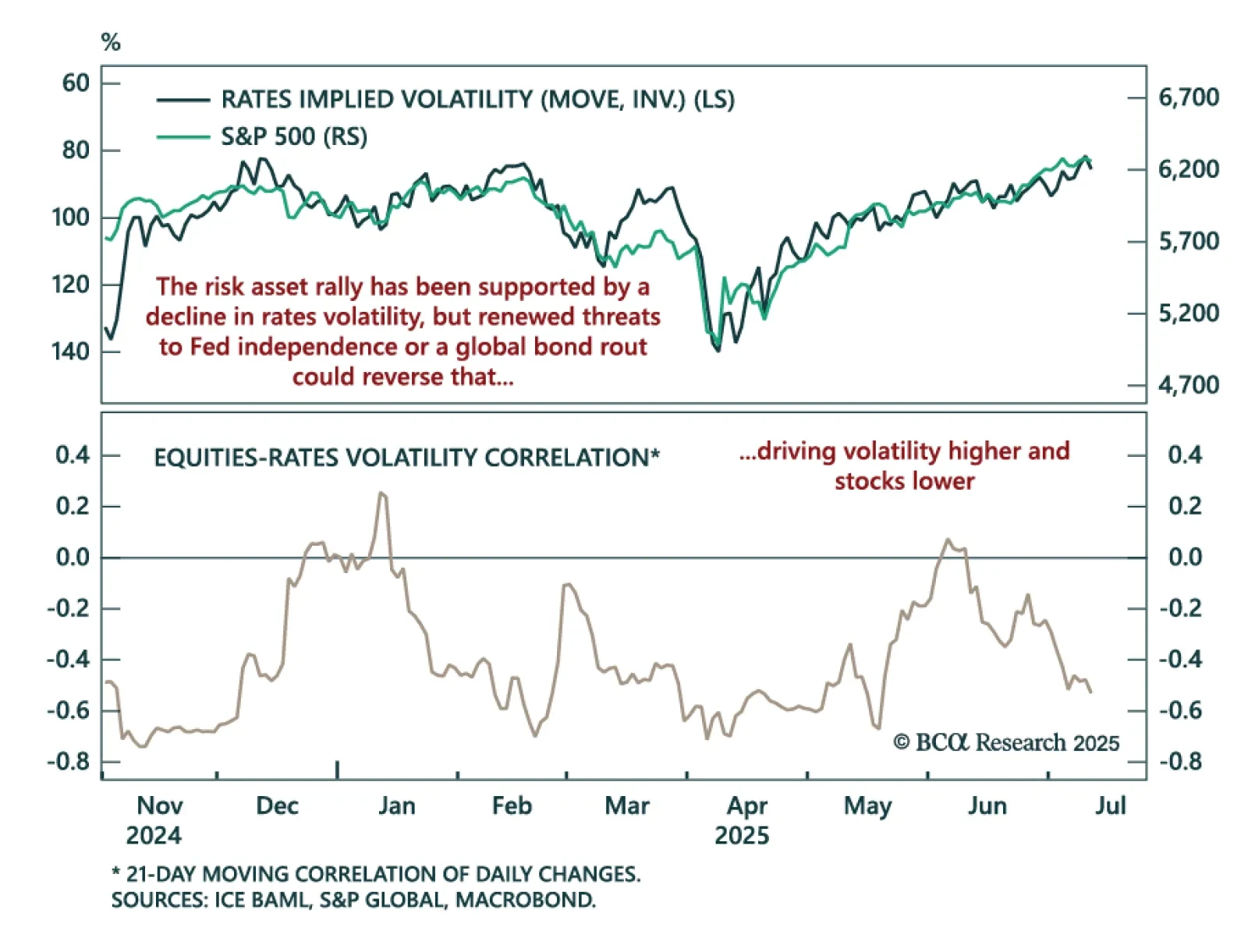

Jay Powell won’t be removed as Fed Chair before the expiry of his term next May, but we will learn the identity of his replacement this year, setting up a potentially awkward “shadow Fed Chair” situation.

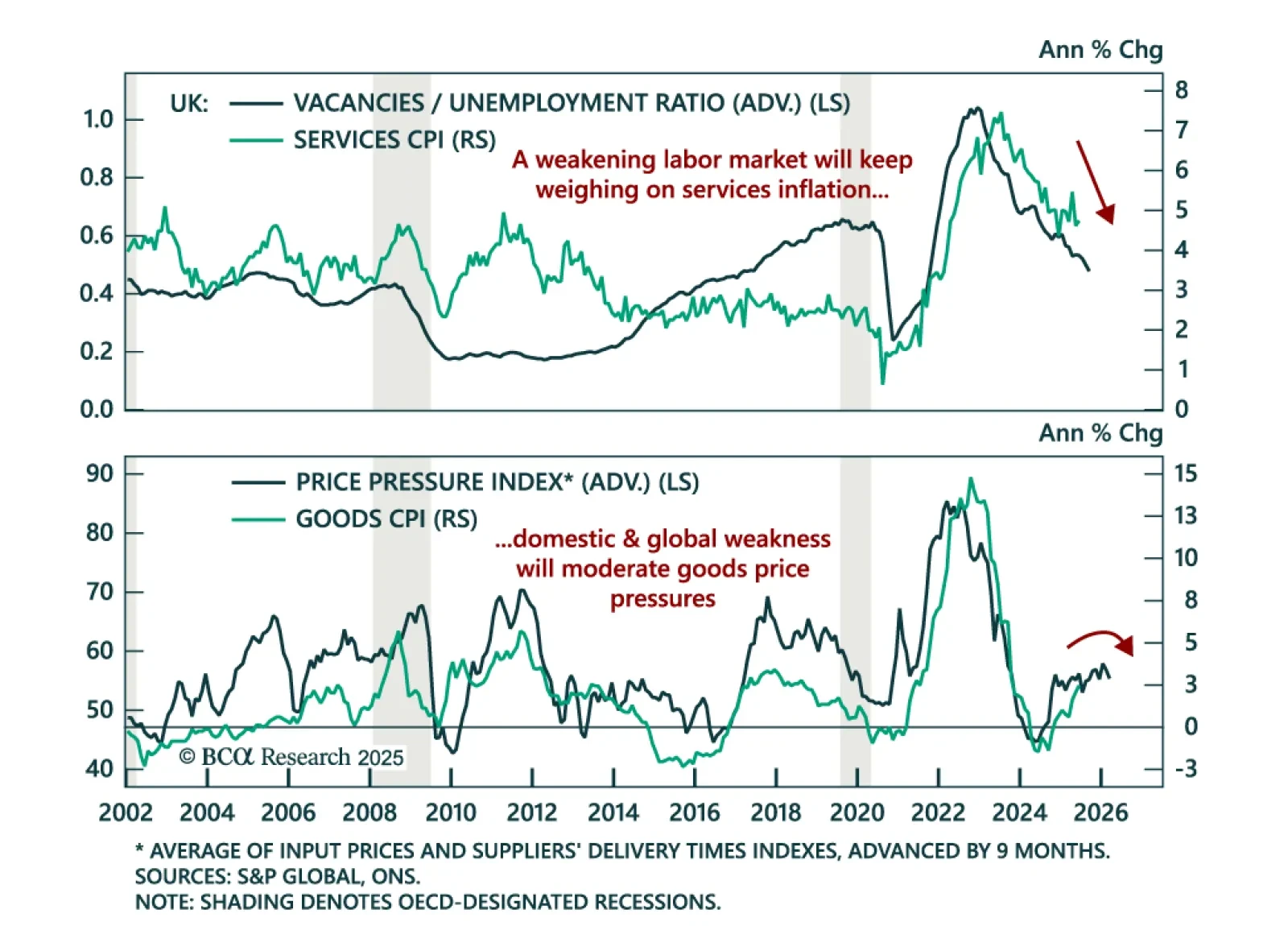

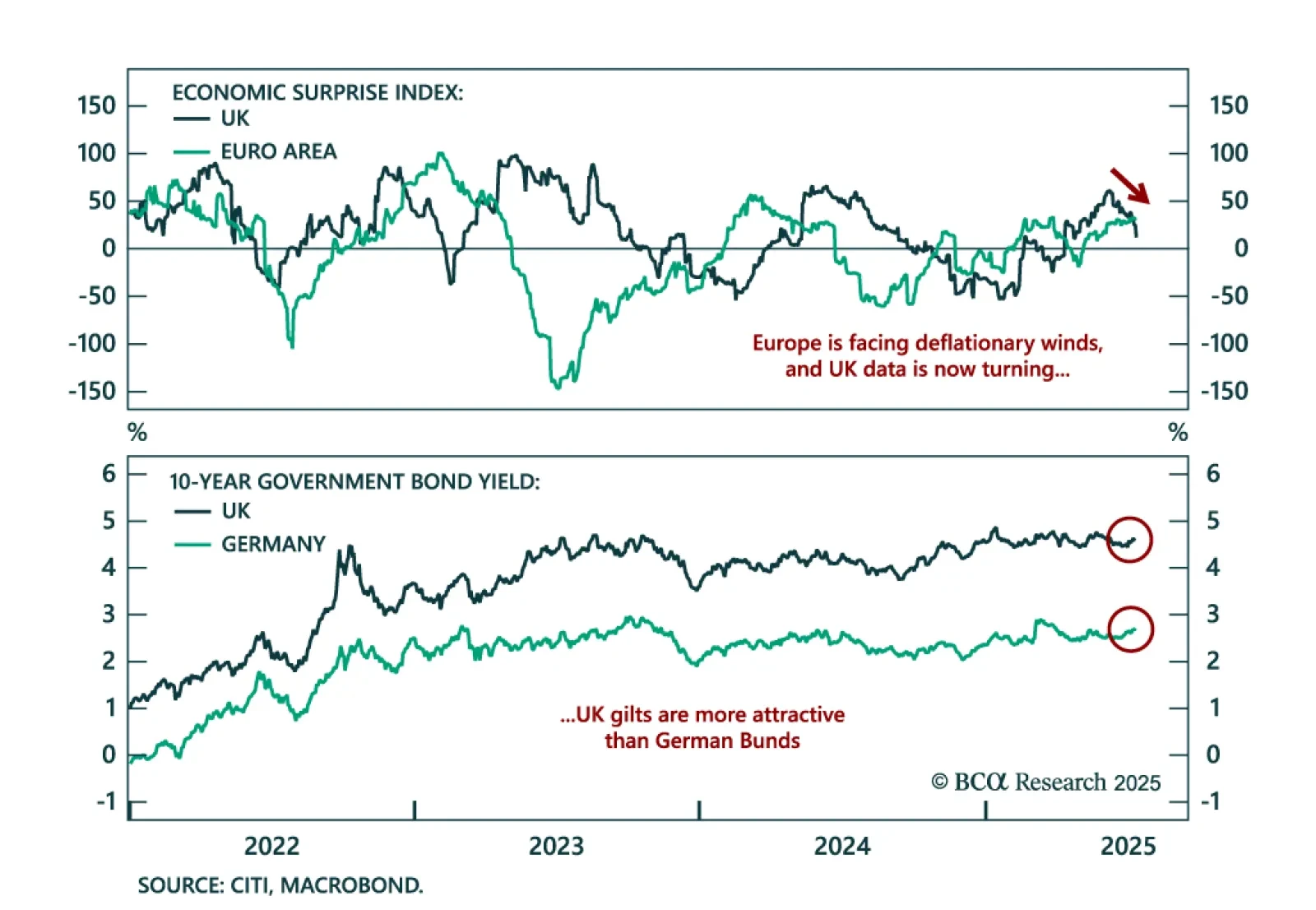

June UK CPI surprised to the upside, but weakening leading indicators point to disinflation ahead. Stay overweight Gilts. Headline inflation accelerated to 3.6% y/y from 3.4%, and core rose to 3.7% from 3.5%. Services inflation held…

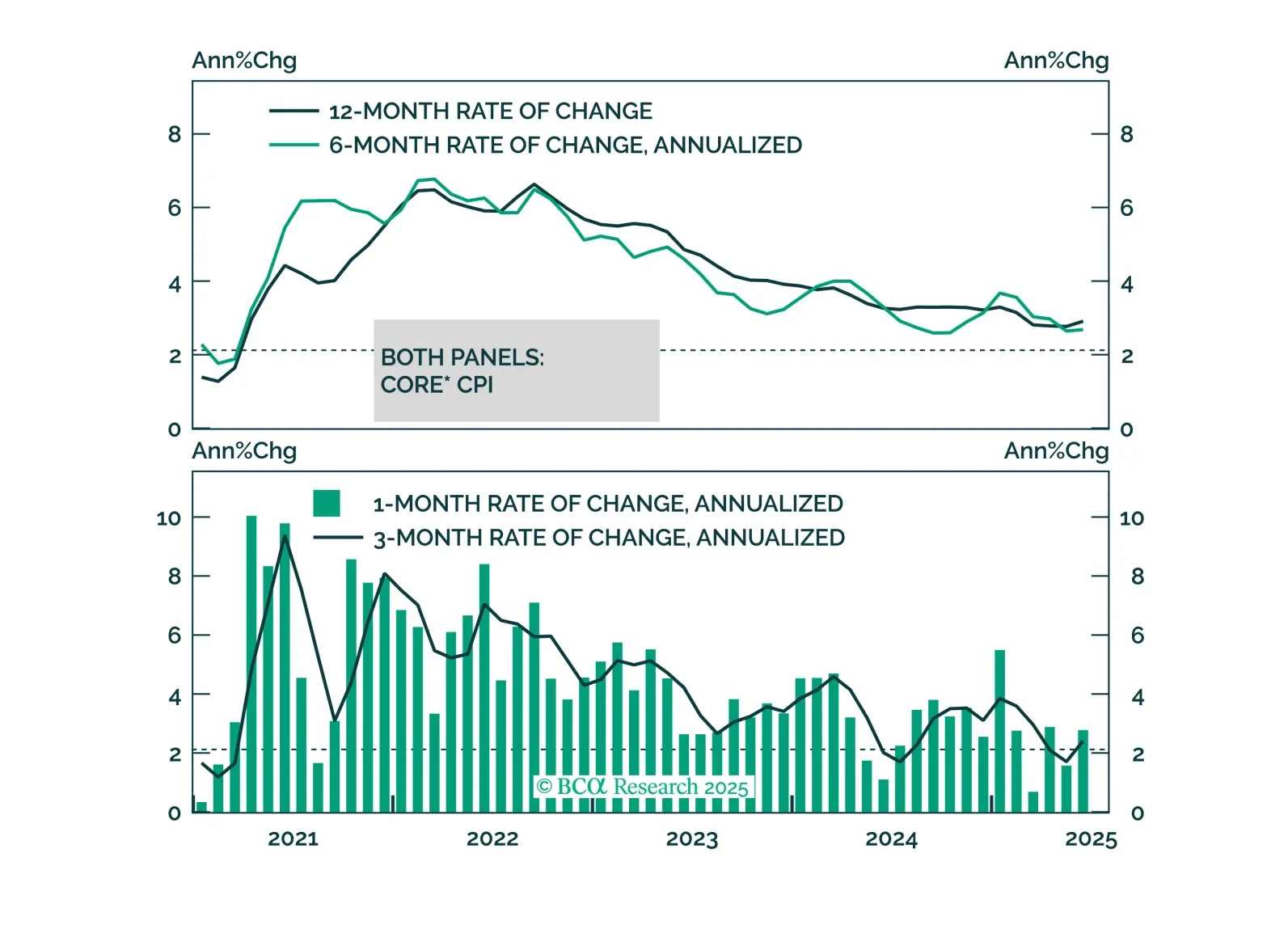

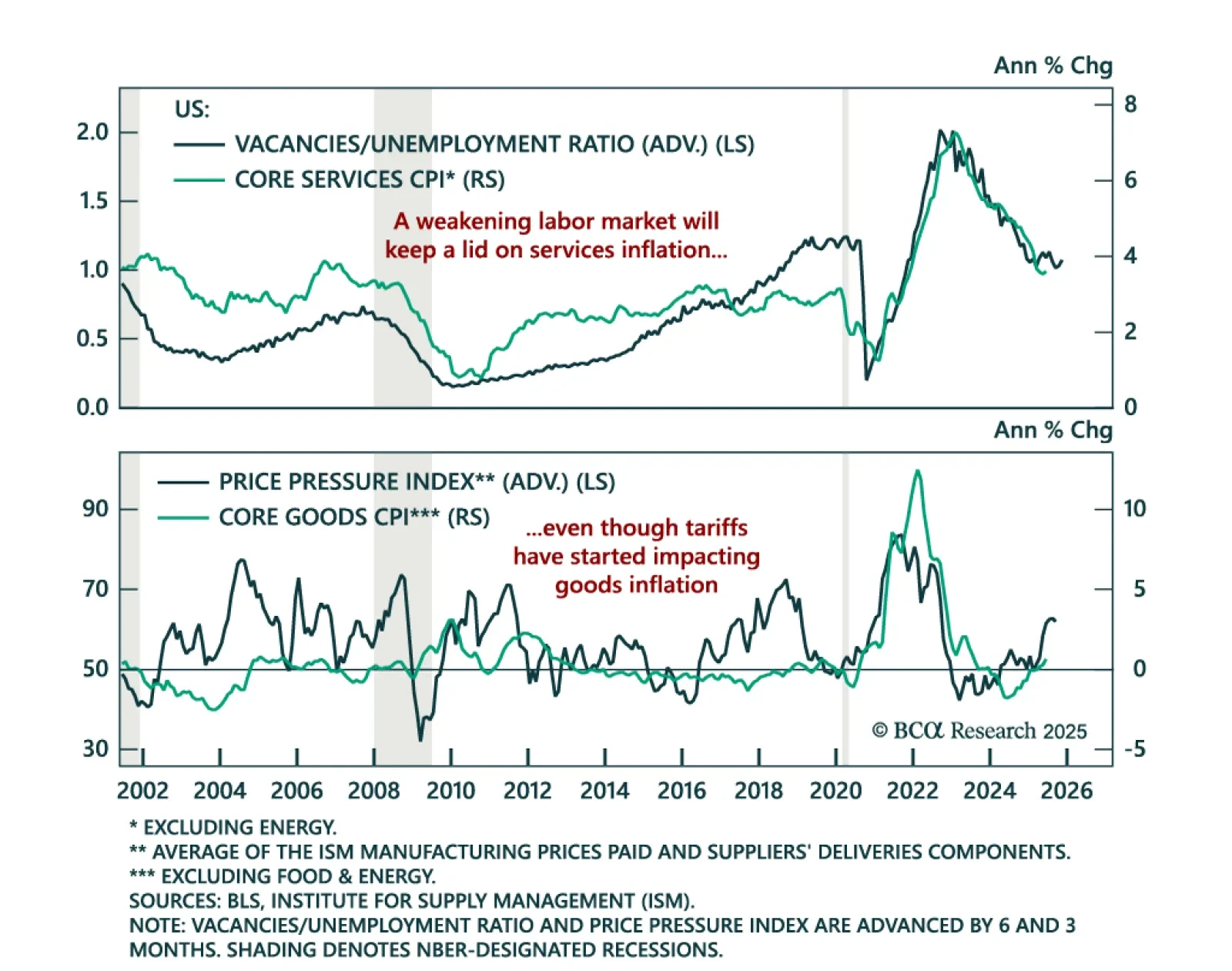

June CPI was broadly in line with expectations, with tariff passthrough building in goods but broader inflation pressures likely to remain contained. Headline inflation came in slightly above expectations at 2.7% y/y (0.3% m/m),…

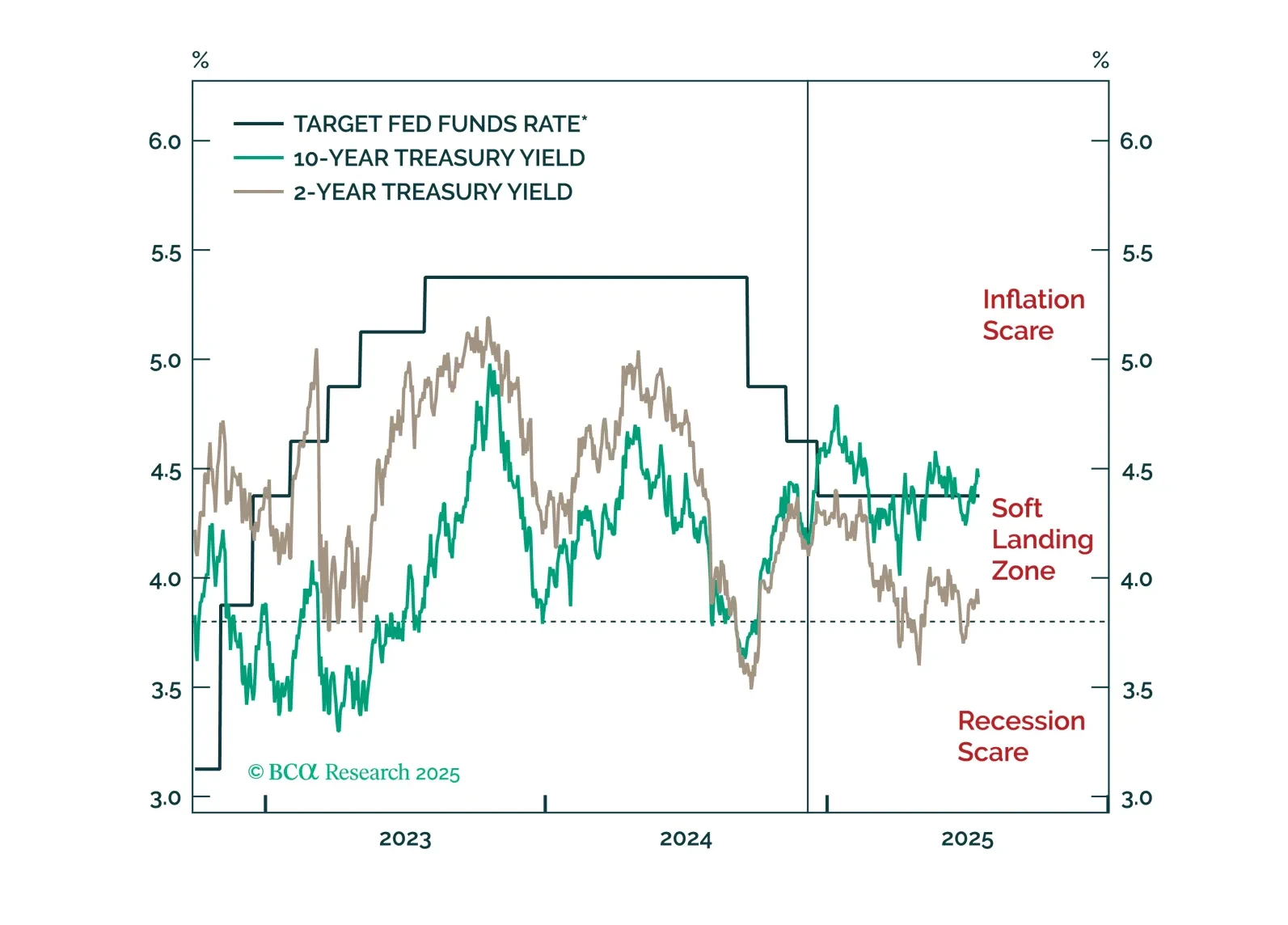

We discuss the implications of this morning’s CPI report and the relative attractiveness of 2/5 Treasury curve steepeners.

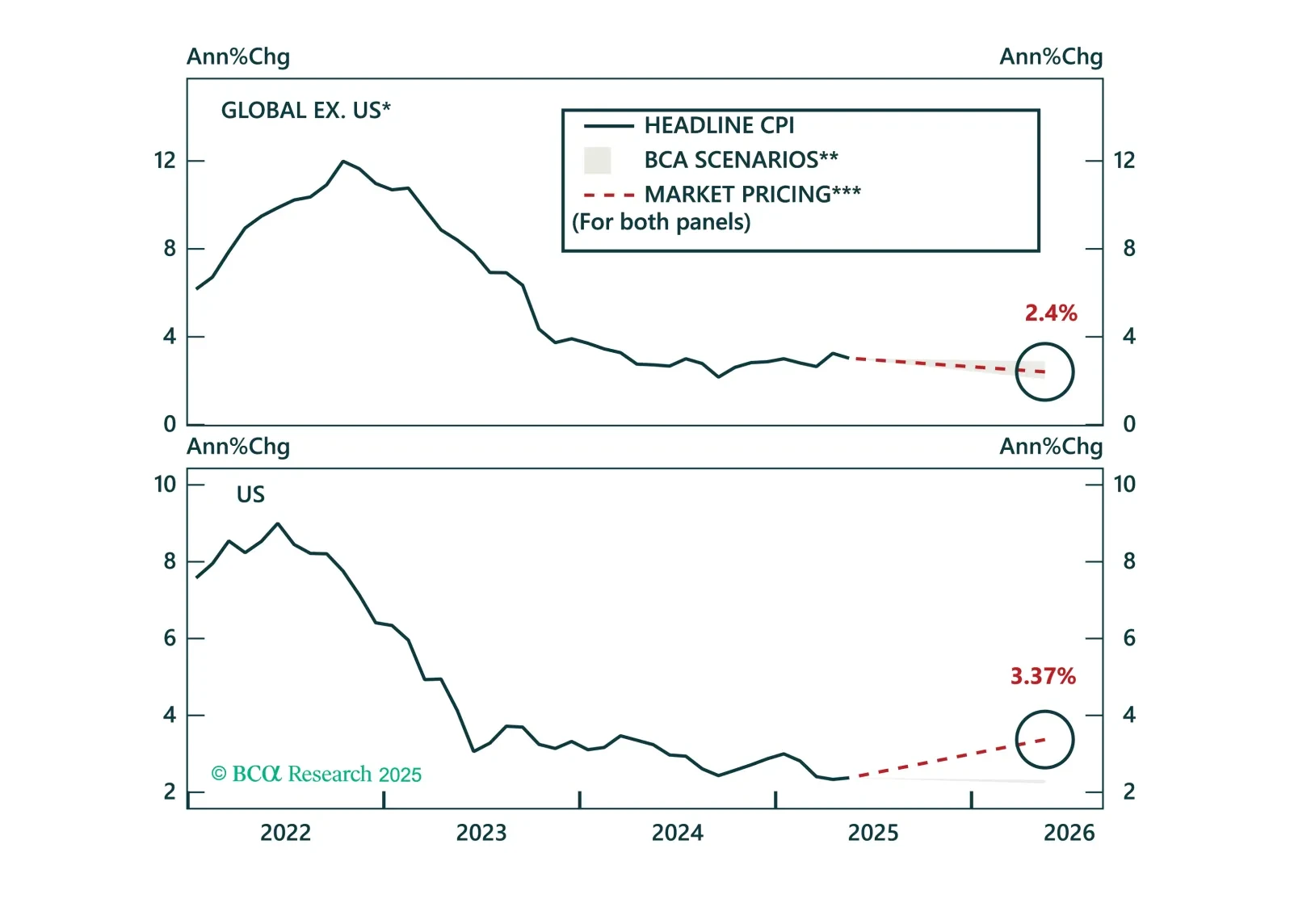

Disinflation continues to unfold globally, and markets are finally catching up. Inflation expectations have broadly realigned with fundamentals, prompting us to shift our global ILB allocation to neutral. While tariff risks are…

Equities have retraced sharply from Liberation Day lows, but renewed policy risk and mispriced volatility keep us tactically cautious. The Trump administration softened its trade stance as equities neared bear market territory in…

UK growth data continues to disappoint, making the case for a Gilts overweight and a dovish BoE. May GDP fell 0.1% m/m, missing estimates and marking a consecutive monthly contraction after April’s 0.3% decline. Industrial and…

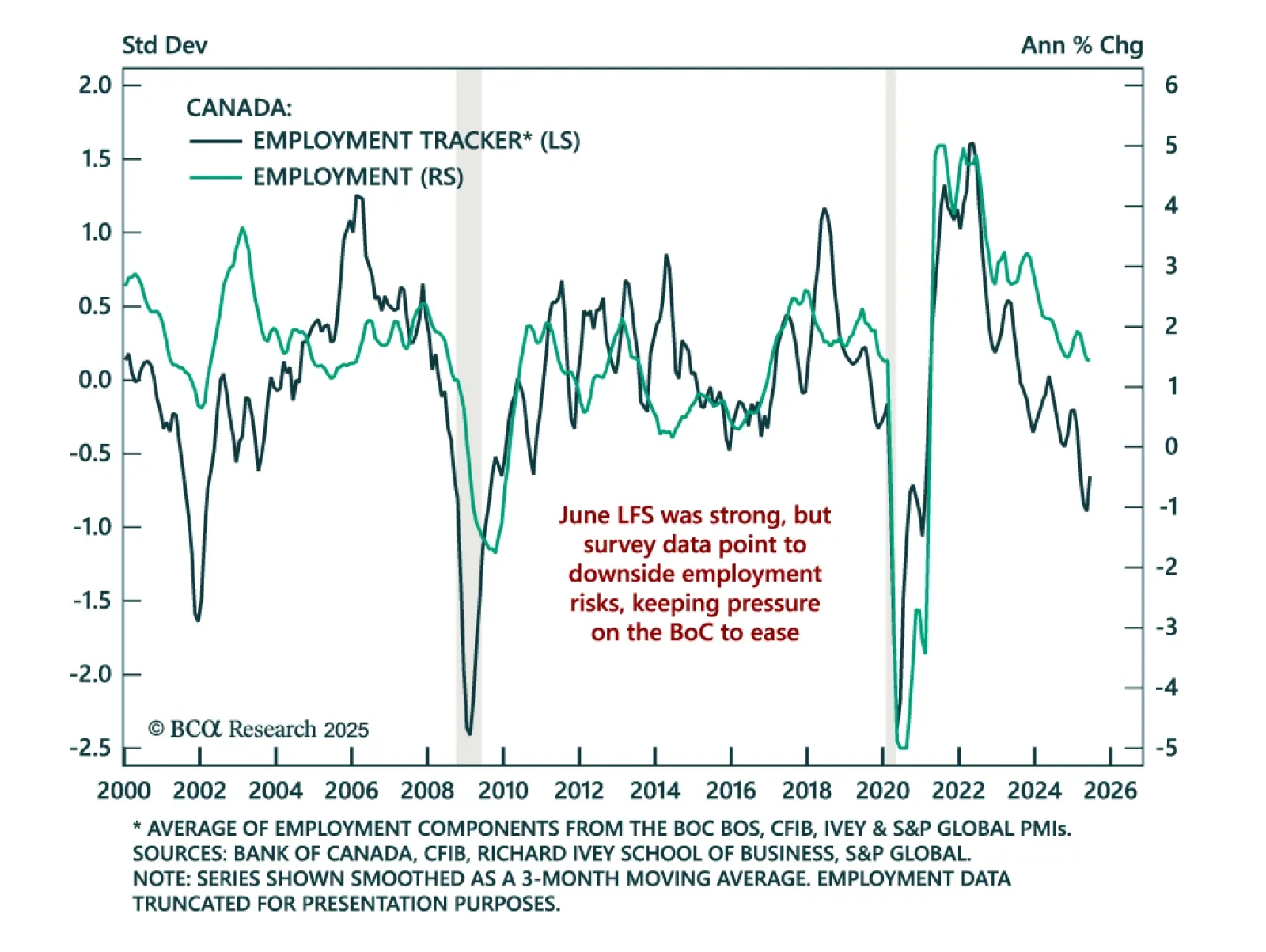

June’s strong Canadian jobs data does not argue against further easing and a CGBs overweight. Employment rose by 83.1k versus expectations for no growth, the first increase since January. The unemployment rate fell to 6.9% from 7.0…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

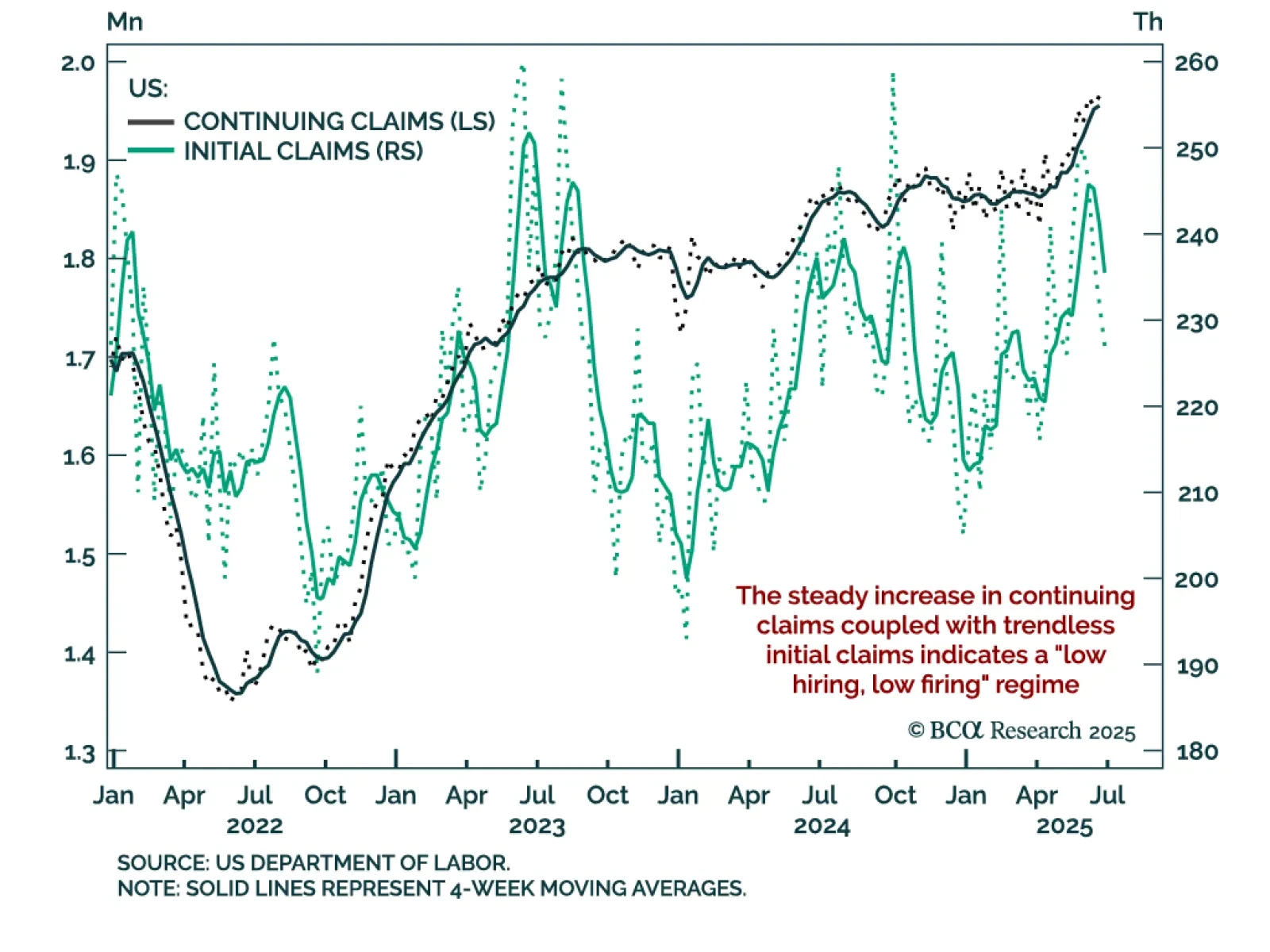

Rising continuing claims and slowing hiring momentum reinforce our defensive allocation stance. Continuing claims have reached a post-COVID high of 1.965m, while initial claims eased to 227k after peaking at 250k. The divergence…