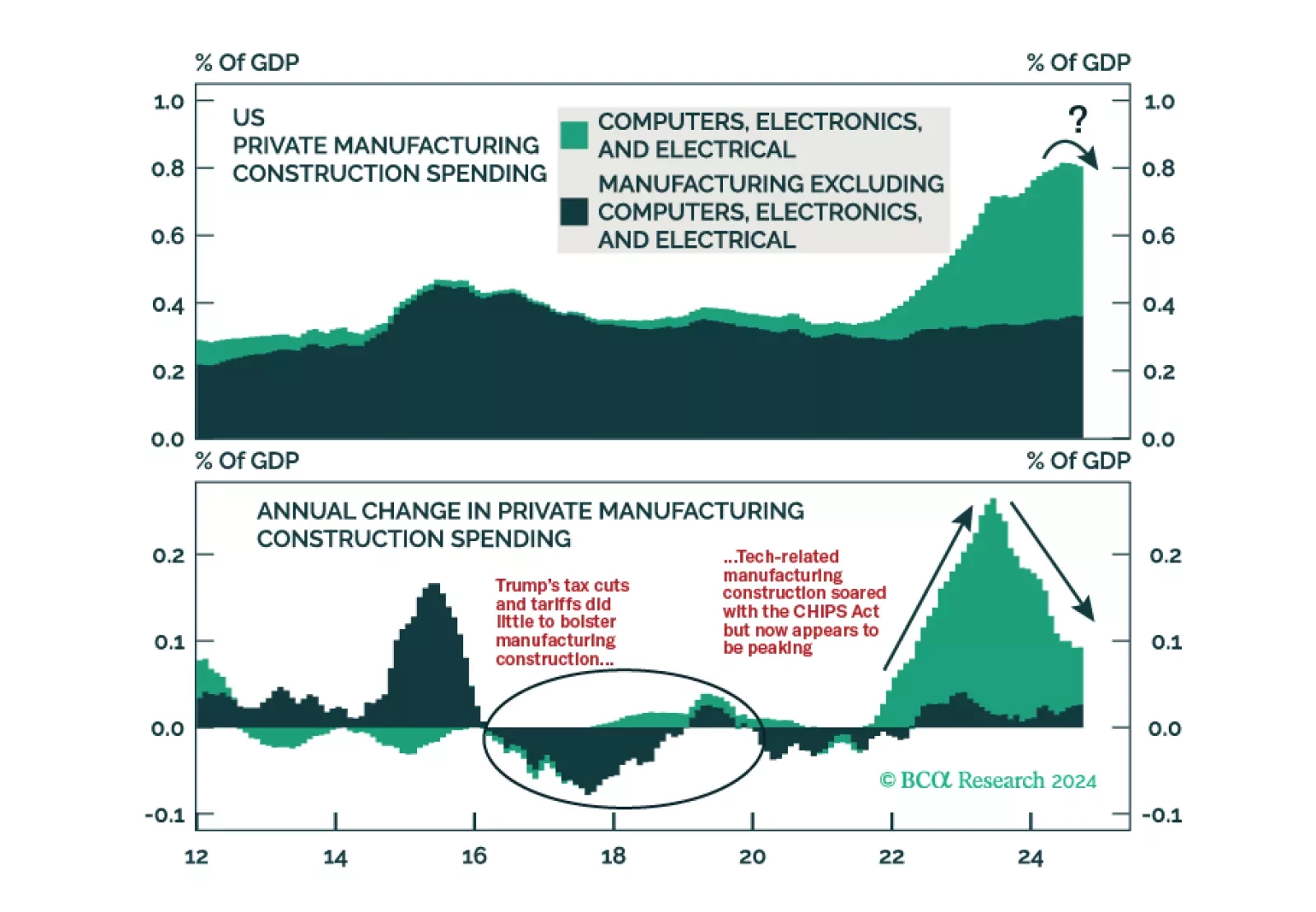

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…

Our thoughts on the bond market’s reaction to the election and this afternoon’s FOMC meeting.

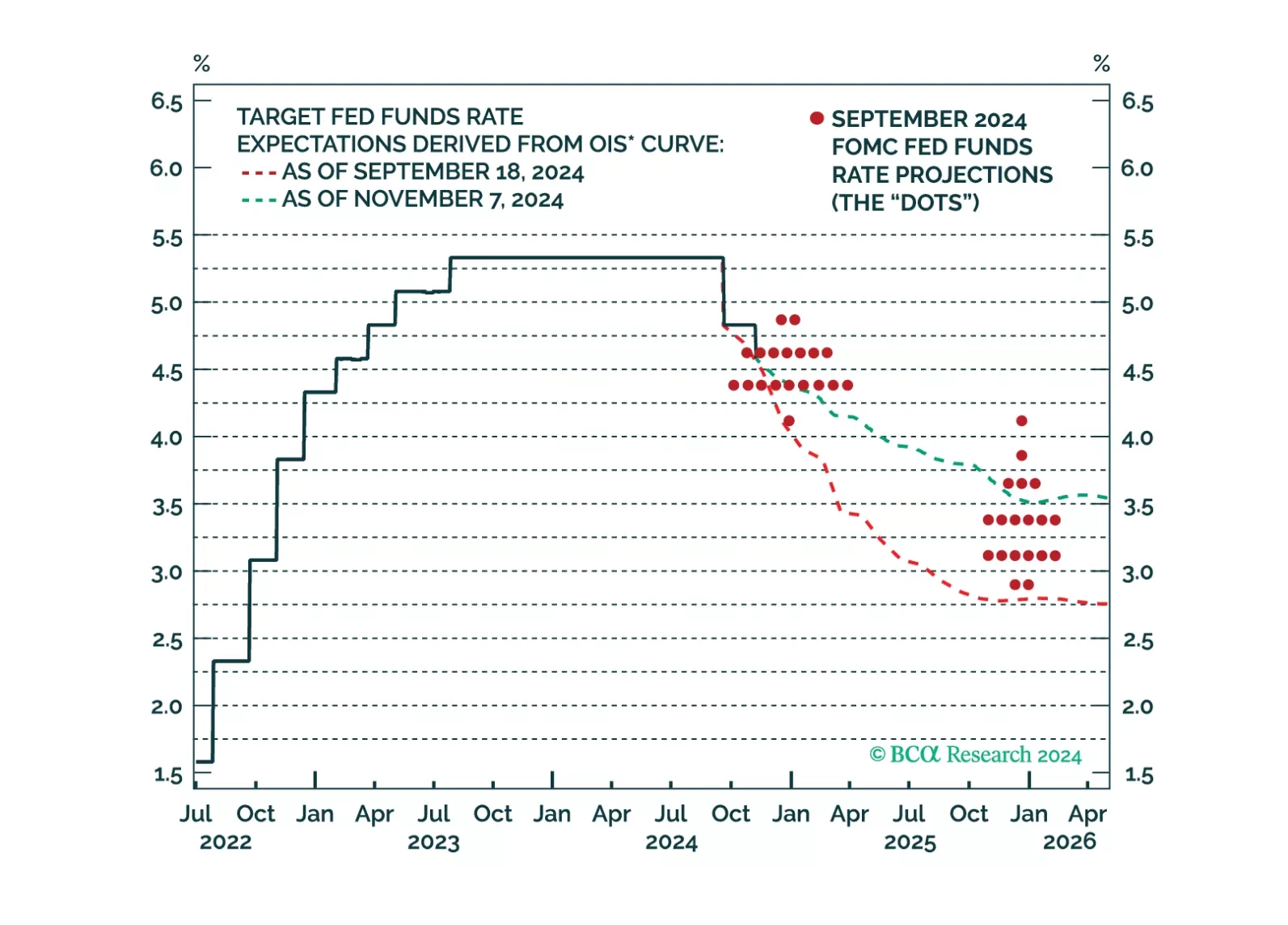

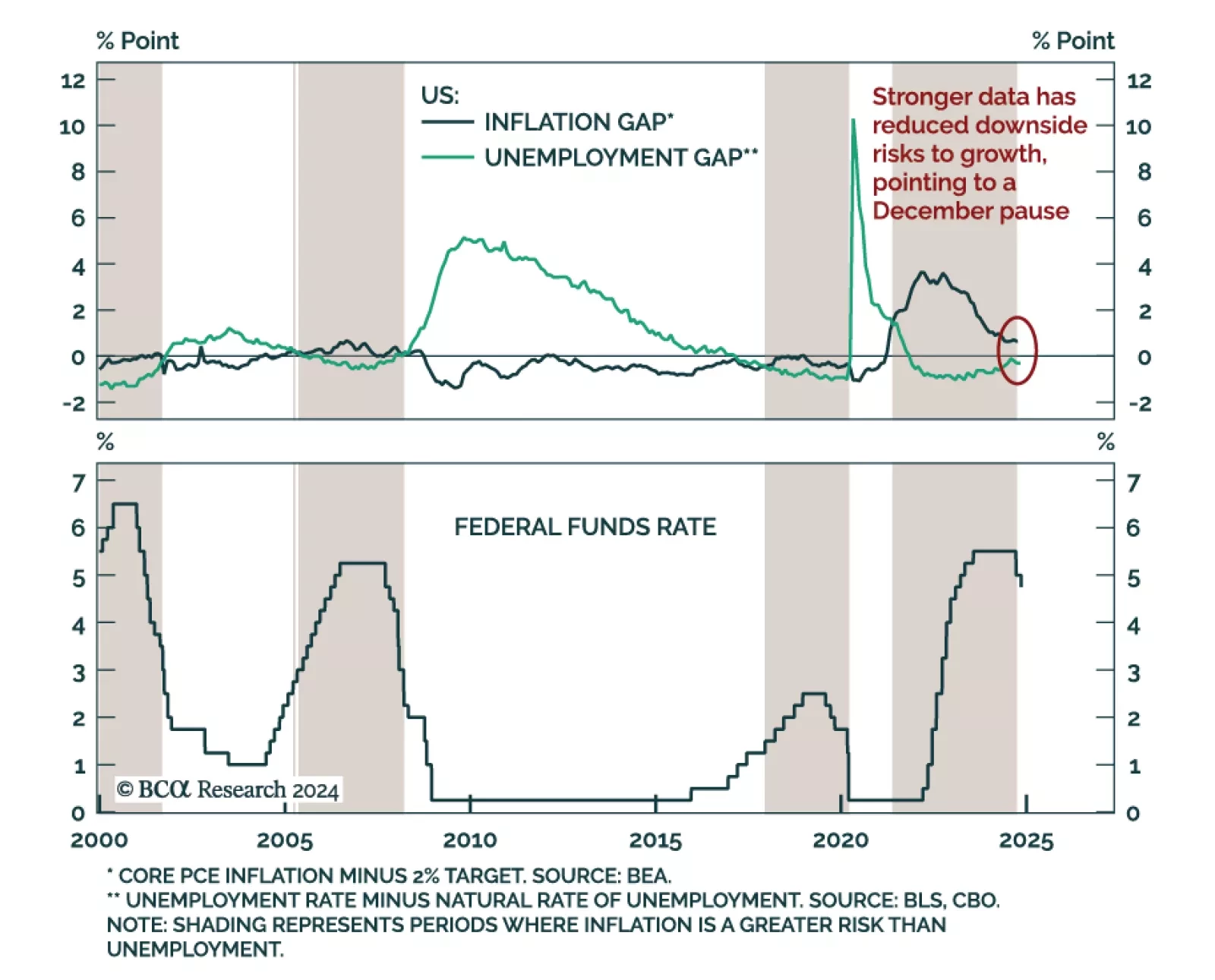

The Federal Reserve cut interest rates by 25 bps as expected yet introduced uncertainty on the timing of its next move. The statement was relatively unchanged, except for the removal of a segment from September highlighting they…

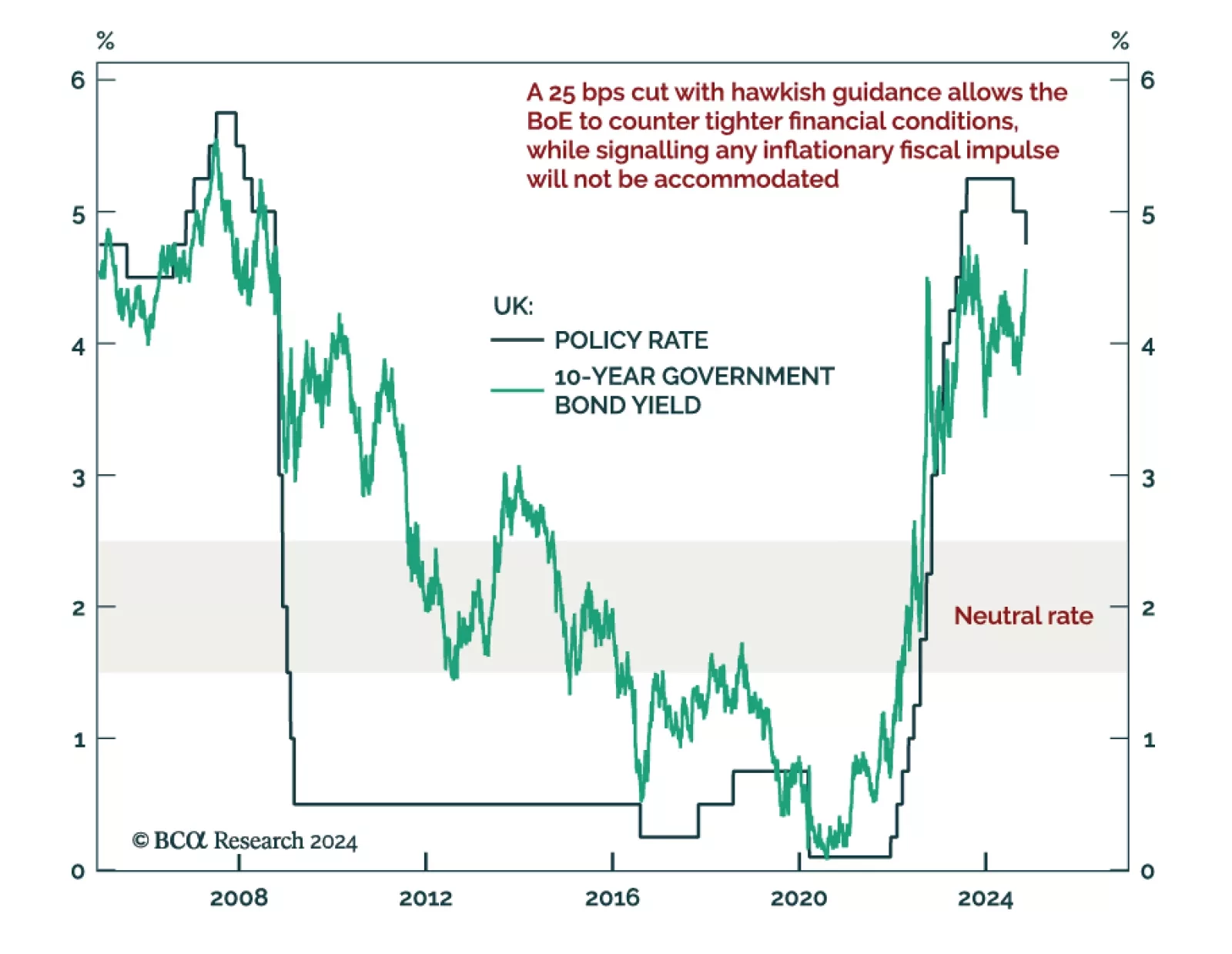

The Bank of England cut its policy rate in line with expectations to 4.75%, but it signaled a more gradual pace of cuts as it increased its inflation forecast following last week’s budget. A 25 bps cut with hawkish…

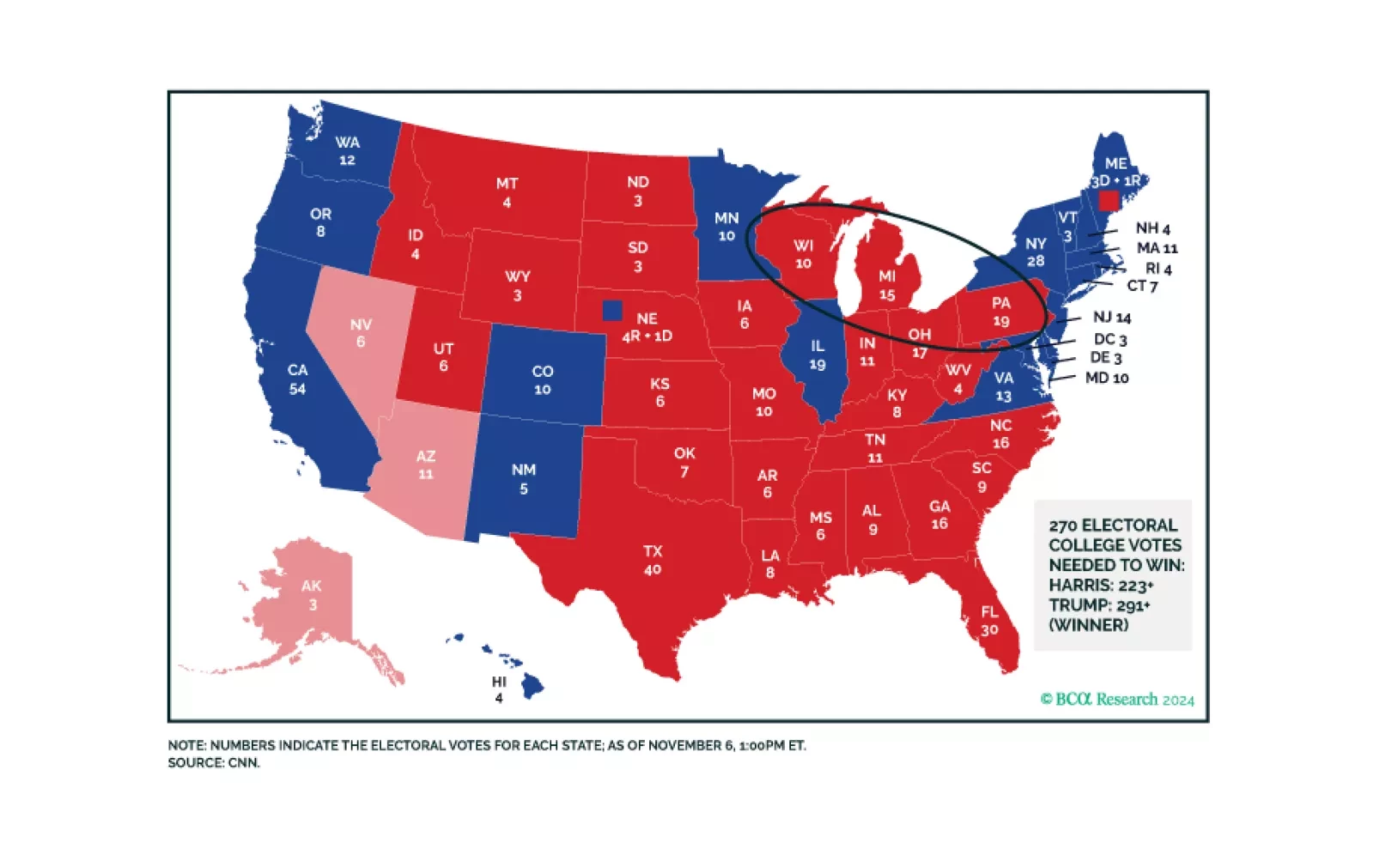

Our US Political strategists assessed the magnitude of the Republican sweep and discuss the path ahead as they take control of Washington. The GOP sweep was a resounding victory as they also clinched the popular vote. The…

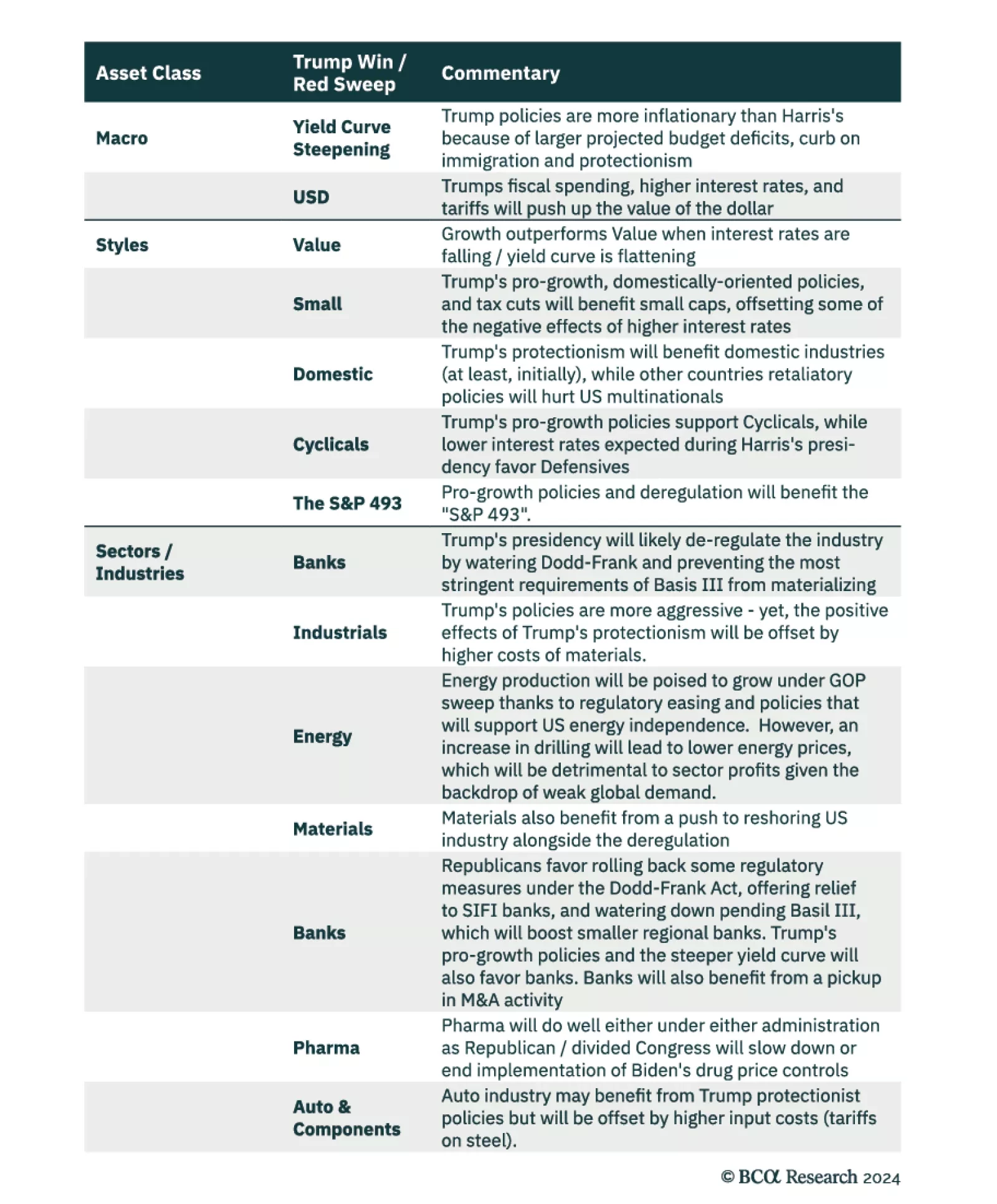

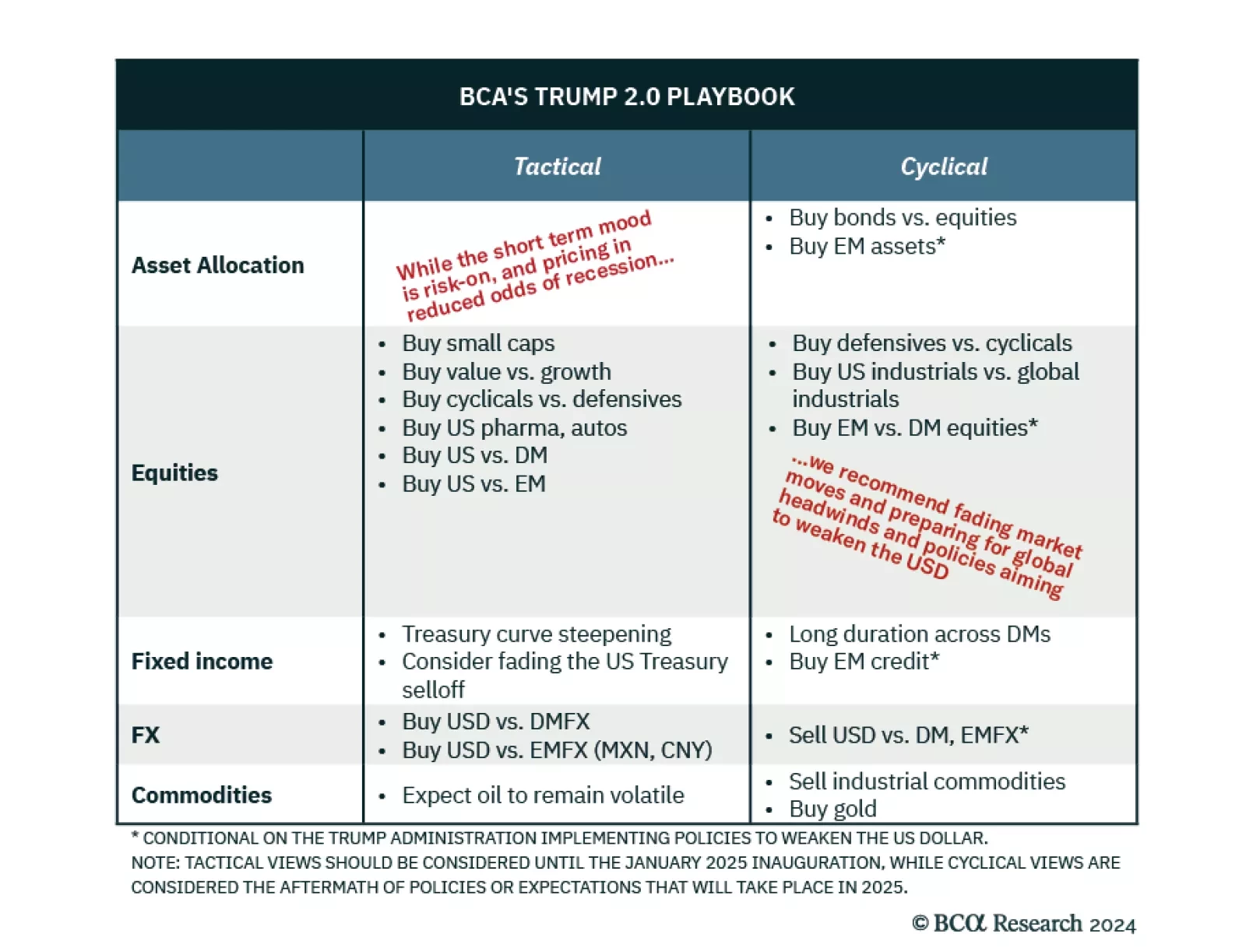

Our US Equity strategists prepared a Post-Election US Equity Cheat Sheet. Here are highlights of their recommended positioning for a US equity portfolio in a Red Sweep scenario. Protectionism and pro-growth domestic policies will…

Although foreseen by our US & Geopolitical strategists, a “Red Sweep” now makes the macro environment more volatile. After convening for our BCA Live & Unfiltered meeting, we offer three main takeaways.…

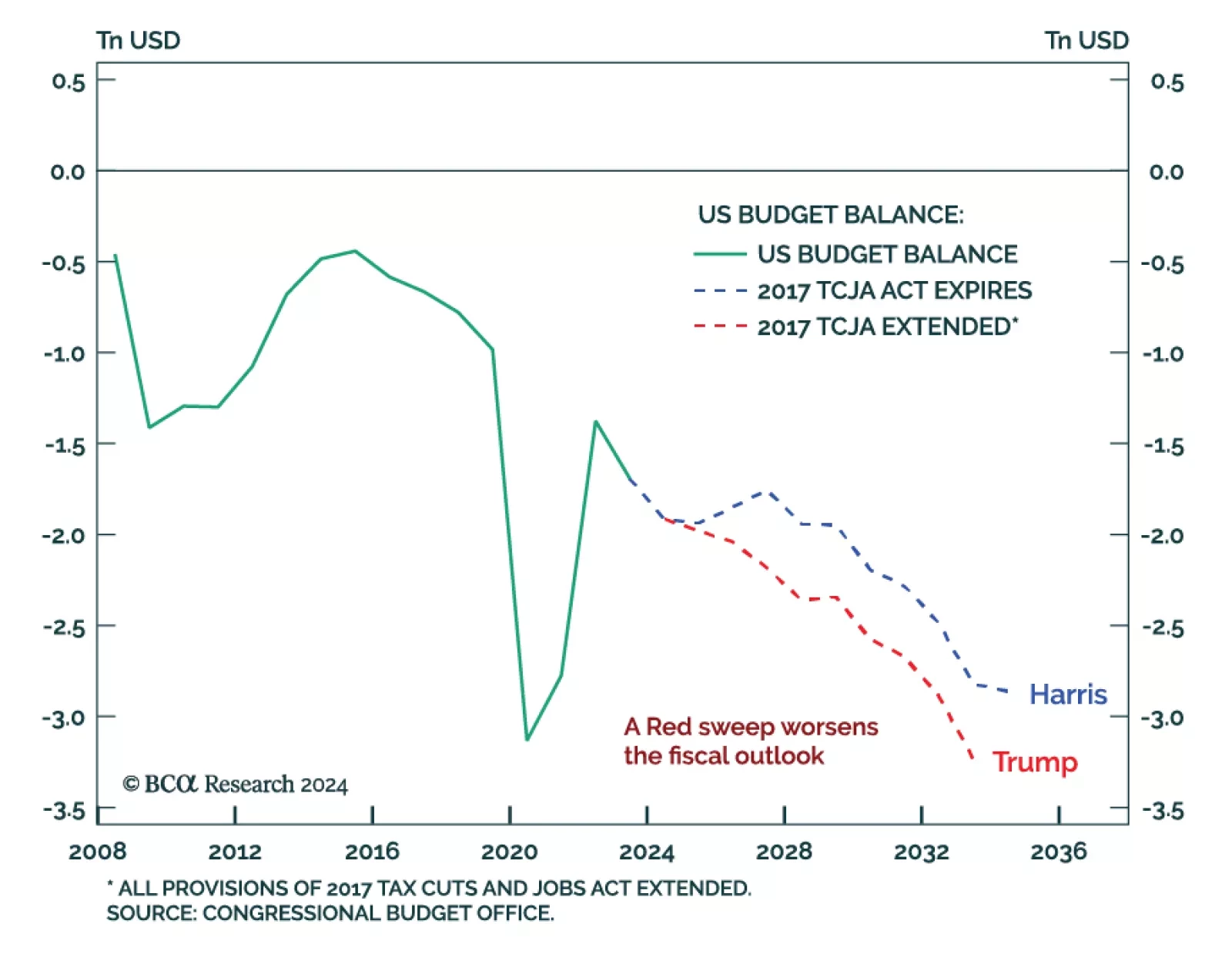

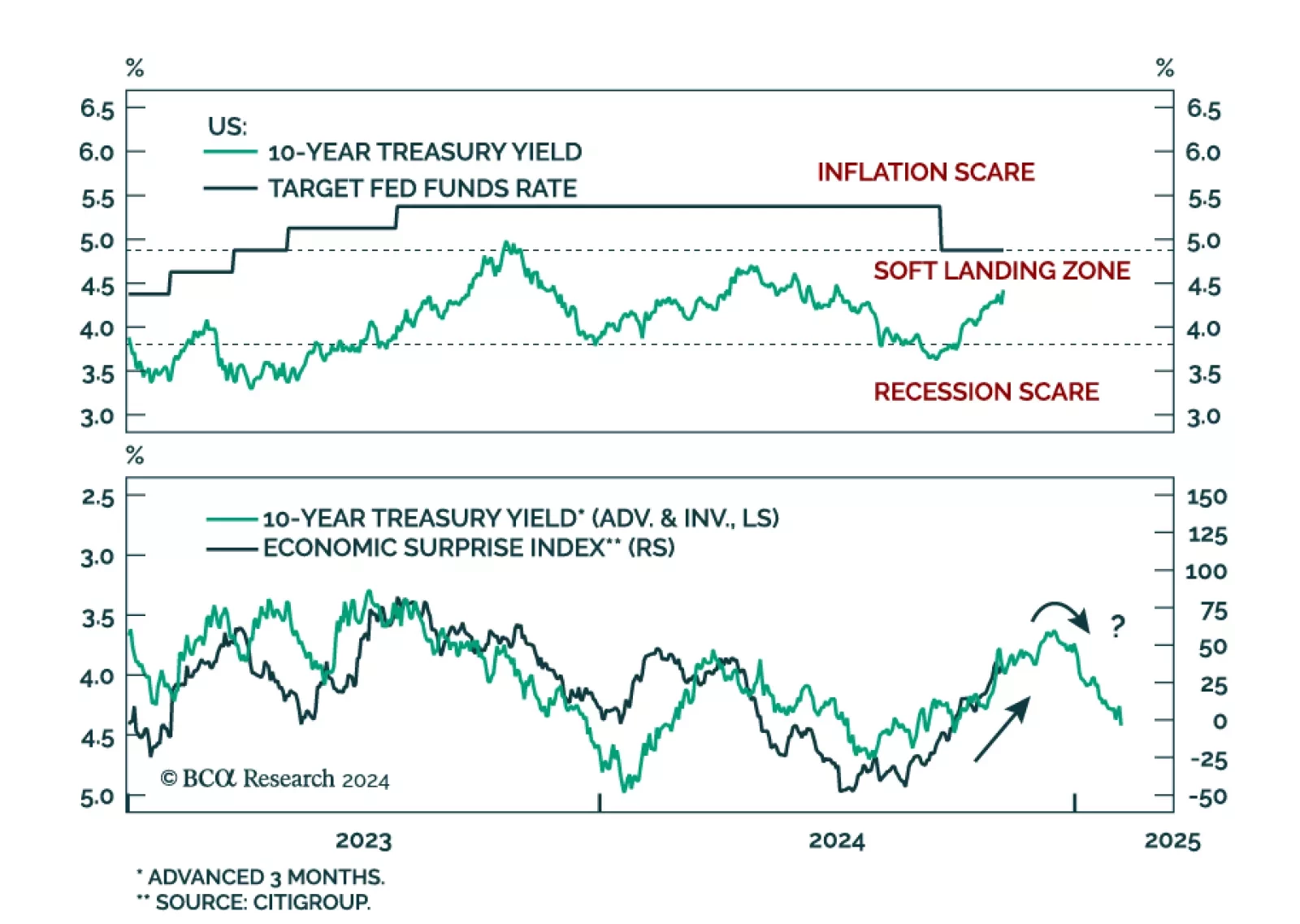

The bond market had long anticipated a Trump 2.0 administration, but bond yields still spiked as a Trump victory materialized. What’s the path ahead for US rates? Our US bond strategists believe 10-year yields can go up…

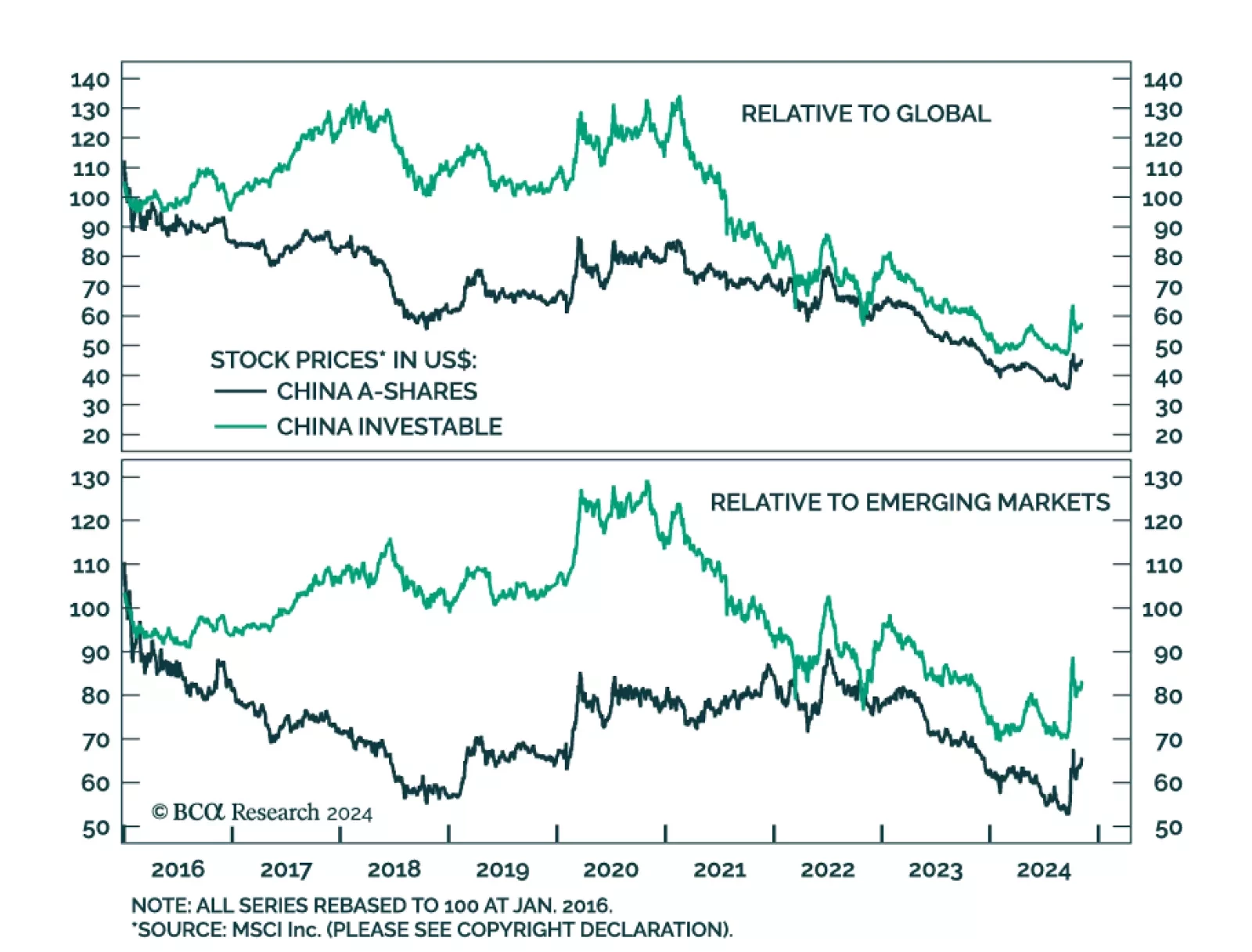

Will the prospect of expanding trade tensions lead to more Chinese stimulus, and create an opportunity for Chinese equities? Not necessarily, as the election results were already factored in our EM and China strategists’…

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…