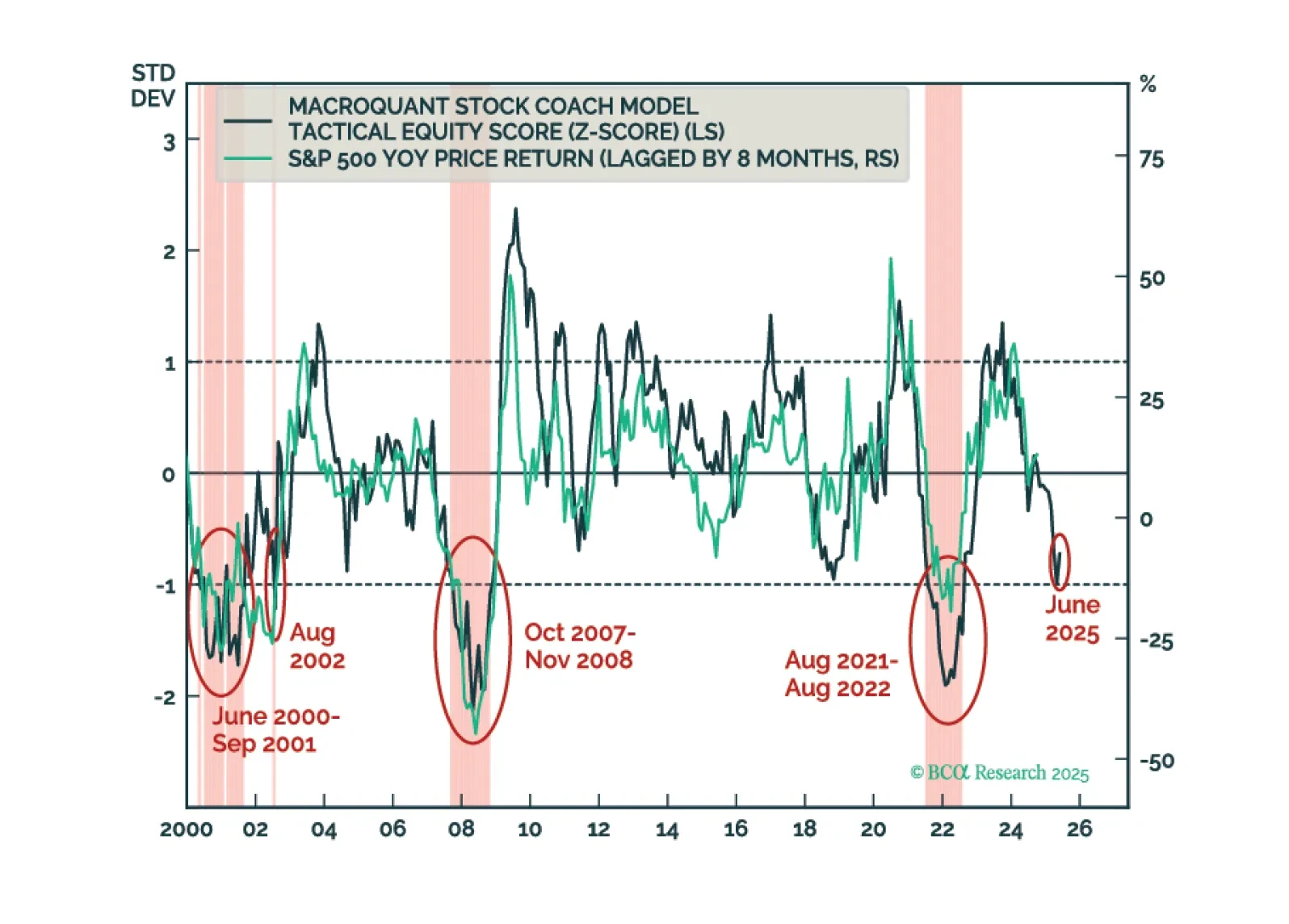

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

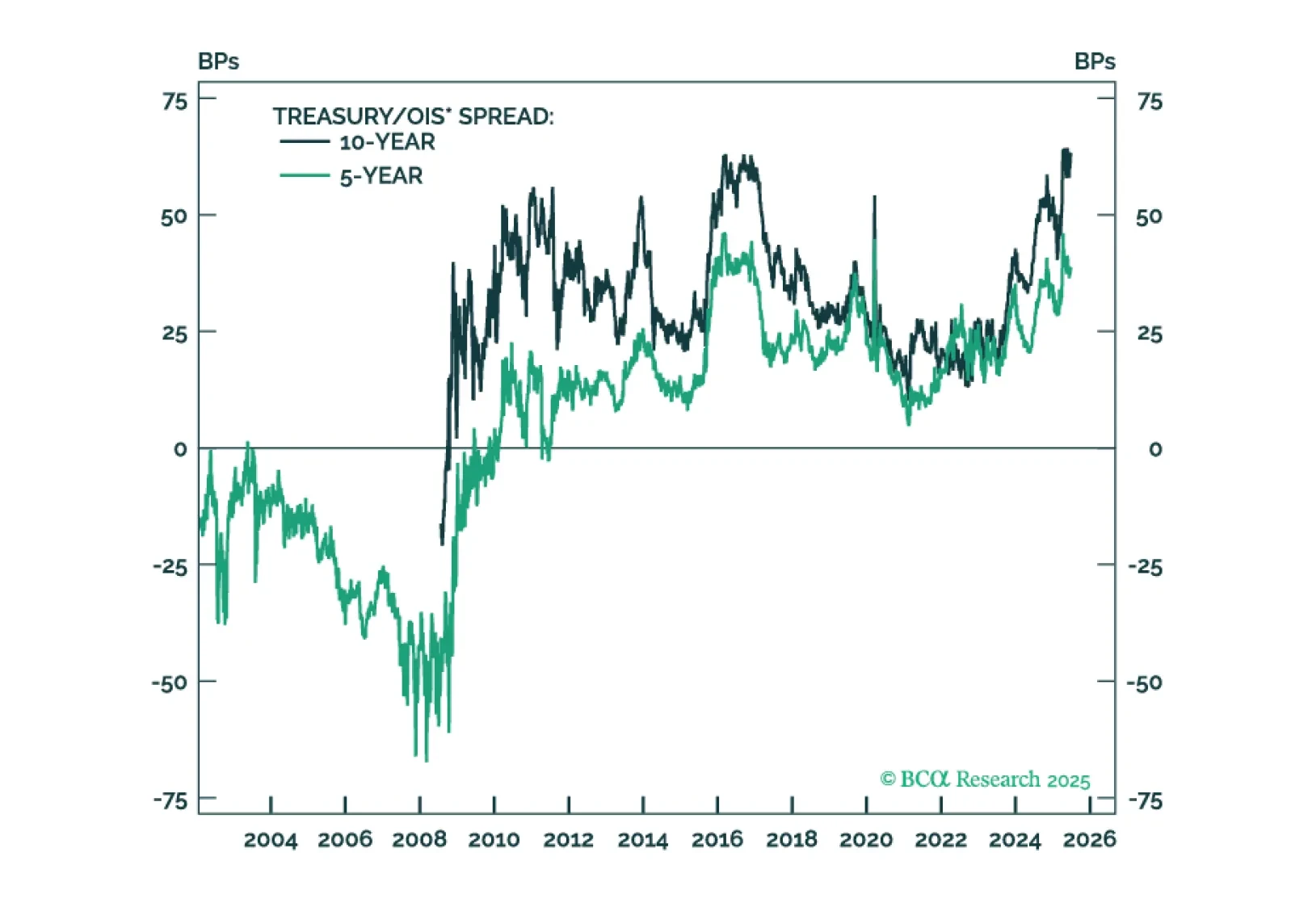

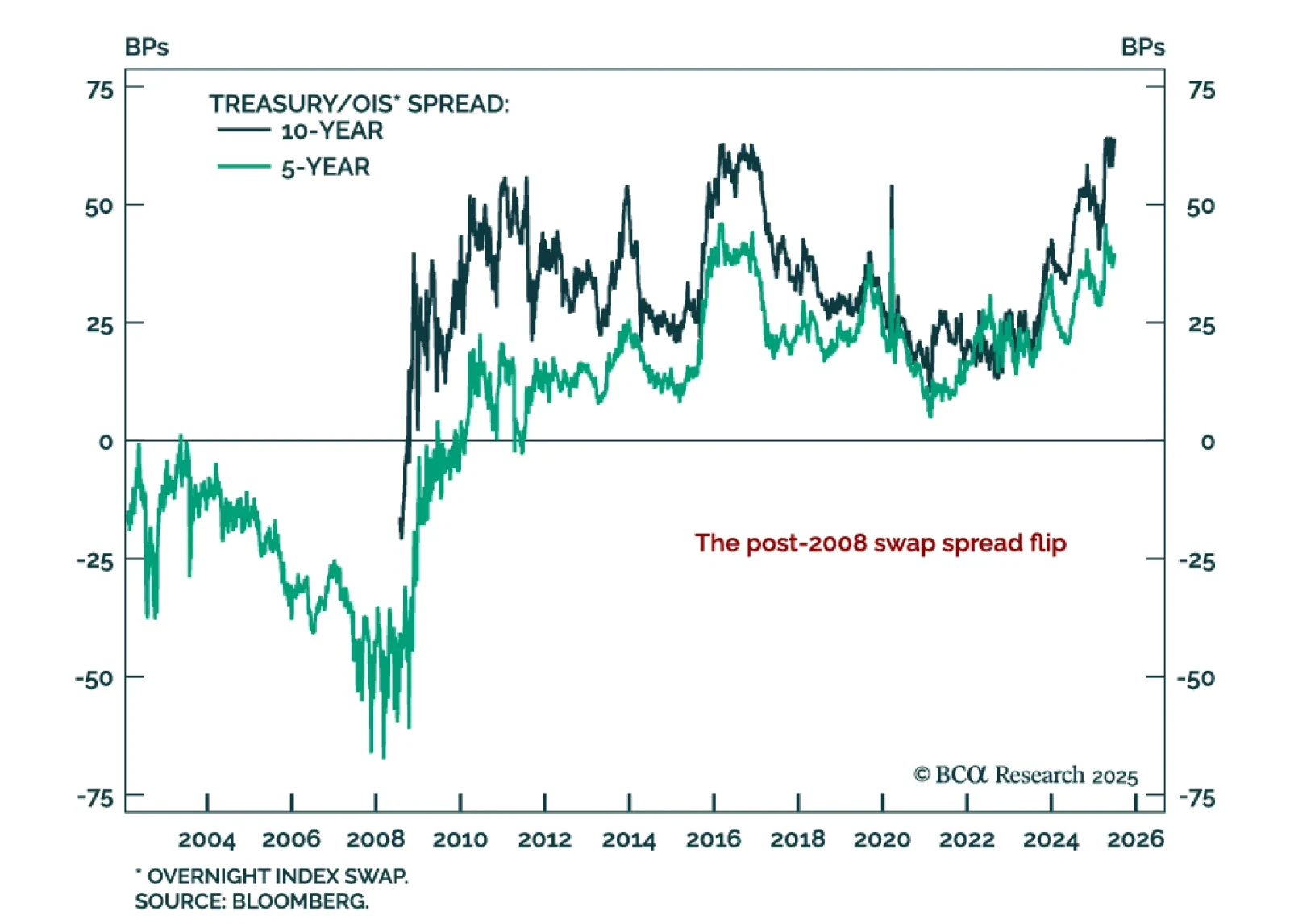

Our US Bond strategists expect a modest narrowing of the Treasury/OIS spread, supporting a cyclical long-duration stance and 2s10s steepeners. Over the past year, the spread has added roughly 30 bps to the 10-year Treasury yield,…

Regional Fed surveys confirm sluggish US manufacturing and tame inflation, supporting long duration positioning outside the US. The June Dallas Fed Manufacturing survey missed expectations, rising to -12.7 from -15.3, still deep in…

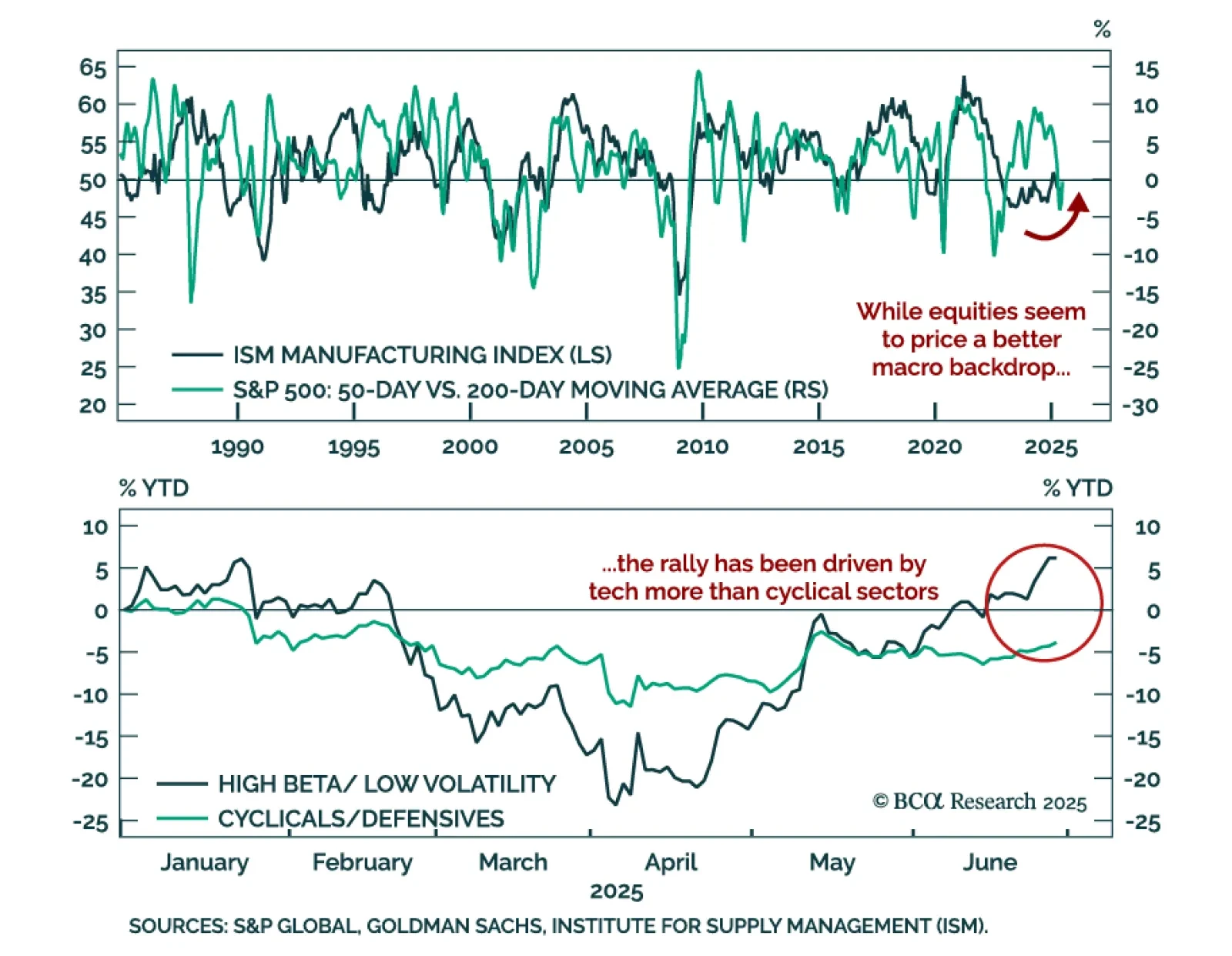

Tech-led momentum is driving the S&P 500 to new highs despite weak growth and rising cyclical risks. The rally has accelerated following a de-escalation in geopolitical tensions and ongoing hopes for positive trade developments.…

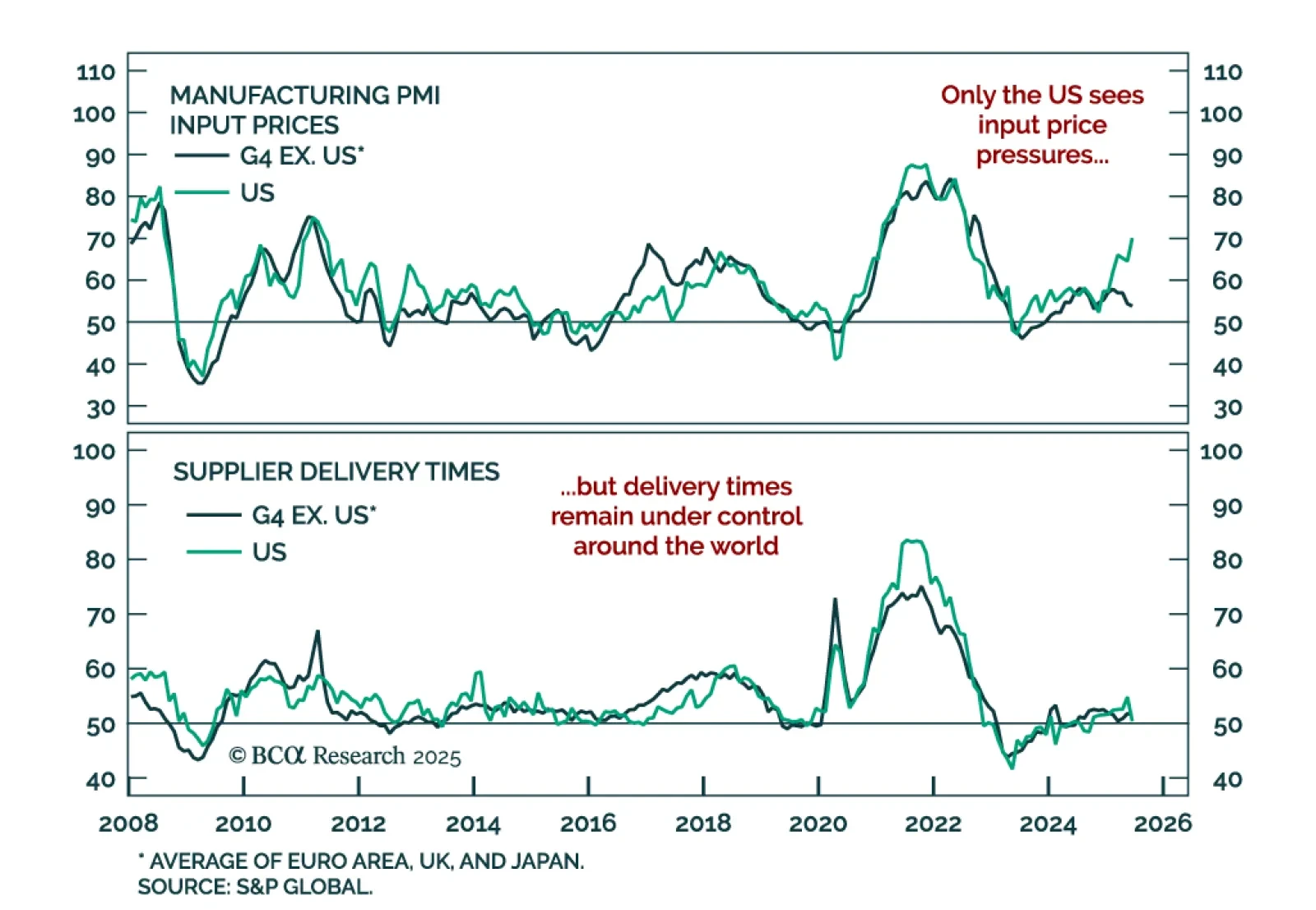

Global inflation risks remain subdued, reinforcing a long duration stance across select DM government bonds. Our price pressure index shows moderate input price inflation outside the US and stable delivery times globally.…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

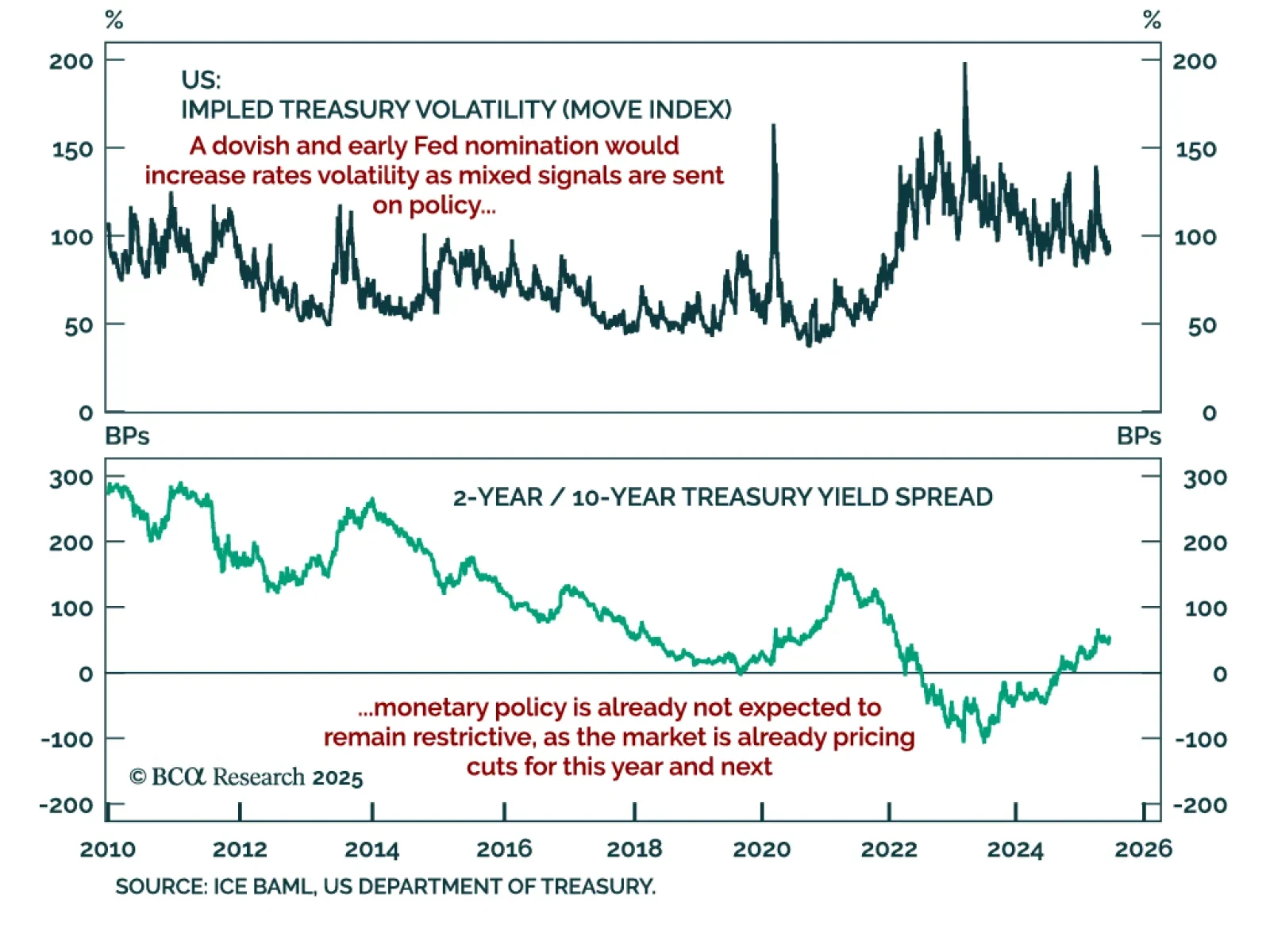

A dovish early Fed nominee would increase volatility in rates and FX as markets reassess the credibility of US monetary policy. News reports indicate the Trump administration is considering nominating a Fed successor ahead of the end…

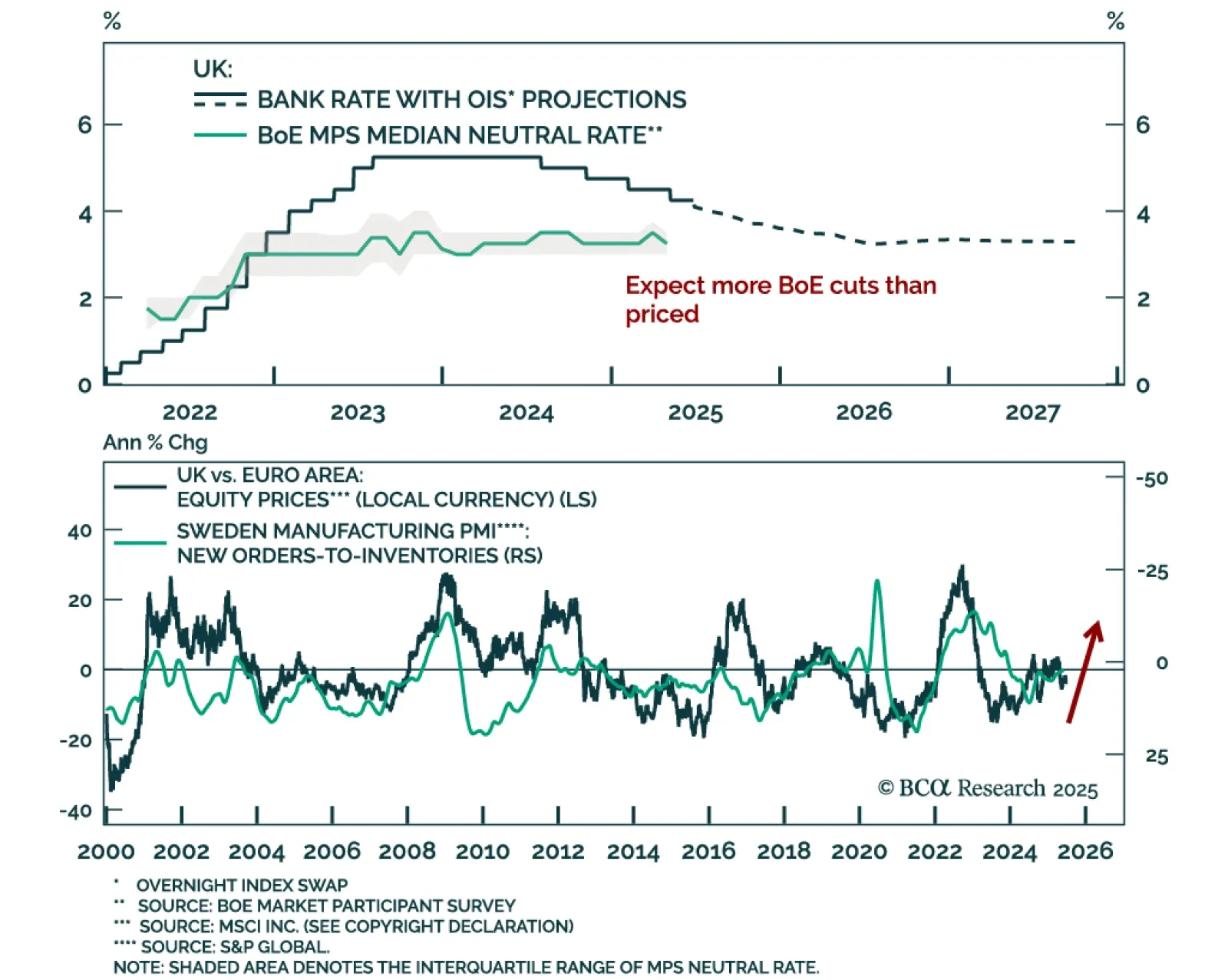

Our Global Fixed Income, FX, and European strategists expect aggressive BoE easing amid disinflation and labor market weakness, supporting an overweight in Gilts and UK equities versus the euro area. While UK productivity remains…

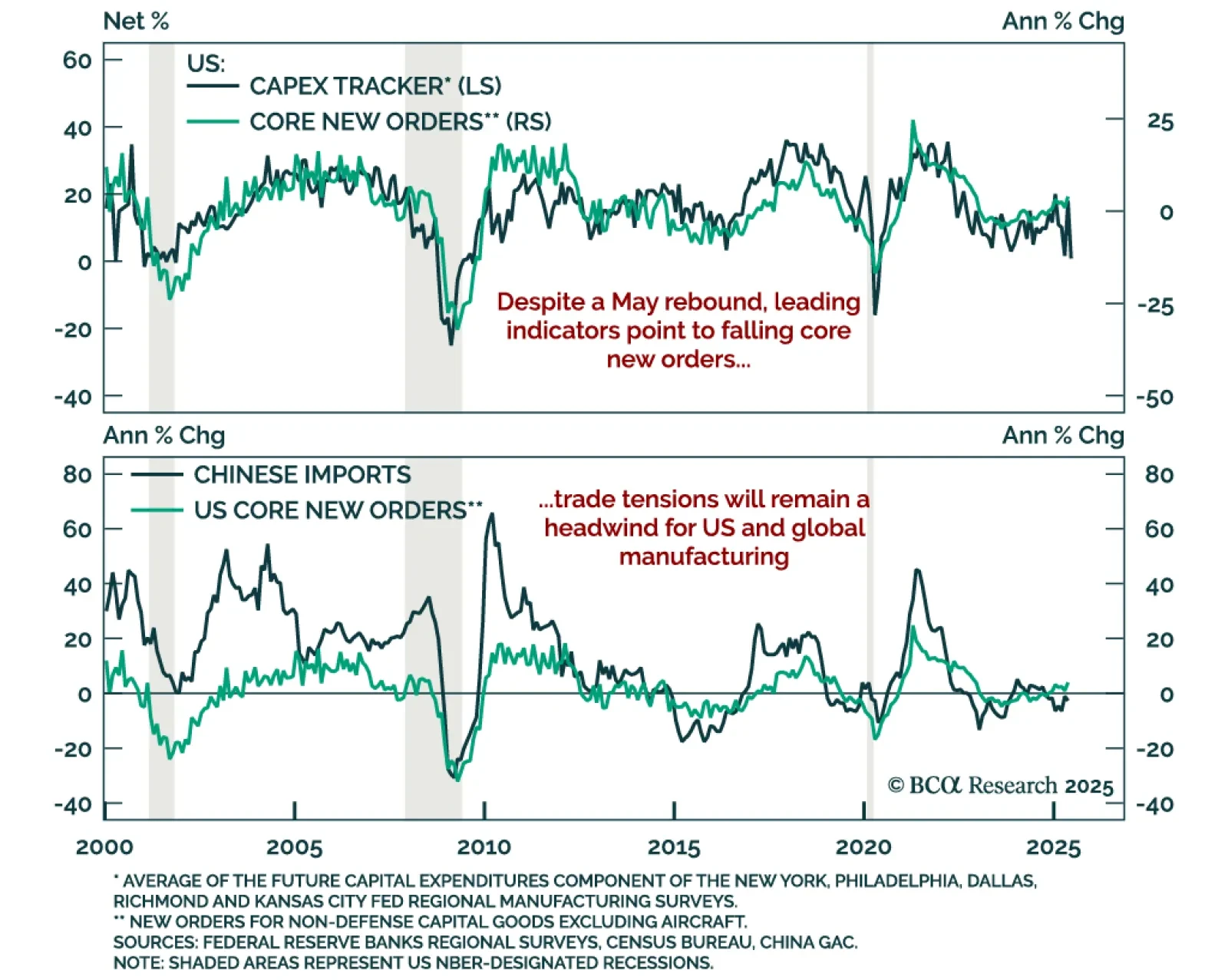

Headline strength in US capital goods orders is unlikely to last, reinforcing our defensive stance and preference for steepeners. New orders for core capital goods (nondefense ex-aircraft) rose 1.7% m/m in May, beating expectations…