Highlights Global stocks are very vulnerable to a correction. But cyclically the Fed is committed to an inflation overshoot and the global economy is recovering. China’s fiscal-and-credit impulse fell sharply, which leaves global…

Feature Chinese stocks remain in limbo despite robust economic data in April and early May (Chart 1). Onshore equities are pricing in policy tightening risks and a peak in the domestic economic cycle. Meanwhile, a regulatory…

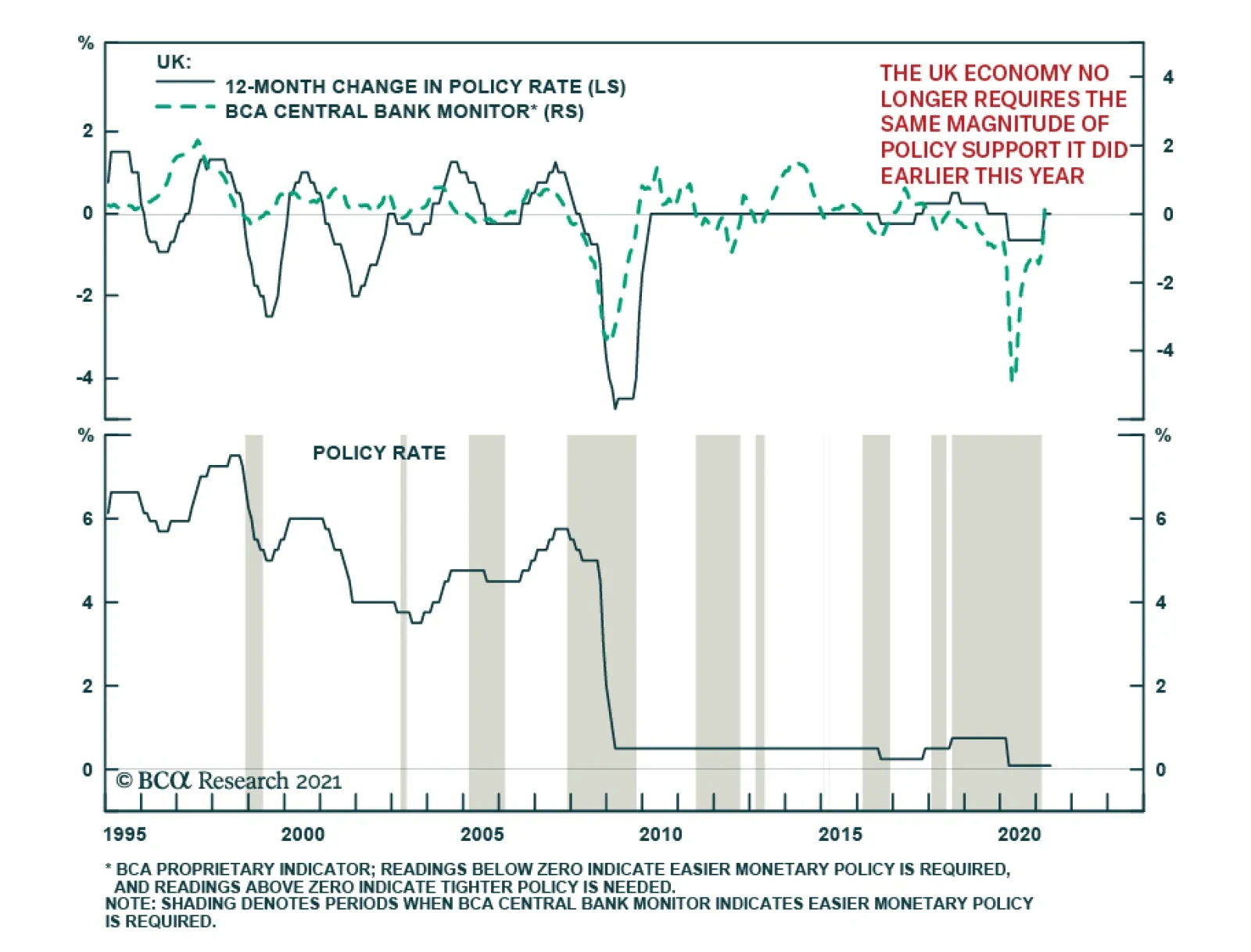

Highlights Global Tapering: The Bank of England has joined the Bank of Canada as central banks tapering the pace of bond buying. Markets are now trying to sort out who is next and concluding that it will not be the Federal Reserve,…

Highlights Non-US stocks have greatly underperformed US equities over the last decade, but a leadership change might be underway. As such, equity flows could be an important factor in dictating currency trends over a cyclical horizon…

Highlights The modern-day version of the Phillips curve posits that core inflation is determined by long-term inflation expectations and the amount of slack in the economy. In practice, using the Phillips curve to forecast inflation…

As expected, the Bank of England maintained the bank rate at 0.1% and kept the total target stock of asset purchases unchanged at its Thursday meeting. However, the central bank upgraded its growth outlook and now forecasts GDP…

Highlights US natural gas prices will remain well supported over the April-October injection season, as the global economic expansion gains traction, particularly in Europe, which also is refilling depleted storage levels. China's…

Highlights Sweden’s economic recovery is robust and will deepen. Policy is accommodative. Very few advanced economies will benefit as much from the global economic rebound. The labor market will tighten, capacity utilization…

Highlights The kiwi will continue to benefit from a pandemic-free recovery and normalization in monetary policy from the RBNZ. However, the kiwi is becoming expensive according to most of our models. This will begin to impact growth…

Highlights Biden’s first 100 days are characterized by a liberal spend-and-tax agenda unseen since the 1960s. It is not a “bait and switch,” however. Voters do not care about deficits and debt. At least not for now.…