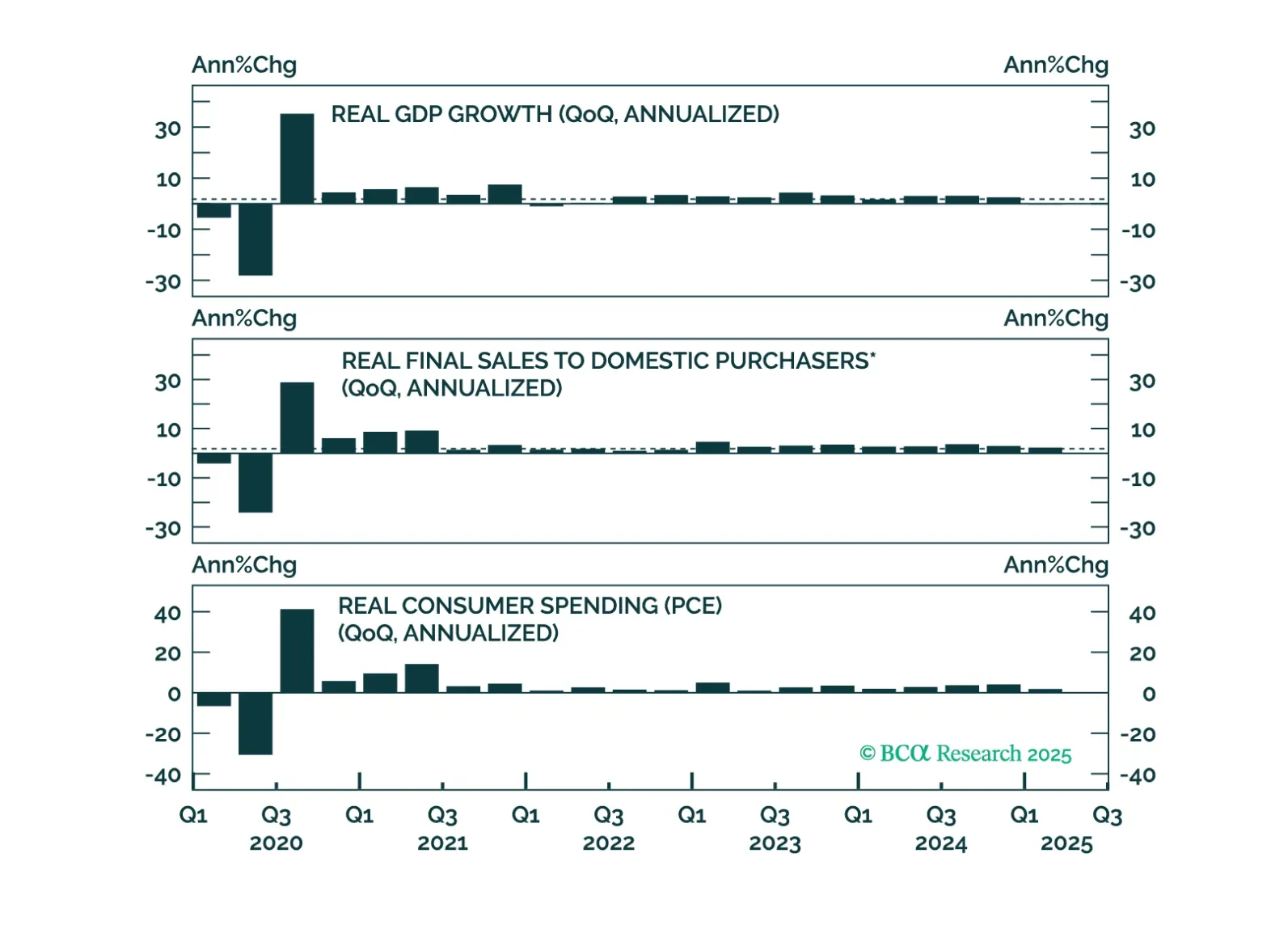

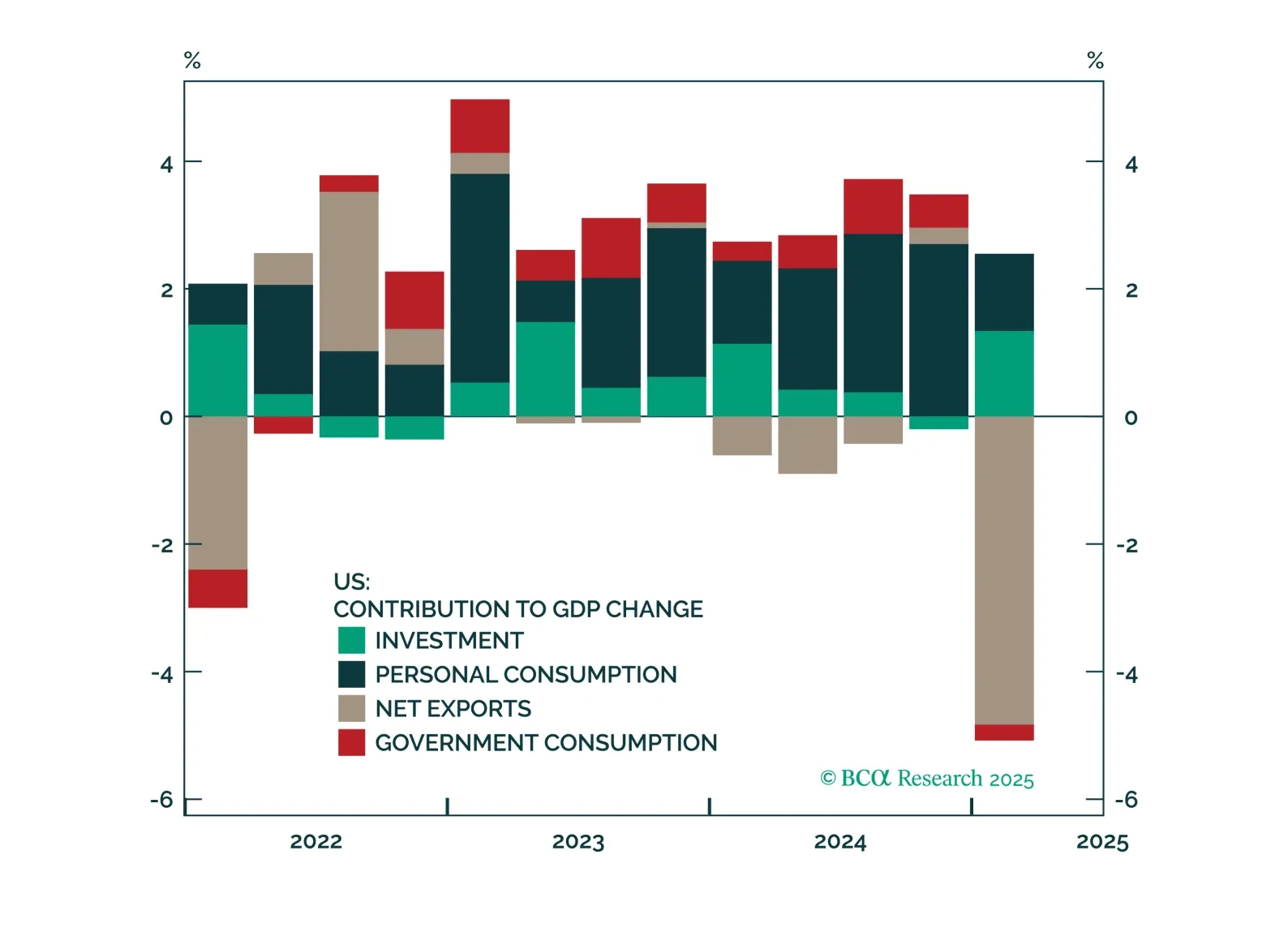

Economic Growth

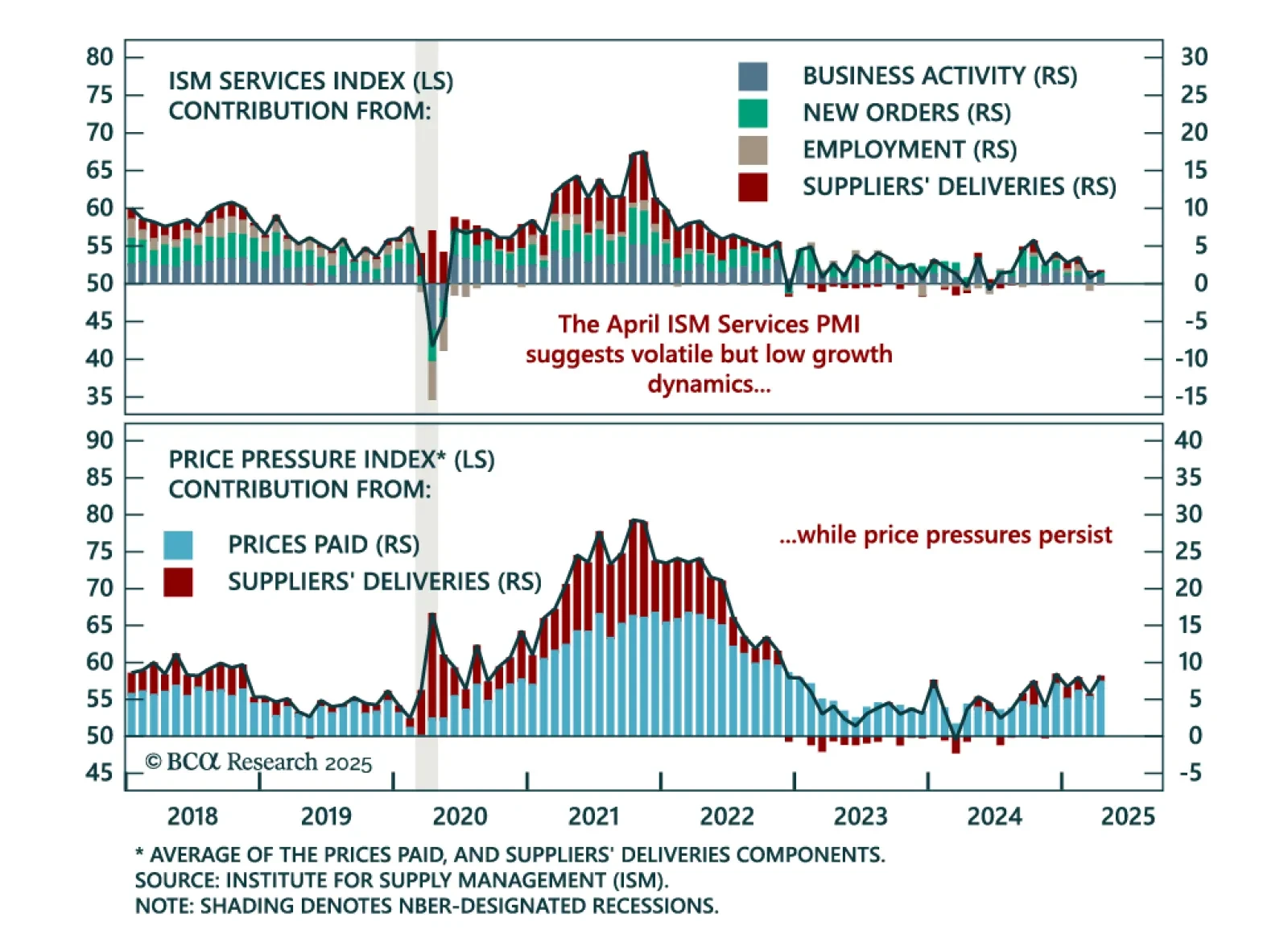

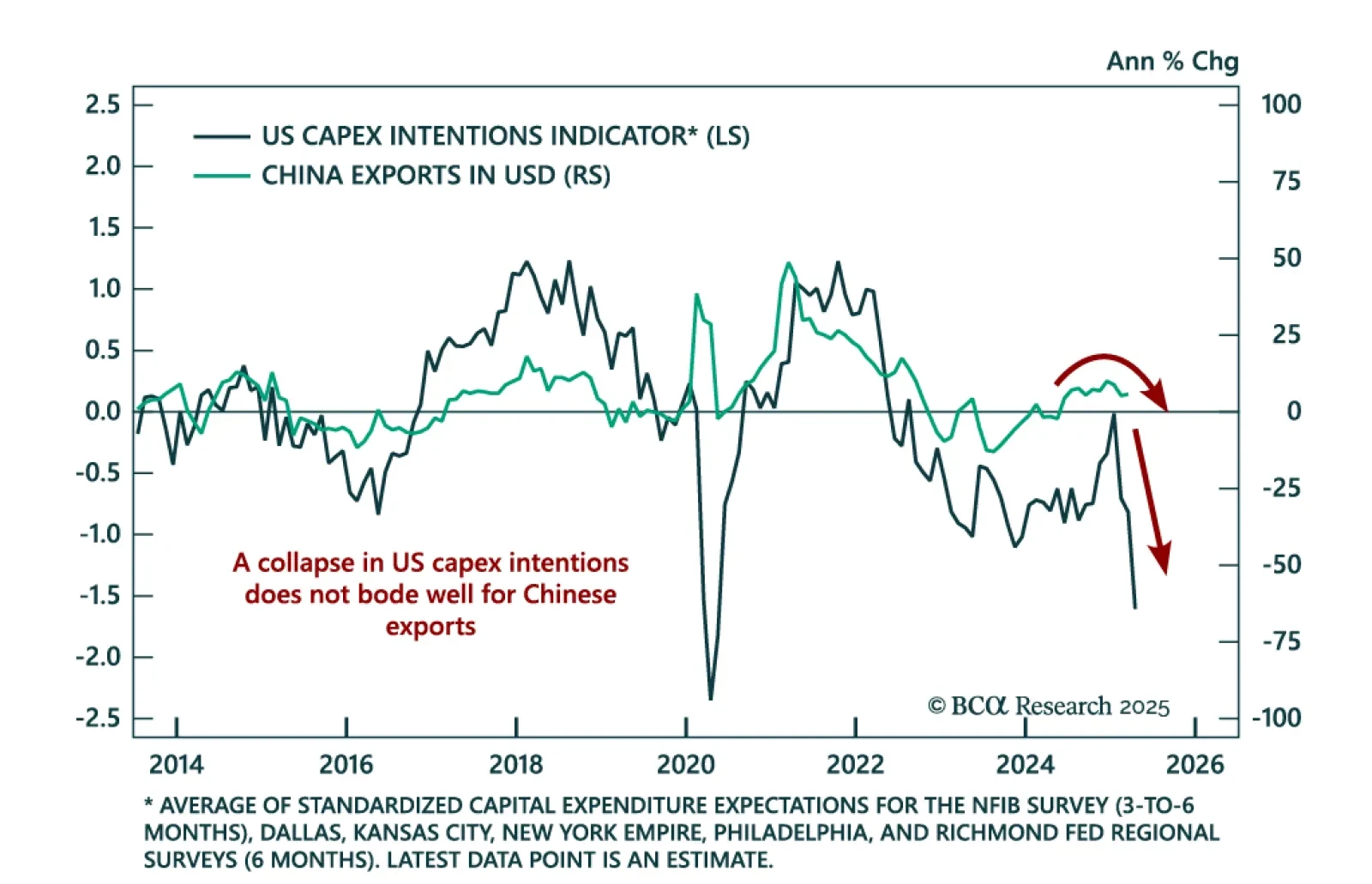

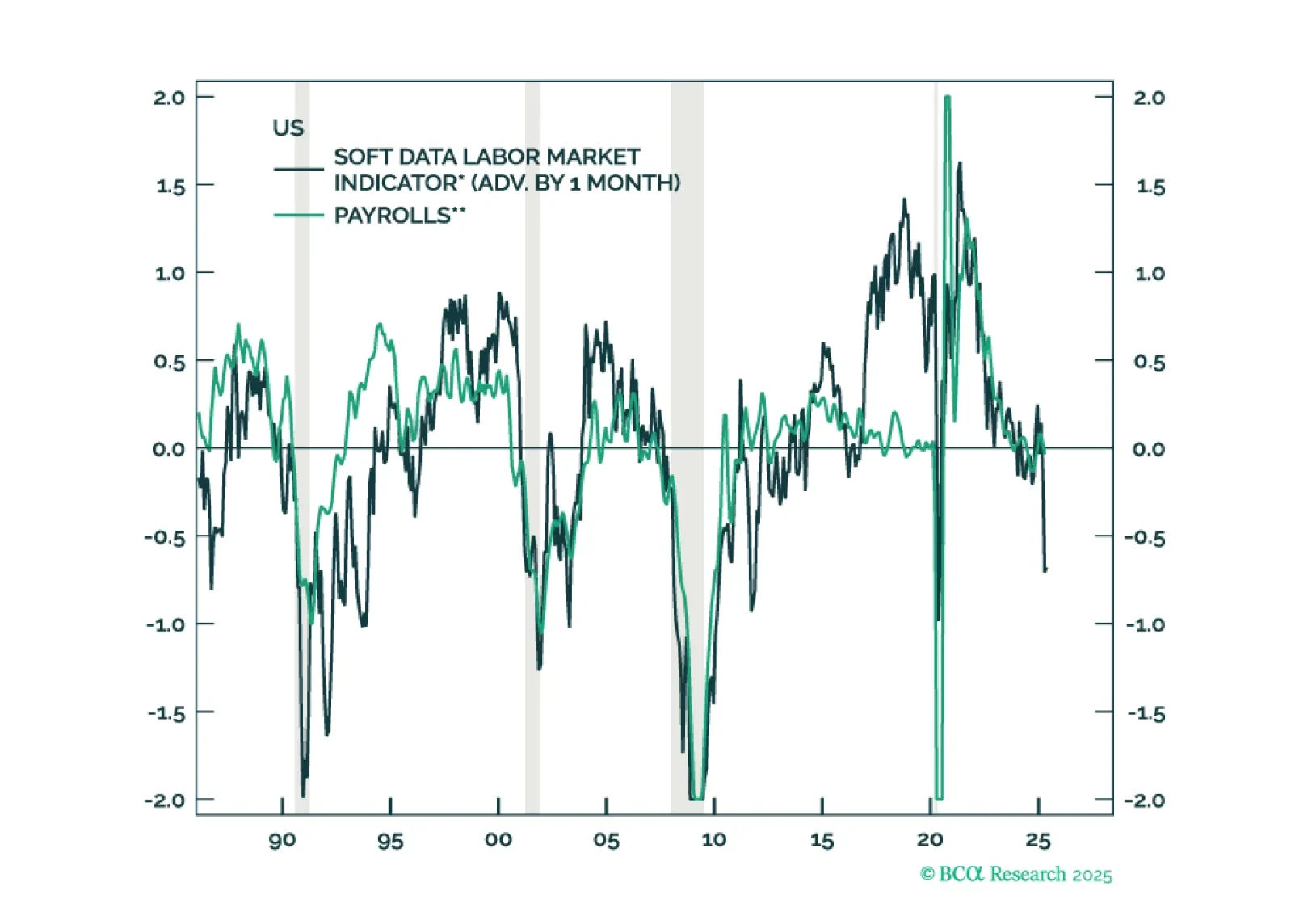

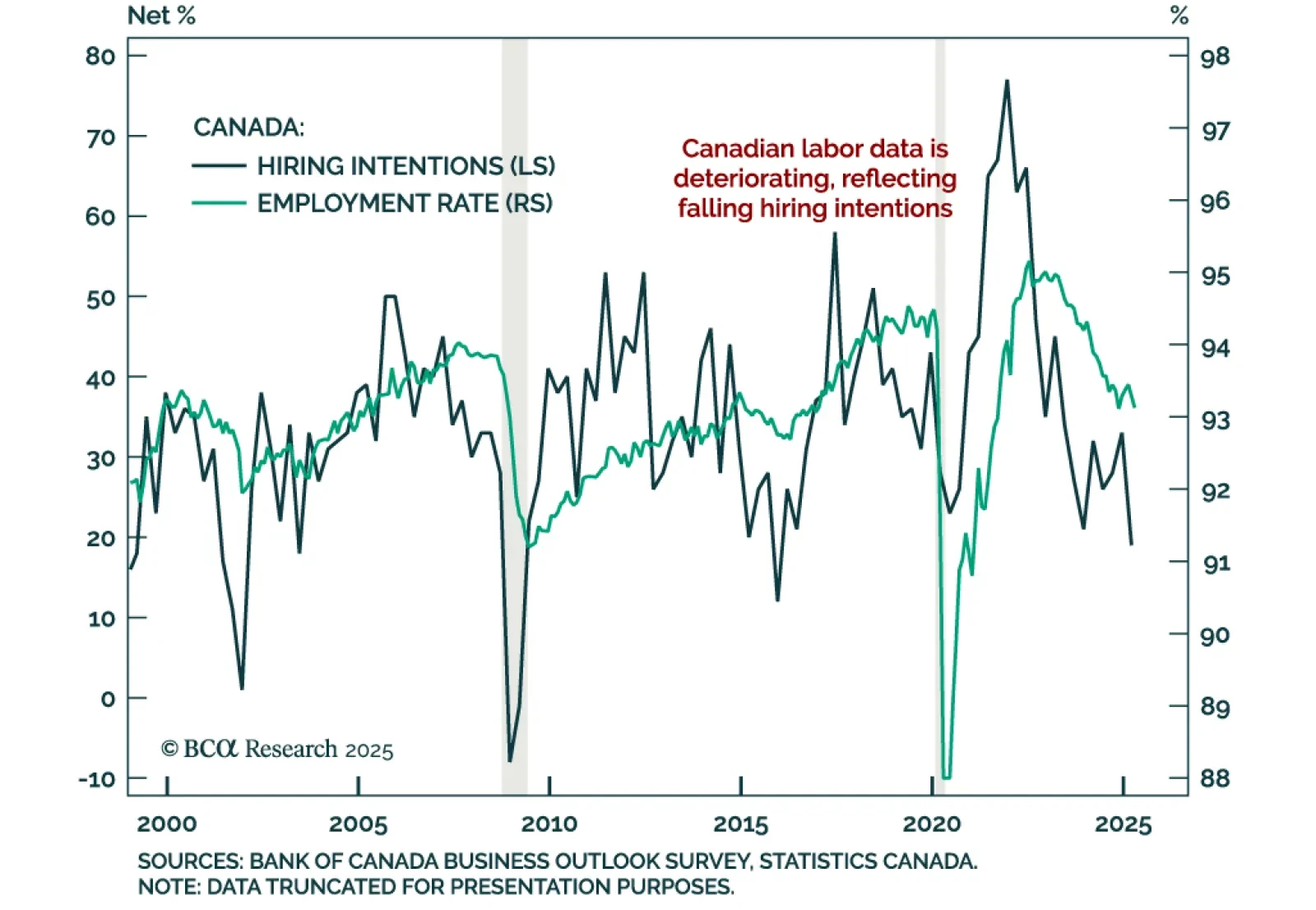

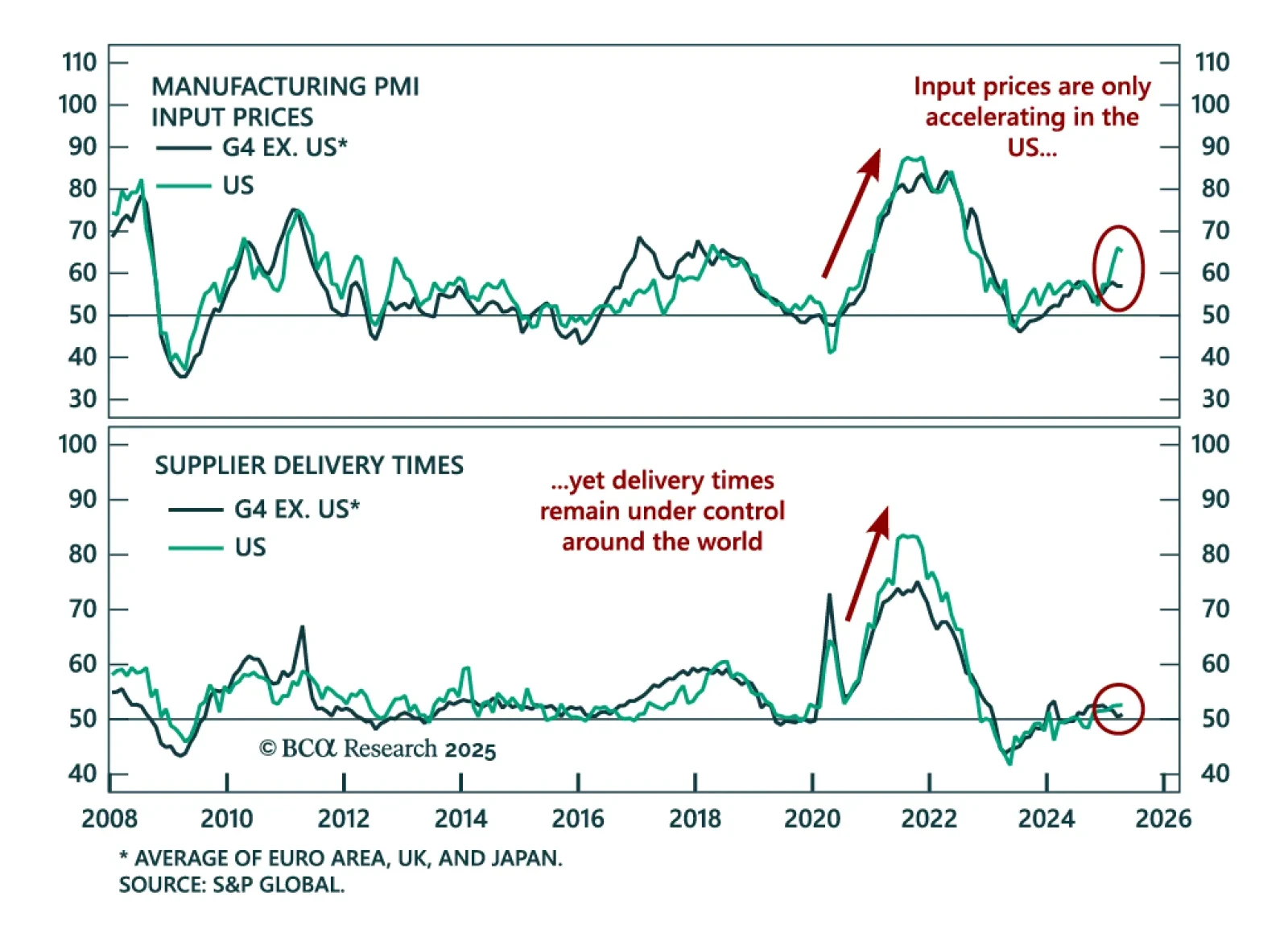

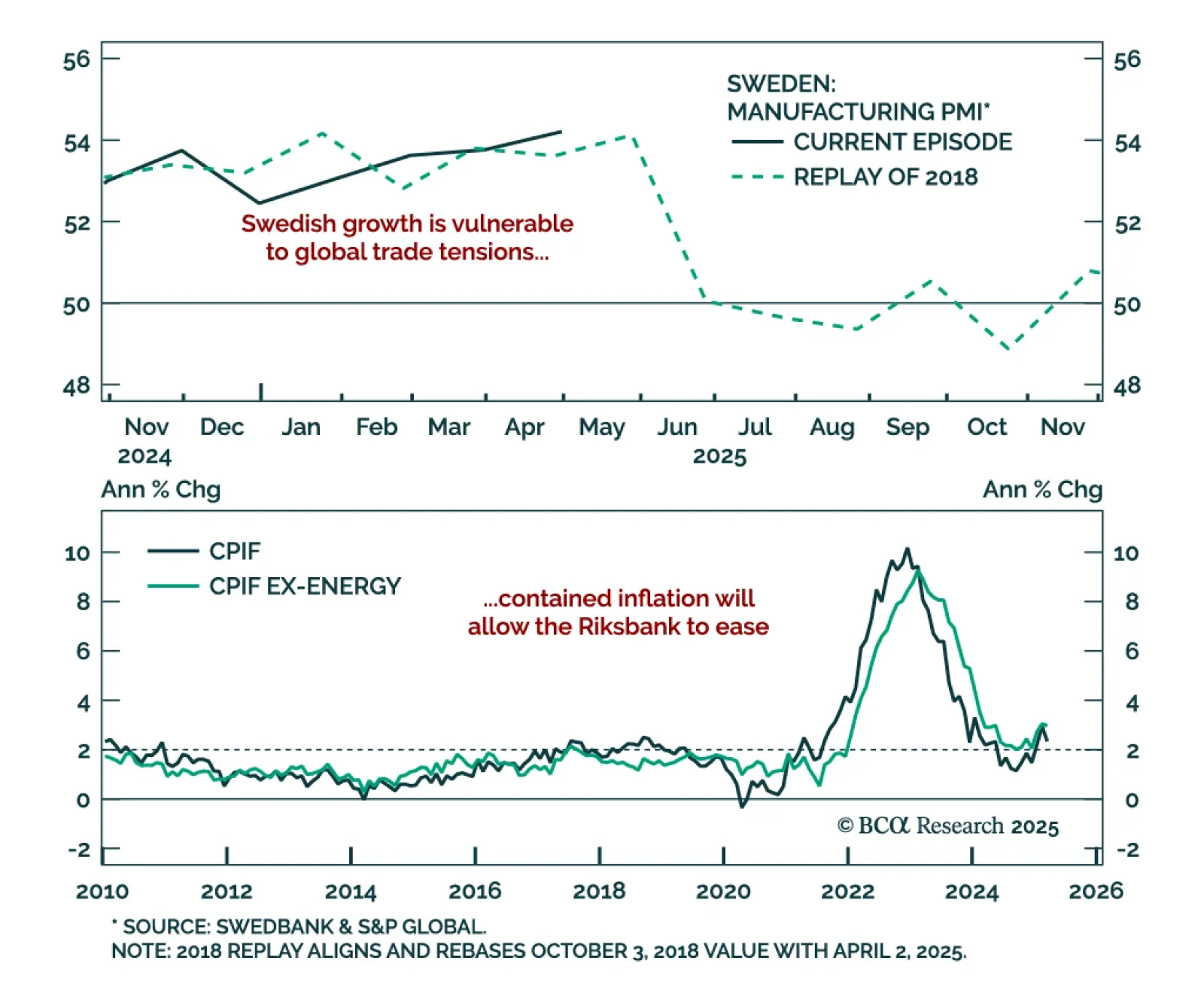

It may take several months for the tariff shock and policy uncertainty to filter through the real economy, but survey-based data are already sending a warning. Equities have priced in a lot of good news, and investors are too sanguine about the risk of a US recession.

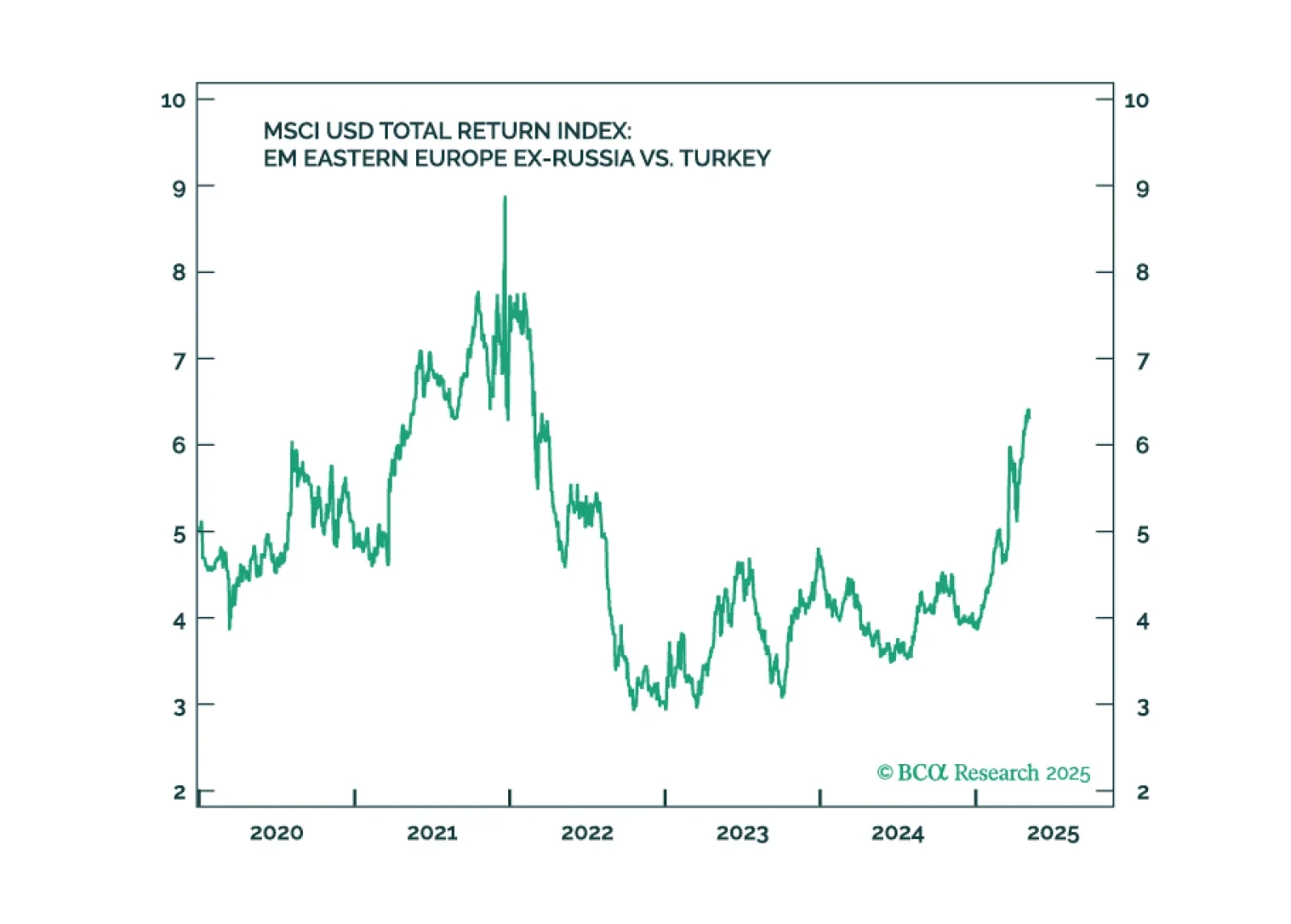

Erdogan's rule continues to decline. Social unrest will persist, governance will erode, and the macro backdrop will deteriorate further. We recommend underweighting Turkish assets.

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White House to backpedal.