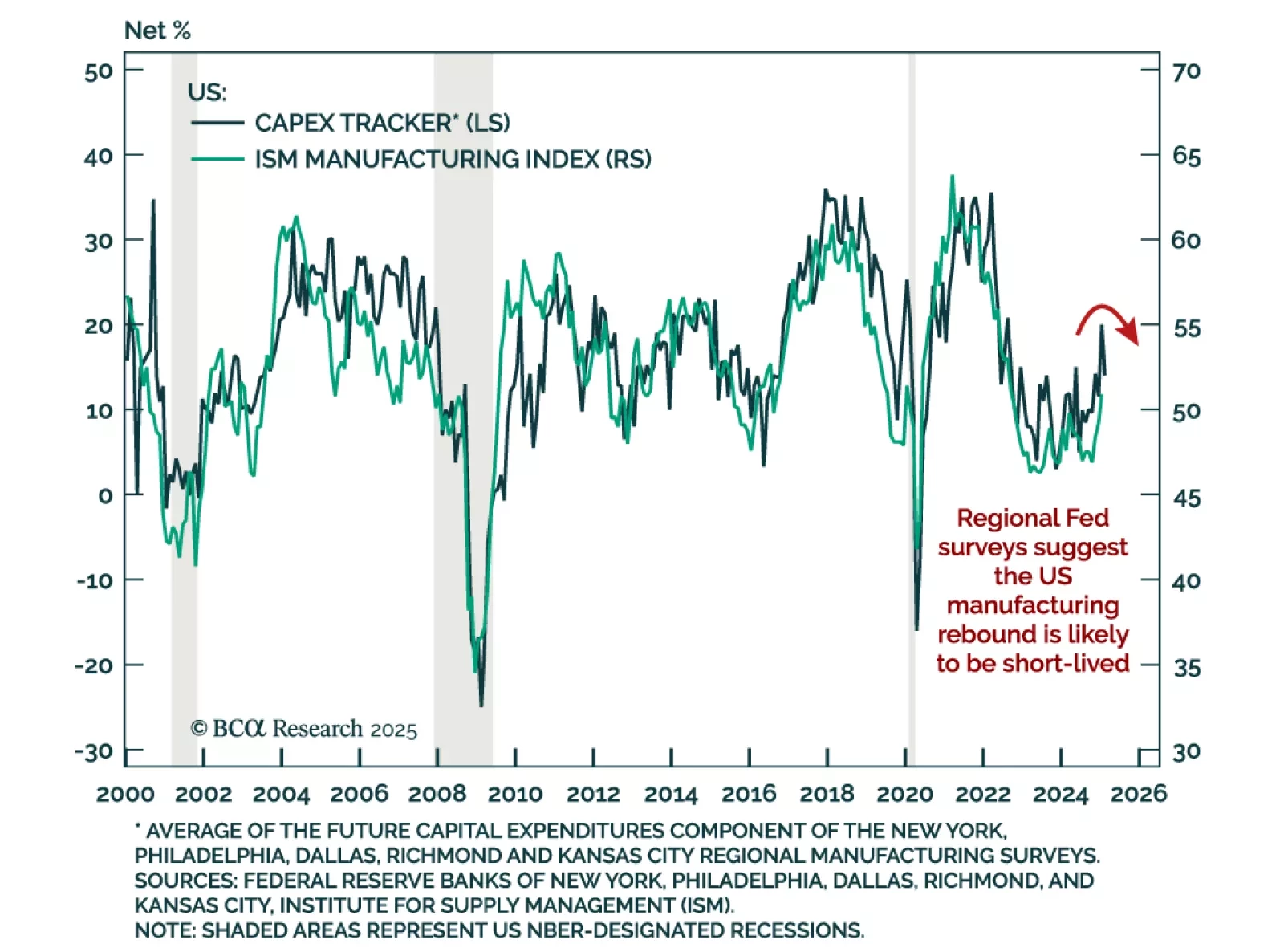

The February Dallas Fed Manufacturing index missed estimates, contracting at -8.3 vs. expanding at 14.1 in January. The underlying details of the report were quite poor, with current and future measures of activity broadly ticking…

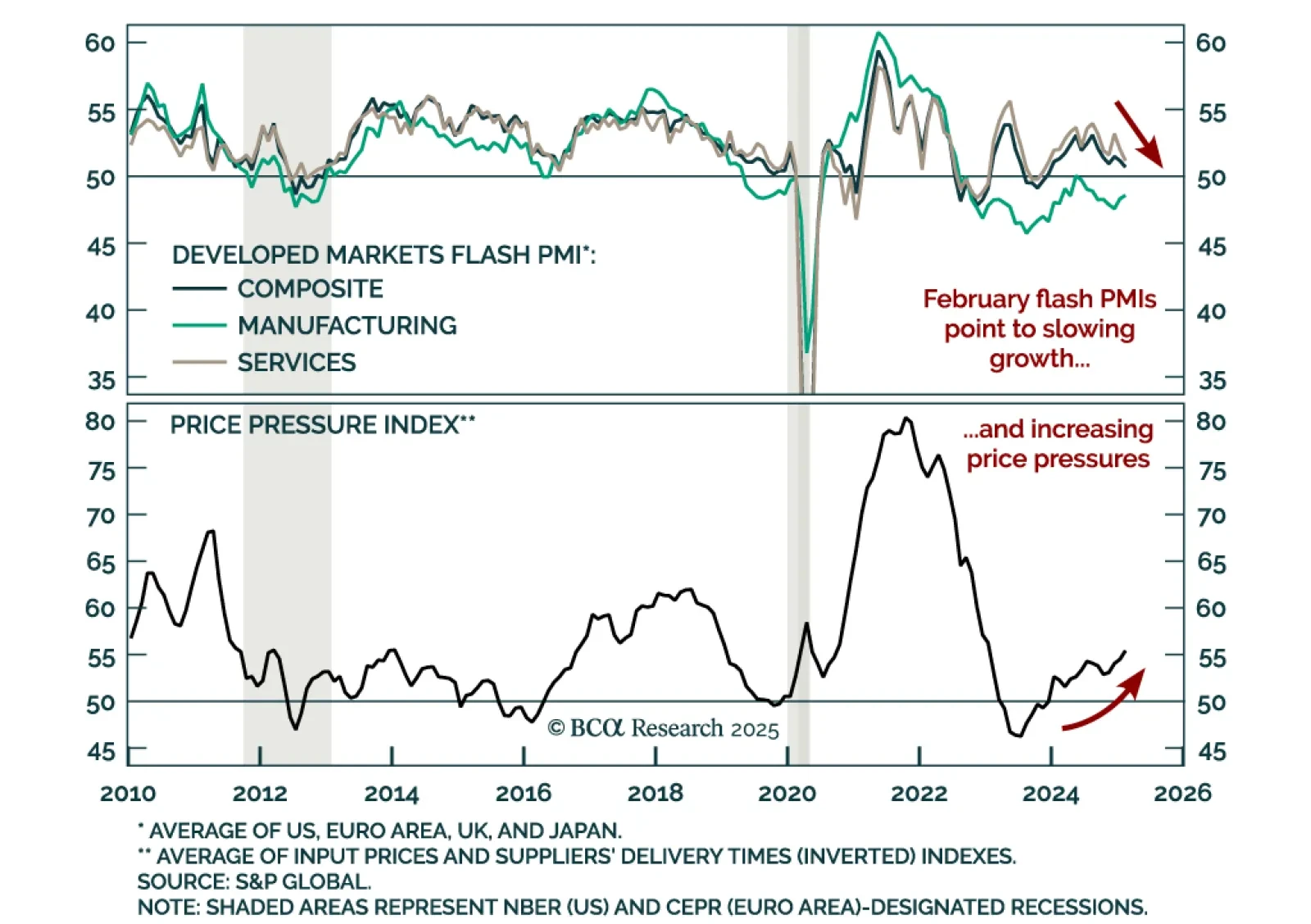

February’s flash PMIs for the major developed markets showed softening growth, and rising price pressures. The US composite index missed estimates and decreased to 50.4 from 52.7 in January. Services were a big contributor to the…

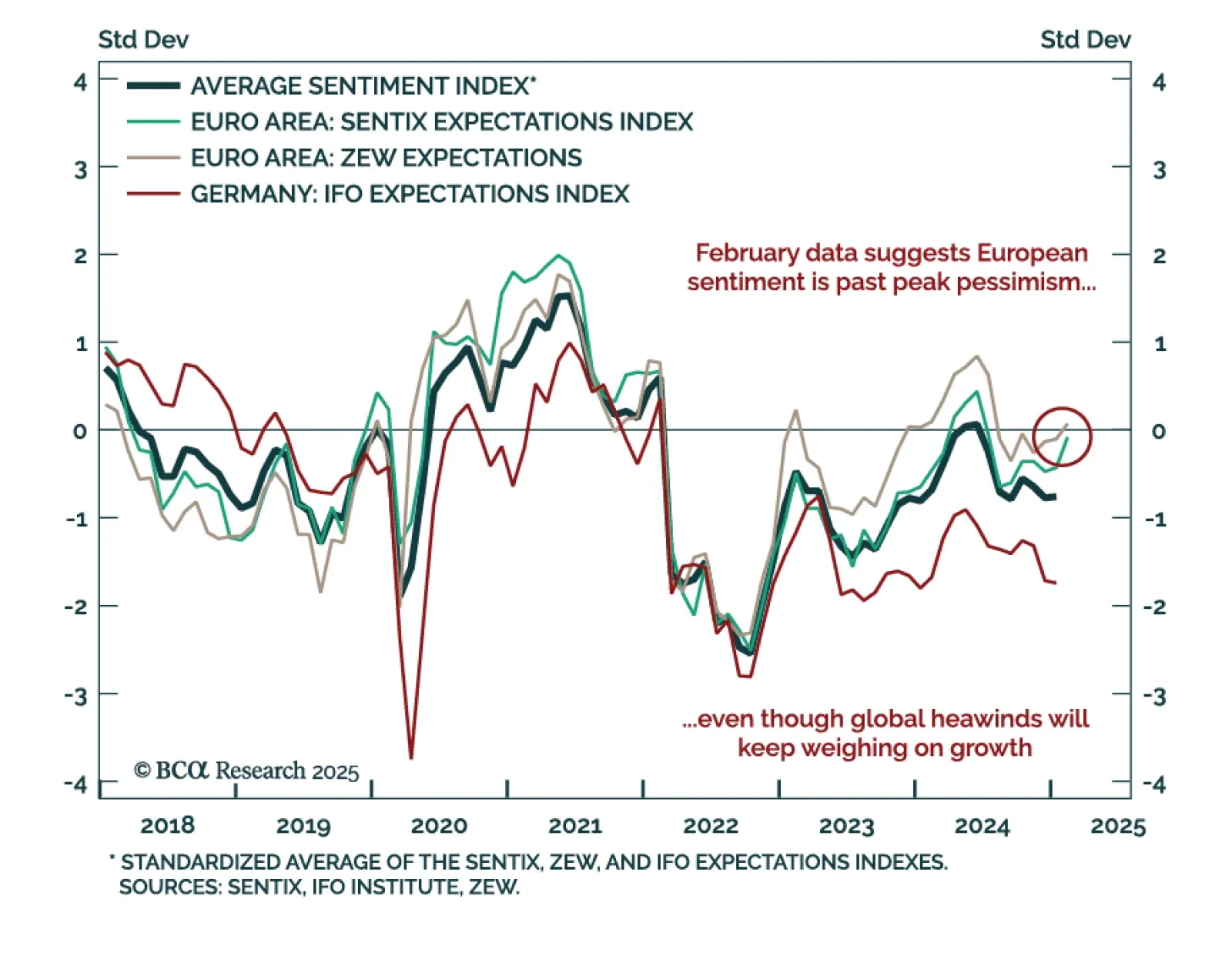

A nascent theme in the latest data is the broad improvement in European sentiment. The February Sentix and ZEW surveys both improved, and flash estimates for European consumer confidence beat estimates, ticking up to -13.6%.…

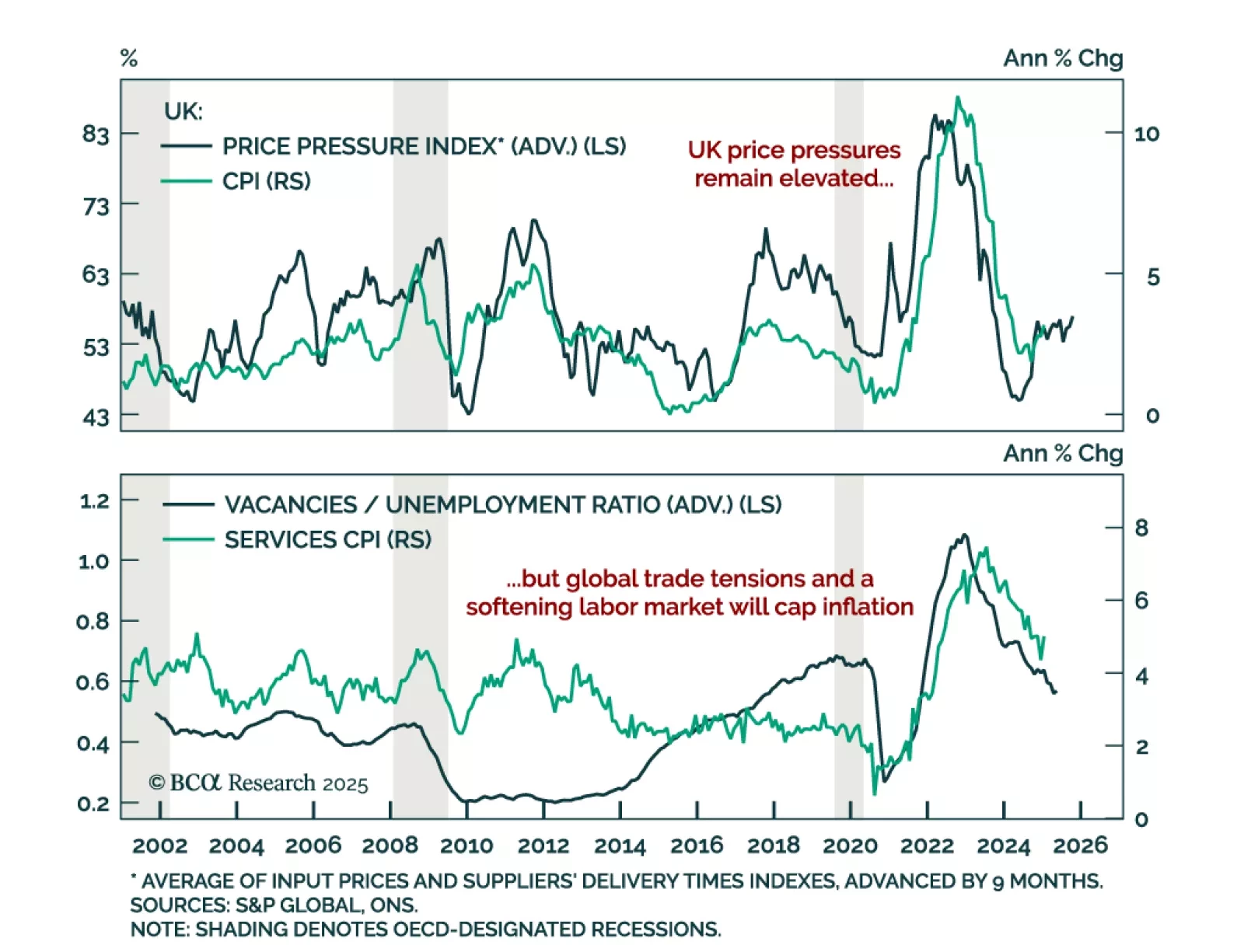

The January UK CPI was slightly hotter than expected. Headline inflation beat estimates, rising to 3.0% y/y from 2.5% in December. Core inflation also jumped but was in line with expectations at 3.7%. Services were strong, albeit…

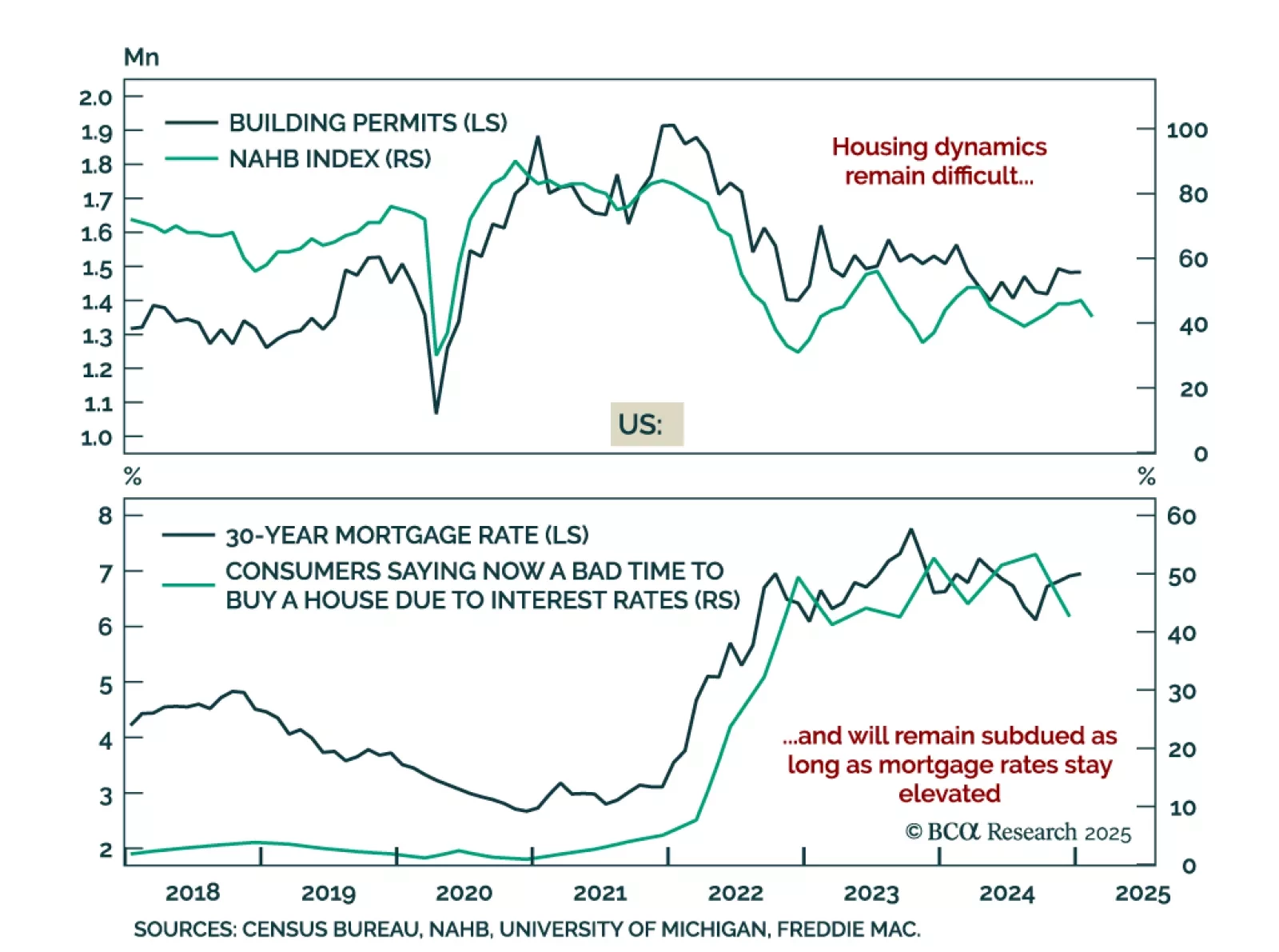

US January housing data disappointed, with housing starts falling 9.8% m/m after expanding 16.1% in December. The February NAHB Housing Market Index also weakened, falling to 42 from 47 in February. Building permits were the one…

The February ZEW index for Germany and the eurozone beat estimates, with the expectations component rising to 26.0 from 10.3 a month prior. The current situation assessment also improved, although it remains deeply negative at -88.5…

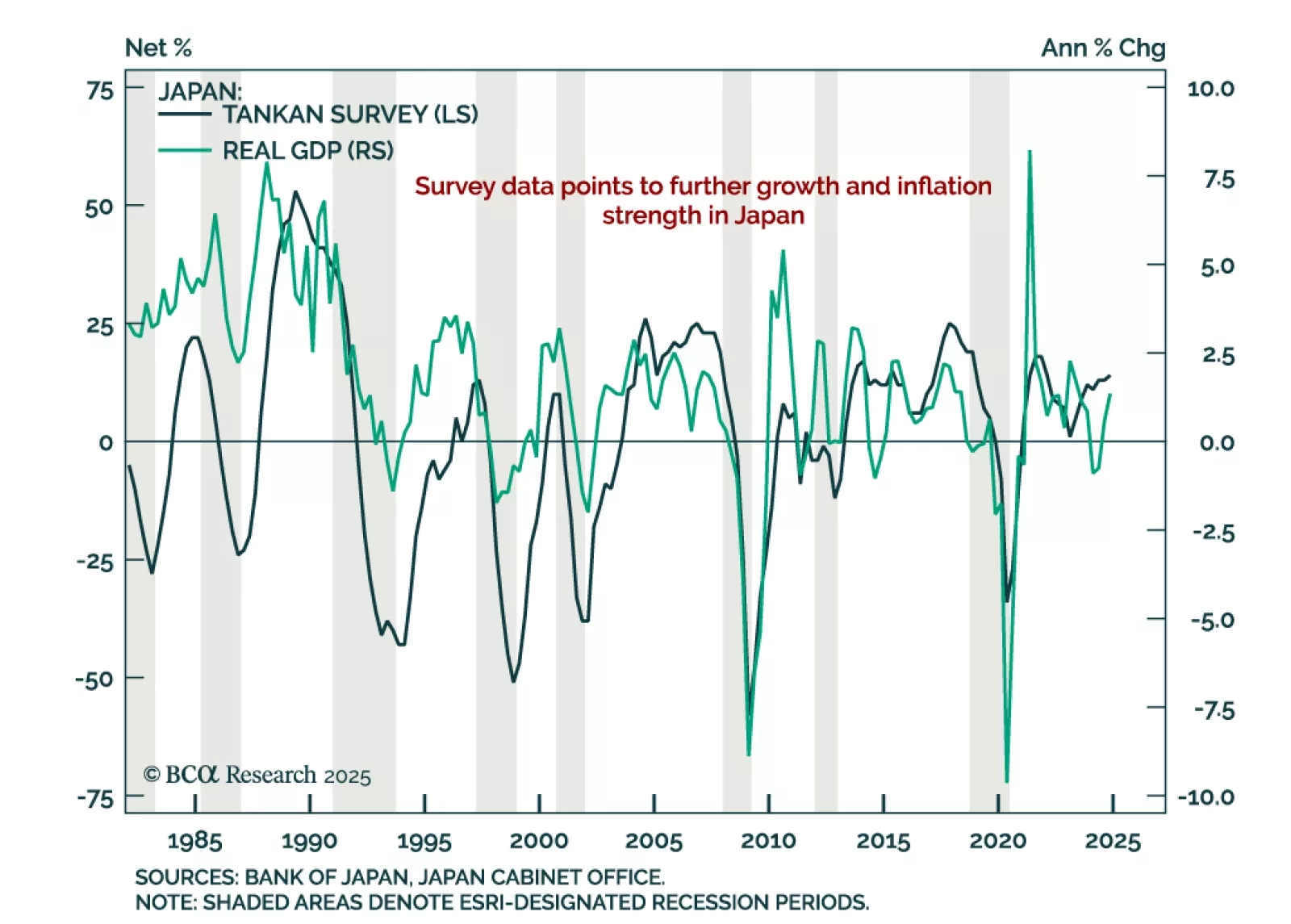

Preliminary estimates of Q4 real GDP growth in Japan was stronger than expected, rising to 2.8% q/q annualized from 1.7% in Q3. Domestic demand remained strong, and the GDP deflator increased to 2.8% y/y. Japan’s economy is…

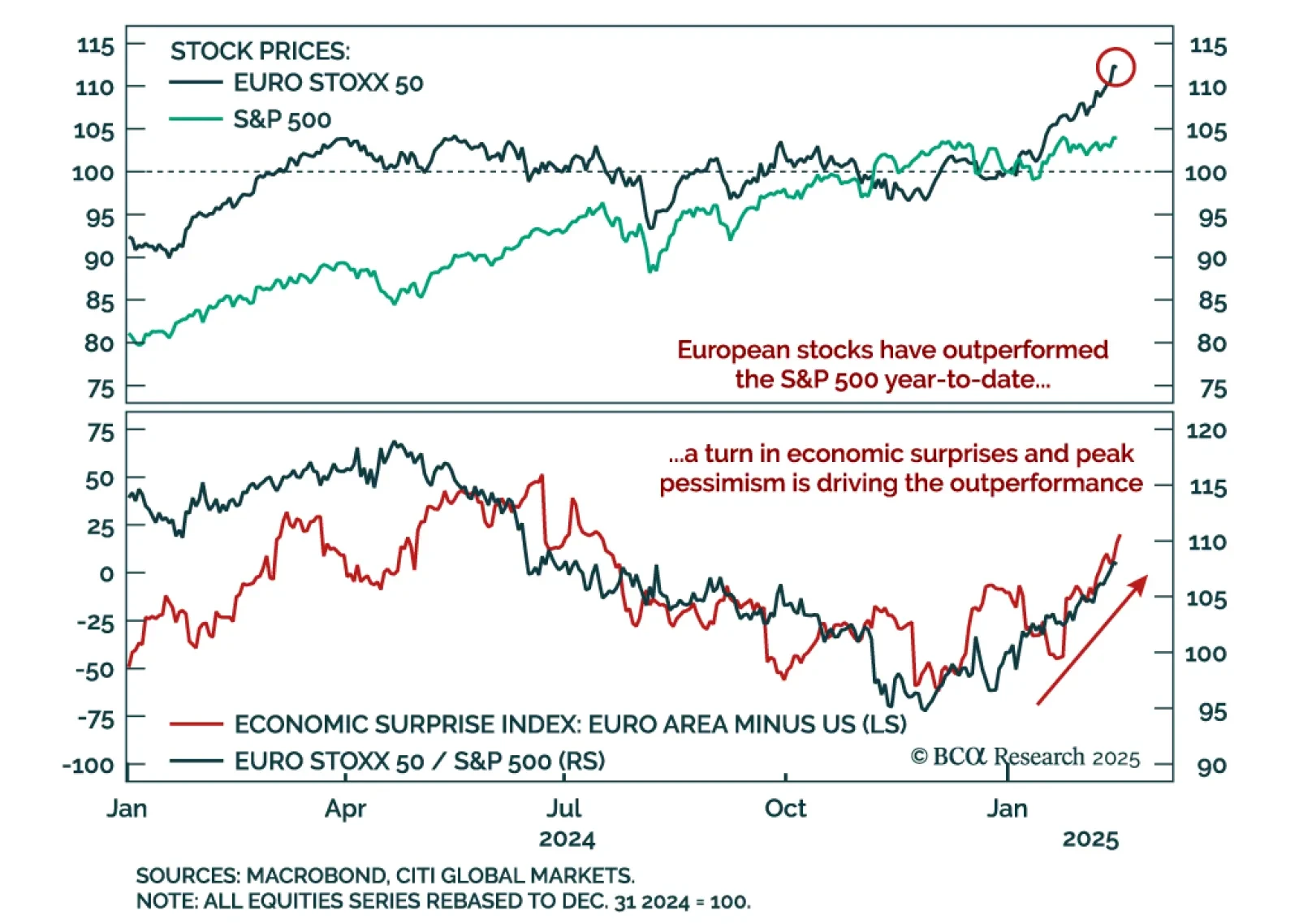

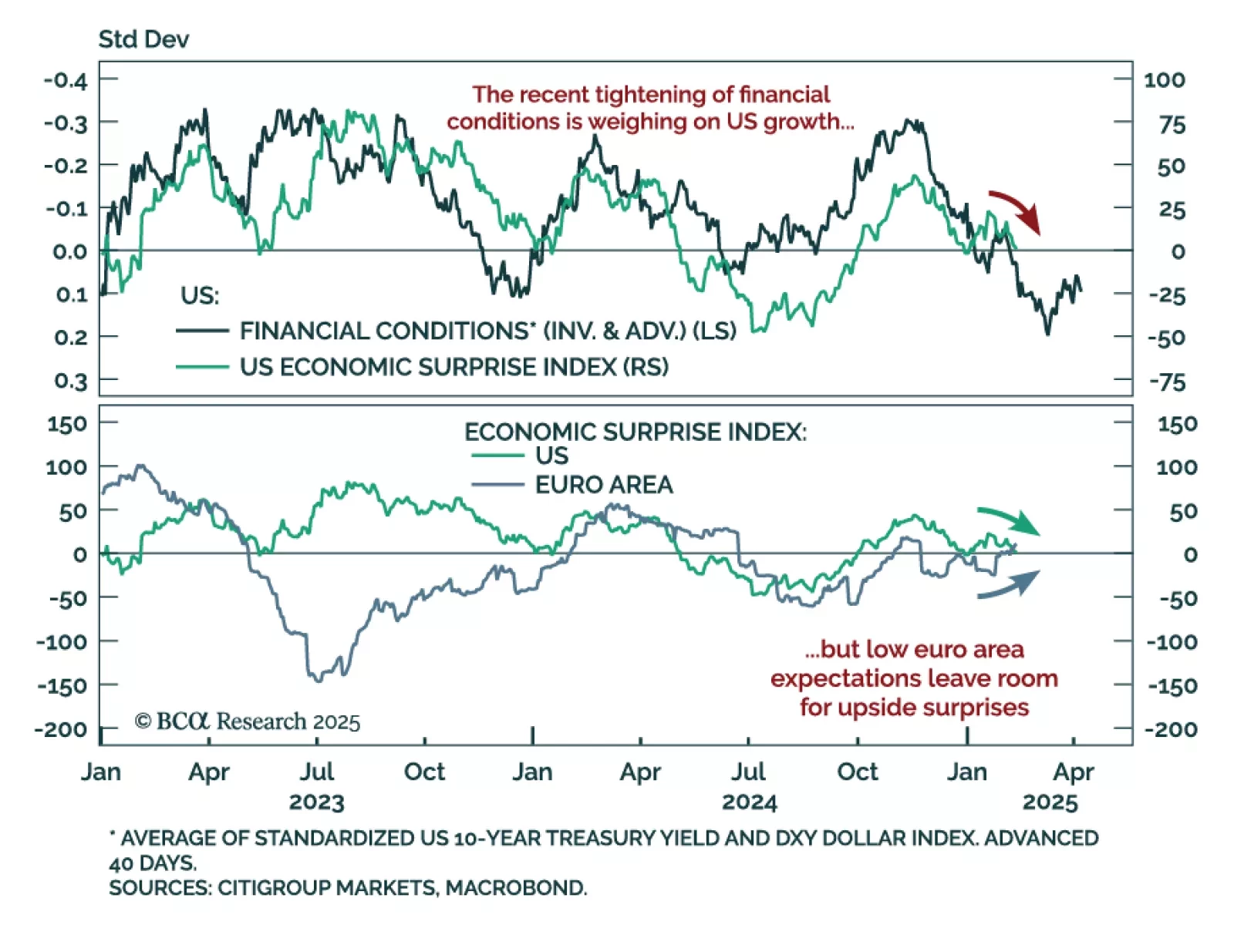

While the main Q1 2025 theme has been “America First”, the year-to-date market story has been more nuanced. “America First” would suggest an outperformance of US assets, but it is European assets that have started the year on a…

While geopolitics captured the latest headlines, Eurozone economic surprises have turned positive, while those in the US are on the verge of turning negative. Global economic surprises hinge on expectations and…

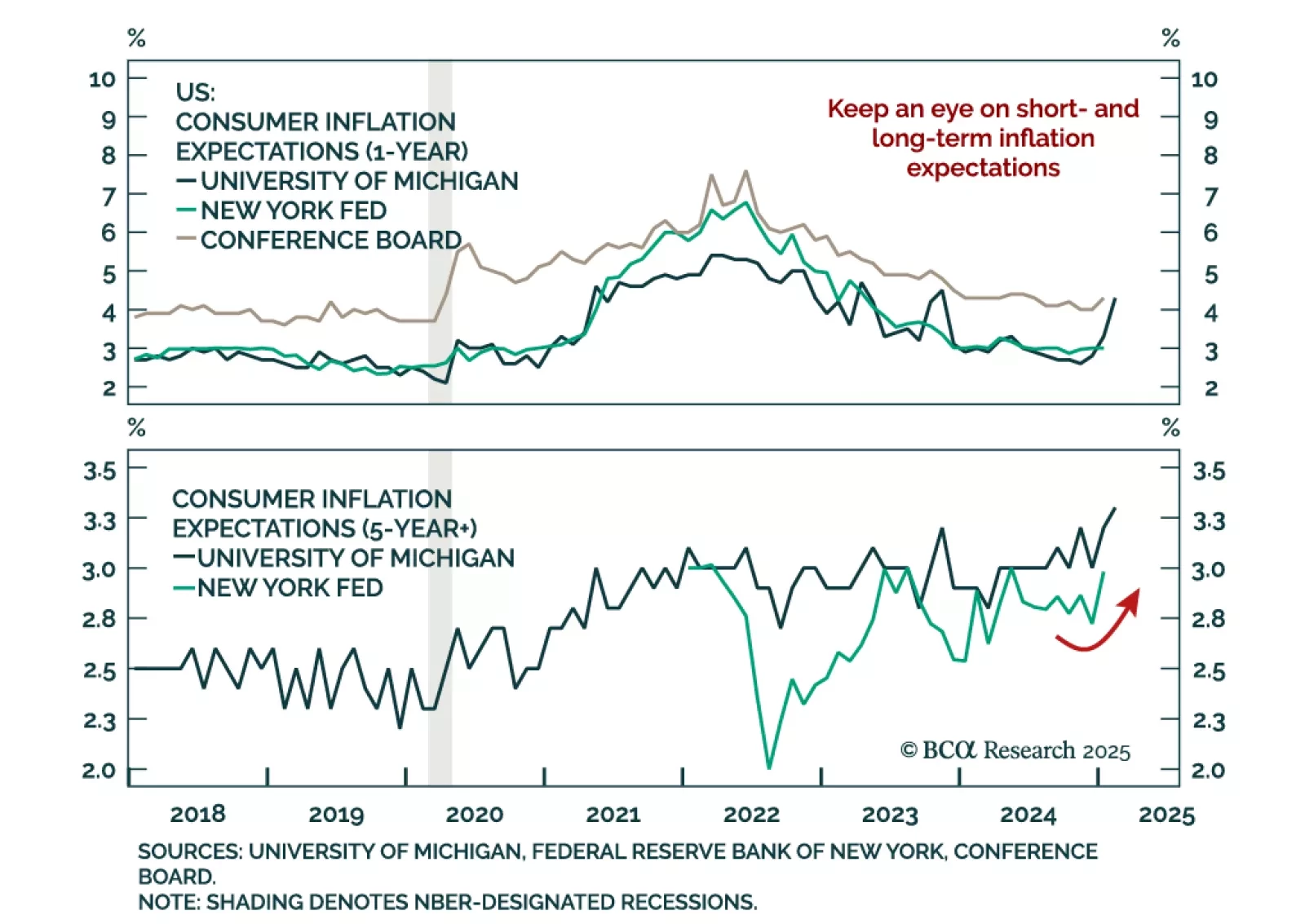

The New York Fed’s Survey of Consumer Expectations’ 1-year and 3-year inflation expectations were unchanged in January. Five-year ahead expectations however increased, as did expectations for staples inflation, while spending…