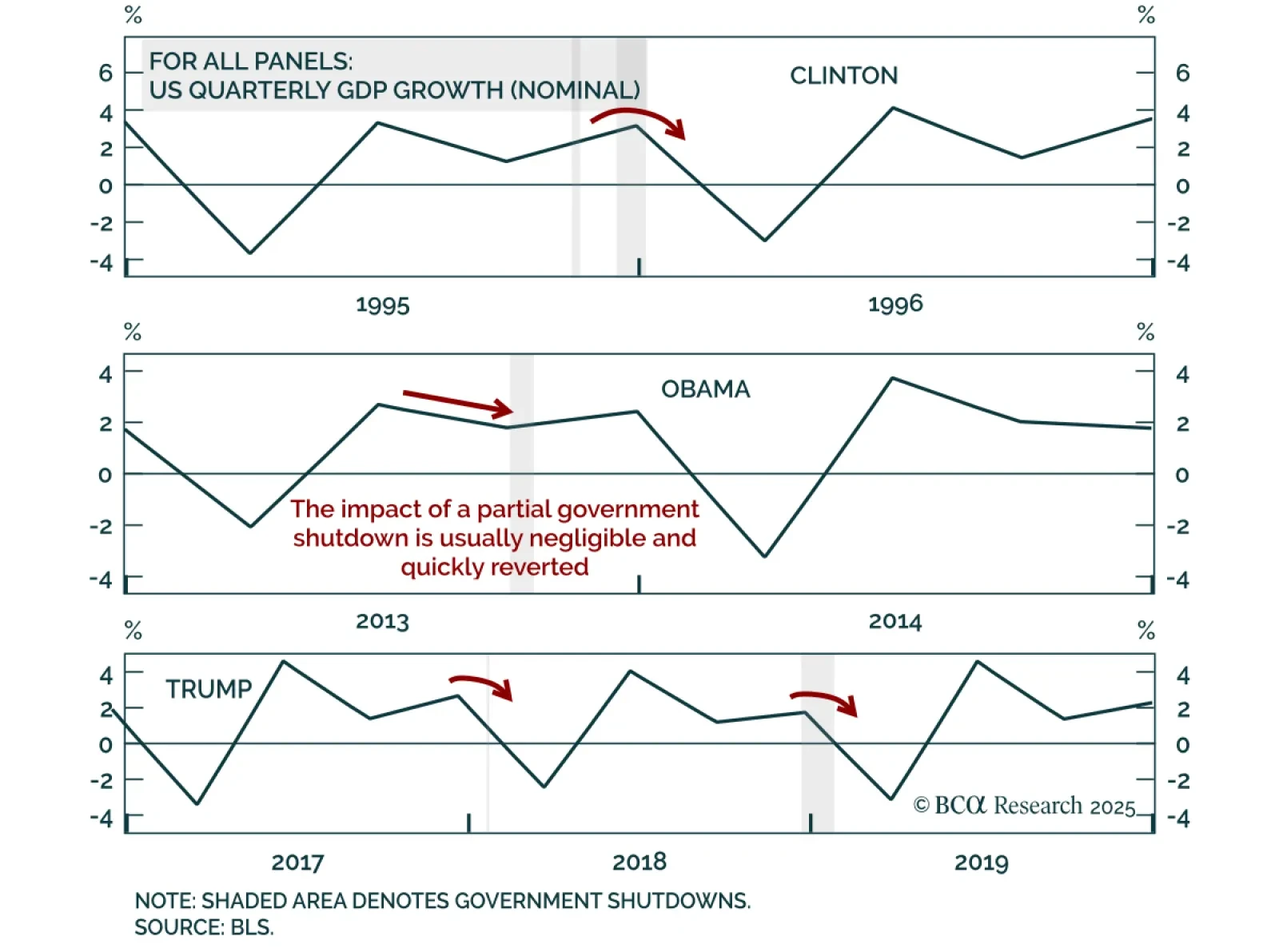

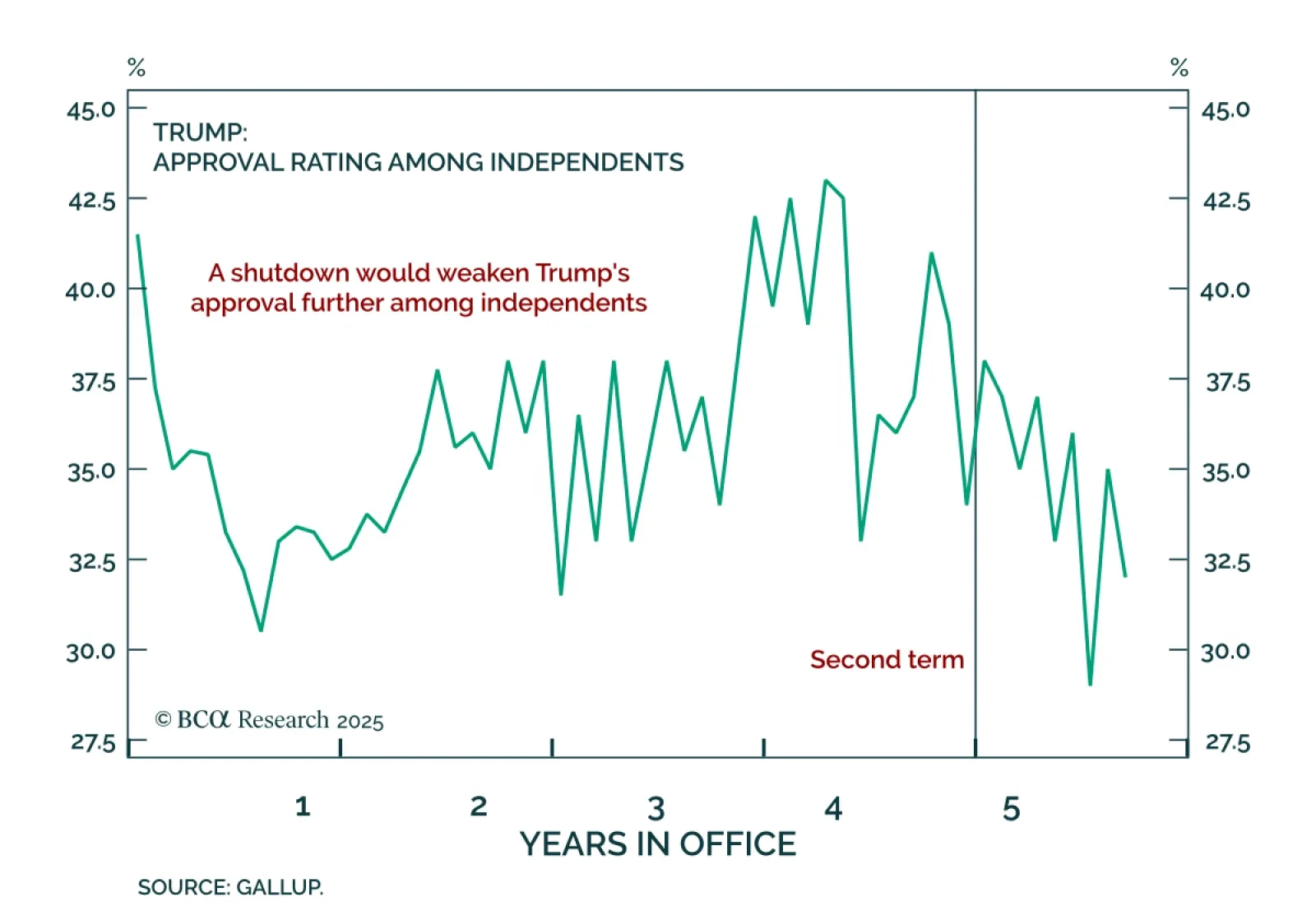

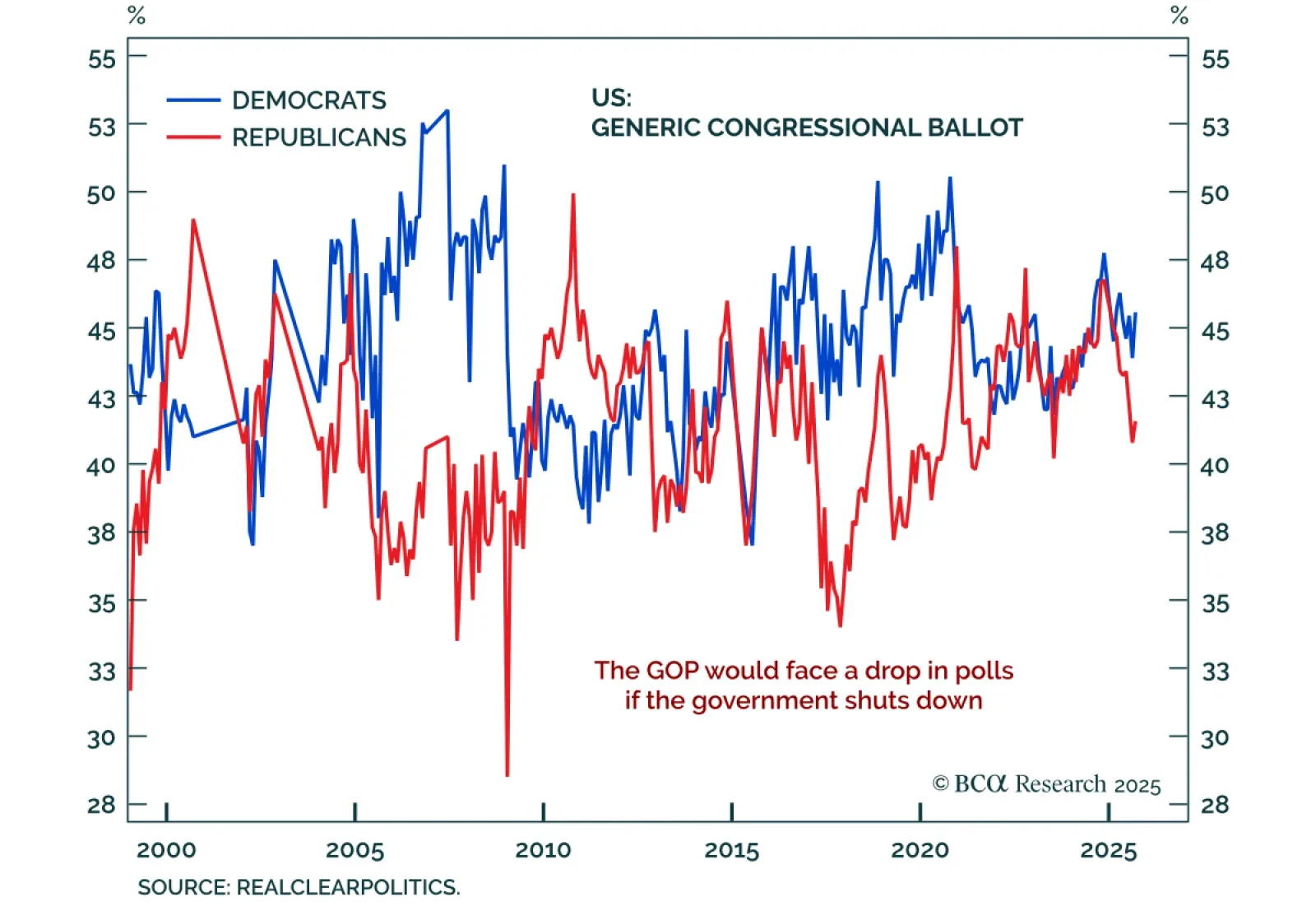

The October 1 partial US government shutdown risks denting near-term GDP and sentiment but should present a buying opportunity if it triggers equity weakness. The US federal government partly shutdown on October 1 after the…

President Trump said a partial federal government shutdown is "probably likely" late in the afternoon on September 30. Senators have until midnight to pass a continuing resolution already passed by the House that would keep the…

Will the US federal government shutdown on October 1? Congressional leaders are meeting with President Trump in the White House as we go to press. If eight Democratic senators do not vote with Republicans to pass a no-frills "…

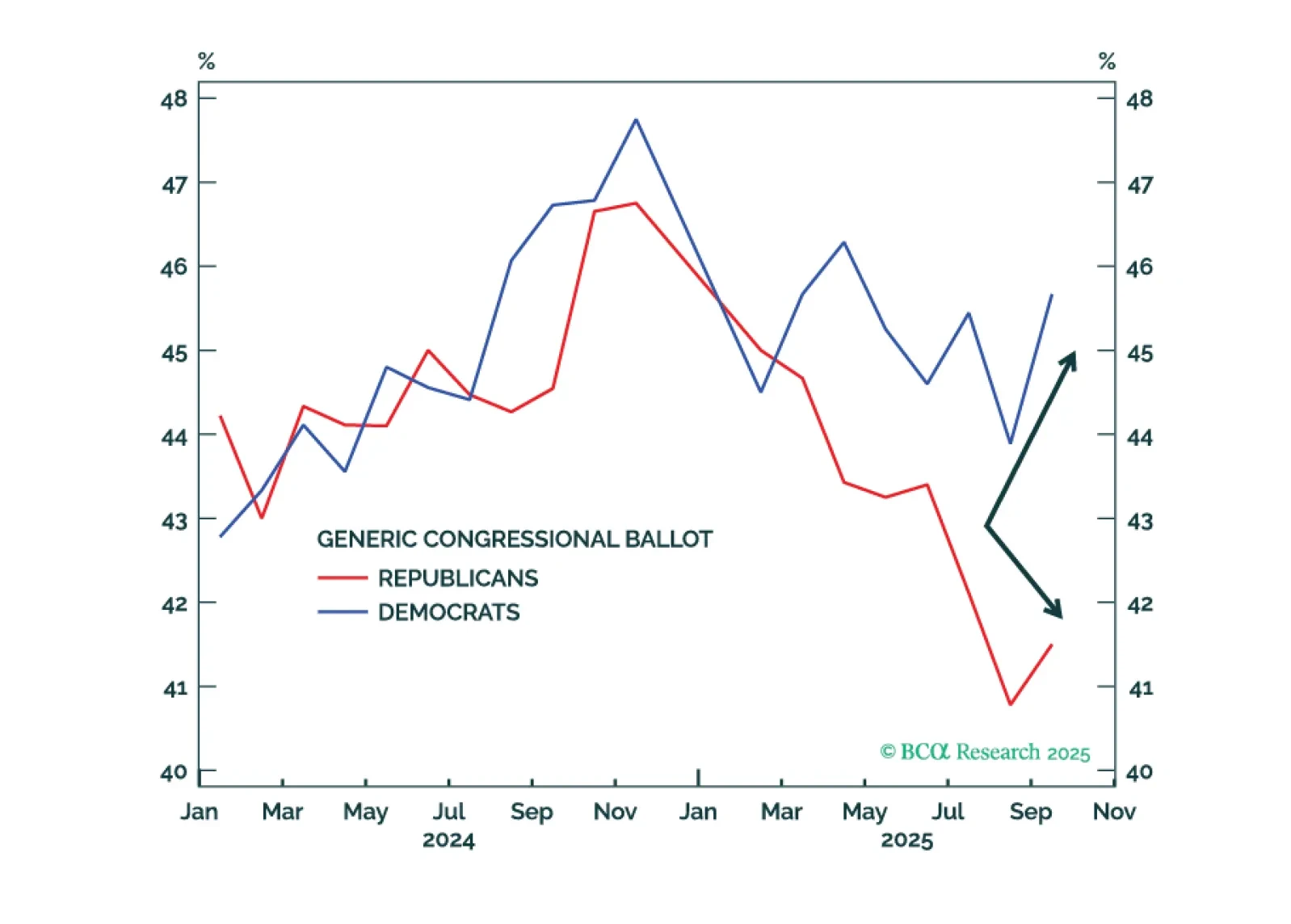

We give a one-third probability of a federal government shutdown. It probably will not happen before November. At worst, government shutdowns only cause temporary market volatility.

Our US Political Strategists give a one-third probability of a federal government shutdown before November. The odds could increase after that. But the market impacts are limited. The source of the disagreement is the enhanced…

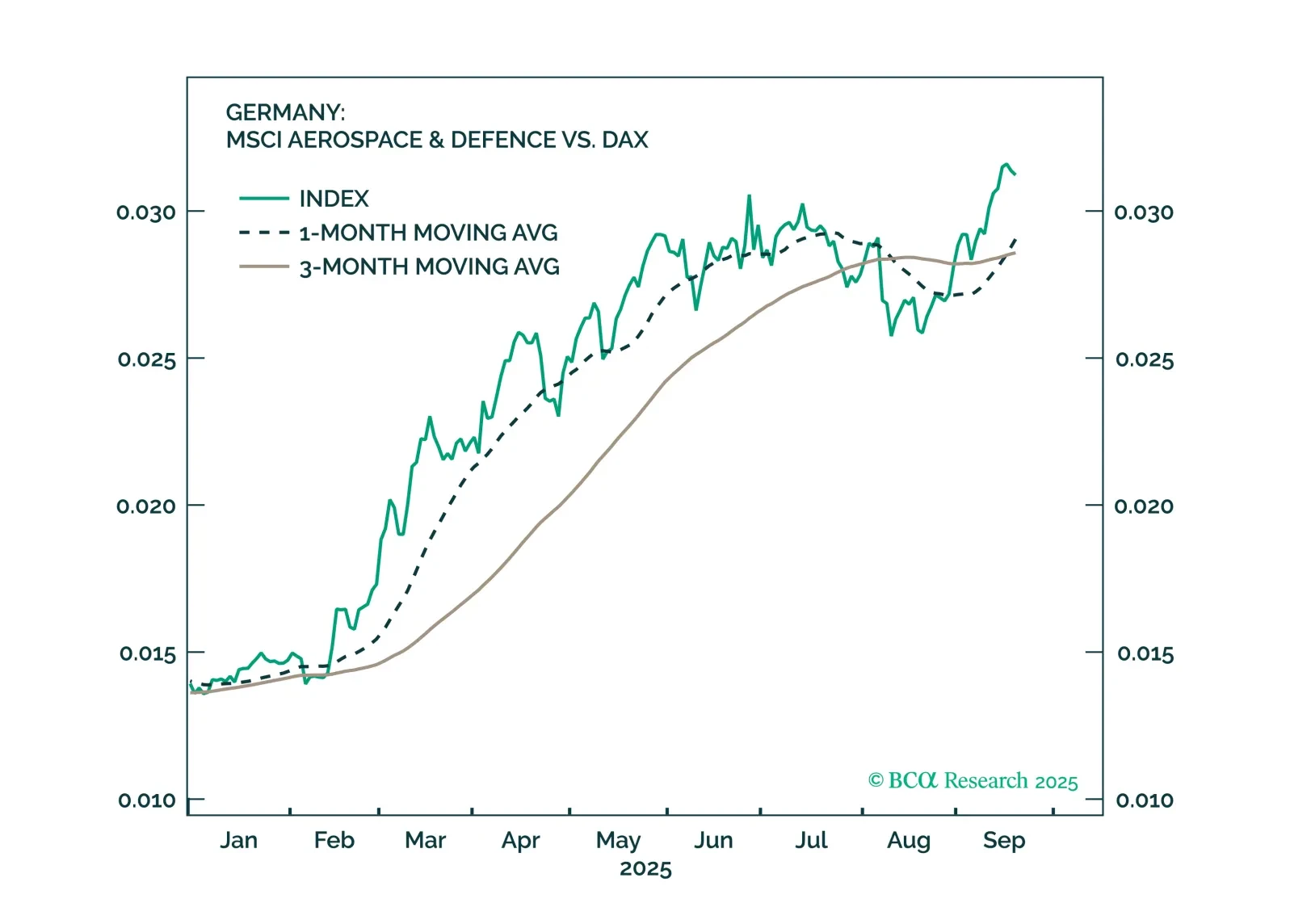

Germany is moving forward with implementing the large fiscal and defence spending announced earlier this year. Fiscal reforms are also positive, though they will fall short of expectations.

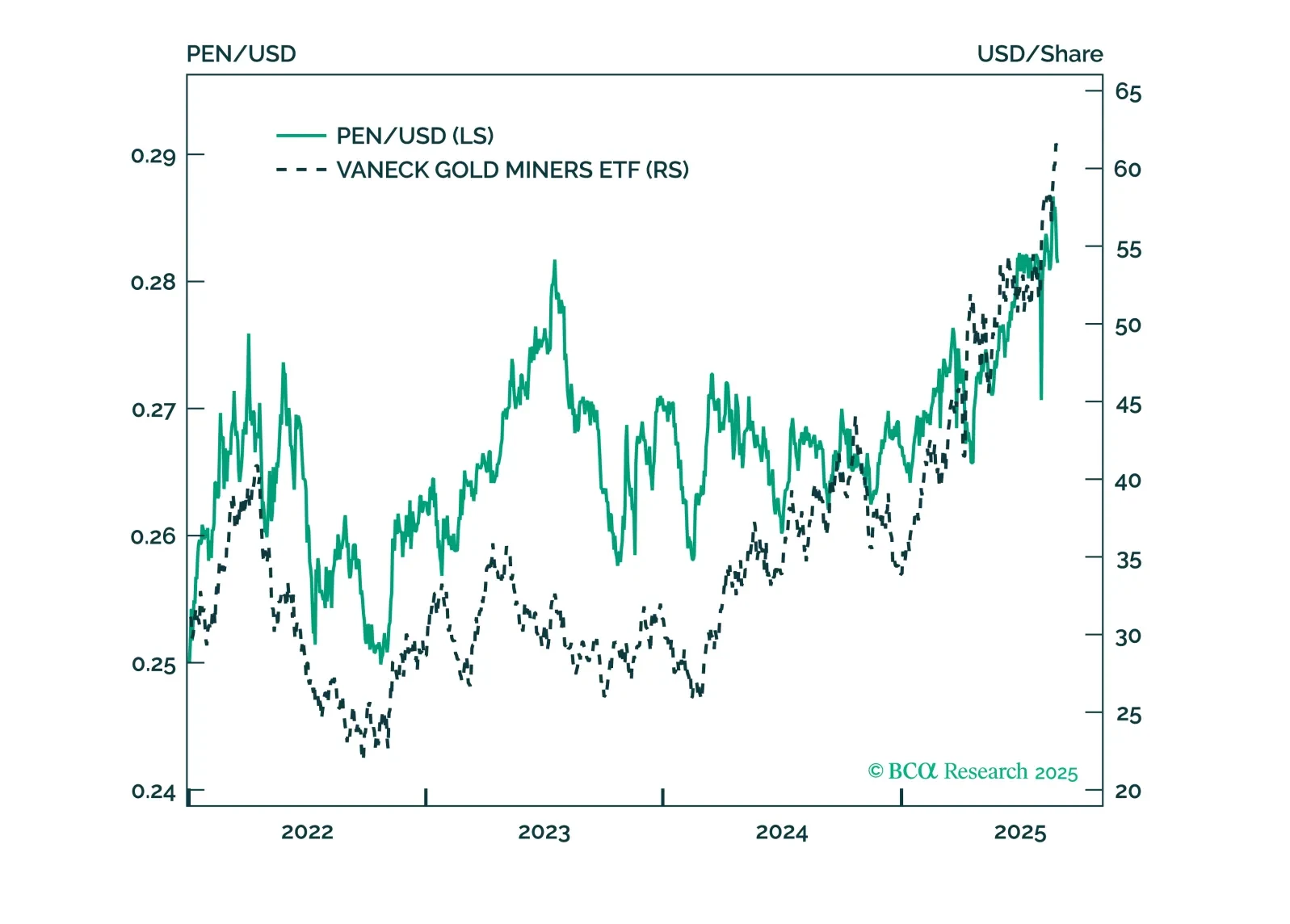

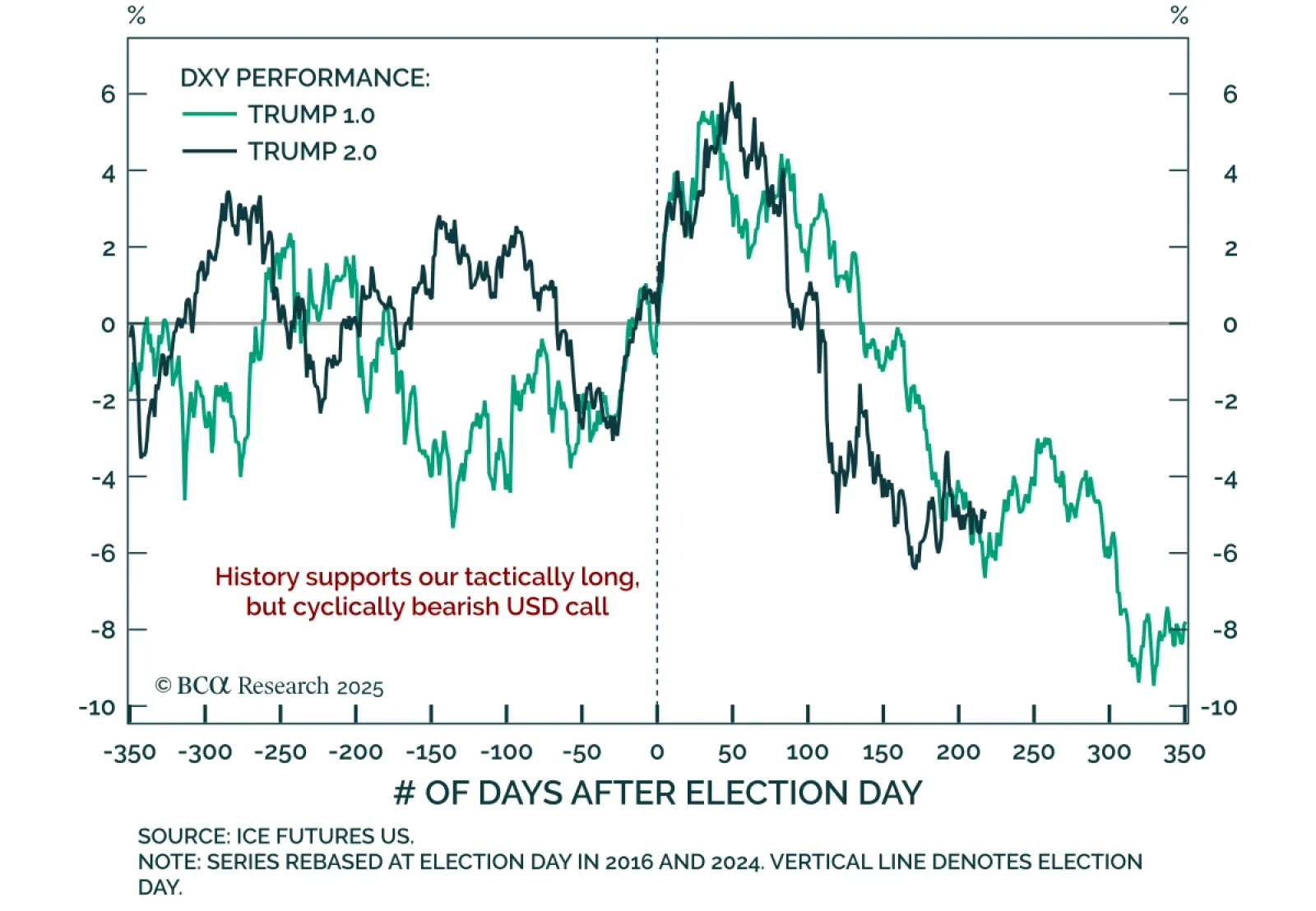

Trump-era policy patterns are reappearing in FX, supporting a temporary bounce in the dollar. Our Chart Of The Week comes from Chester Ntonifor, FX Solutions and Special Reports strategist.Chester updated his “KISS” (Keep It Simple…

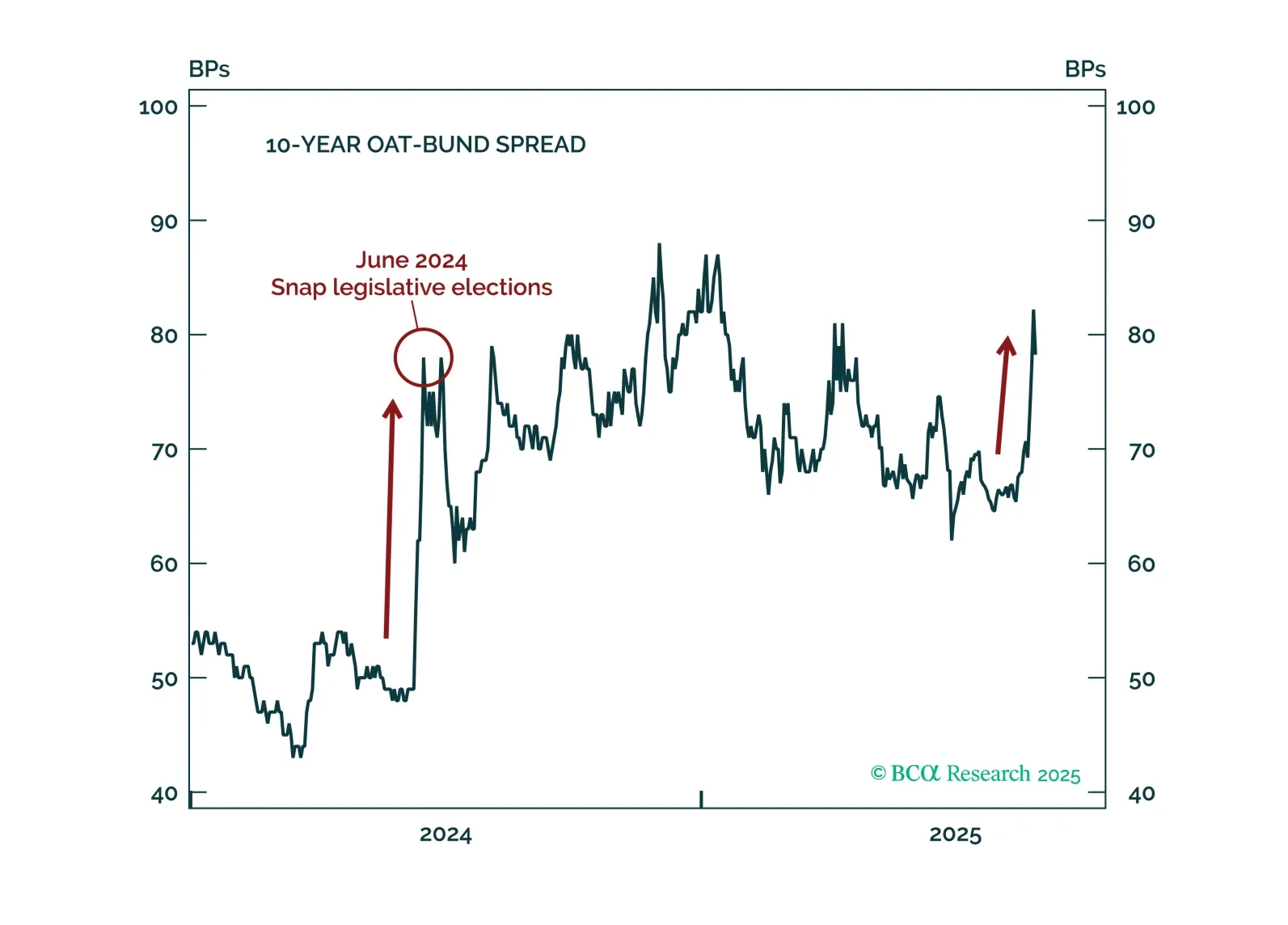

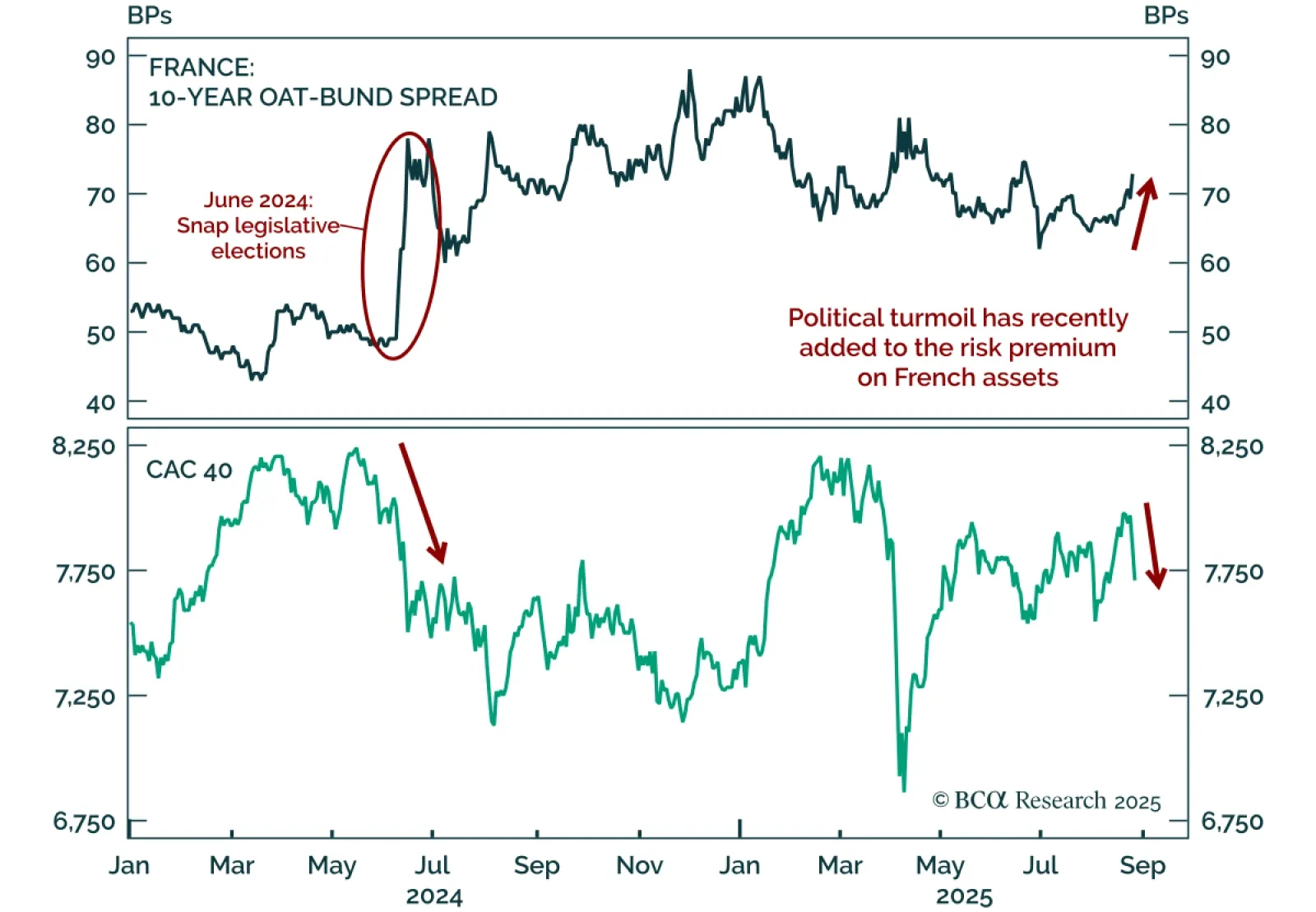

Political instability will persist in France as PM François Bayrou loses the confidence vote. The nomination of a new PM will not end the country’s political paralysis and will further fuel fiscal fears. Investors should remain…

France’s renewed political turmoil highlights fiscal risks for OATs, but creates opportunities to buy French equities on dips. PM Bayrou has called a September 8 confidence vote over his deficit-cutting budget proposals,…