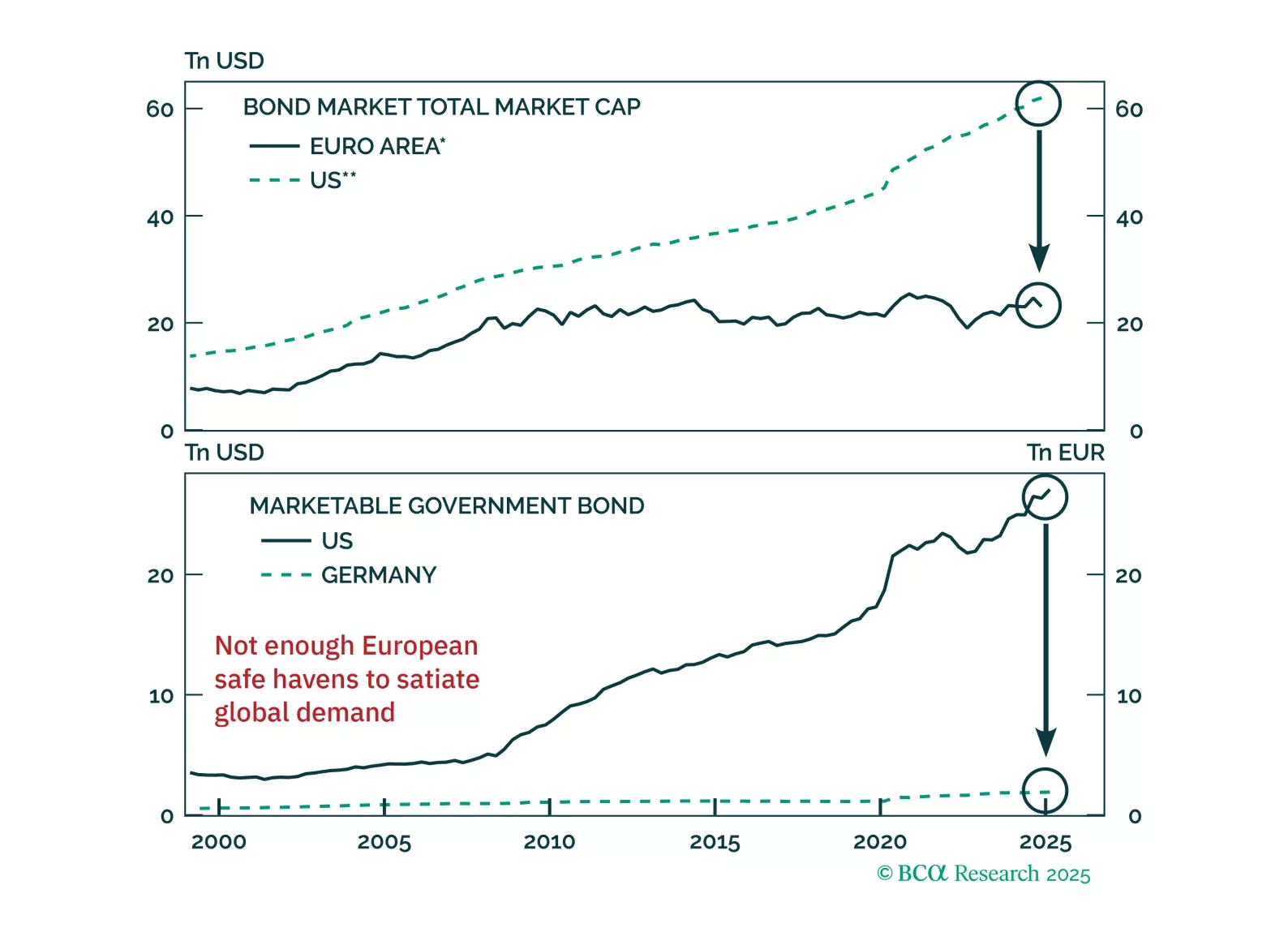

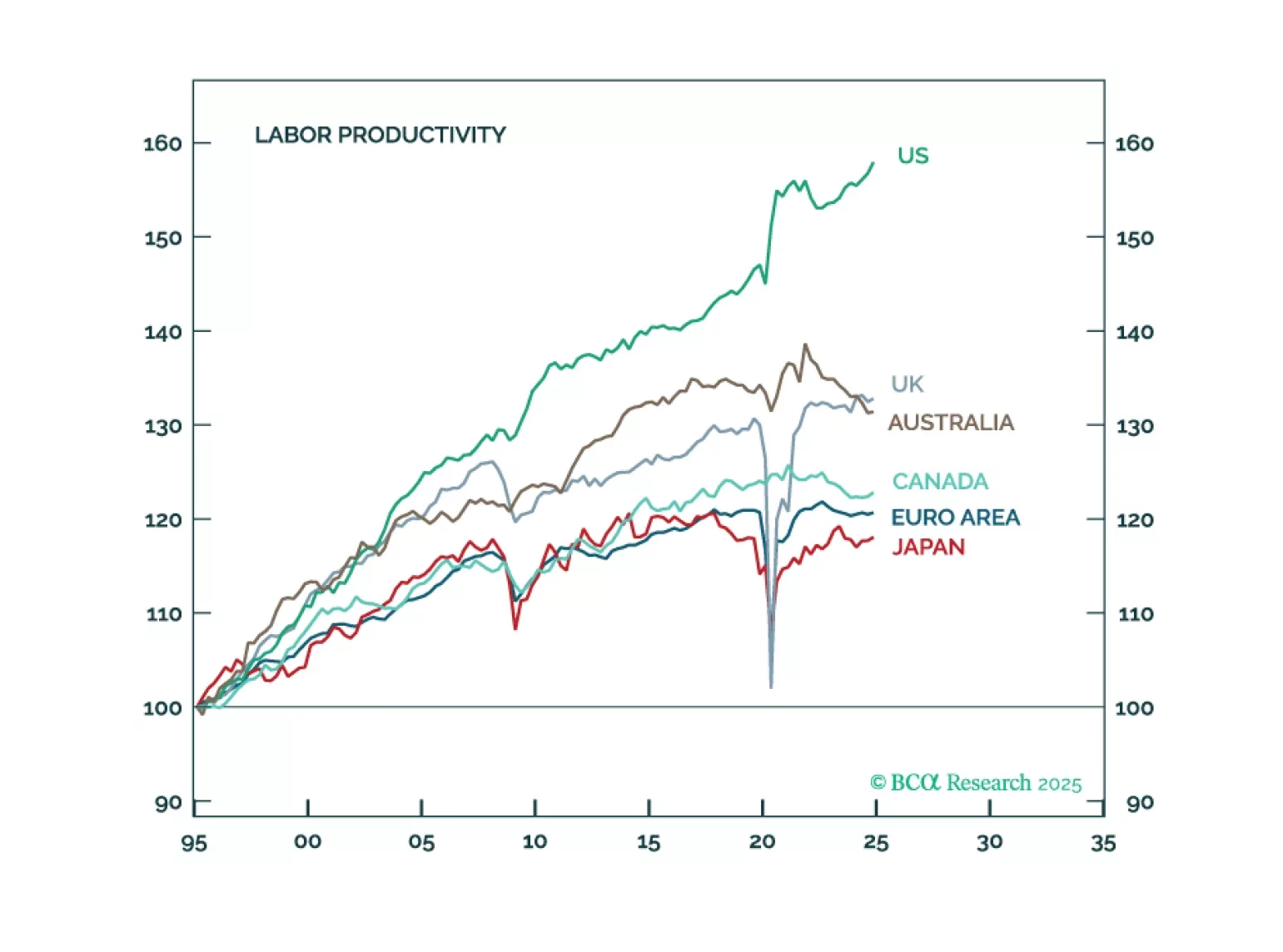

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

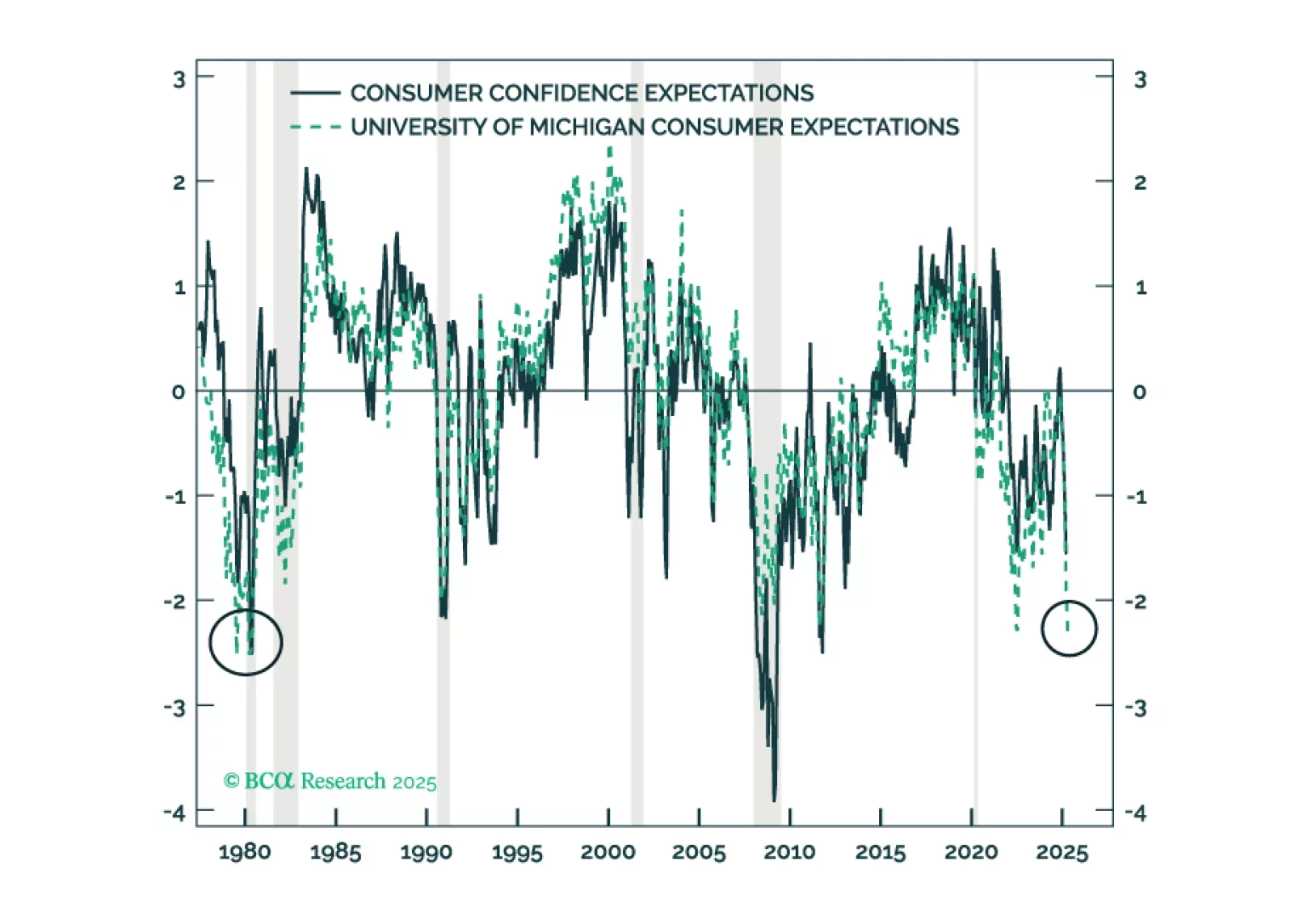

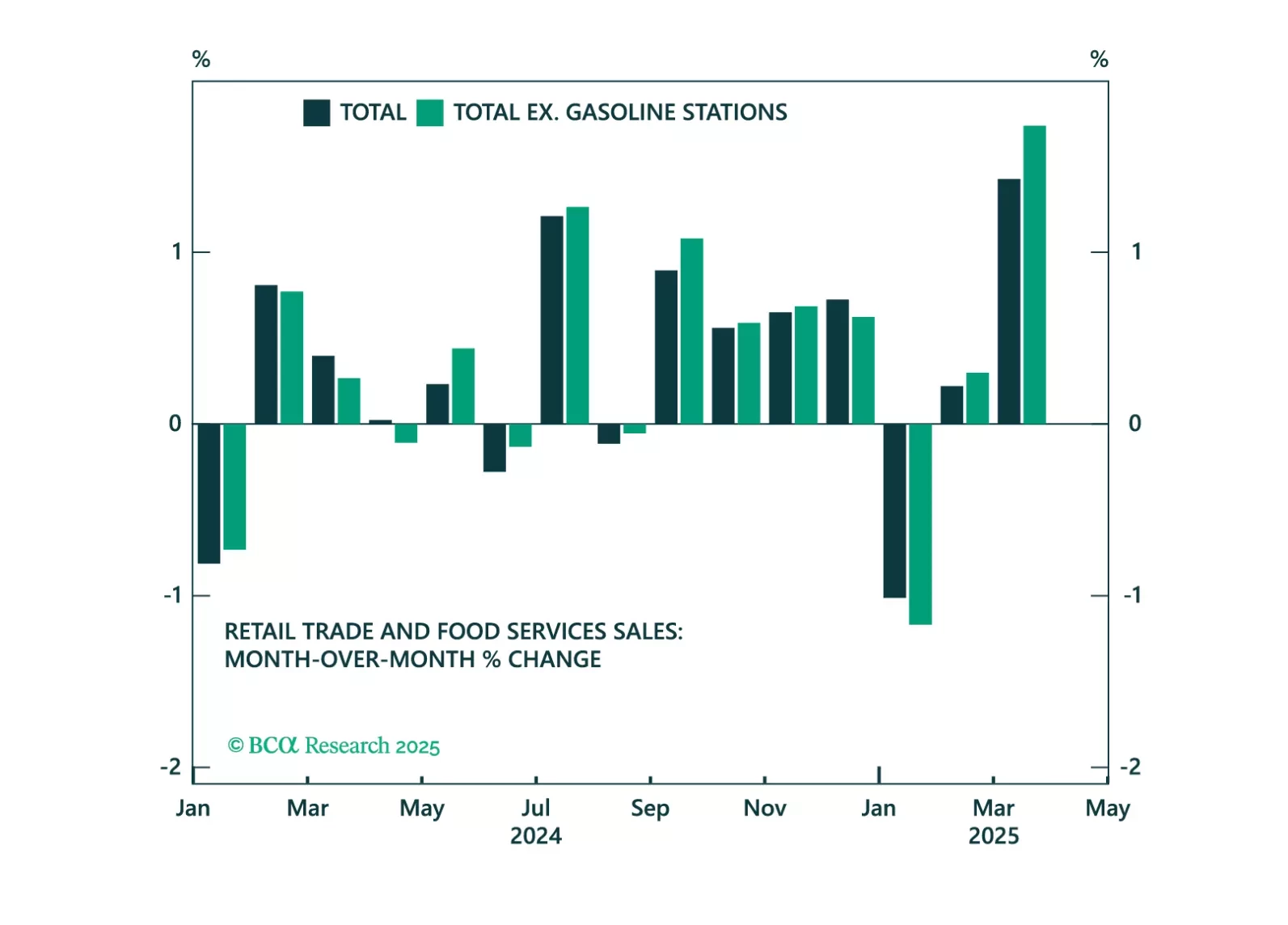

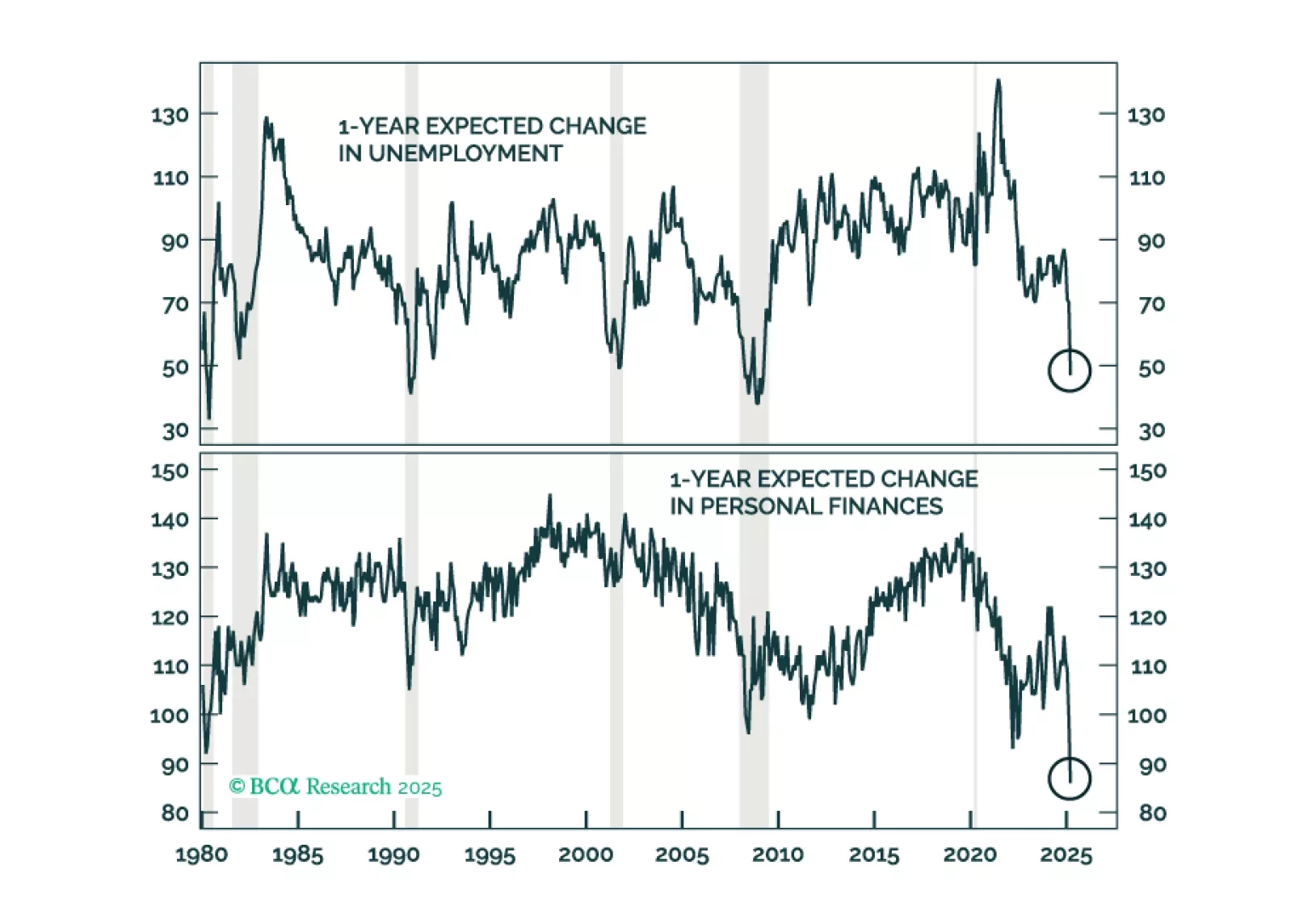

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our…

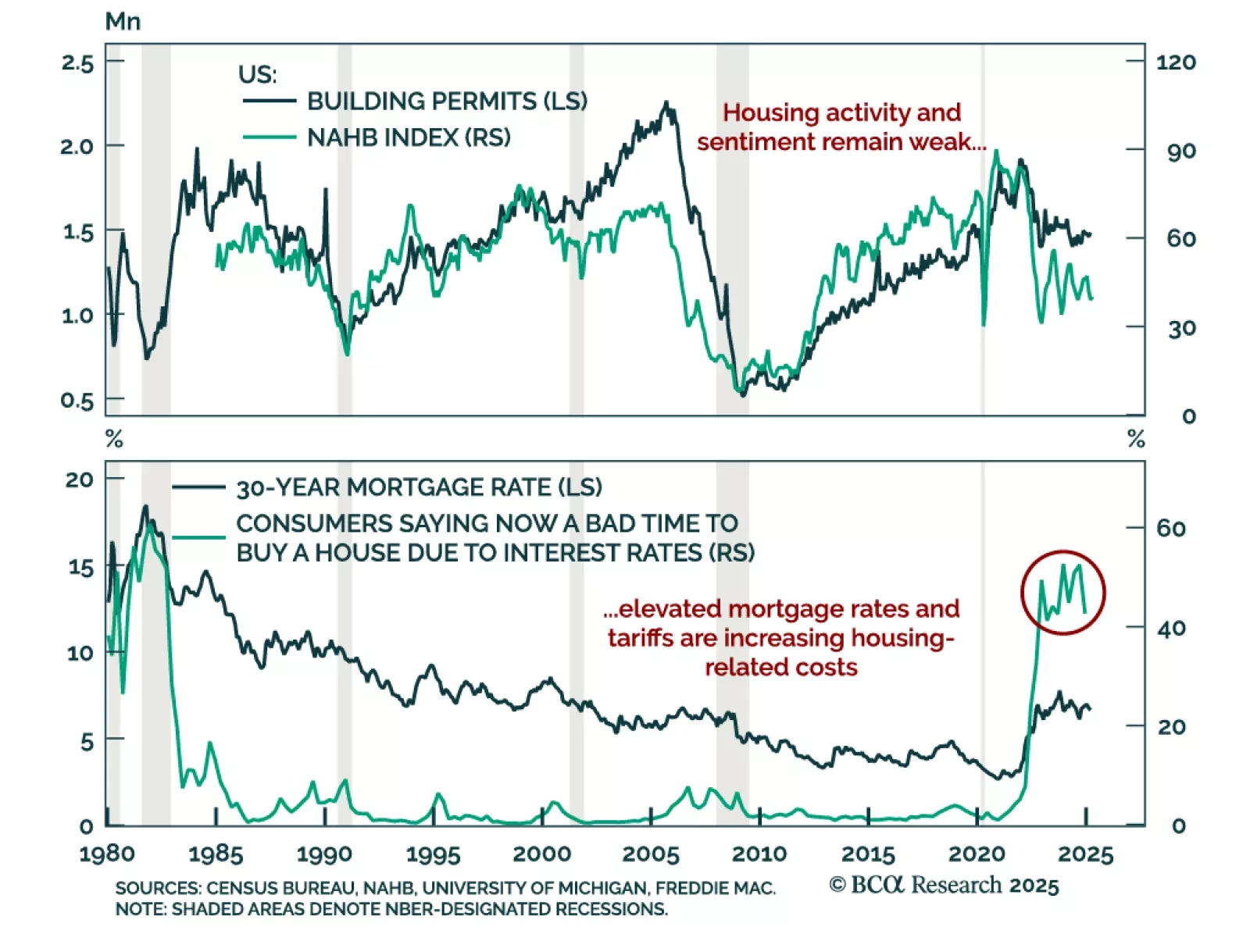

Weak housing data reinforces our defensive positioning, as recession odds remain underpriced in risk assets. US housing starts fell sharply, declining a larger-than-expected annualized rate of 11.4% in March after a 9.8% rebound in…

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.

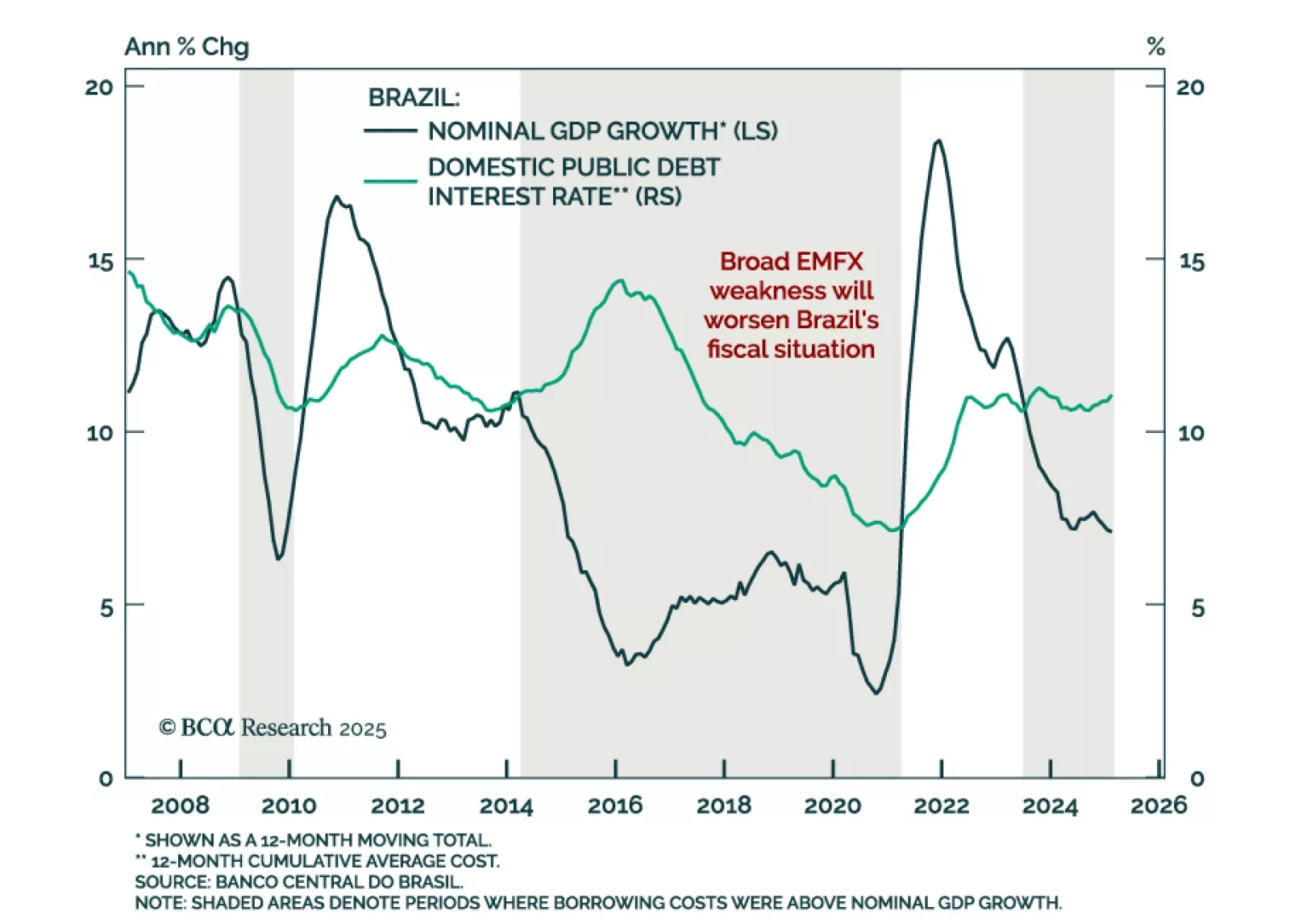

Brazil’s deteriorating fiscal dynamics and rising stagflation risks reinforce our negative stance on Brazilian assets, both outright and relative to EM peers. The latest global financial turmoil, combined with President Trump’s…

The stimulus measures driving the post-COVID expansion were beginning to wane after five years and pointing the economy in the direction of an organically occurring recession. Now that DOGE and the multi-front trade war have sped up…

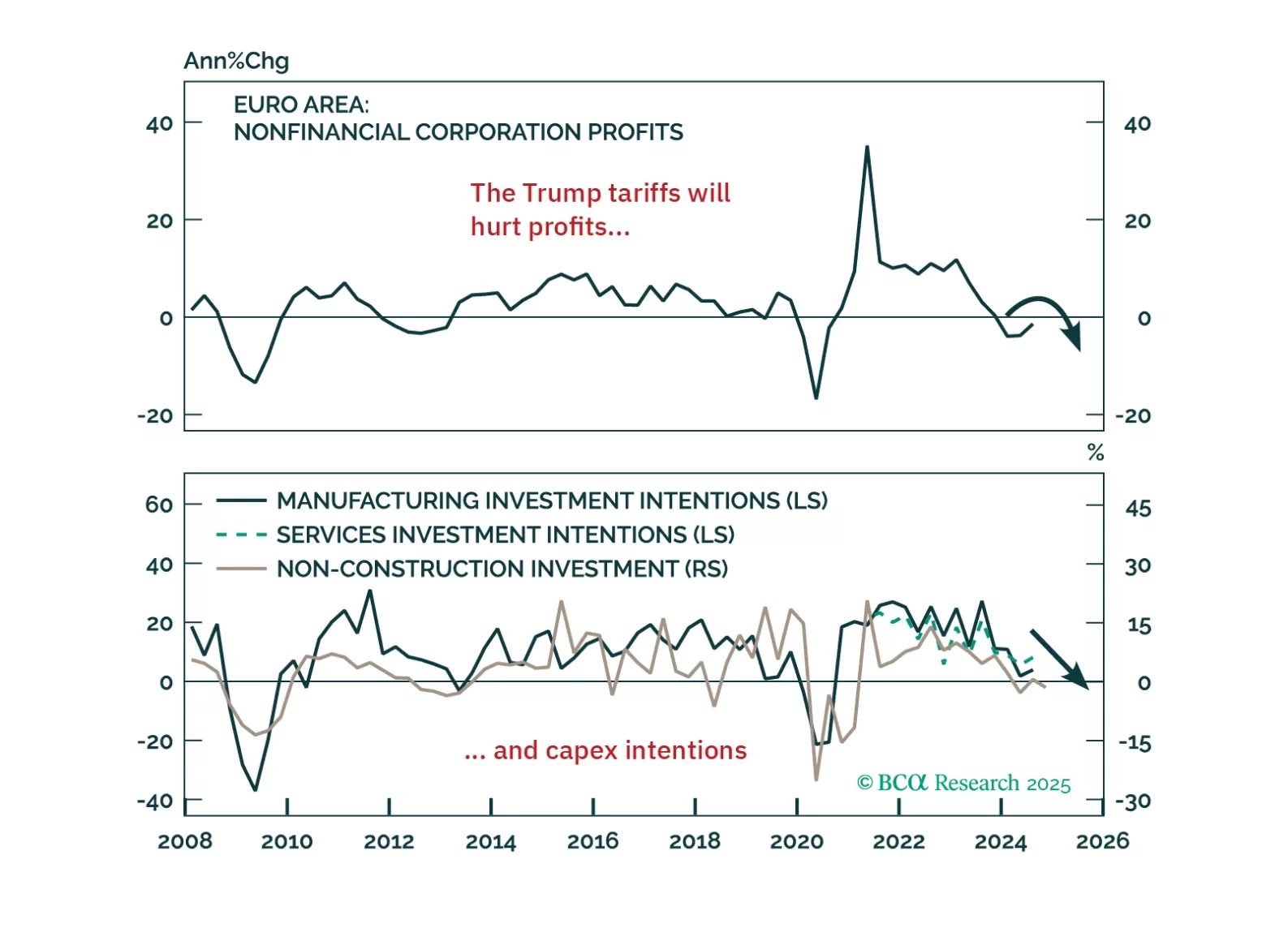

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…

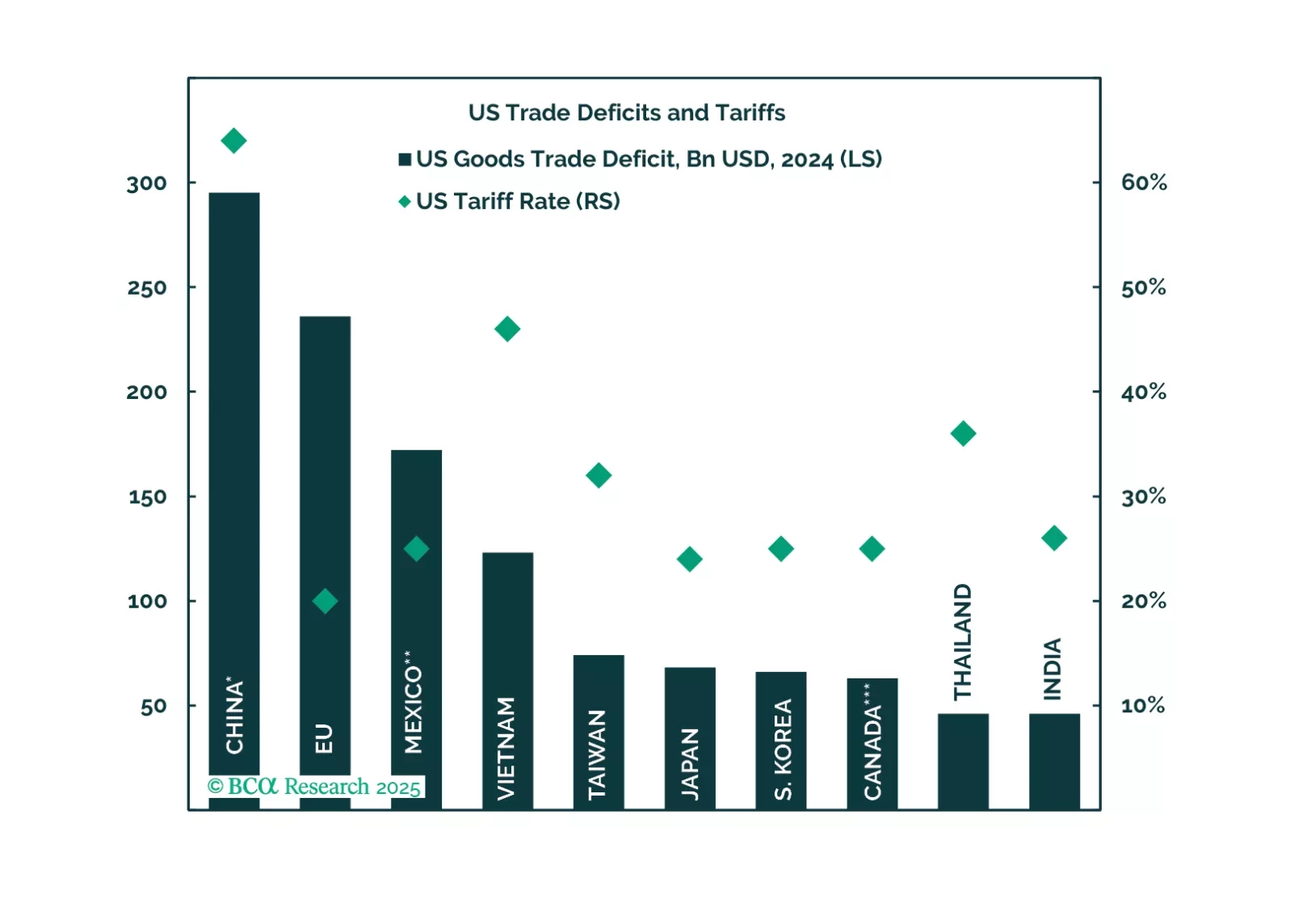

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.