Dear Client, We will be presenting our quarterly webcast next week, and, as a result, will not be publishing on 29 July 2021. We will cover our major calls for the quarter and provide a look-ahead. I look forward to…

Feature June’s economic data and second-quarter GDP indicate that China’s economic recovery may have peaked. Slight improvements in some sectors, including manufacturing investment, exports and consumption, were offset by…

Highlights Yield curves have flattened considerably in the major economies since April. Slowing global growth, the perception that the Fed is turning more hawkish, and technical factors have contributed to flatter yield curves.…

Highlights Global oil demand will remain betwixt and between recovery and relapse through 3Q21, as stronger DM consumer spending and increasing mobility wrestles with persistent concerns over COVID-19-induced lockdowns in Latin America…

Highlights It is too early to conclude that the PBoC’s surprise rate cut last Friday to its reserve requirement ratio (RRR) marks the beginning of another policy easing cycle. Historically it took more than a single RRR…

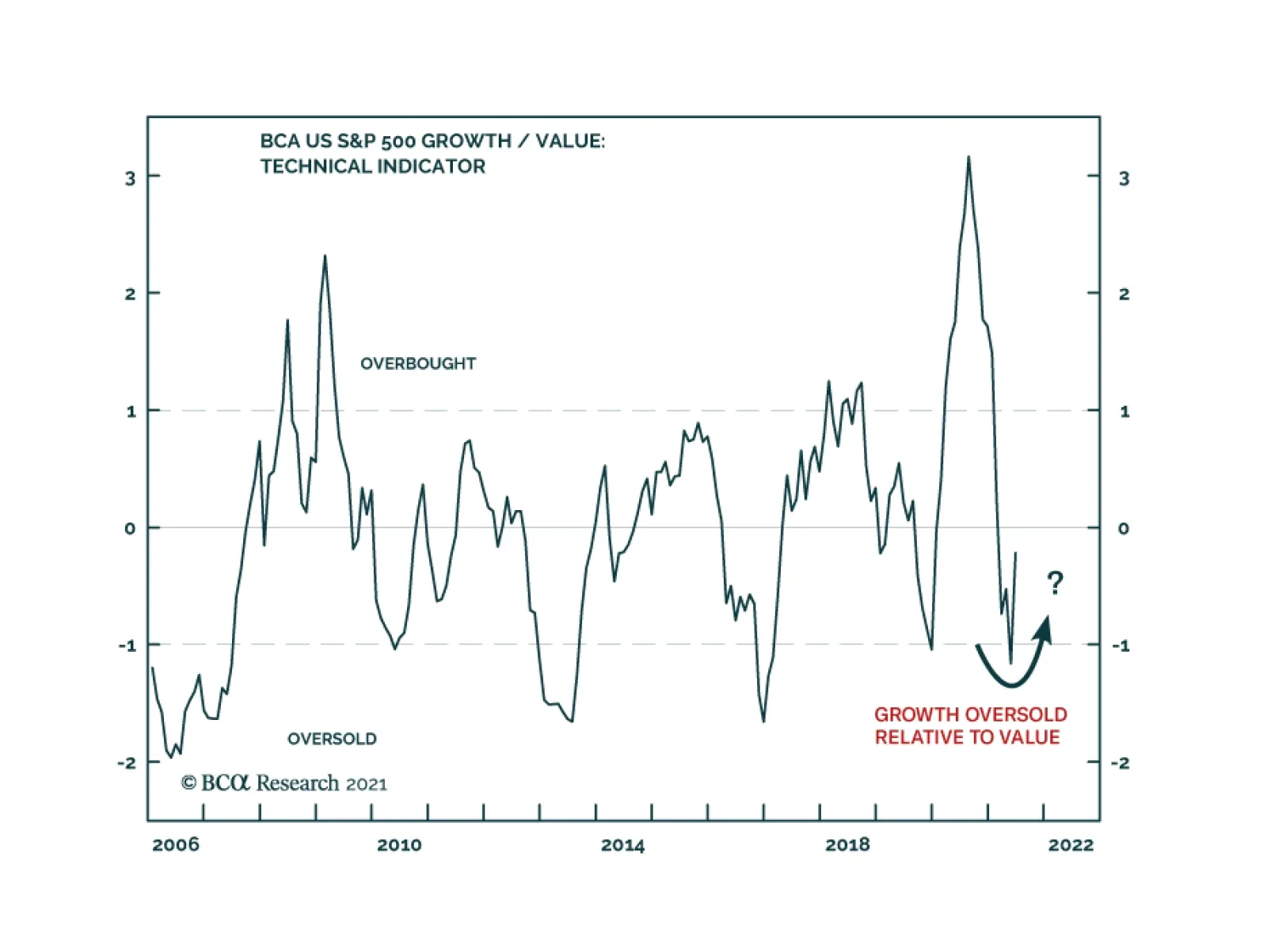

As economies started to reopen, and long-term bond yields began to rise, global Value stocks outperformed global Growth stocks by almost 20% from November to May. However, over the past couple of months this trend has reversed…

Highlights Three distinct forces are likely to make South Asia’s geopolitical risks increasingly relevant to global investors. First, India’s tensions with China stem from China’s growing foreign policy assertiveness…

Dear Client, We are sending you our Strategy Outlook today, where we outline our thoughts on the macro landscape and the direction of financial markets for the rest of 2021 and beyond. Next week, please join me for a webcast on…

Highlights Tactically downgrade cyclical equities from overweight in Europe. The shift in global growth drivers, the beginning of the global liquidity withdrawal, and lingering COVID worries create headwinds for the cyclicals-to-…