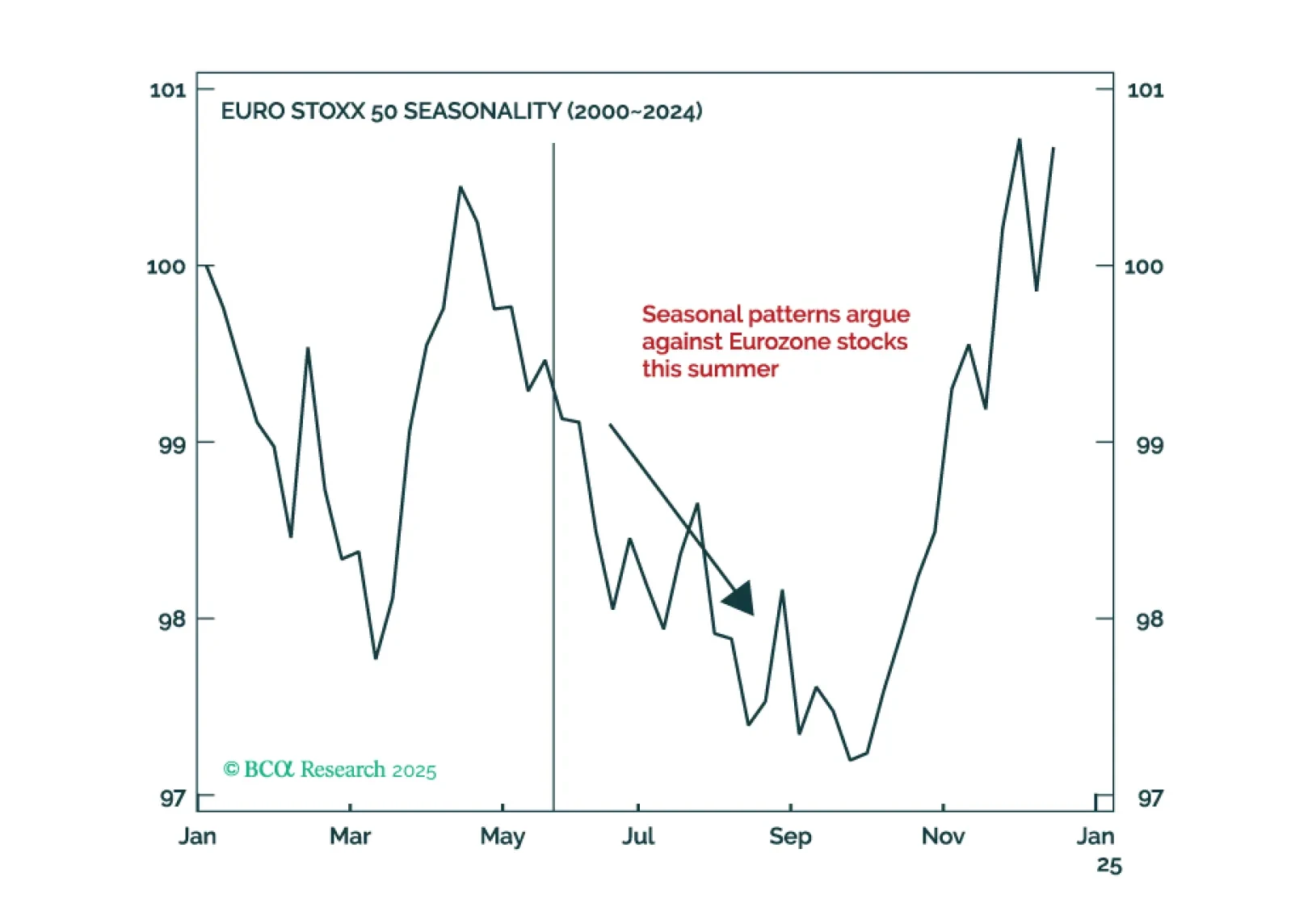

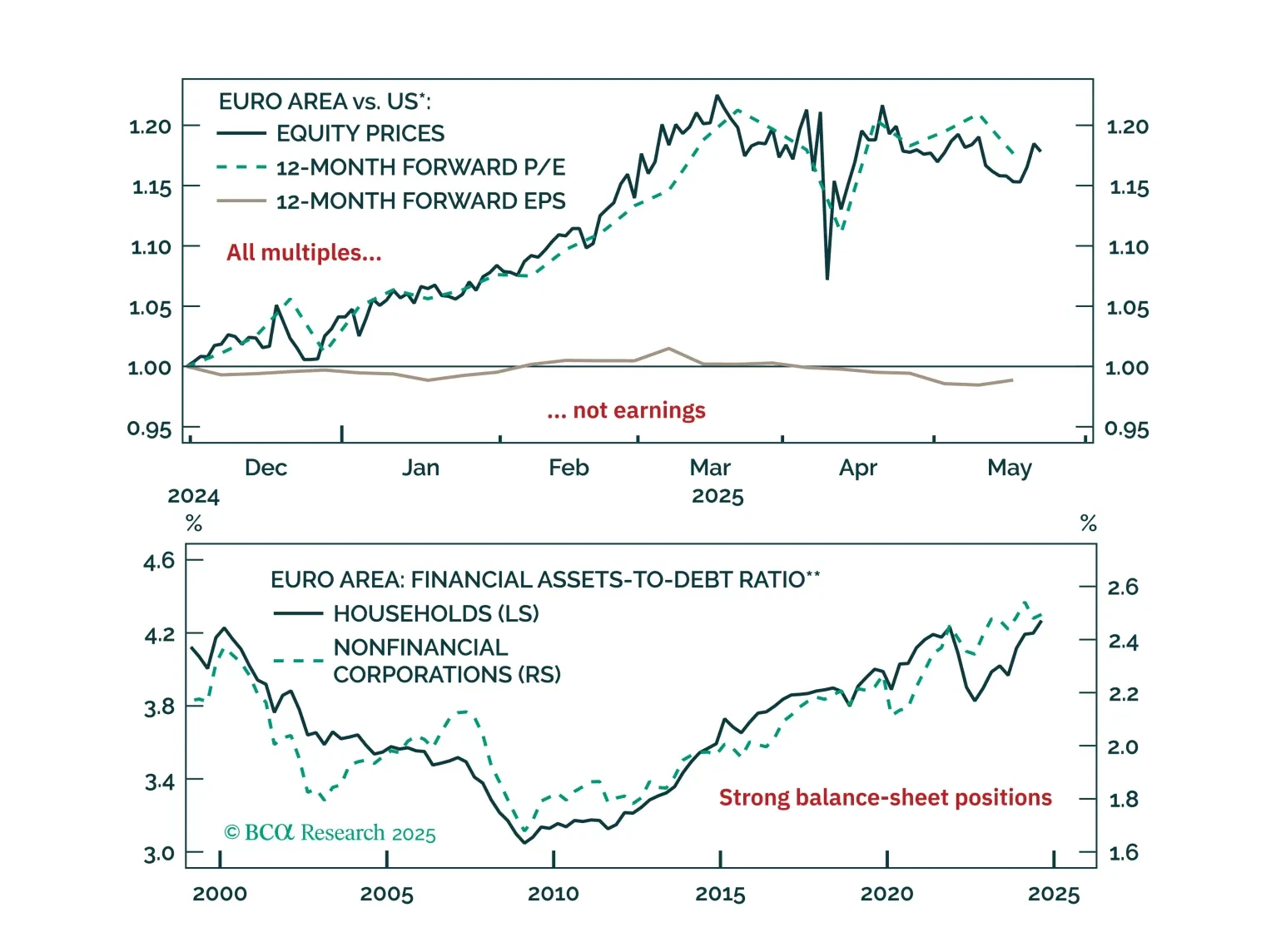

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

The latest hard data out of the US signals trouble for the economy, prompting caution on US equities. While Q1 growth was revised up slightly from -0.3% to -0.2% quarter-on-quarter, consumer spending slowed and was revised…

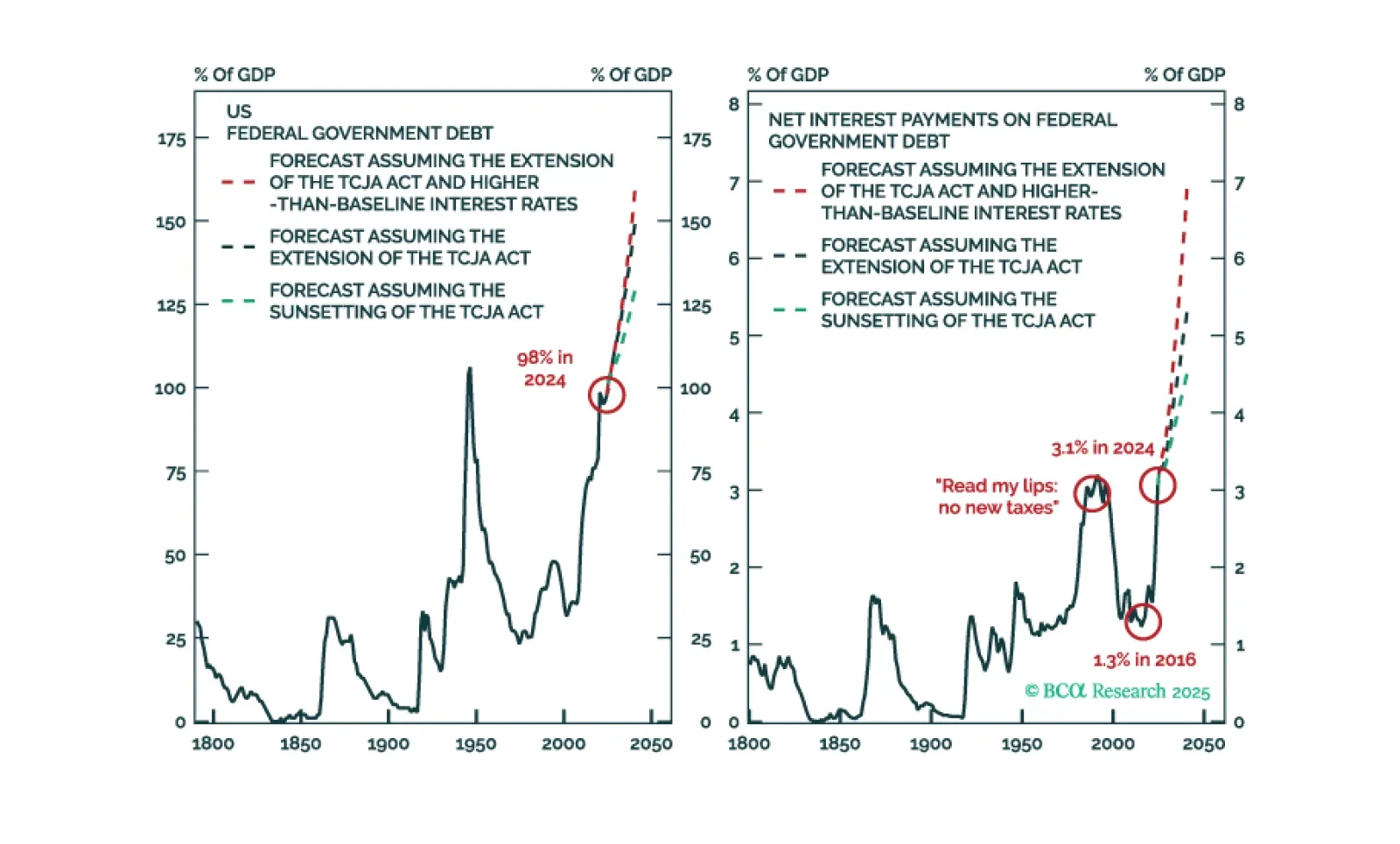

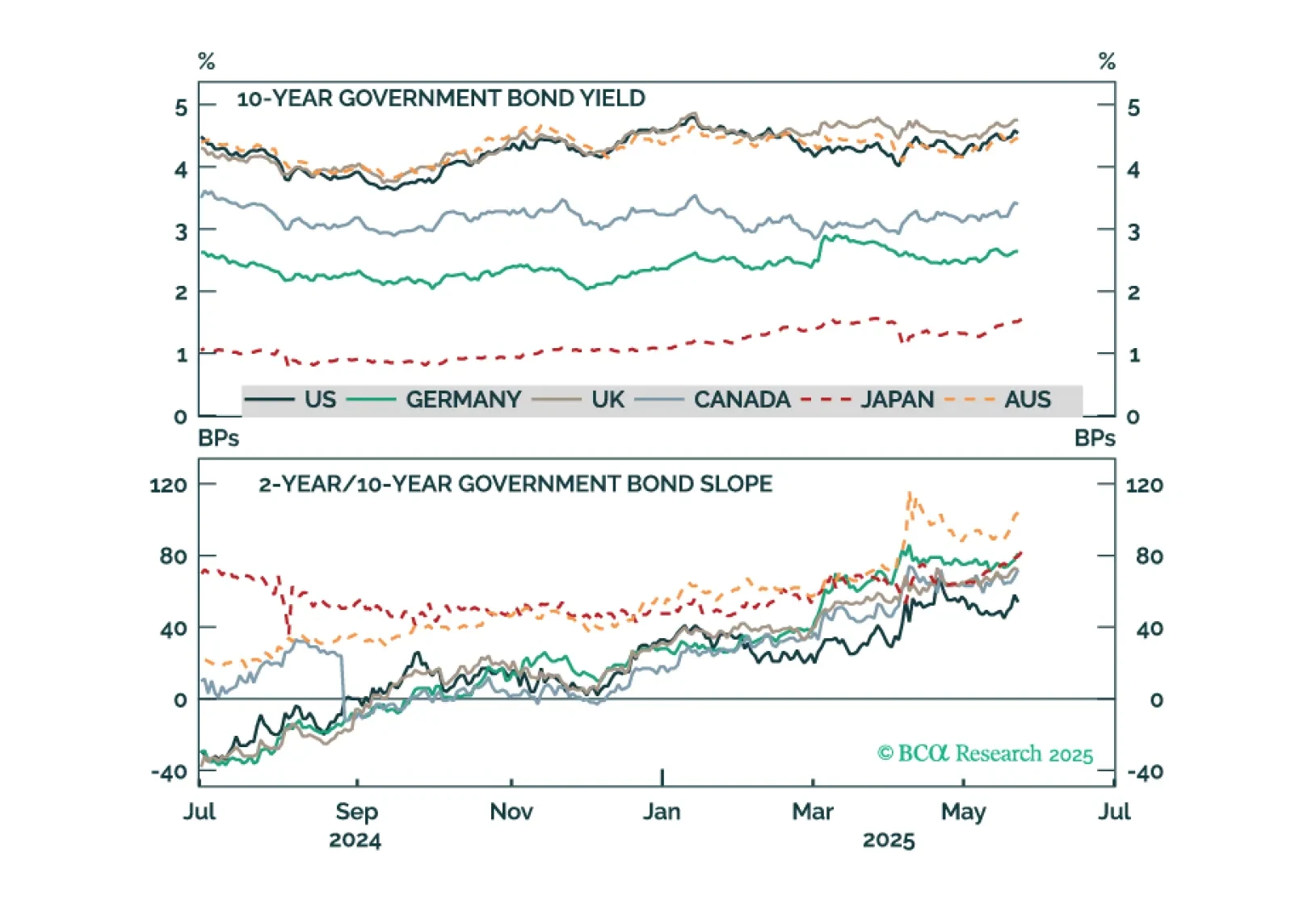

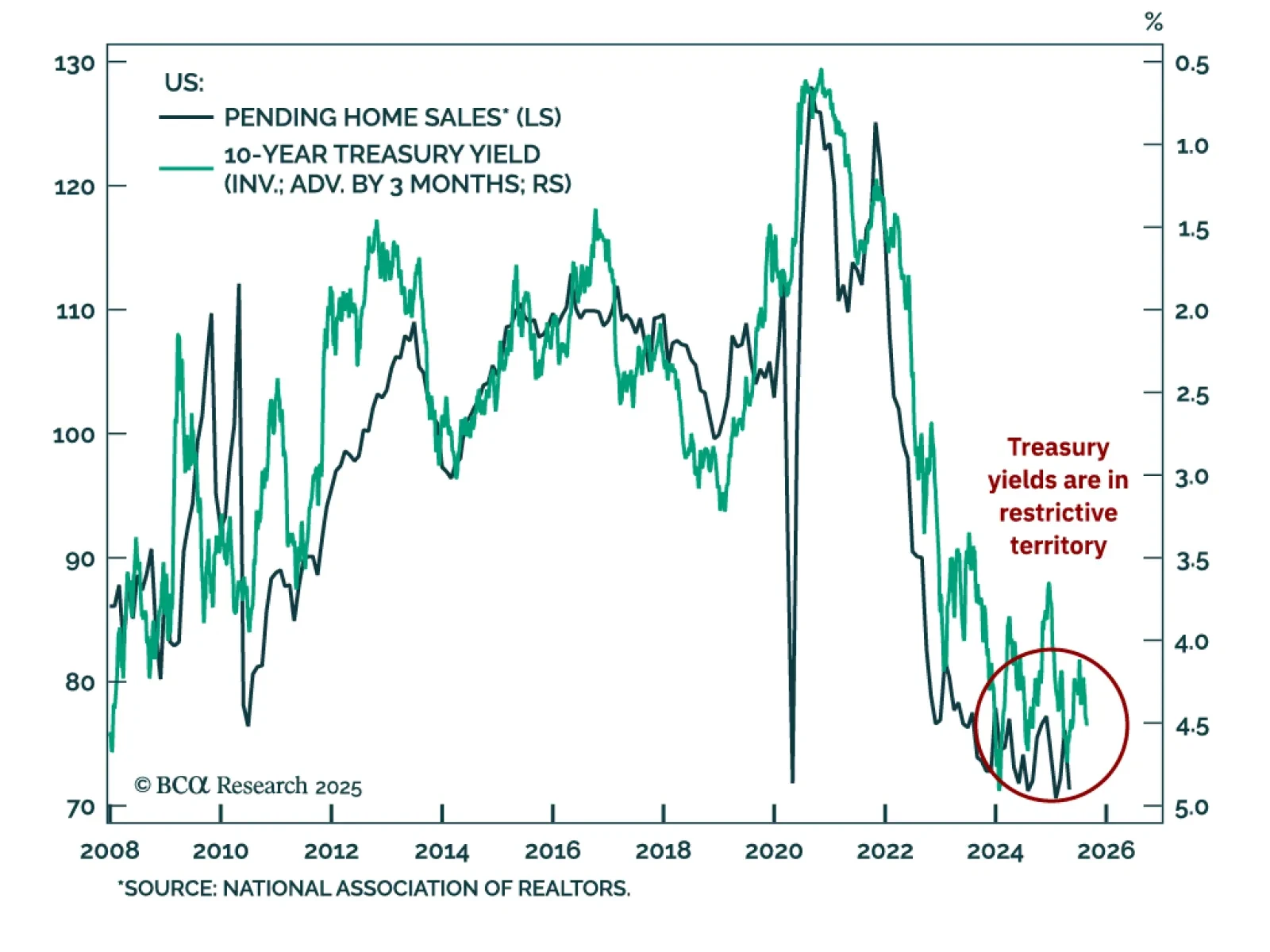

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

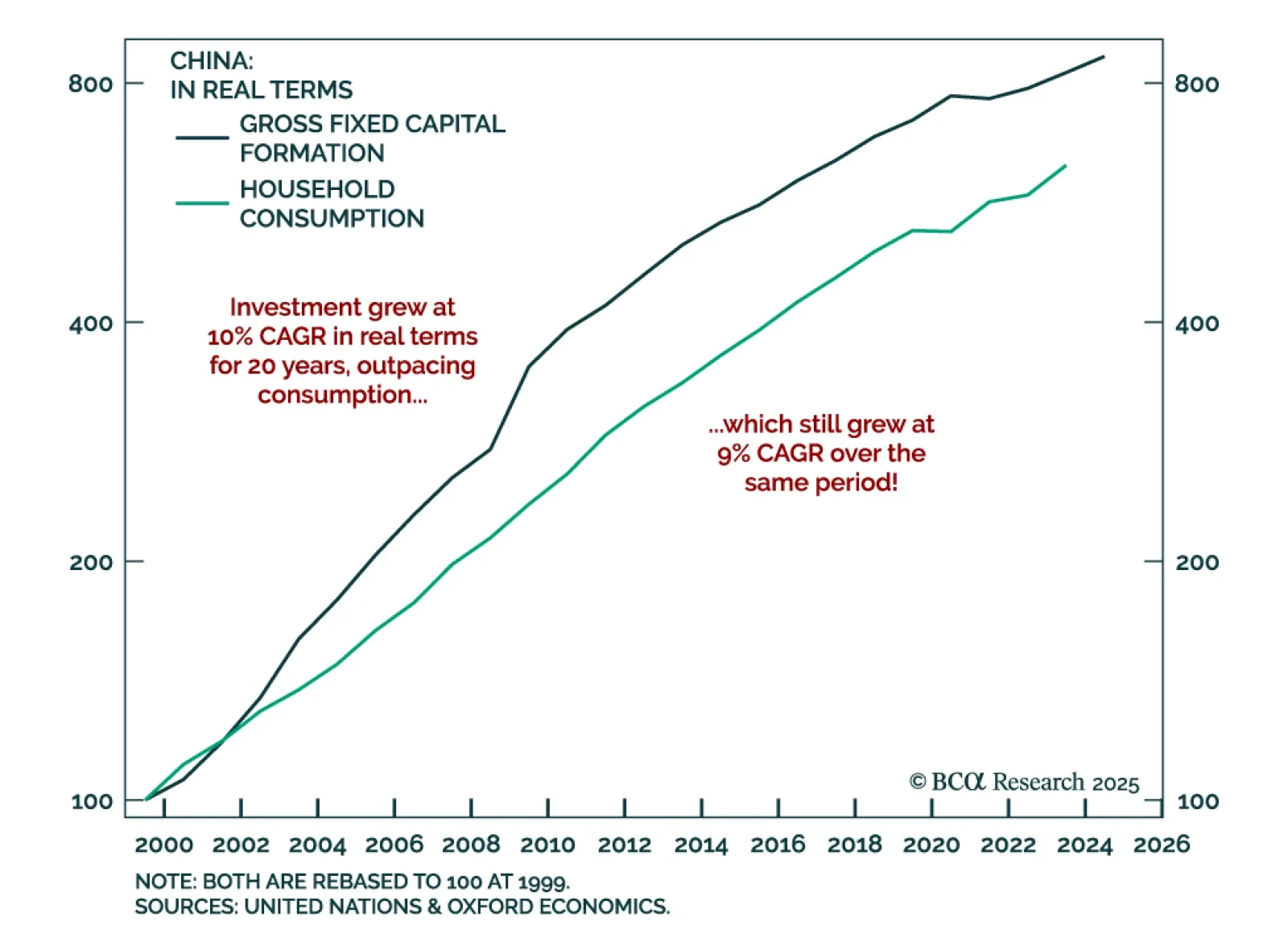

Our EM strategists warn that China’s overinvestment problem has no quick fix, keeping deflationary pressures in place and limiting upside for Chinese equities. Excessive domestic investment, driven by aggressive credit creation, is…

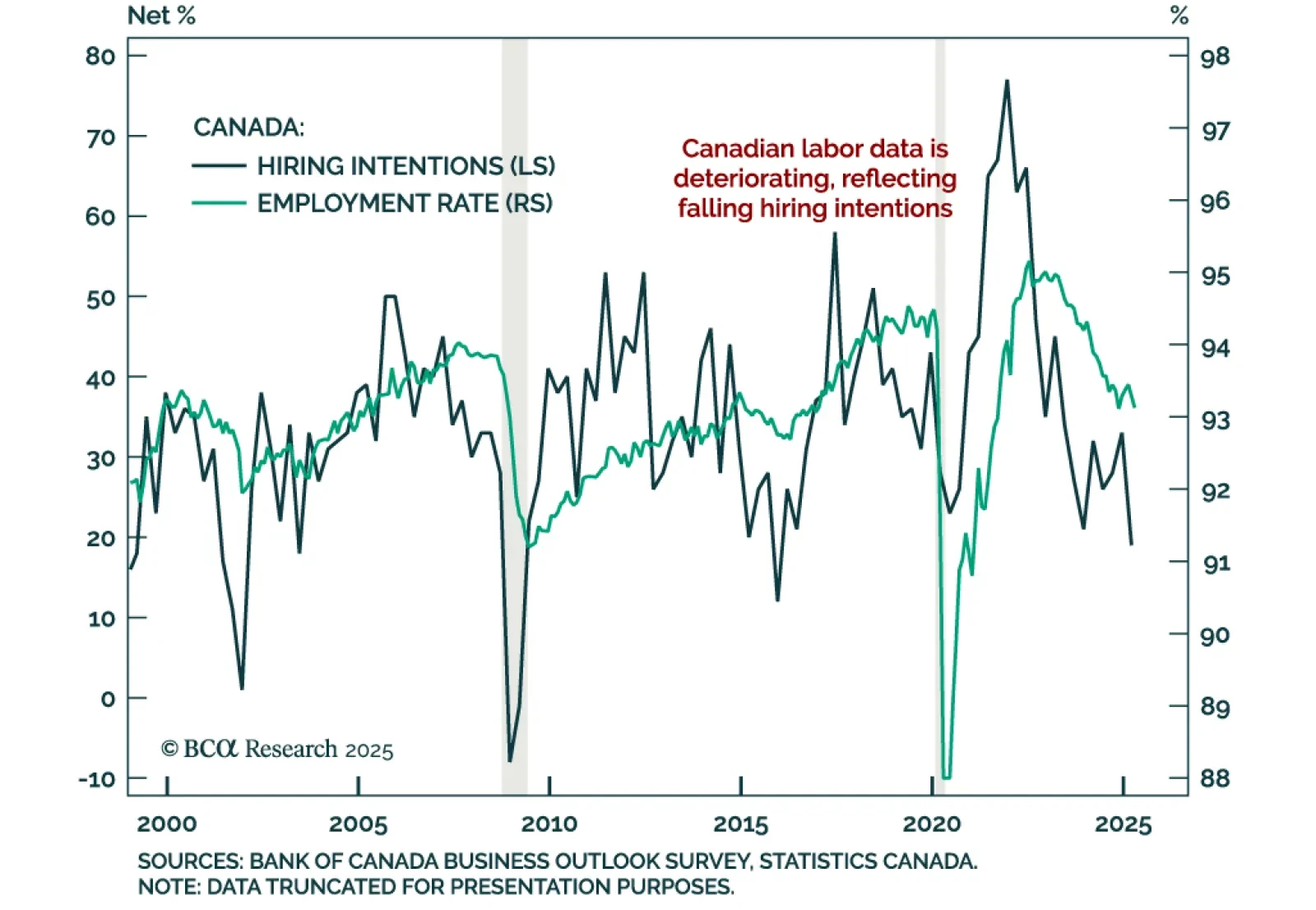

Soft April jobs confirm the Canadian labor market stall, yet we remain neutral on CGBs and structurally bullish on the CAD. The unemployment rate rose more than expected to 6.9% from 6.7%. Employment growth exceeded expectations but…

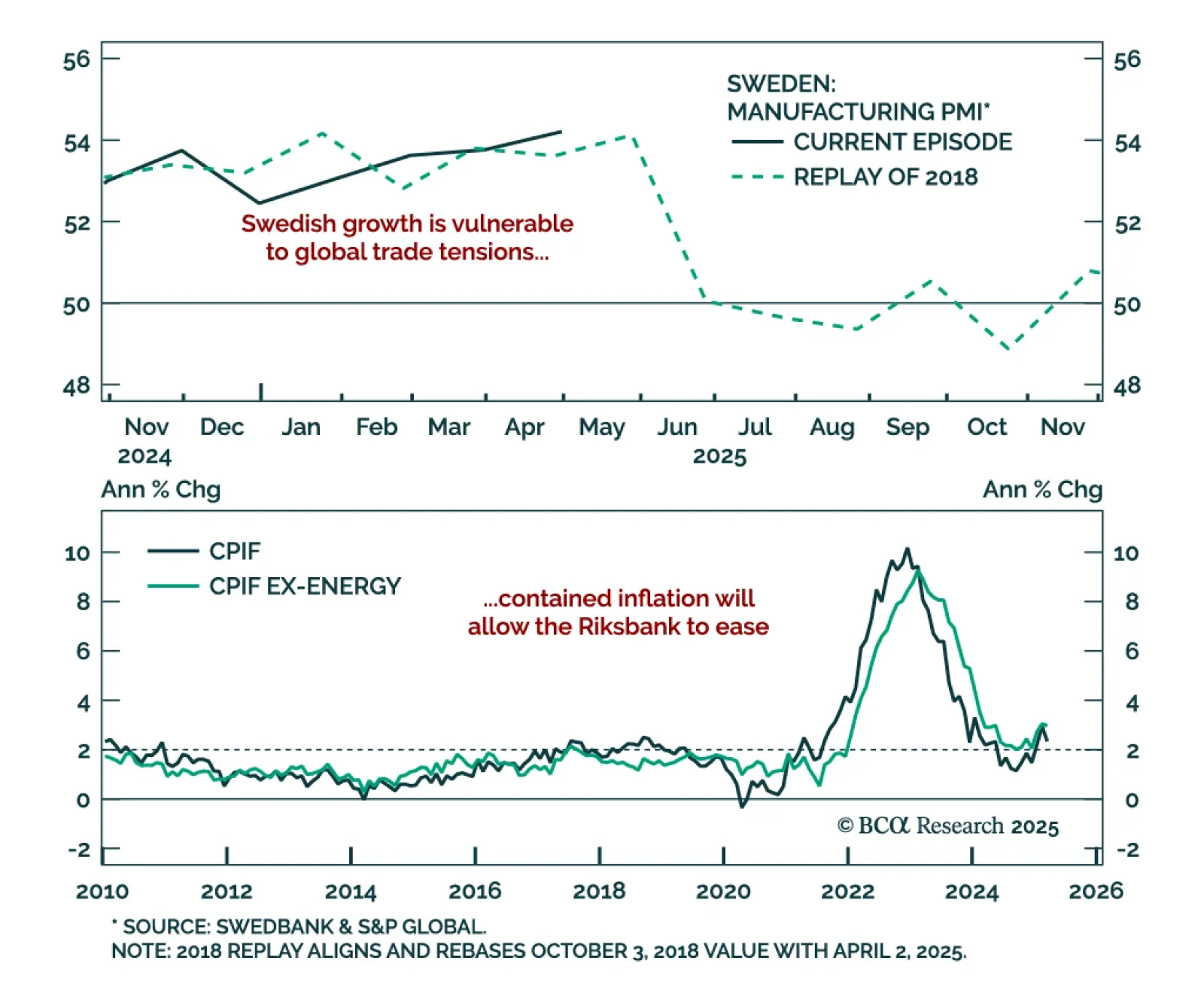

The Riksbank’s cautious stance sets up a dovish pivot, reinforcing our long Swedish bonds view and SEK fade vs. USD. The central bank held rates at 2.25% for the second time this year, with Governor Thedéen describing policy as well-…

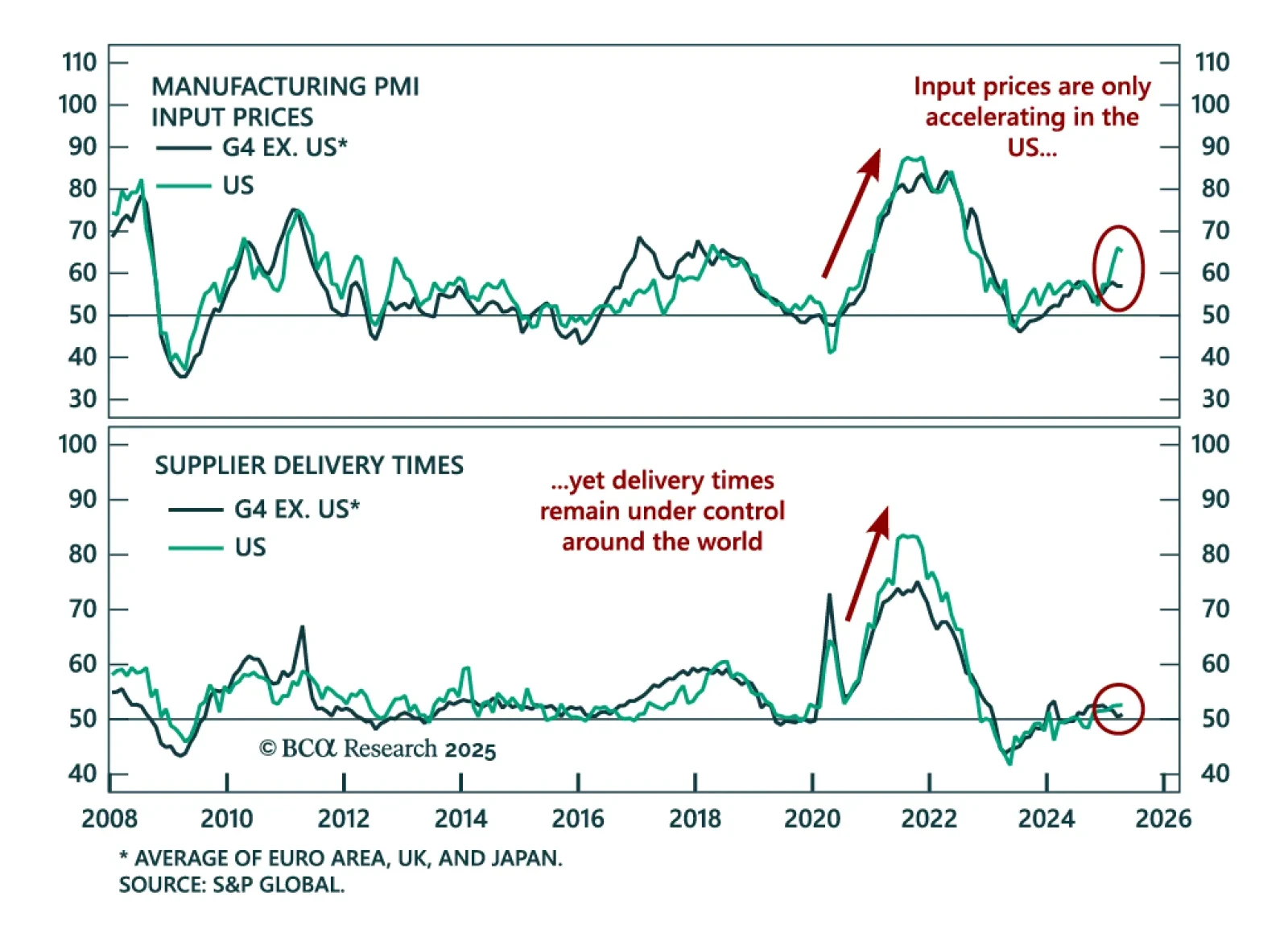

The inflation divergence between the US and Eurozone drives our call to stay long US duration. Inflation, typically a lagging indicator, blends slow-moving labor pressures with fast-moving supply drivers. The COVID inflation spike…