Our US Equity strategists maintain a constructive outlook on equities, supported by easing policy and resilient earnings, but recommend reducing beta to guard against tail risks. Slowing growth and tariff pressures are expected to be…

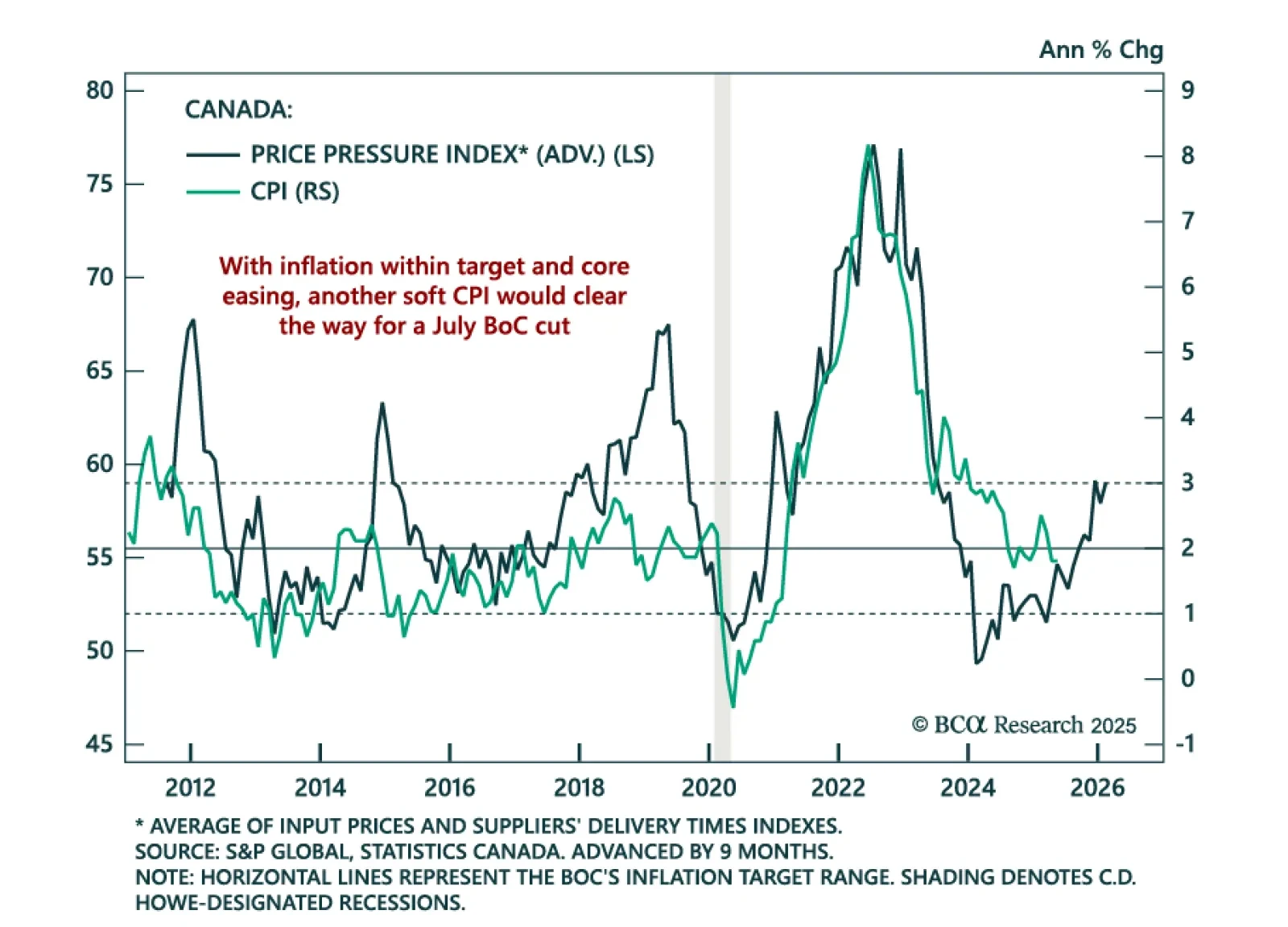

Contained Canadian inflation and soft macro conditions support our overweight on Canadian government bonds. May CPI was in line with expectations, with headline inflation holding at 1.7% y/y and core measures slowing to 3.0%, the…

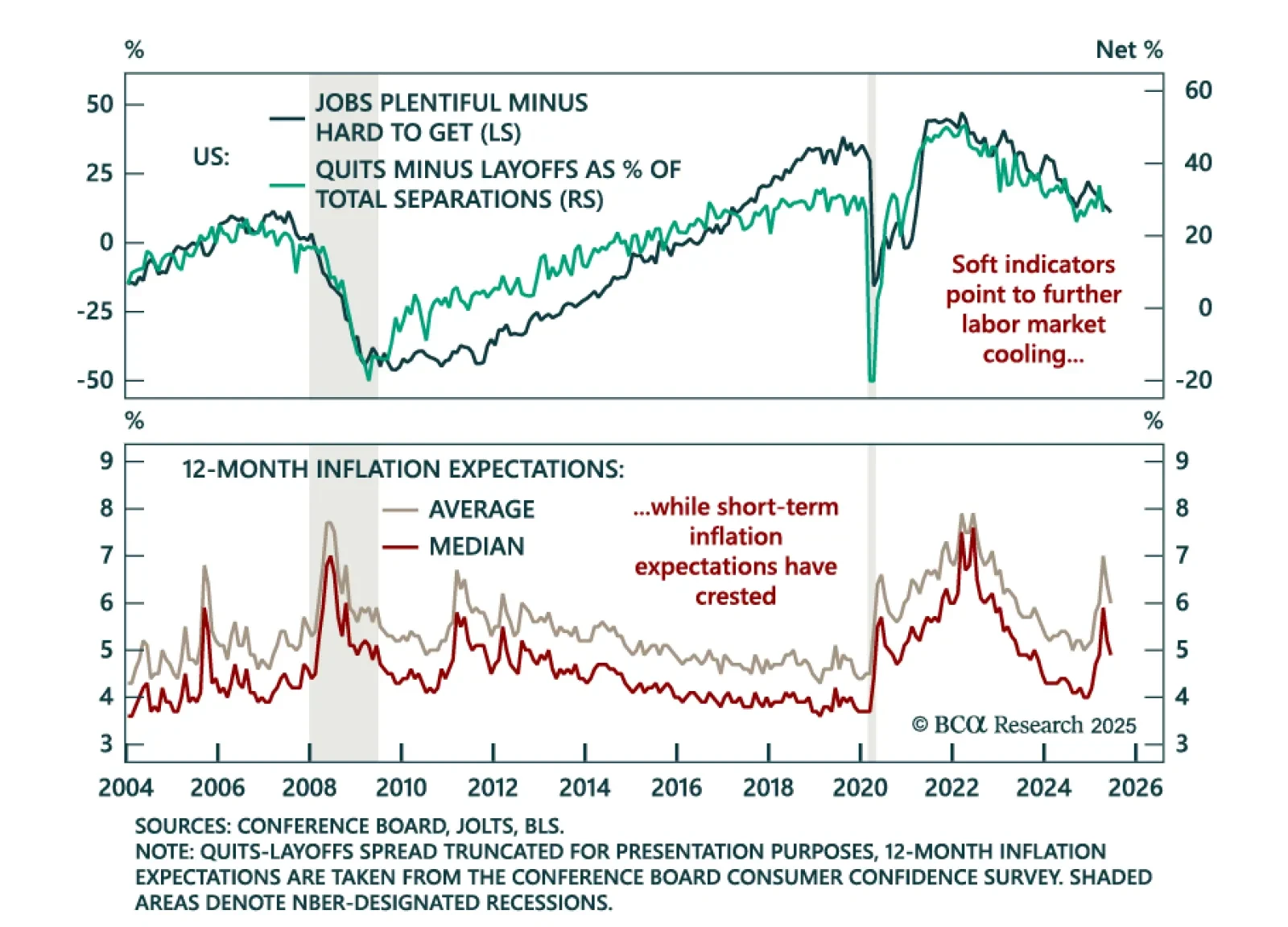

Weakening consumer confidence and fading labor momentum support a long duration stance as inflation fears recede. The June Conference Board Consumer Confidence index dropped 5 points to 93.0, missing expectations. Both present…

Please join Chief Strategists Mathieu Savary and Jeremie Peloso for a Roundtable on Tuesday, June 25 at 3:00 PM CEST (2:00 PM BST, 9:00 AM EDT).

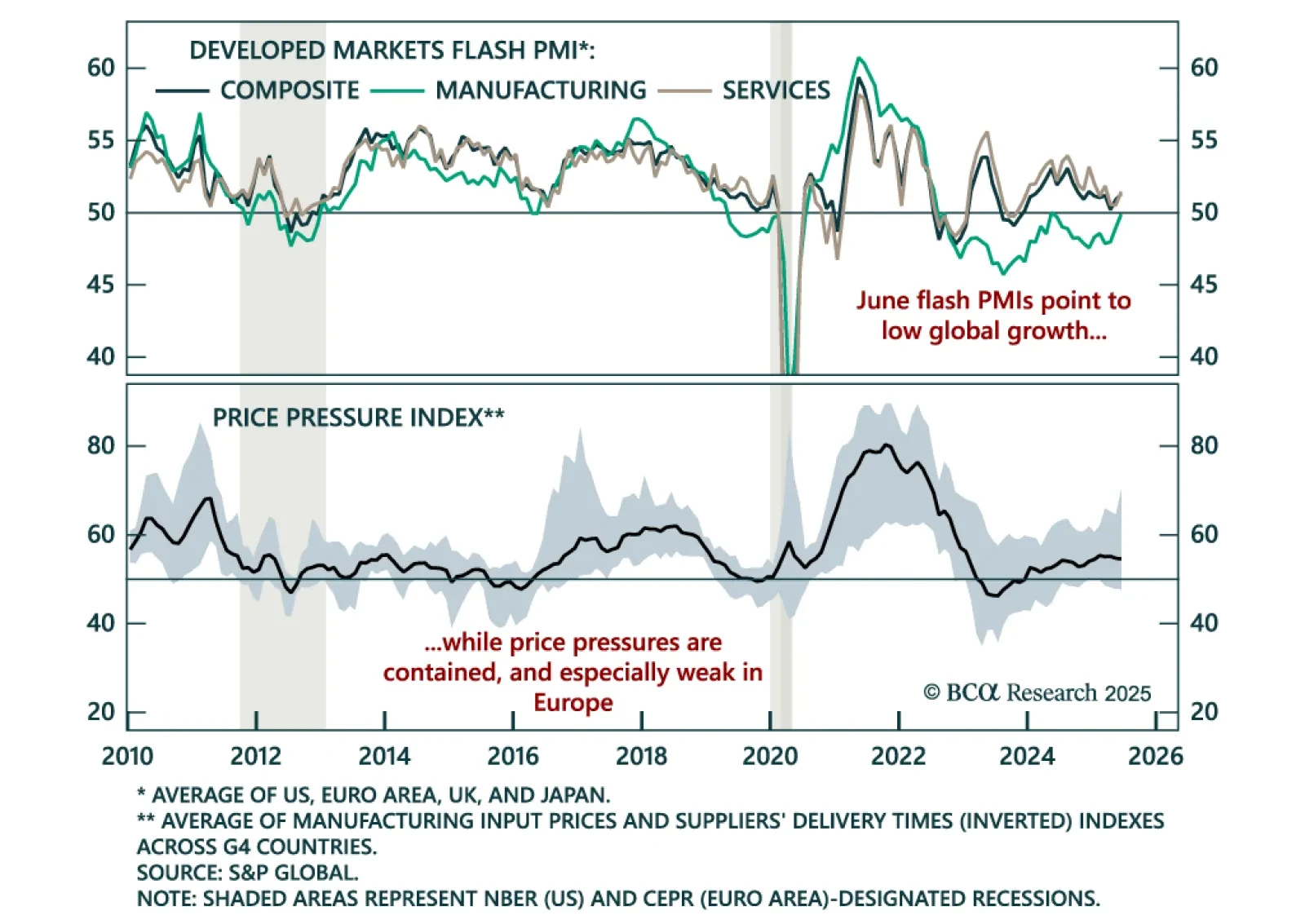

June PMIs confirm low global growth and support a long duration stance as price pressures remain contained. The flash PMIs were mixed across DMs: Sideways in the US and euro area, but firmer in the UK and Japan. Yet the overall…

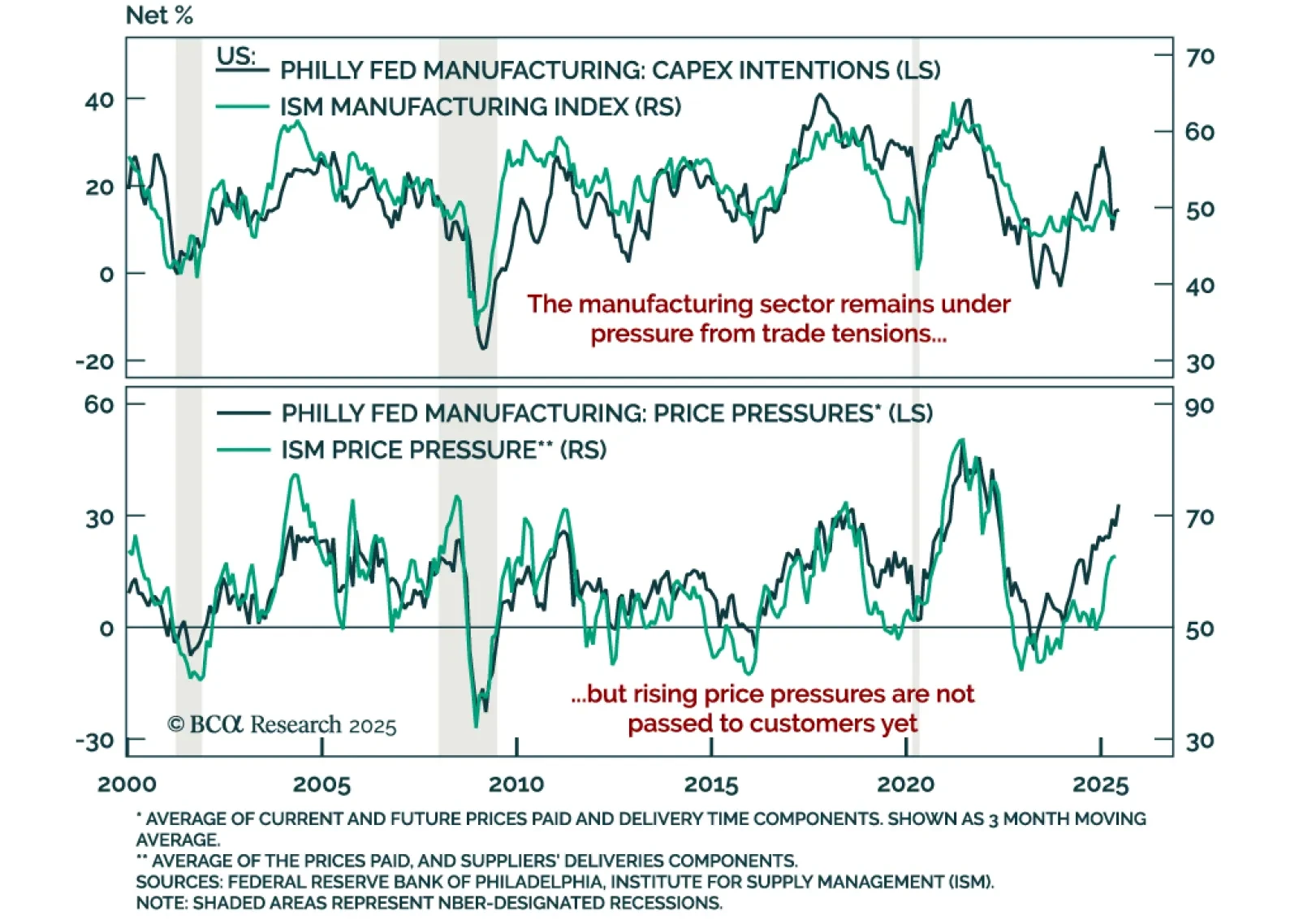

Worsening manufacturing momentum supports a long duration stance as recession risks remain elevated. The June Philly Fed survey came in below expectations, unchanged at -4.0. While shipments increased, new orders decelerated and…

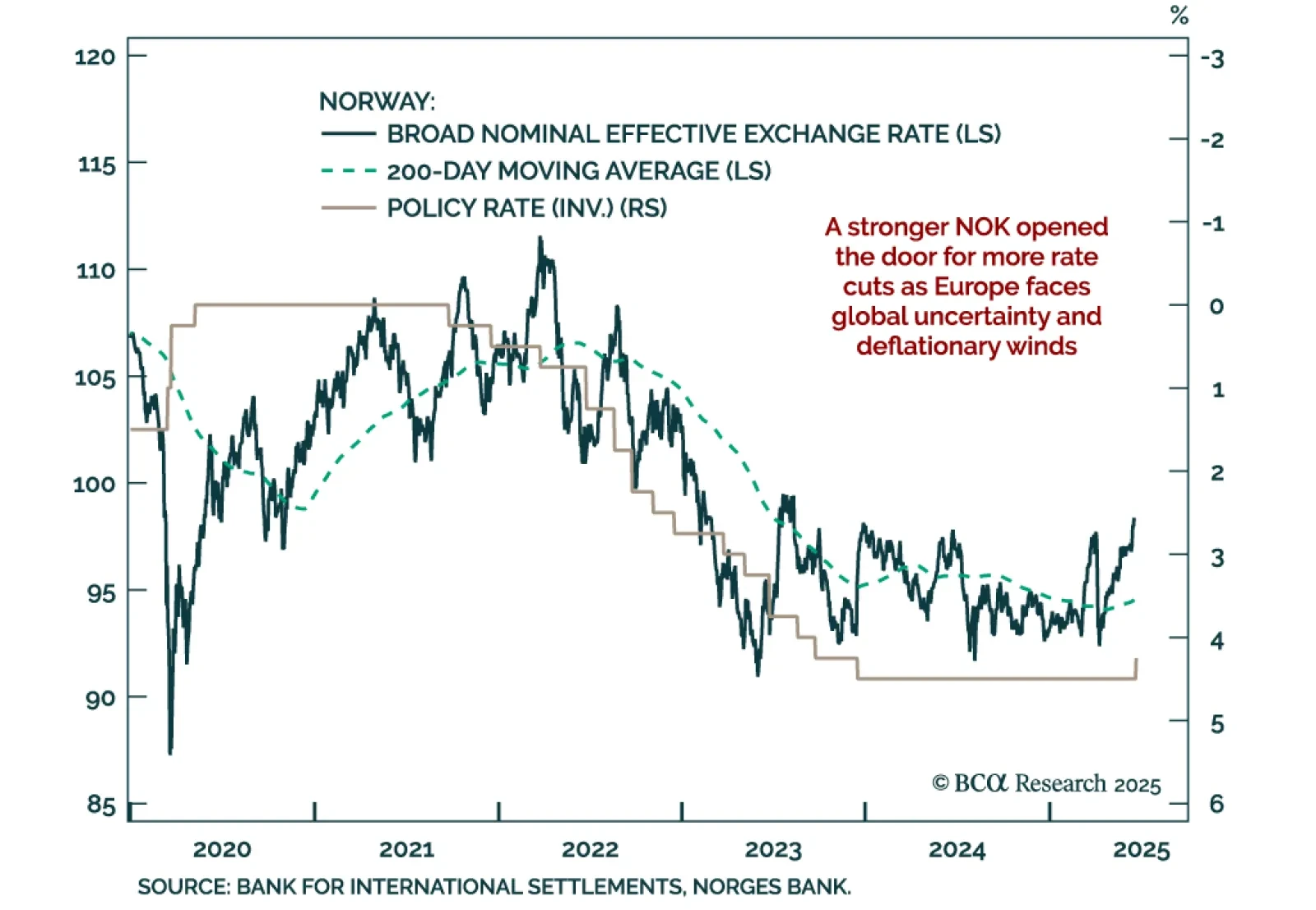

A stronger Norwegian krone has opened the door to more rate cuts, making Norwegian government bonds more attractive. Our Chart Of The Week comes from Jeremie Peloso, European Strategist. With its surprise 25 basis point cut, the…

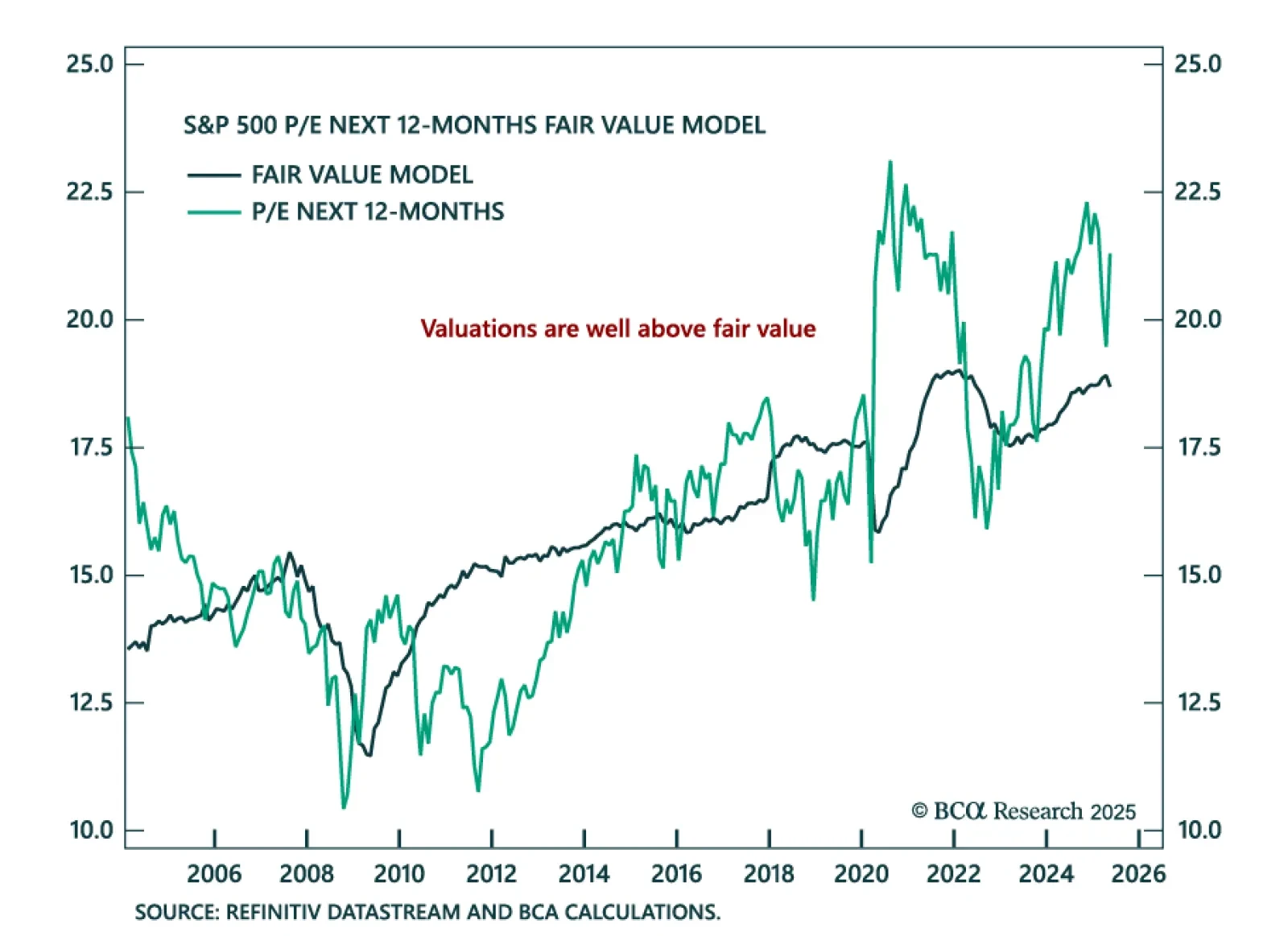

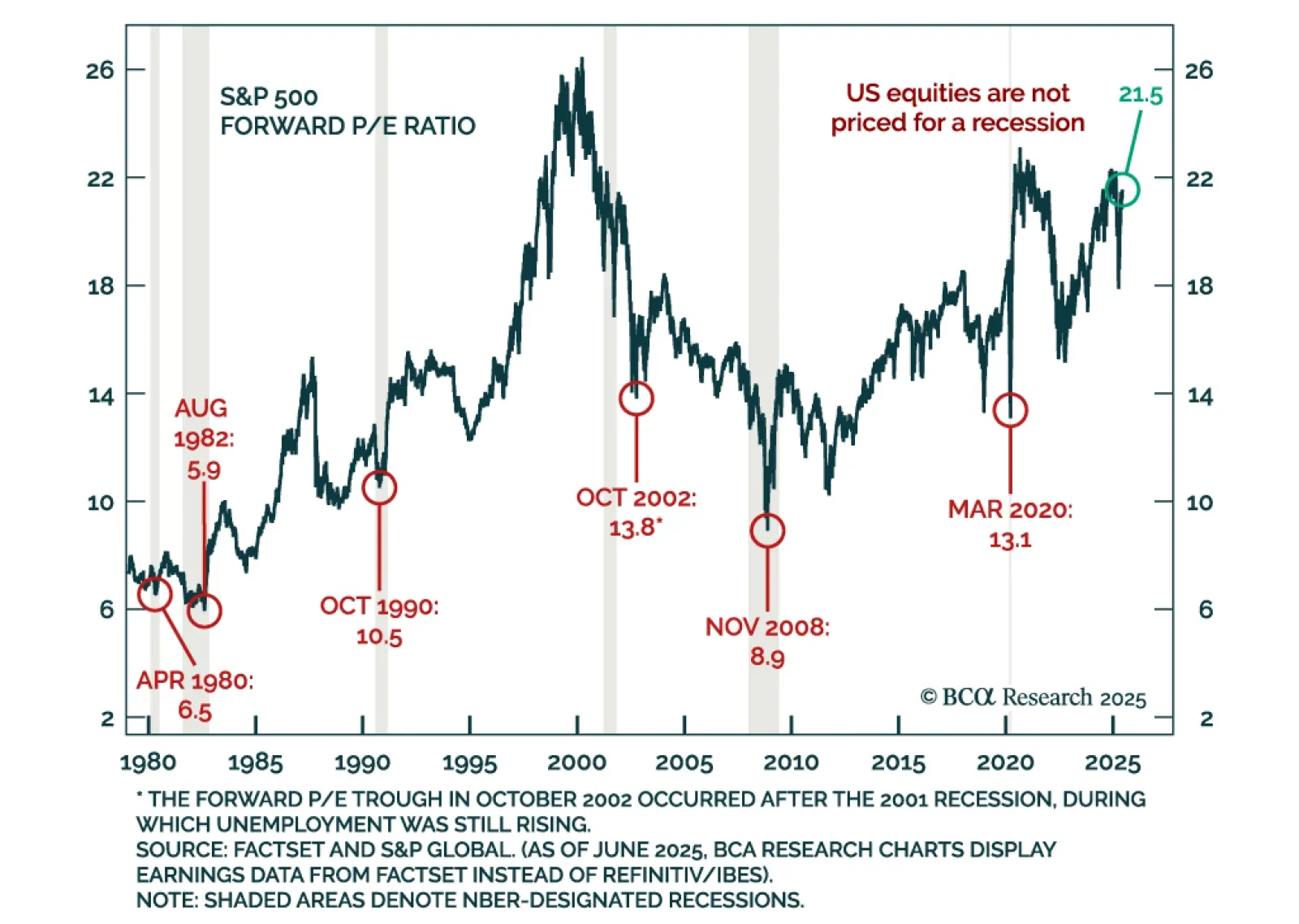

Geopolitical risks and fragile margins reinforce a defensive allocation stance, as oil shocks and high US equity valuations pose growing downside risks. At this month’s Views Meeting, our strategists discussed the potential fallout…

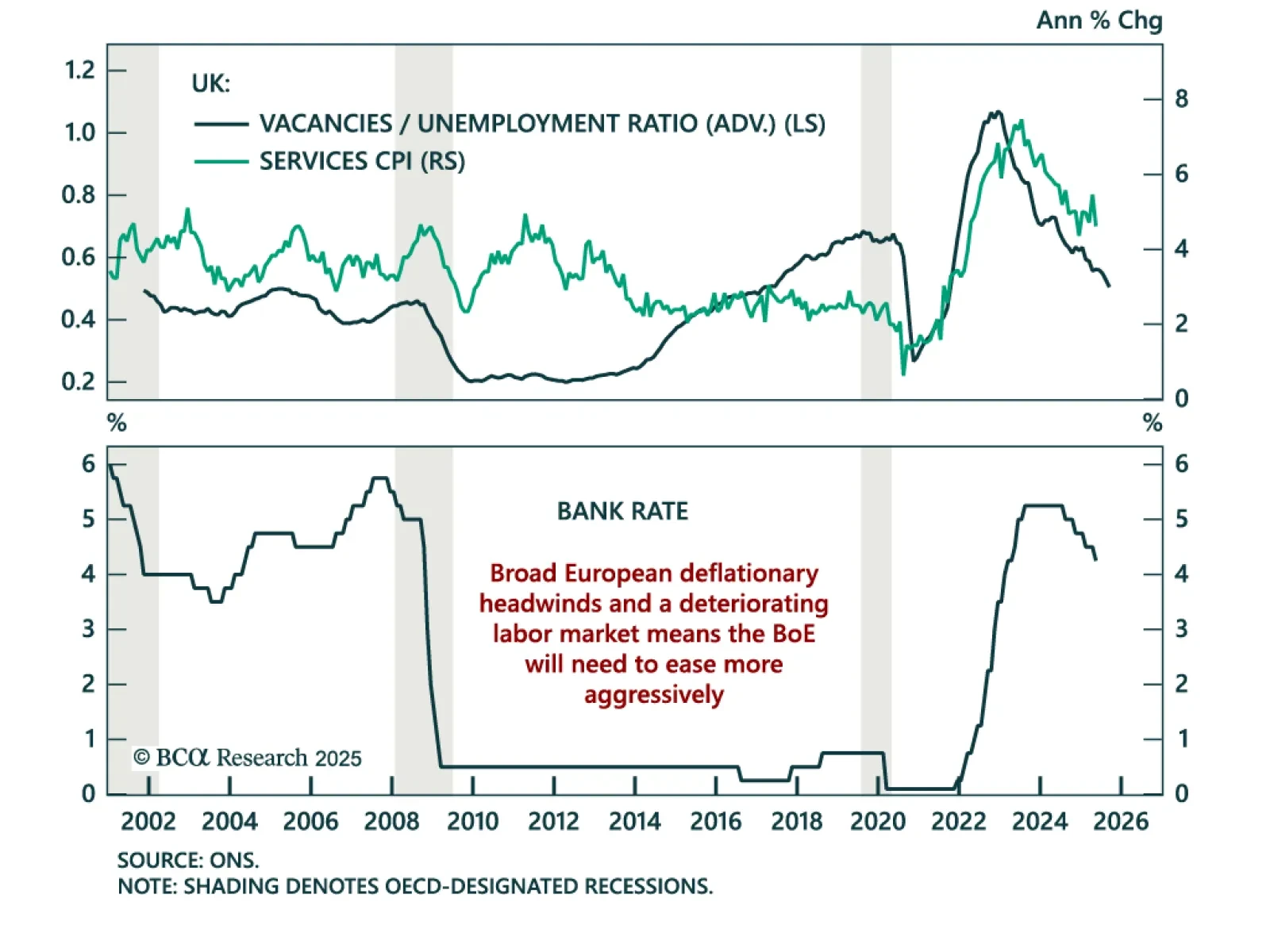

European central banks are pivoting quickly amid deflationary pressure, reinforcing our long UK Gilts and short GBP trades. The Norges Bank surprised with a 25 bps cut to 4.25%, abandoning its hawkish stance. The Swiss National Bank…

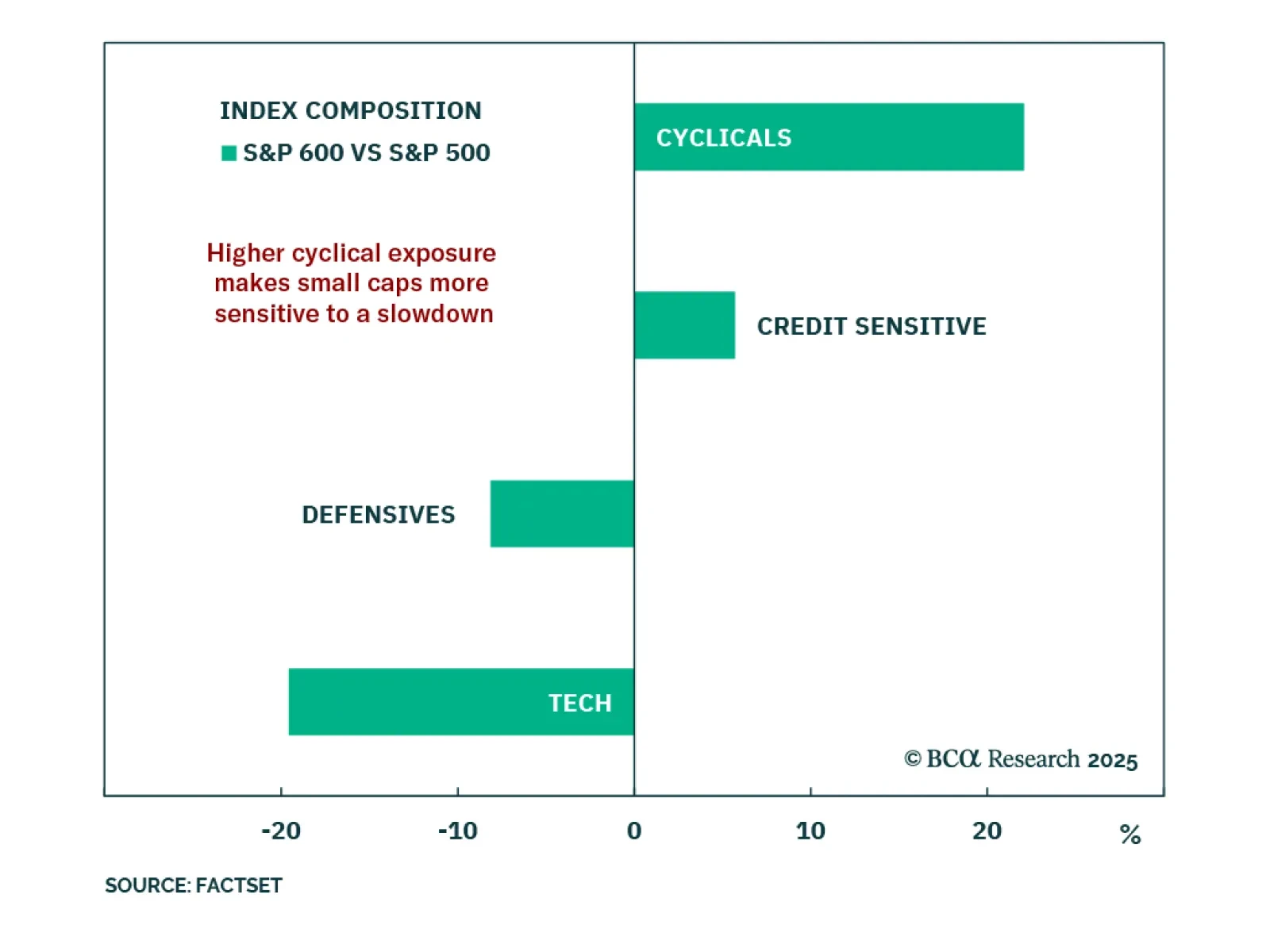

Our US Equity strategists remain cautious on small caps, as tariff exposure and slowing growth continue to weigh on this equity style. With the S&P 500 nearing its recent peak, some investors are rotating into riskier segments…