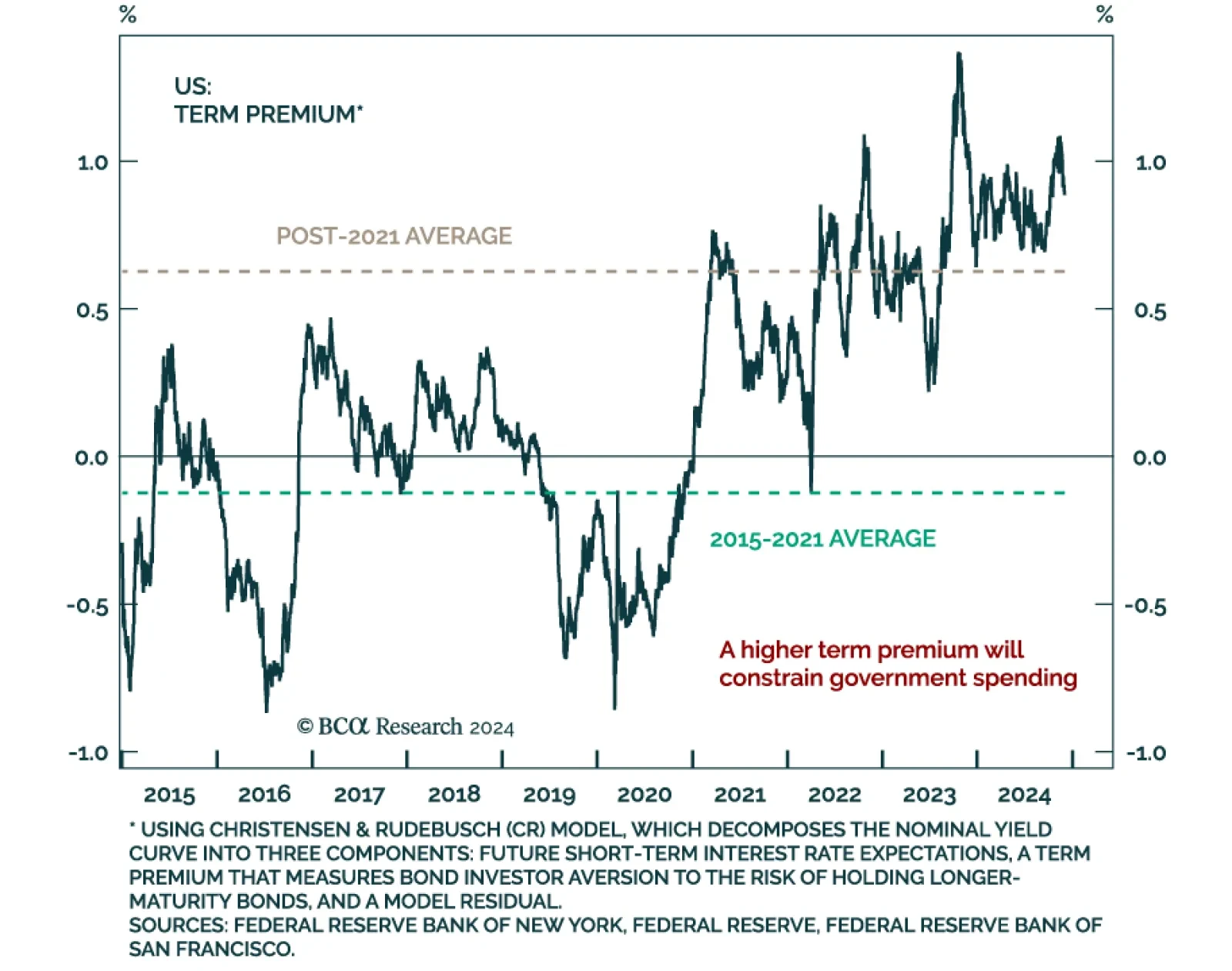

Our Global Asset Allocation strategists published their monthly tactical asset allocation report and foresee a change of trend for 2025. “Thin is back in” for government budgets, growth, and valuations. The post-…

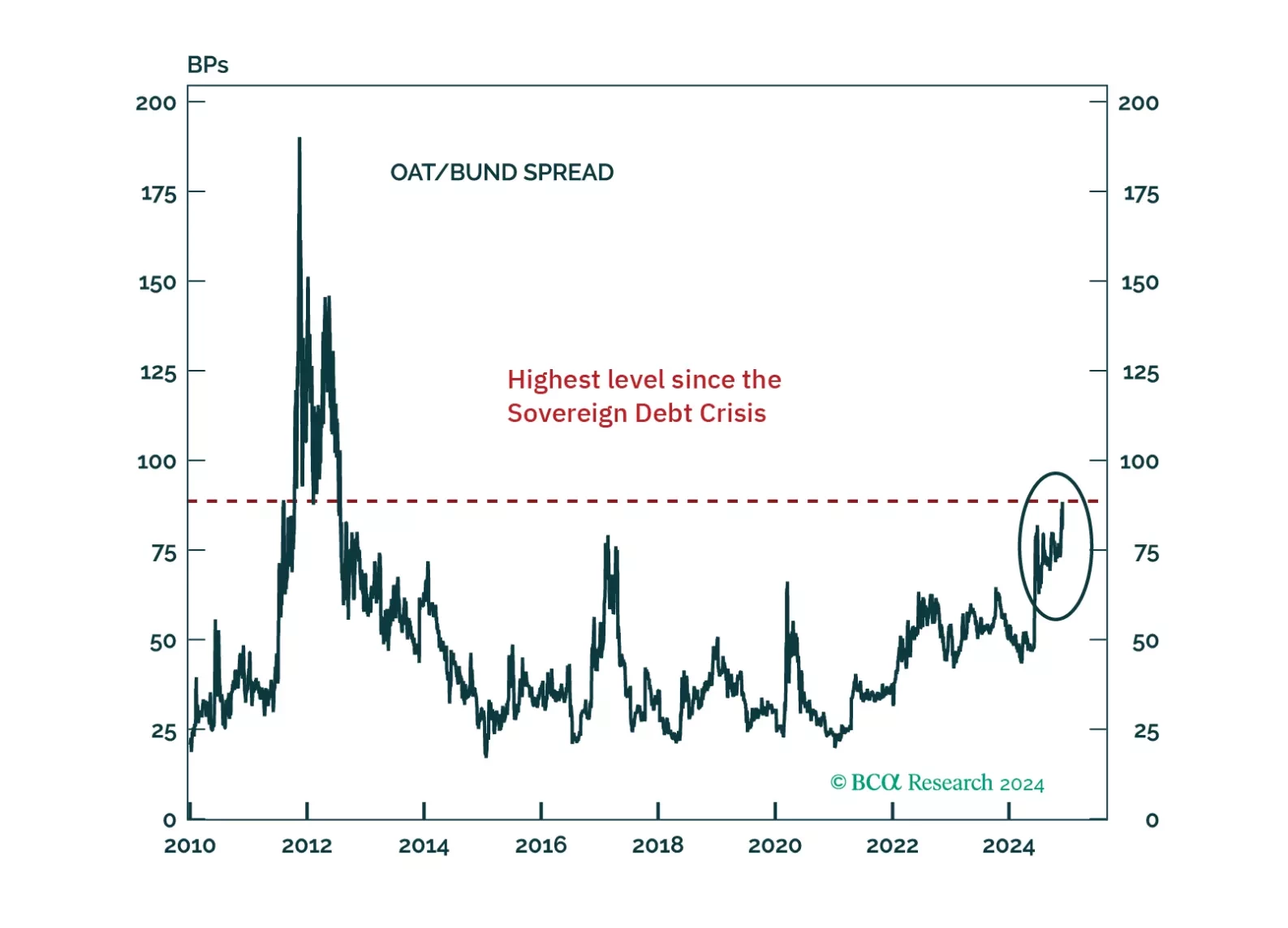

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

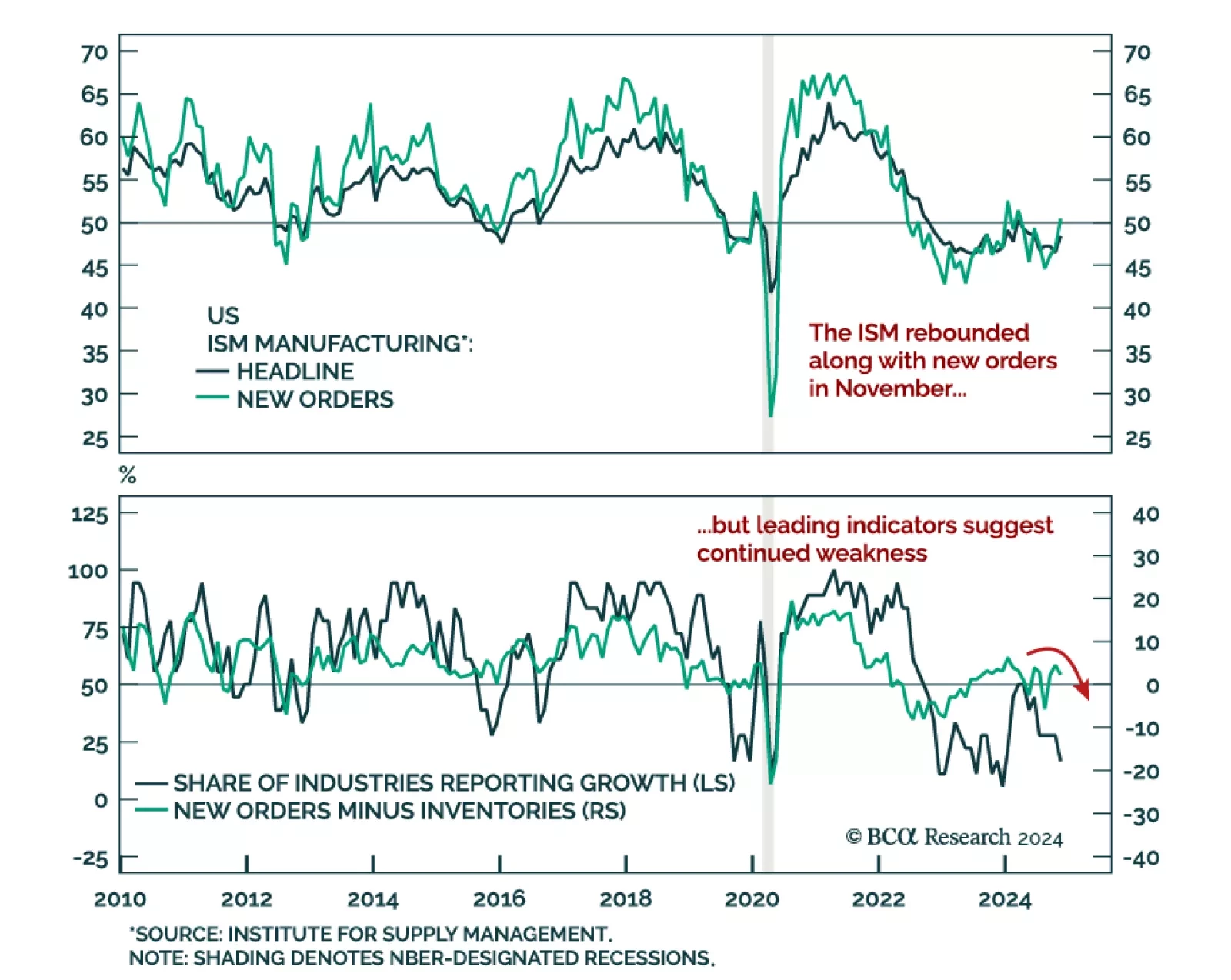

The November ISM Manufacturing index beat expectations, increasing to 48.4 from 46.5 in October. The improvement was partly driven by the new orders component, which increased to 50.4 from 47.1. Price pressures moderated.…

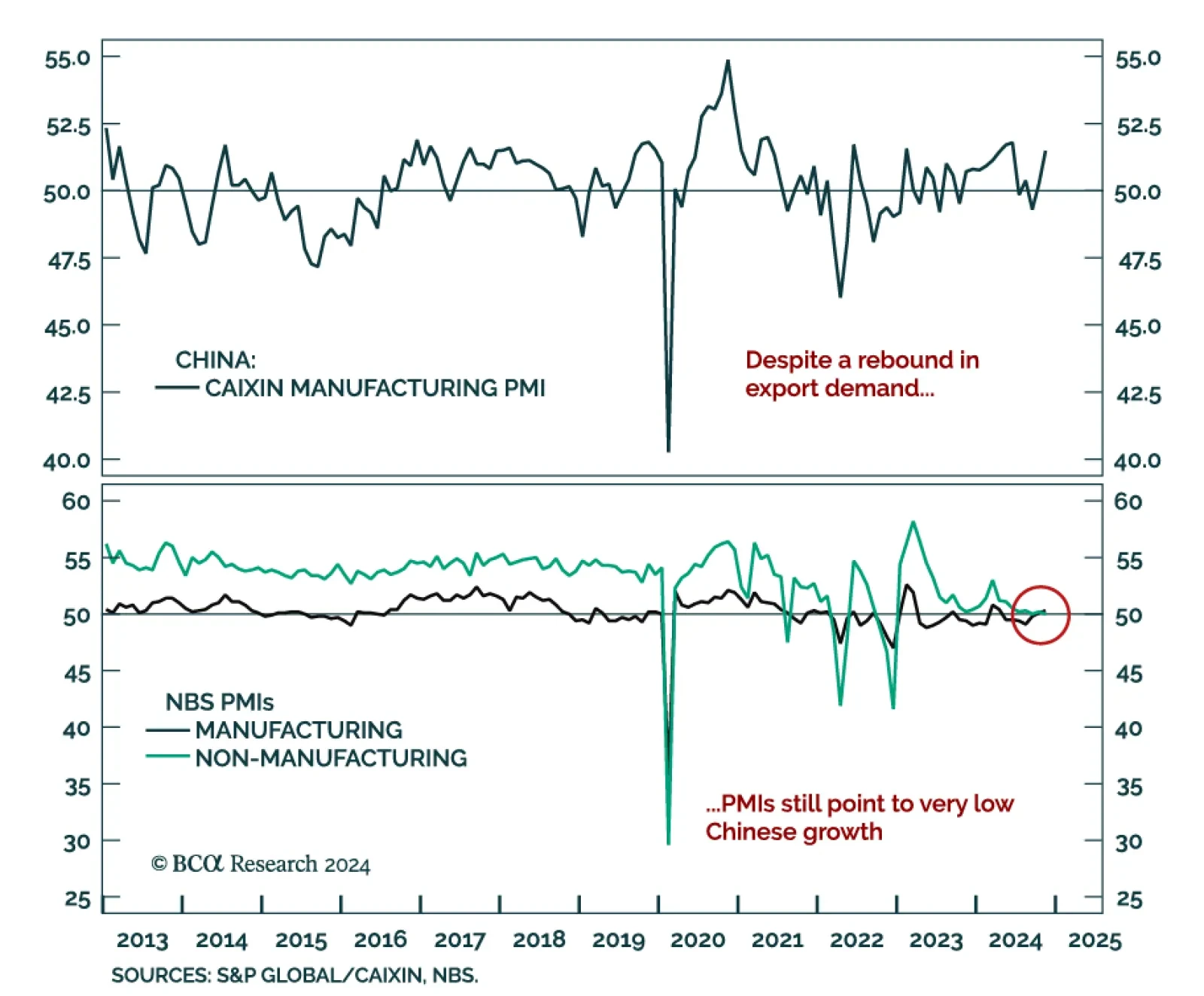

China’s November PMIs were mixed, and reflected very low growth. The official composite PMI was unchanged at 50.8, driven by a small uptick in manufacturing to 50.3 and a small downtick of services to 50. The Caixin…

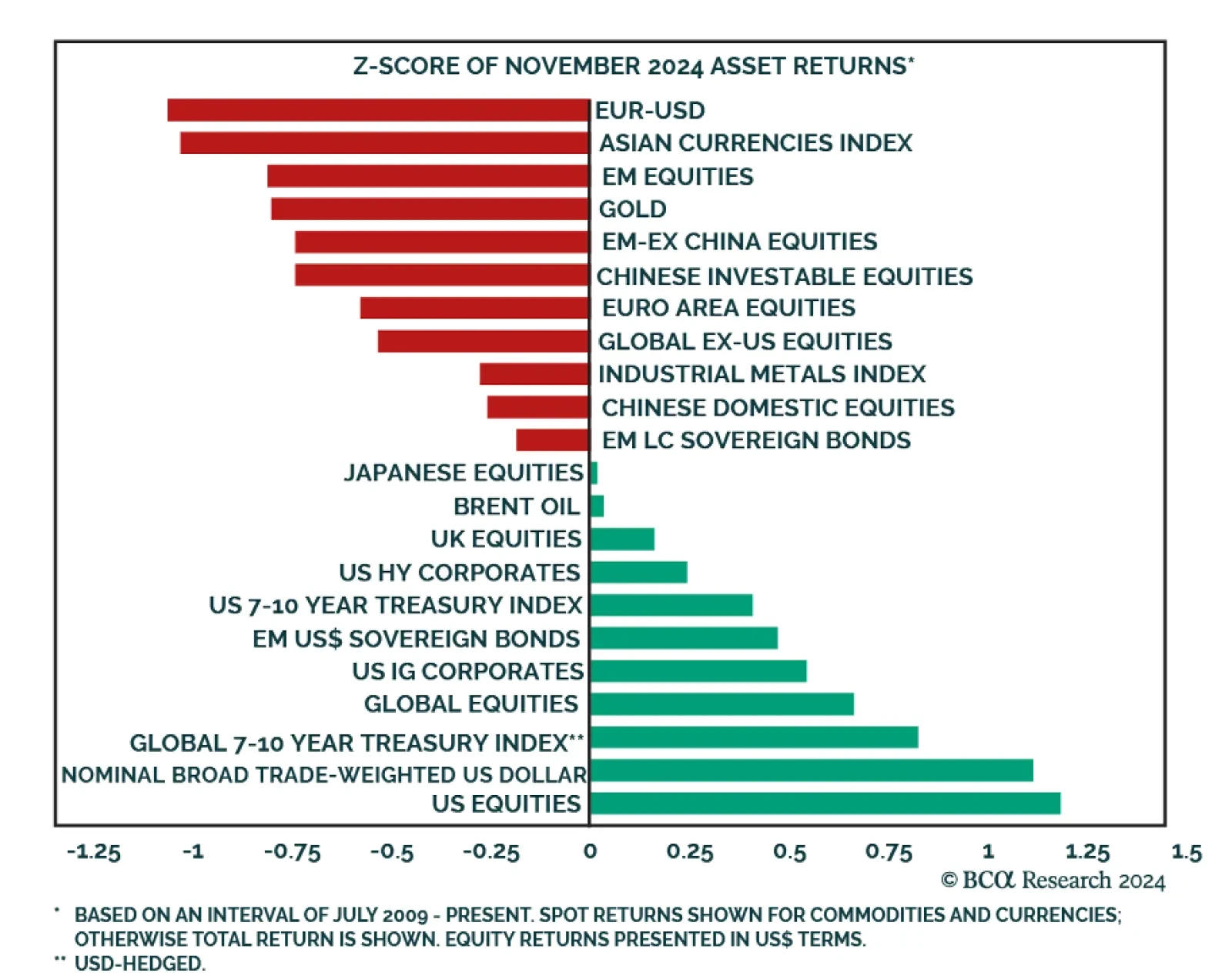

November trading was centered around the US election and its aftermath. US assets led the way, with US equities significantly outperforming their global counterparts. The US dollar strengthened considerably against both DM and EM…

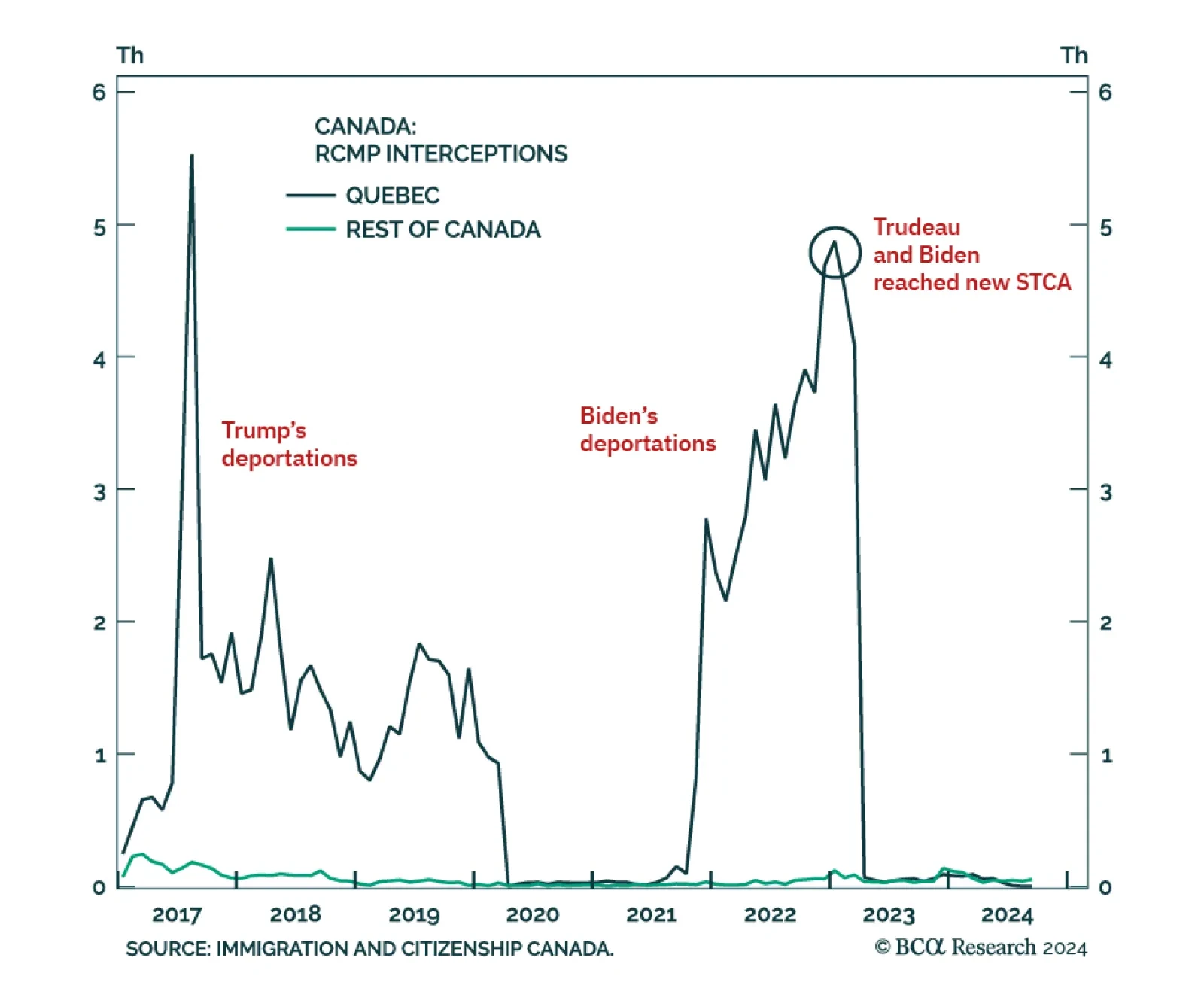

As 2024 closes out a busy electoral calendar for North America, our Geopolitical strategists look at Canada, where an election will be held by October 2025. Canada is poised for a likely change in leadership next year.…

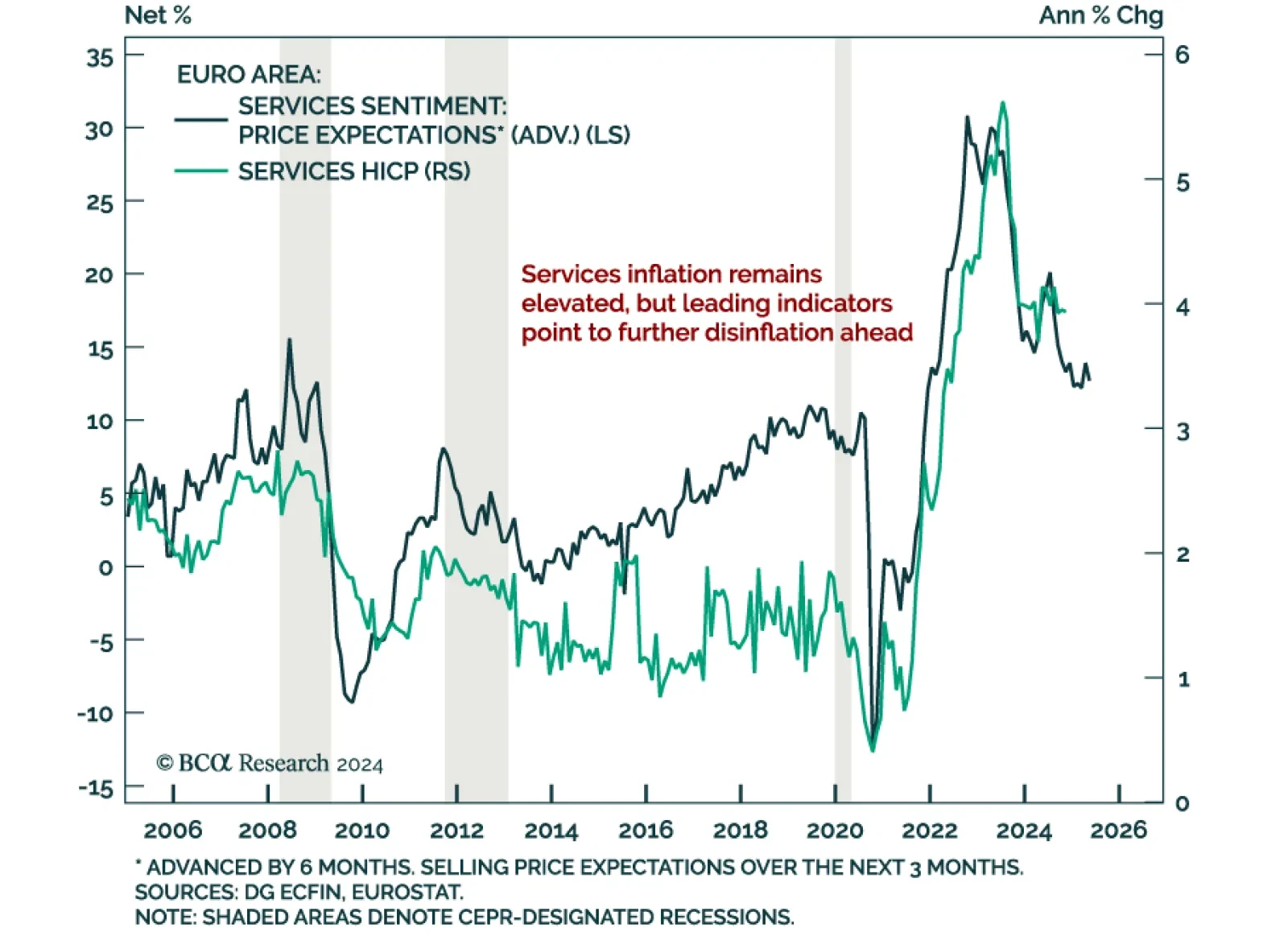

The November flash Eurozone inflation estimate met expectations, with headline HICP accelerating to 2.3% y/y from 2.0% in October, above the ECB’s target. Core inflation remained constant at 2.7%. At 3.9%, services…

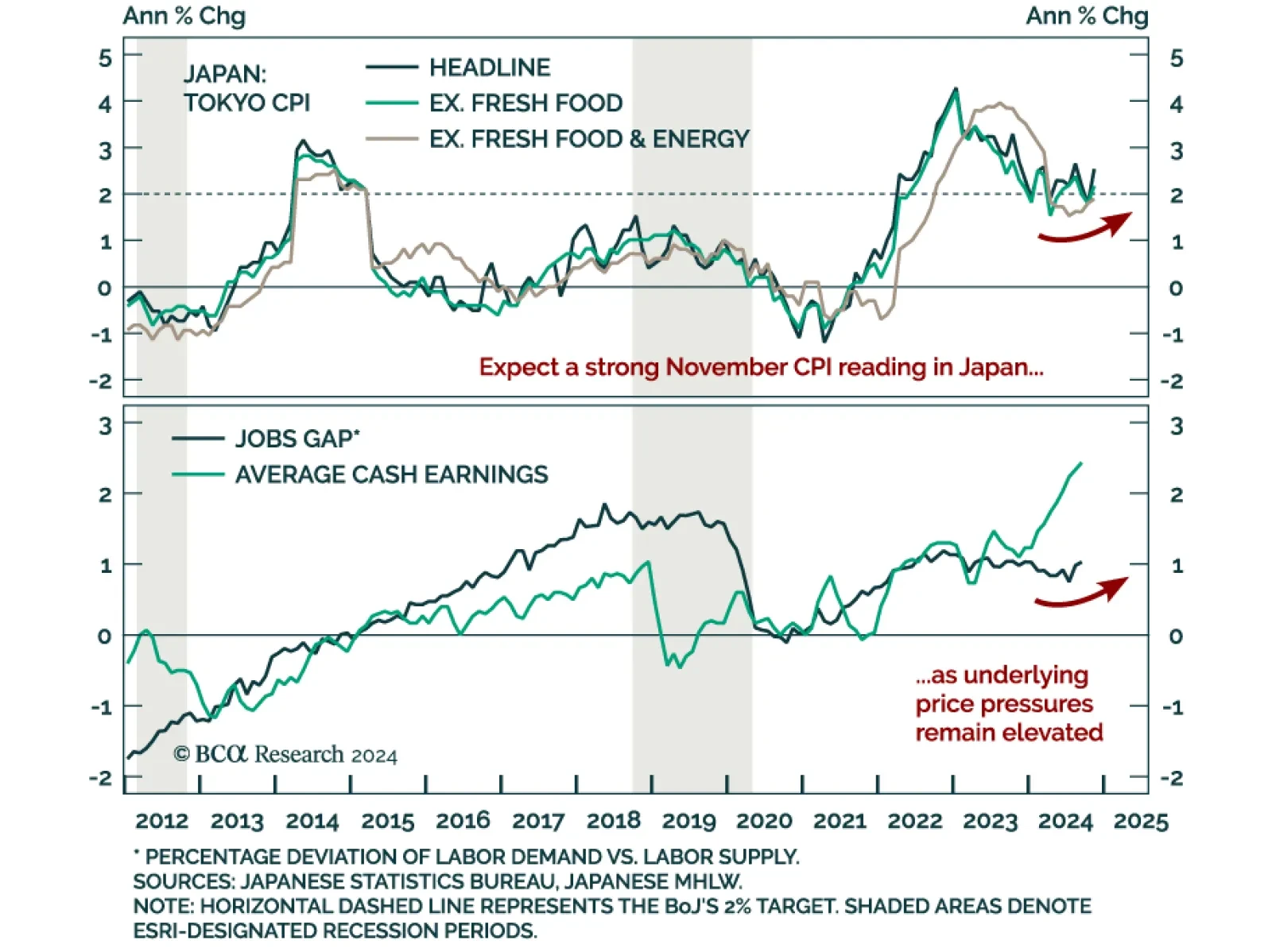

The November Tokyo CPI beat expectations, with headline inflation accelerating to 2.6% y/y from 1.8%. The core (ex. fresh food) and “core core” (ex. fresh food and energy) measures also reaccelerated to 2.2% and 1.9…