Our US equity strategists just published their annual outlook, where they discuss the environment and rotation they foresee in 2025, which is more bullish than our House View. Our colleagues see Trump 2.0 policies…

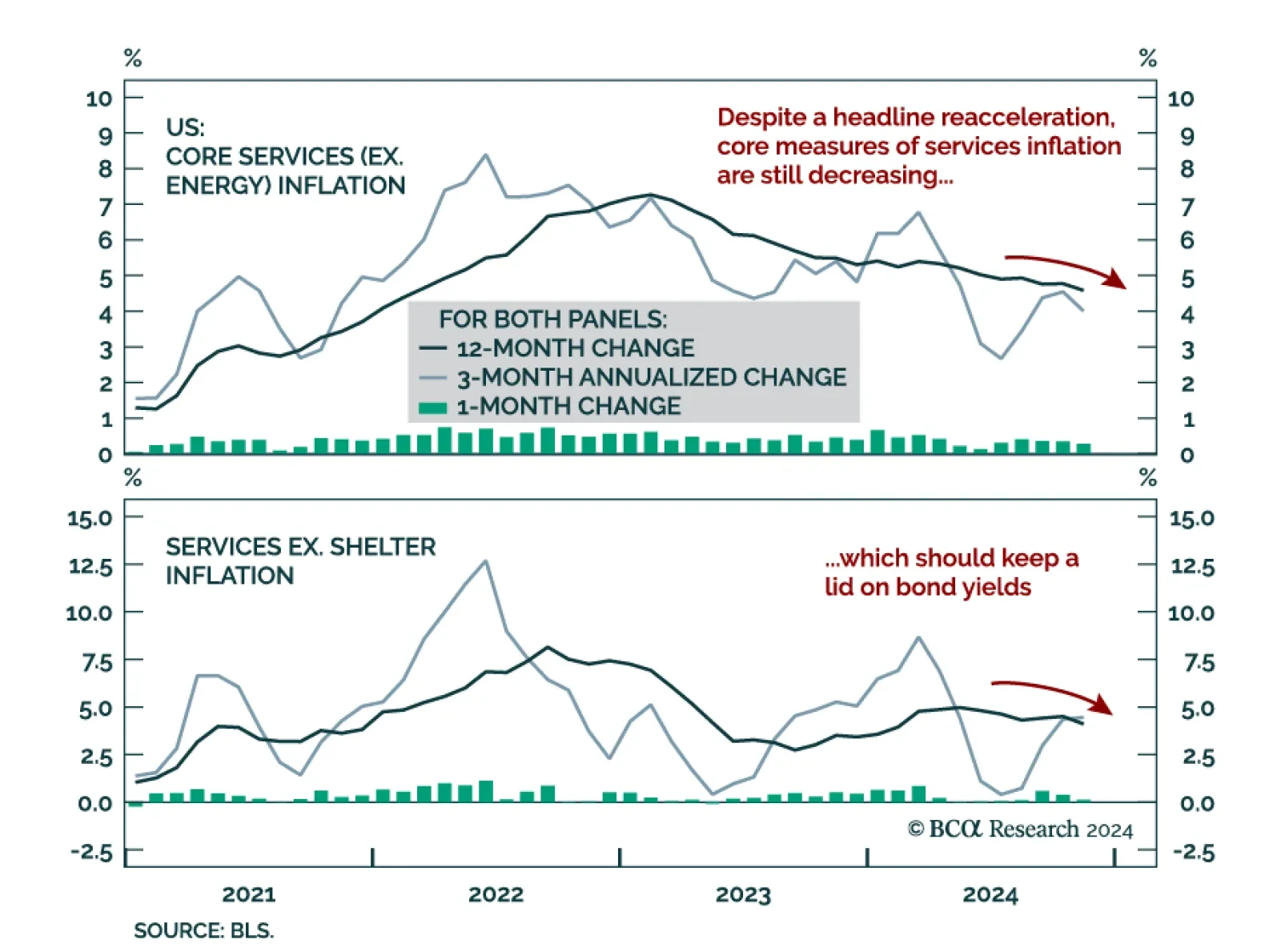

The November CPI came in line with expectations, accelerating to 0.3% m/m (2.7% y/y) from 0.2% (2.6% y/y) in October. Core also printed at 0.3% m/m, the same as October and remaining at 3.3% y/y. The acceleration was mainly…

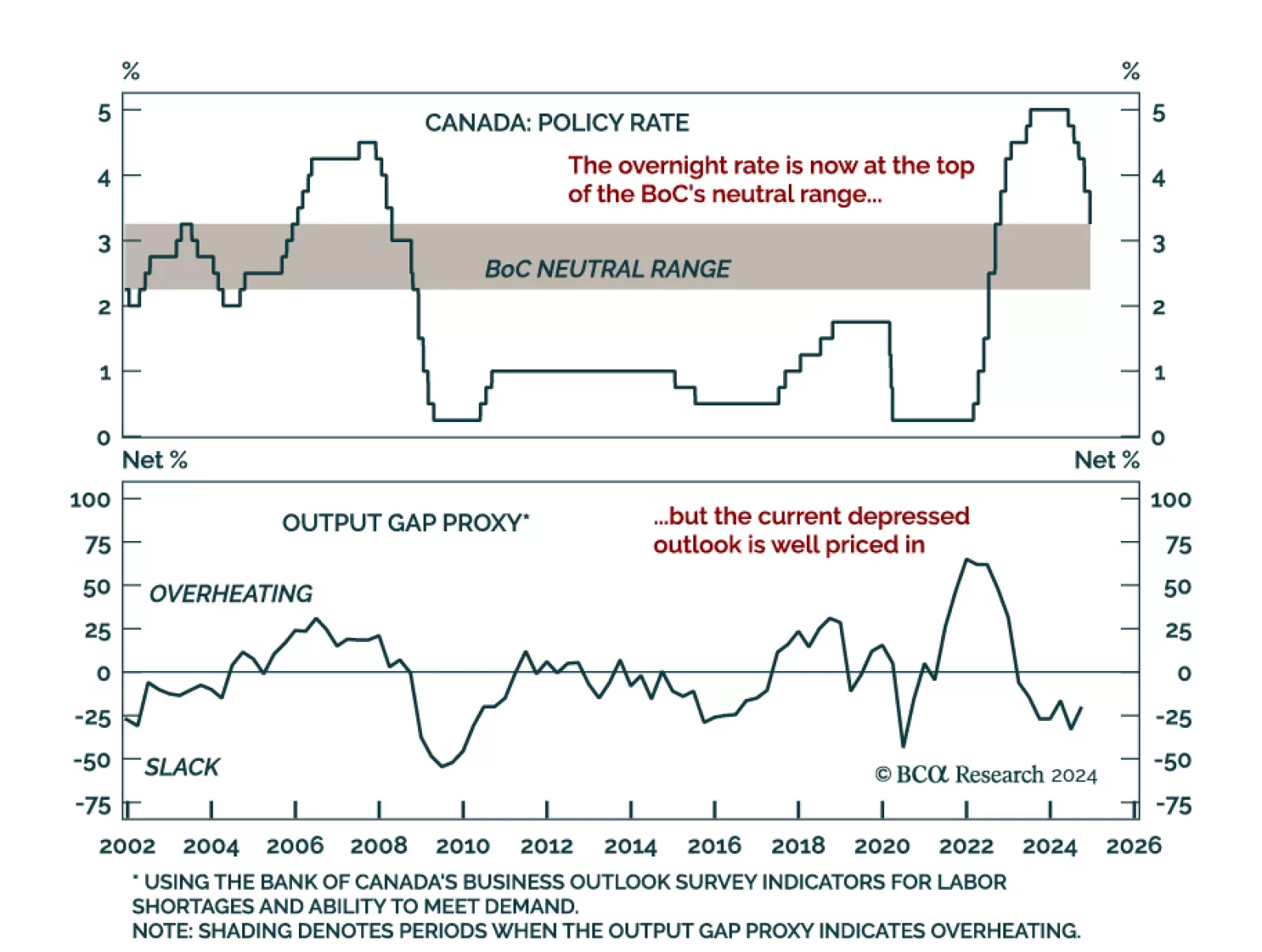

The Bank of Canada cut the overnight rate by 50 bps to 3.25%, a move predicted by economists and roughly priced in. The consecutive supersized cut brings the policy rate in the upper end of the 2.25%-to-3.25% range the BoC…

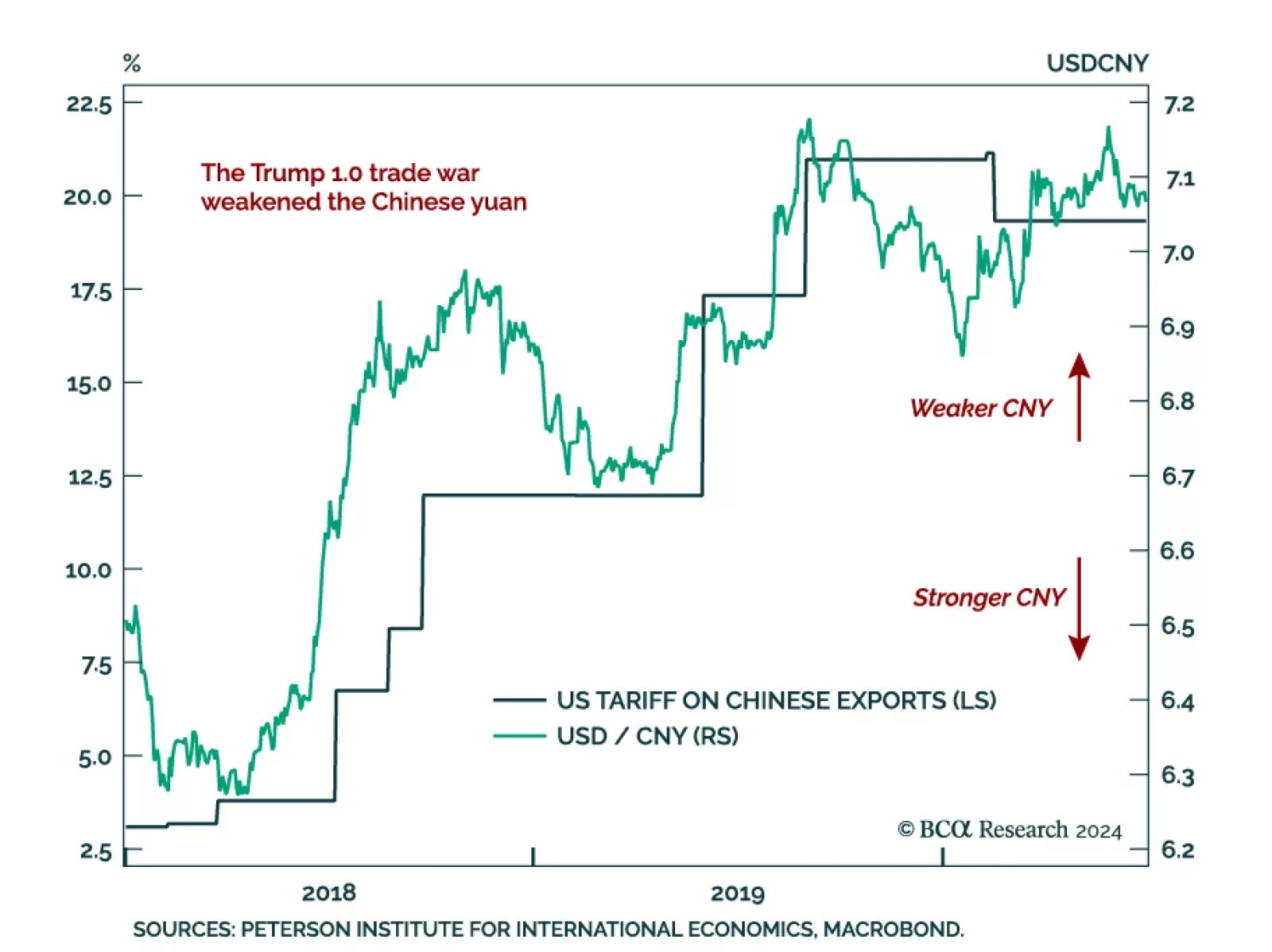

The USD has steamrolled both DM and EM currencies since the US election. Among the victims was the Chinese yuan, with USDCNY strengthening towards 7.3, a multi-year resistance level, from 7.11 on the day of the election. The CNY…

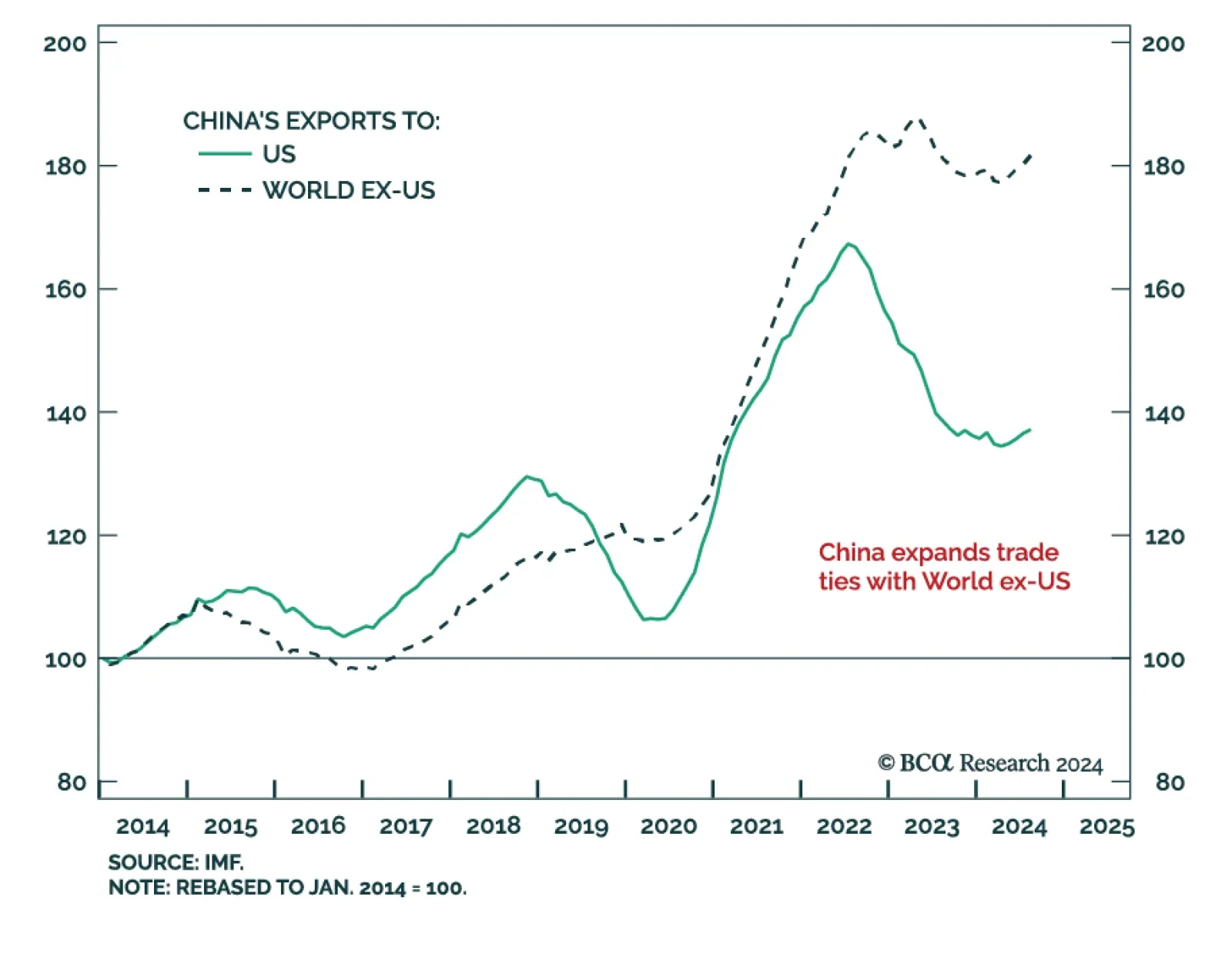

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

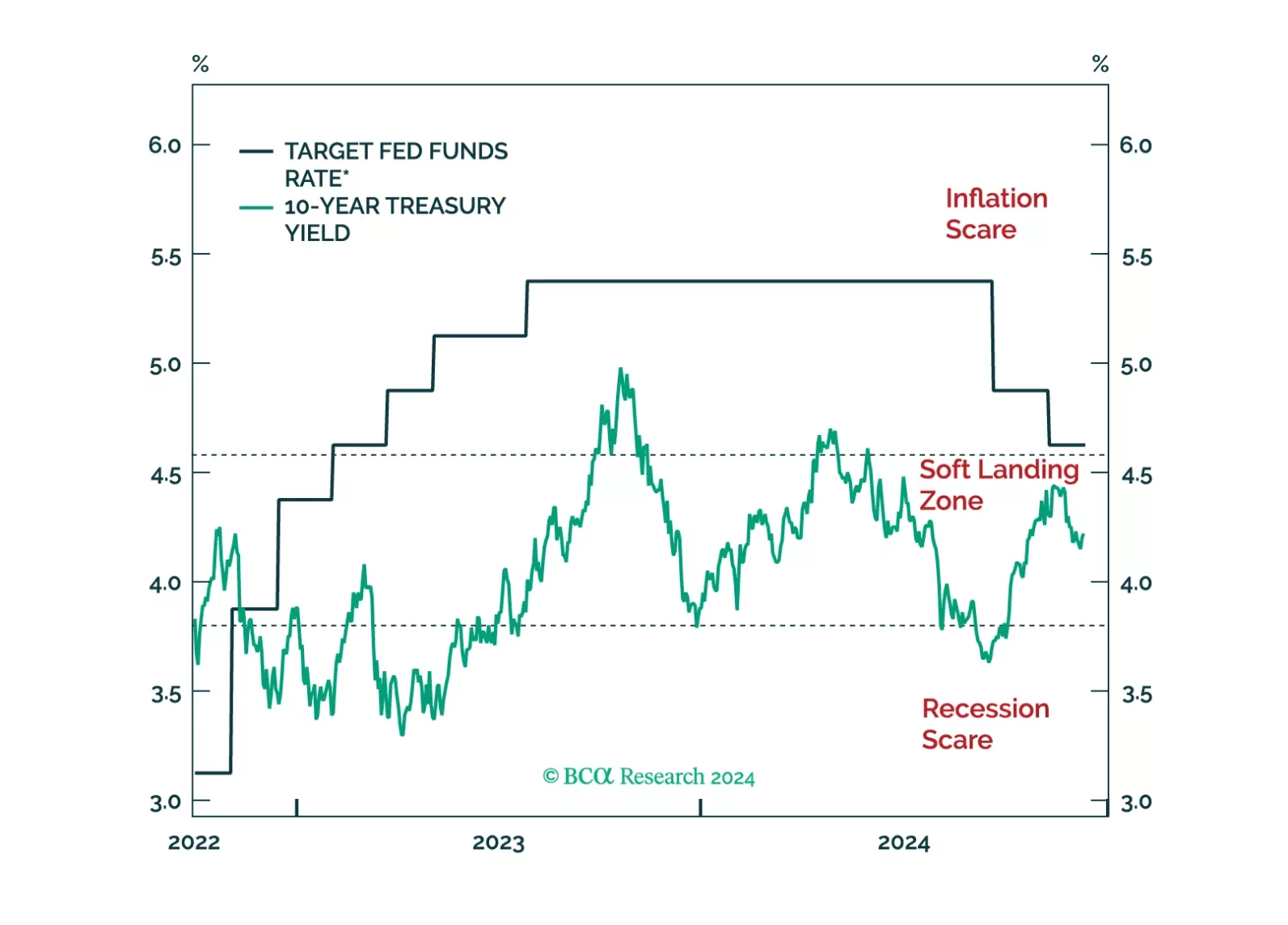

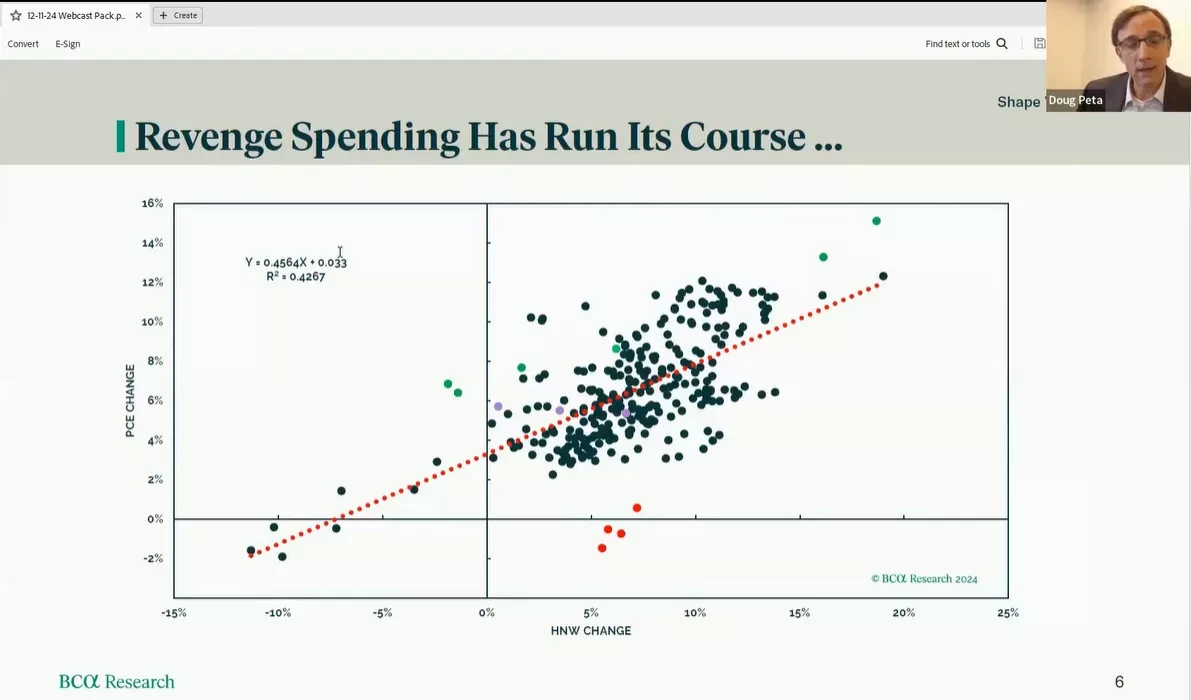

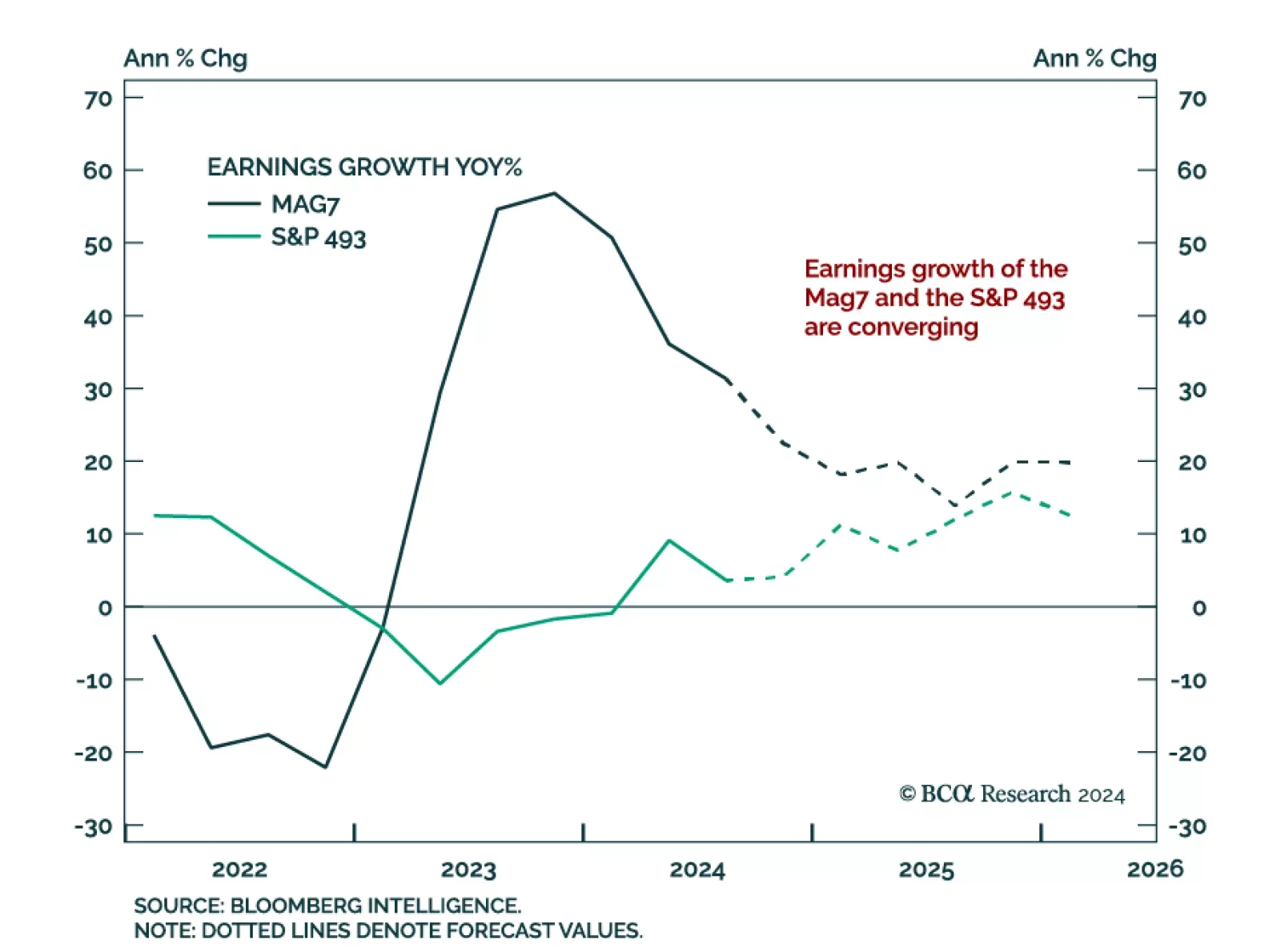

US economic data have generally surprised to the upside for the last few months, further swelling the bulls’ ranks. BCA is skeptical of the optimism, however, and recommends that investors pull in their horns ahead of the new year.

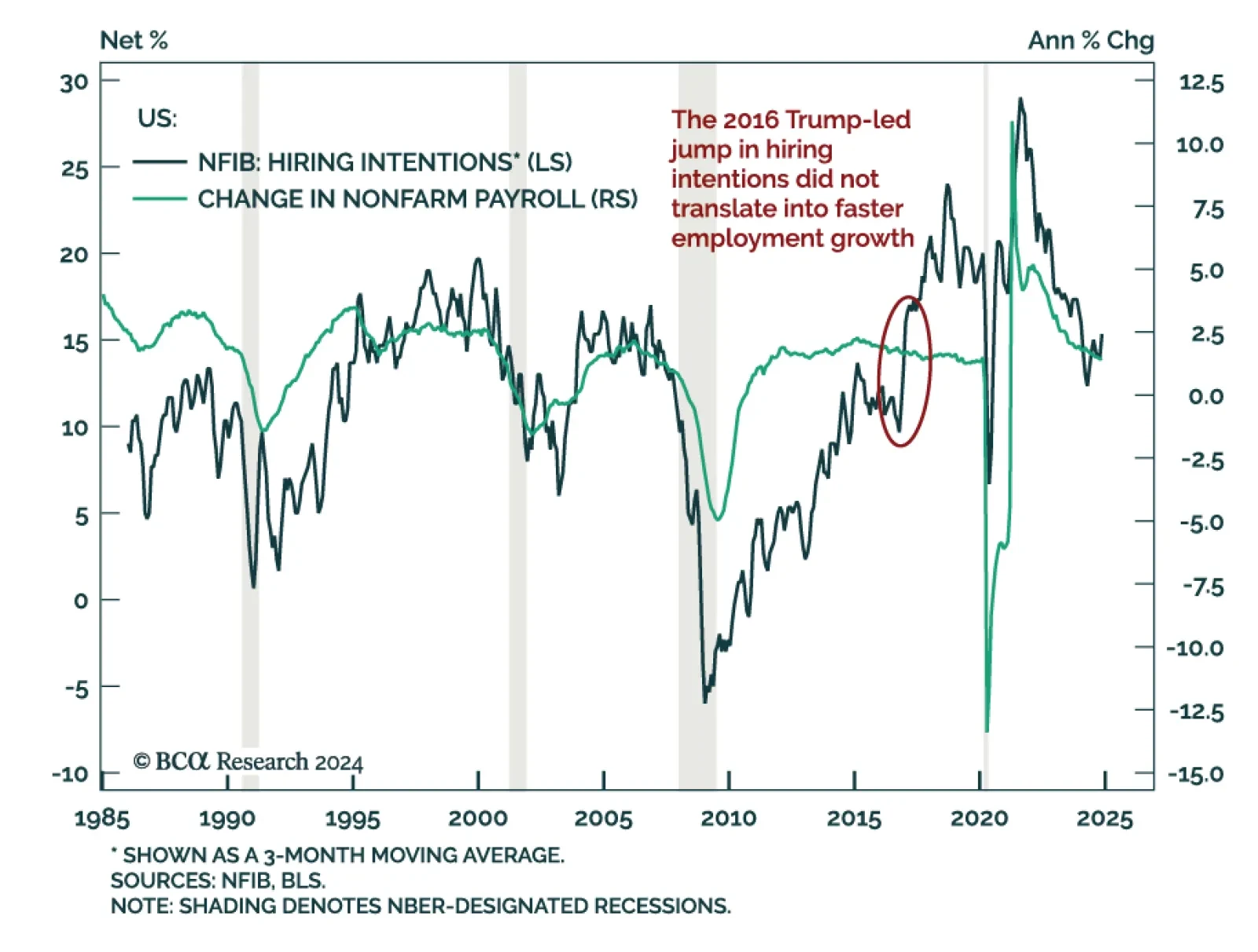

The November NFIB Small Business Optimism index beat expectations, jumping to 101.7 from 93.7 in October. Outside of inventory satisfaction, which was flat, all index subcomponents increased, led by measures of expectations. The…

Our Geopolitical Strategy team published their annual outlook, and see three trends shaping 2025. First, Congress is expected to pass tax cuts by the end of 2025, providing a fiscal thrust of 0.9% of GDP in 2026.…

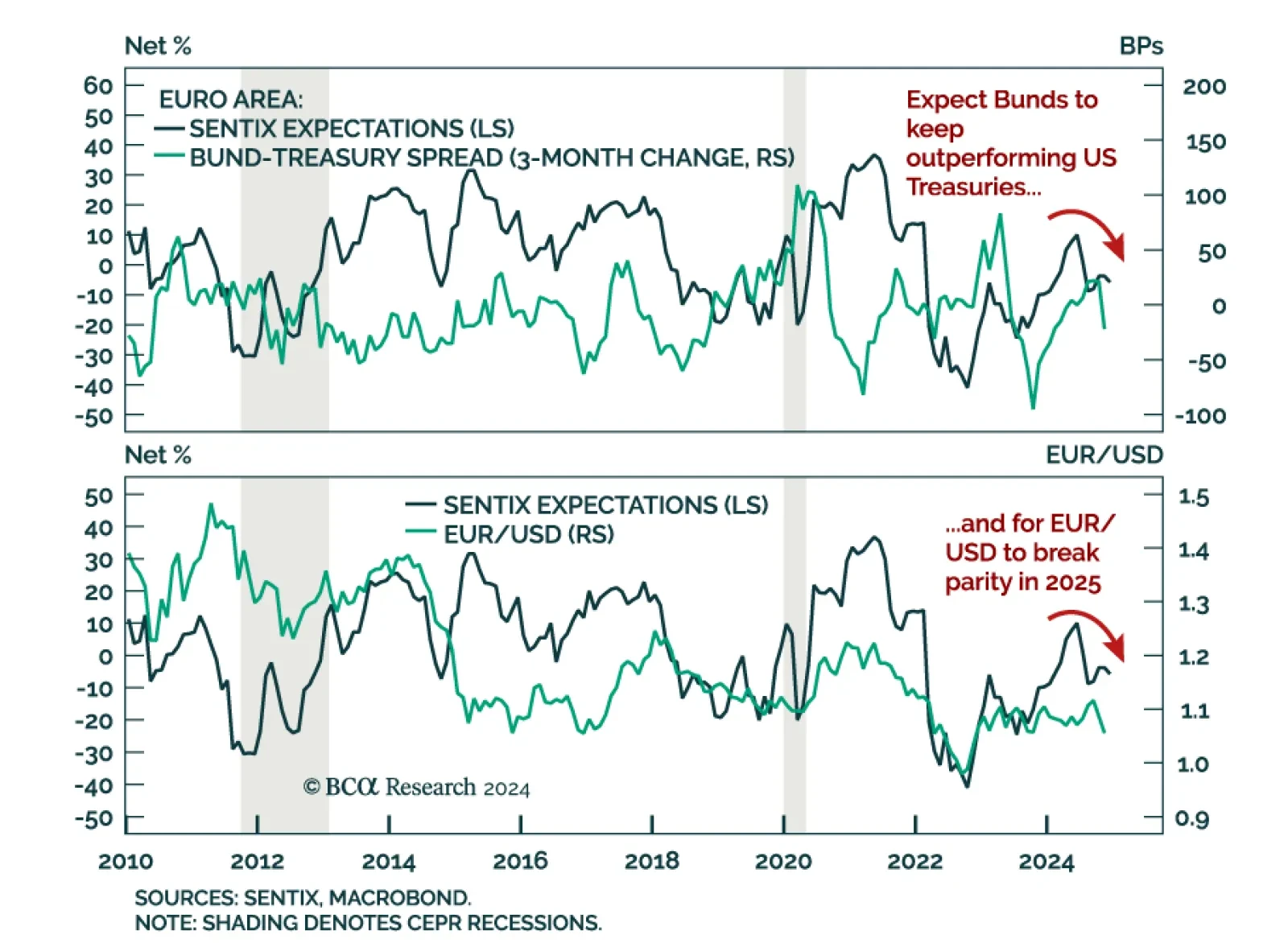

The December Sentix Economic Index for the Euro Area missed expectations, declining to -17.5 vs. -12.8 in November. Both the current situation and expectations components declined. As the first sentiment indicator for…