Our Global Asset Allocation strategists upheld their yearly tradition of putting together reading or listening recommendations for the holiday period. This year, our strategists and research teams sent their best recommendations for…

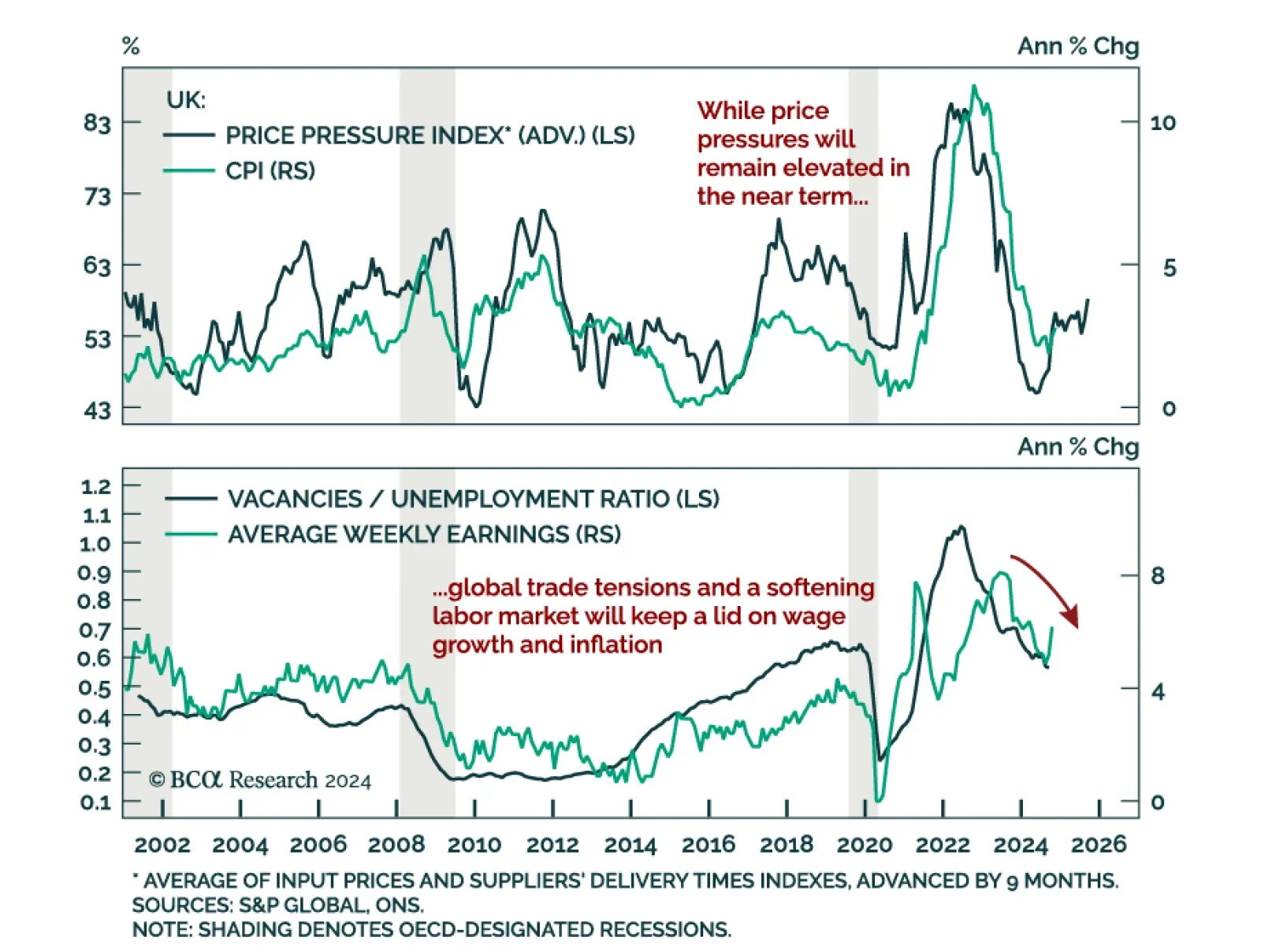

The November UK CPI, in line with estimates, hit an eight-month high, accelerating from 2.3% y/y to 2.6%. Core and services inflation were also strong at 3.5% (vs. 3.3% in October) and 5.0% (flat from October), respectively.…

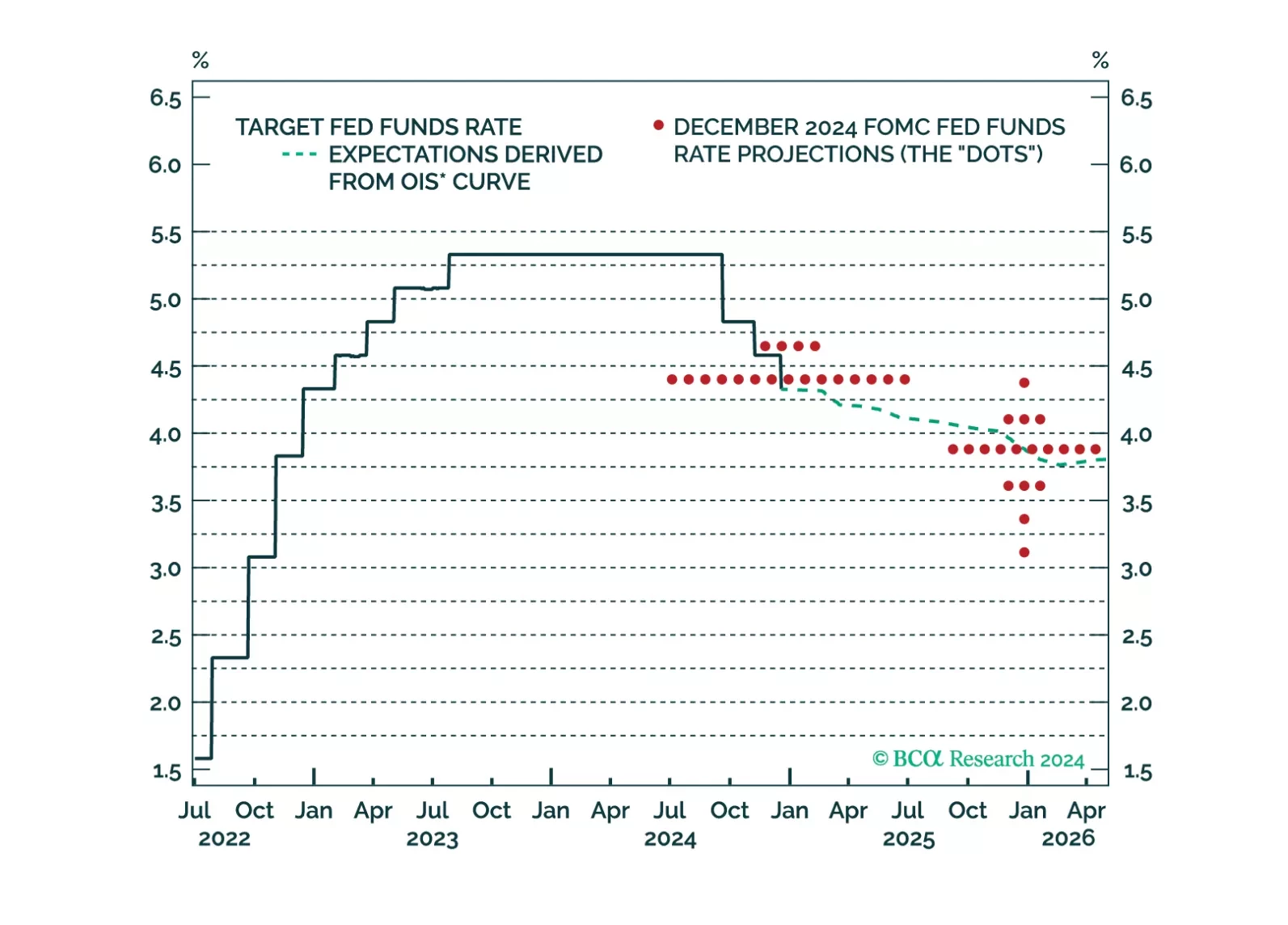

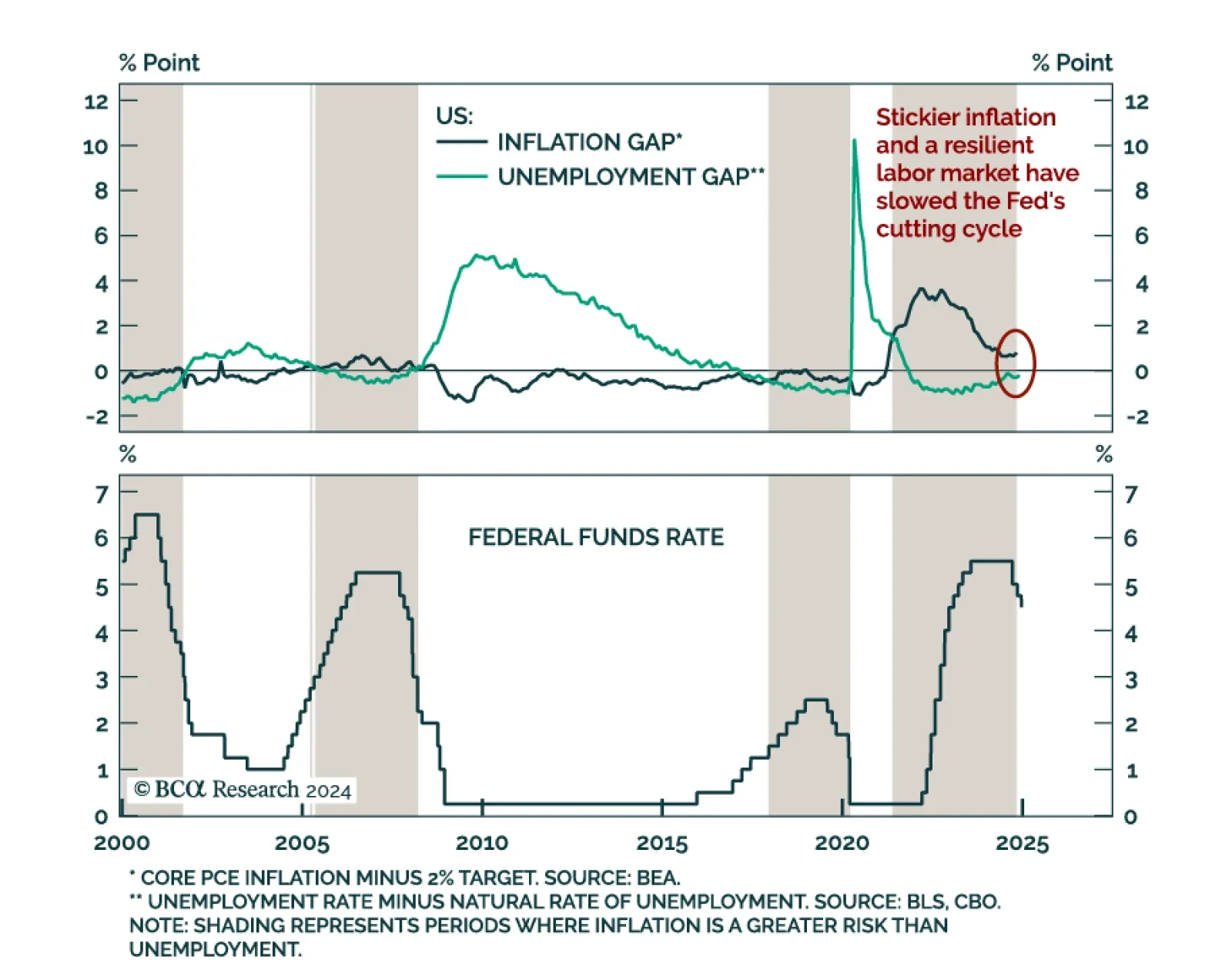

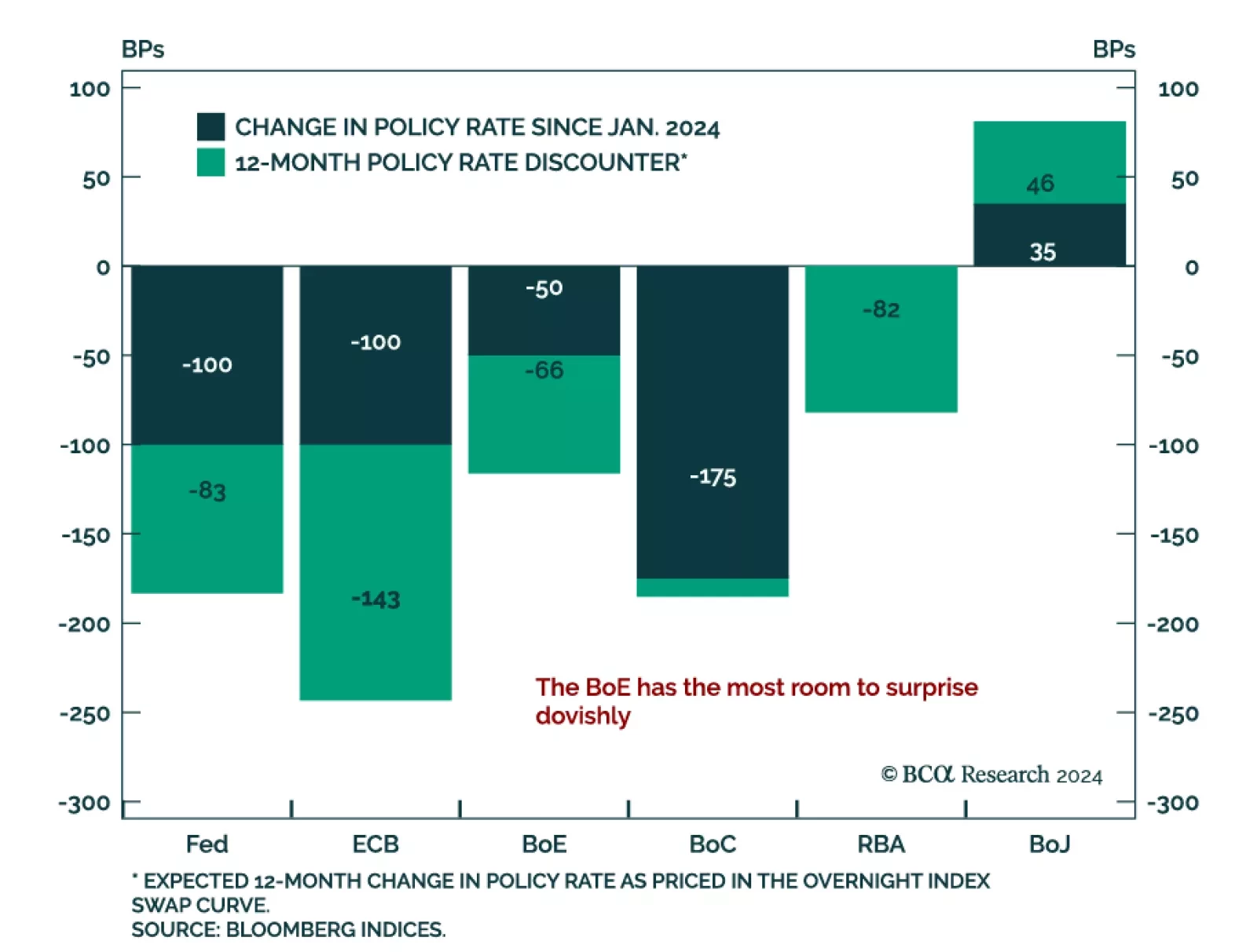

The Federal Reserve cut the fed funds rate by 25 bps to a 4.25%-4.5% range, as expected. However, it was a “hawkish cut”; the FOMC signaled a slower pace of easing ahead. The statement signalled less urgency, saying…

Our Global Fixed Income and FX strategists published their 2025 outlook, and provide five key views for the year ahead. Duration revival: After three years of underperformance versus cash, government bonds will…

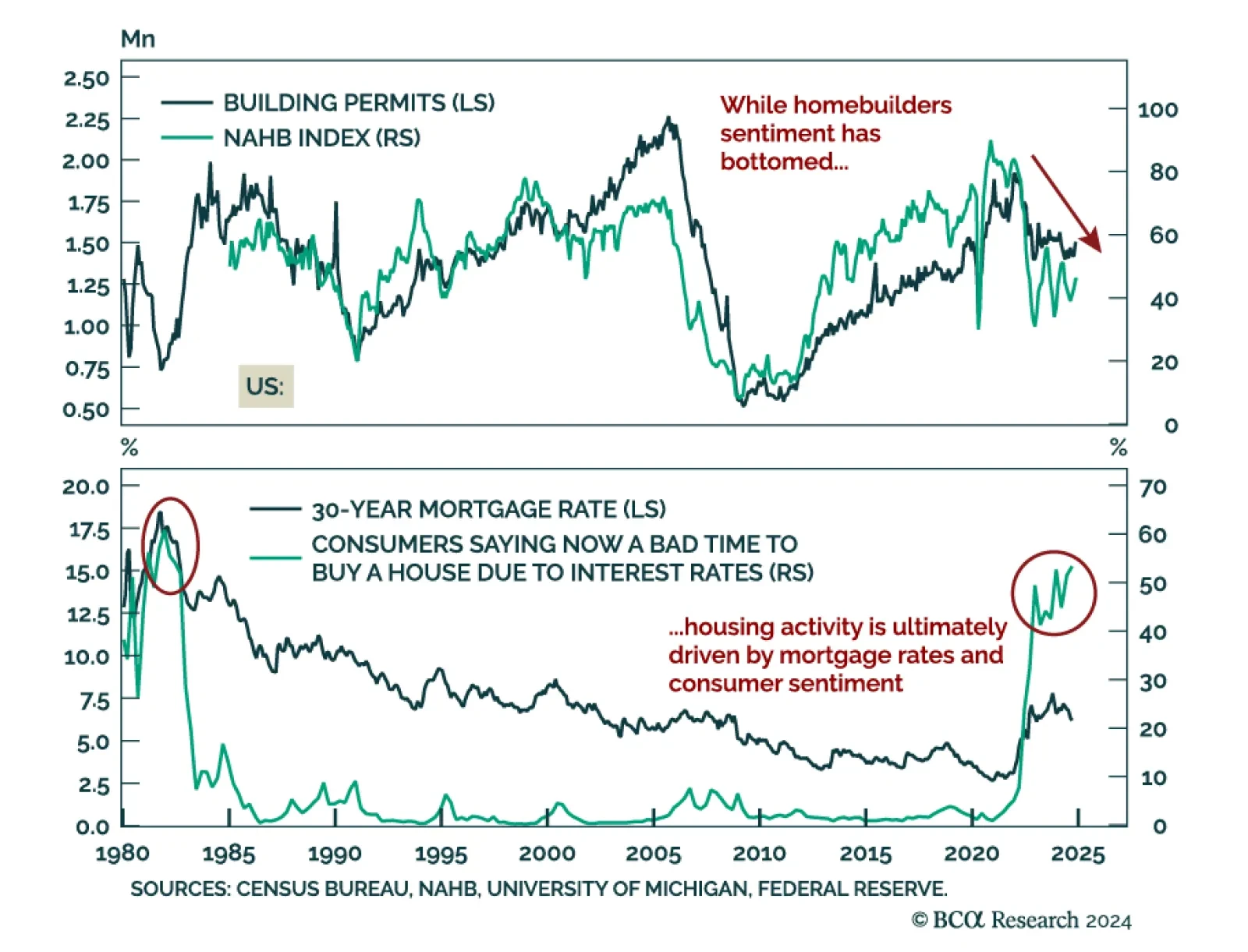

US November housing data was mixed, but still reflected a weak picture. Housing starts were down 1.8% m/m, below expectations of a 2.6% increase. However, building permits were stronger than expected, increasing 6.1%. Units under…

Our thoughts on this afternoon’s Fed decision and the bond market reaction.

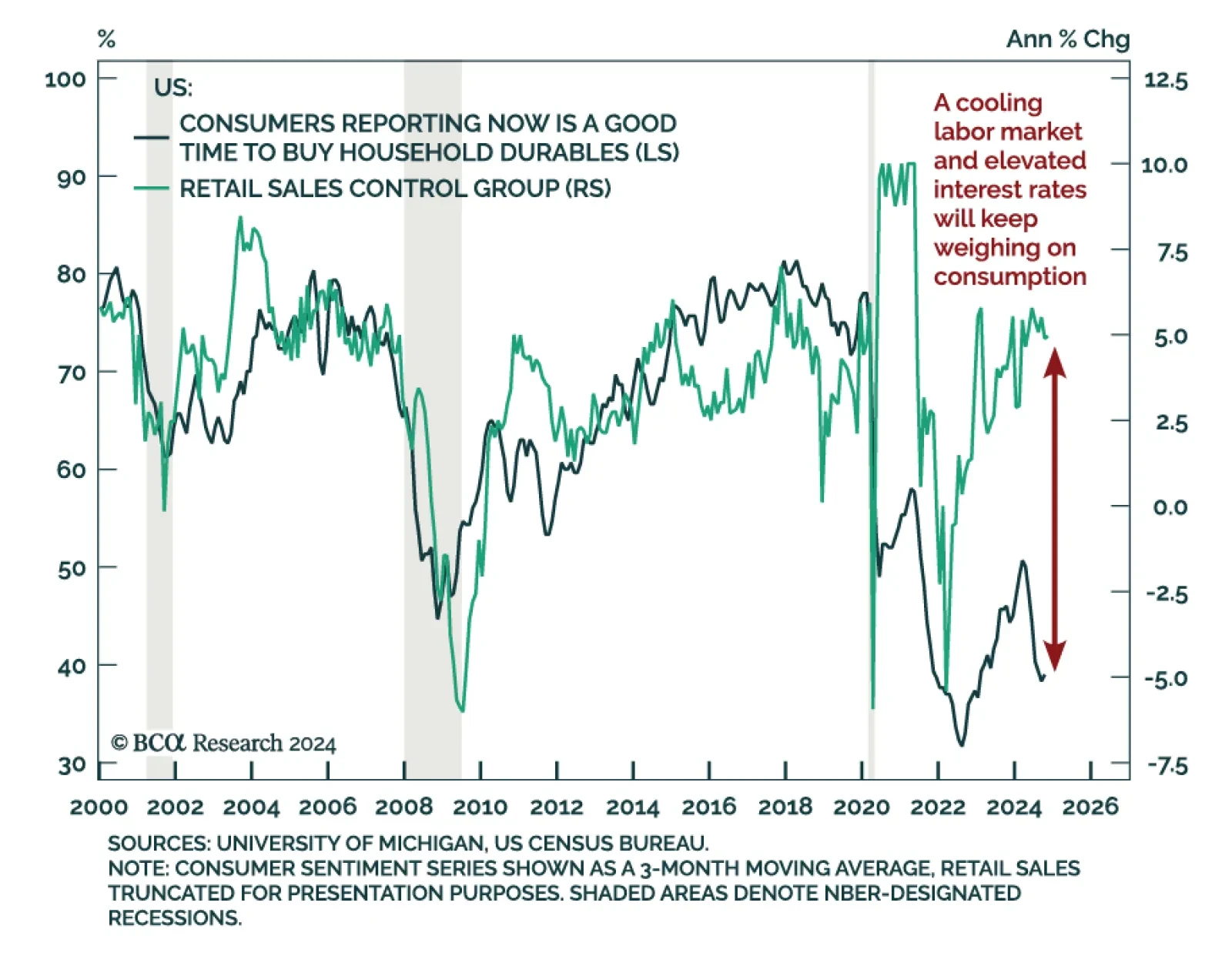

November retail sales were roughly in line with expectations, with headline growth at 0.7% m/m vs. 0.4% in October. Vehicle sales were solid. Excluding auto and gas, sales rose a more modest 0.2% m/m, below expectations. The…

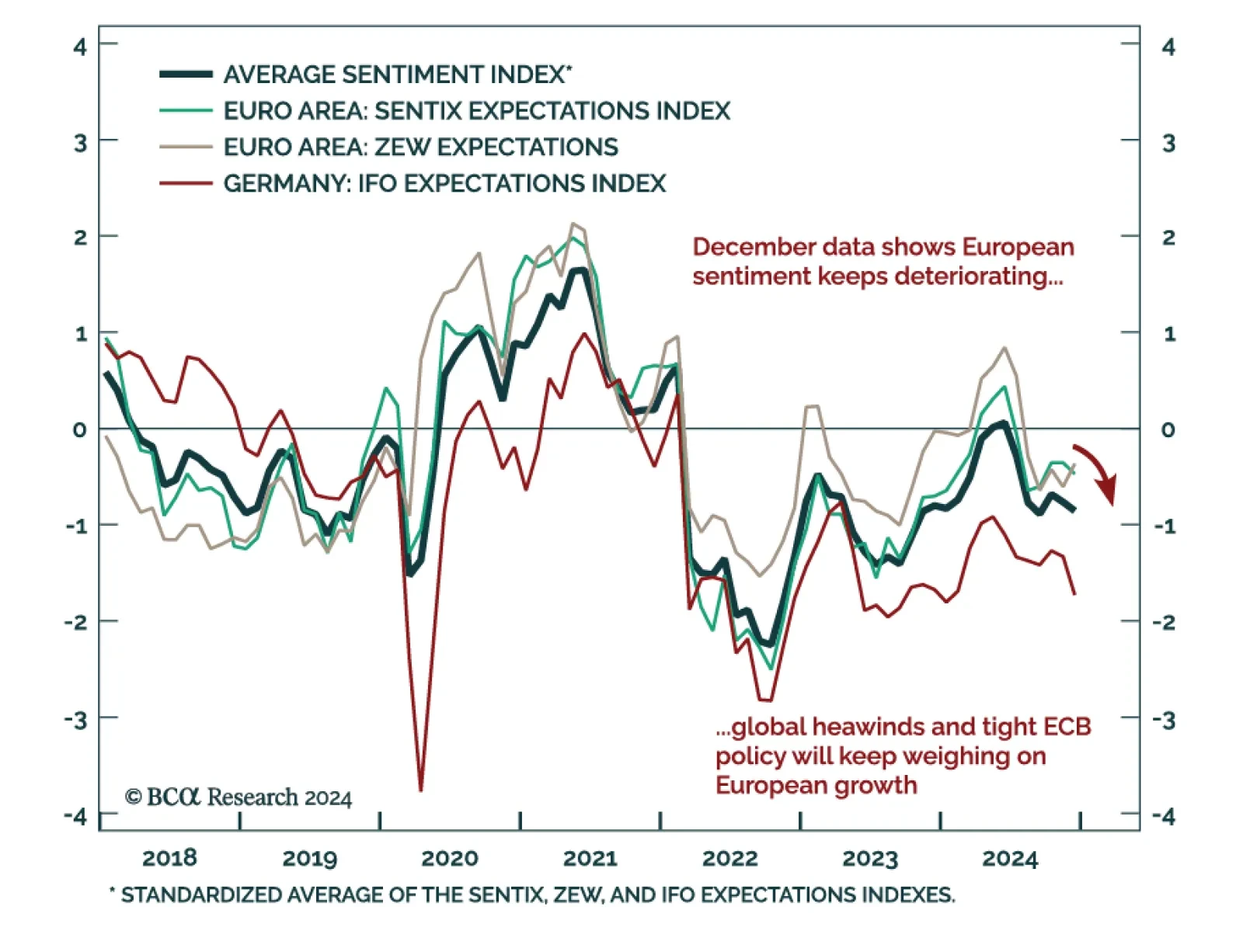

European sentiment data was mixed. The December Ifo Business Climate index for Germany missed estimates and was down 1 point to 84.7 from November. The decrease came from its expectations component, which fell to 84.4 from 87.2.…

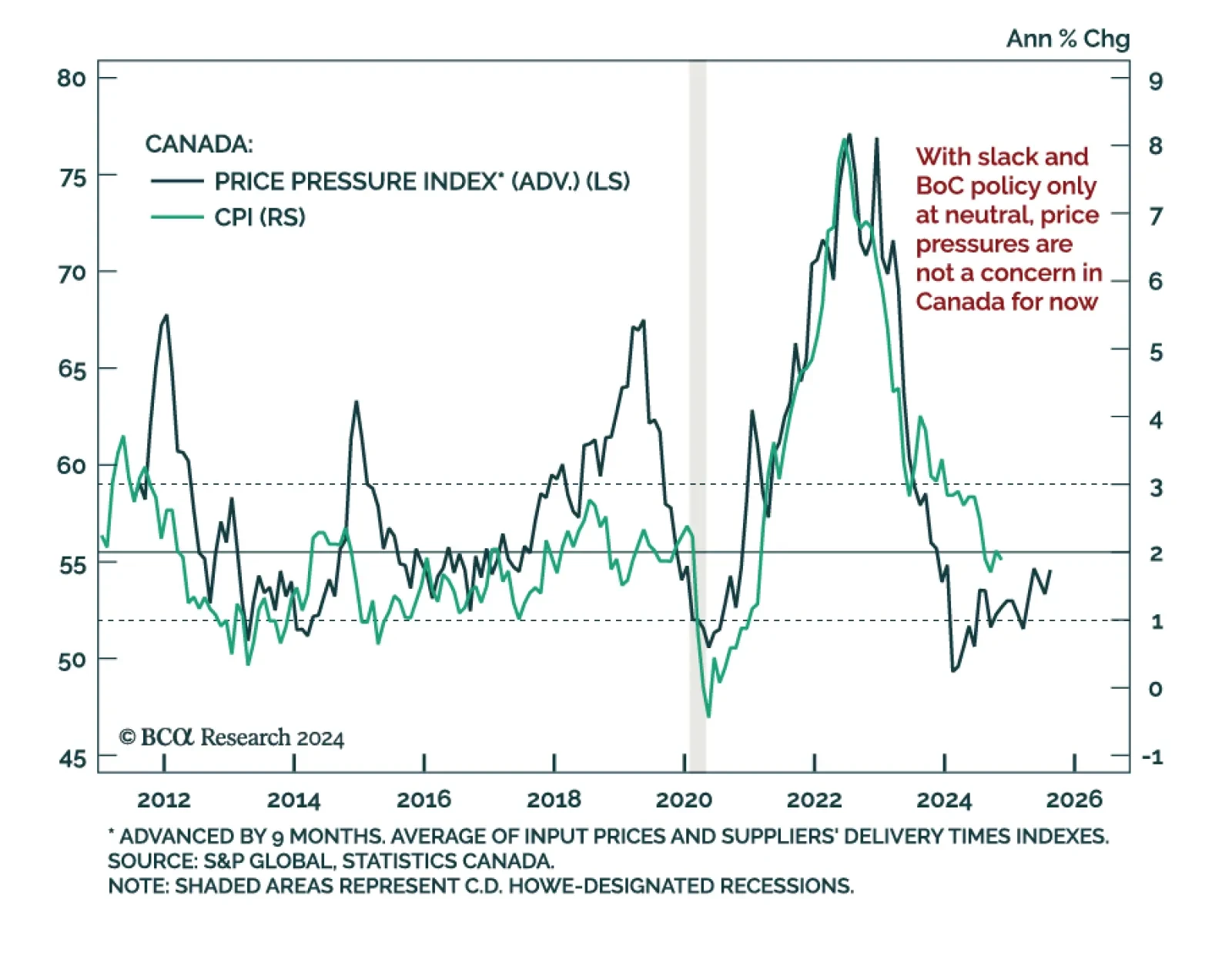

The November Canadian CPI was slightly below estimates, declining to 1.9% y/y from 2.0%, below the BoC’s 2% target but within the 1%-to-3% range. The BoC’s favored core measures, median and trim, were flat at 2.6% and…