According to BCA Research’s US Political Strategy service, the results of the 2023 off-year elections are positive marginally for the equity market according to the team's “Golden Rule of the 2024 Election,…

Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…

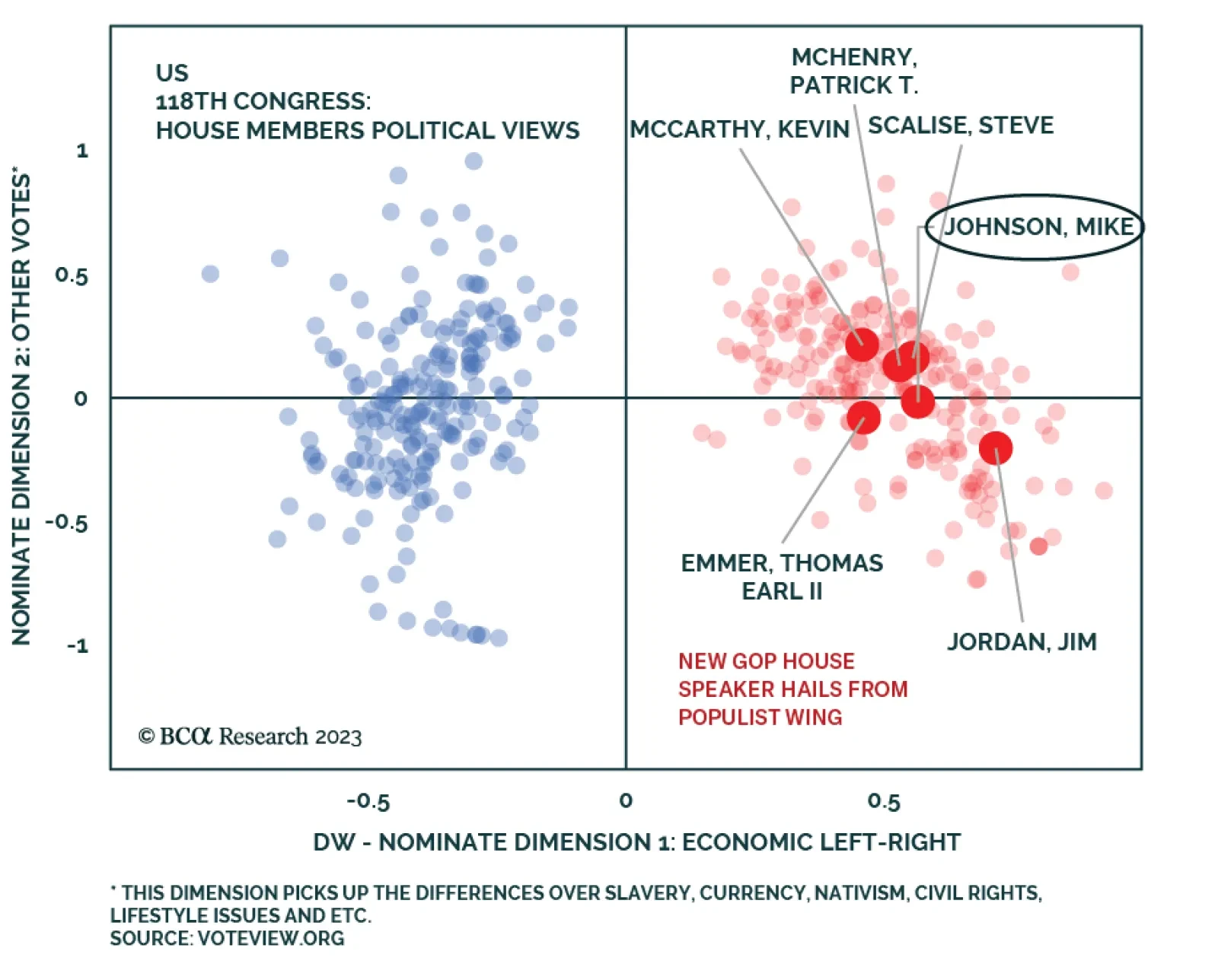

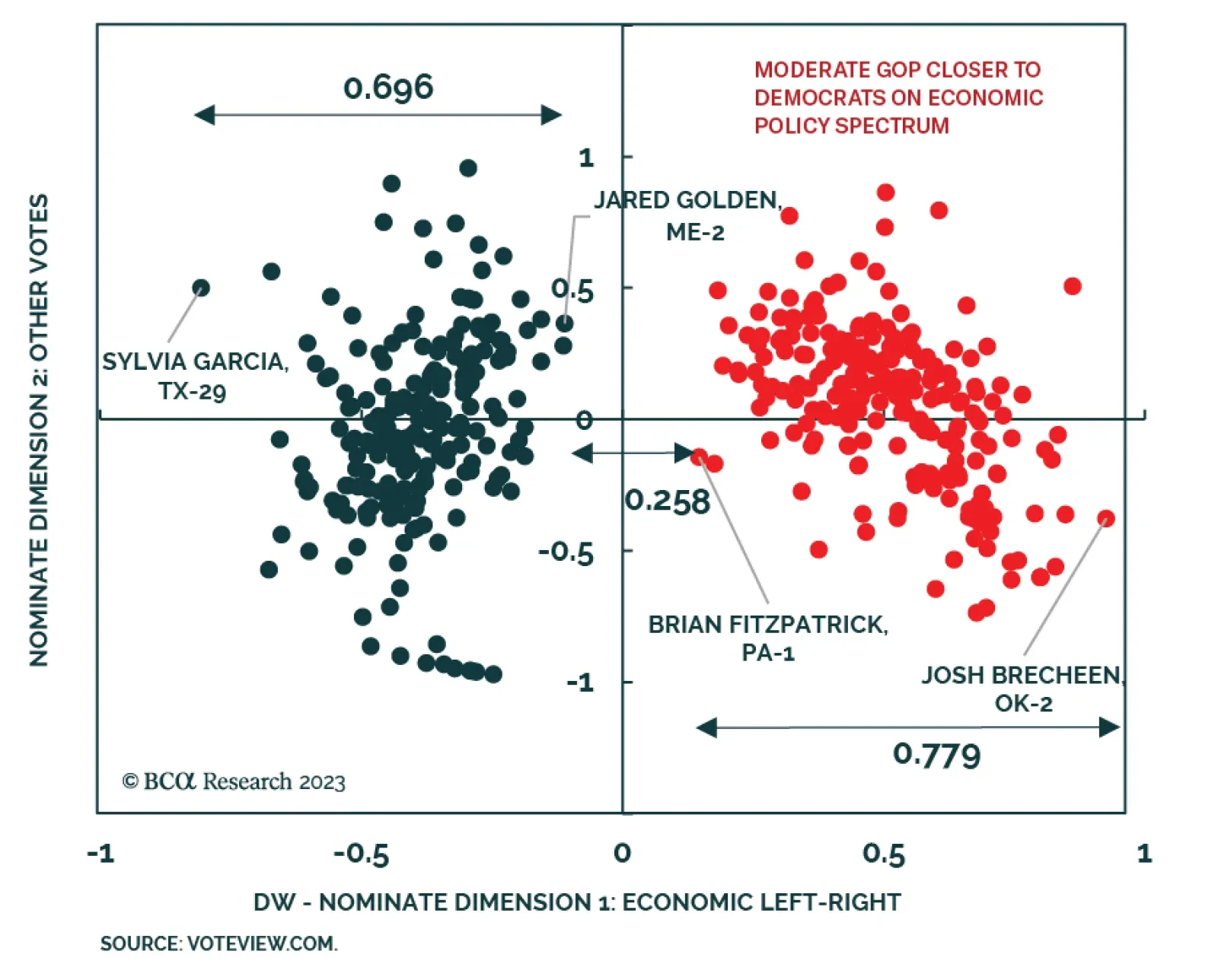

The US House of Representatives finally got a Speaker, but according to BCA Research’s US Political Strategy service, his voting record indicates that he will be a populist hardliner, which increases the chance that there…

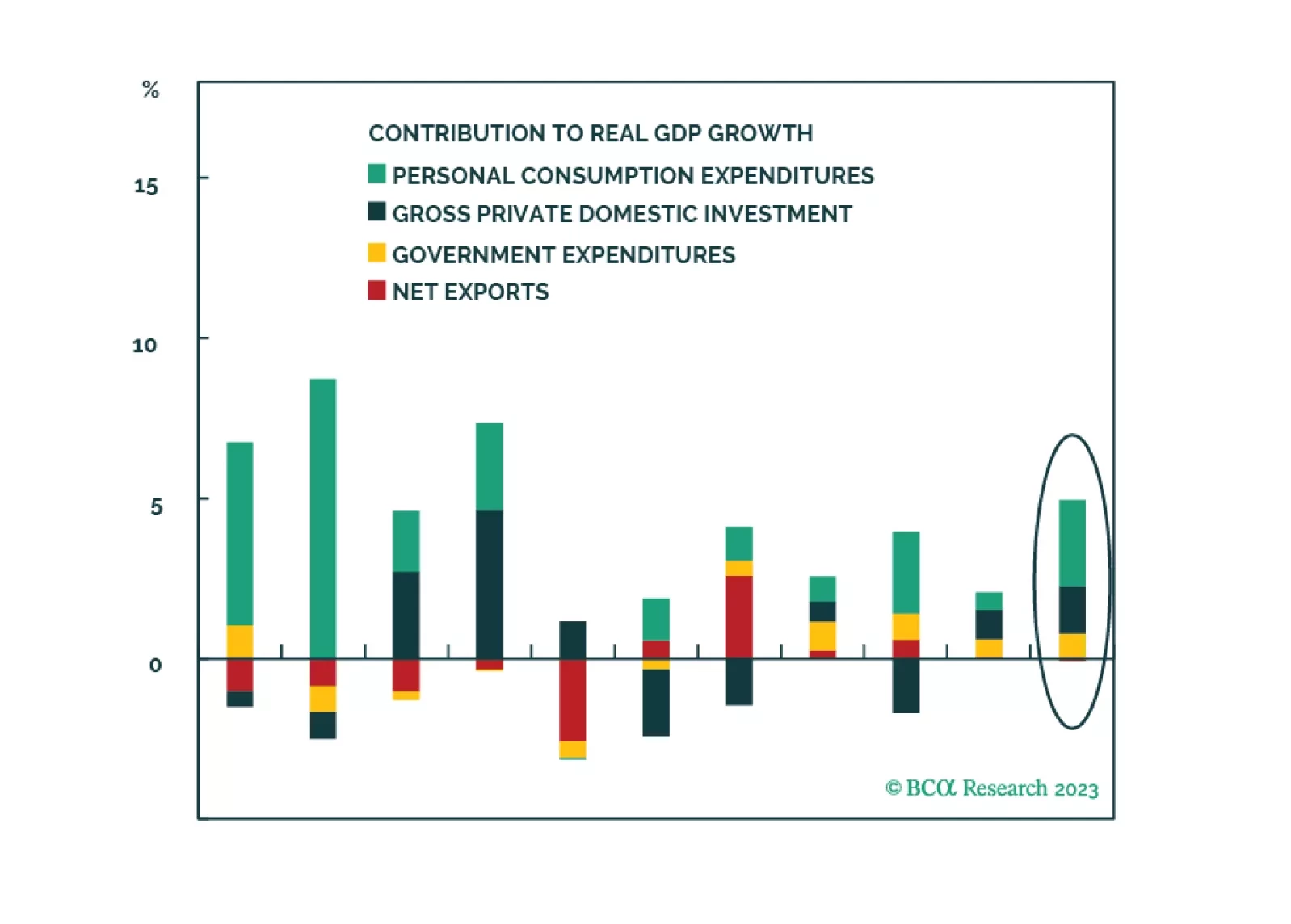

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

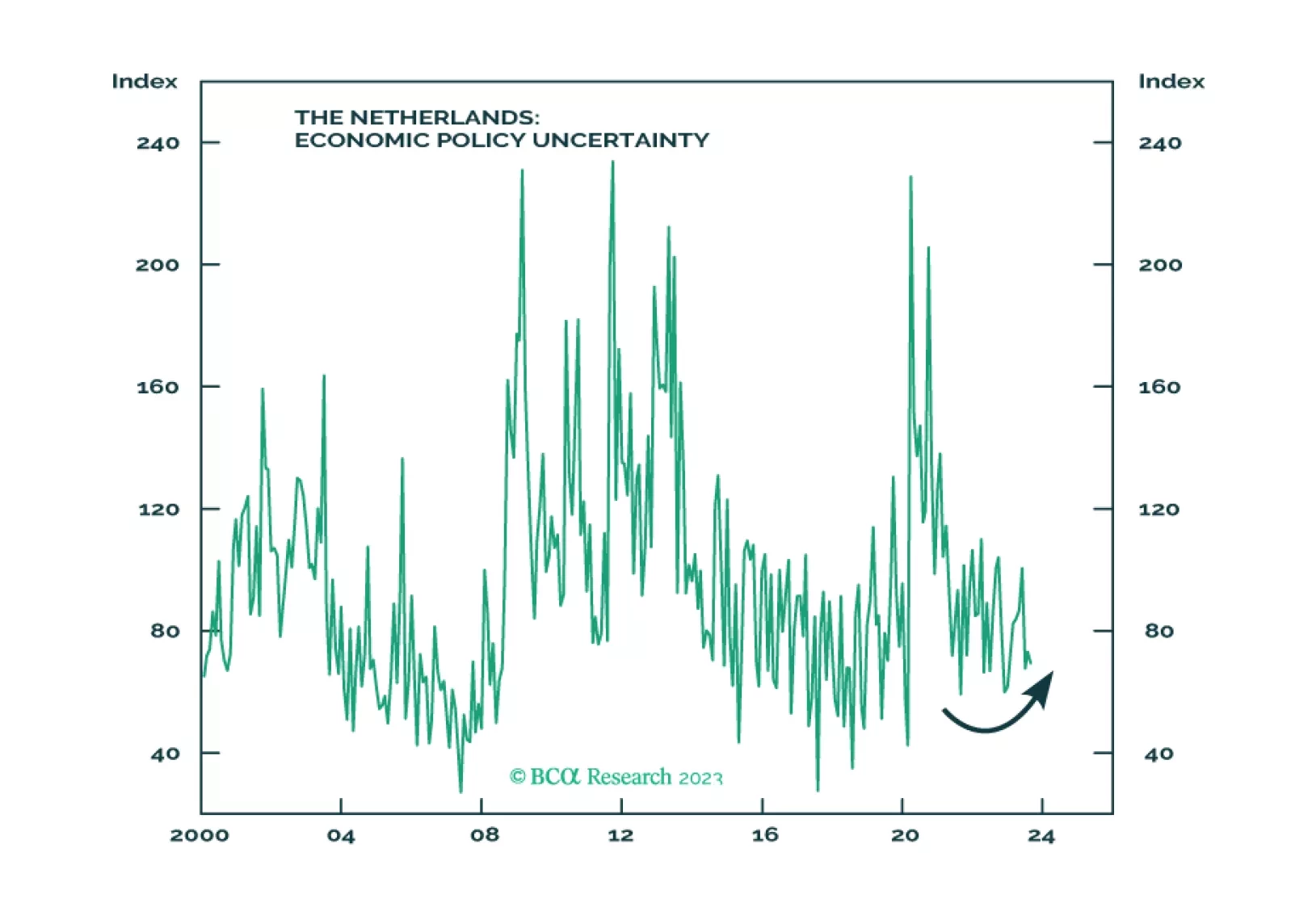

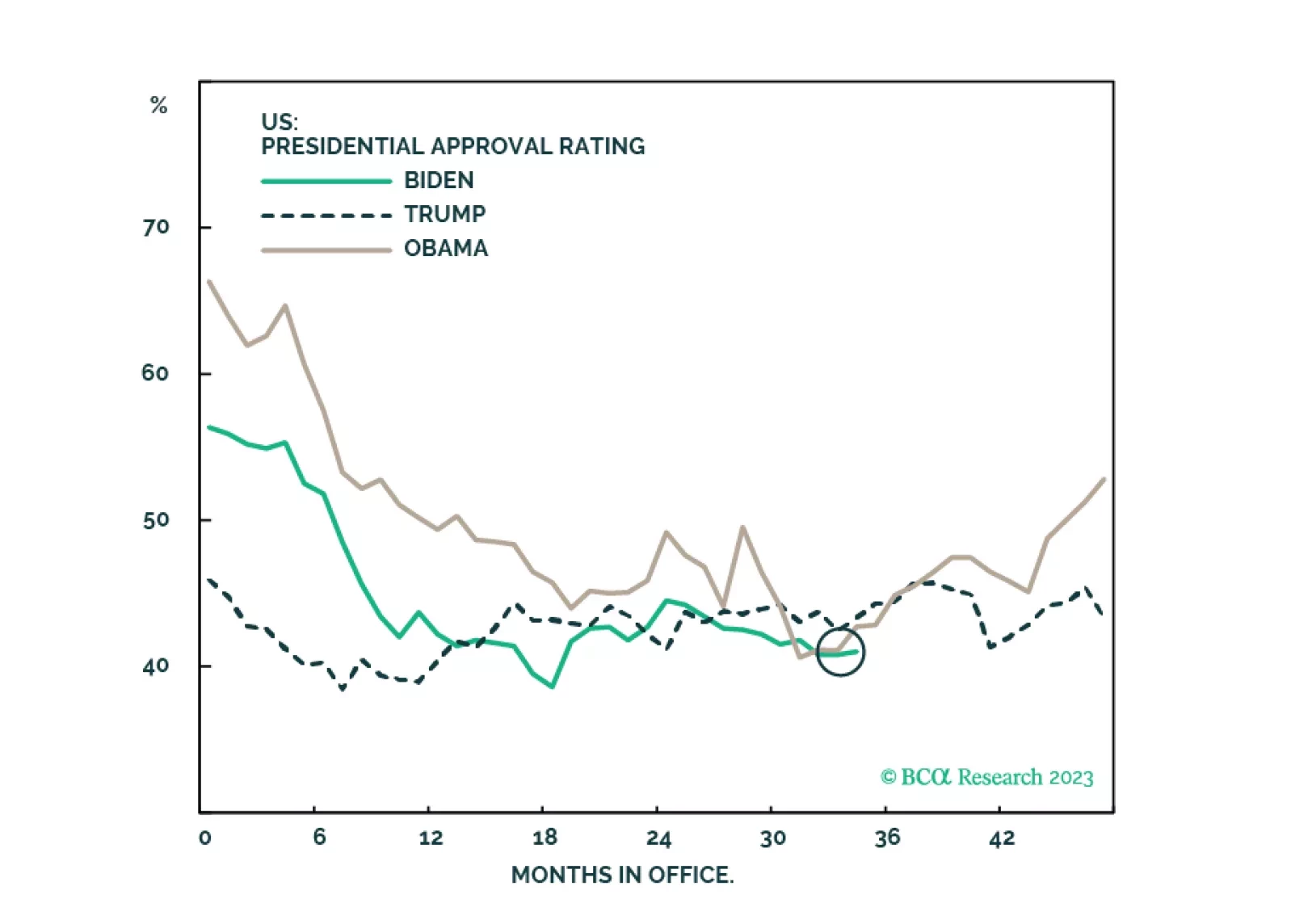

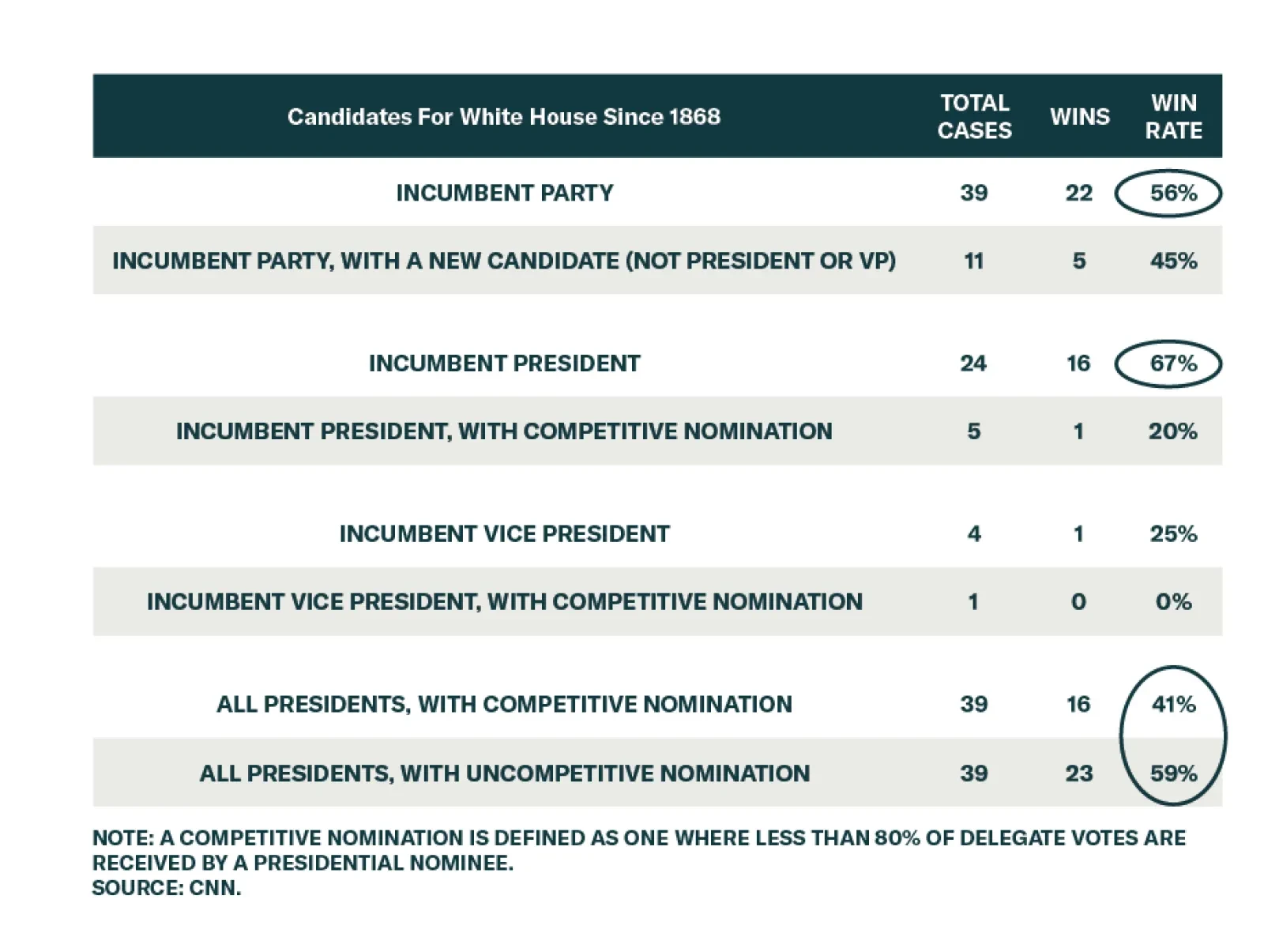

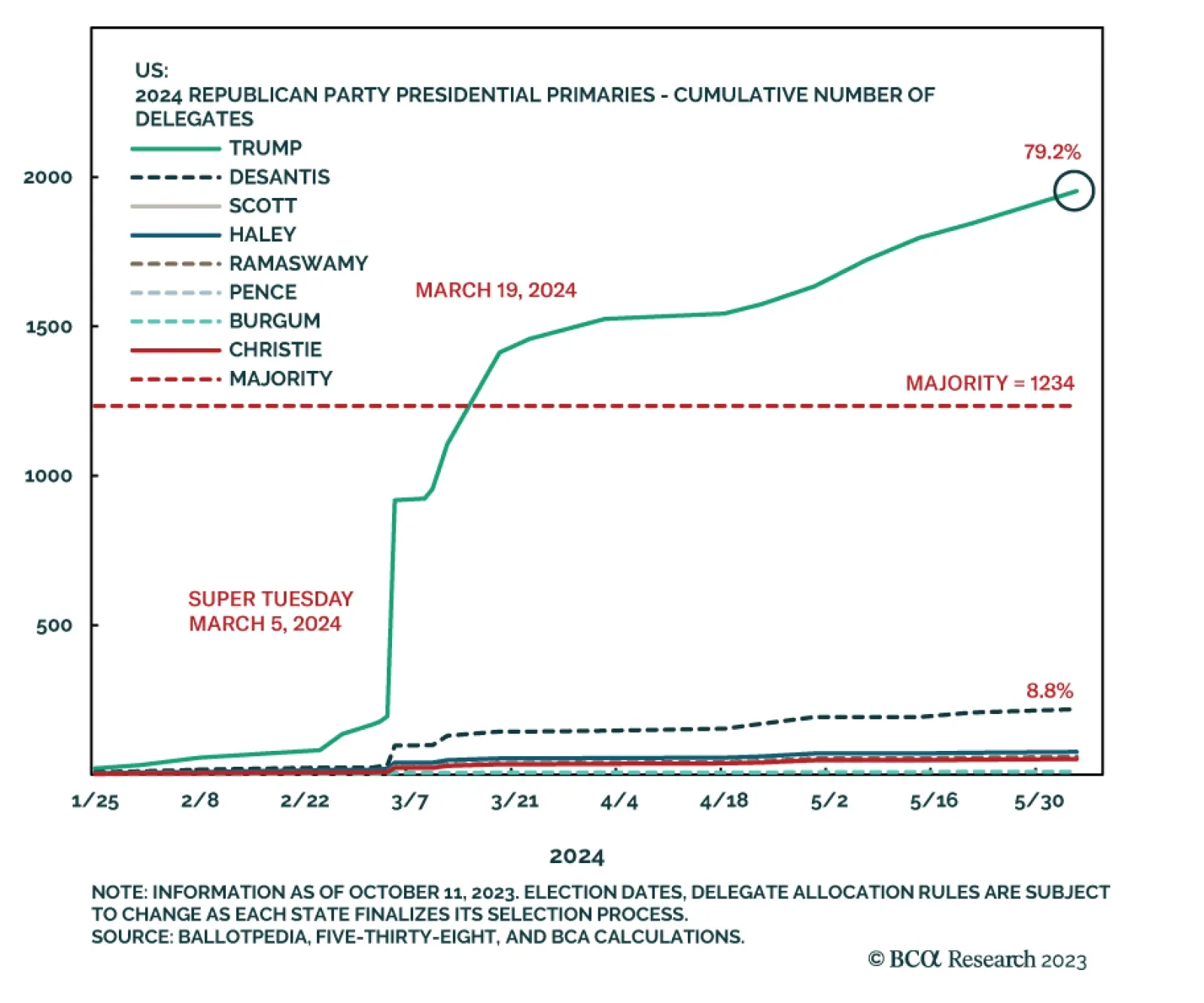

According to BCA Research’s US Political Strategy service, Trump is lined up to win the Republican presidential nomination by March 19, 2024. The takeaway is greater risk of party change, higher US and global policy…

More equity volatility is coming in the short run. Trump’s nomination looks to be smooth, which marginally reduces the incumbent party advantage and increases policy uncertainty.

According to BCA Research’s US Political Strategy service, the odds of a US government shutdown are 50/50 and will go higher if Democrats harden their demands or if Republicans pick a populist speaker. The next deadline…

There is a connection between the bond market meltdown and Republican Party’s meltdown. Investors should expect more short-term financial market volatility as a result of the triple whammy of high bond yields, high oil prices, and a…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.