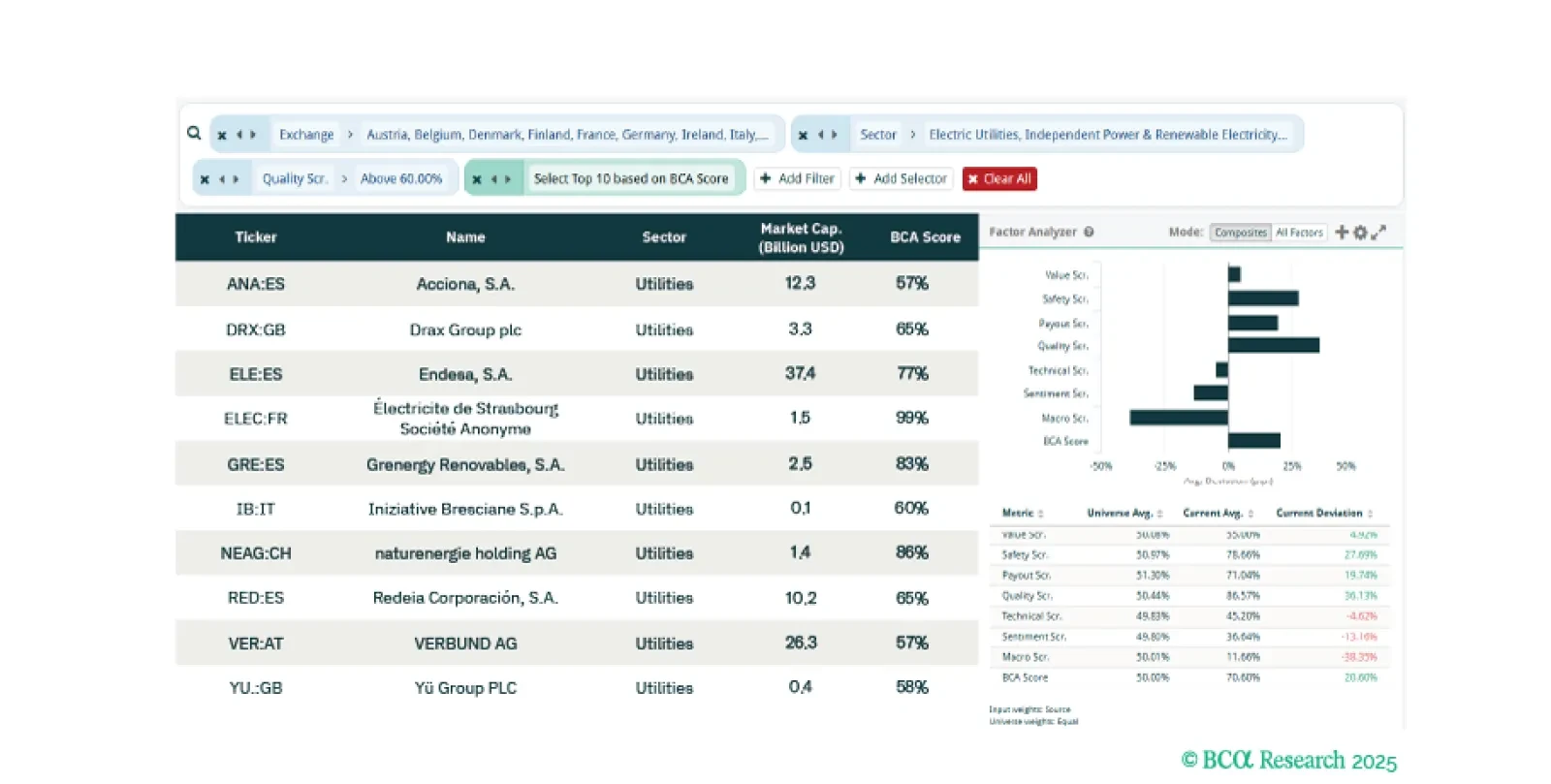

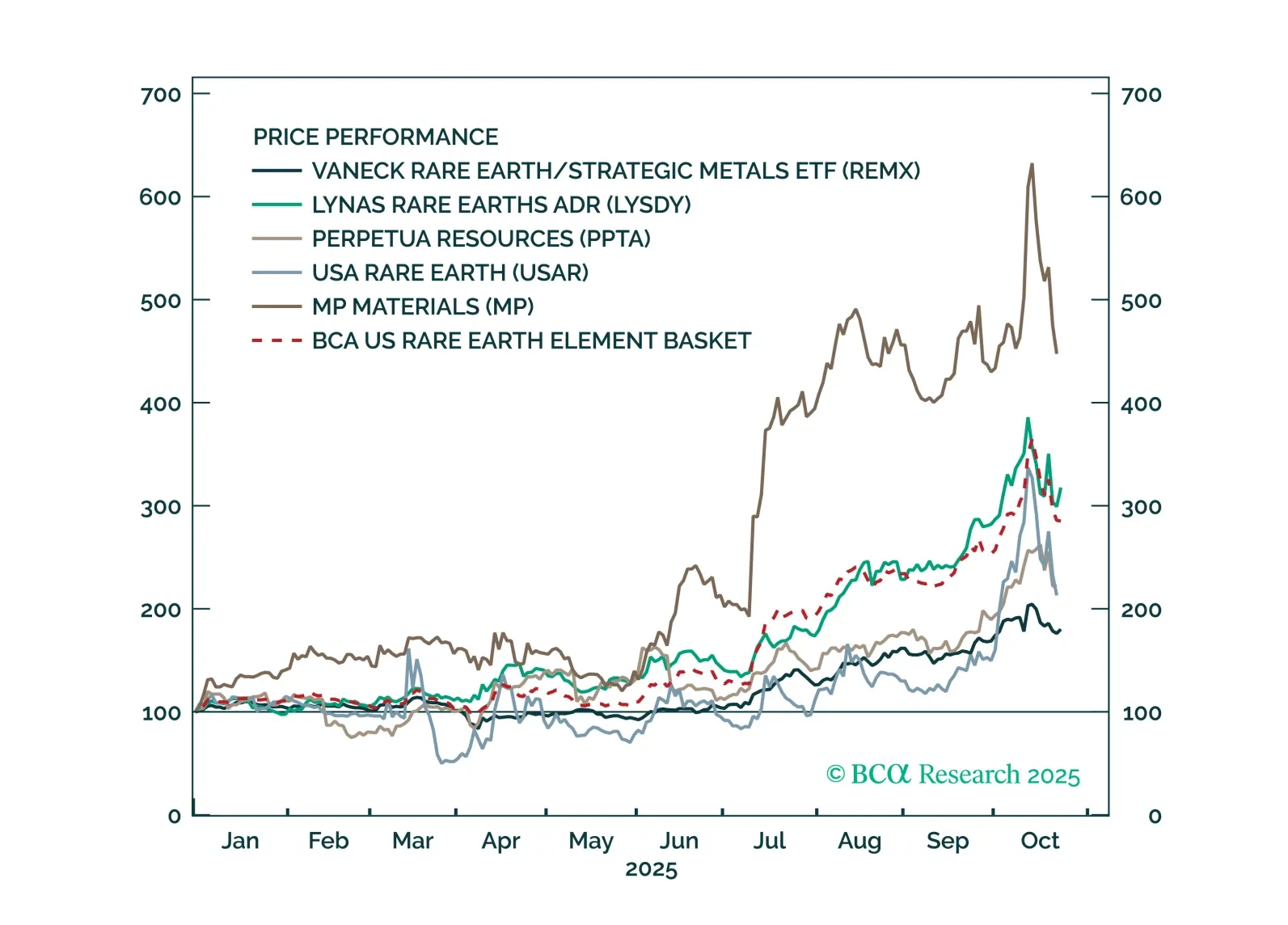

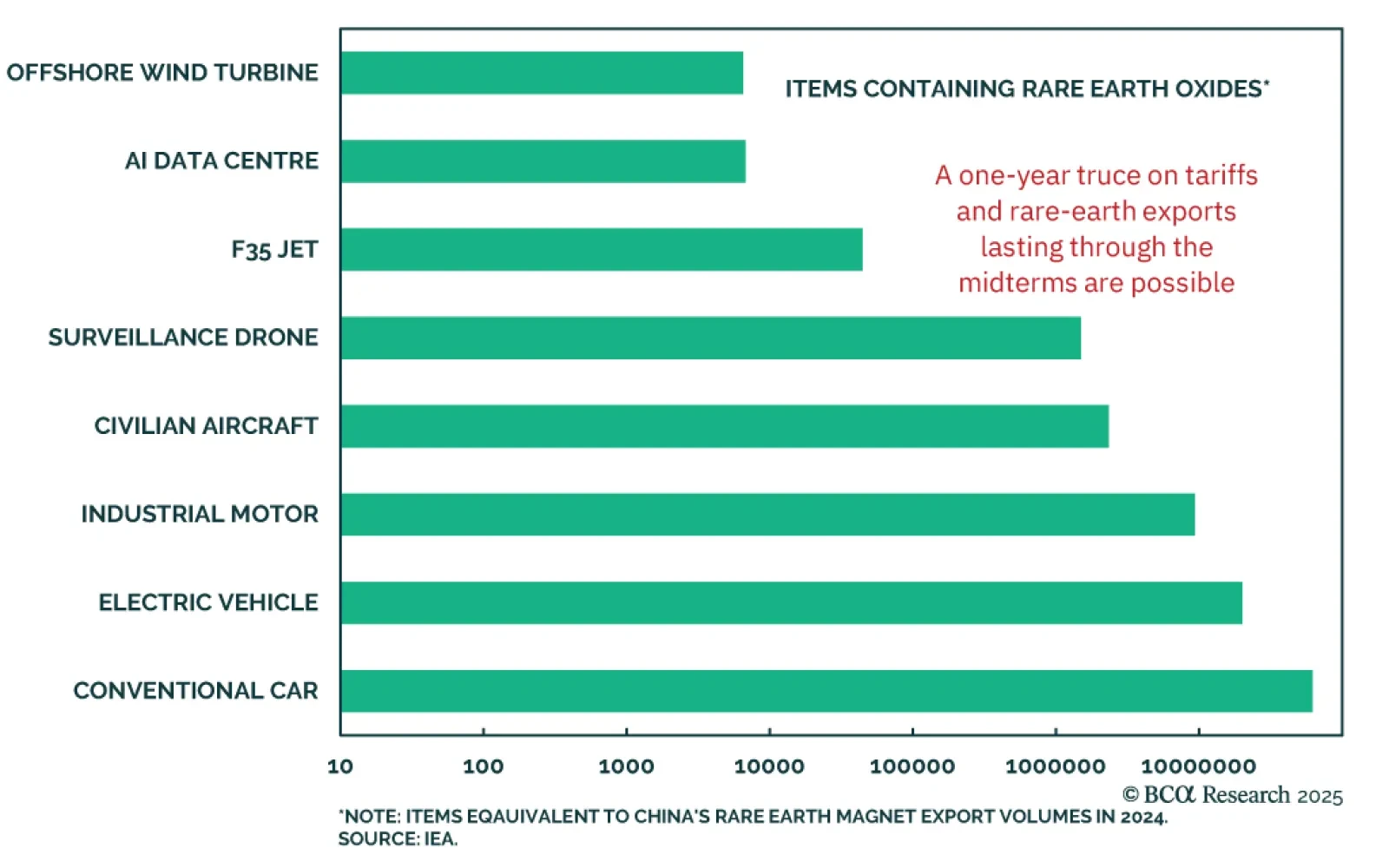

This week, our screeners explore opportunities arising from Europe’s electrification, identify high-quality Rare Earth plays, and propose a portfolio to hedge against a major global conflict.

The US and China appear to be moving toward a trade deal, though it remains unclear whether the goal is simply damage control or a genuine expansion of market access. Presidents Trump and Xi are scheduled to meet on October 30 in…

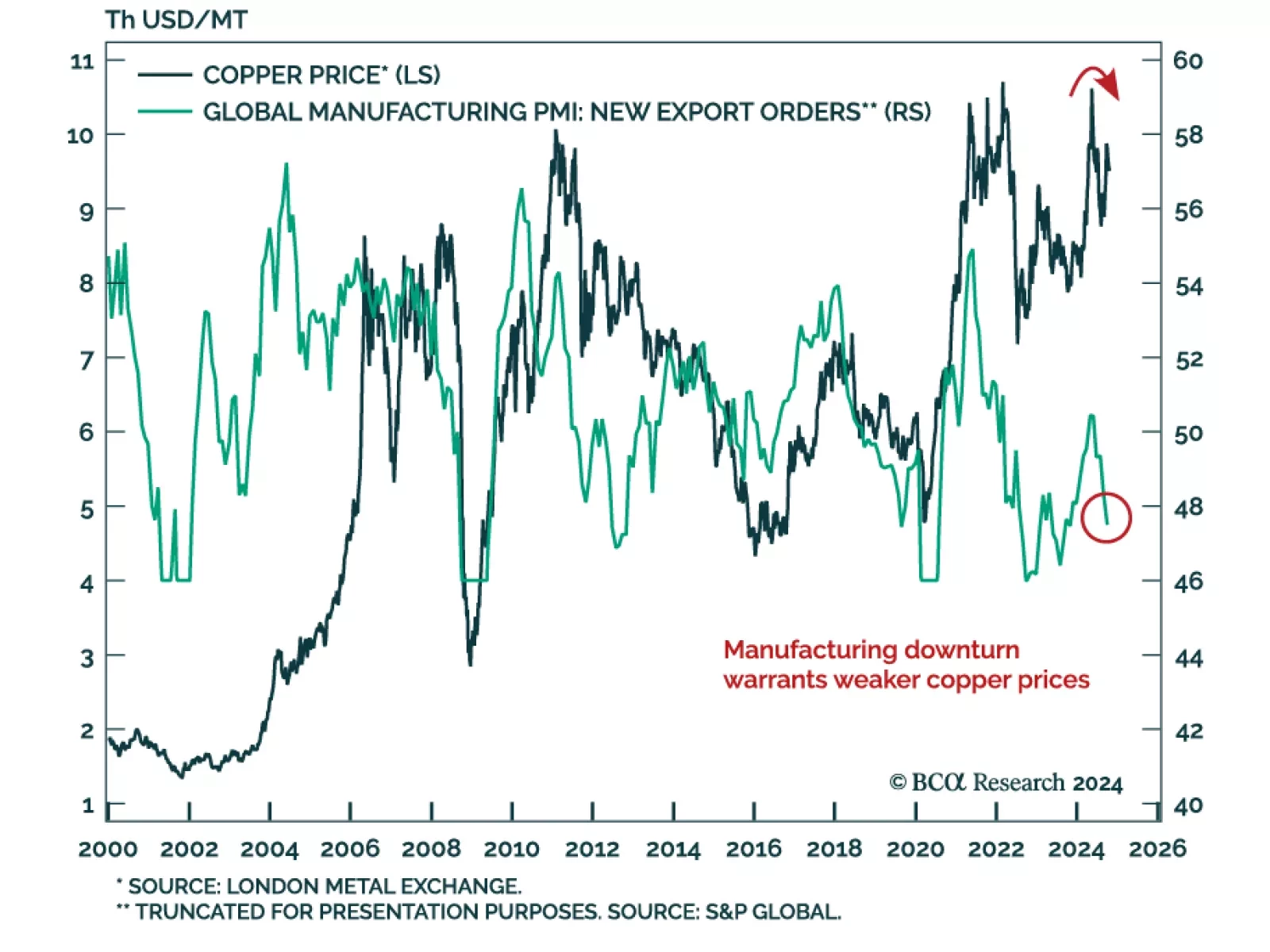

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

Today we upgrade the S&P Metals & Mining industry from underweight to neutral: This industry is one of the few beneficiaries of the war in Ukraine, as the military action and global sanctions take offline copious amounts of metals…

Highlights The bond market assumes that when recent inflation has been high, it will be higher than average for the next ten years. Yet the reality is the exact opposite. High inflation is followed by lower than average inflation.…

In yesterday’s Special Report, we initiated a long S&P oil & gas exploration & production / short S&P metals & mining market neutral trade as a way to capitalize on the China/DM growth differential on a 6 to 12-…

Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…