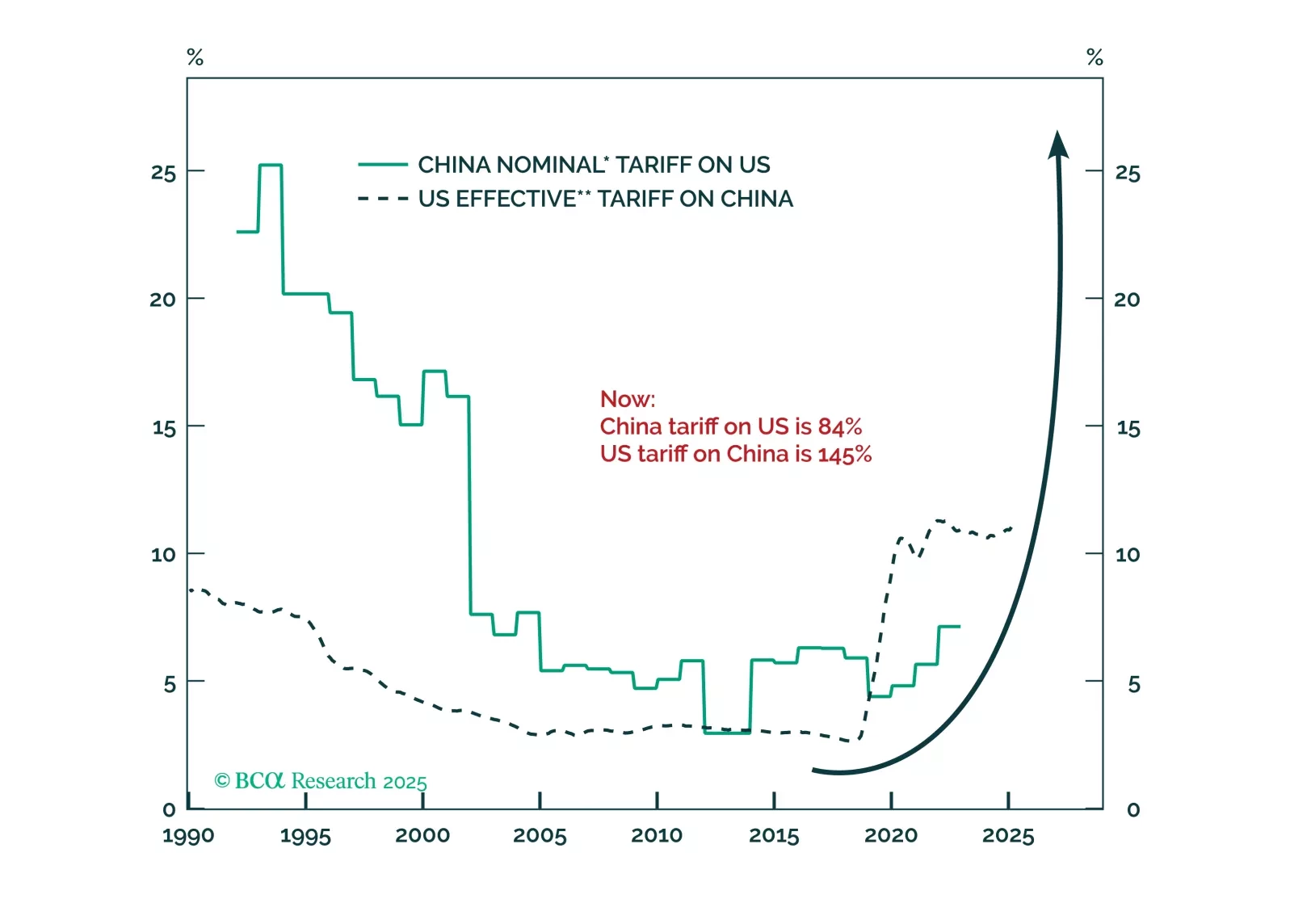

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…

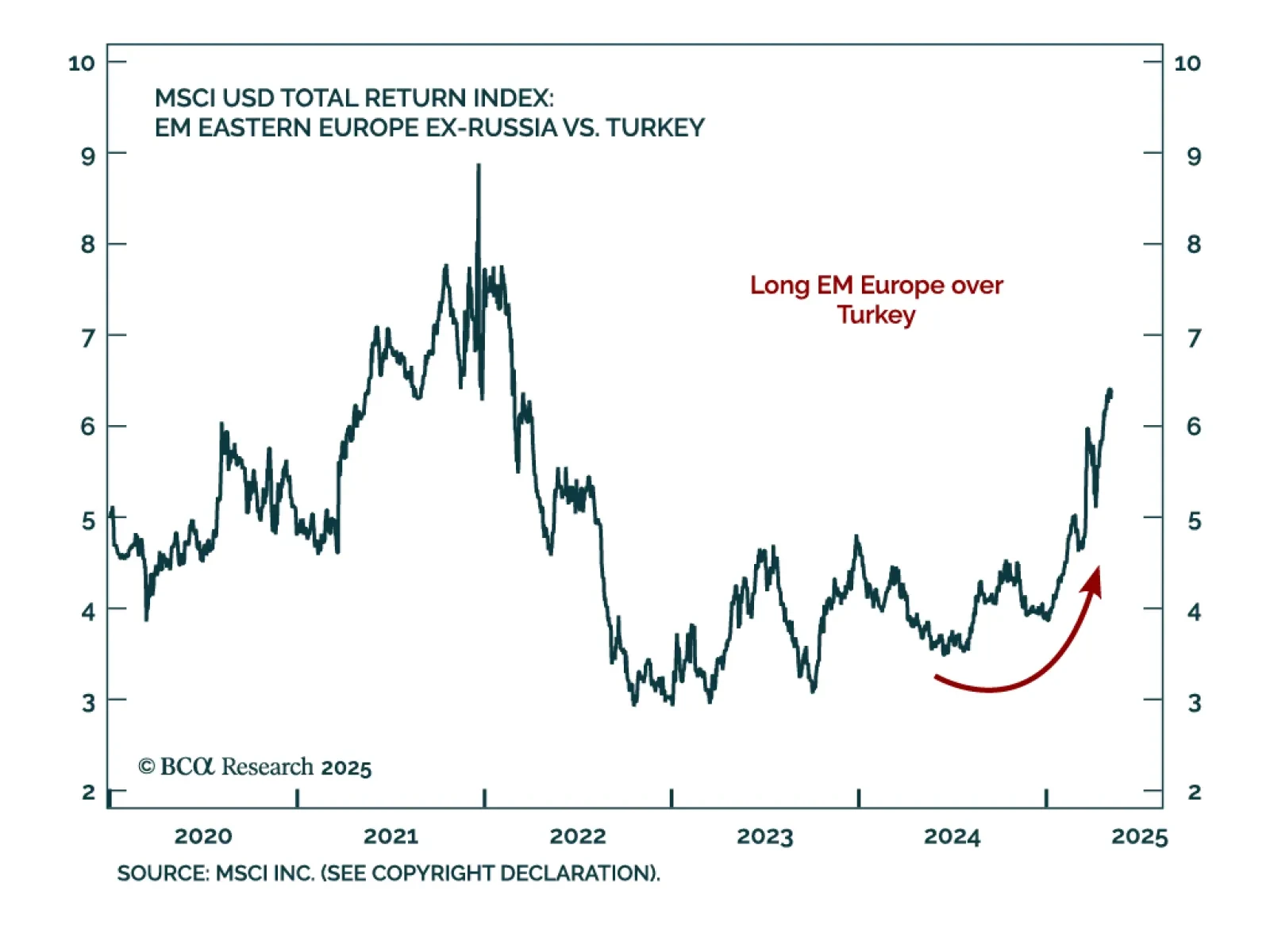

Our Geopolitical strategists recommend underweighting Turkish assets. Erdogan’s weakening rule, rising social unrest, and eroding governance are deepening Turkey’s macro deterioration. Inflation will stay sticky as odds of new…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

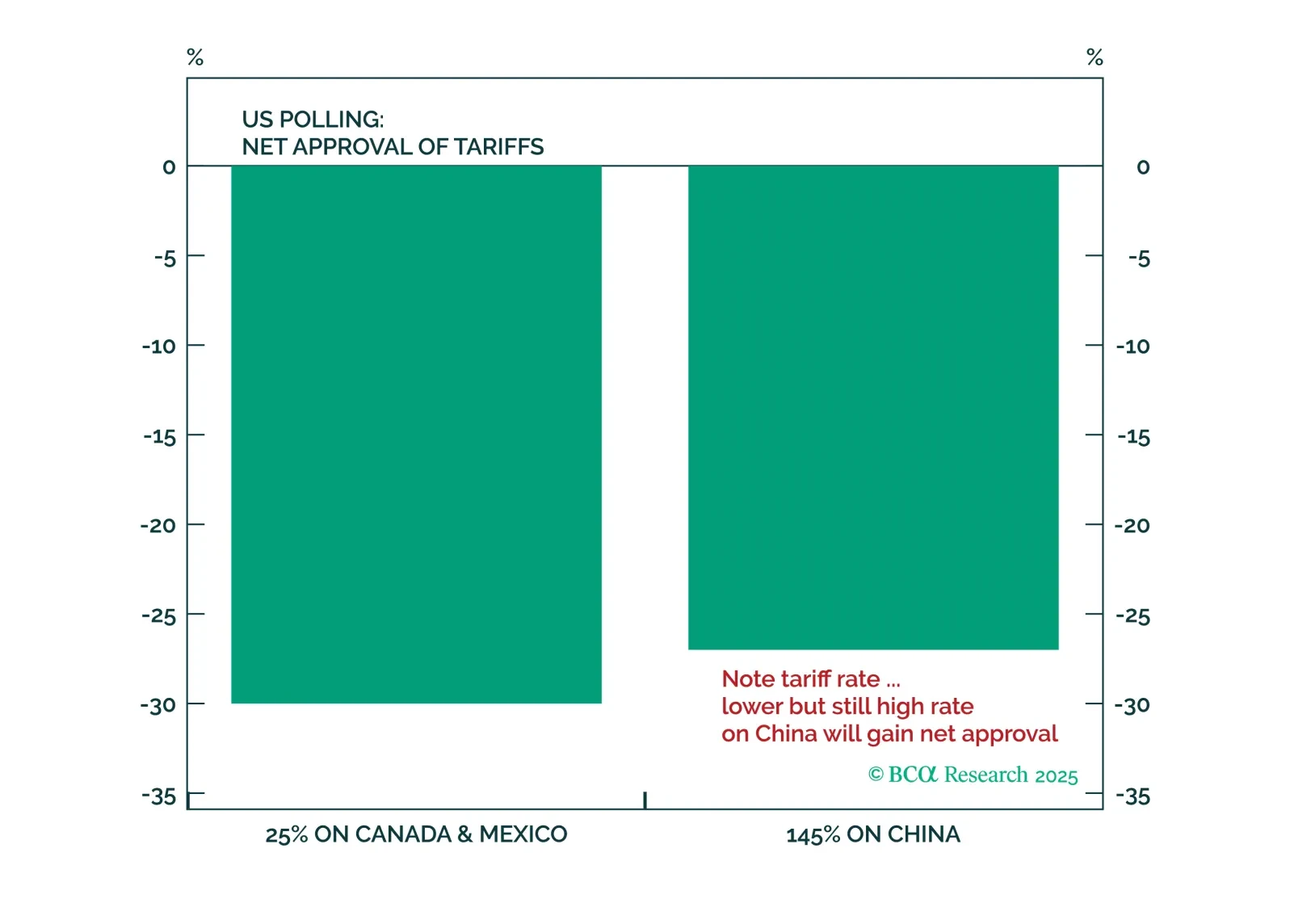

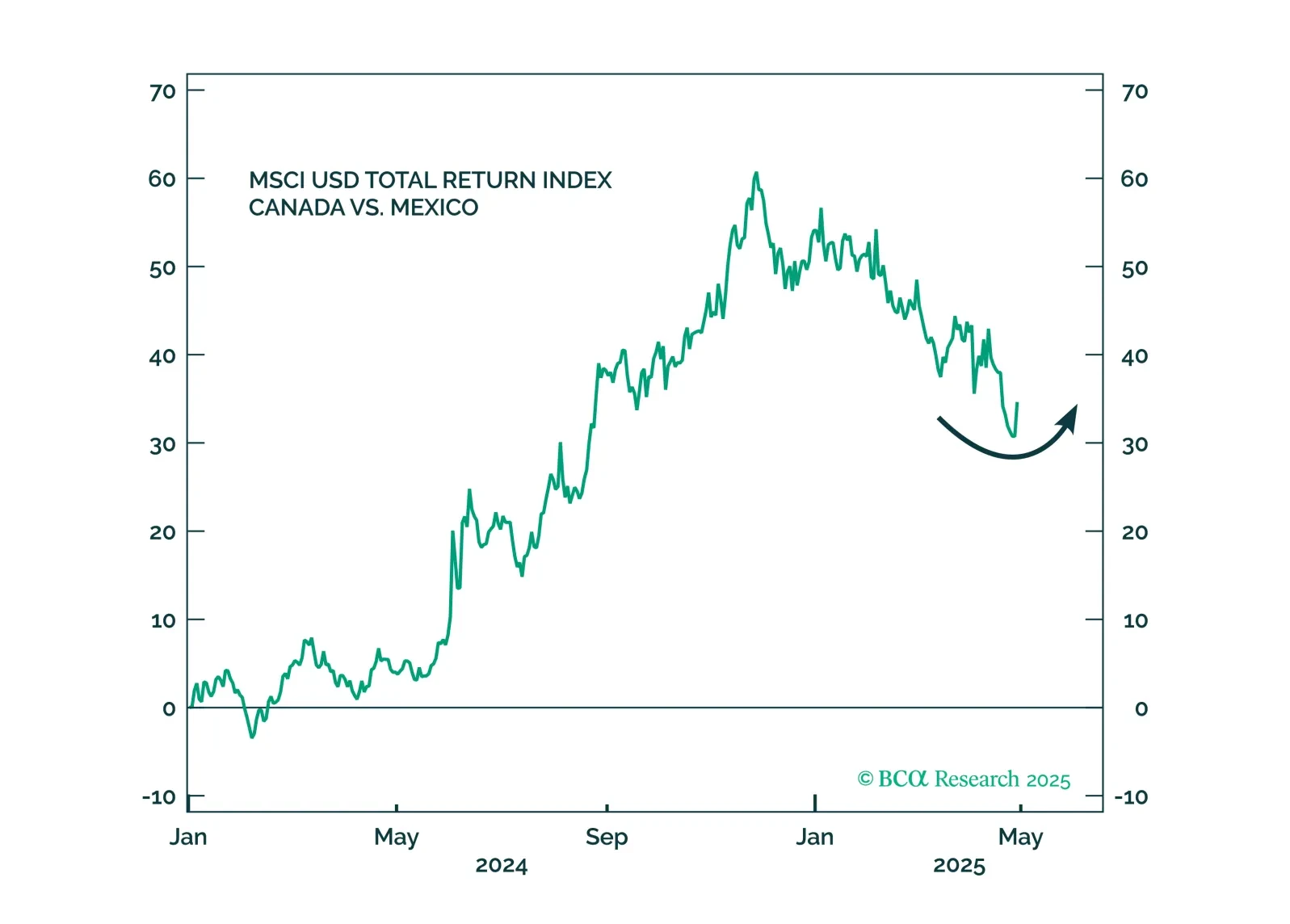

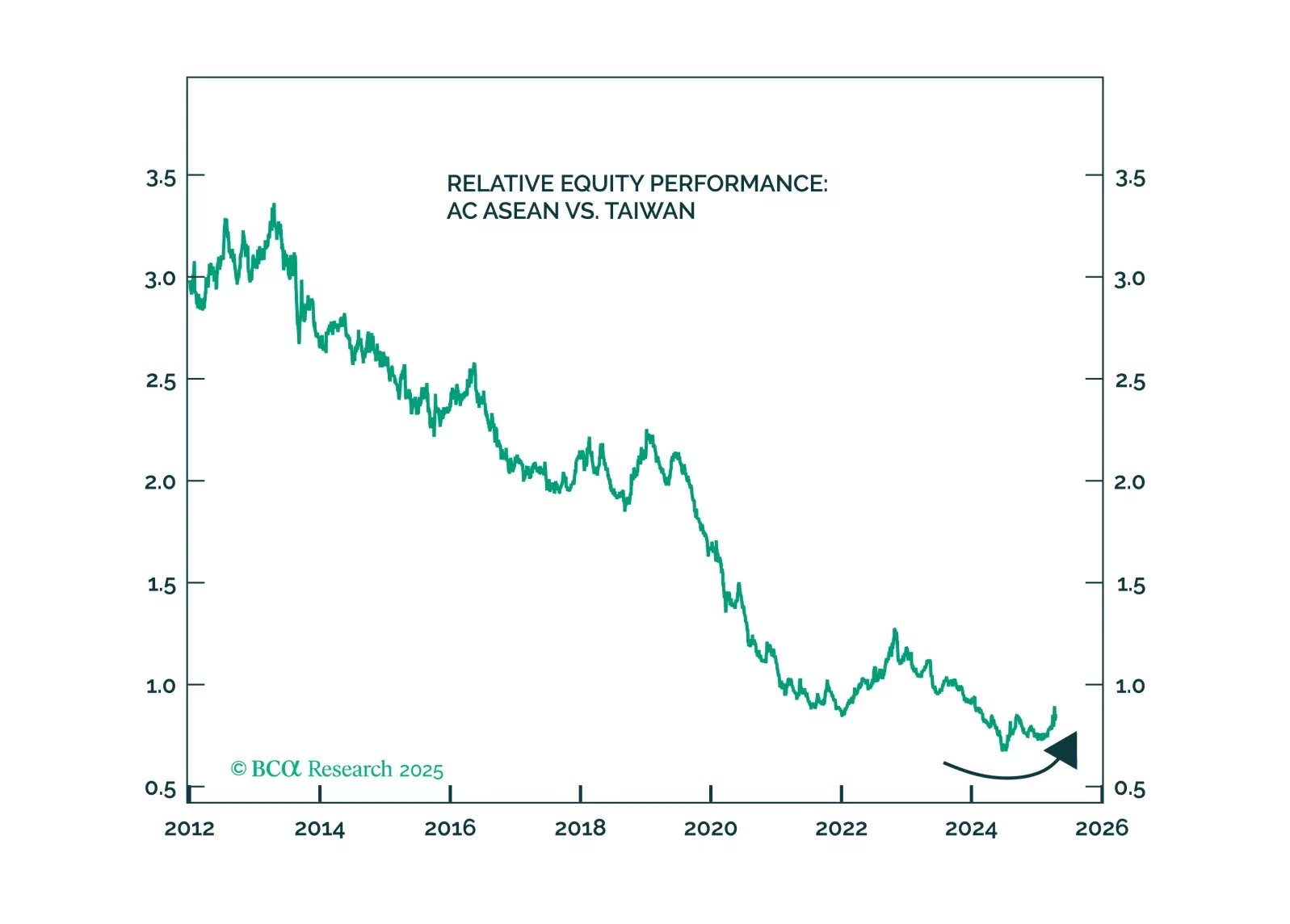

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

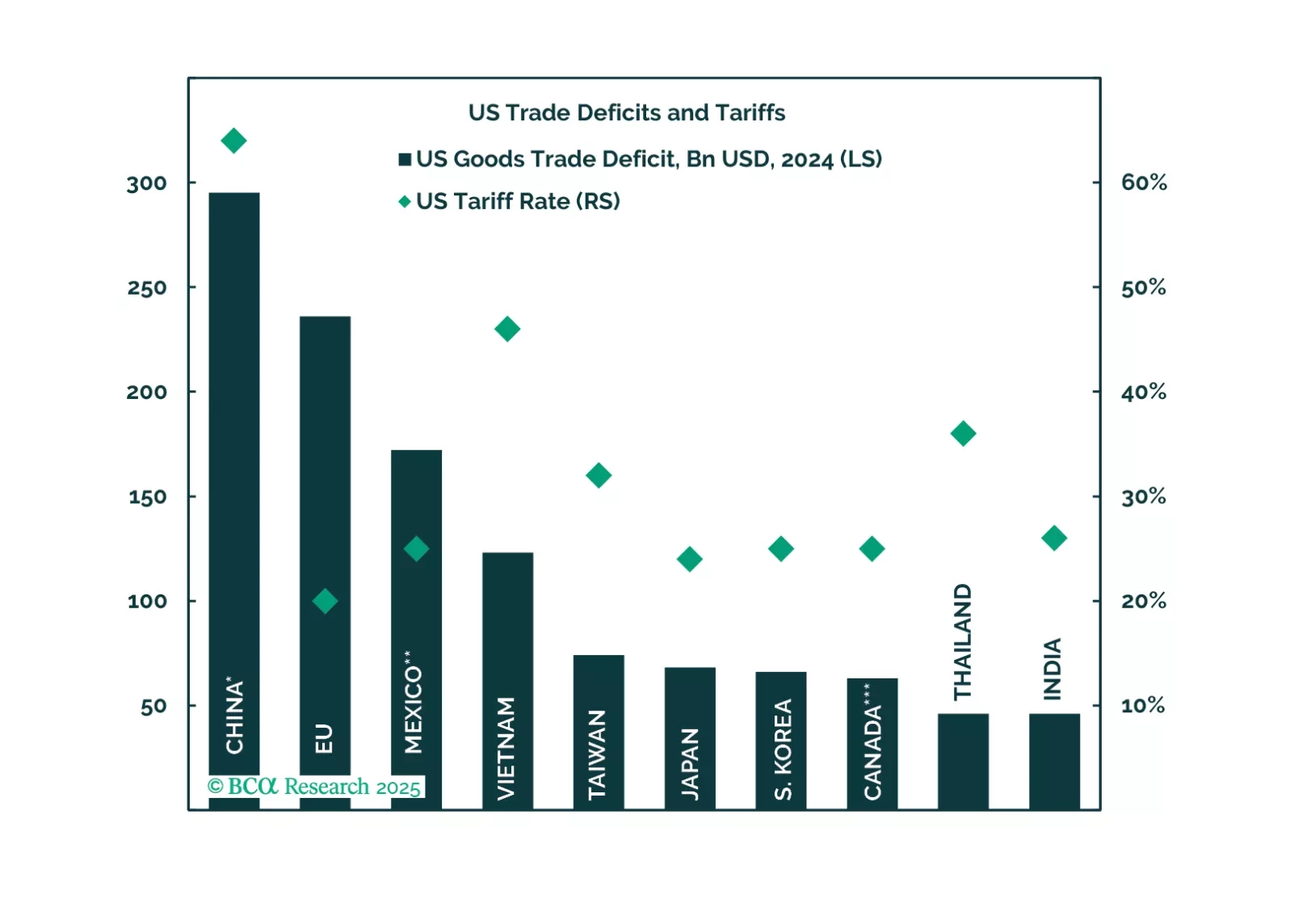

President Trump imposed tariffs on the world in his first 100 days, as we expected. Tariffs may have catalyzed a recession in the US, given the weakness in consumer sentiment and demand. Trump will soon backpedal and grant exemptions…

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.