Executive Summary Investors Think The Fed Will Not Be Able To Raise Rates Much Above 2% The neutral rate of interest is 3%-to-4% in the United States. This is substantially higher than the market estimate of around 2%. It…

Executive Summary Higher Prices Expected Global oil supply will move lower for a few months, until shipping can be re-routed and re-priced in response to sanctions against Russian oil producers and refiners. In the…

Dear Client, Next week, in lieu of our regular weekly report, I will be hosting two webcasts where I will discuss our view on China’s economy and financial markets. In particular, I will share our view on the announced economic…

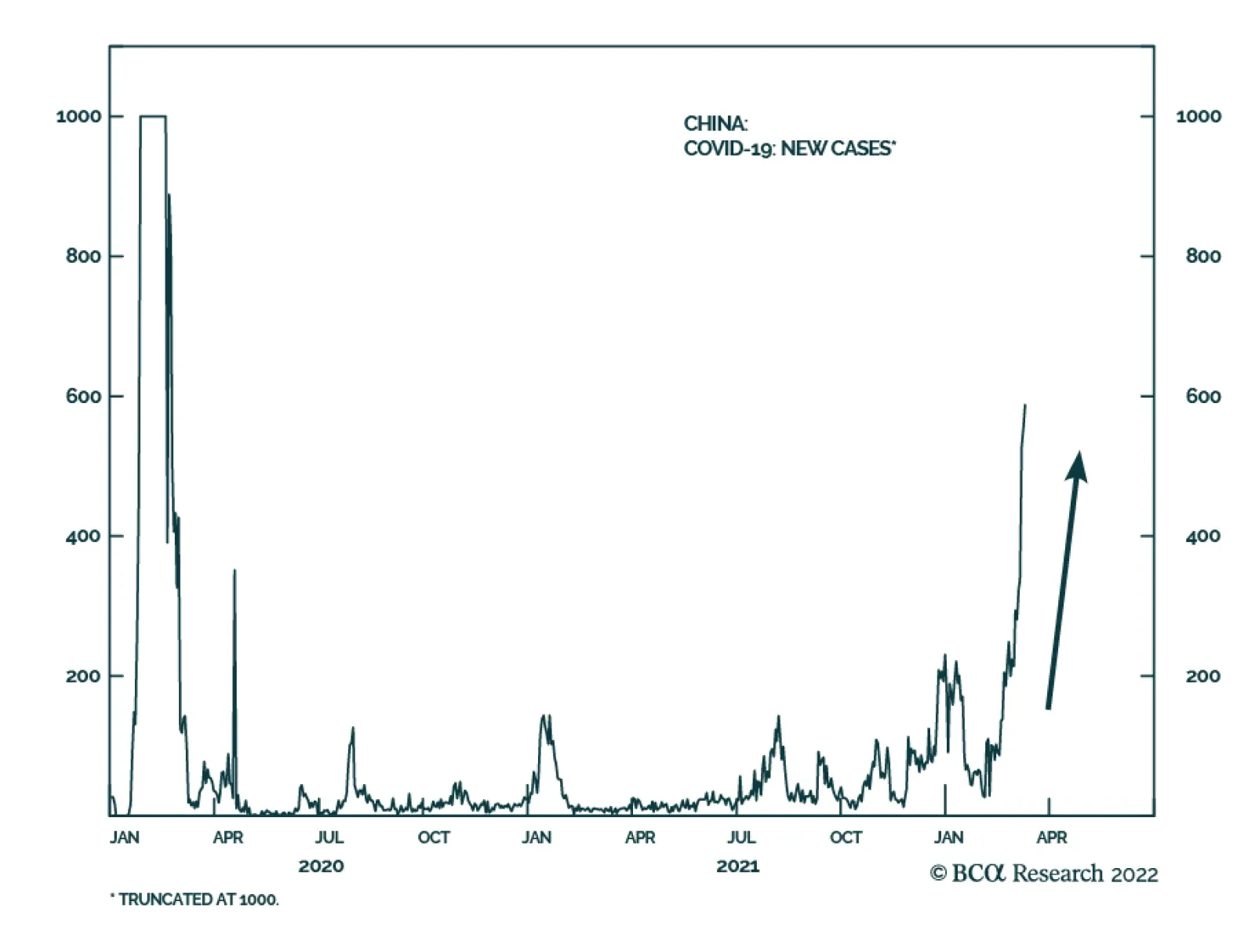

China’s zero tolerance policy towards the COVID-19 virus is a source of downside risk to the near-term economic outlook. Multiple Chinese cities have been placed under lockdown in an effort to tame surging COVID-19 cases…

Executive Summary On a tactical (3-month) horizon, the inflationary impulse from soaring energy and food prices combined with the choke on growth from sanctions will weigh on both the global economy and the global stock market. As…

Executive Summary Nuclear Worries Take Center Stage Vladimir Putin has now committed himself to orchestrating a regime change in Kyiv. Anything less would be seen as a defeat for him. Assuming he succeeds, and it is far…

Executive Summary We look at the Ukraine crisis in the broader context of shocks, what we can learn from them, and how we can incorporate them into our strategy for investment, and life in general. Our high-conviction view is that the…

Executive Summary Copper Demand Follows GDP European copper demand will increase on the back of still-accommodative monetary policy, coupled with a loosening of COVID-19-related gathering and mobility restrictions as the…

Executive Summary US biotech is trading at its greatest discount to the market. Ever. Much of biotech’s underperformance is due to transient factors: specifically, the sell-off in long-duration bonds; the focus on delivering a…

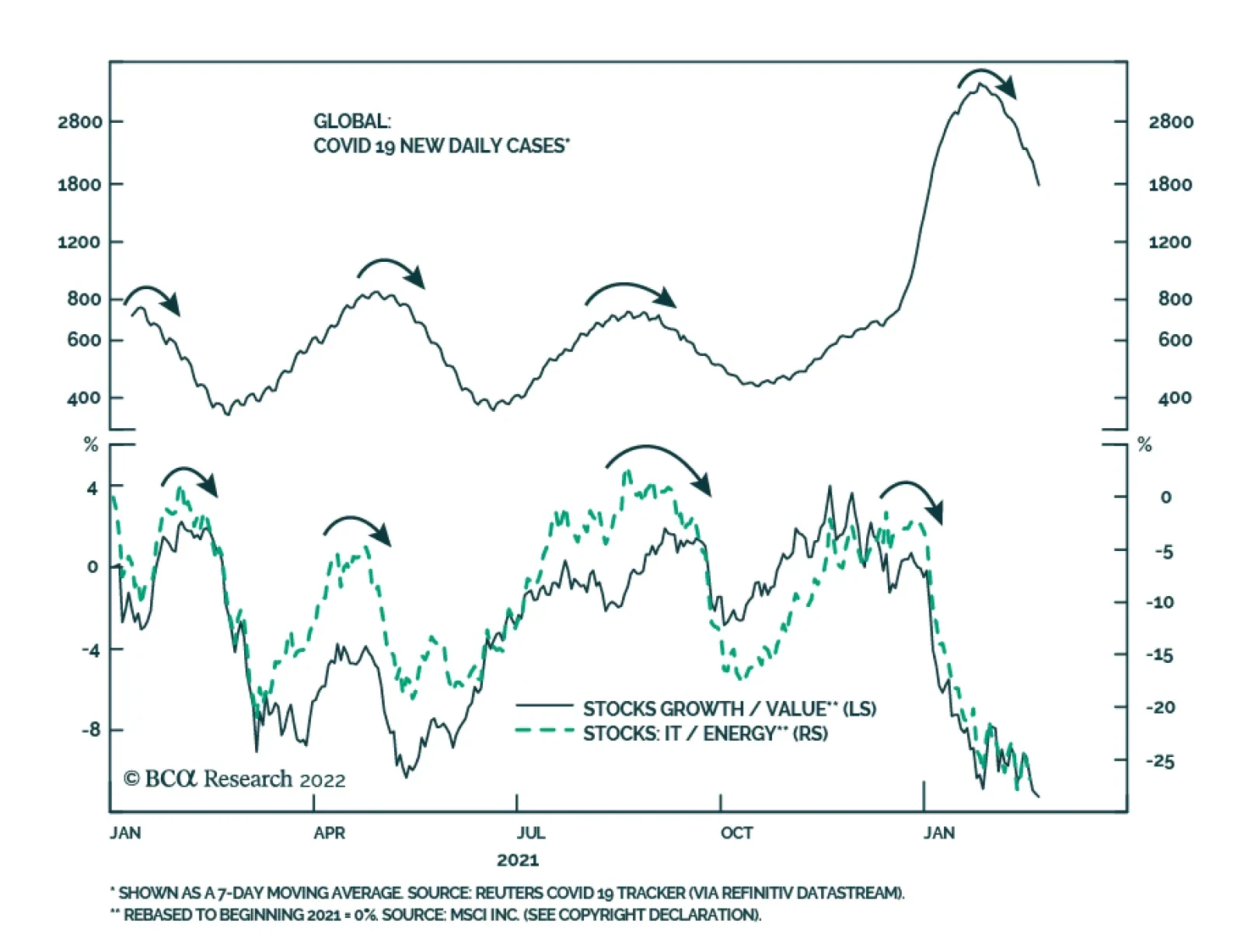

The violent Omicron wave of COVID-19 infections has crested and it is now giving way to a normalization of economic activity. The Markit Flash PMIs’ rebound in February confirms that economies are recovering from the latest…