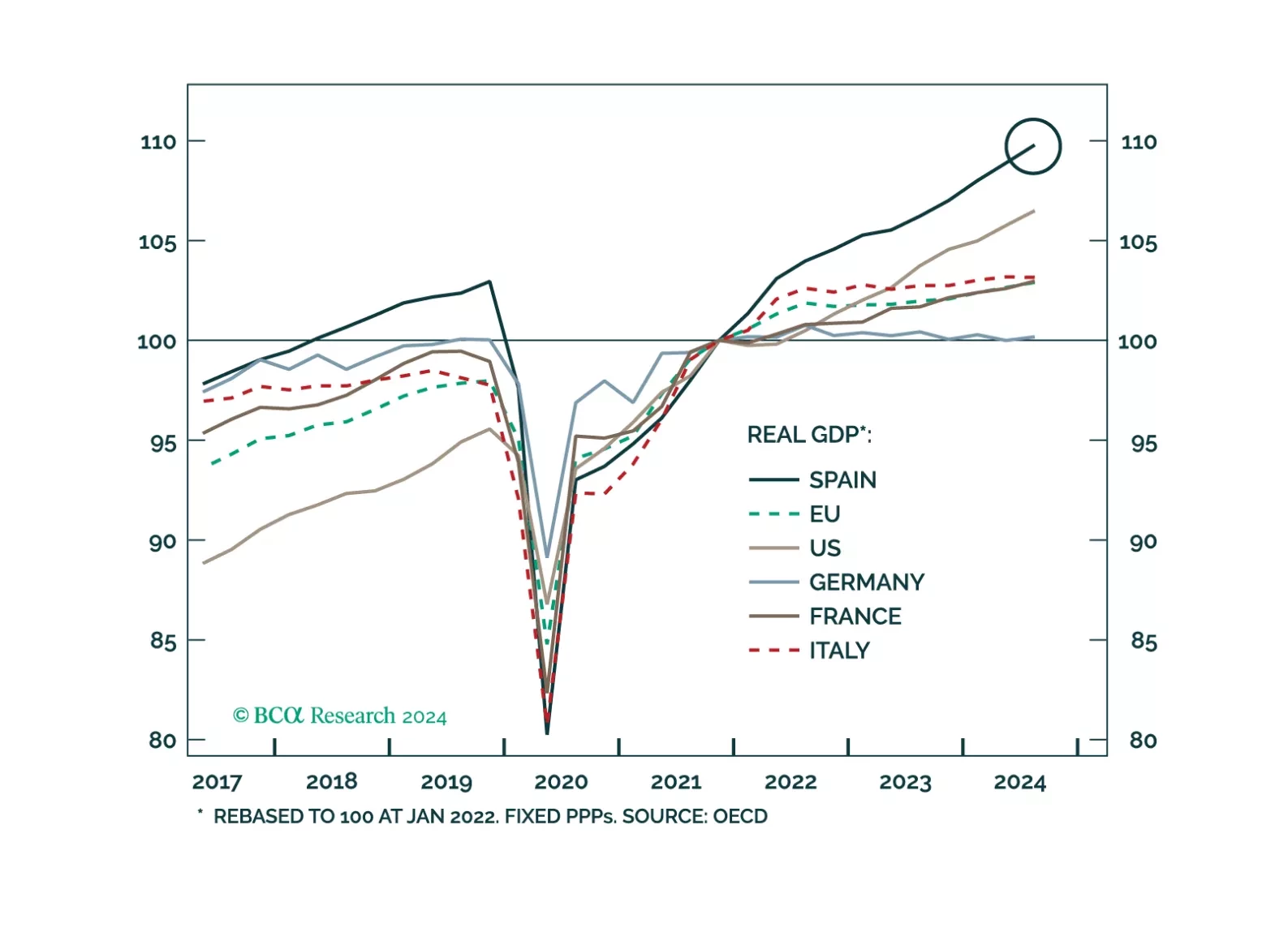

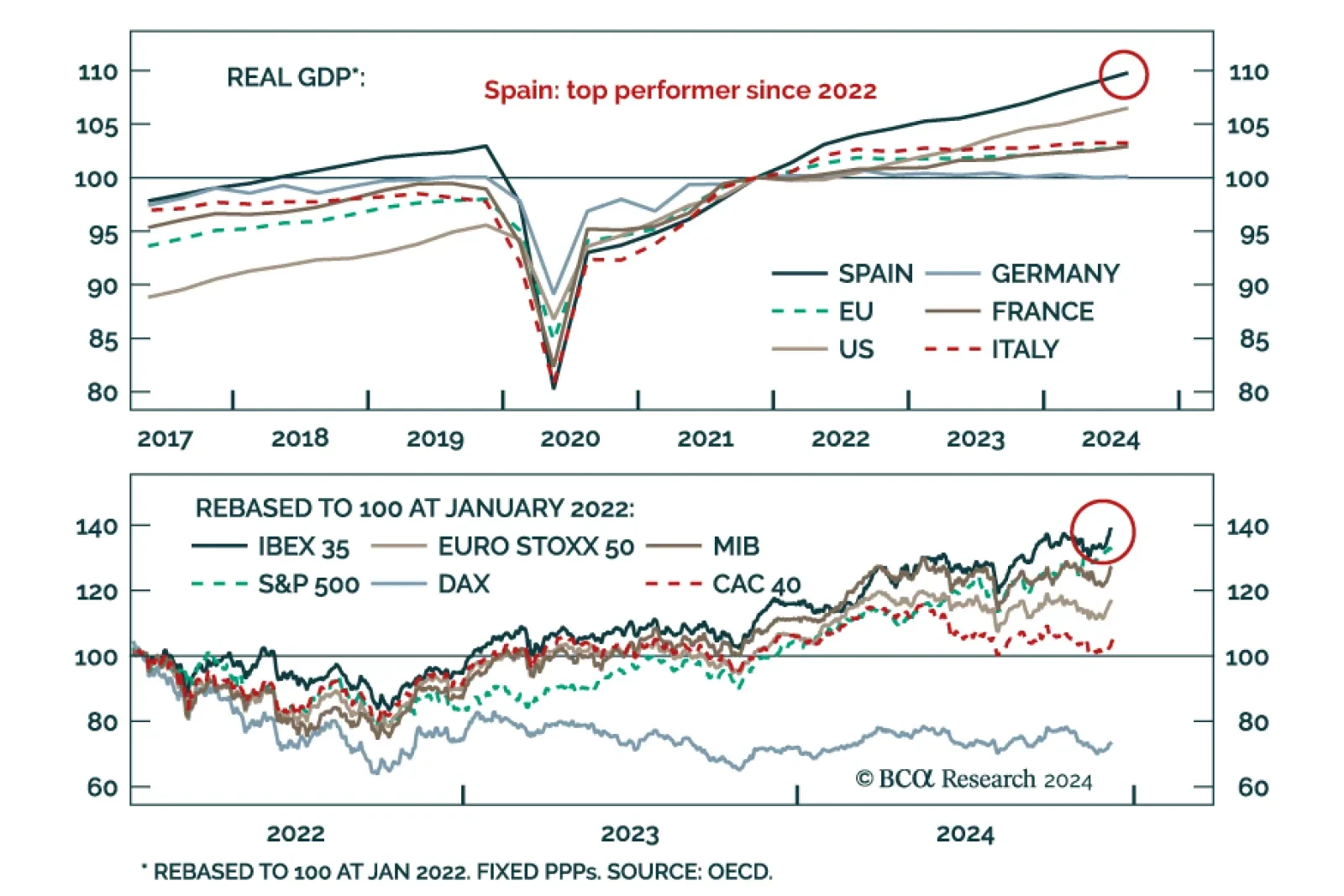

In the final installment of their “PIGS Have Wings” special series, our European investment strategists took a deep dive into the Spanish economy and financial assets. Spain outperformed most developed markets…

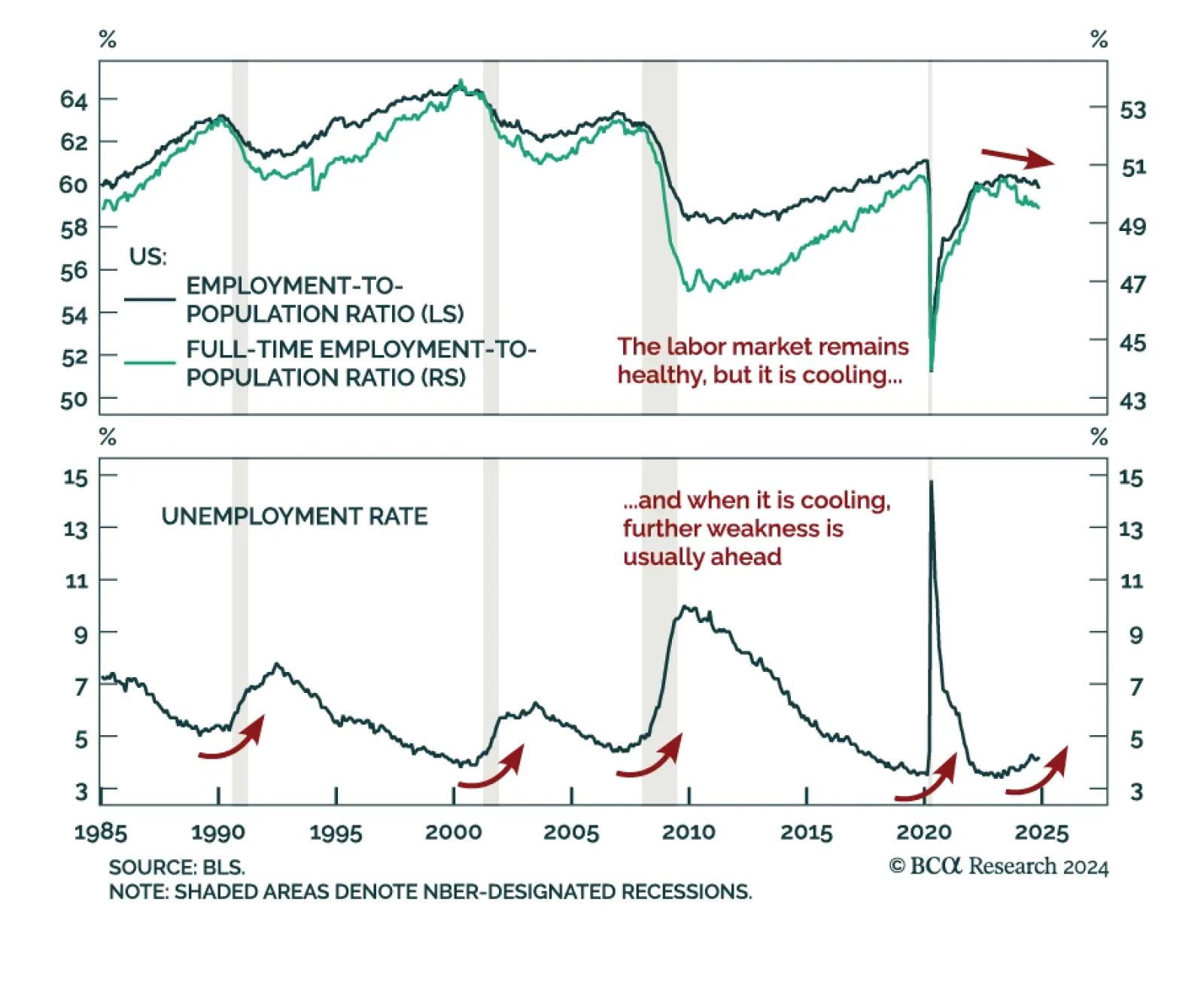

The US November jobs report was mixed. Payrolls rose by 227k vs. an upwardly revised 36k in October, leaving the 3-month moving average at 173k. The unemployment and underemployment rates however rose 0.1% to 4.2% and 7.8%,…

The US Treasury yield curve recently bull flattened, with the 2-year/10-year segment almost completely flat. Meanwhile, the breakeven inflation curve has re-inverted, with 2-year breakeven inflation rate now above the 10-year…

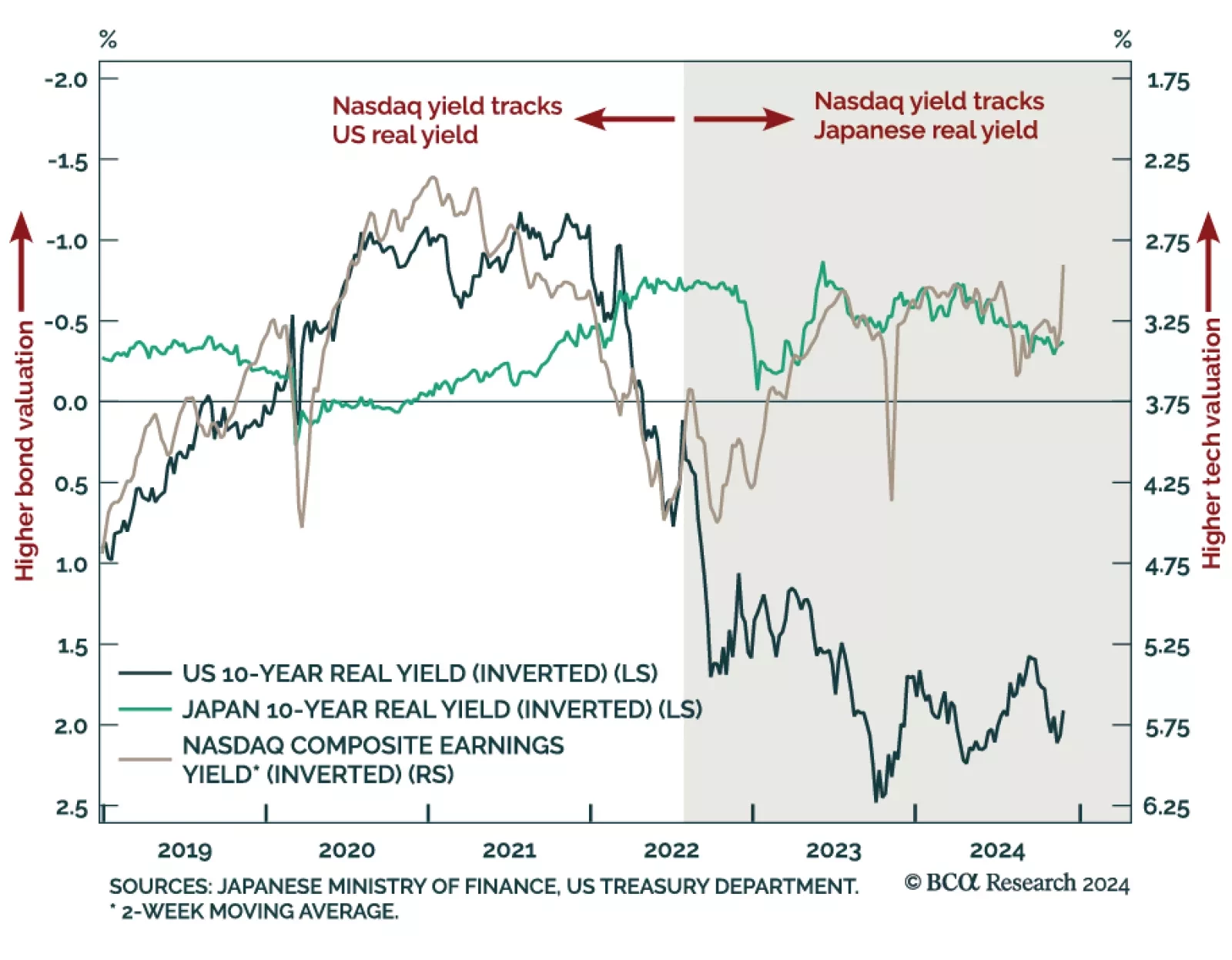

Our Counterpoint strategists published their 2025 outlook; they see major market movements for the year ahead hinging on Japan. Japan remains the cornerstone of global liquidity, with rising Japanese real yields posing a key…

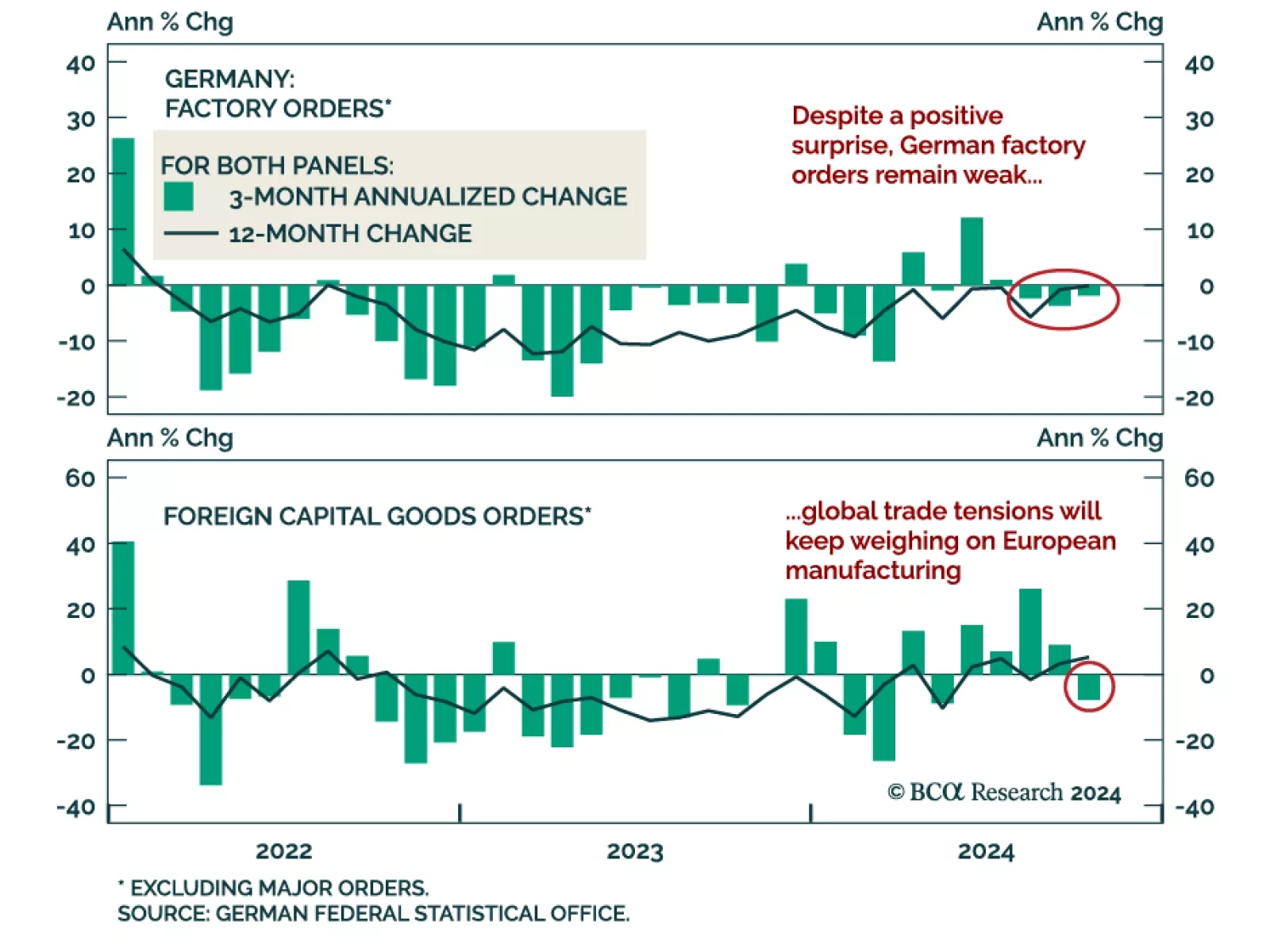

German factory orders decreased less than expected in October, falling 1.5% m/m after rising 7.2% in September. Excluding major orders, which often distort the overall picture, core new orders rose 0.1%, after rising 2.7% a month…

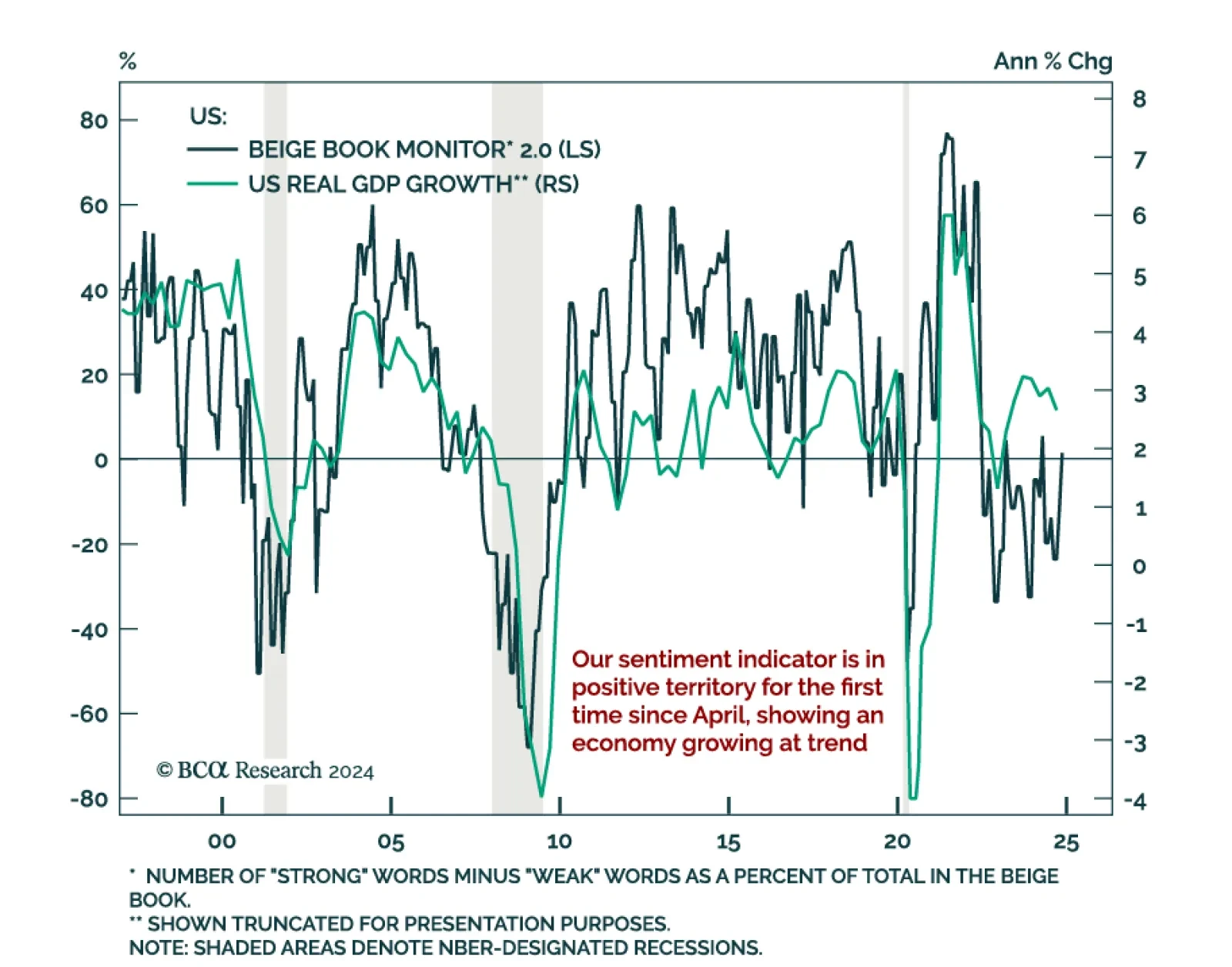

The Federal Reserve’s Beige Book shows a modestly growing economy imbued with post-election optimism, while highlighting some caution about employment. The latest Beige Book is in line with other sentiment indicators…

The November ISM Services PMI missed expectations, declining to 52.1 from 56 in October. All subcomponents declined, with new orders falling from 57.4 to 53.7. Employment also weakened but remains in expansion, while price…

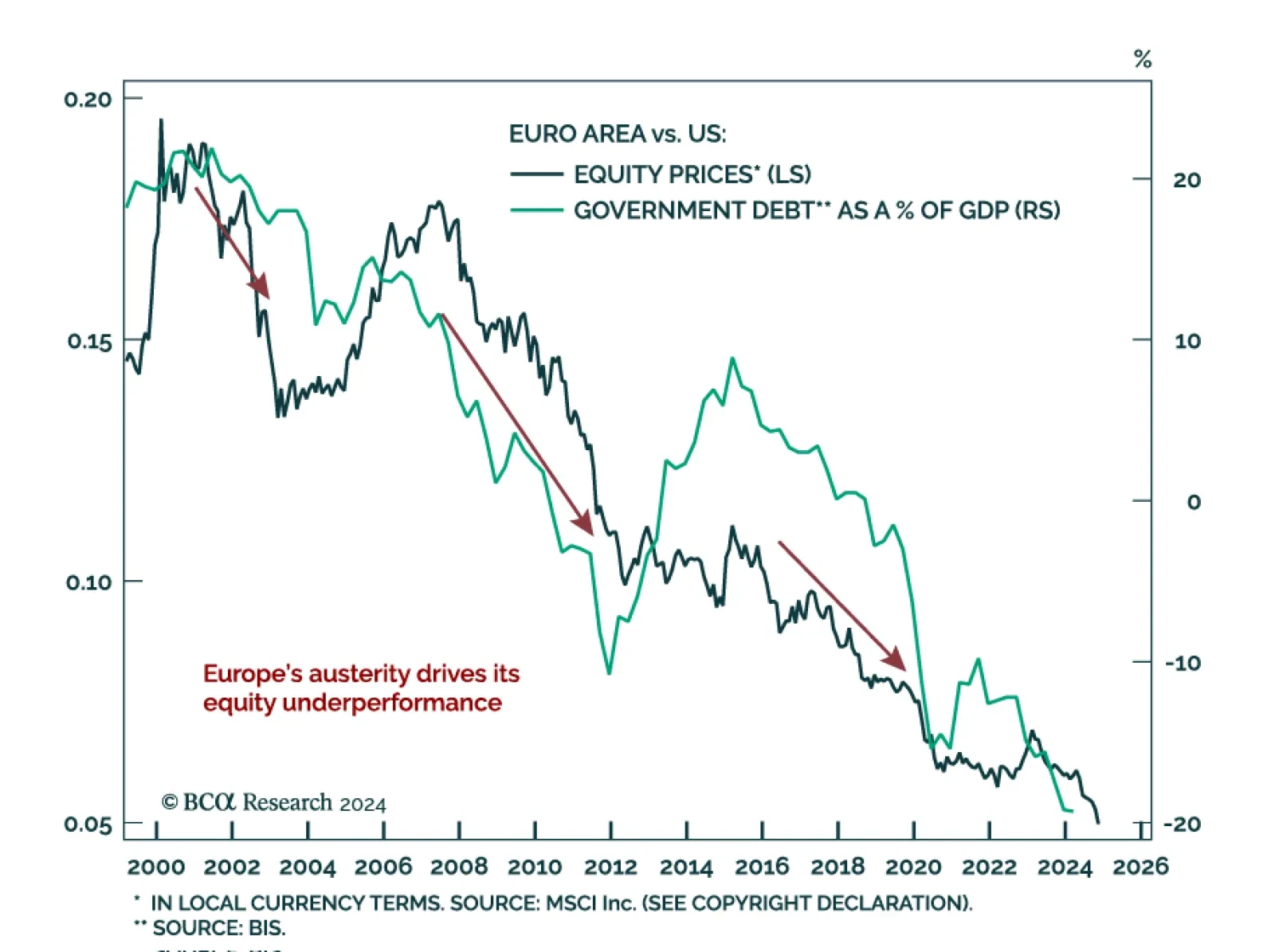

Our European Investment Strategy and GeoMacro Strategy teams published a joint report, digging into the structural challenges behind Europe’s economic underperformance, while pointing out to potential turnaround…

Job openings beat expectations in October, increasing to 7.74m from 7.44m in September. The details of the JOLTS report were mixed, however. Hires ticked down, driven by interest rate-sensitive sectors. Outside of hires, the rest…