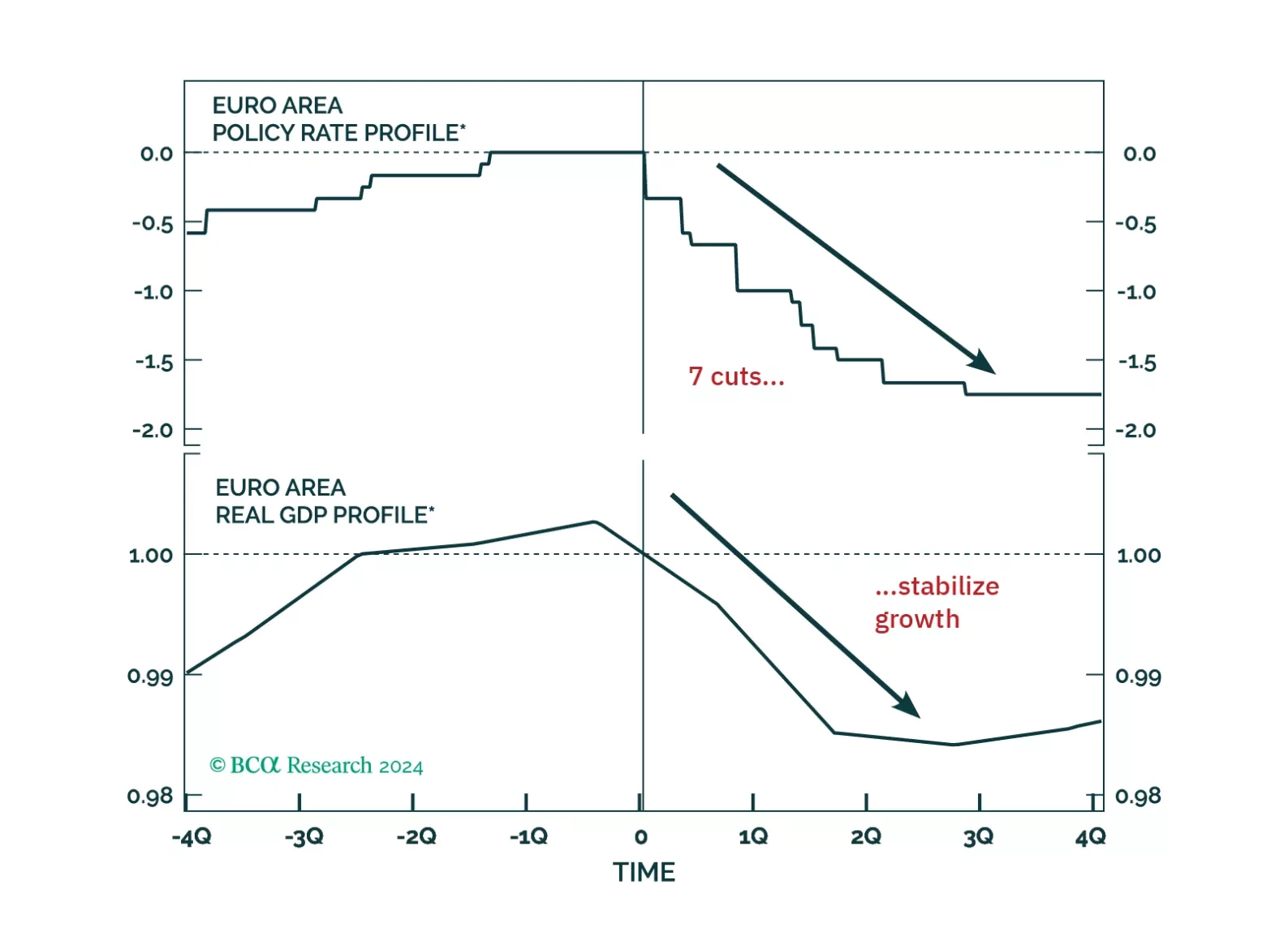

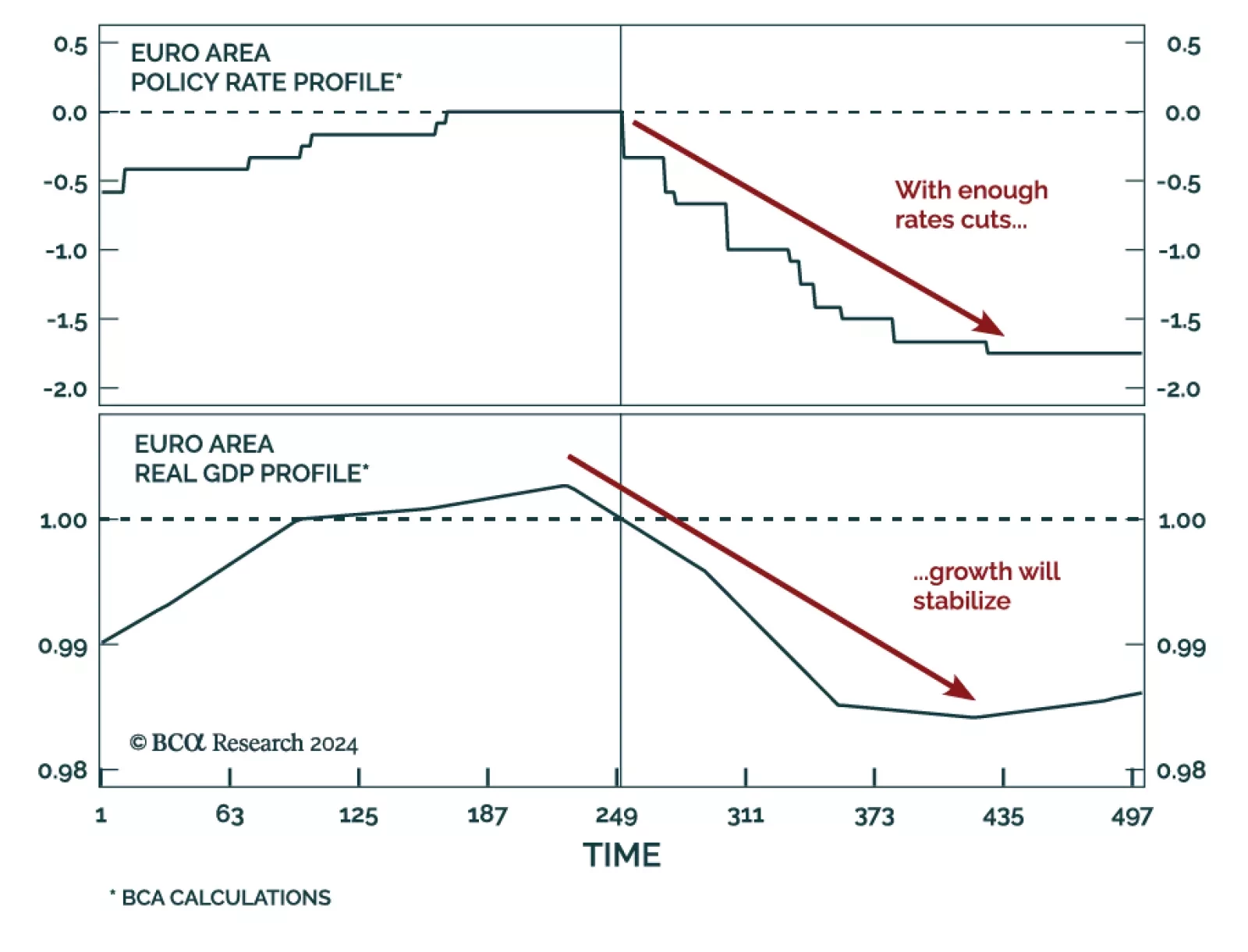

Our European Investment Strategy team published their annual outlook, outlining five key themes that will shape Europe’s economy and markets in 2025. Europe will enter a mild recession in H1 2025, but growth is…

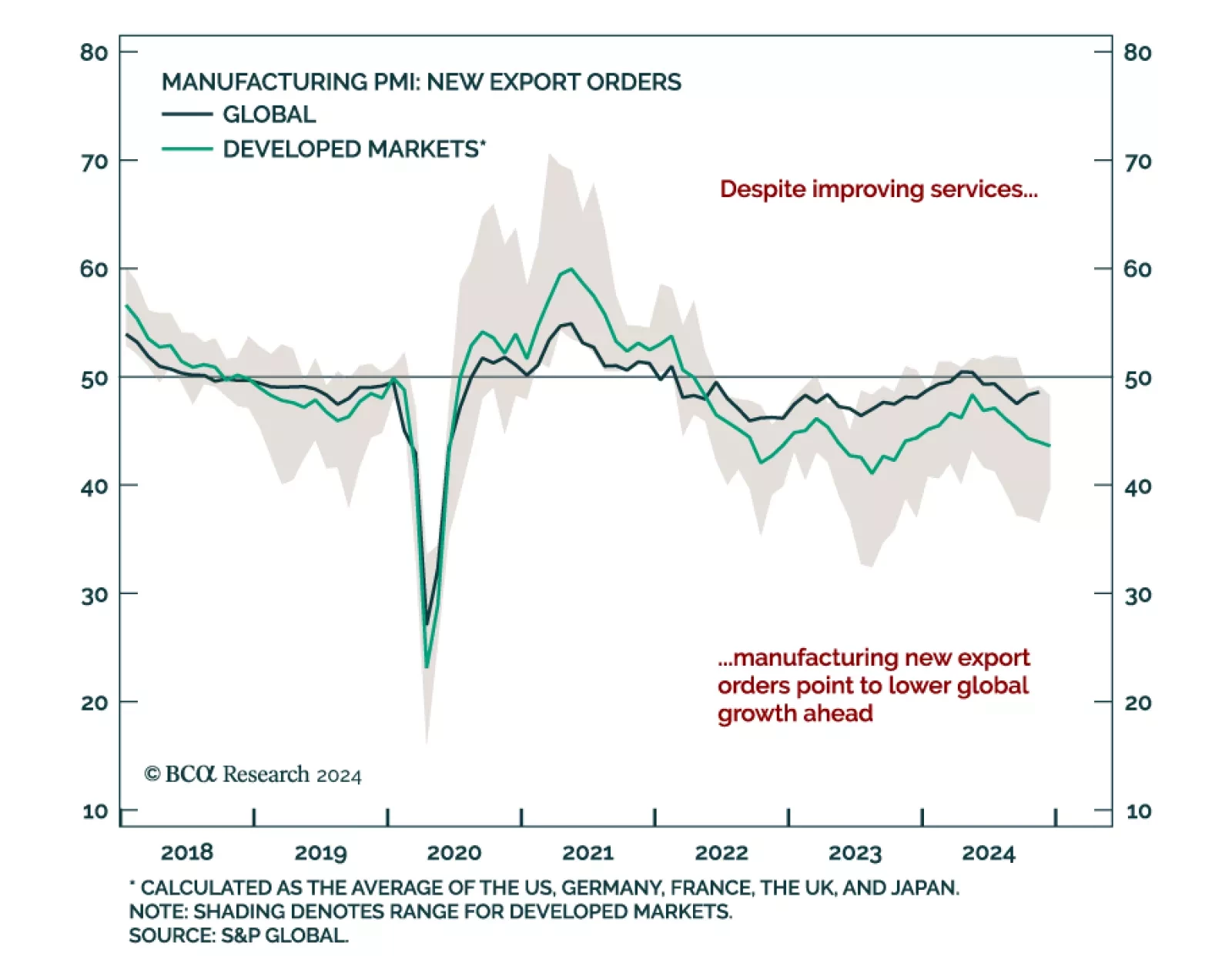

December flash PMIs for the core advanced economies showed service sector growth picking up. Manufacturing keeps contracting, and the US continues to outperform its DM peers. The US composite index beat expectations and…

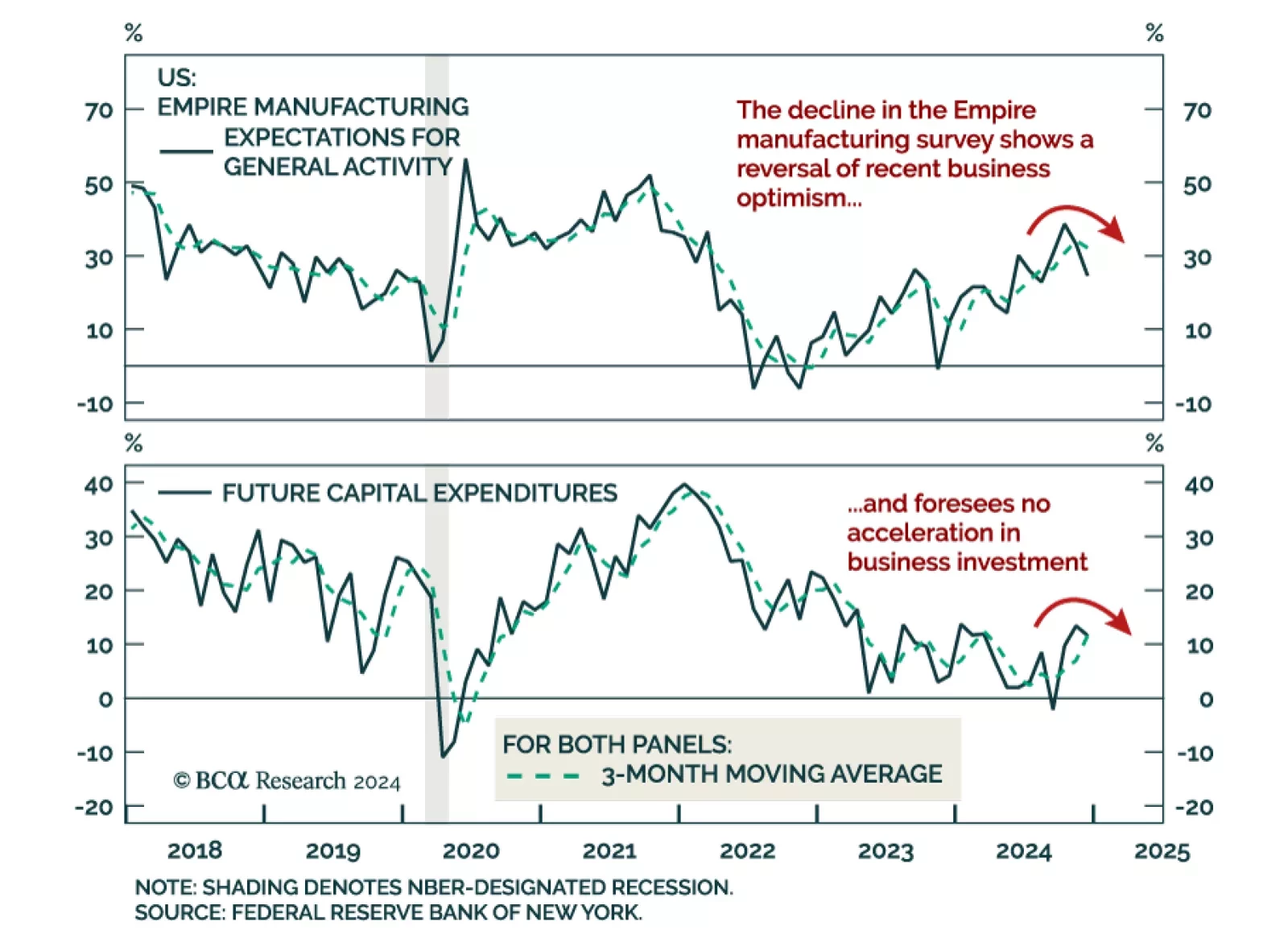

The December Empire Manufacturing index missed expectations, slowing to 0.2 from 31.2 in November. Most cyclical components eased, suggesting last month's surge was a post-election blip. The new orders subcomponent…

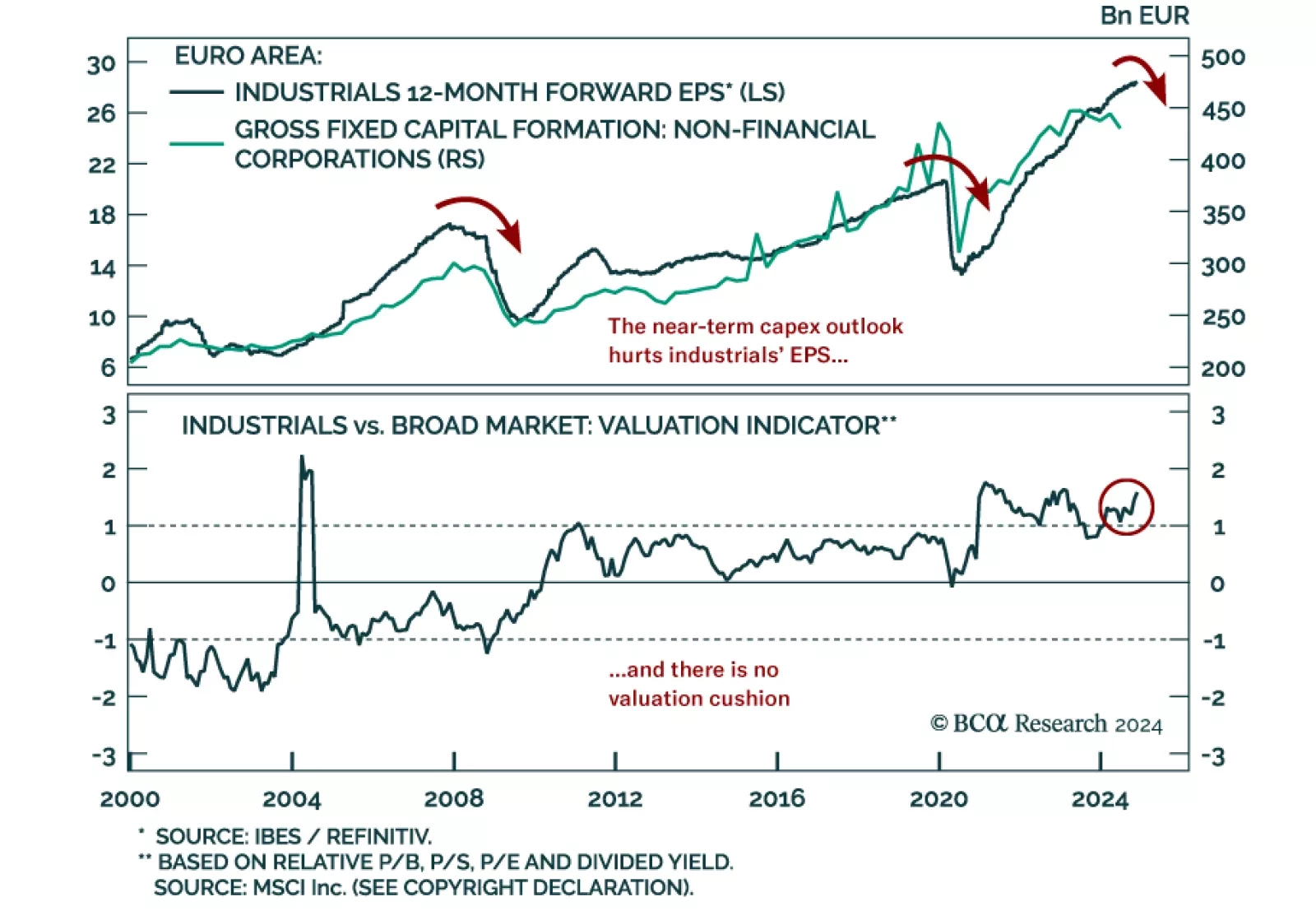

Our Chart Of The Week comes from Mathieu Savary, Chief Strategist of our European Investment Strategy service. Mathieu sees a dimming outlook for European industrial stocks in the near term.The sector has been one of the strongest…

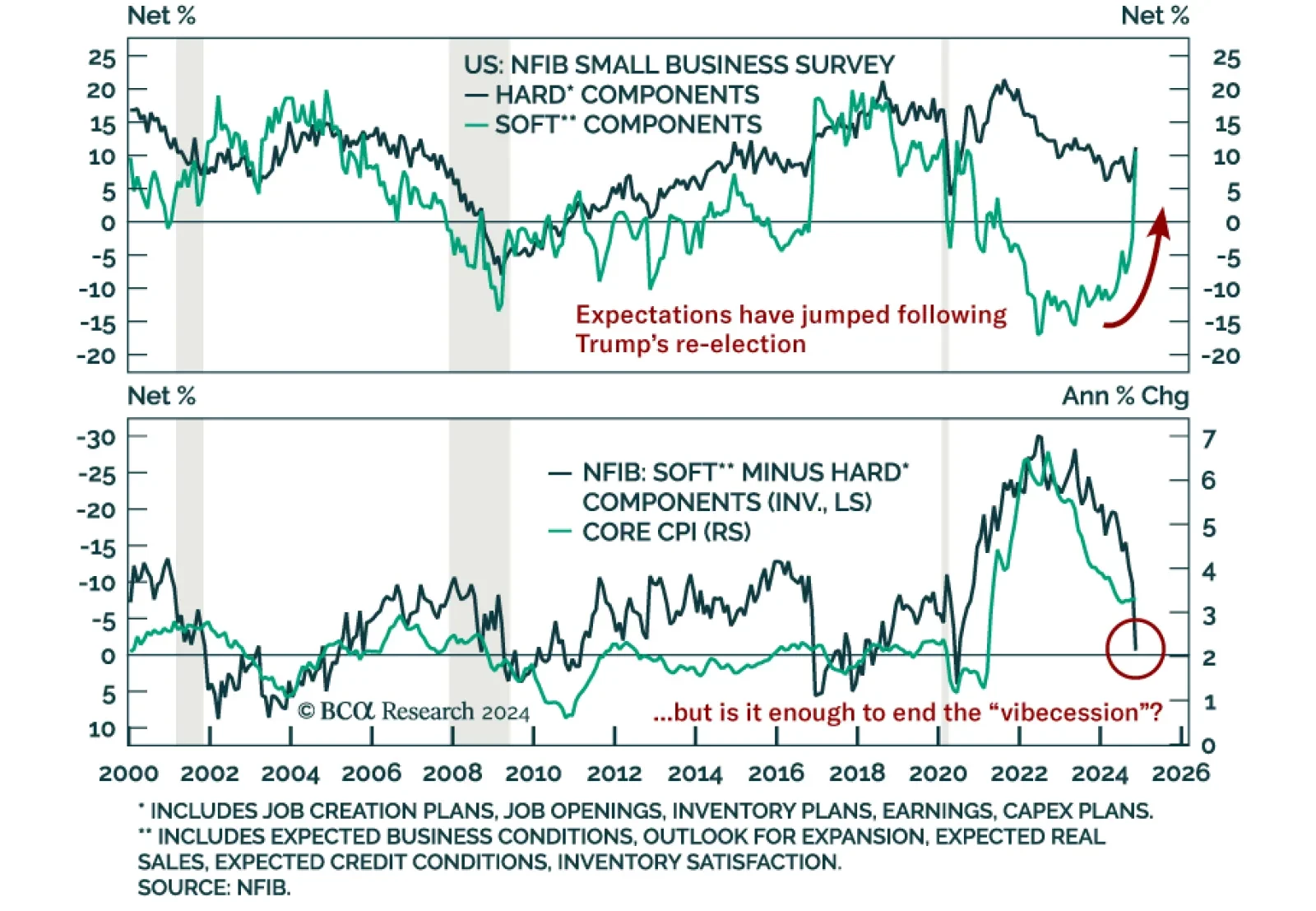

The post-COVID US recovery was different from previous cycles. Despite an ebullient economy, US consumers and firms have just not been feeling it, as reflected by the depressed signals from so-called soft, survey-based indicators…

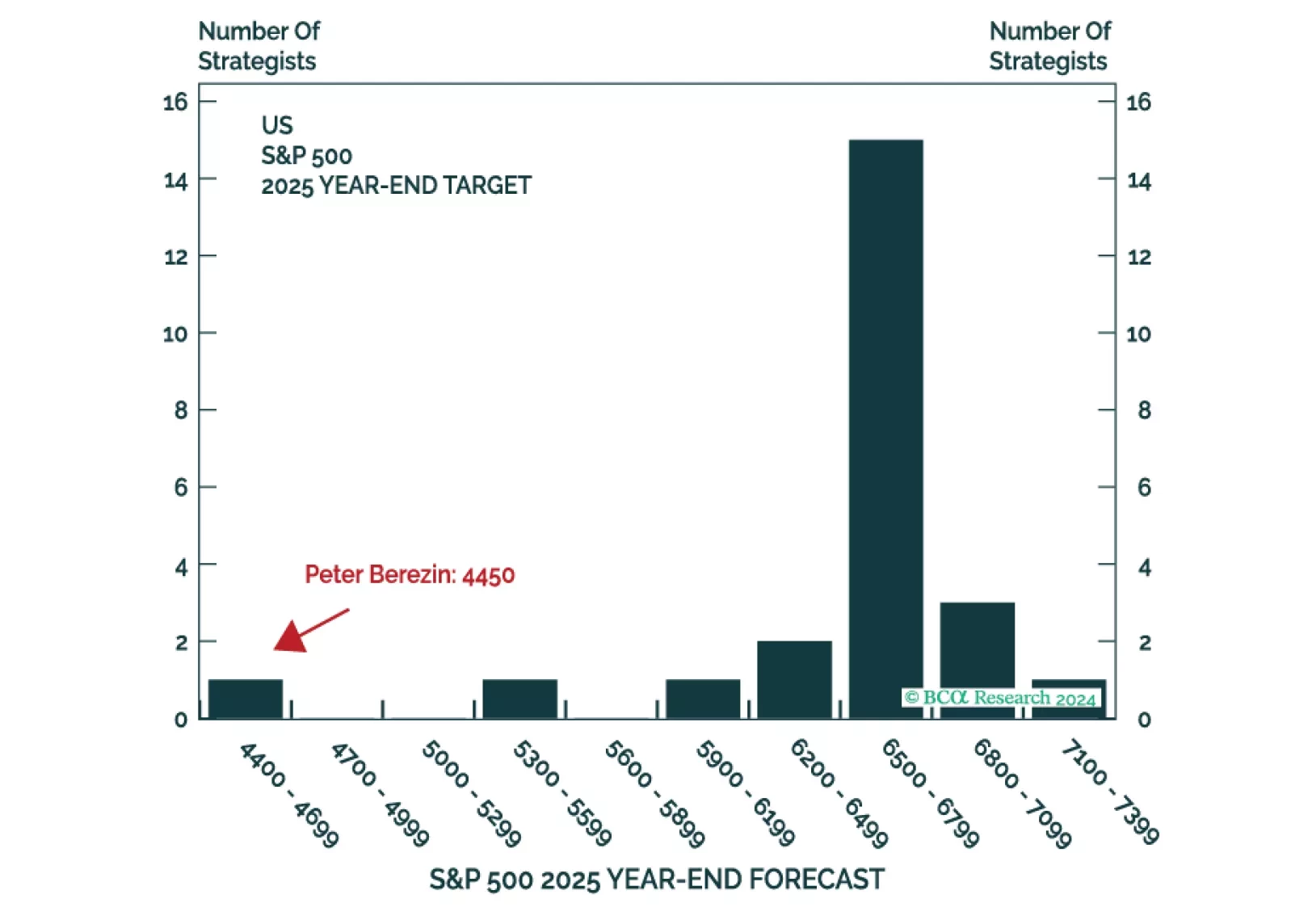

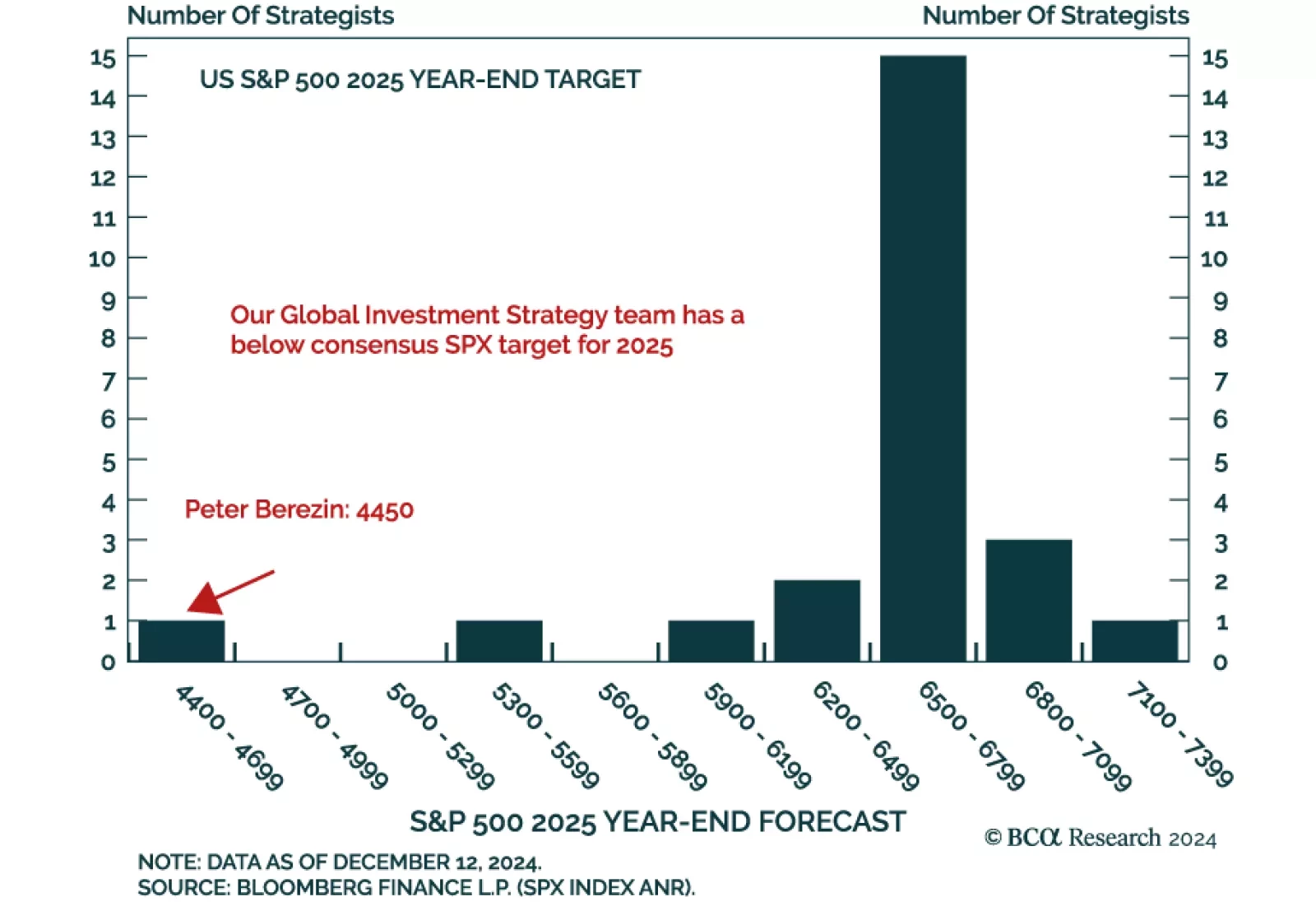

Our Global Investment Strategy team released their 2025 outlook, adopting the unique perspective of time-travelers reporting from January 2, 2026. They foresee a challenging 2025, with the global economy slowing sharply and…

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

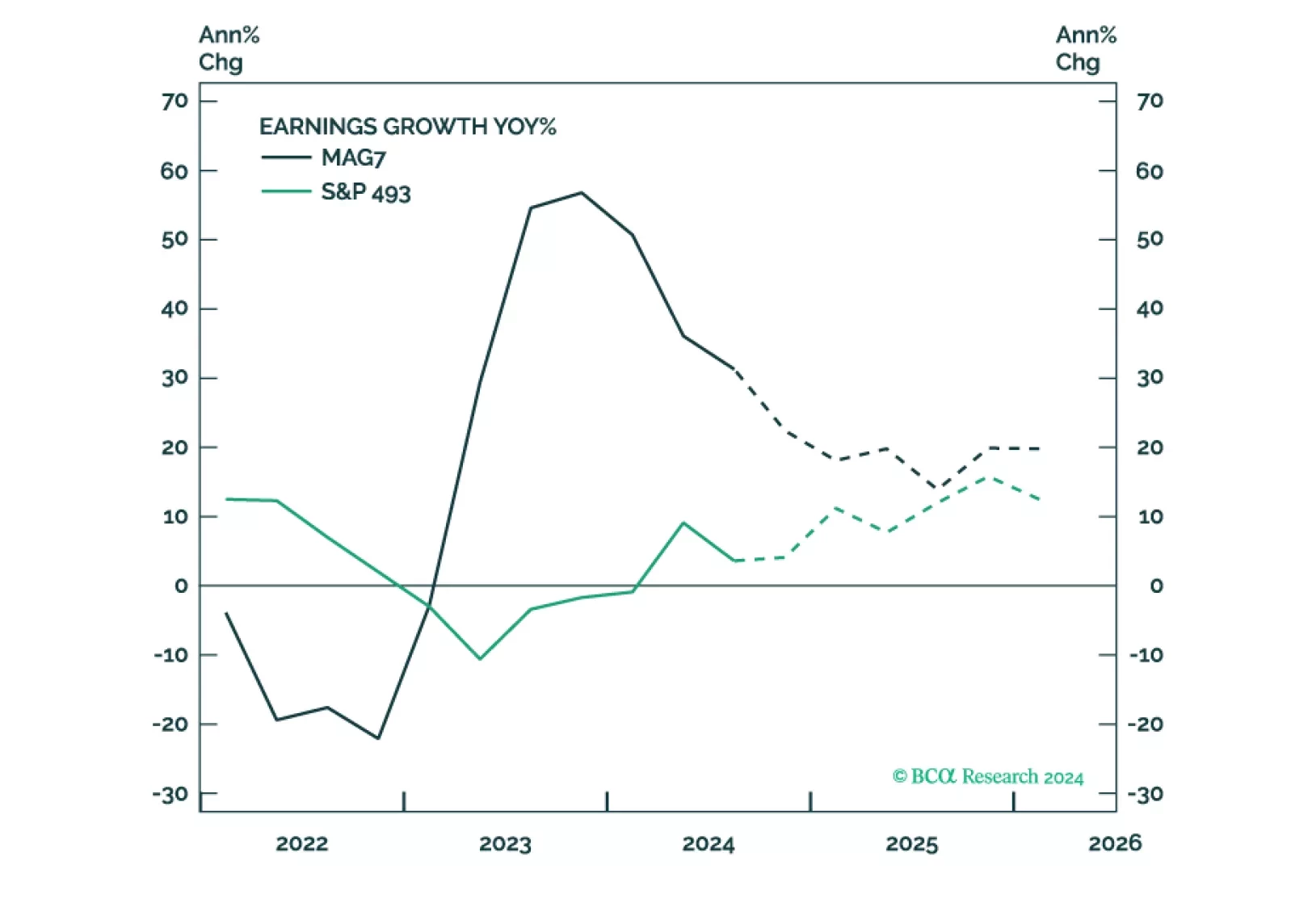

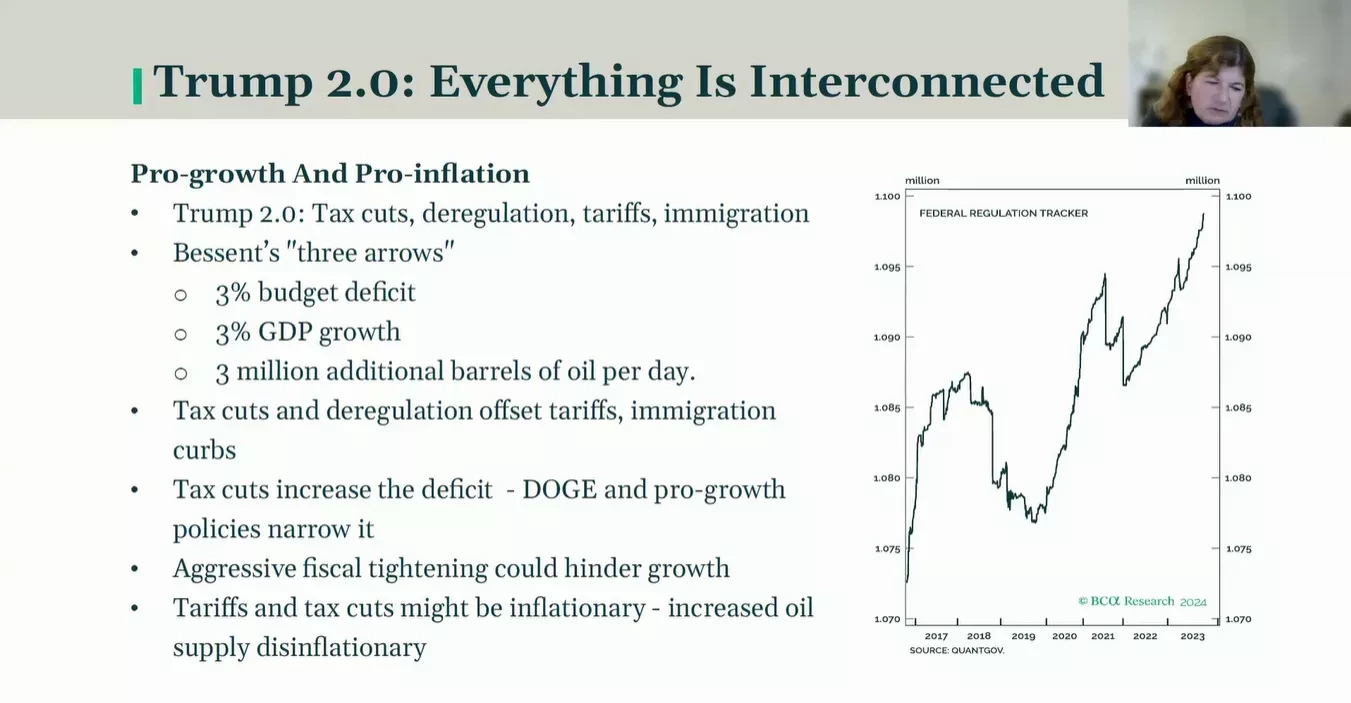

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

Irene will discuss positioning equity portfolio for the Trump presidency.