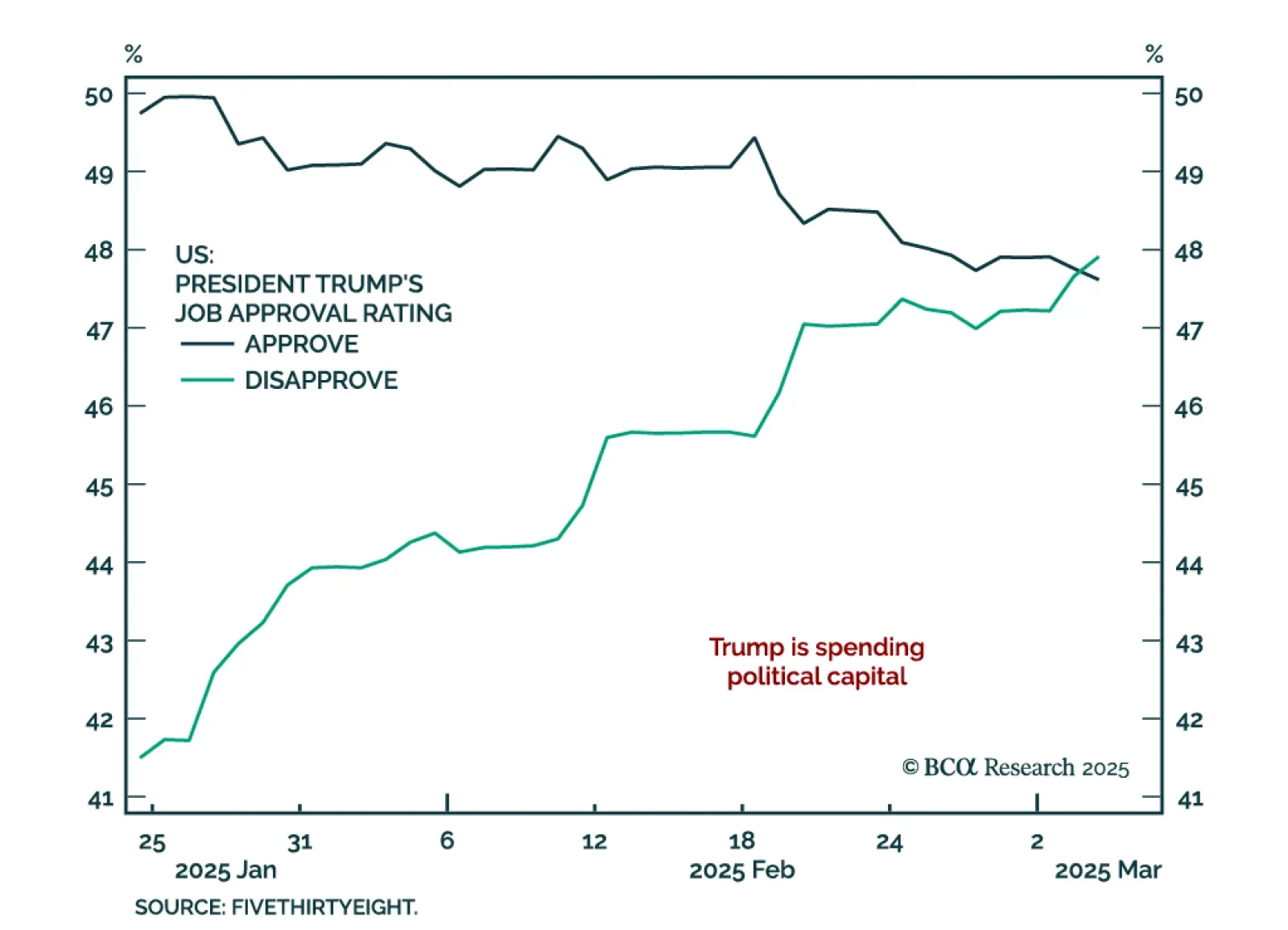

In light of President Trump’s address to Congress and the ebb-and-flow of tariff announcements, our Geopolitical strategists assessed the constraints on the administration’s disruptive agenda. Trump’s ability to implement his…

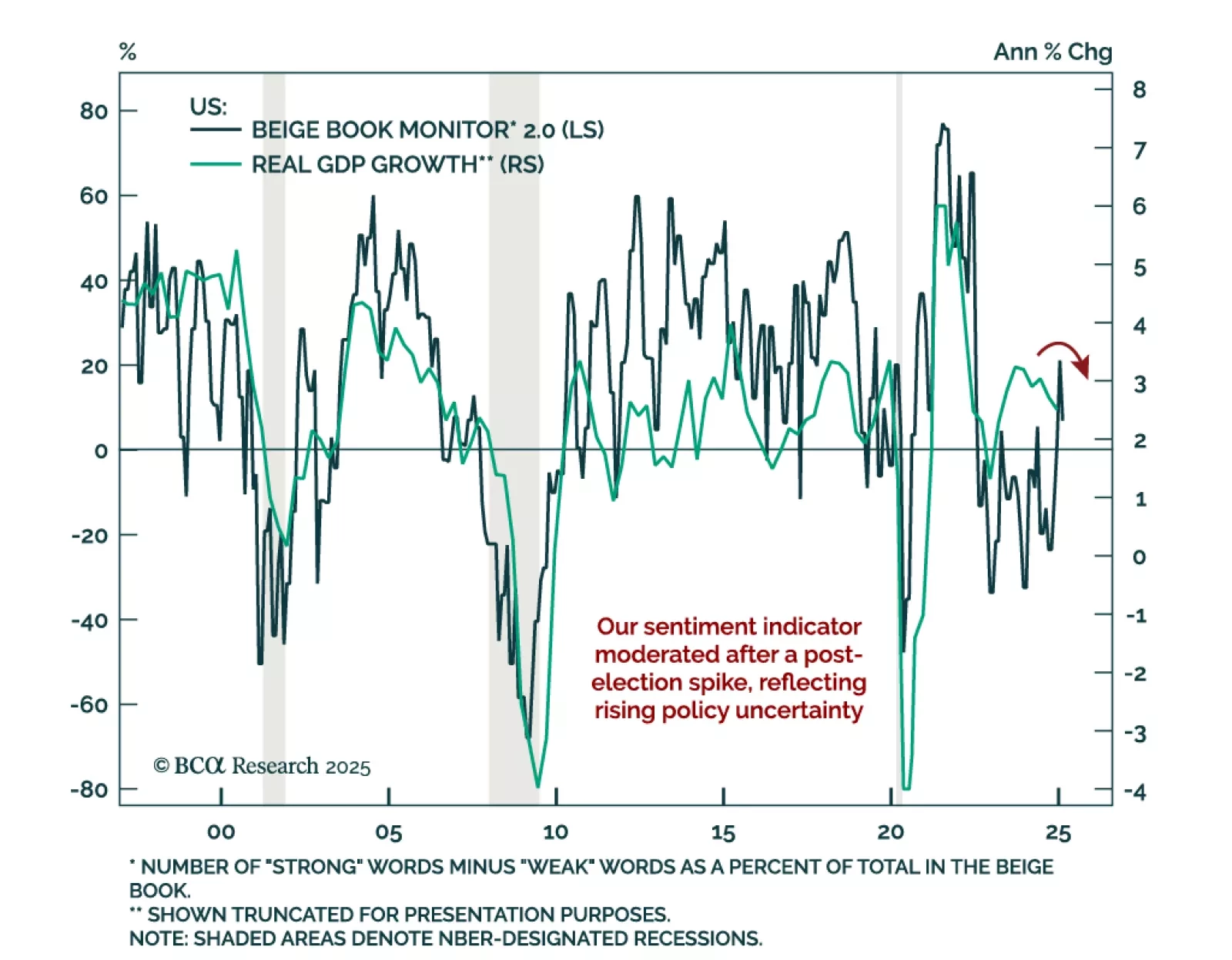

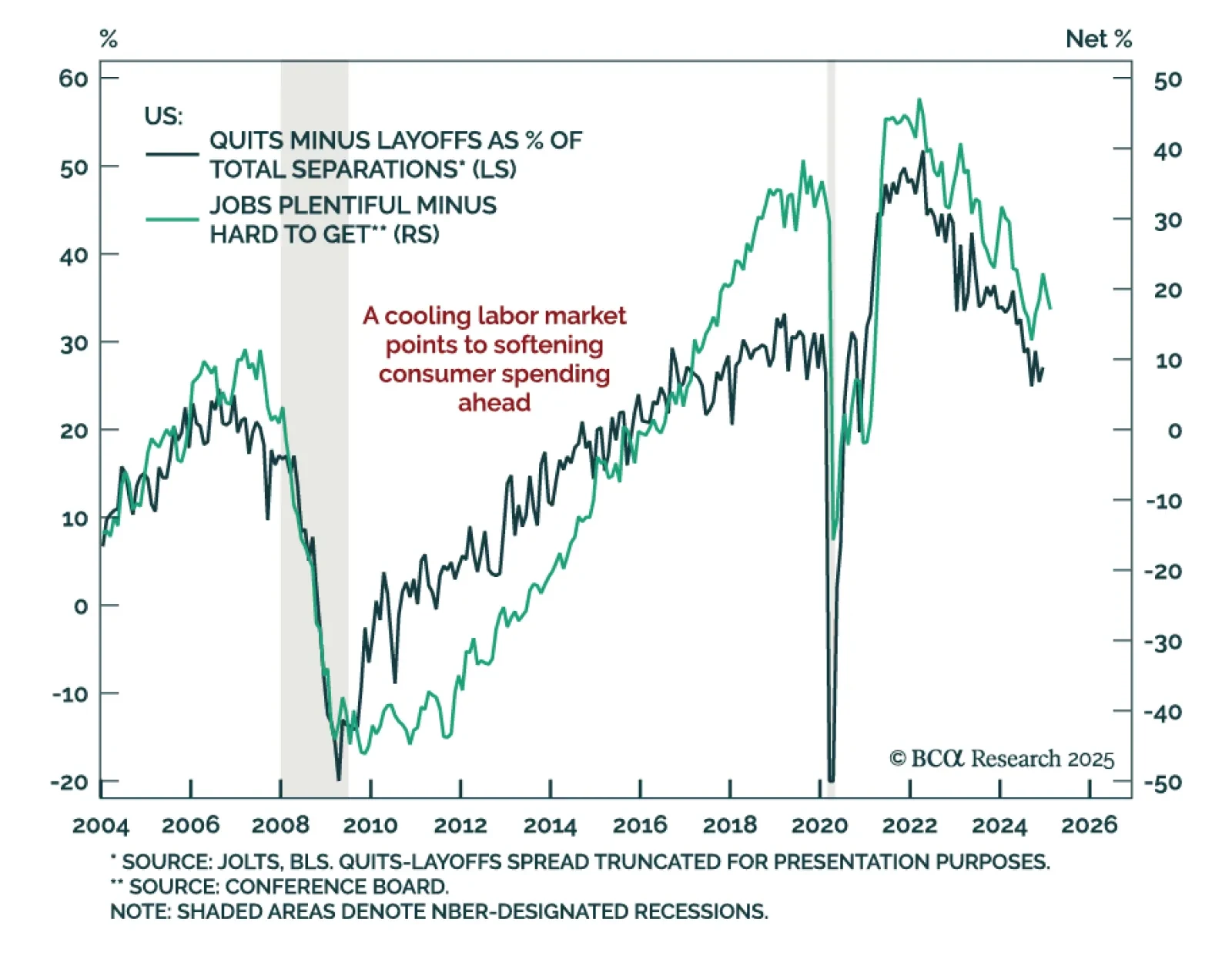

The Federal Reserve’s Beige Book shows a slowing economy, a moderating labor market, and rising price pressures. The latest Beige Book is in line with other sentiment indicators showing slower growth and decreased confidence…

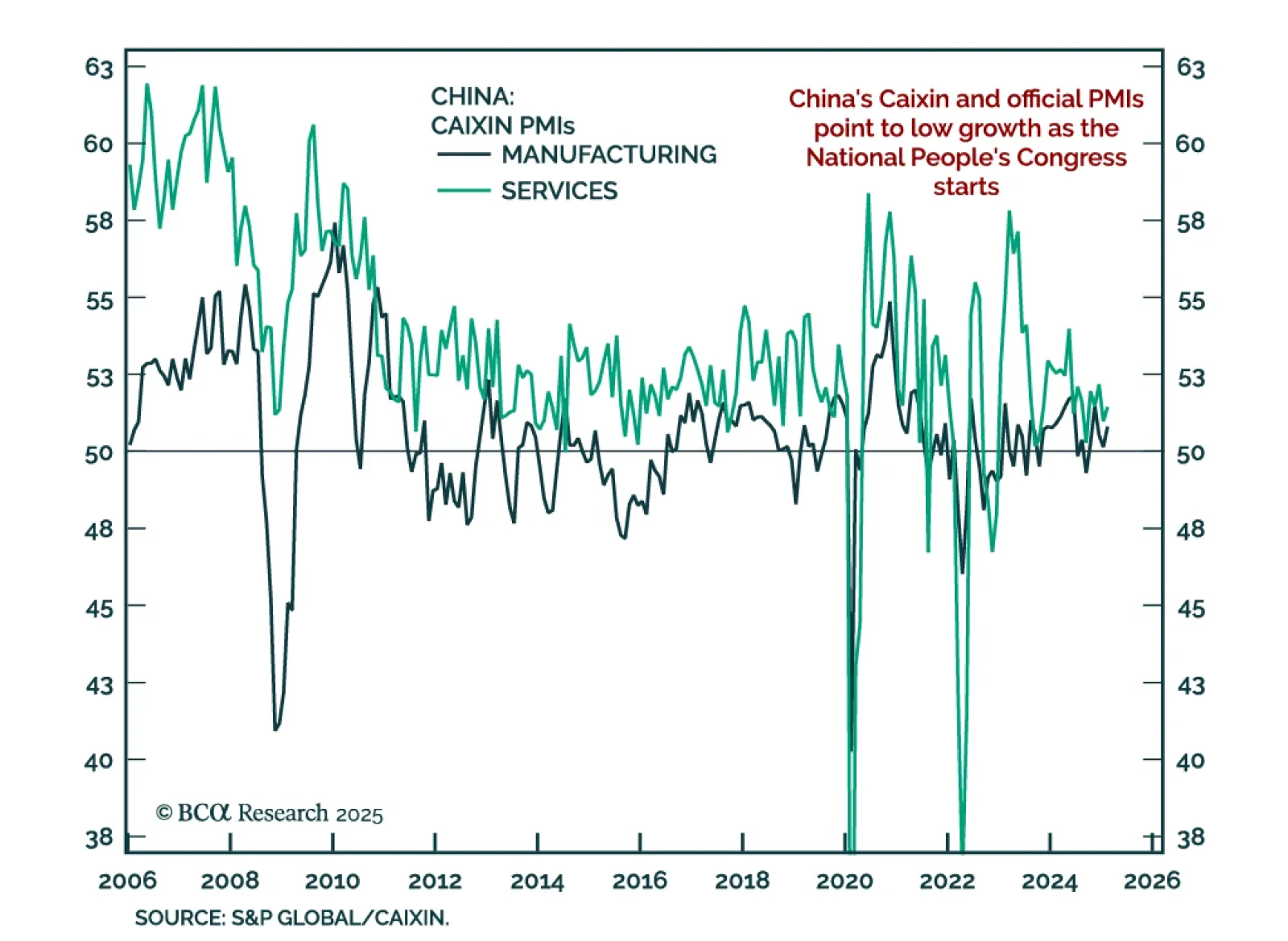

China’s February Caixin PMIs showed growth remains tepid. The composite ticked up to 51.5 from 51.1. Services are still showing a very faint expansion at 51.4, with manufacturing ticking up to 50.8. The message from the official NBS…

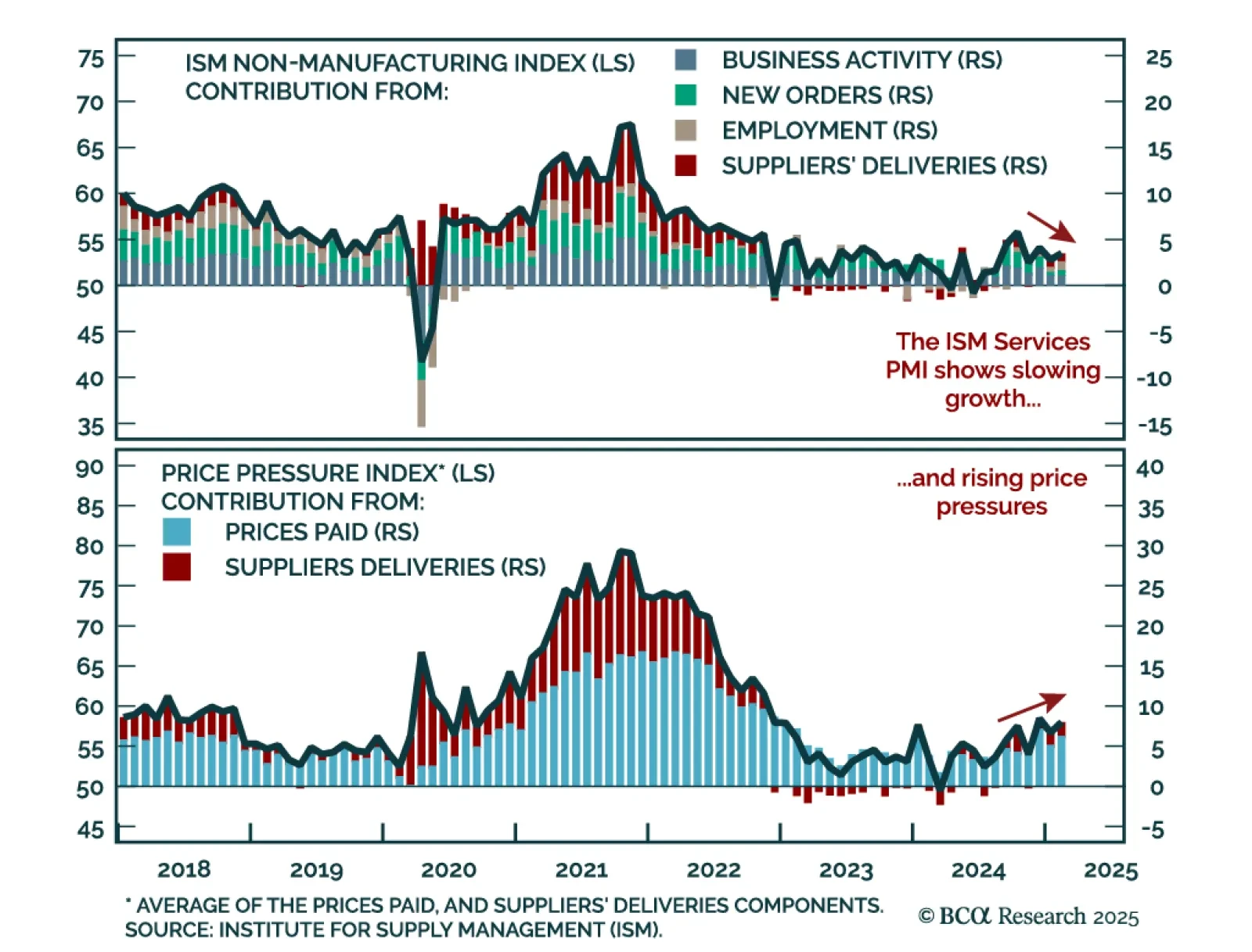

The February ISM Services beat estimates, rebounding to 53.5 from 52.8. All activity subcomponents increased, with new orders and employment ticking up. Price pressures however also increased, as prices paid went up and suppliers’…

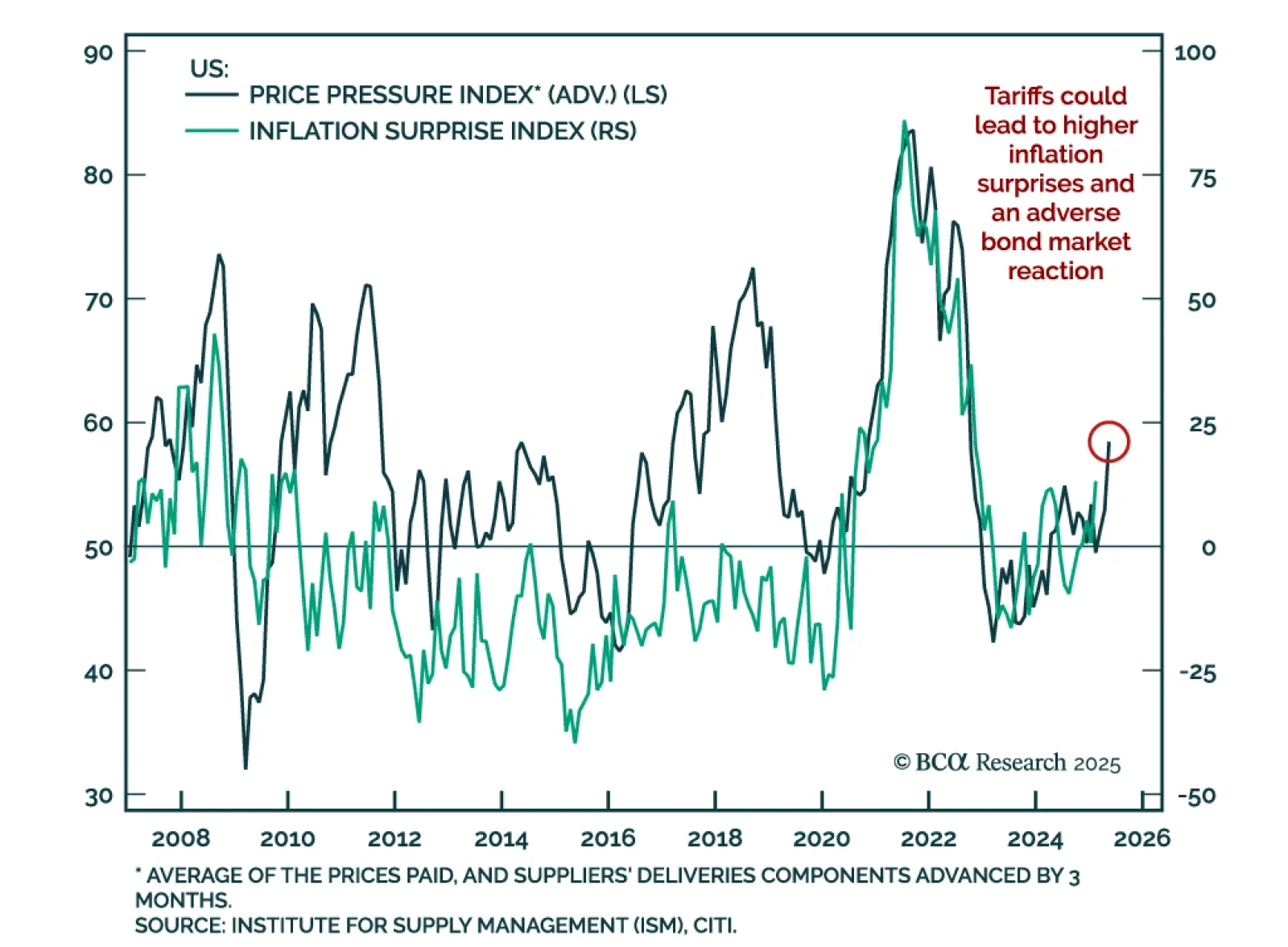

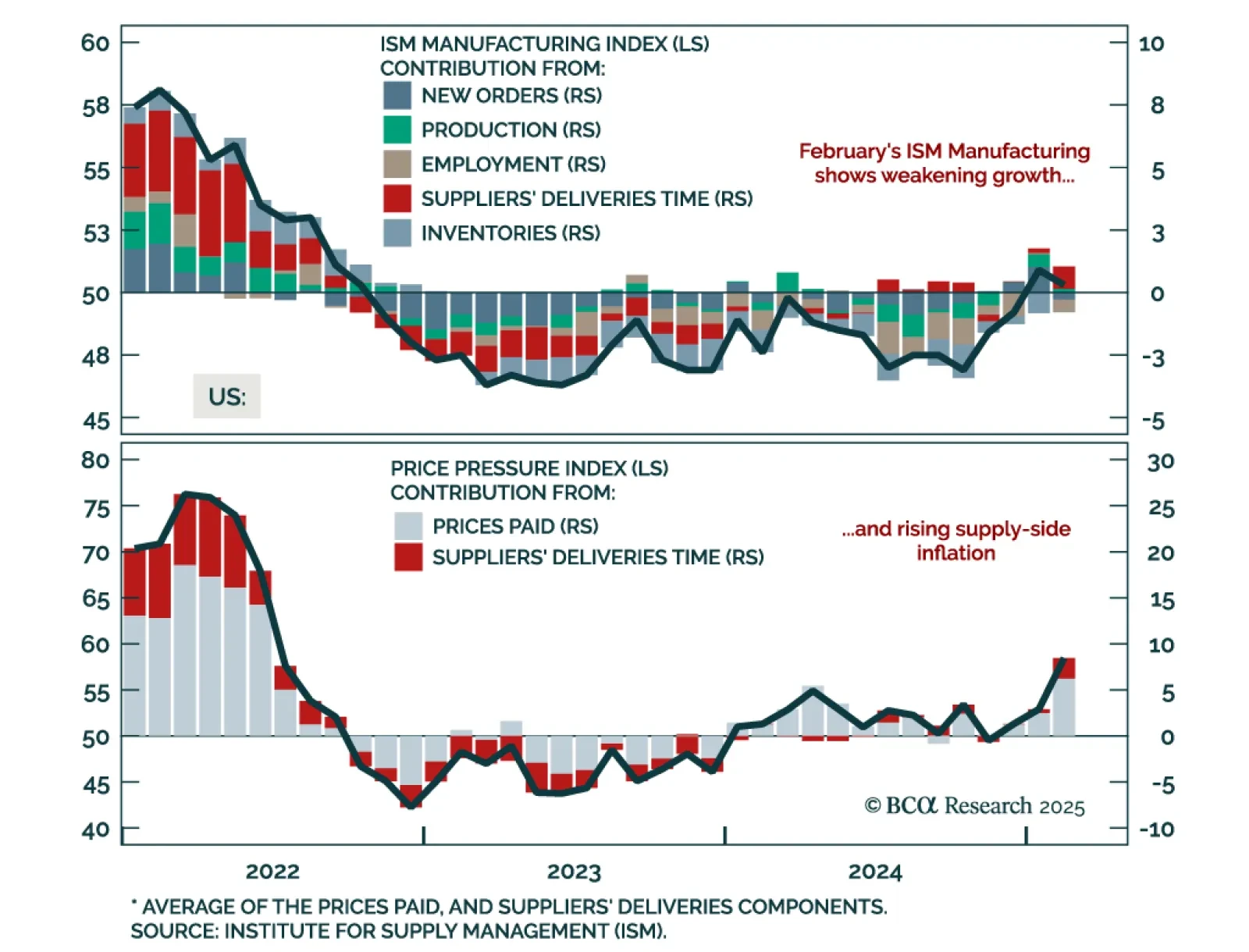

Leading US growth indicators have slowed, with economic surprises now in negative territory. However, Monday’s ISM Manufacturing showed that while activity is slowing due to tariffs uncertainty, supply-side price pressures are…

The February ISM Manufacturing index was weaker than expected, declining to 50.3 from 50.9. New orders plunged to 48.6 from 55.1, with employment also contracting. Price pressures however increased. Prices paid and suppliers’…

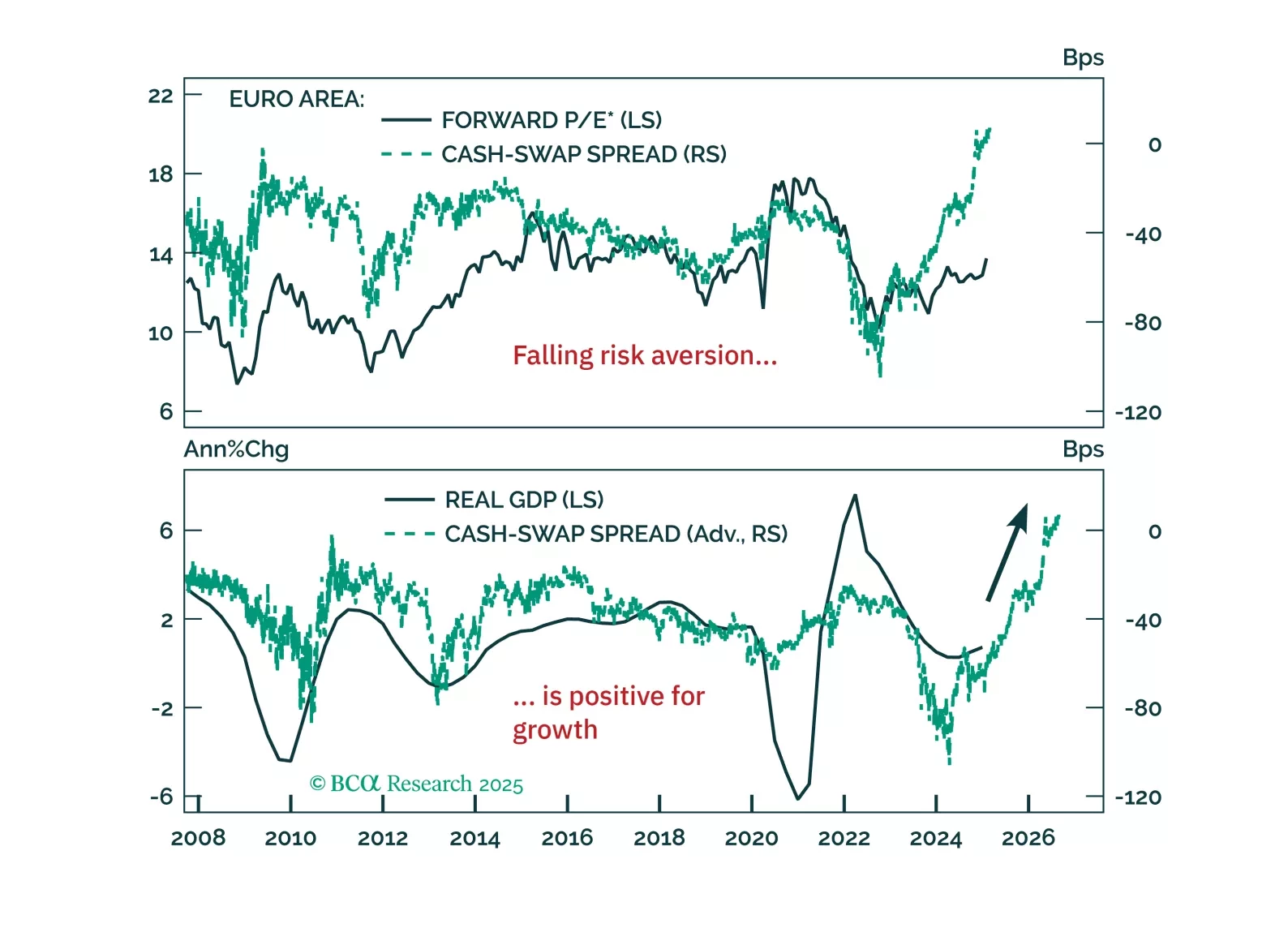

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

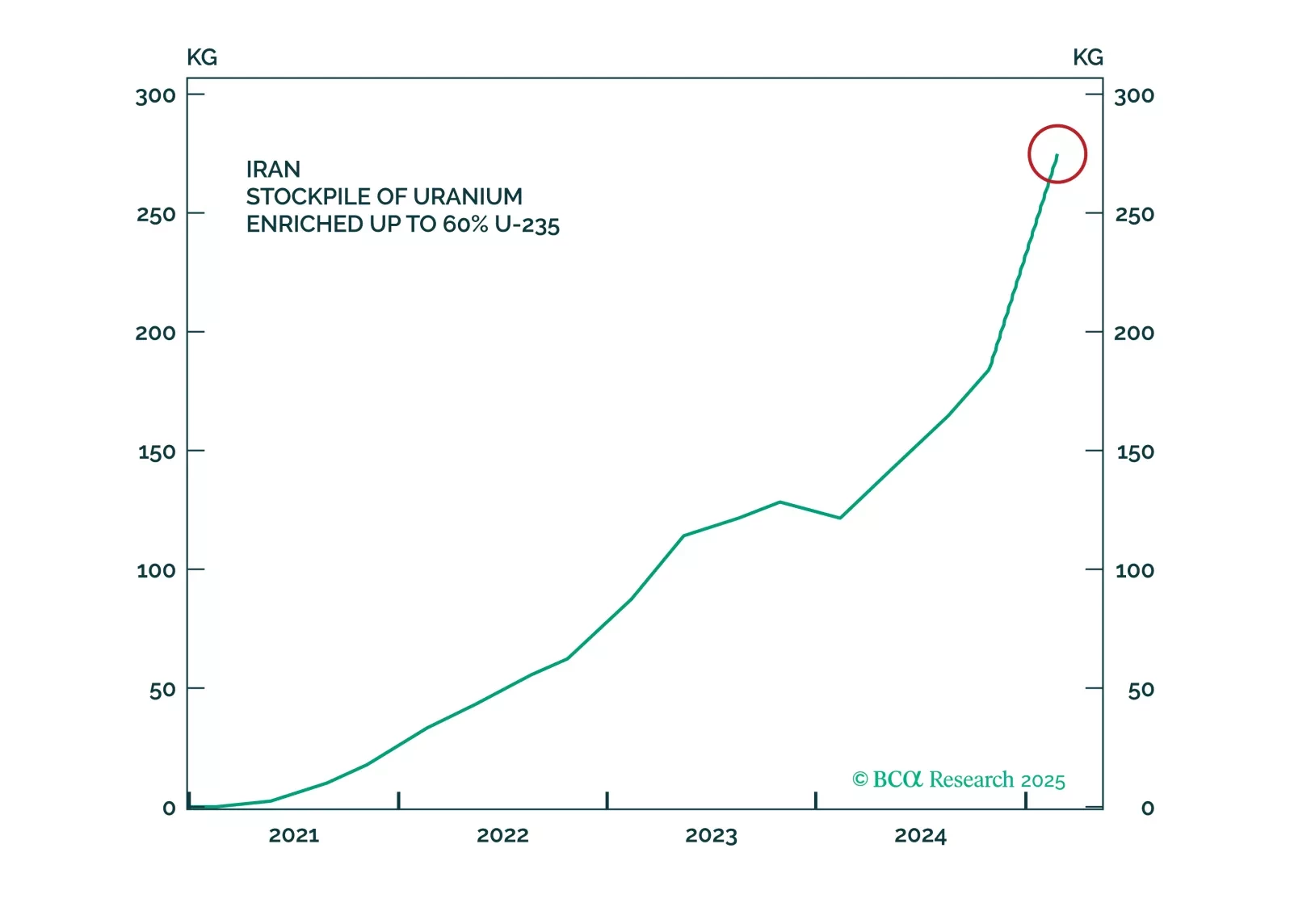

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

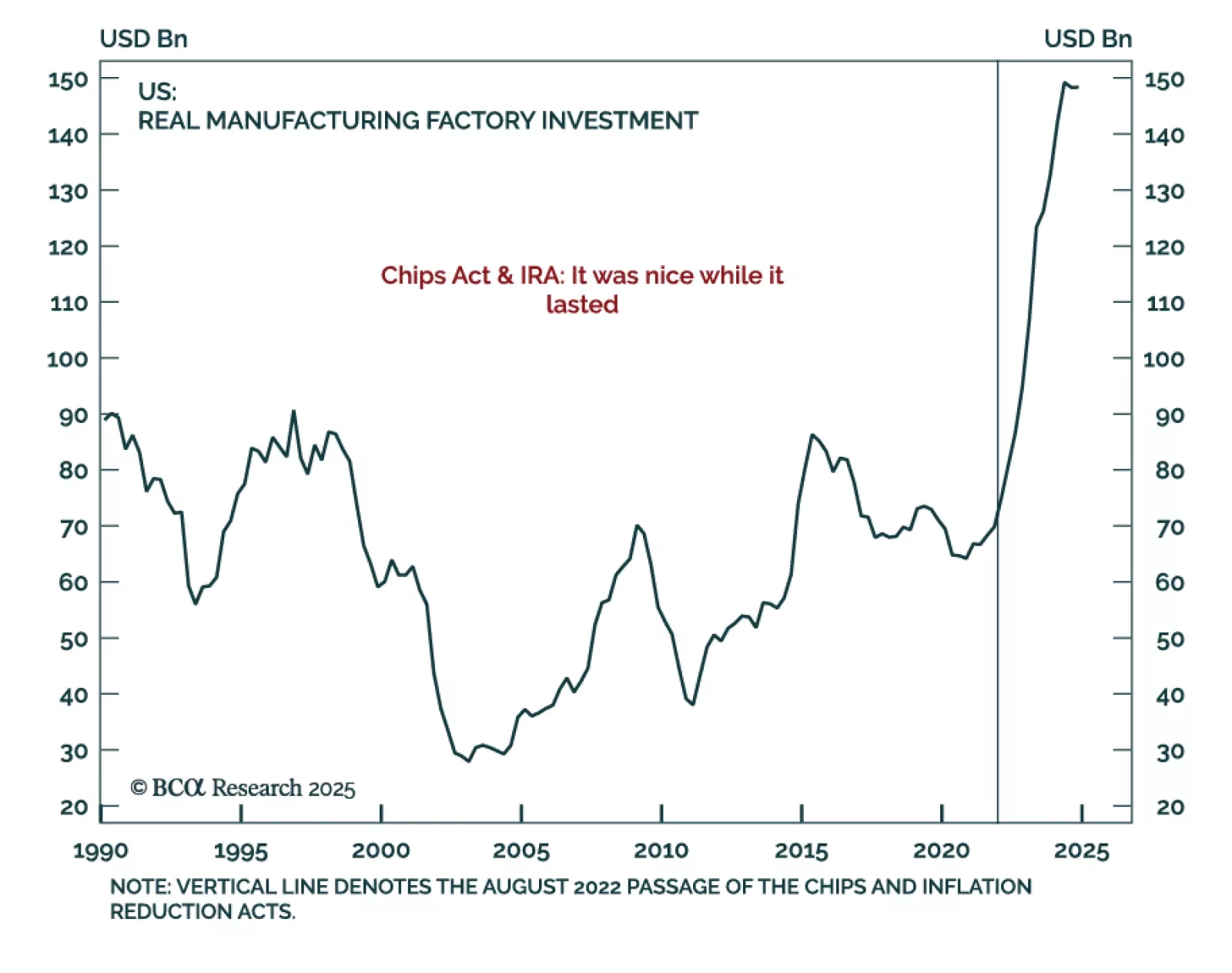

Our US Investment strategists visited Midwest clients, and provided a summary of their discussions with investors. Despite solid data, investors should focus on where the economy is headed rather than where it has been. Excess…

The February Conference Board Consumer Confidence index missed estimates for the third month in a row, falling to 98.3 from 105.3. Consumers’ assessment of both their current situation and their expectations worsened, with the latter…