The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

Global oil demand growth is tracking with our estimate of ~ 1.8mm b/d for this year. Supply discipline is being maintained by OPEC 2.0, where the core (KSA and the UAE) and Russia have reduced production by ~ 240k b/d yoy in 1H23.…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

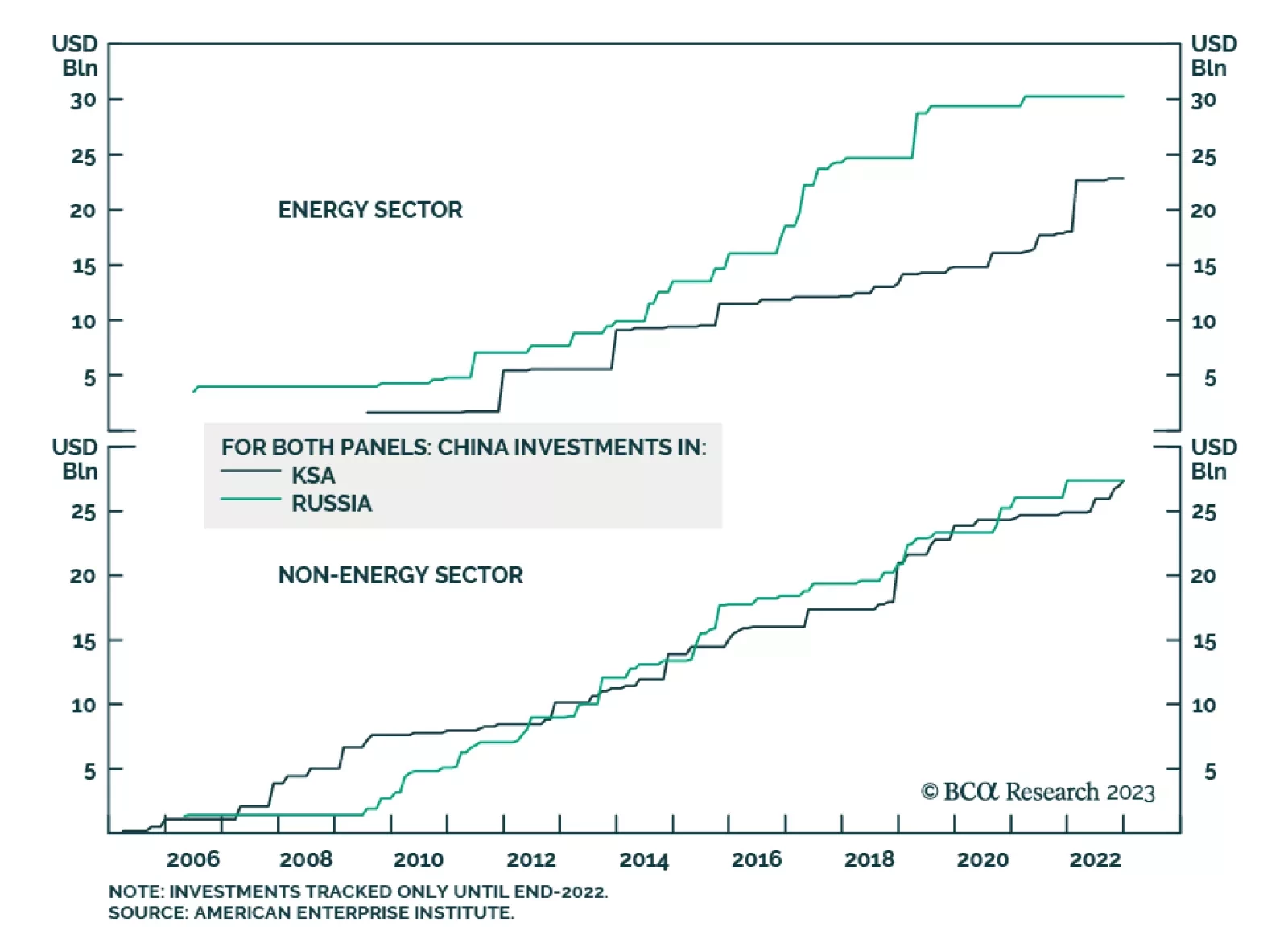

Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

China’s economic and diplomatic interests in the GCC region will expand, as will its military presence. Whether or not this stabilizes the region is yet to be determined, particularly if tensions in the South China Sea and other…