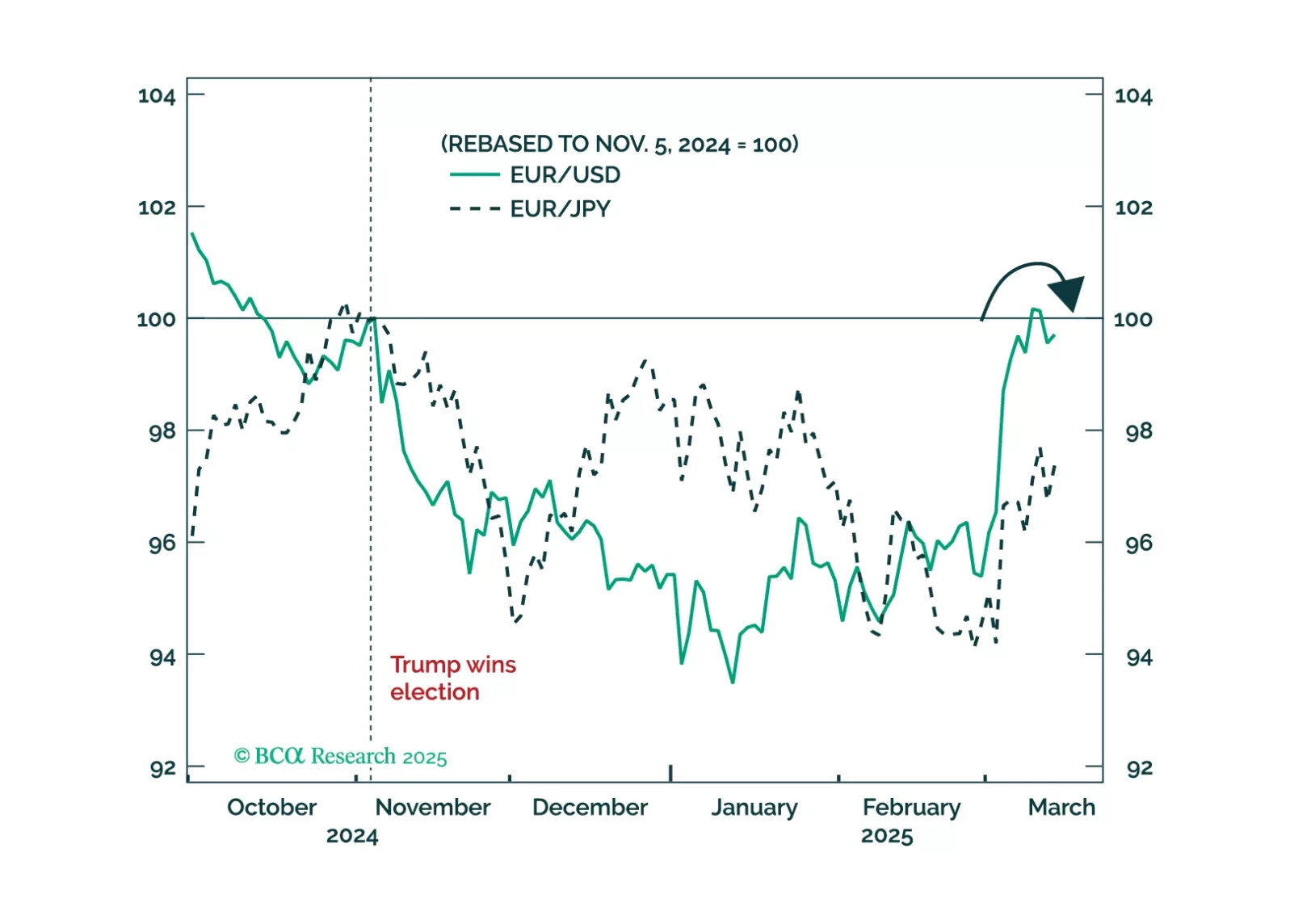

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

Fears of Europe’s decline due to Russian aggression and shifting US policy are overblown. President Trump’s tough stance on Ukraine is a strategic move to consolidate domestic support, not an abandonment of Europe, while Russia’s…

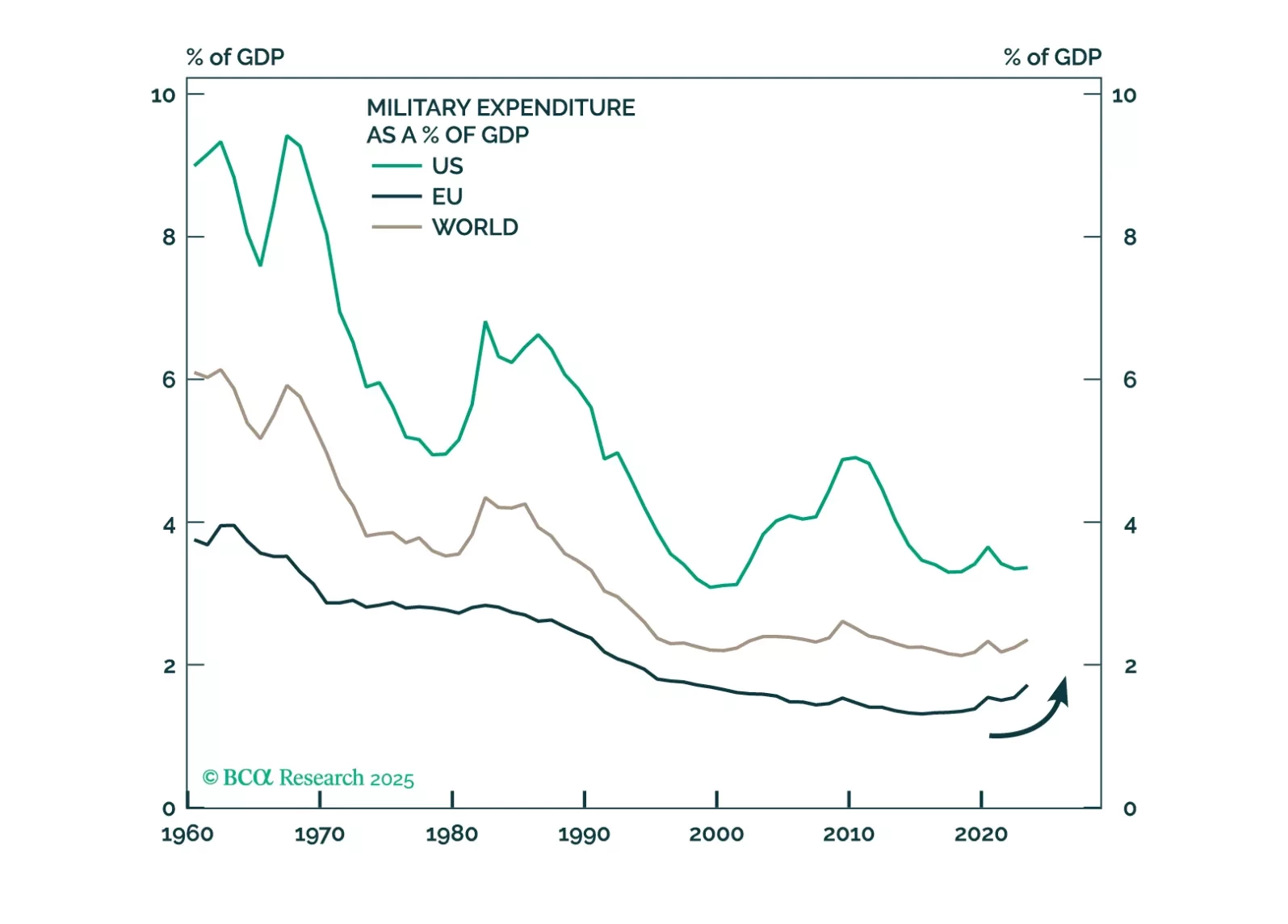

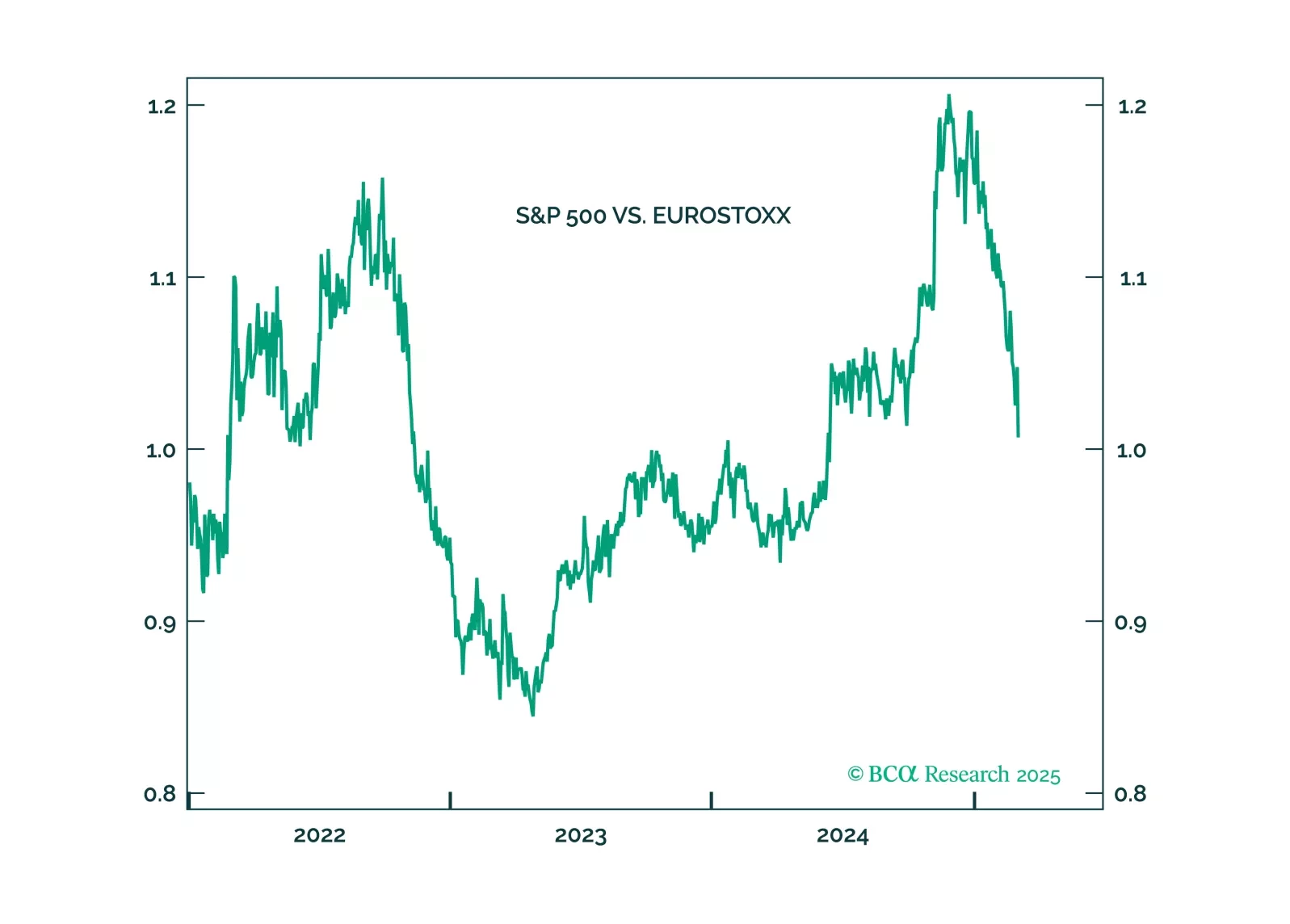

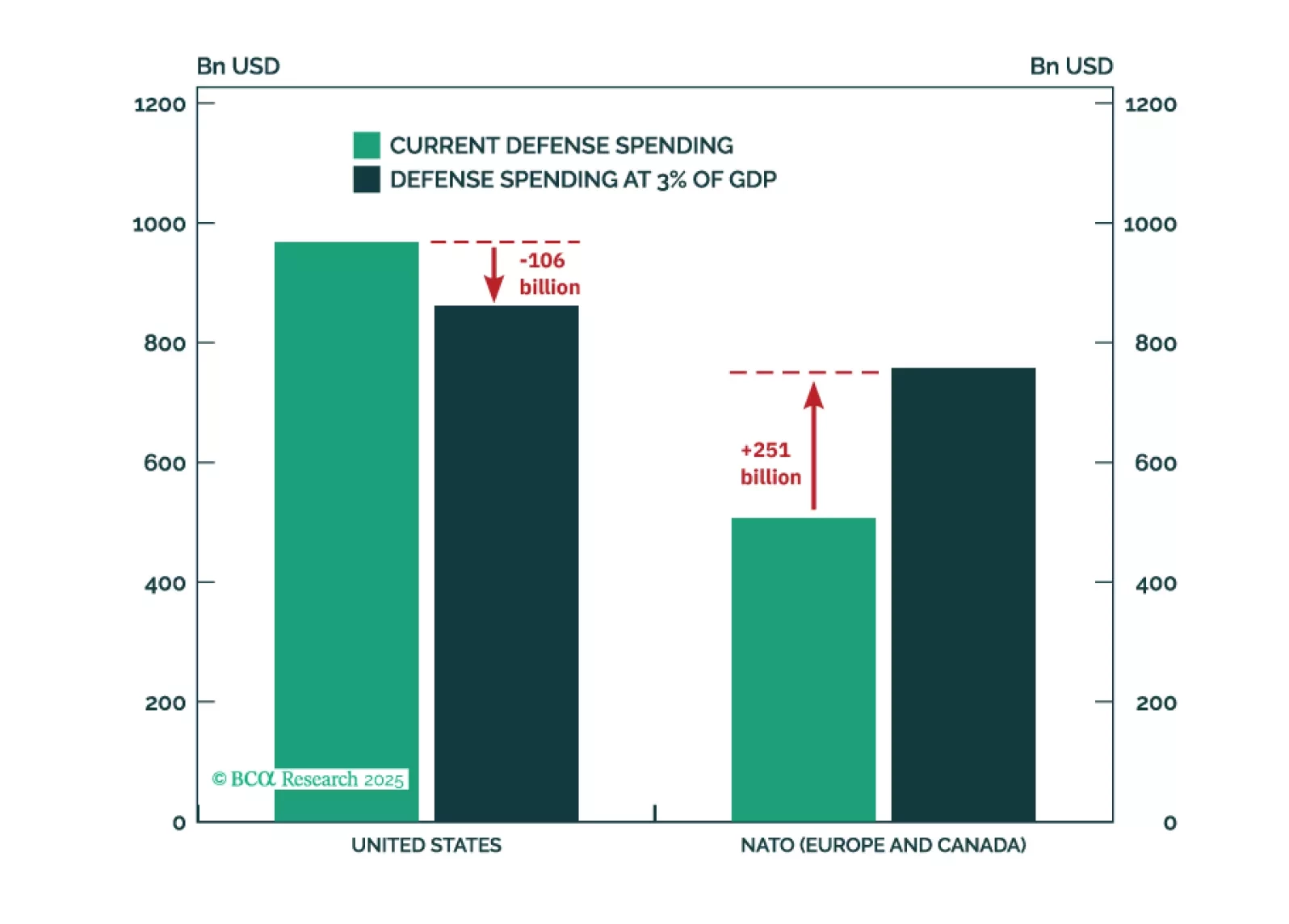

Trump will pull back from the trade war when stocks approach bear market territory. He will not withdraw from NATO. Favor European stocks on fiscal policy.

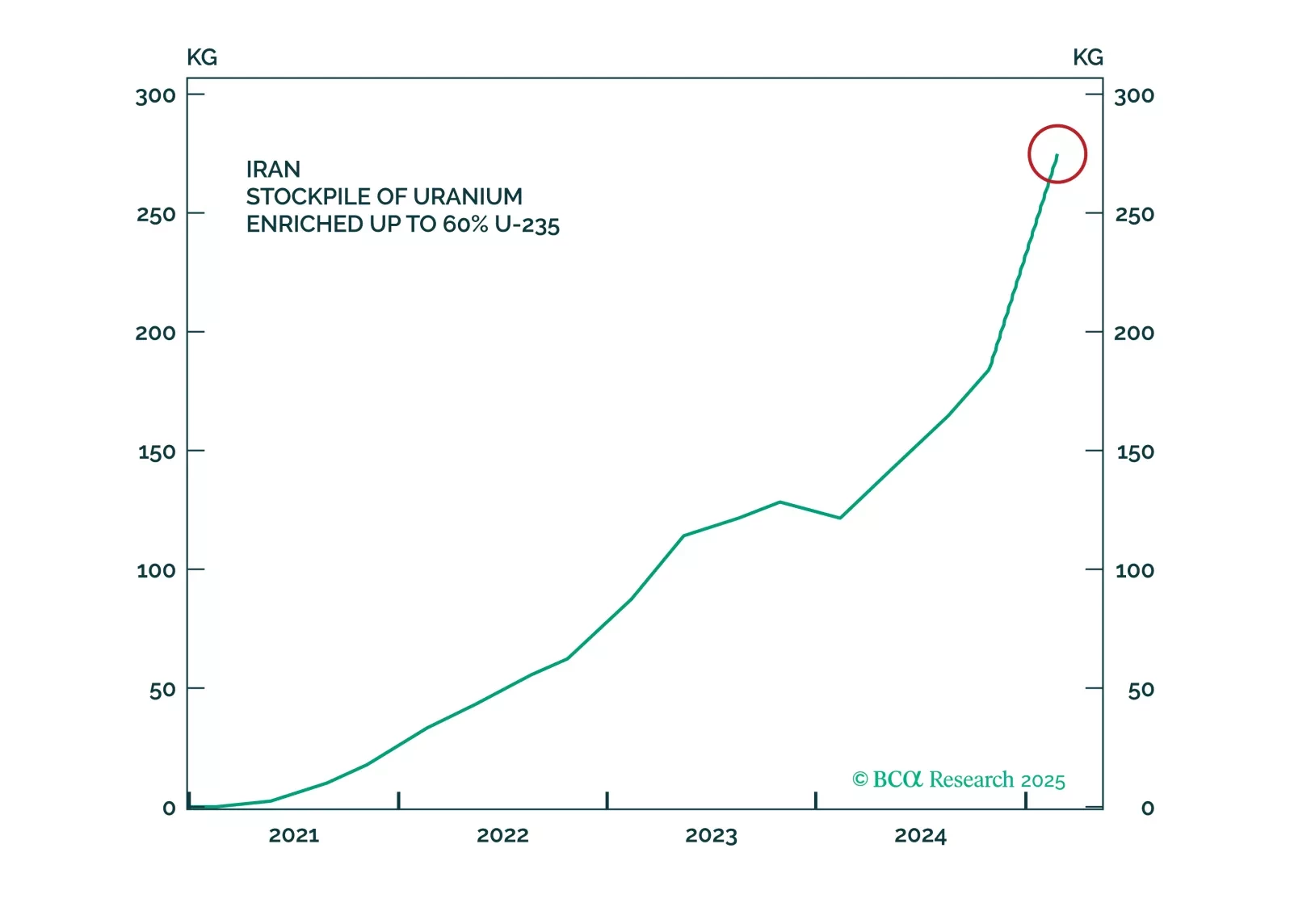

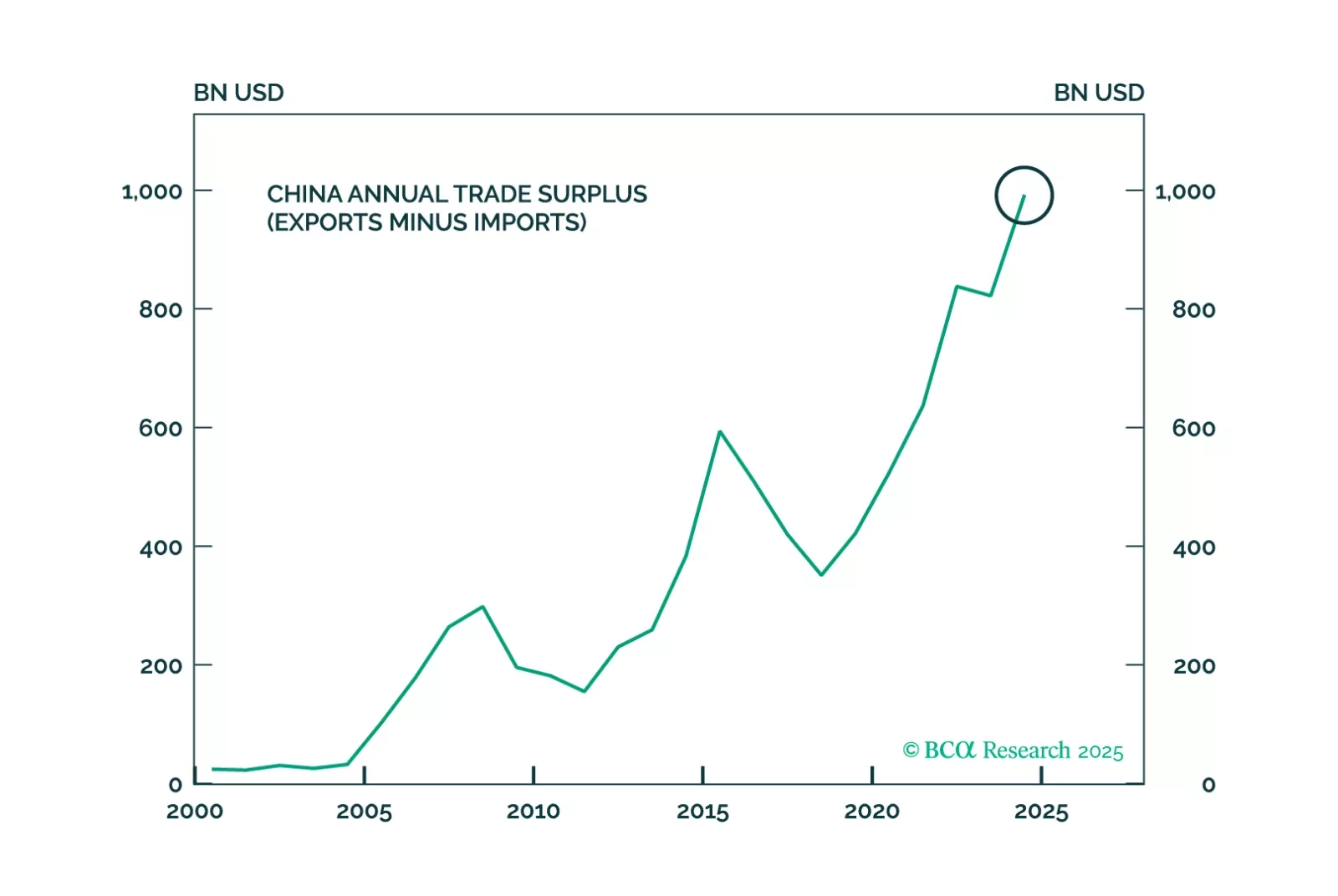

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

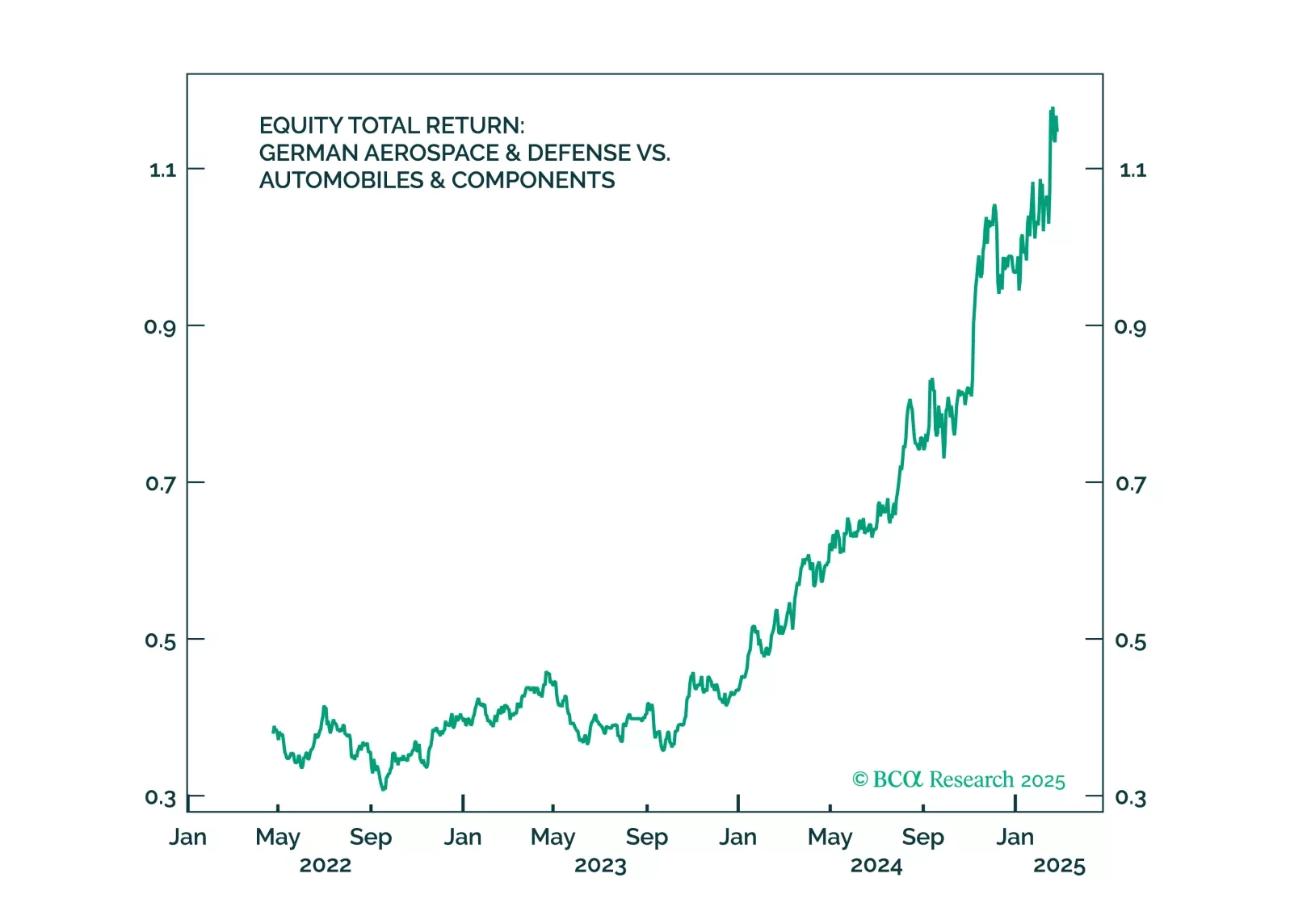

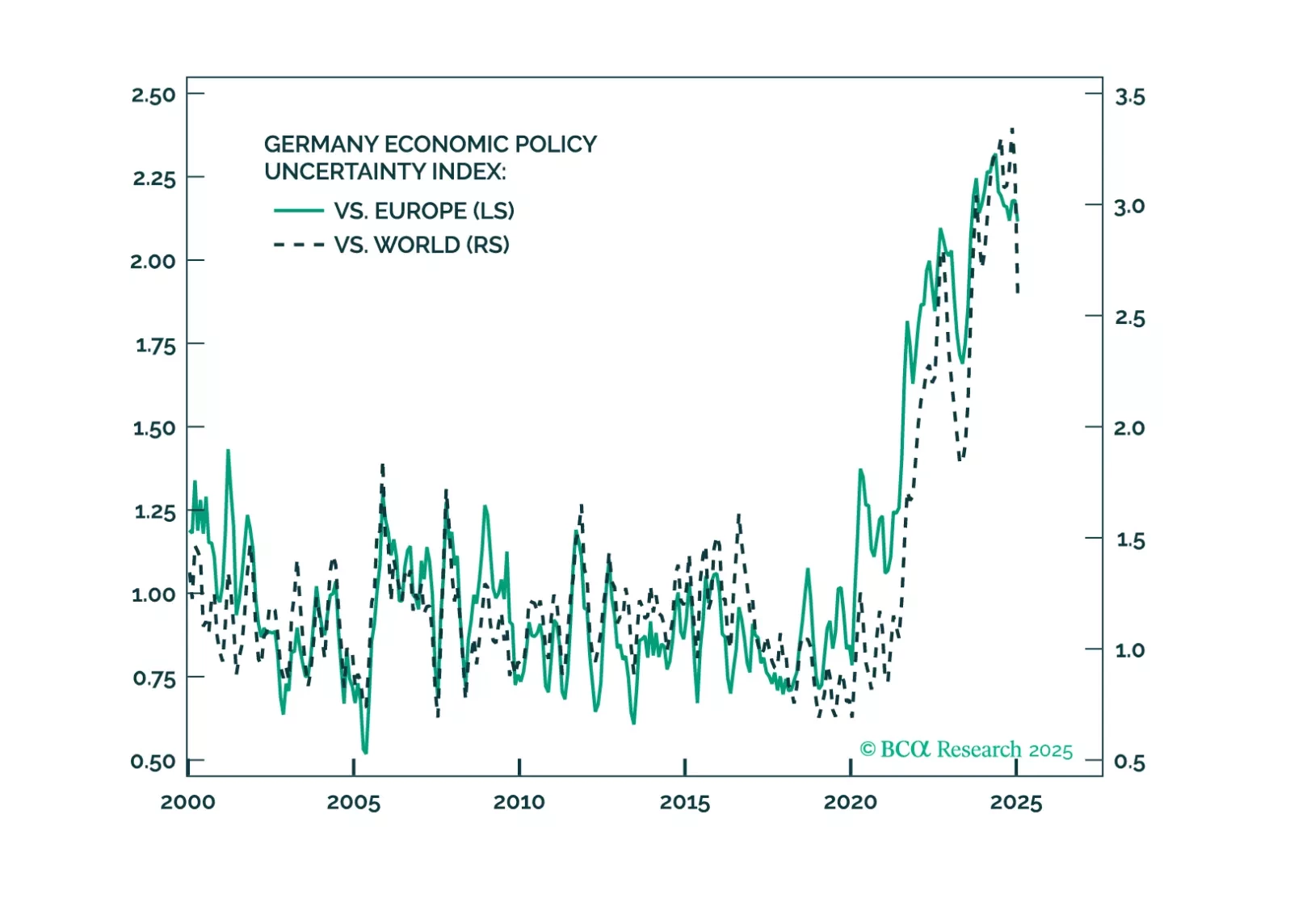

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

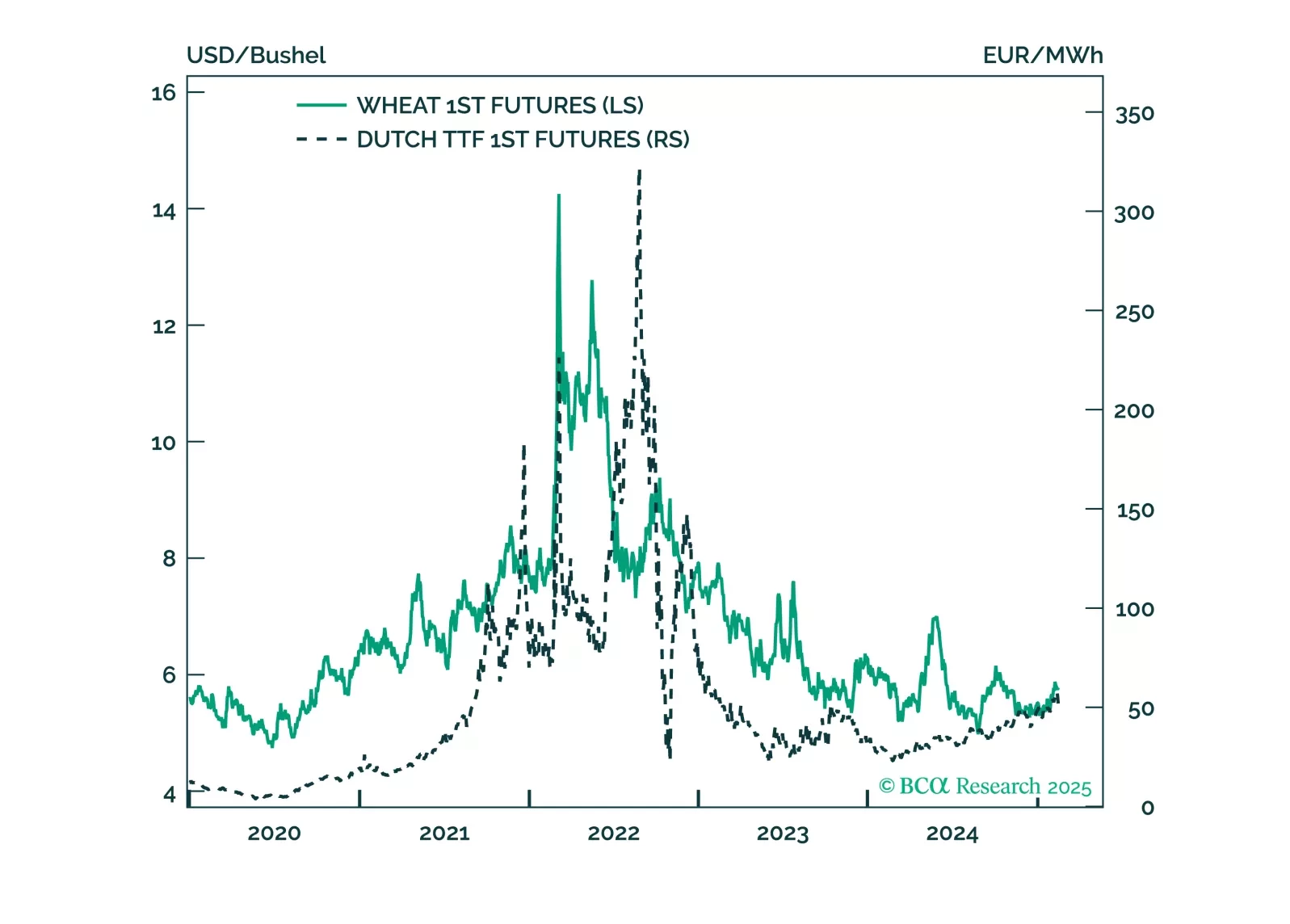

President Trump is negotiating a ceasefire in Ukraine. This will be a marginal headwind to some commodities which benefitted from the conflict like natural gas and wheat, and will be a marginal tailwind for European assets,…

We revisit our view on the “fiscal gravy train” as well as President Trump’s negotiating style. We re-print parts of our March 2024 net assessment, particularly for the benefit of our new clients who have joined us at BCA Research.…