Executive Summary Natural Gas Markets Eerily Quiet An eerie calm in European natural gas markets belies the state of war in Ukraine that already is producing a cutoff of Russian natgas supplies in retaliation for the EU…

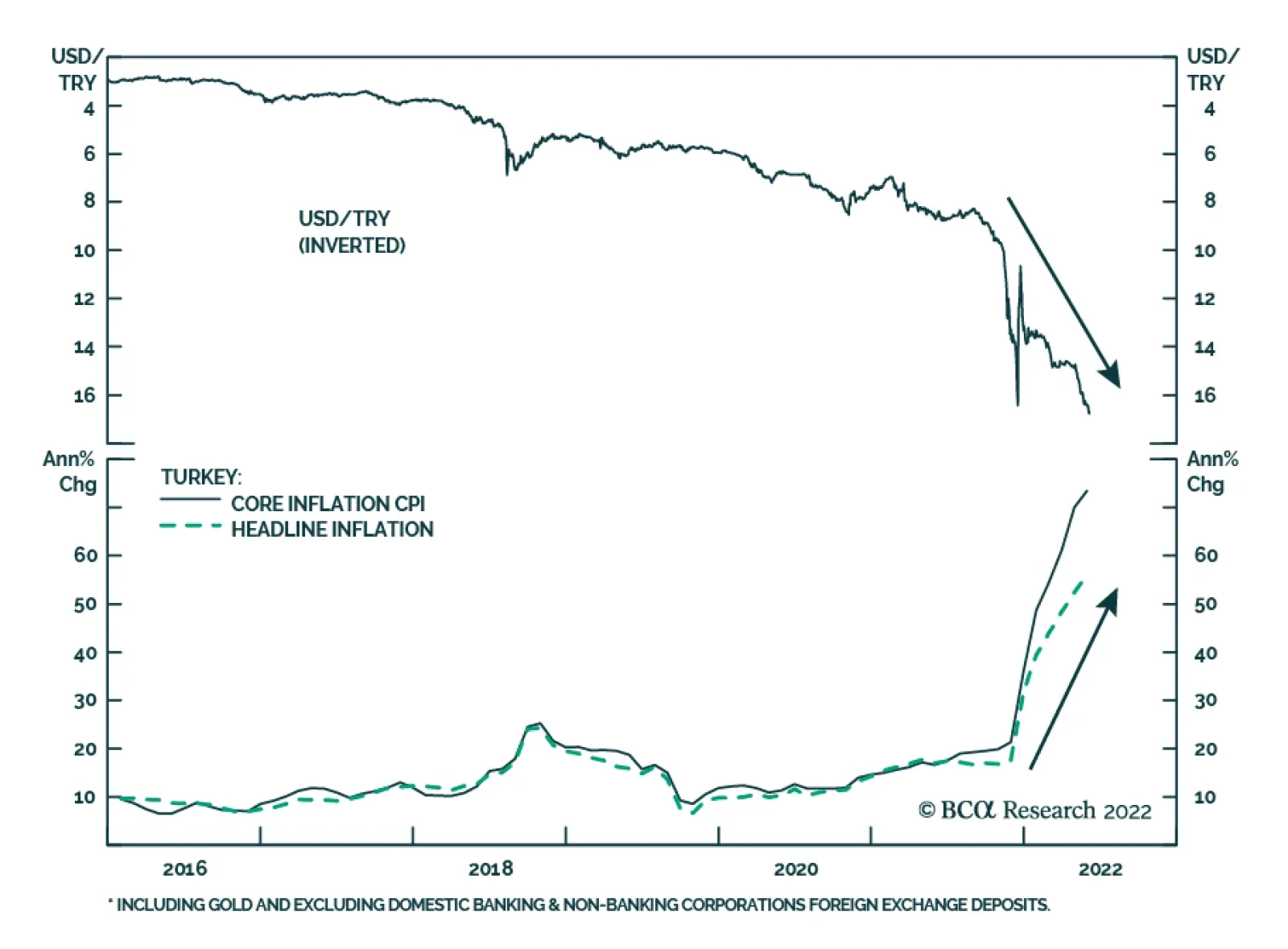

After a brief period of stability earlier this year, the Turkish lira has resumed its downtrend. The culprit behind this weakness is dovish monetary policy amid extreme inflationary pressures. Headline CPI inflation accelerated…

Executive Summary Crude Oil Prices Will Remain High The EU embargo on Russian seaborne oil imports will tighten global crude oil and refined-product markets further. Pipeline imports are due to phase out by year-end.…

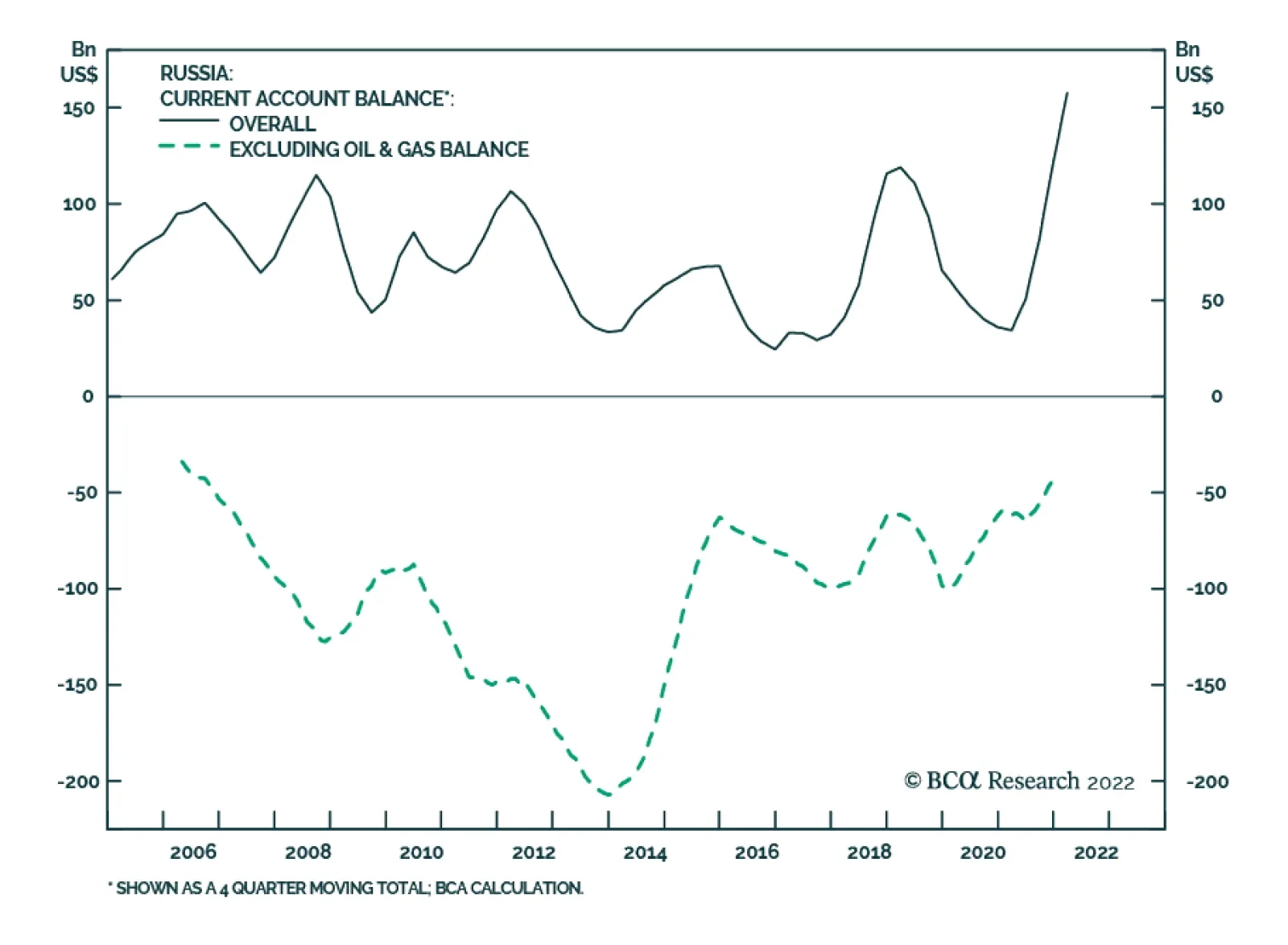

The Russian ruble has been the strongest currency in the world versus the US dollar since early March, following the invasion of Ukraine. Yet, the ruble’s performance is not a sign of economic strength. Rather, the reason…

Executive Summary EU Embargoes Russian Oil The EU imposed an embargo on 90% of Russian oil imports, which will provoke retaliation. Russia will squeeze Europe’s economy ahead of critical negotiations over the coming 6-…

Executive Summary EU Surprises Carbon Market With Increased CO2 Emission Allowance Supply The EU's failed foreign policy – premised on ever-deeper engagement with the Soviet Union and, after it collapsed, Russia…

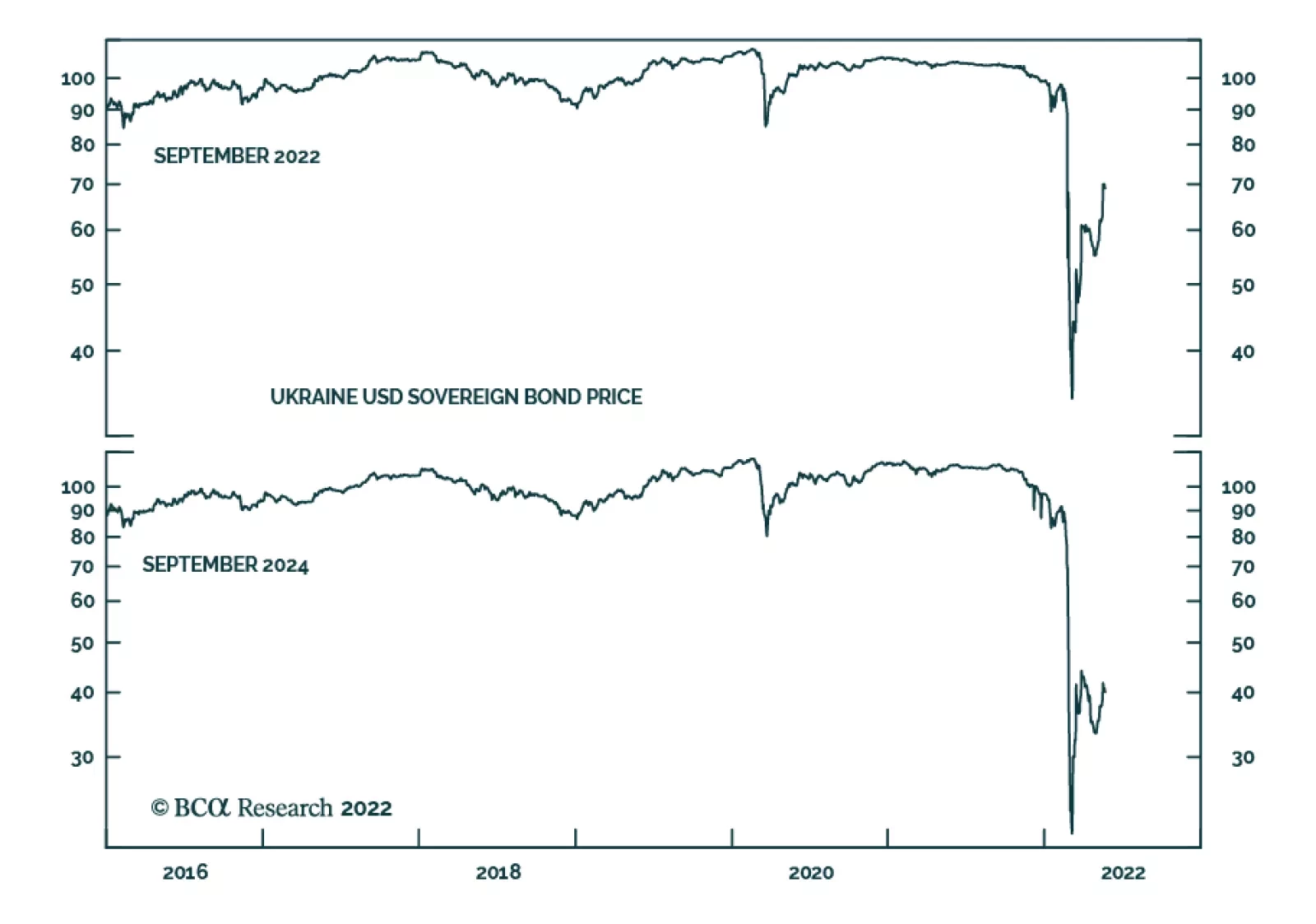

Although Ukranian US dollar sovereign bonds have rebounded since the beginning of the war, their risk-reward tradeoff is not yet attractive. First, the war is likely to be prolonged. US and NATO military and economic…

Listen to a short summary of this report. Executive Summary The US Inflation Surprise Index Has Rolled Over Global equities are nearing a bottom and will rally over the coming months as…

Listen to a short summary of this report. Executive Summary EUR/JPY And The DXY: Unsustainable Gap Three interrelated themes are likely to play out by the end of 2022 – peak Fed hawkishness,…

Executive Summary Loss Of Russian Production Will Lift Brent With German imports of Russian oil close to 10% of its total requirements – following an impressive decline from 35% pre-invasion – we expect the EU to…