In a recent insight, we highlighted our Global Investment Strategists’ view that slowing growth, fears that the Fed is turning more hawkish, and technical factors are all contributing factors to recent US yield curve…

Highlights Global oil demand will remain betwixt and between recovery and relapse through 3Q21, as stronger DM consumer spending and increasing mobility wrestles with persistent concerns over COVID-19-induced lockdowns in Latin America…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

Highlights Gold is – and always will be – exquisitely sensitive to Fed policy and forward guidance, as last month's "Dot Shock" showed (Chart of the Week). Its price will continue to twitch – sometimes…

Dear Client, We are sending you our Strategy Outlook today, where we outline our thoughts on the macro landscape and the direction of financial markets for the rest of 2021 and beyond. Next week, please join me for a webcast on…

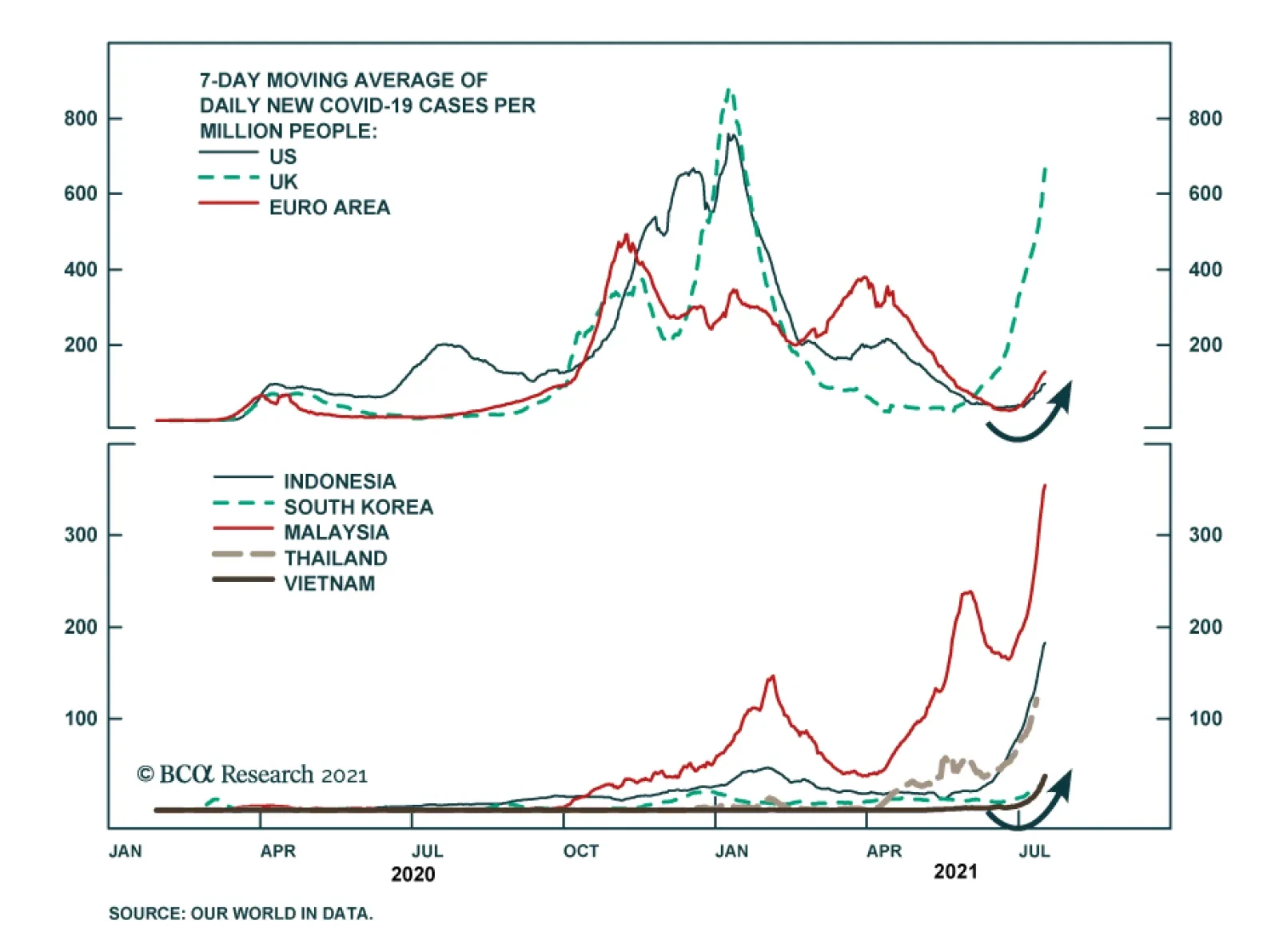

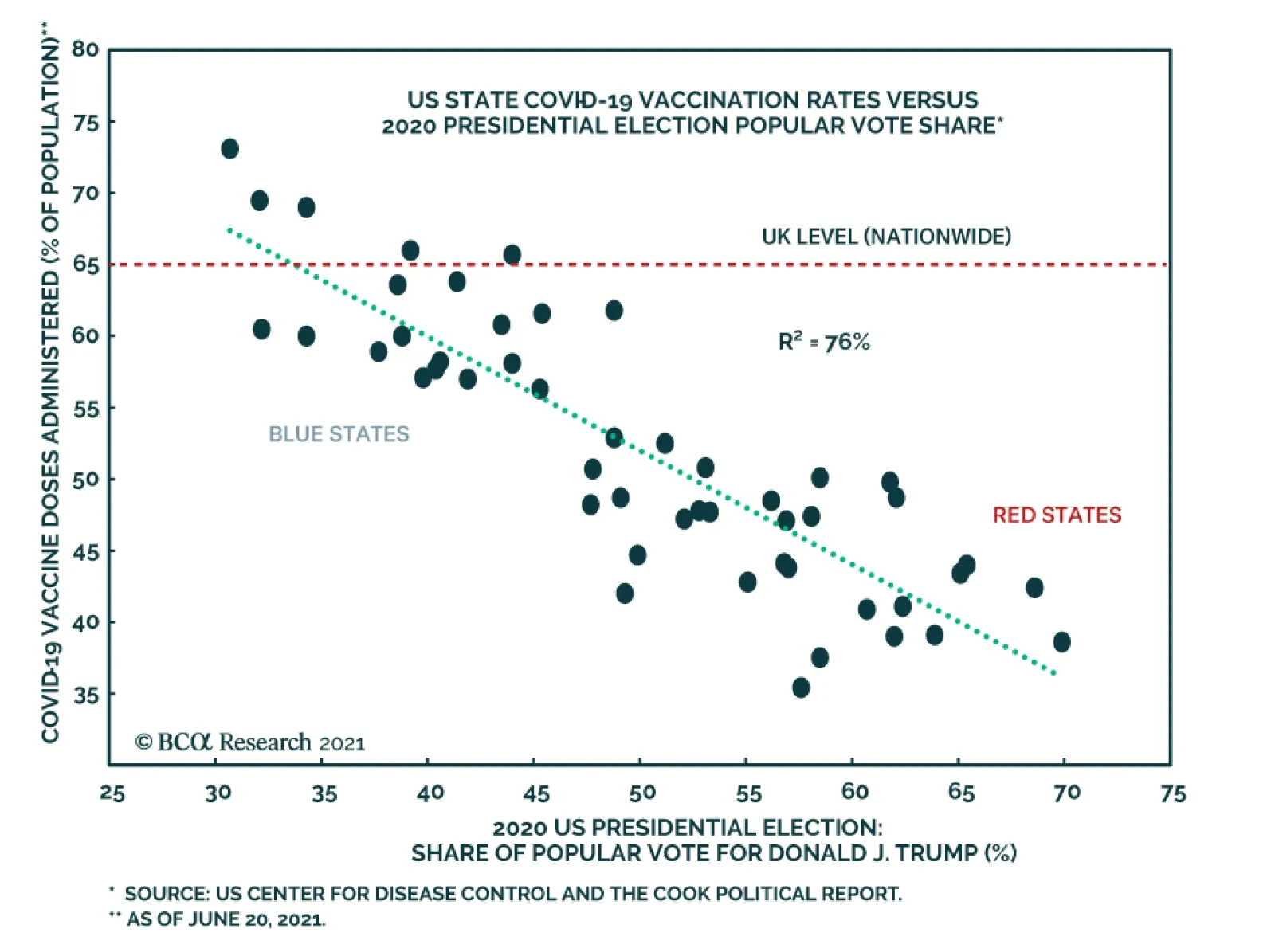

The “Delta variant” has been swiftly spreading across the globe of late. The mutated virus has caused a resurgence in COVID-19 new infections and now accounts for over 90% of all new cases in the UK, forcing the UK…

Highlights Economy – As always, there is no lack of things that could go wrong: COVID-19 could have a resurgence, international softness could be a drag, wage growth could erode profit margins or trigger inflation and households…

Highlights Entering 2H21, oil and metals' price volatility will rise as inventories are drawn down to cover physical supply deficits brought about by the re-opening of major economies ex-China. As demand increases and oil and…

Highlights The ongoing transition to a post-pandemic state and fiscal policy are either positive or net-neutral for risky asset prices. Fiscal thrust will turn to fiscal drag over the coming year, but the negative impact this will…