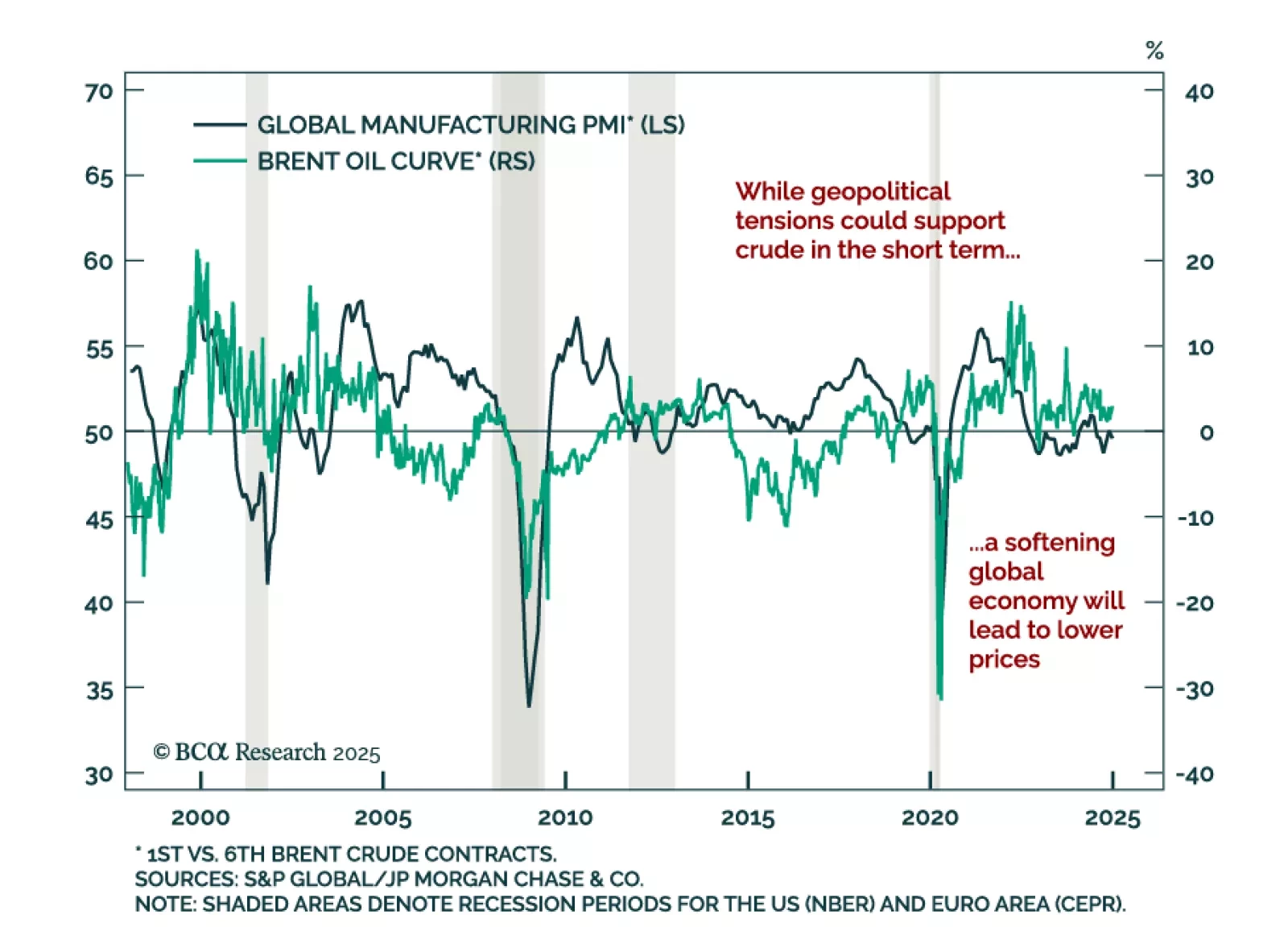

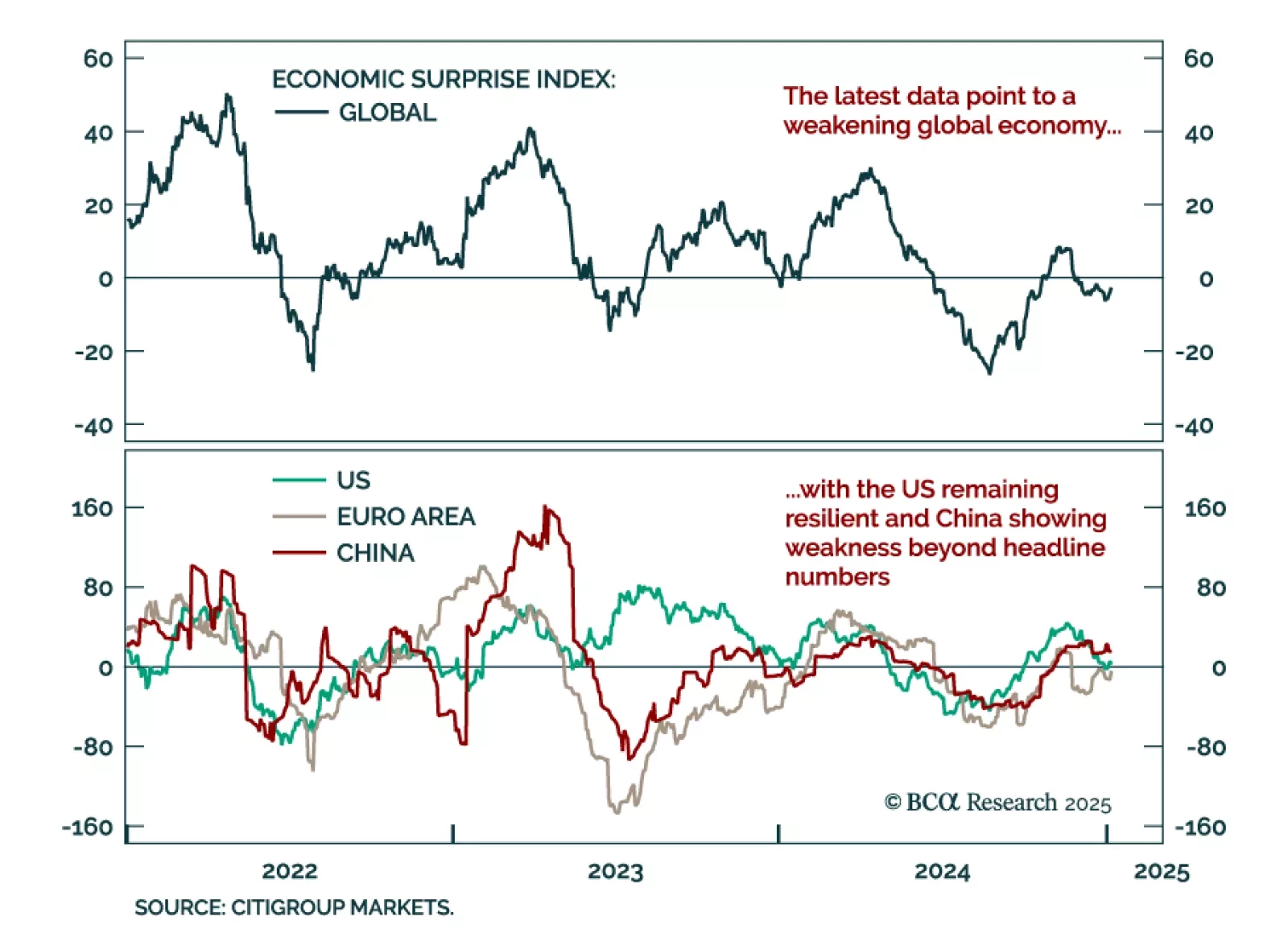

Oil prices have broken out above resistance from a tight trading range since the holidays. We attribute this latest rally to geopolitical tremors more than a vote of confidence from markets on global growth given softening data.…

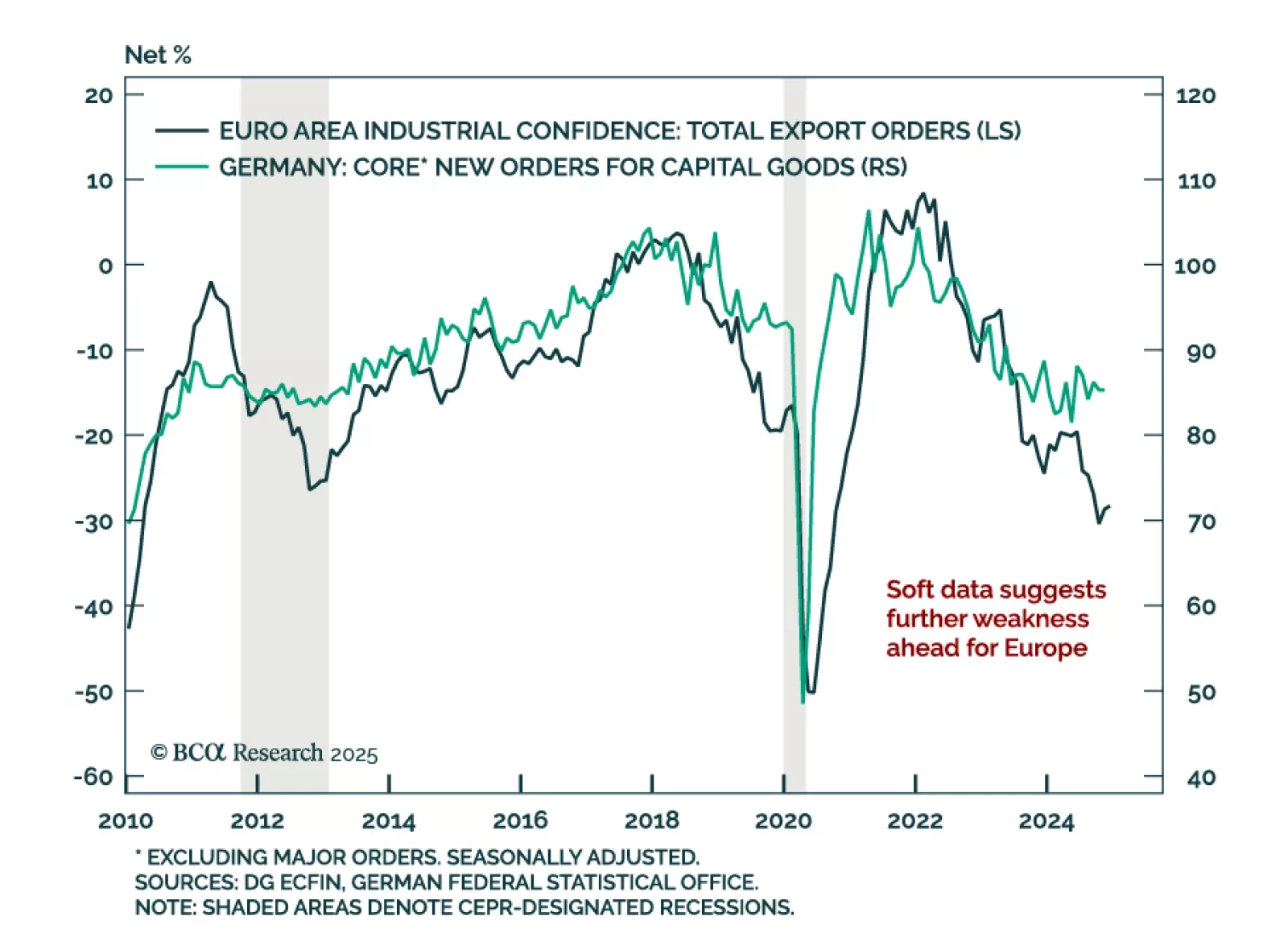

November factory orders in Germany widely missed estimates, falling by 5.4% m/m, worsening the 1.5% October decline. Excluding major orders, which often distort the overall picture, core new orders fell 1.7% y/y after growing 5.7% in…

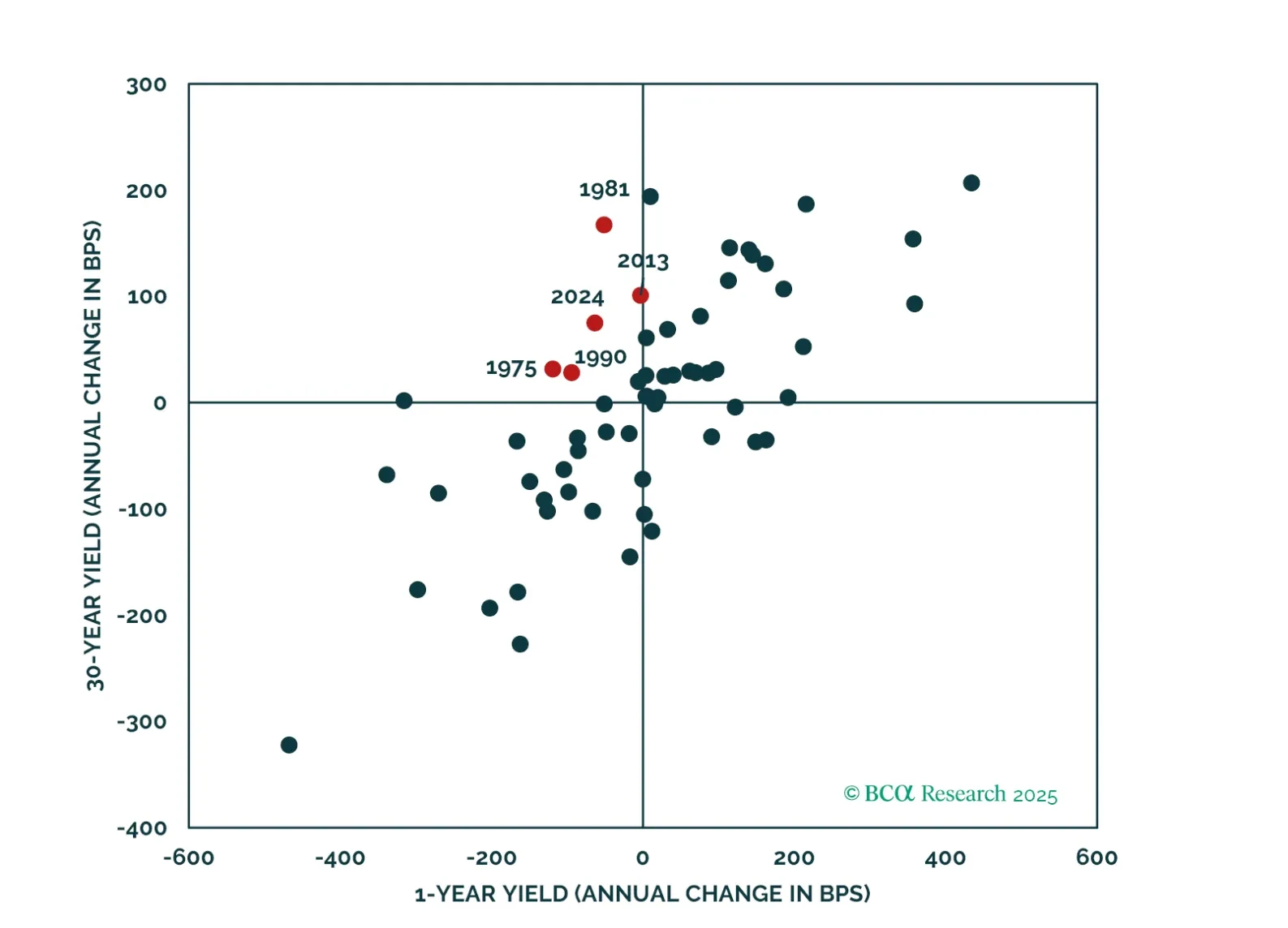

Our GeoMacro strategists published their Alpha Report, outlining their view that President Trump will have to pare back his fiscal ambitions to avoid a bond market riot. The long end of the US bond market continues to sell off,…

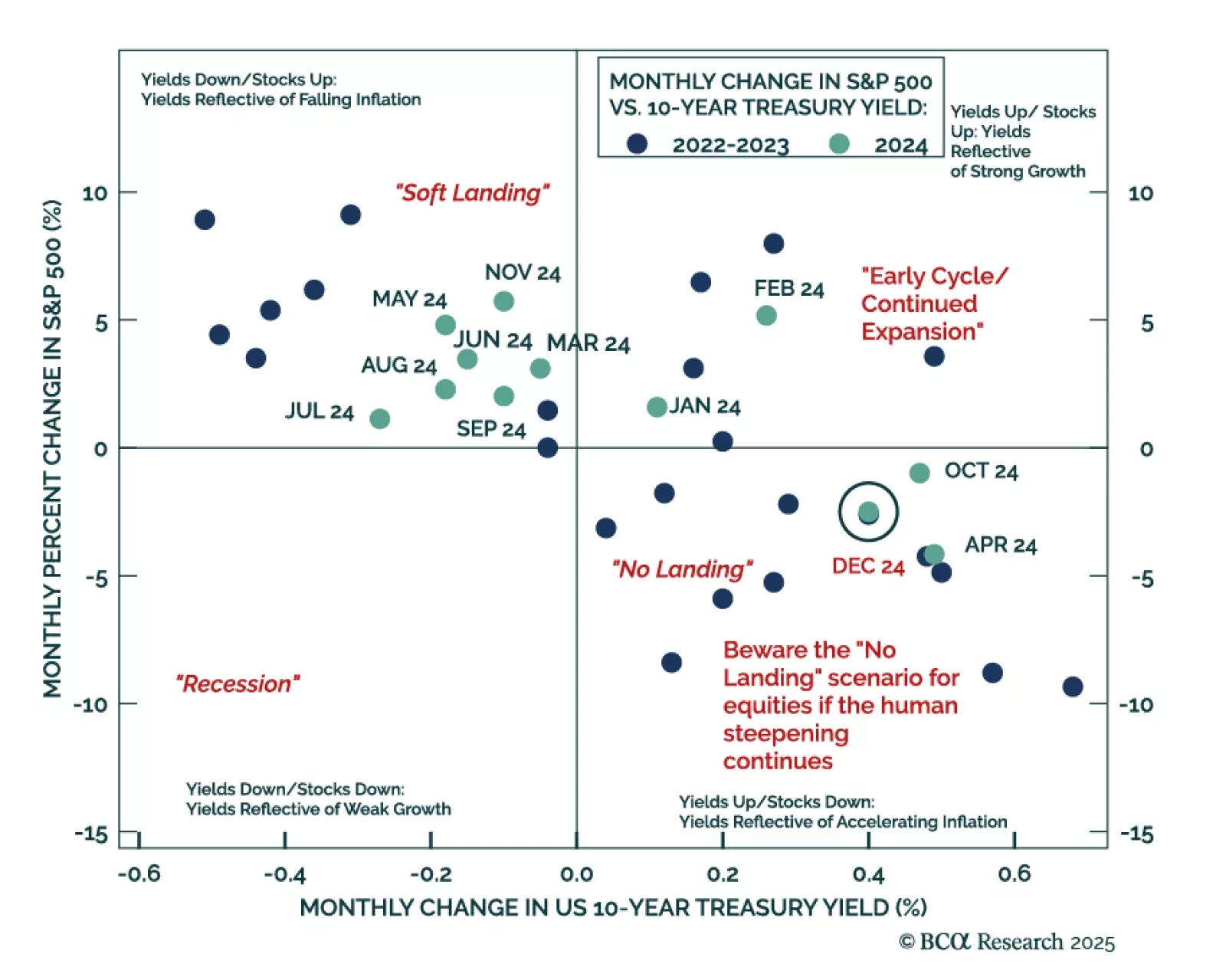

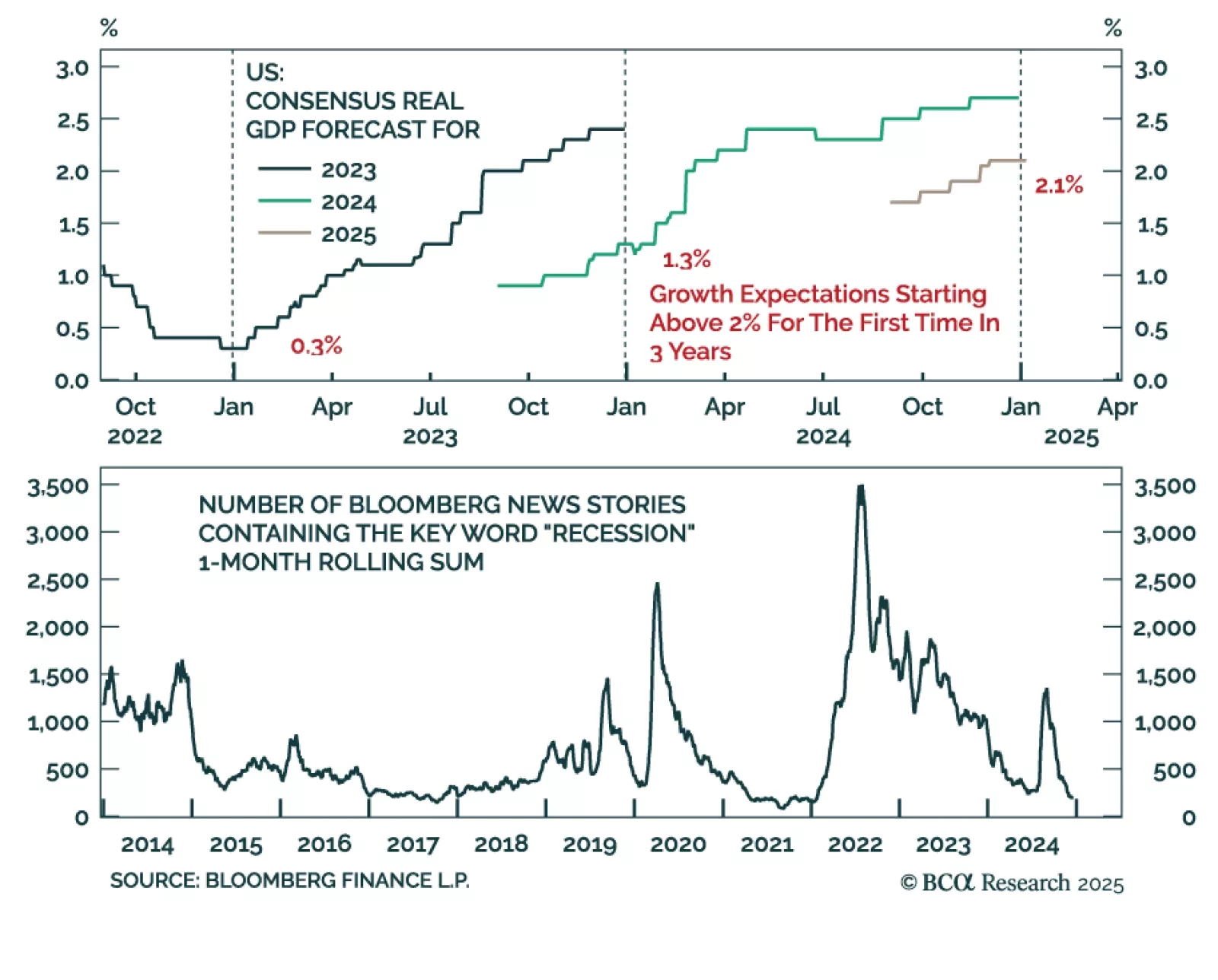

Our Global Asset Allocation strategists published their monthly tactical asset allocation report, where they illustrate booming expectations in the US will be self-limiting. For the first time since 2022, US GDP growth is…

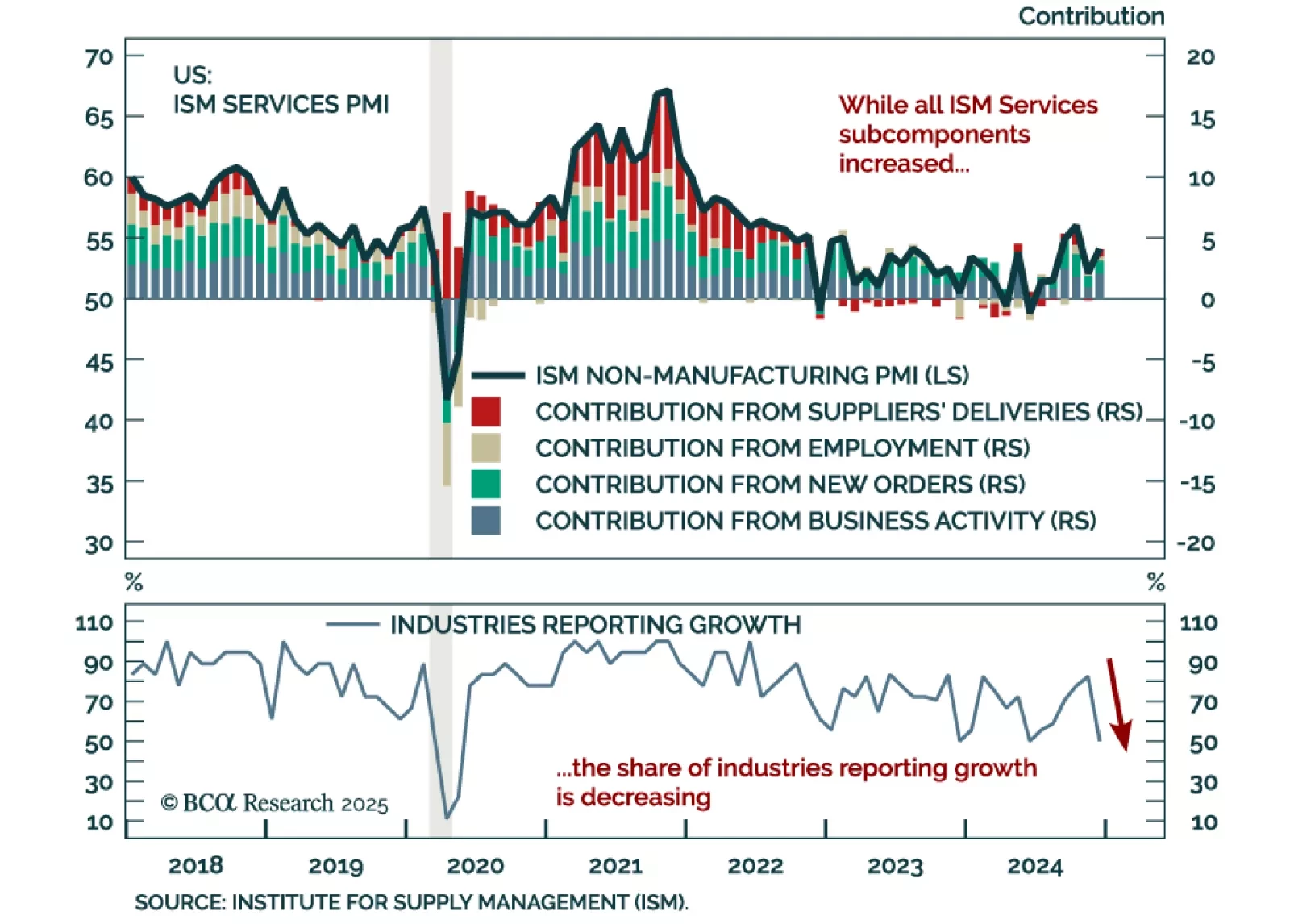

The December ISM Services PMI beat estimates, increasing to 54.1 from 52.1 in November. All subcomponents increased except for employment, which nonetheless remains in expansion. The prices paid component was especially strong,…

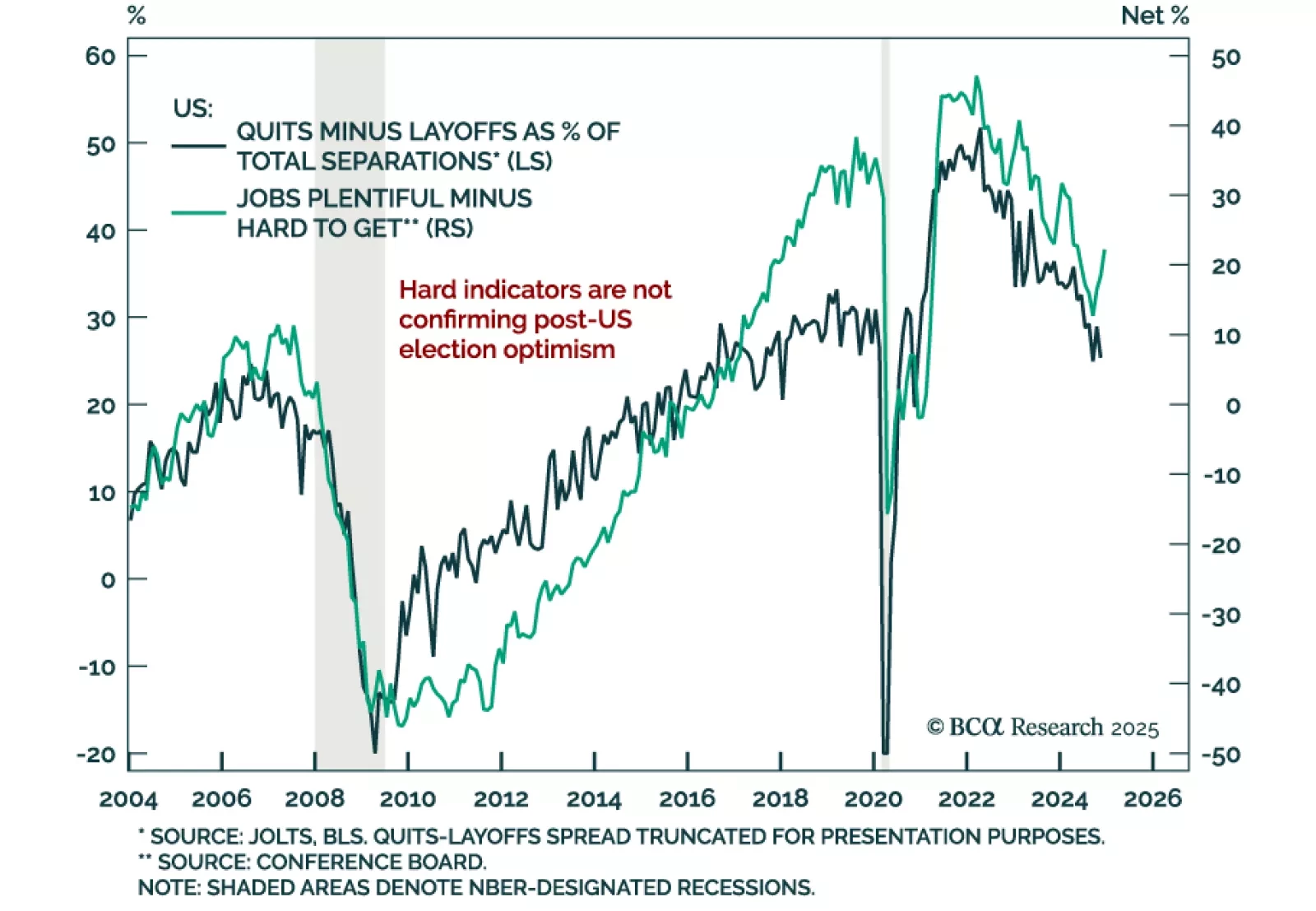

Job openings once again beat expectations in November, increasing to 8.1m from 7.8m in October. However, hires and quits decreased and layoffs increased. The gap between quits and layoffs, a leading indicator of labor market demand,…

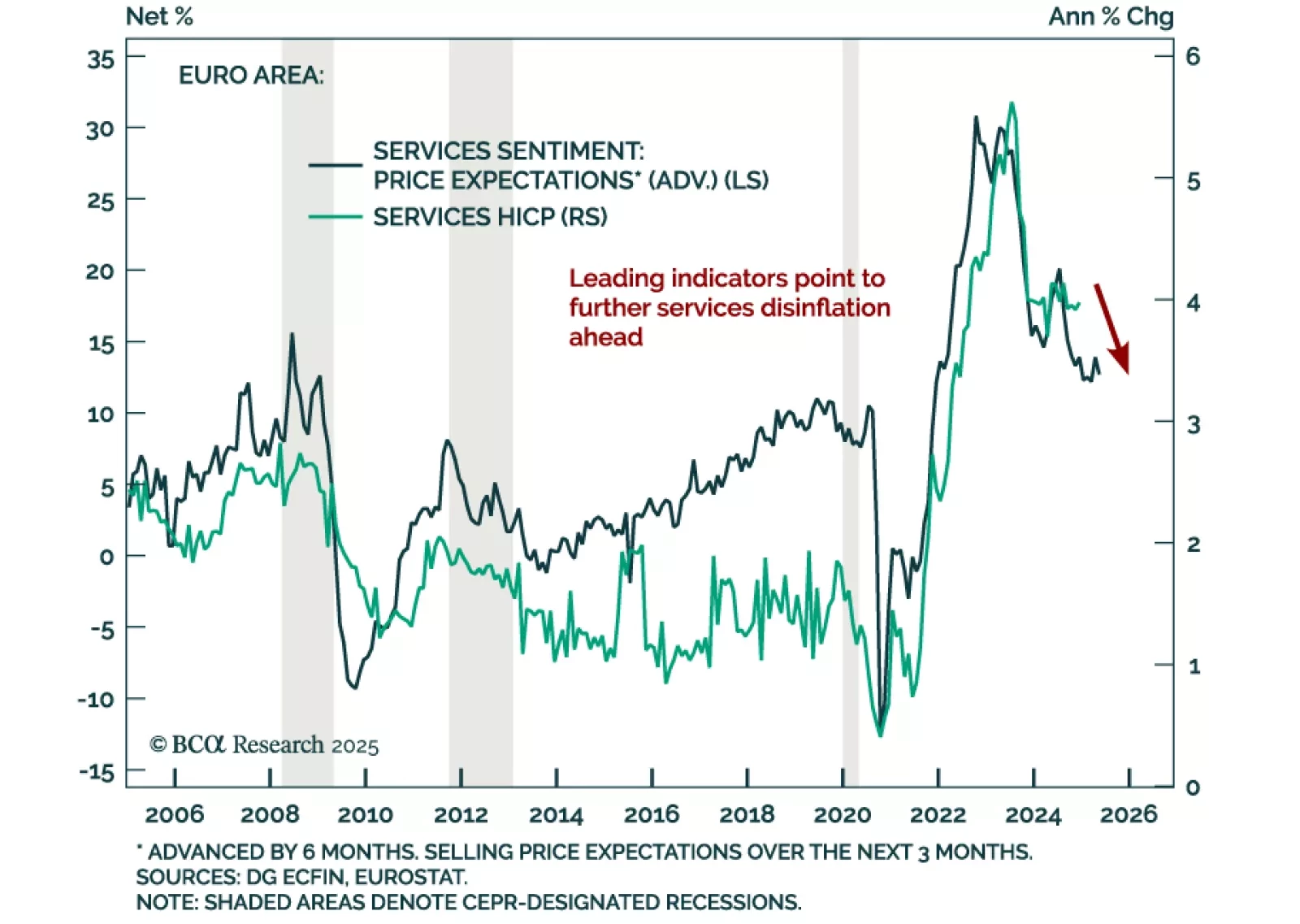

December euro area inflation met expectations, with headline HICP printing at 2.4% y/y from 2.2% in November, and core steady at 2.7%, above the ECB’s target. Services inflation remains elevated at 4.0% y/y, up from 3.9% a month…

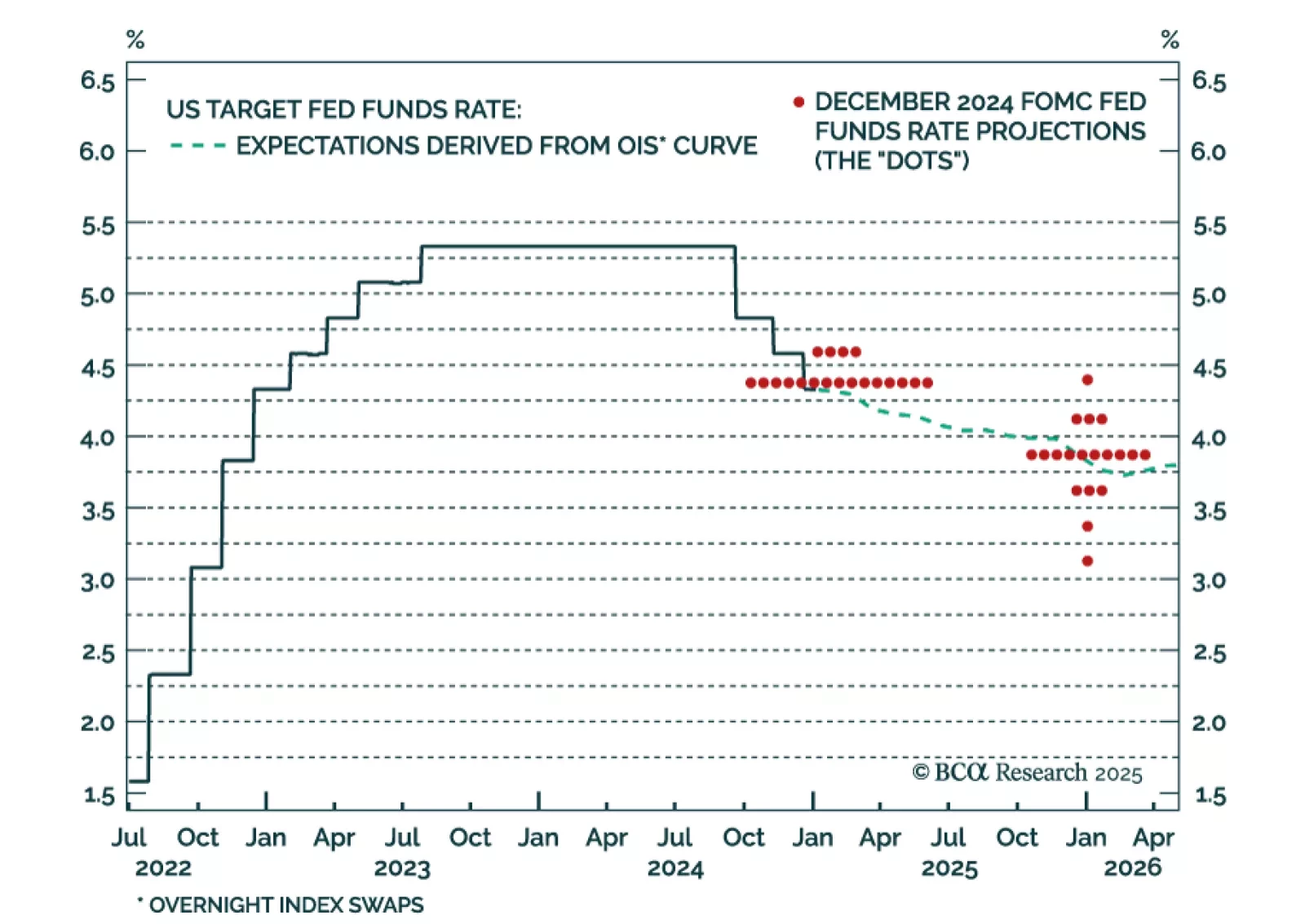

Our US Bond Strategy team published their outlook for the Fed in 2025. They expect more cuts than the 50 bps signaled by the Fed at its December meeting. Core PCE inflation is tracking well below the Fed’s 2.5% forecast, while…

Economic data released over the holiday period extended recent trends, reflecting a softening global economy with resilient US growth, and an ailing manufacturing sector. The December global manufacturing PMI declined to 49.6…

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…