Highlights Negative Interest Rates: Time will tell if negative bond yields are indeed the “new normal”. We need to see negative yields maintained outside of a growth slowdown to prove that thesis. USTs & Bunds: U.S.…

Highlights A unified push among central banks to drop their currencies inevitably leads to lower interest rates, which eventually sows the seeds of a recovery. However, with prospects of a full-blown trade war in front view,…

Highlights U.S.-China: The escalation of the trade war has renewed investor fears that uncertainty could create an even deeper drag on global growth, requiring a more aggressive easing of global monetary policy. Fed: The Fed had an…

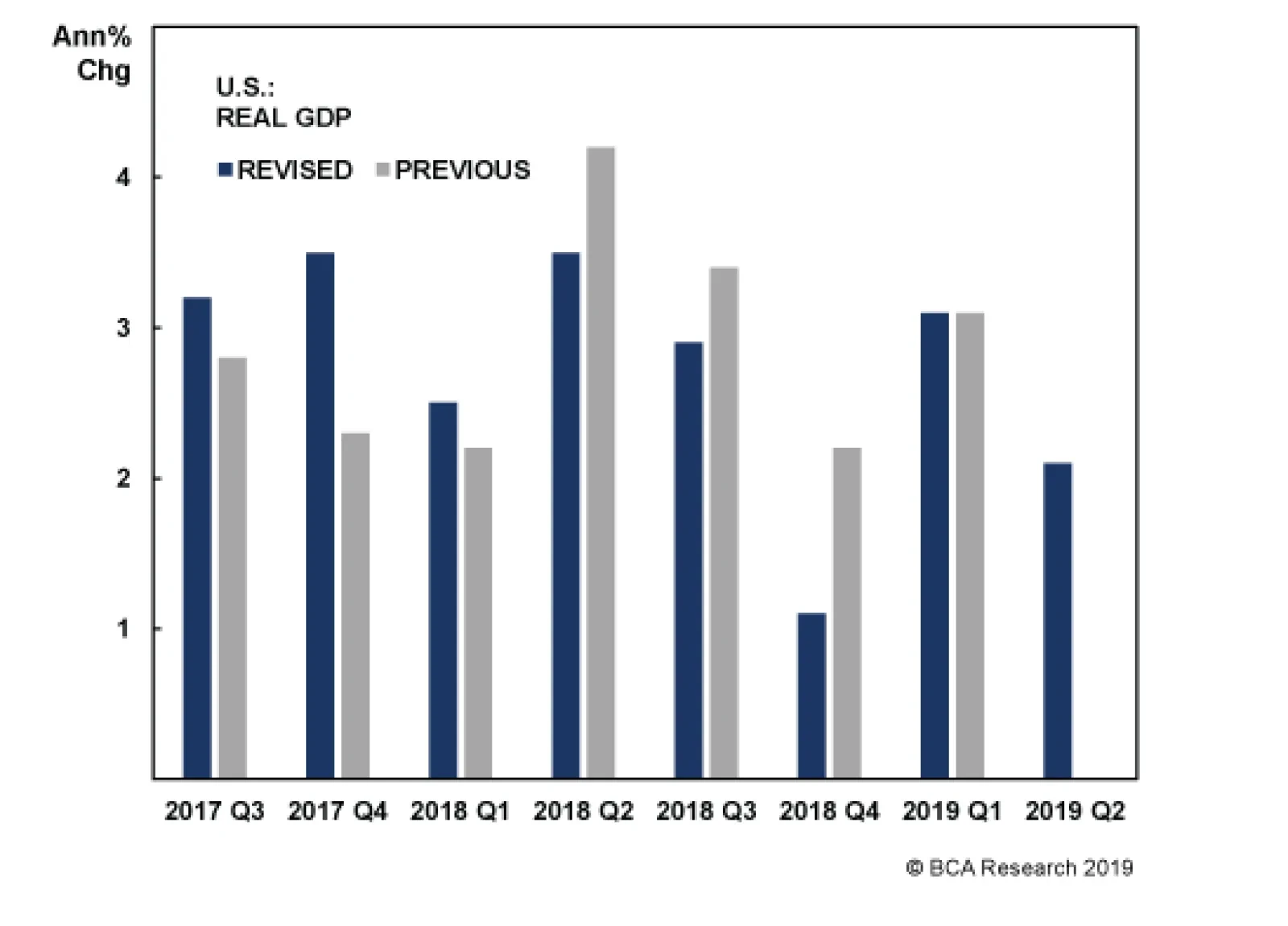

In Q2, U.S. quarterly annualized growth slowed to 2.1% from 3.1%, but nonetheless beat expectations of 1.8%. Moreover, final sales to domestic purchasers, a good measure of final domestic demand, rebounded to 3.5% from 1.8%,…

Highlights Global inflation will slow further, allowing central banks to ease policy. Liquidity indicators will have more upside as monetary policy will remain accommodative. Widening fiscal deficits, easing Chinese credit trends and…

Dear Clients, In addition to this Weekly Report, you will also be getting a Special Report authored by some of our top strategists on global growth. The manufacturing recession that began in early 2018 has lasted longer than most…