Highlights We’ve searched in vain for imminent domestic weakness in the U.S. economy, … : Much of our work this spring has focused on trying to poke holes in our view that the equilibrium fed funds rate remains above the…

Highlights The trade war escalation is just the catalyst and not the cause of the market correction. This year’s absolute double-digit returns have most likely already been made during the early-2019 star alignment of near-…

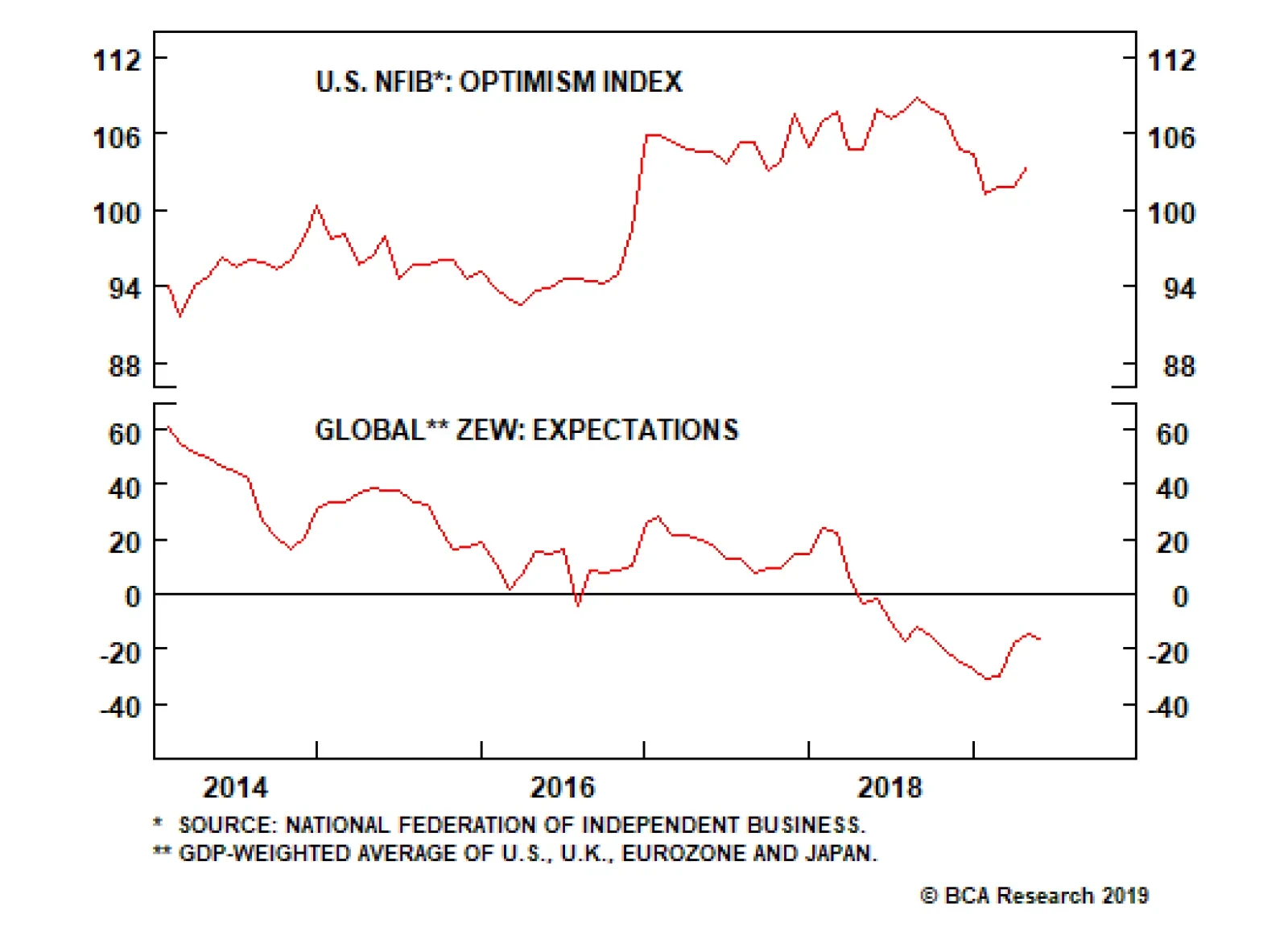

The U.S. NFIB small business optimism index for April improved significantly to 103.5 from 101.8. Meanwhile, according to the May ZEW survey, European investors became more worried about German and euro area growth, with the…

Highlights U.S.: The Fed remains decidedly neutral, despite market expectations (and White House pressure) for lower U.S. interest rates. Treasury yields are mispriced and should grind higher over the next 6-12 months, led first by…

Highlights The March data brought the first signs of a stabilization in China’s “hard” economic data, albeit from a weak level. The April PMIs disappointed, but they remained in expansionary territory; this is in…

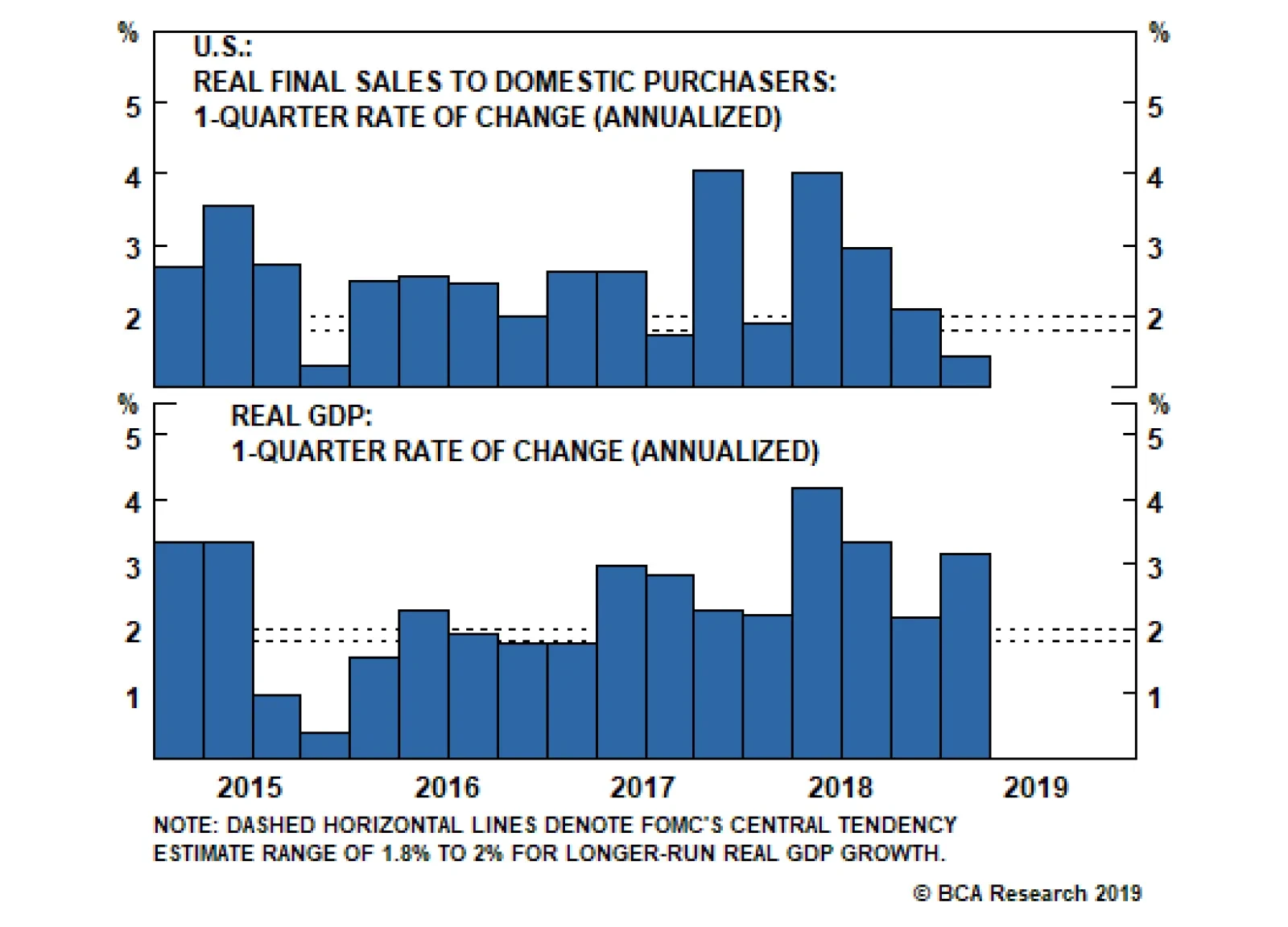

Much like how core measures of inflation strip out volatile food and energy prices to give a better sense of the underlying trend, we can also look at Real Final Sales To Domestic Purchasers (FSDP) to get a better sense of the…

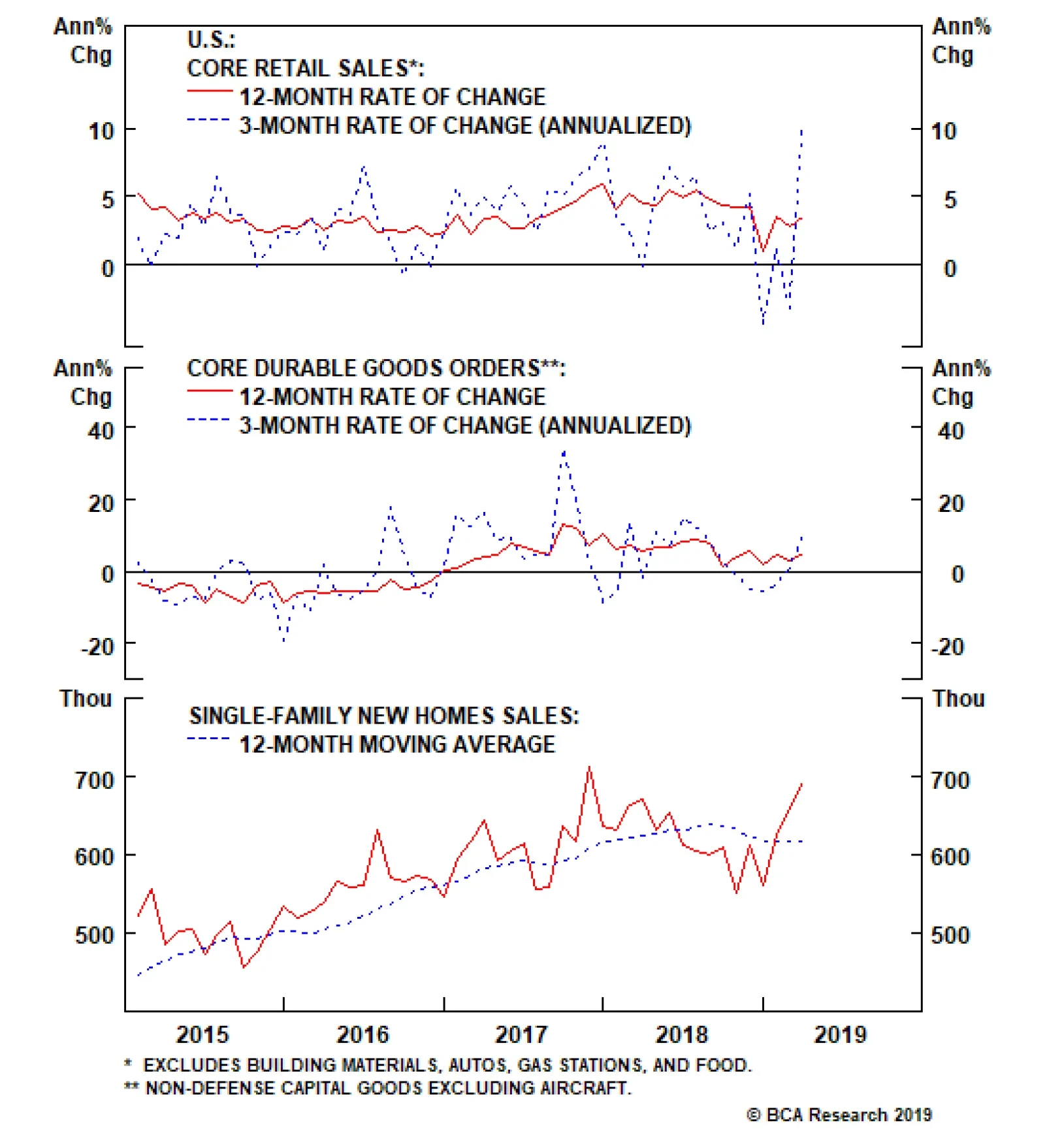

Consumer Spending Consumer spending added a meager +0.8% to GDP in Q1, but core retail sales growth has recovered sharply after having plunged near the end of last year. What’s more, with consumer sentiment close to…

Feature What Could Sour The Sweet Spot? This continues to look like a very benevolent environment for risk assets. Growth in the U.S. remains decent, with Q1 GDP growth beating expectations at 3.2% QoQ annualized (albeit somewhat…

Highlights Fed: Fed policymakers are sending a unified message that they want to keep rates on hold until they see a significant increase in inflation. However, our reading of their recent remarks suggests that they will be reluctant to…

Highlights Central bankers appear to be in a rush to boost inflation expectations before the next economic downturn. This in practice should be stimulative for the global economy. Historically, currencies of small, open economies are…