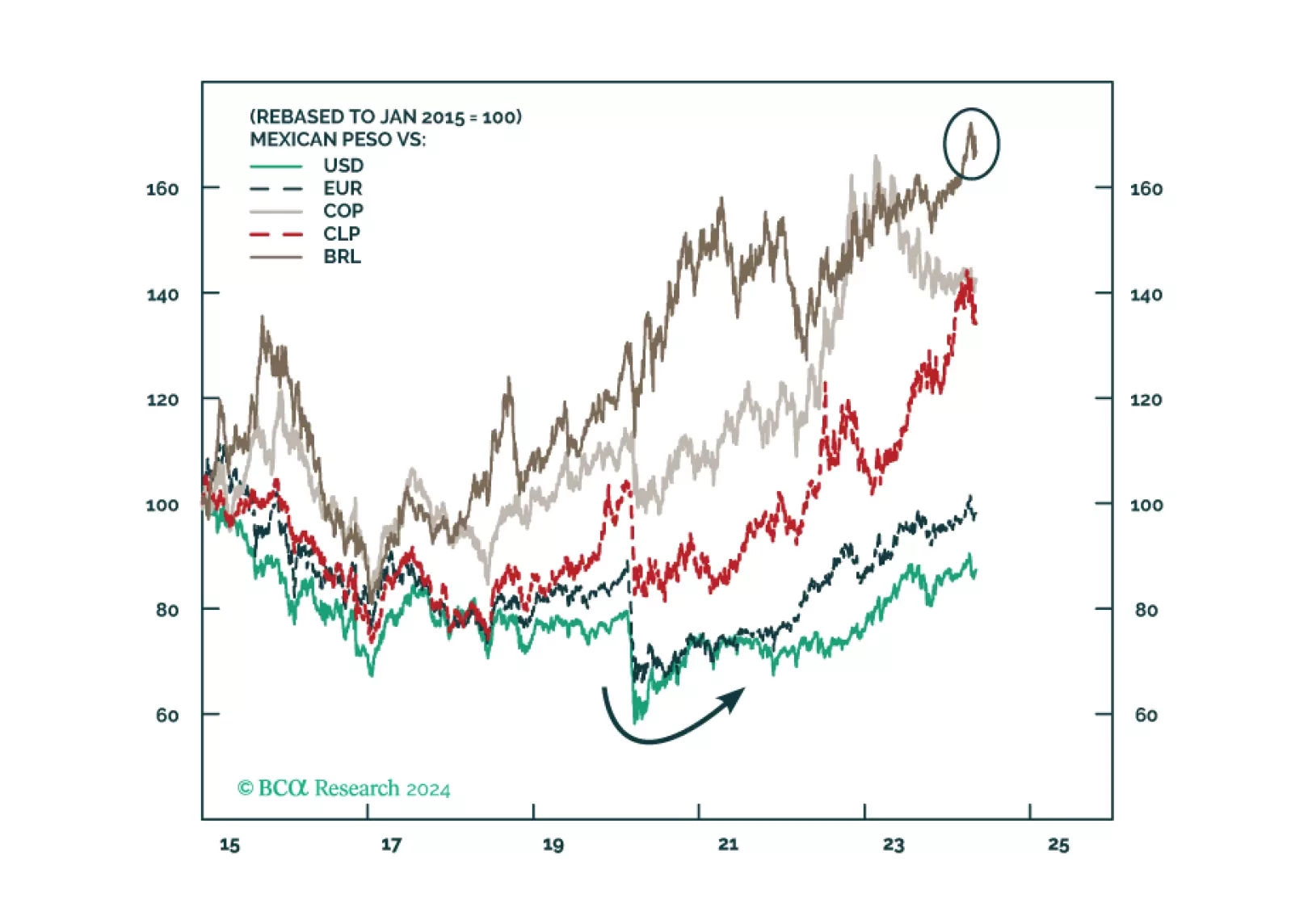

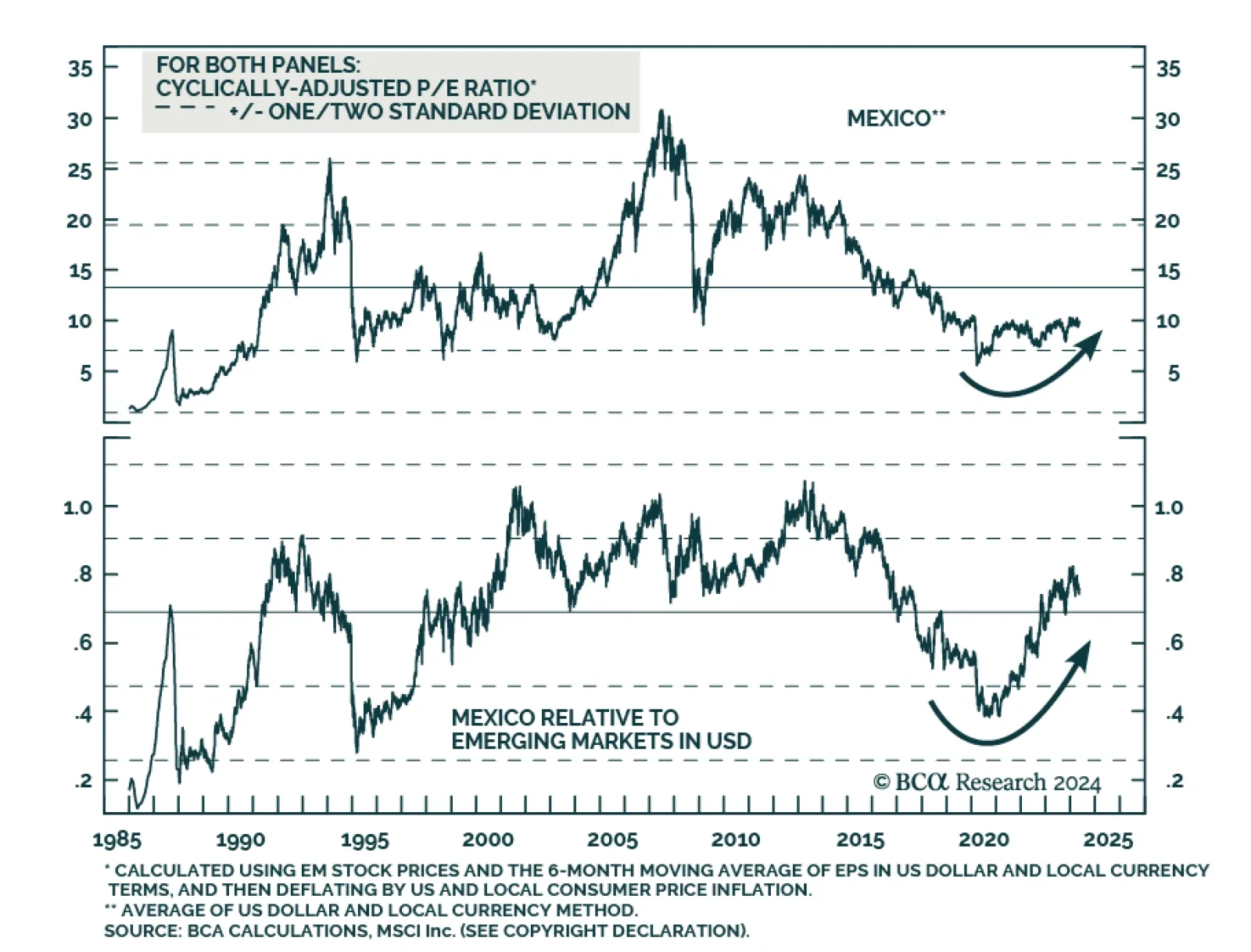

According to BCA Research’s Geopolitical Strategy service, Mexico’s presidential election on June 2 is likely to produce policy continuity, but a big win for the ruling party would be market-negative, at least…

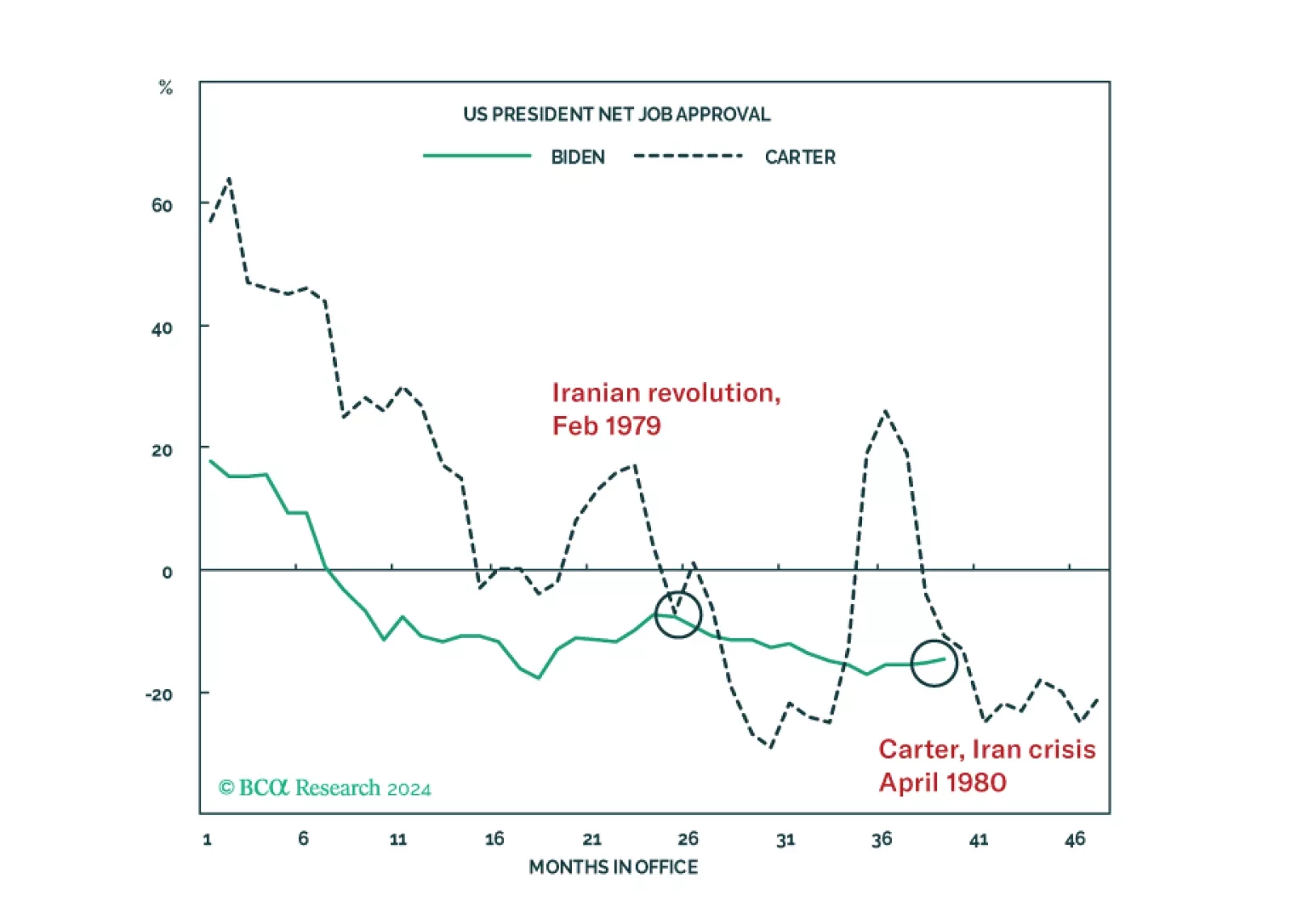

According to BCA Research’s US Political Strategy service, US politics this decade will follow three strategic themes for the decade: (1) generational change, (2) peak polarization, (3) limited big government.…

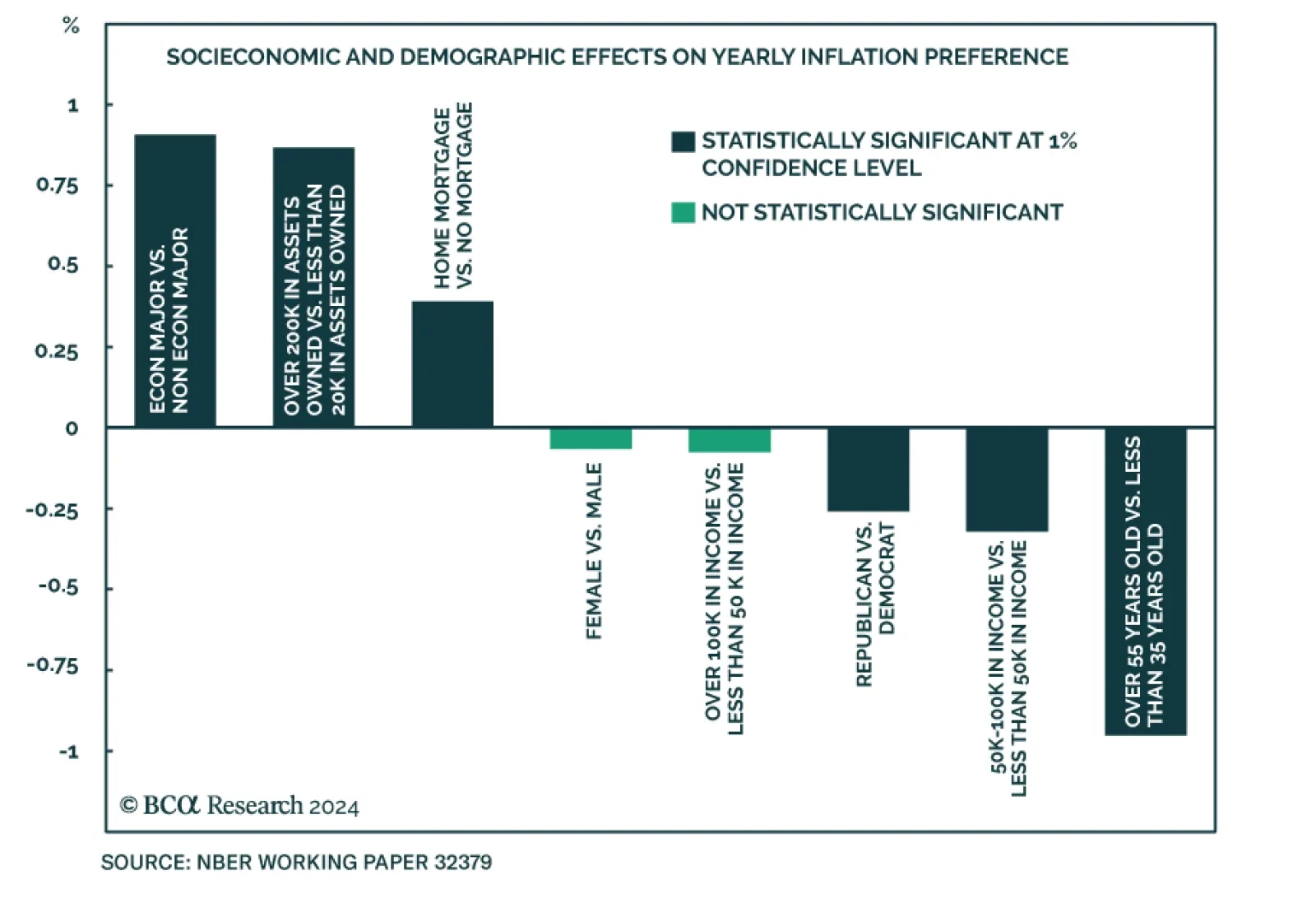

The Federal Reserve has a target inflation of 2%. But what level of inflation does the American public actually prefer? A recent NBER paper titled “Inflation Preferences” by Afrouzi, Dietrich, Myrseth, Priftis, and…

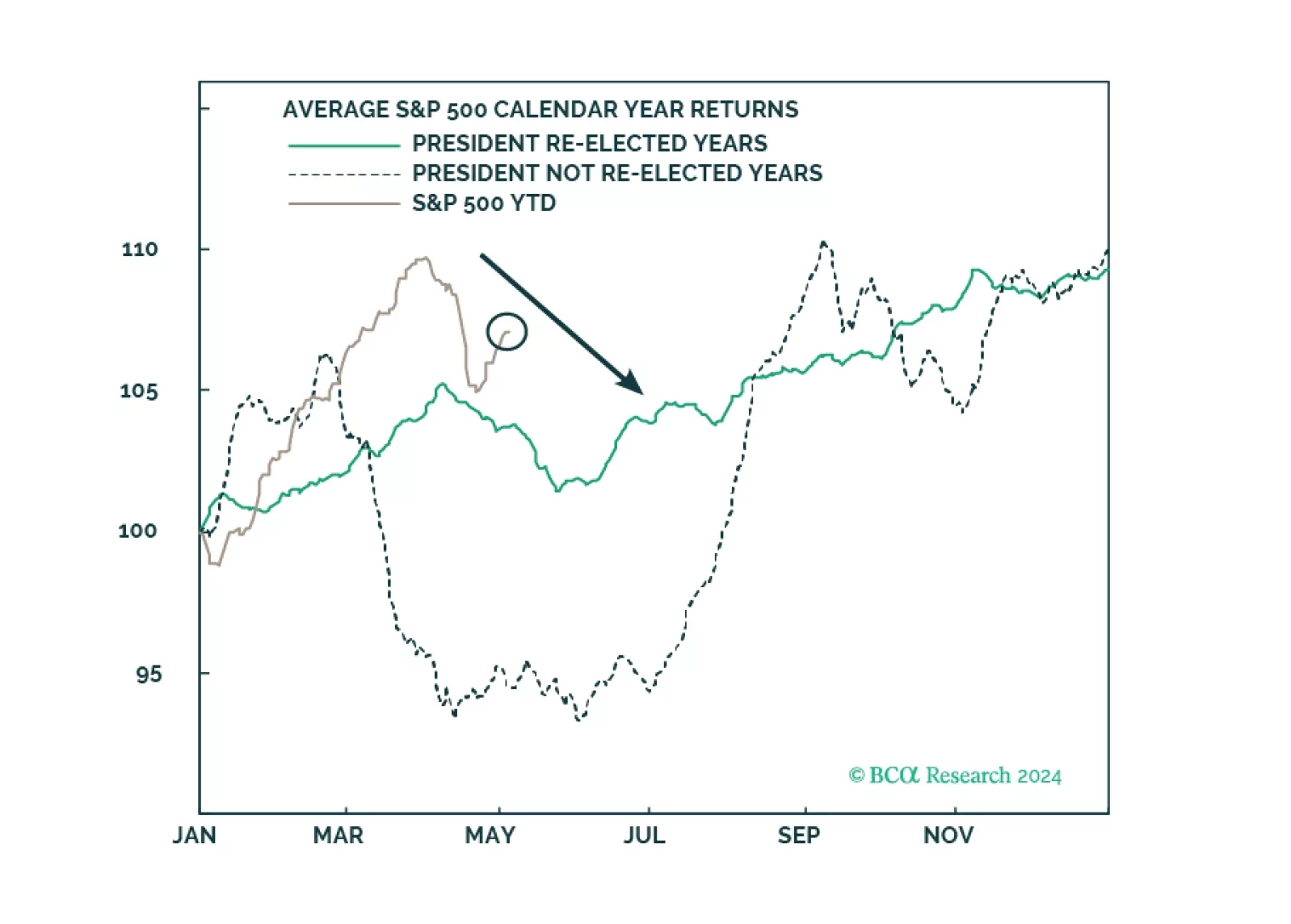

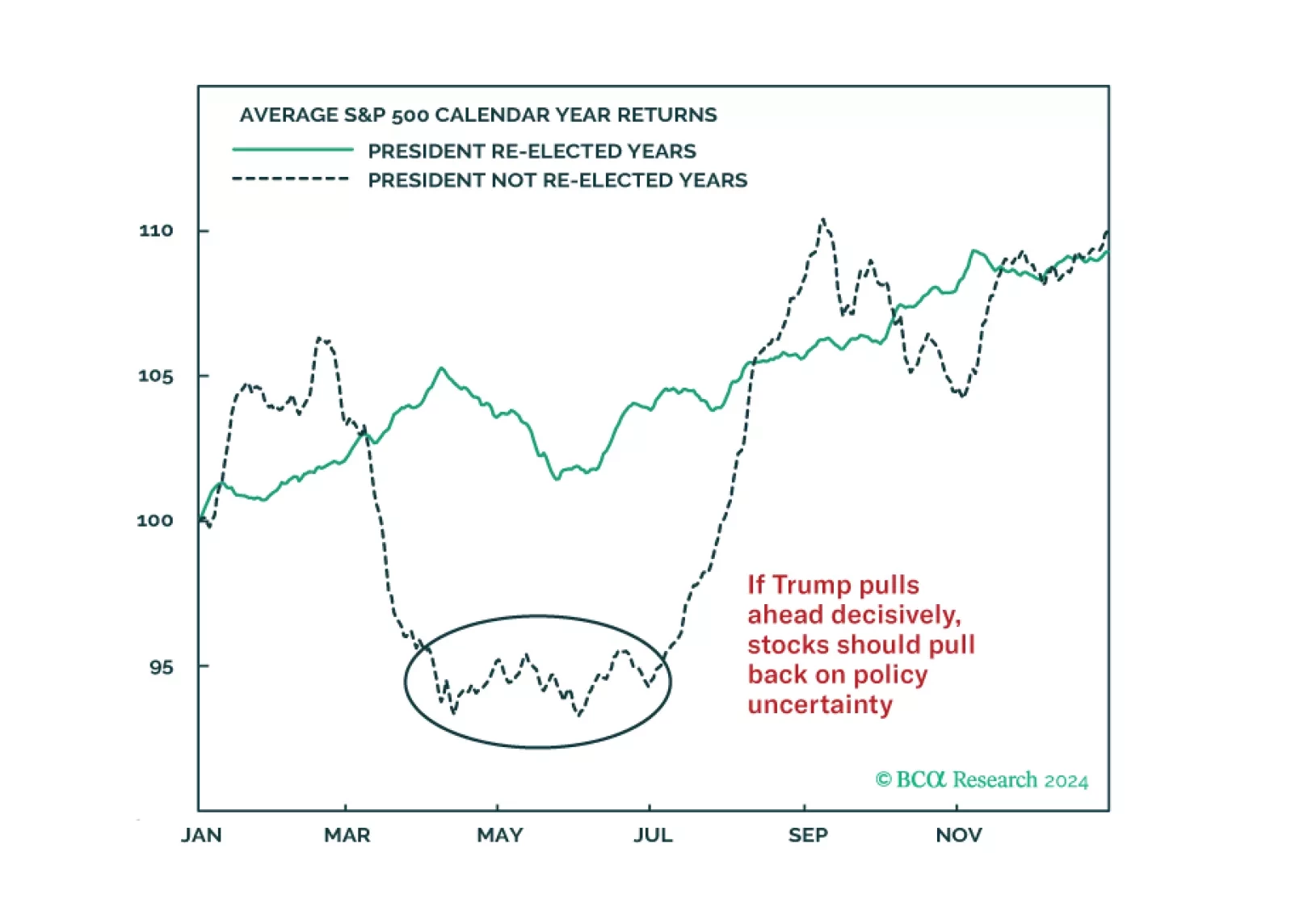

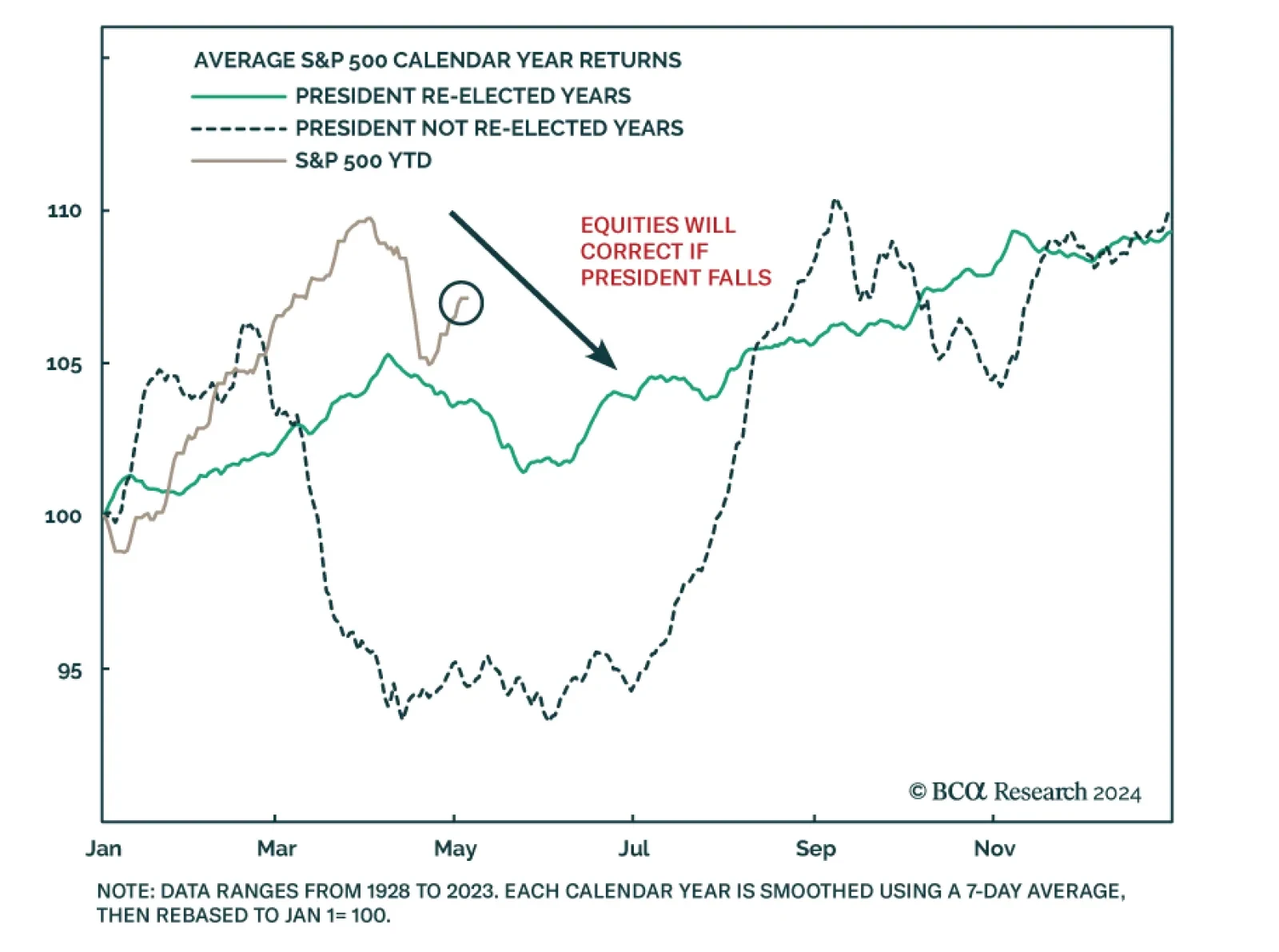

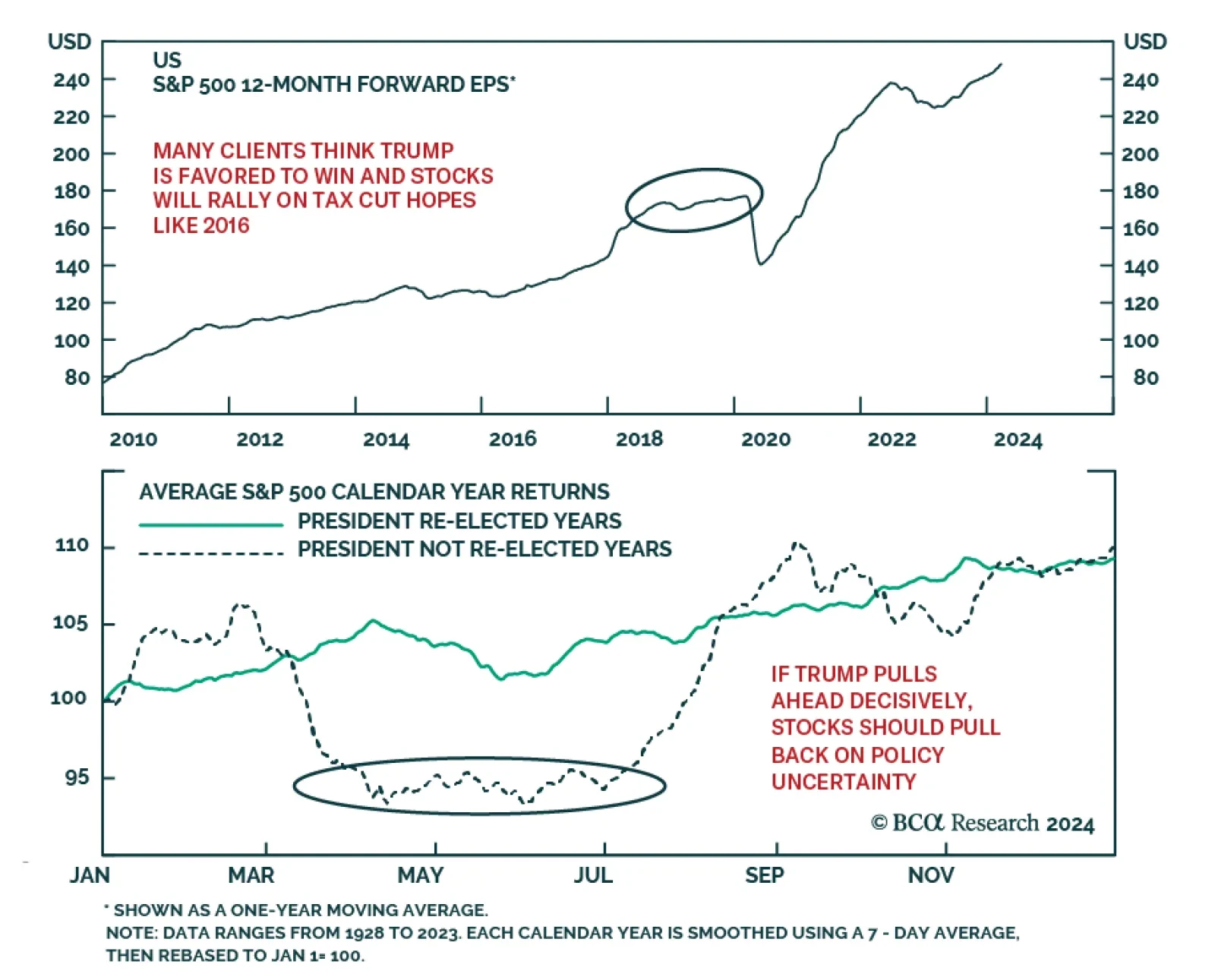

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

Our quant models suggest Democrats are still slightly favored for the White House. Our Senate model favors Republican control, though Montana and Ohio are the weak links that could deliver Democrats a de facto Senate majority in the…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

According to BCA Research’s Geopolitical Strategy service, Trump’s agenda is structurally inflationary and would eventually be needed to be discounted by markets, if he wins. Most retail investors – and many…

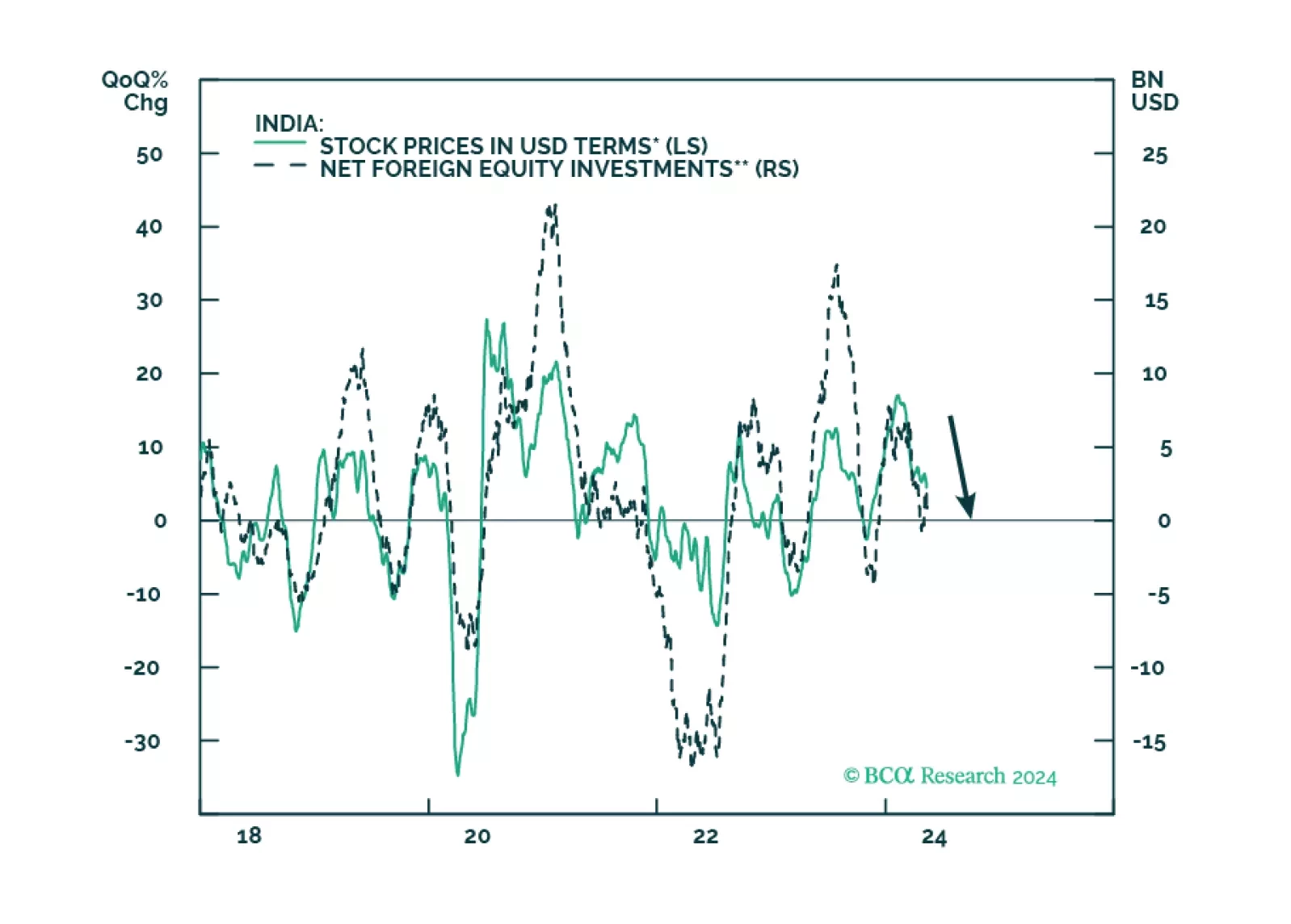

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…