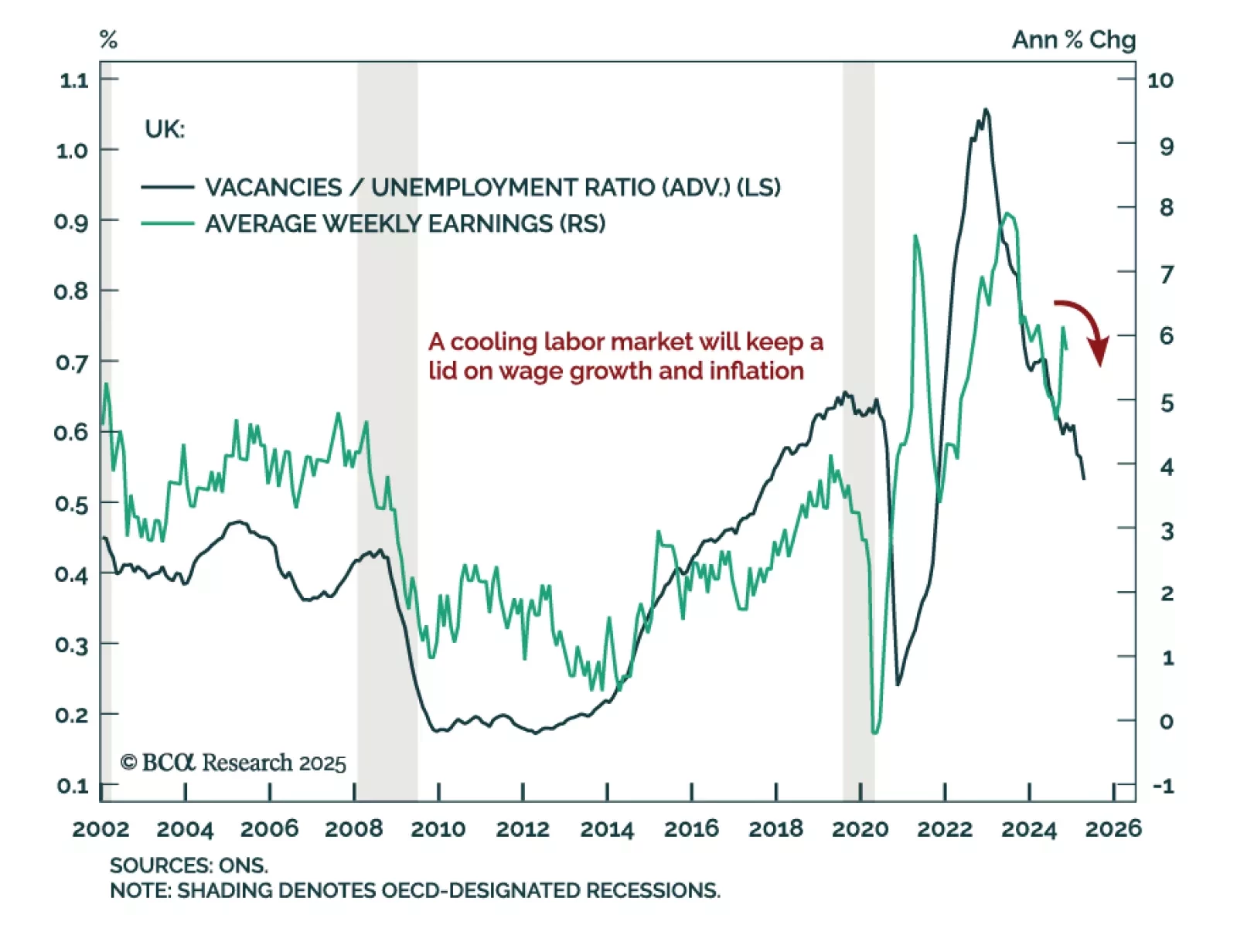

November/December UK employment data was mixed. The November unemployment rate rose 0.1% to 4.4%, in line with expectations. Payrolled employees decreased faster than expected at a 47k pace in December, surpassing the 35k contraction…

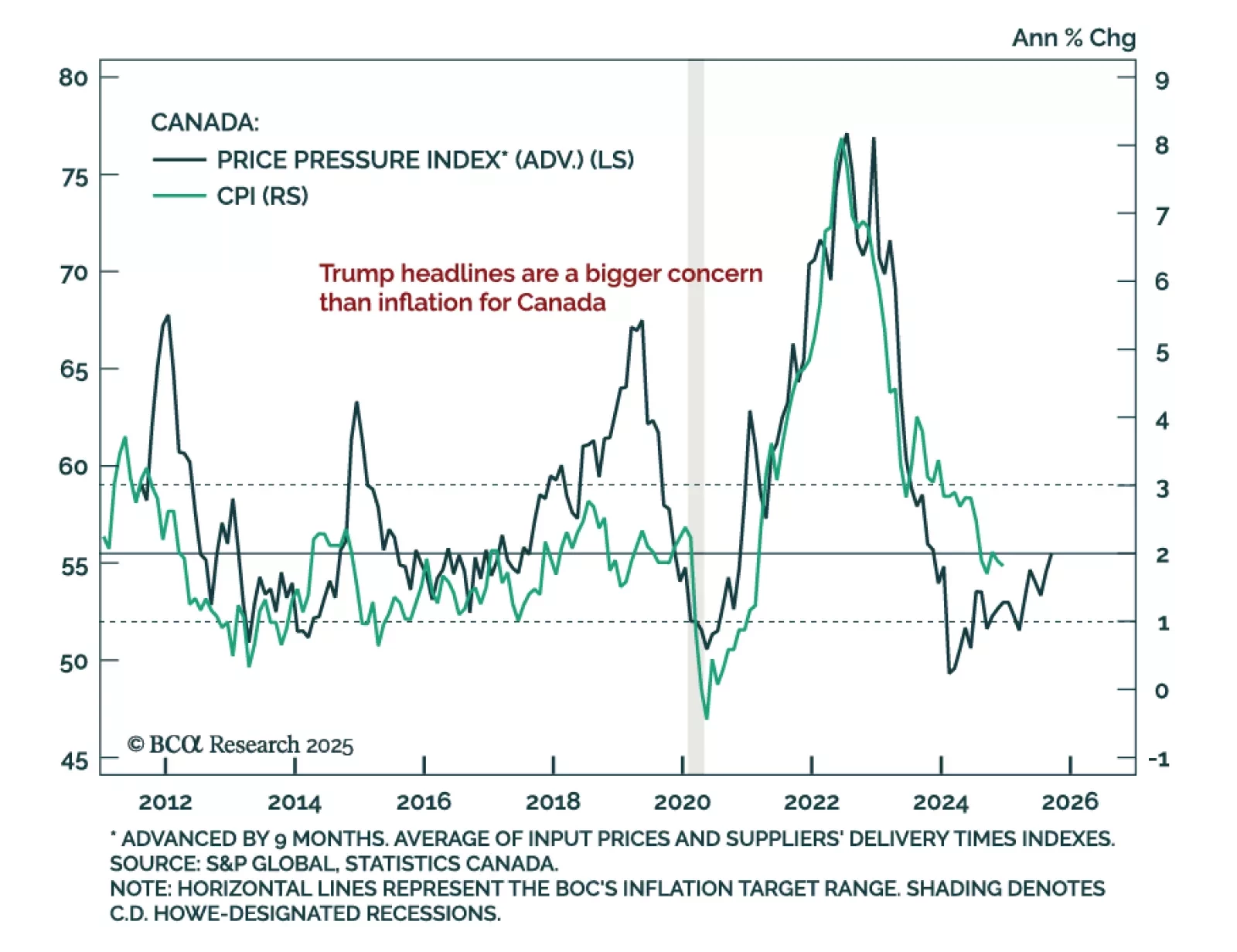

The December Canadian CPI was roughly in line with estimates, with headline inflation ticking down to 1.8% y/y from 1.9% in November. The BoC’s core inflation measures, median and trim, also decreased from 2.6% to 2.4% and 2.5%,…

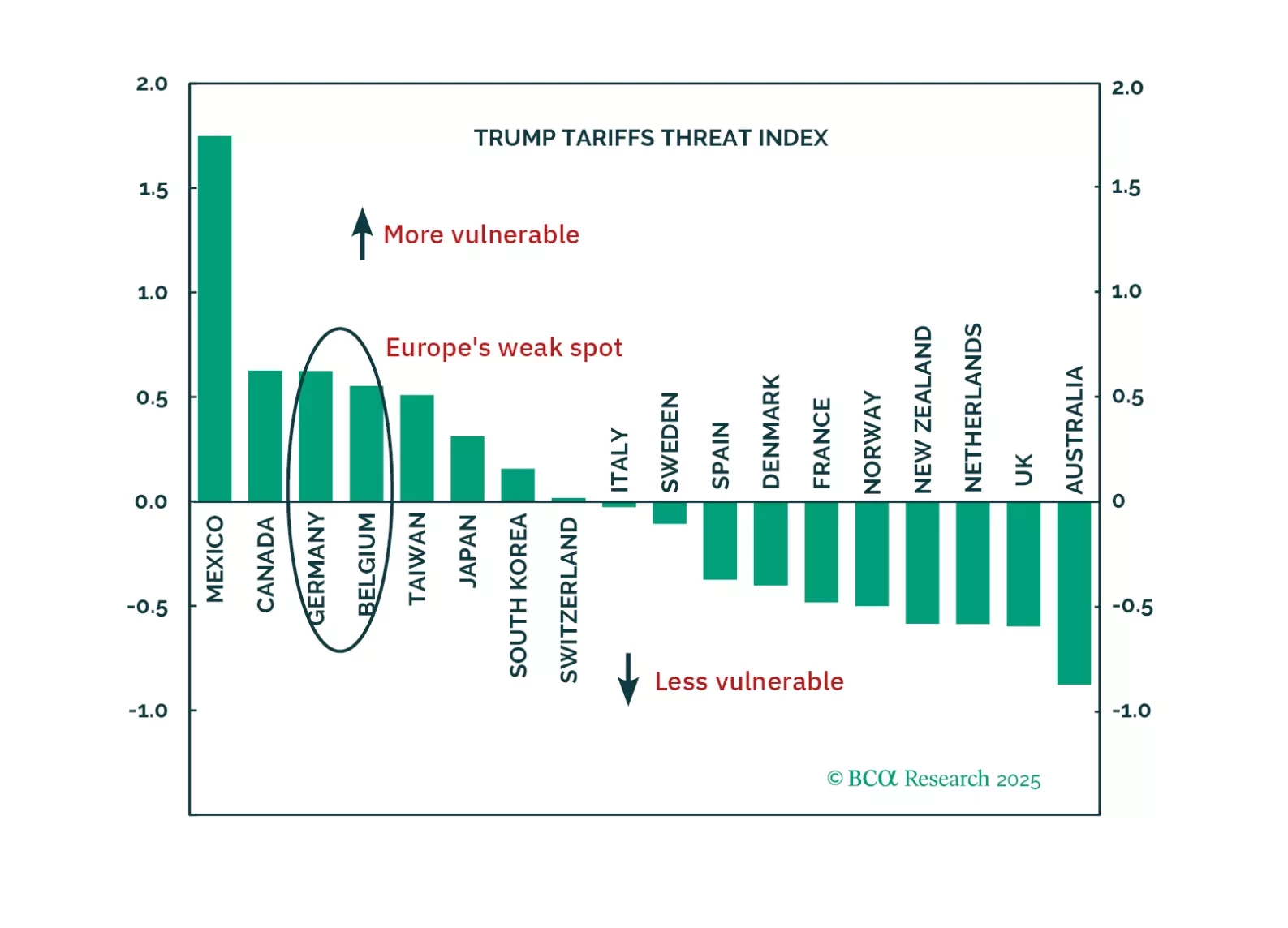

President Trump is about to be inaugurated. Investors often assume all his policies will hurt Europe, but the reality is more nuanced.

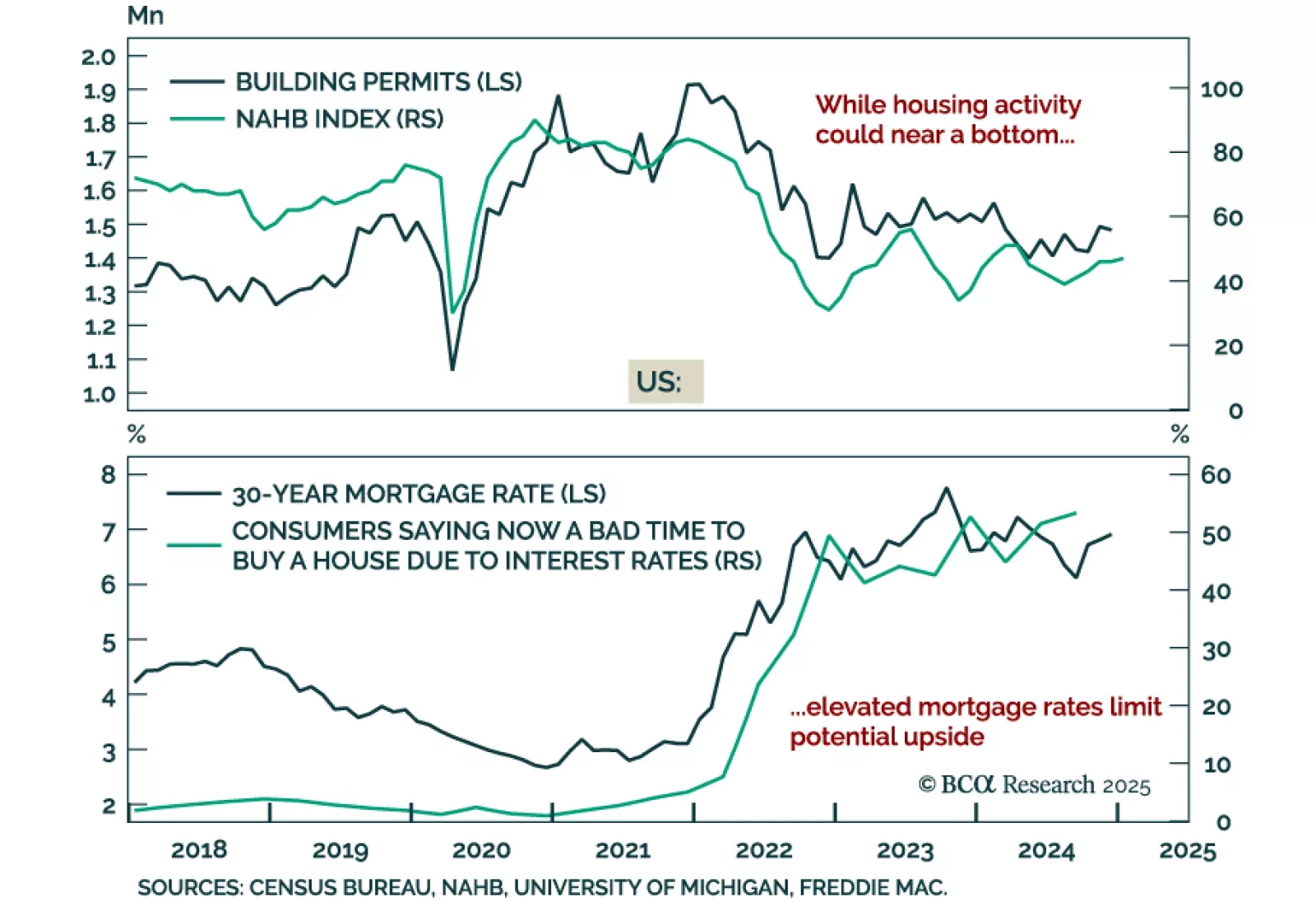

US December housing data was strong, with housing starts printing above estimates at 1.49m, an acceleration from an upwardly-revised 1.29m in November. Building permits also surprised positively at 1.483m, but still decreased from 1.…

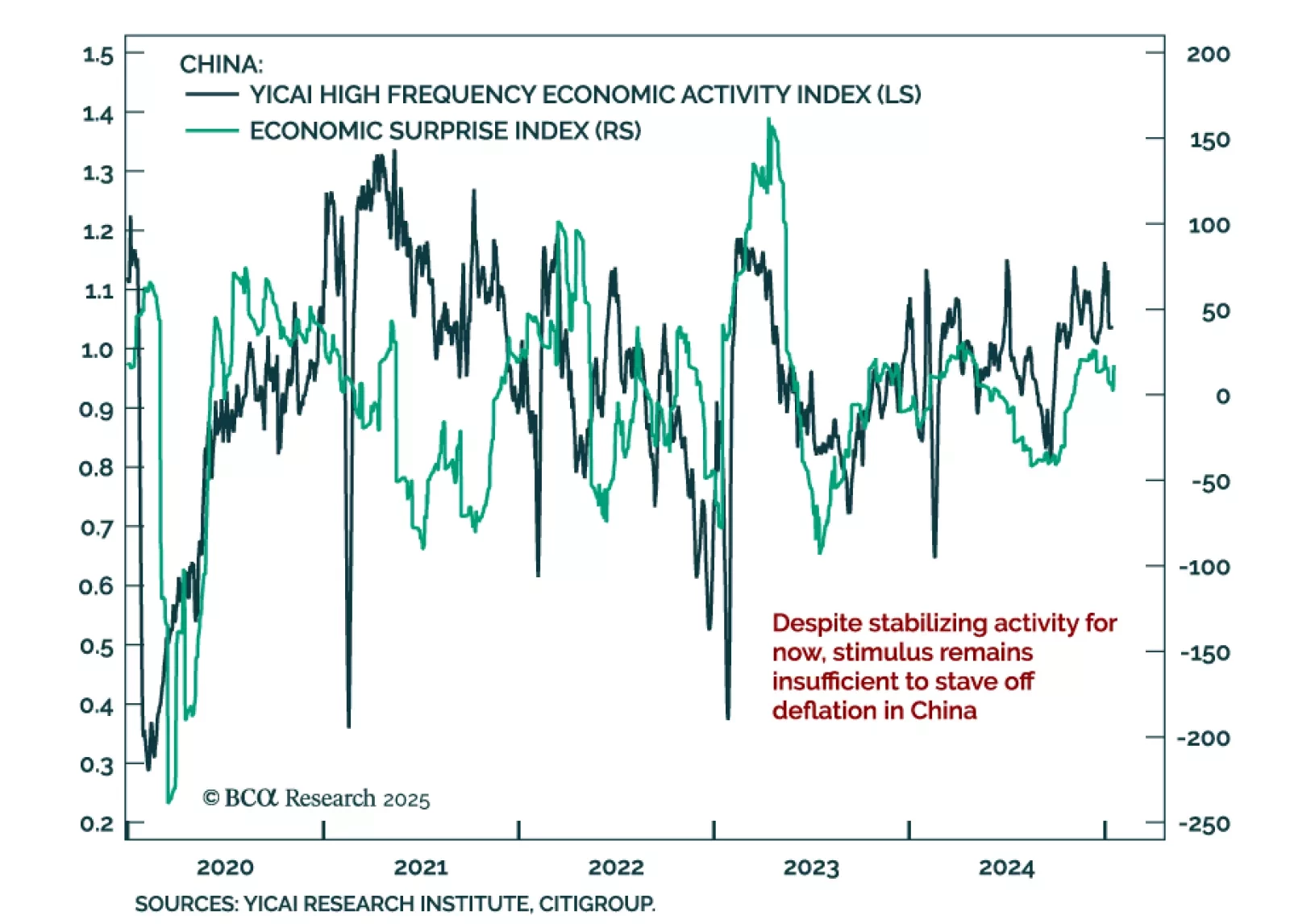

Chinese activity was decent in December, with GDP growth topping the 5% target for 2024. Industrial production growth ticked up to 6.2% y/y from 5.4% in November. Retail sales also picked up, increasing to 3.7% from 3.0% a month…