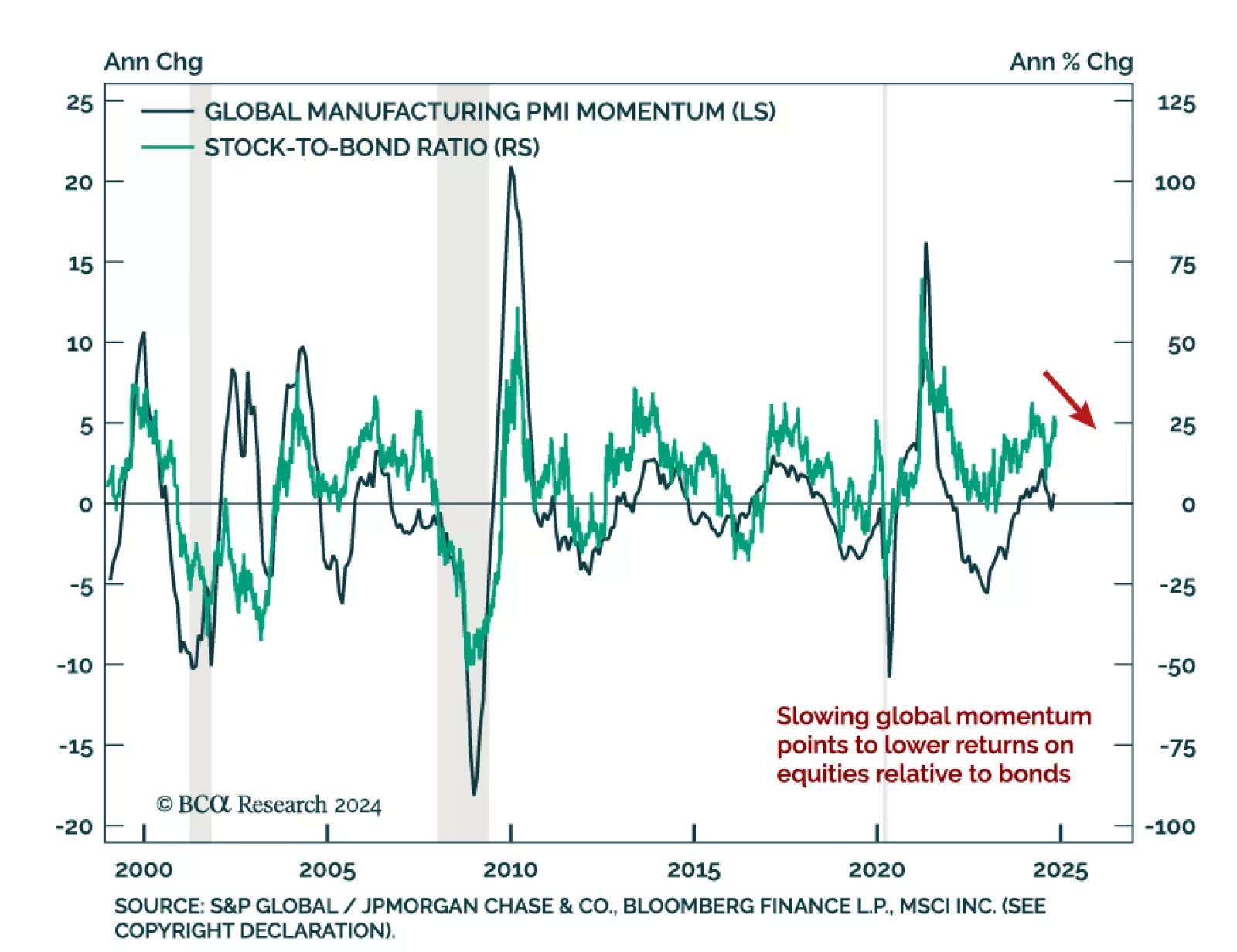

As talks of a market “meltup” abound, we used last Friday’s edition of our BCA Live & Unfiltered meeting to assess our asset allocation recommendations. Our House View has been underweight equities since…

October retail sales beat expectations, printing 0.4% m/m on top of positive revisions for September. However, the numbers were weaker when adjusting for autos or other volatile components, with the control group declining 0.1%…

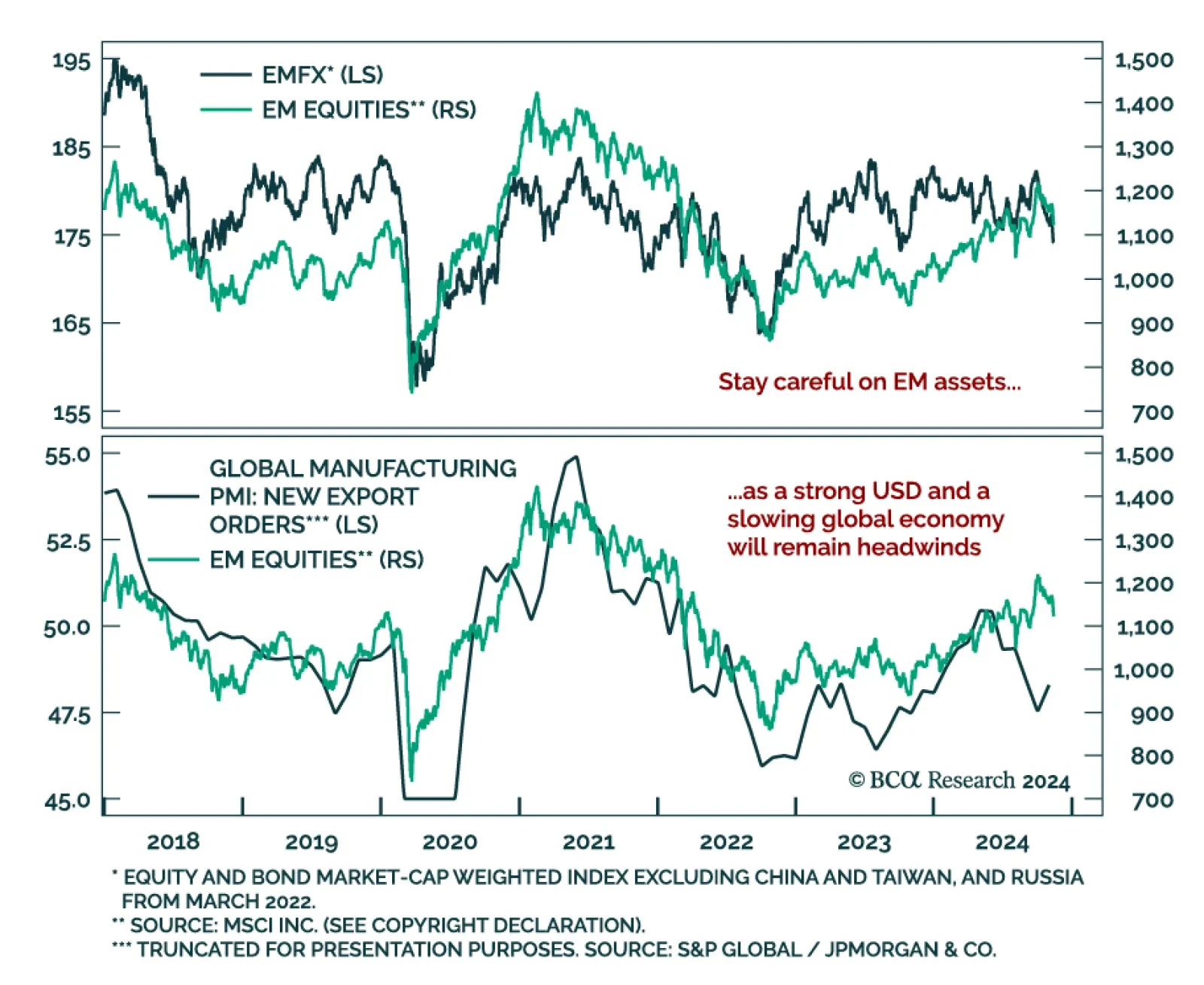

The flipside of the recent US dollar rally has been weakness across both DM and EM FX. The USD rally has legs and will have cross-asset reverberations. EM equities will be affected. A key determinant of EM returns is the…

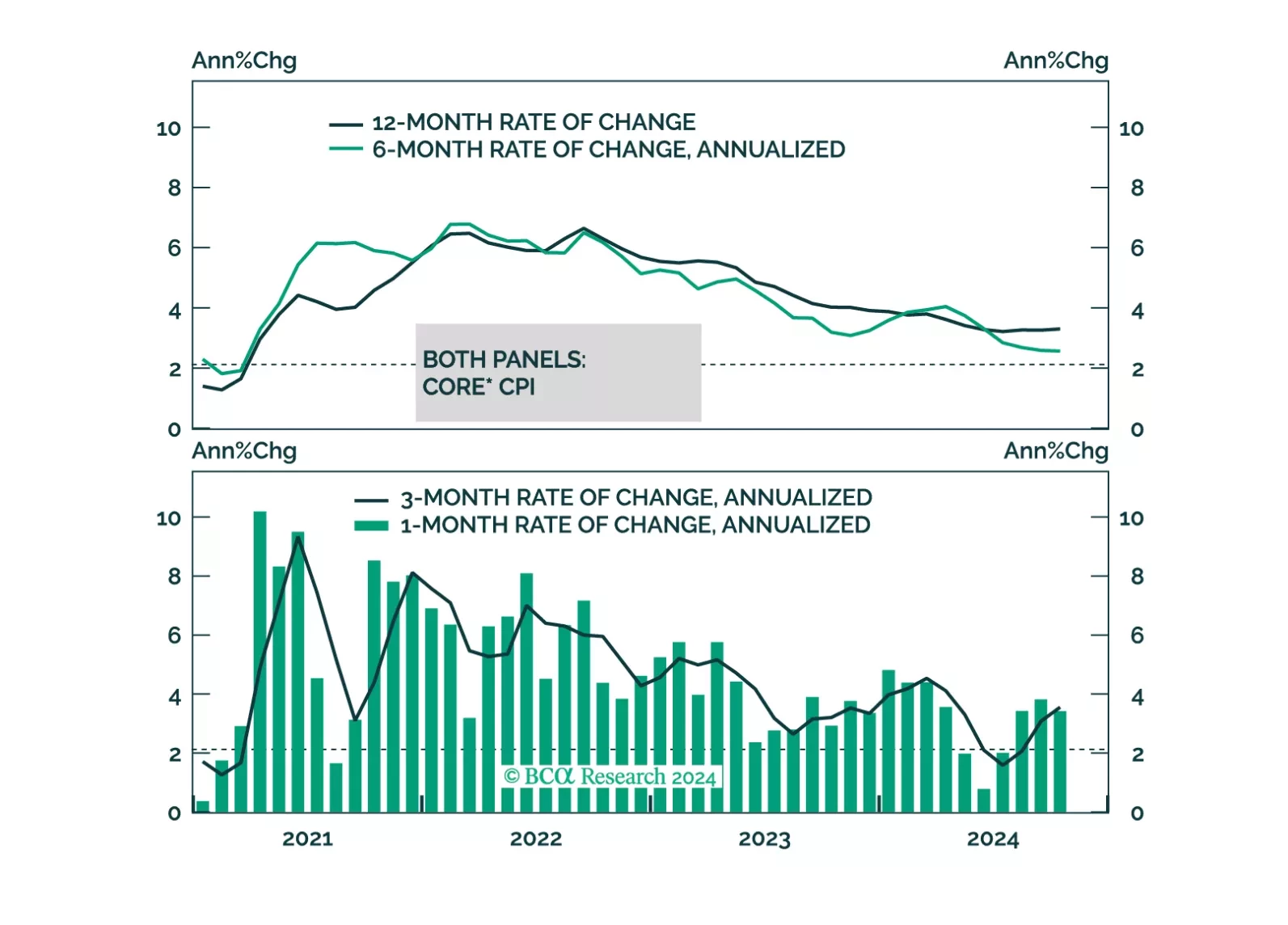

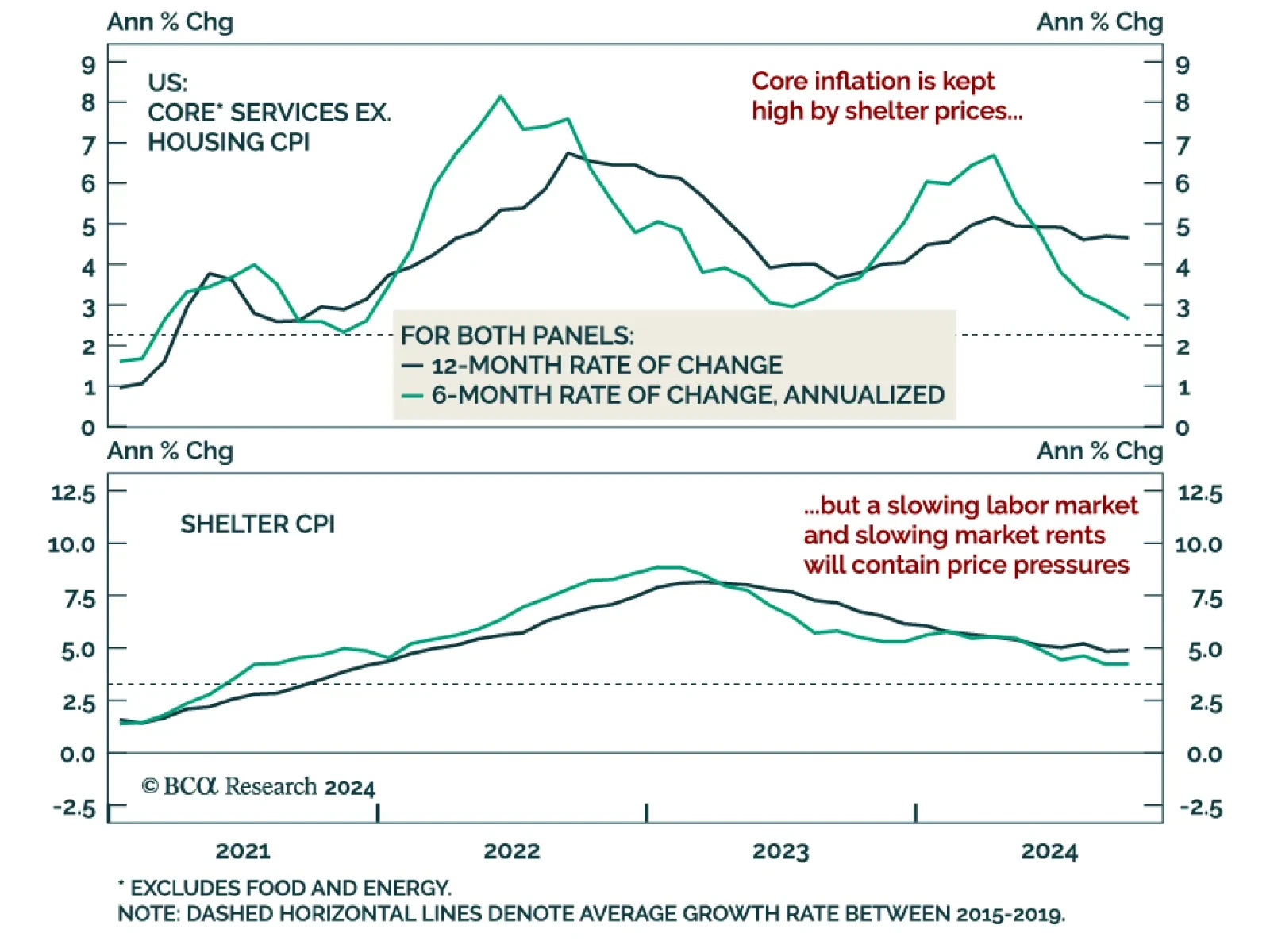

US CPI inflation for October printed in line with expectations and was unchanged from September, with headline at 0.2% month-over-month and core at 0.3%. Headline re-accelerated to 2.6% from 2.4% on an annual basis, and core…

We update our inflation forecast following this morning’s CPI release, concluding that TIPS breakeven inflation rates have room to fall.

Our Portfolio Allocation Summary for November 2024.

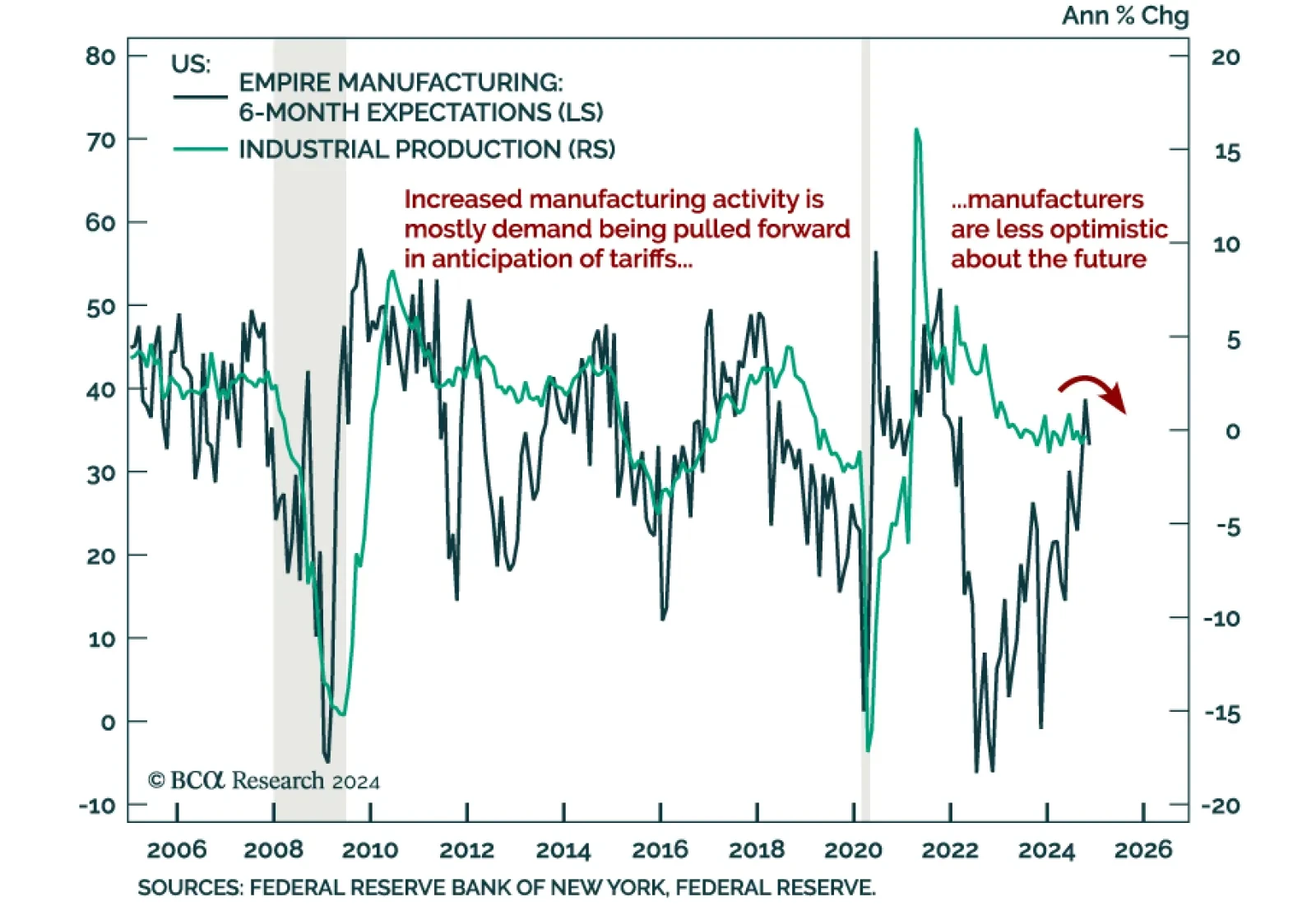

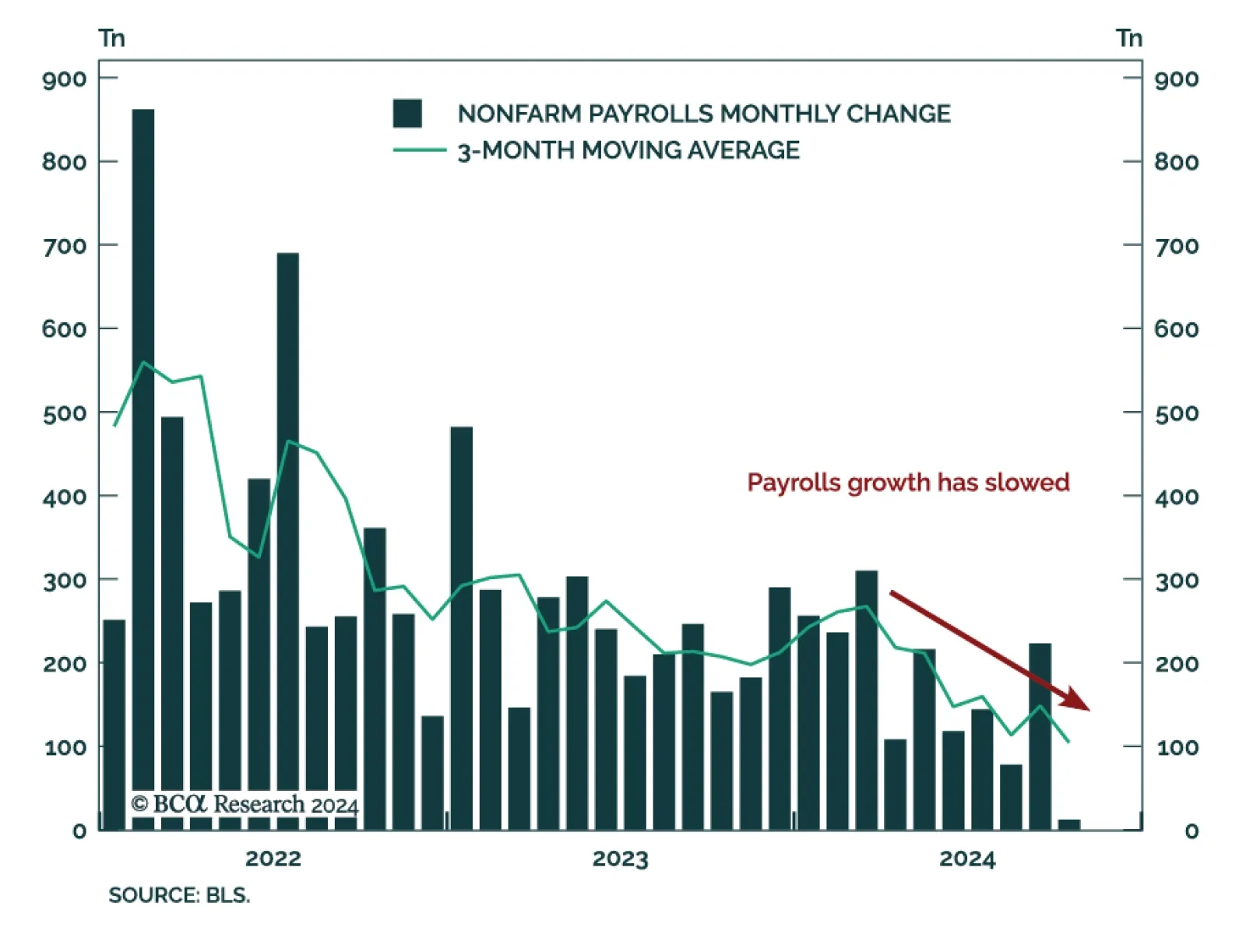

Amidst all the post-election noise, our US Investment Strategy colleagues took a step back and assessed where the US labor market stands. Despite the strong post-election equity rally, they maintain their recession outlook.…

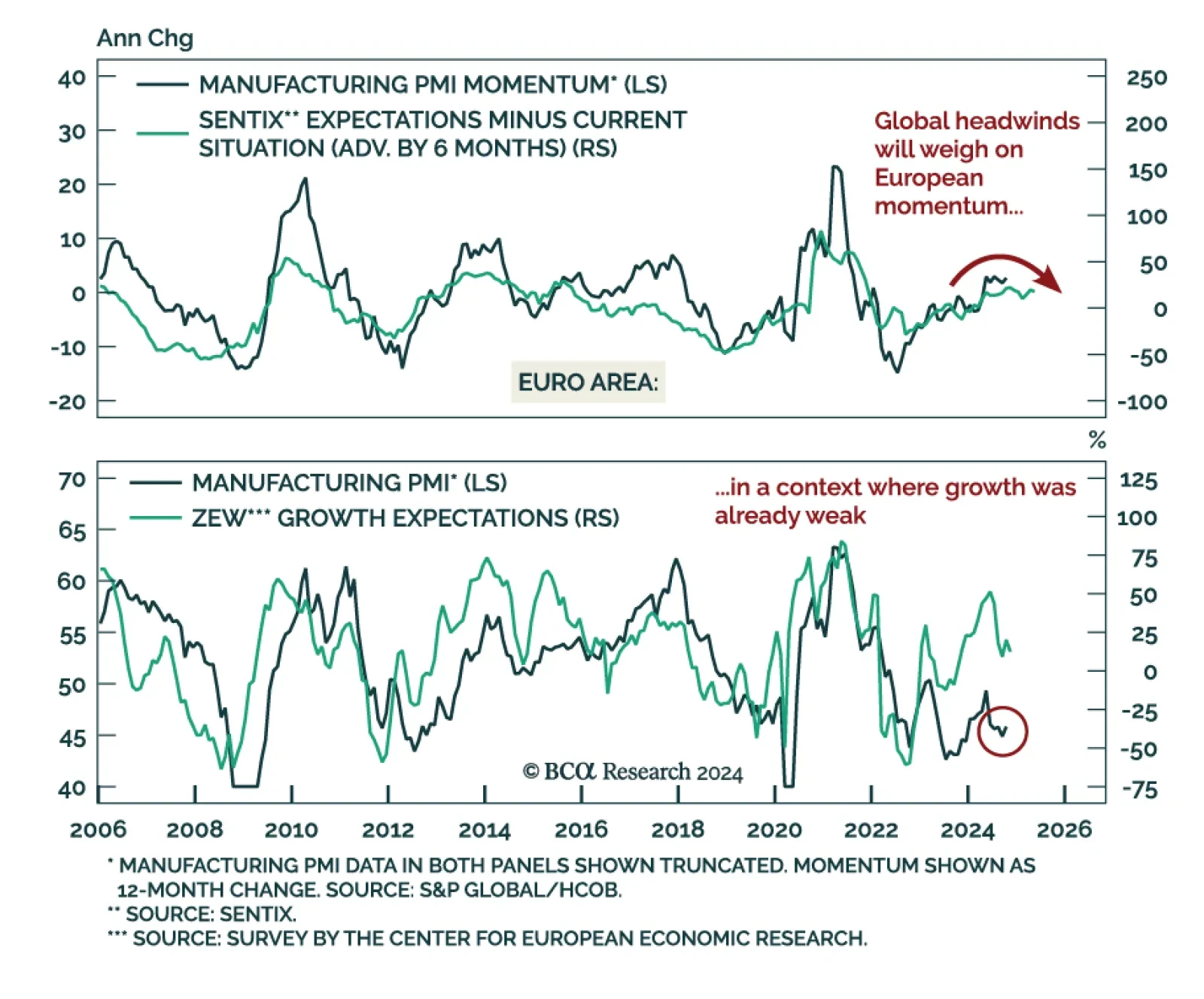

Economic expectations for Germany and the Eurozone disappointed, with the November ZEW decreasing to 12.5 from 20.1. The assessment of current conditions also worsened, implying the sentiment rebound from September will not be…

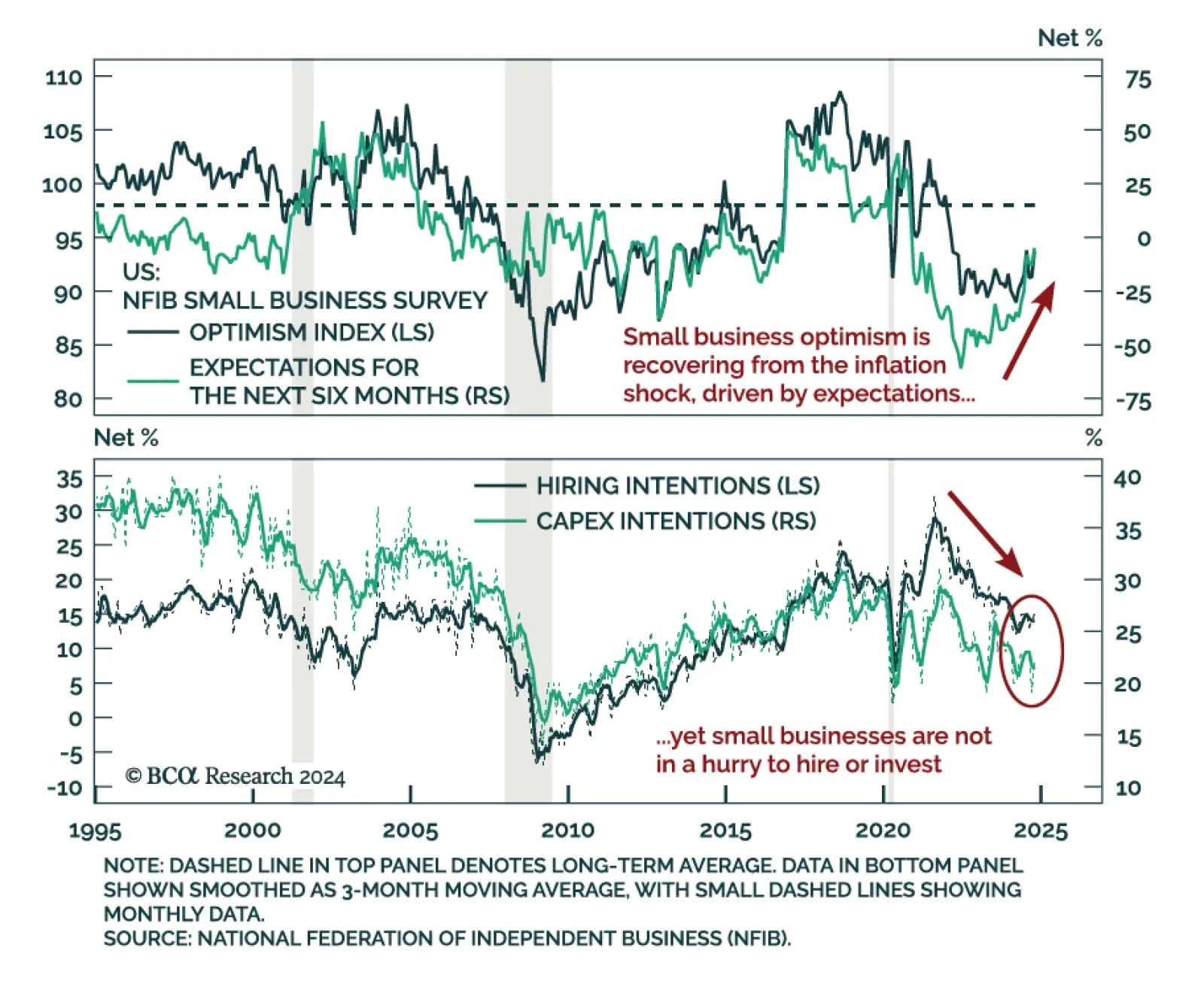

The NFIB Small Business Optimism Index beat expectations in October, increasing to 93.7 from 91.5. Although improvements were broad-based, the increase was led by a brightened outlook. Given that the survey was conducted before…