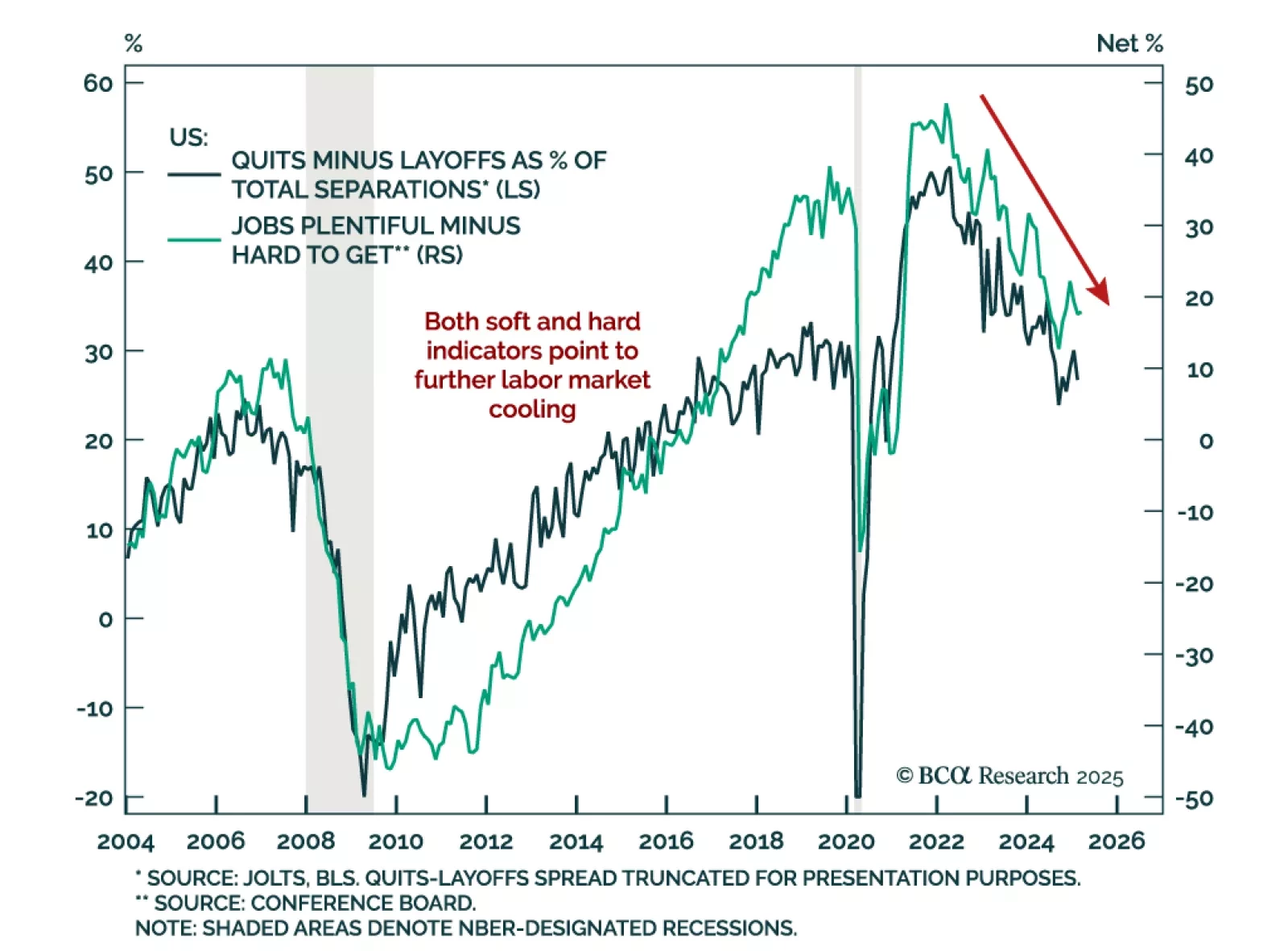

Labor market data continues to cool, reinforcing our overweight in government bonds and above-benchmark duration stance. February job openings fell to 7.6m, below expectations. Declining quits and rising layoffs signal that labor…

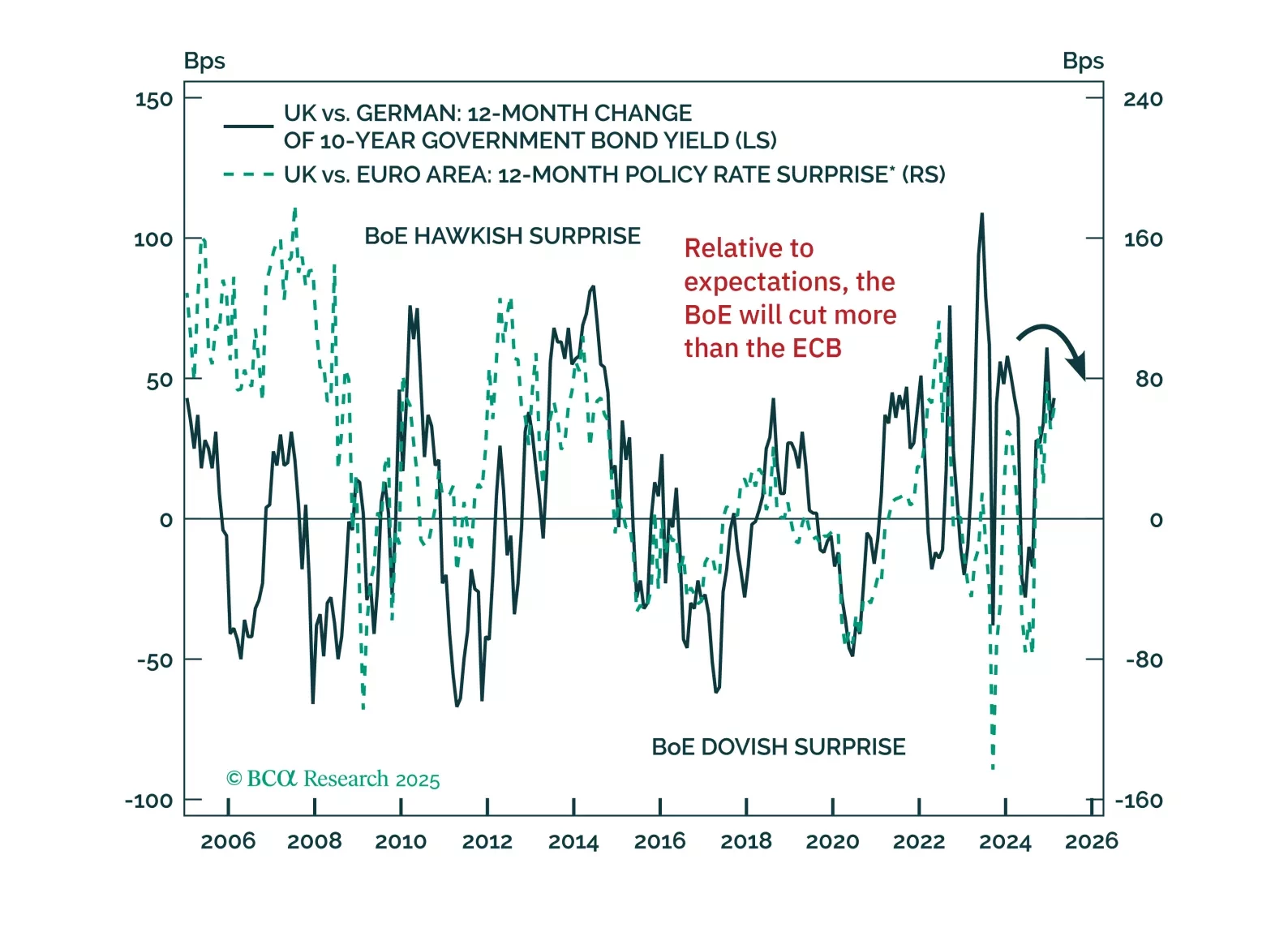

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

February US PCE data adds to the stagflationary tone, reinforcing our overweight duration stance and tactical short in front-end rates. Core PCE inflation rose 0.4% m/m, lifting the year-on-year rate to 2.8%, matching the Fed’s 2025…

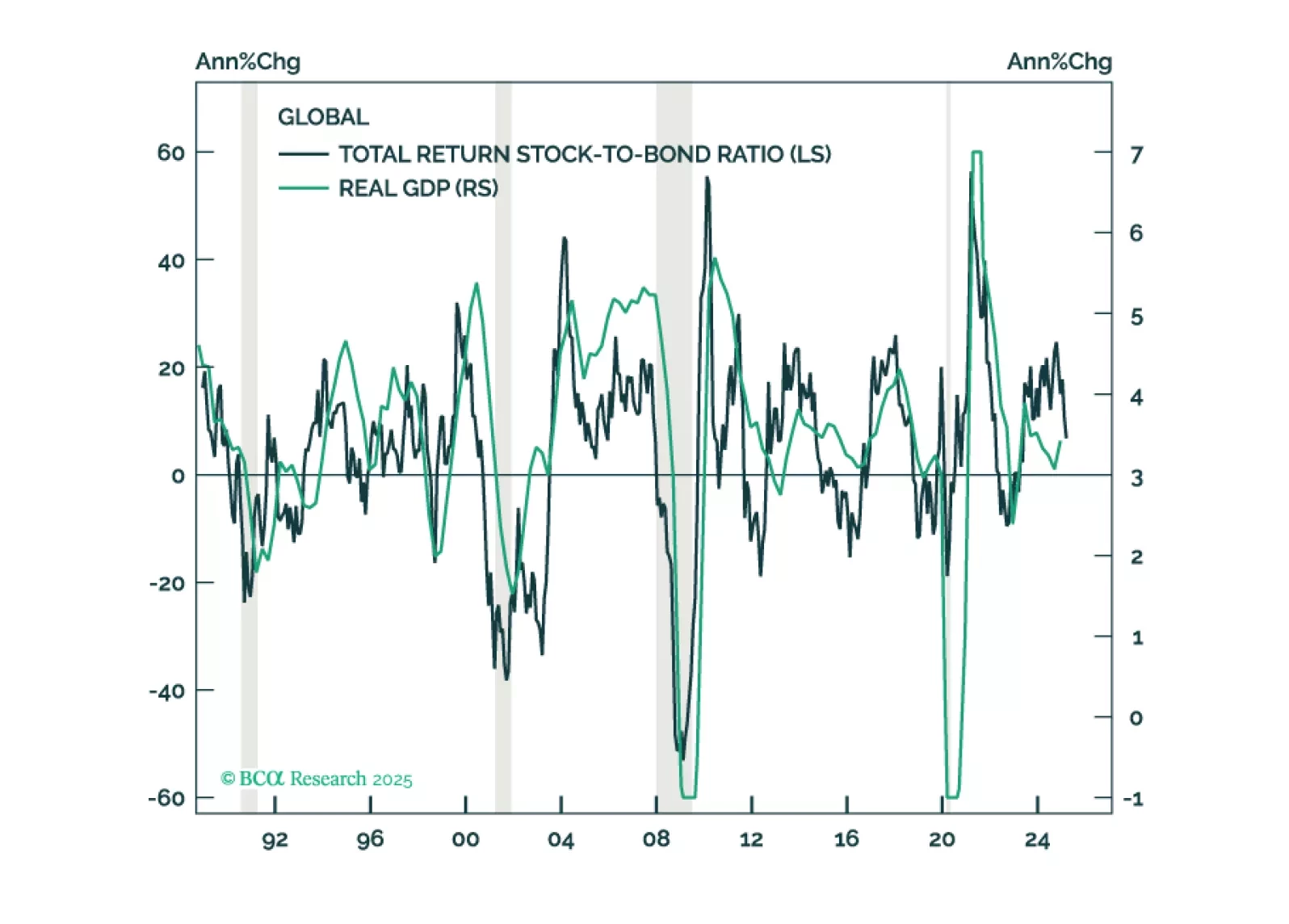

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

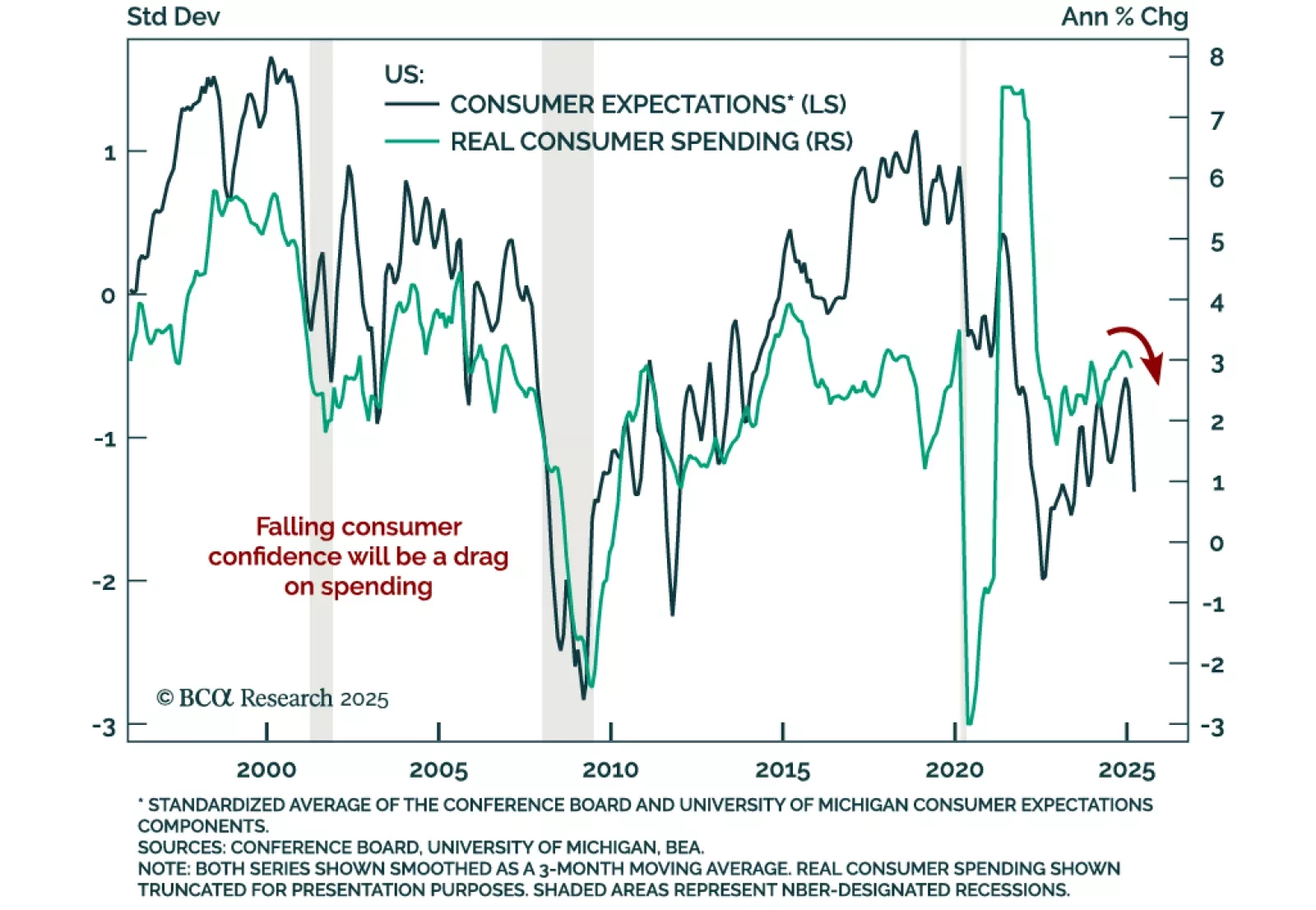

Our US Investment Strategy team recommends investors remain defensively positioned. Stay underweight US equities and overweight Treasuries and cash, on both a tactical and cyclical horizon, as the likelihood of a midyear recession…

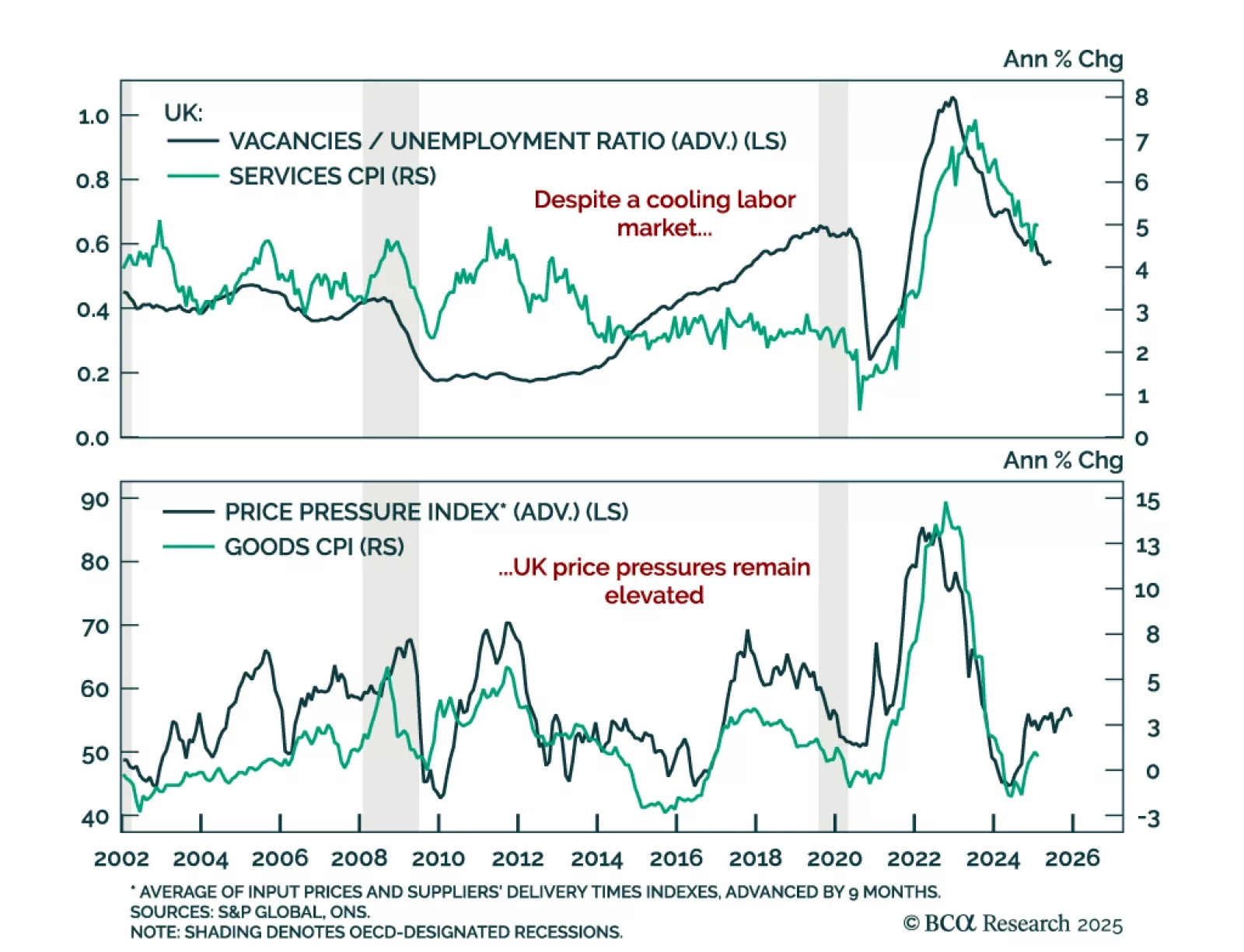

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

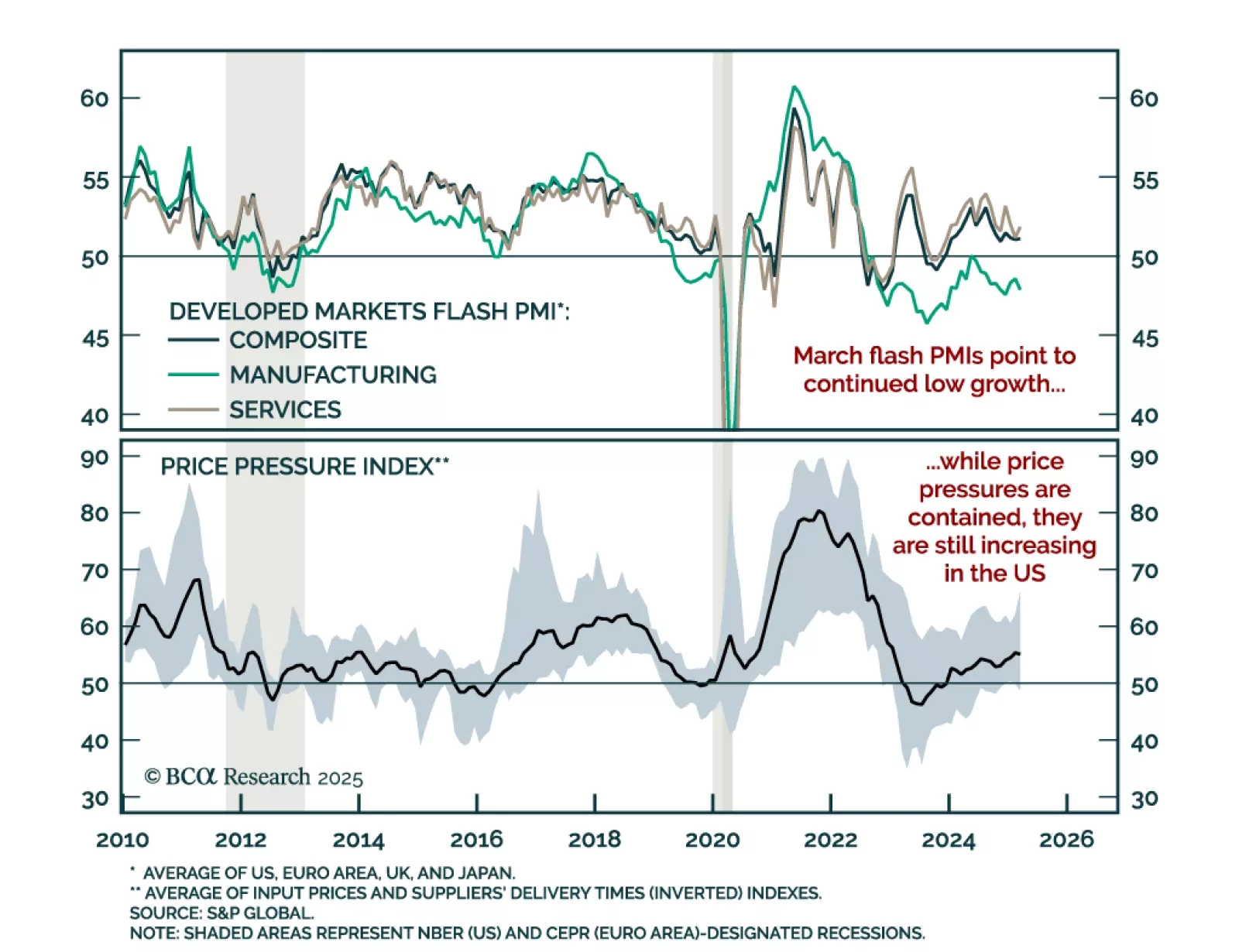

The March PMIs point to a low growth buffer outside the US as uncertainty engulfs the global economy. Aggregate price pressures were contained in March, but input prices still increased in the US. While the market reaction was risk-…

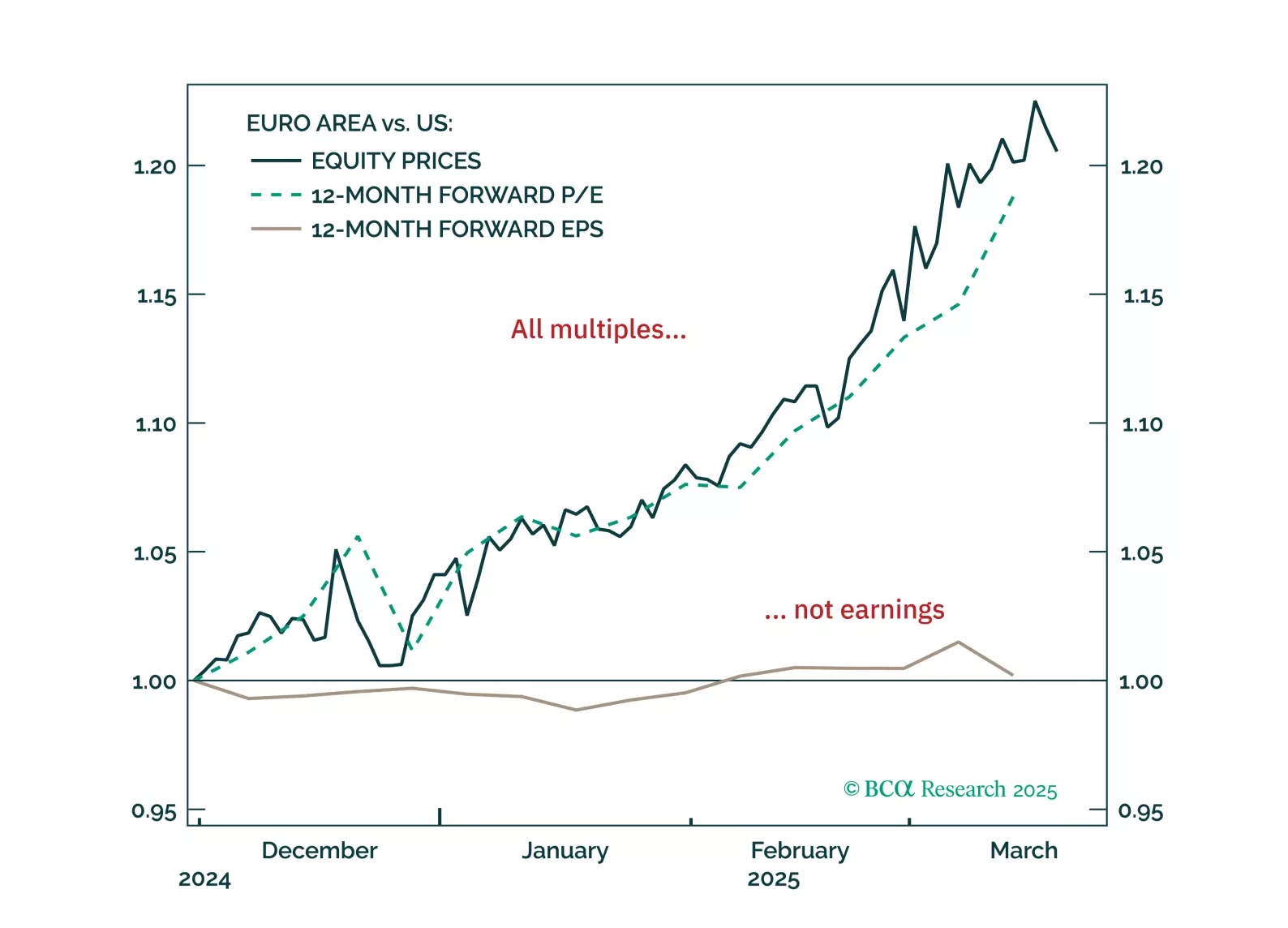

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

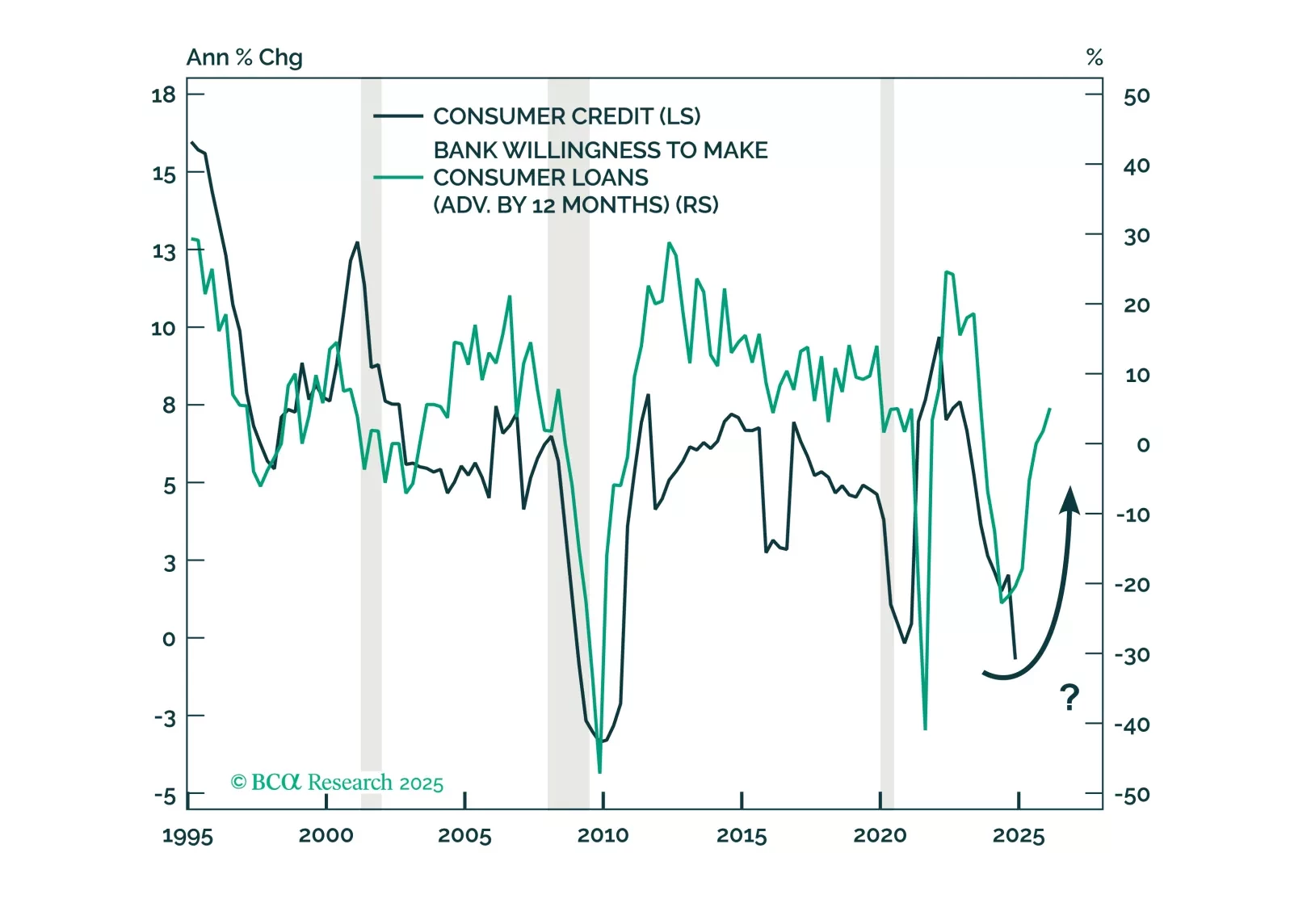

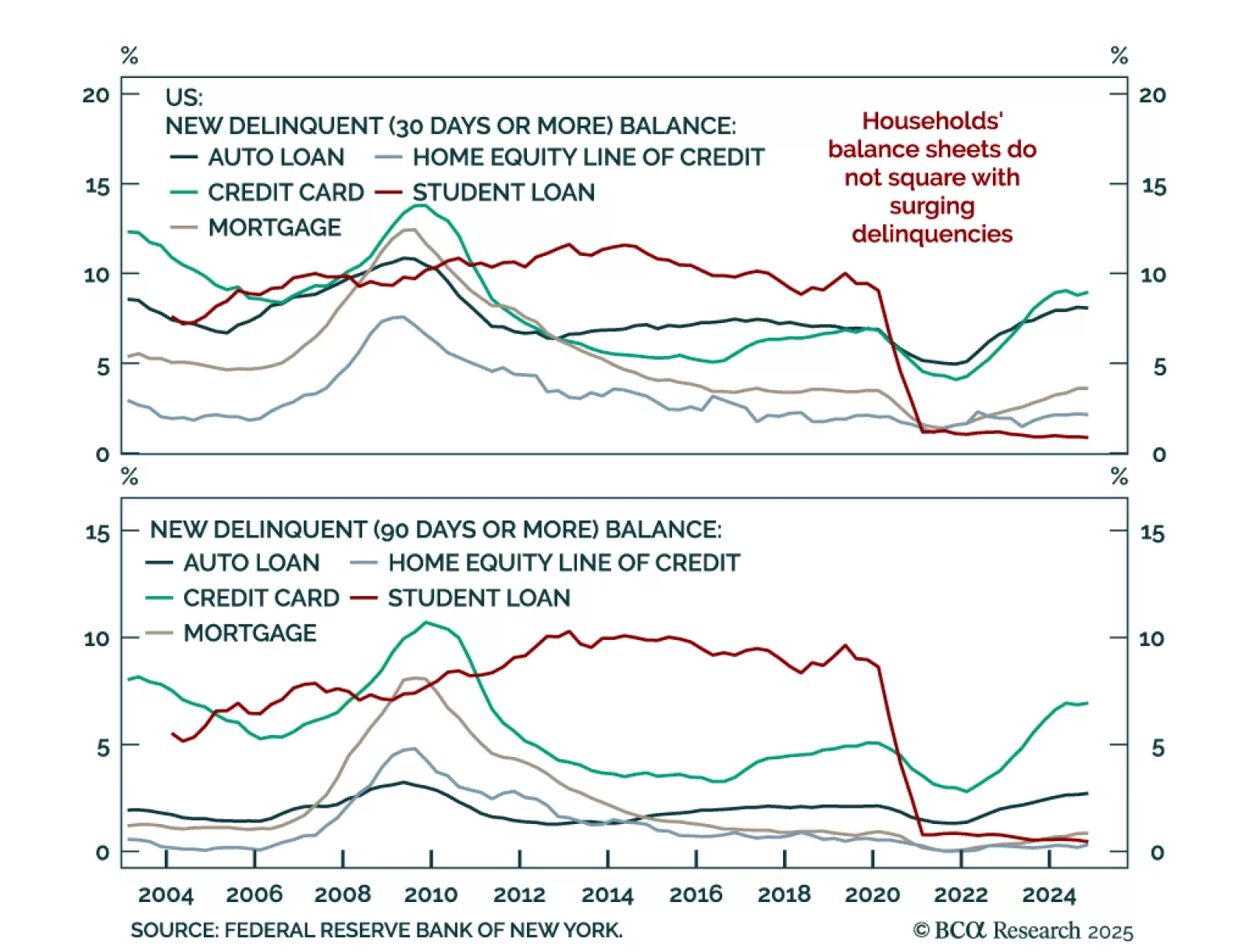

Households’ healthy balance sheets do not square with the rise in credit cards and auto loans delinquencies. The tailwinds that have supported higher-income cohorts’ spending have faded, presaging broad-based deterioration in credit…