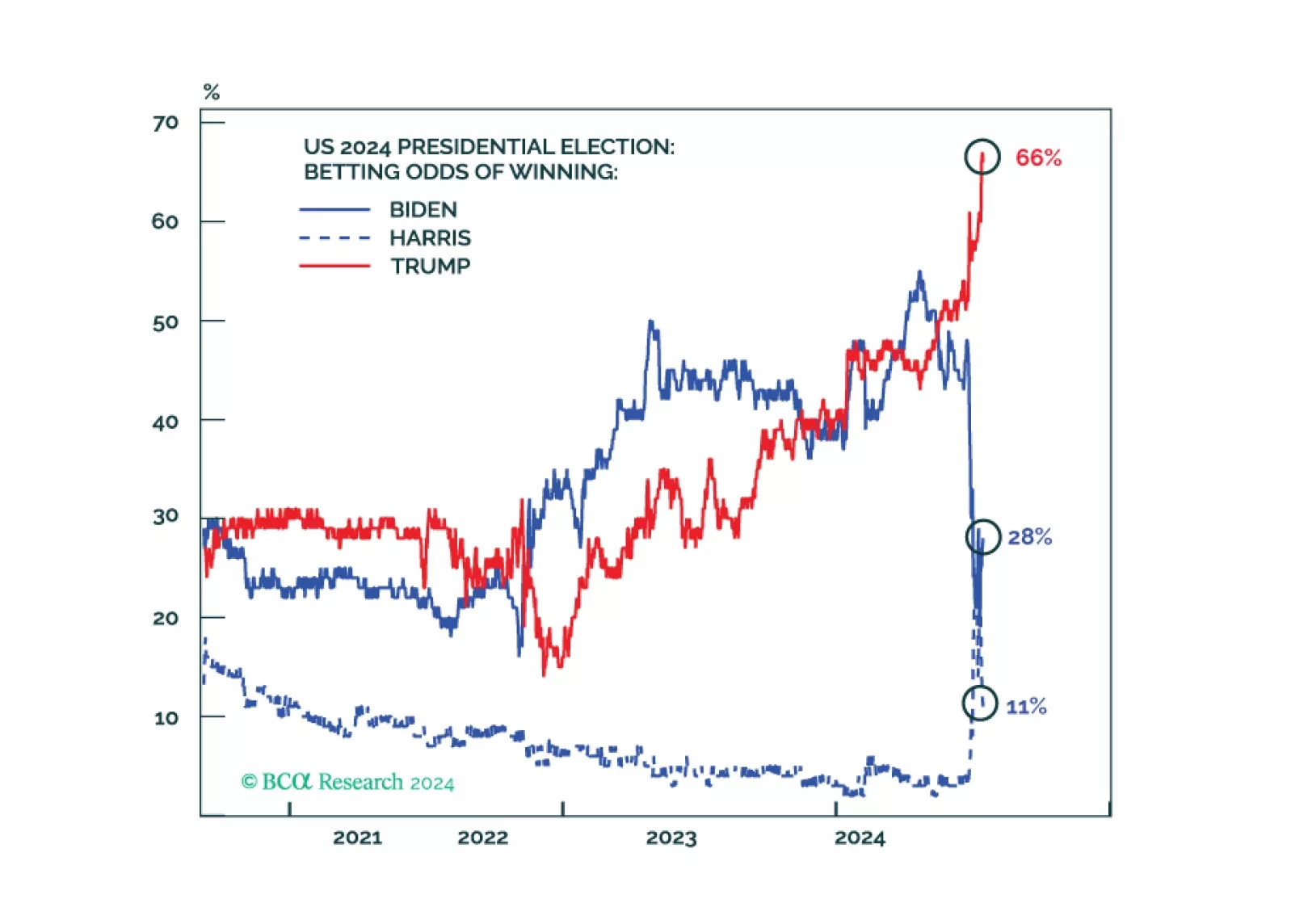

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

According to BCA Research’s Global Investment Strategy service, investors are overstating the degree to which bond yields will rise under a Trump presidency. For one thing, the team expects the US to fall into recession…

The conventional wisdom is wrong: Trump is not going to substantially cut taxes once in office; he is going to raise taxes by jacking up tariffs. To the extent that this dampens economic activity, it is bad news for stocks but good…

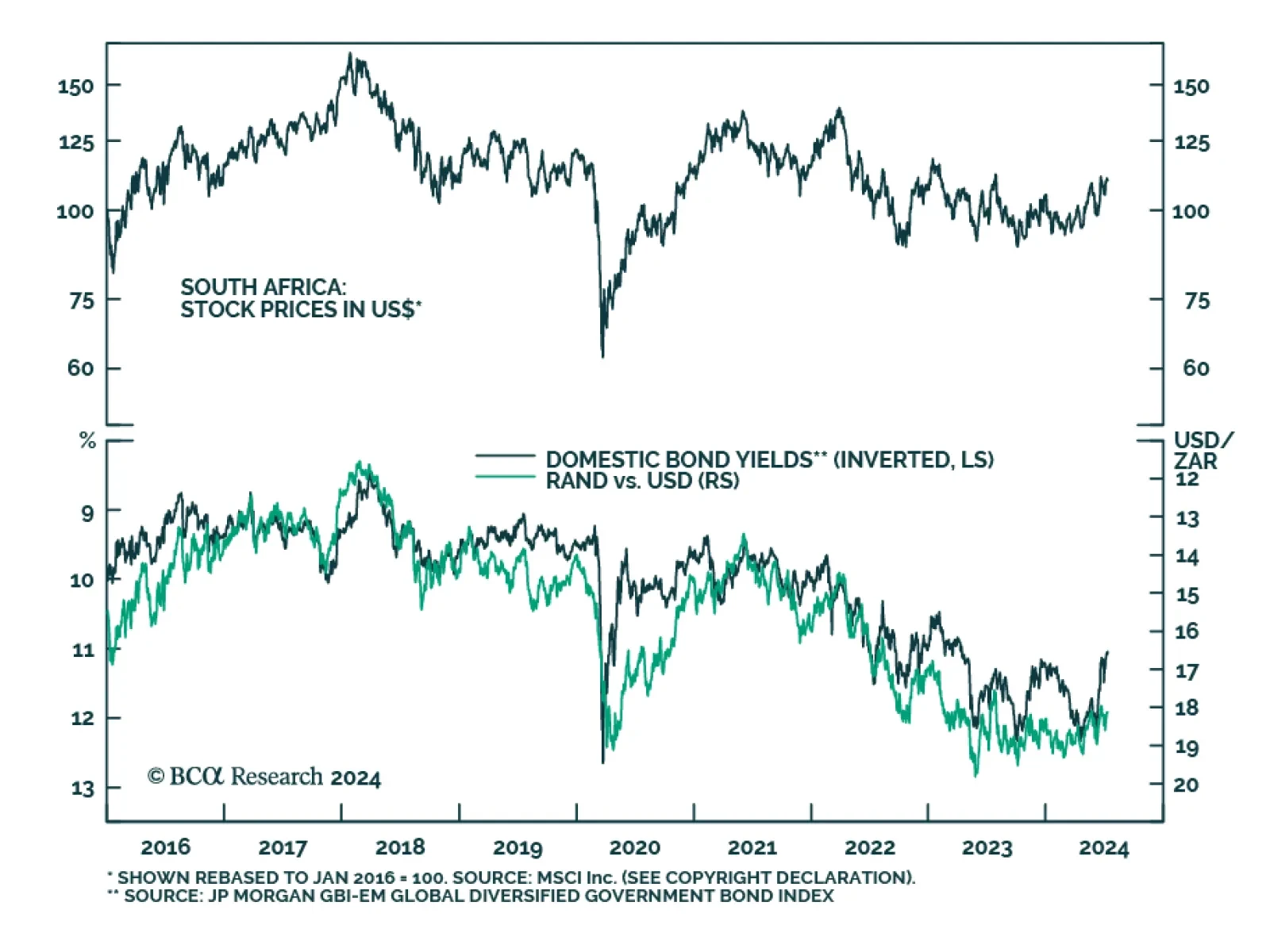

South African stocks, domestic bonds, and currency have all rallied since BCA’s Emerging Markets Strategy team upgraded South African assets last month following the formation of the new national unity government. The rally…

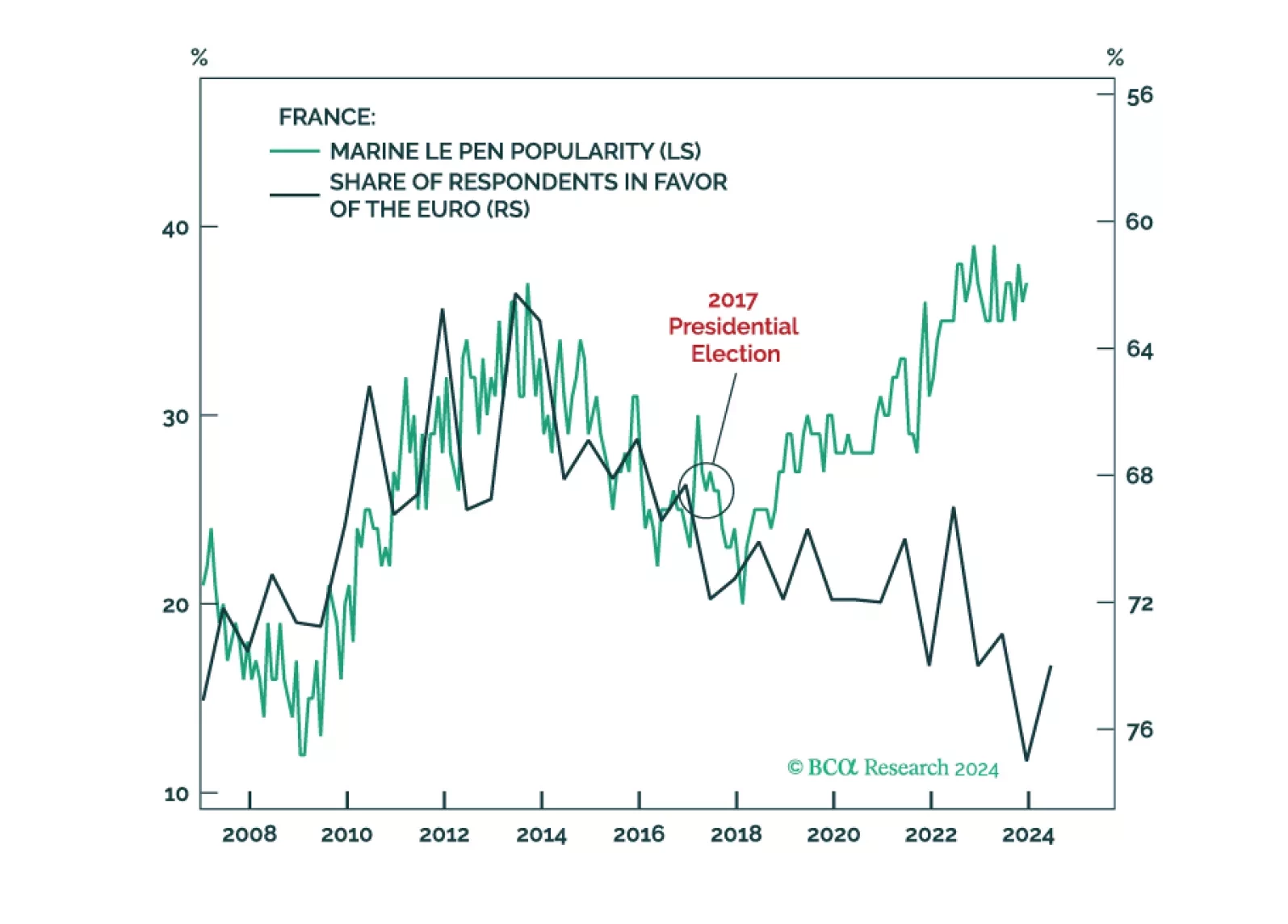

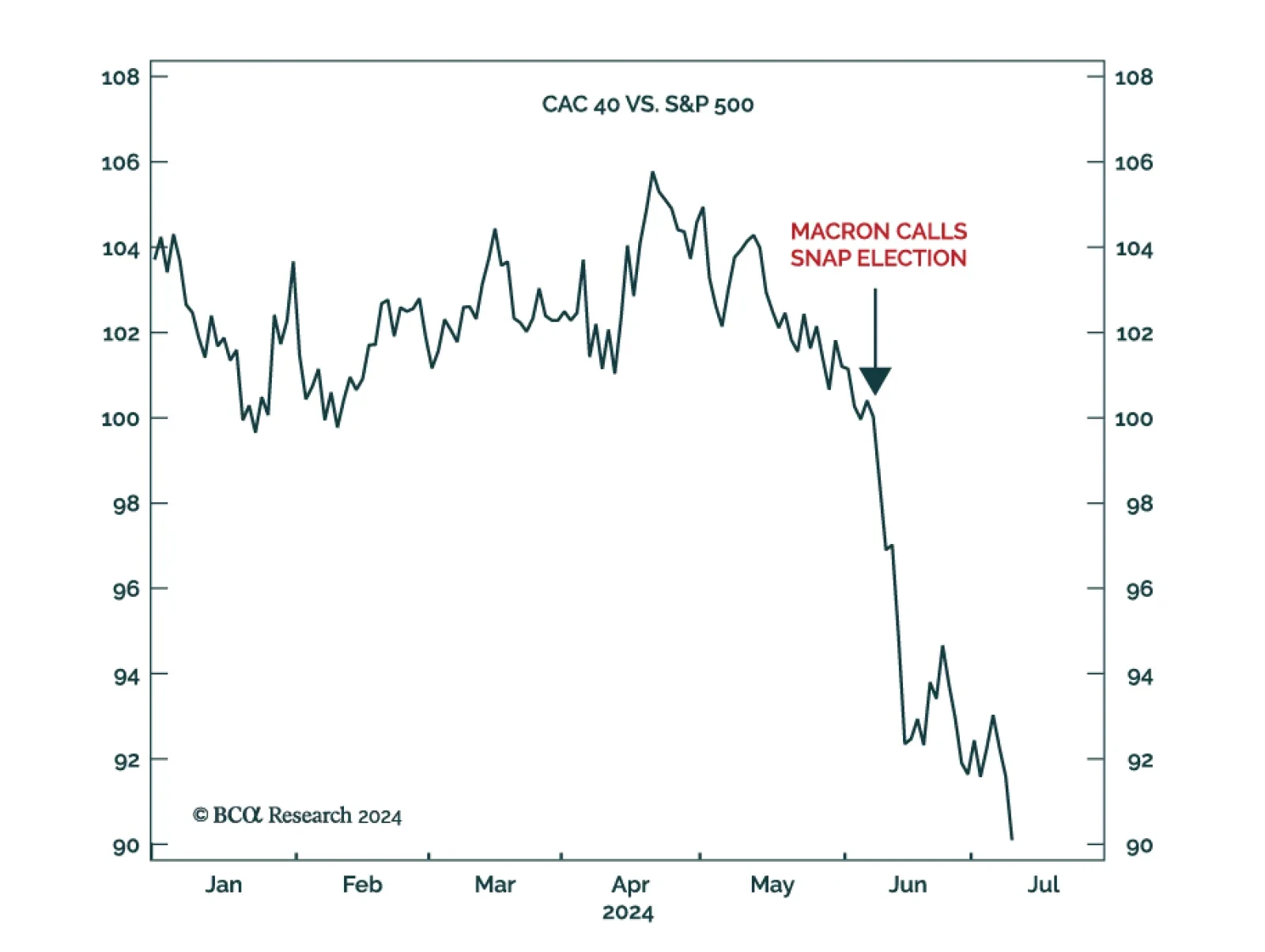

According to BCA Research’s Counterpoint service, the sharp underperformance of the French stock market over political uncertainty is irrational, given the CAC 40’s limited exposure to French domestic economics and…

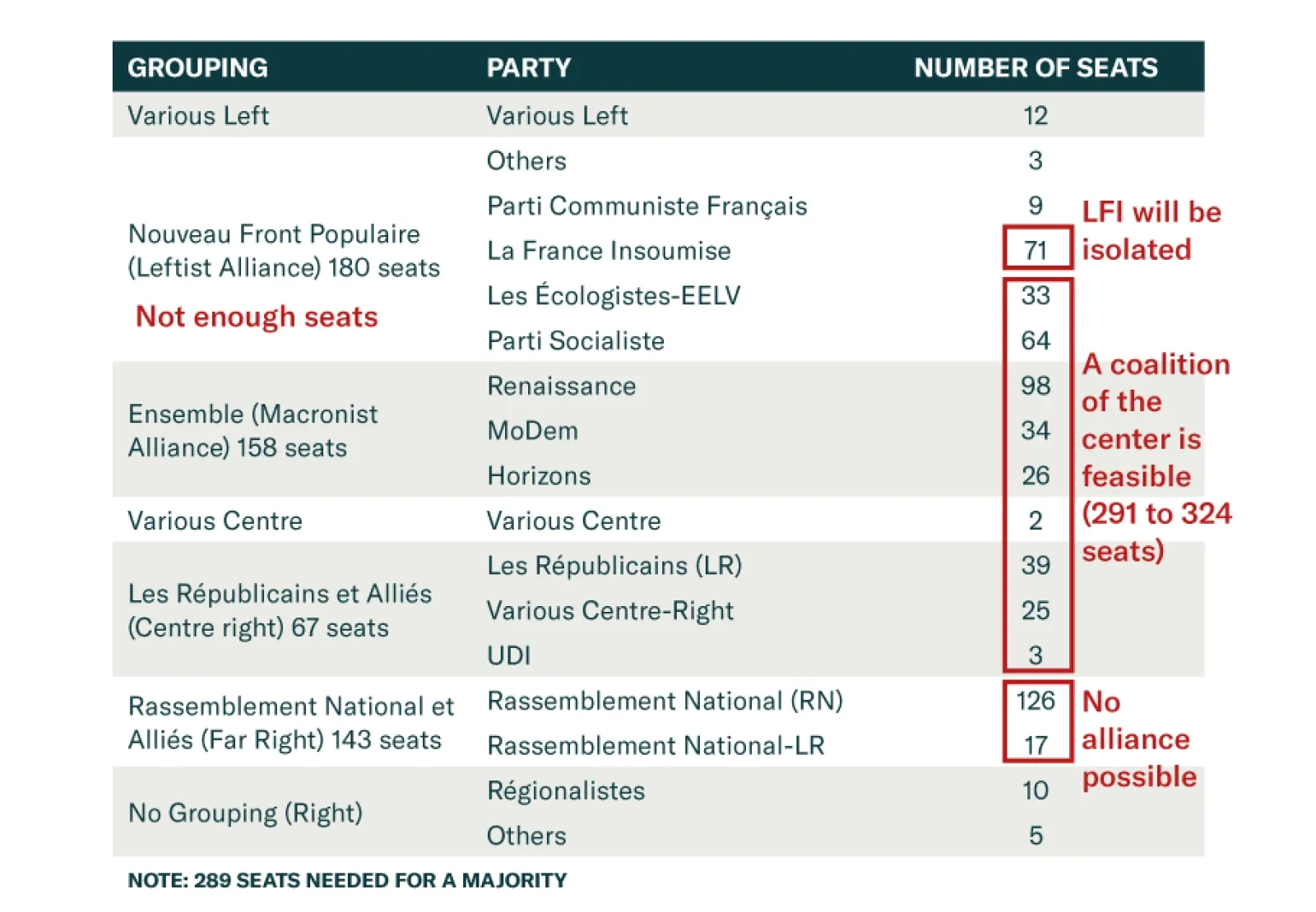

Investors in European sovereign bonds should find solace that continental voters are not turning away from support for EU integration. As such, populist parties are not really that “far” left or right. And as long as they want to…

France’s snap election is over and, according to BCA Research’s European Investment Strategy service, President Emmanuel Macron’s gamble paid off in some ways: neither the far right nor the far left can form a…

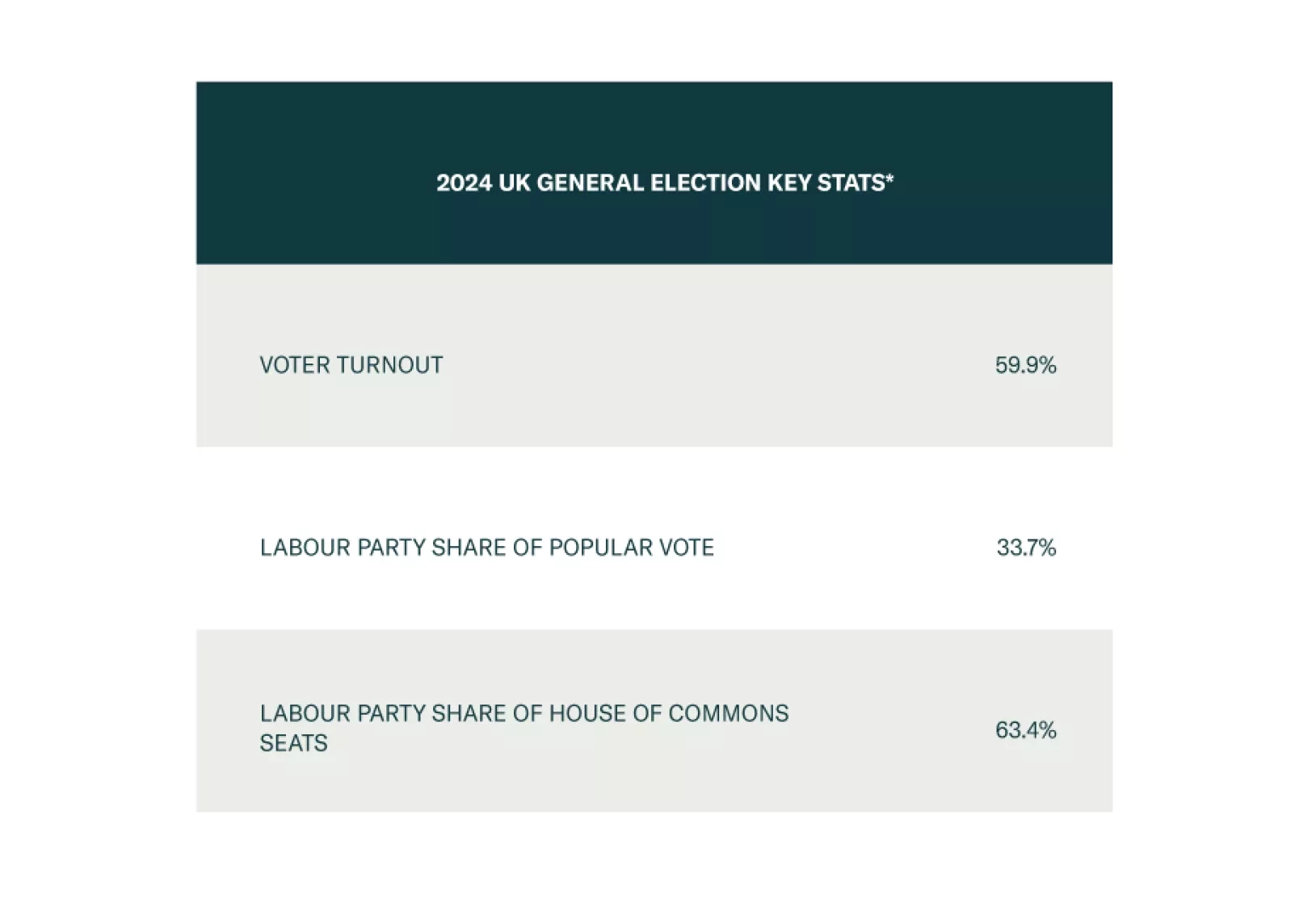

The Labour Party won the UK election, just as BCA Research’s Geopolitical Strategy service predicted back in 2022. However, this win is unlikely to rock the proverbial geopolitical boat. Popular enthusiasm for Sir Keir…

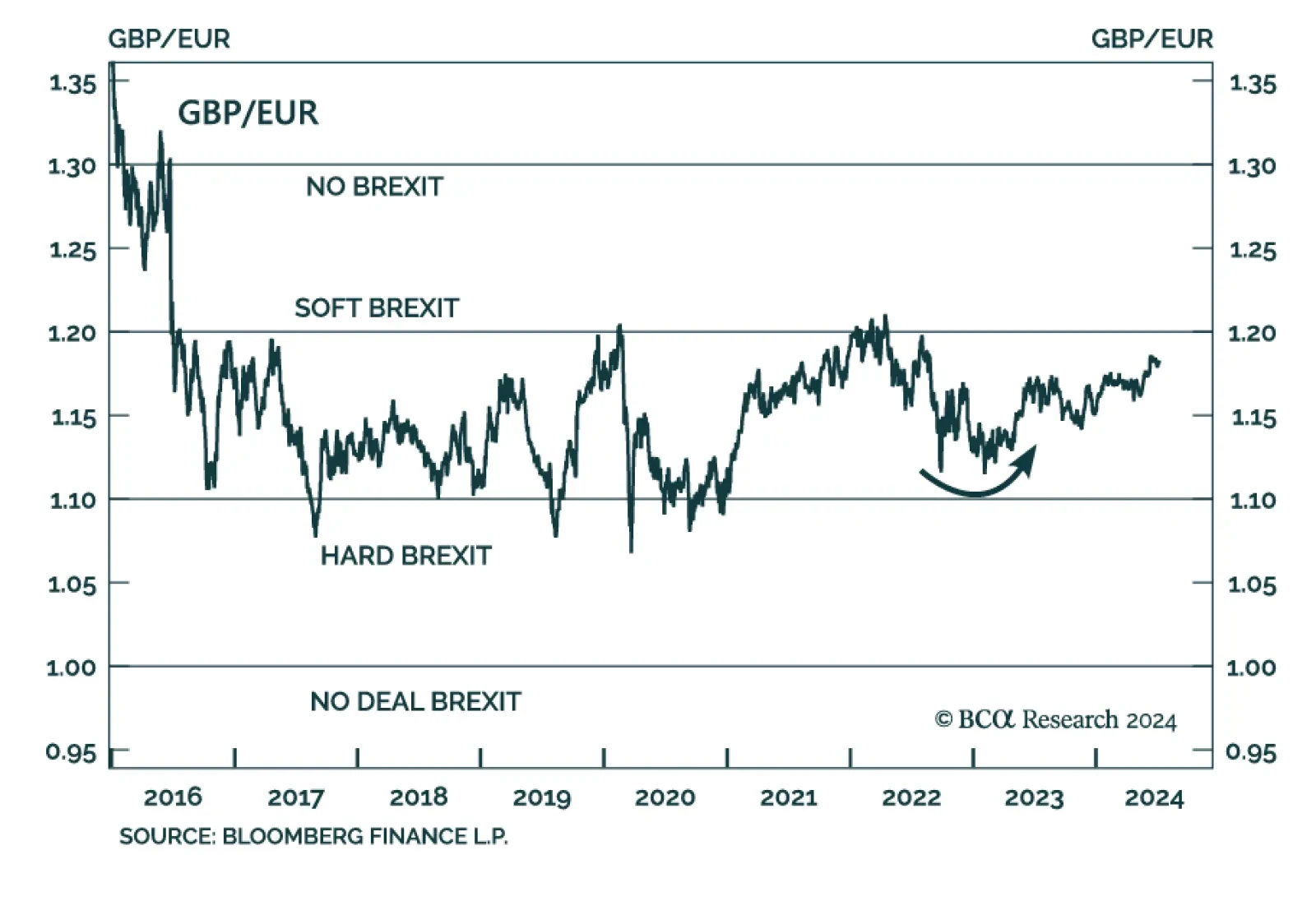

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…

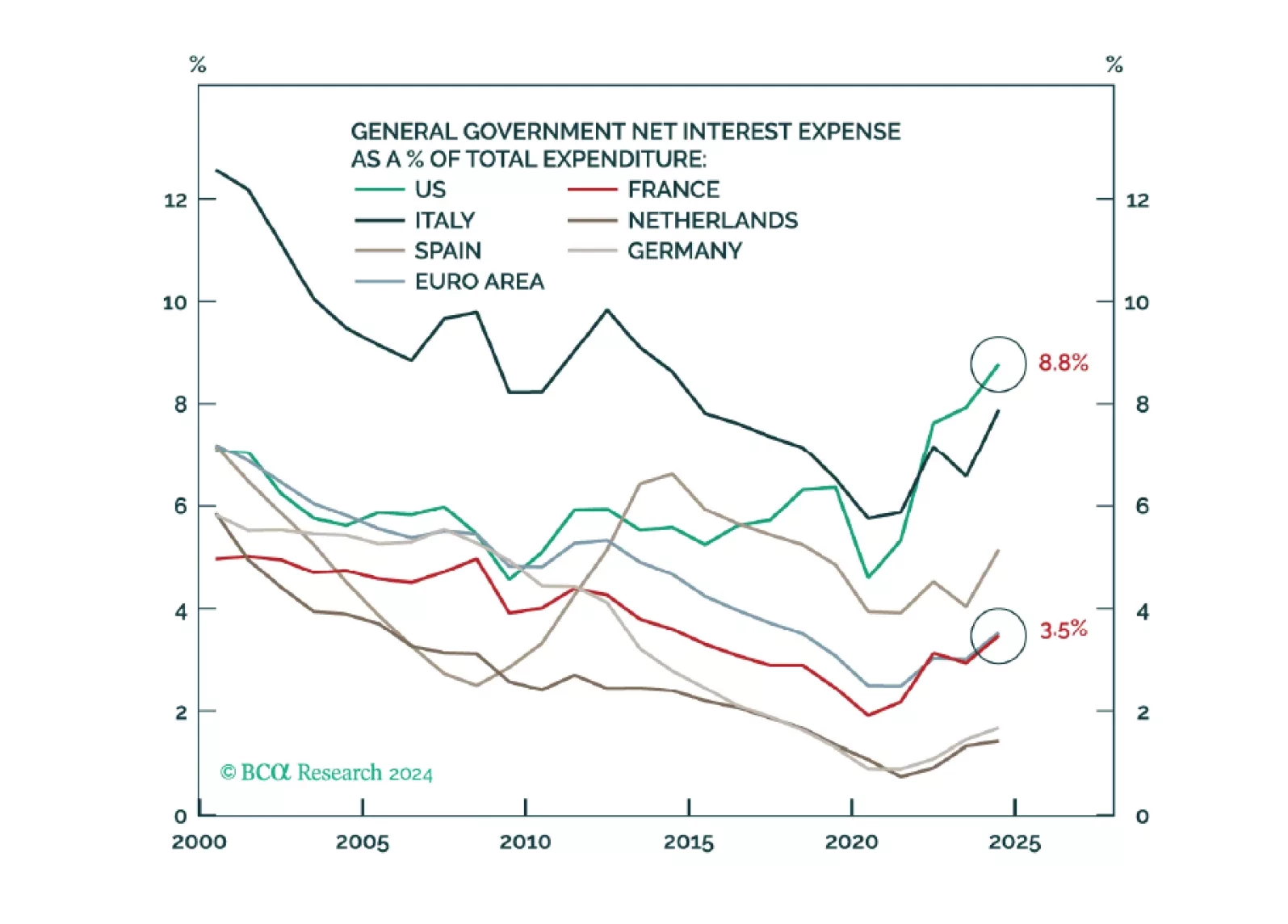

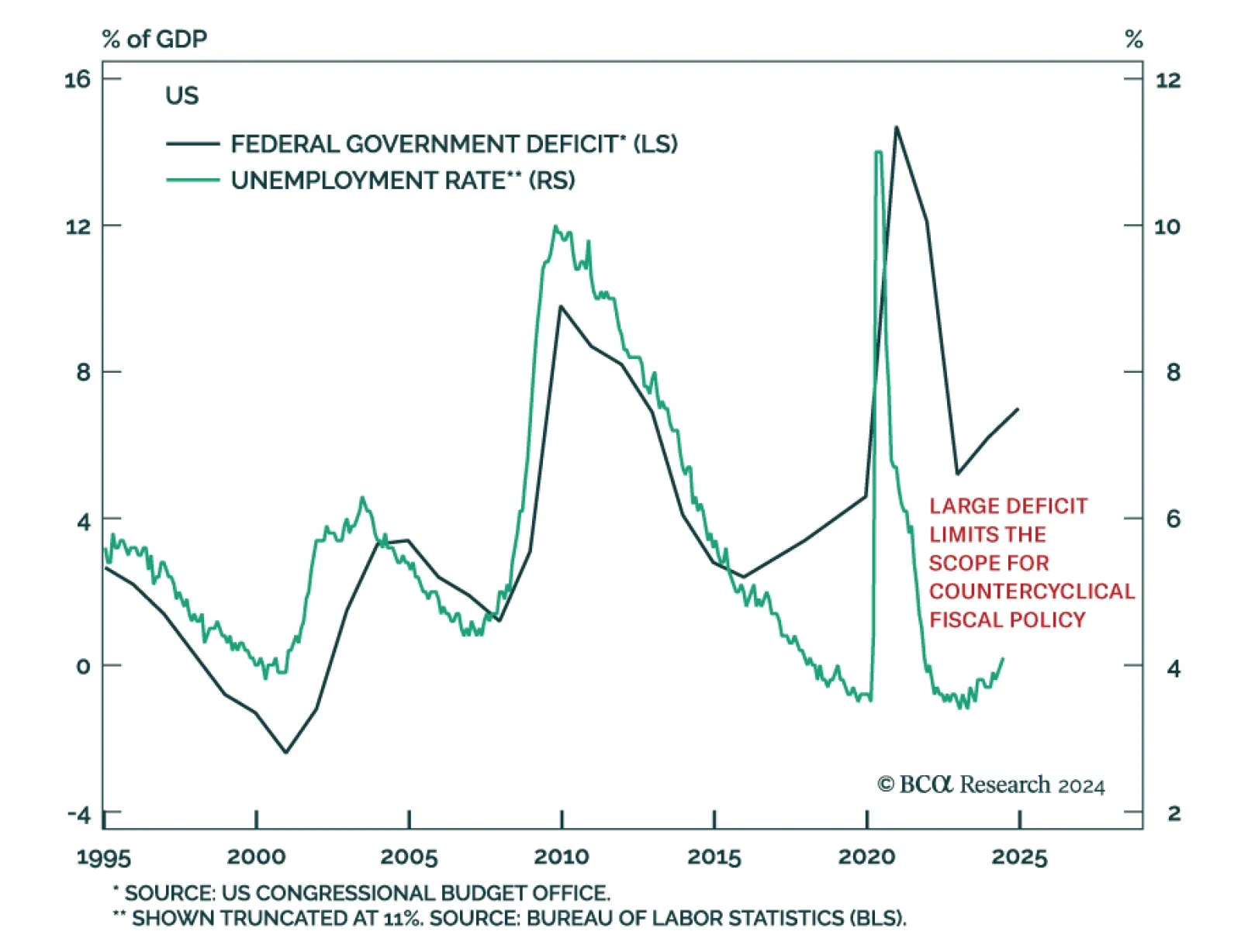

In our Volume I – The Alpha Report – we posit that the French bond market reaction is a mere amuse bouche for what is coming to the US. All year, we have warned investors that US politics could induce a bond market riot. This moment…