Please join us for a BCA Expert Webcast, Thursday, January 16 at 10:00 AM EDT, with Brendan Kelly, former Director for China Economics on the US National Security Council, veteran of the New York Federal Reserve, Treasury Department…

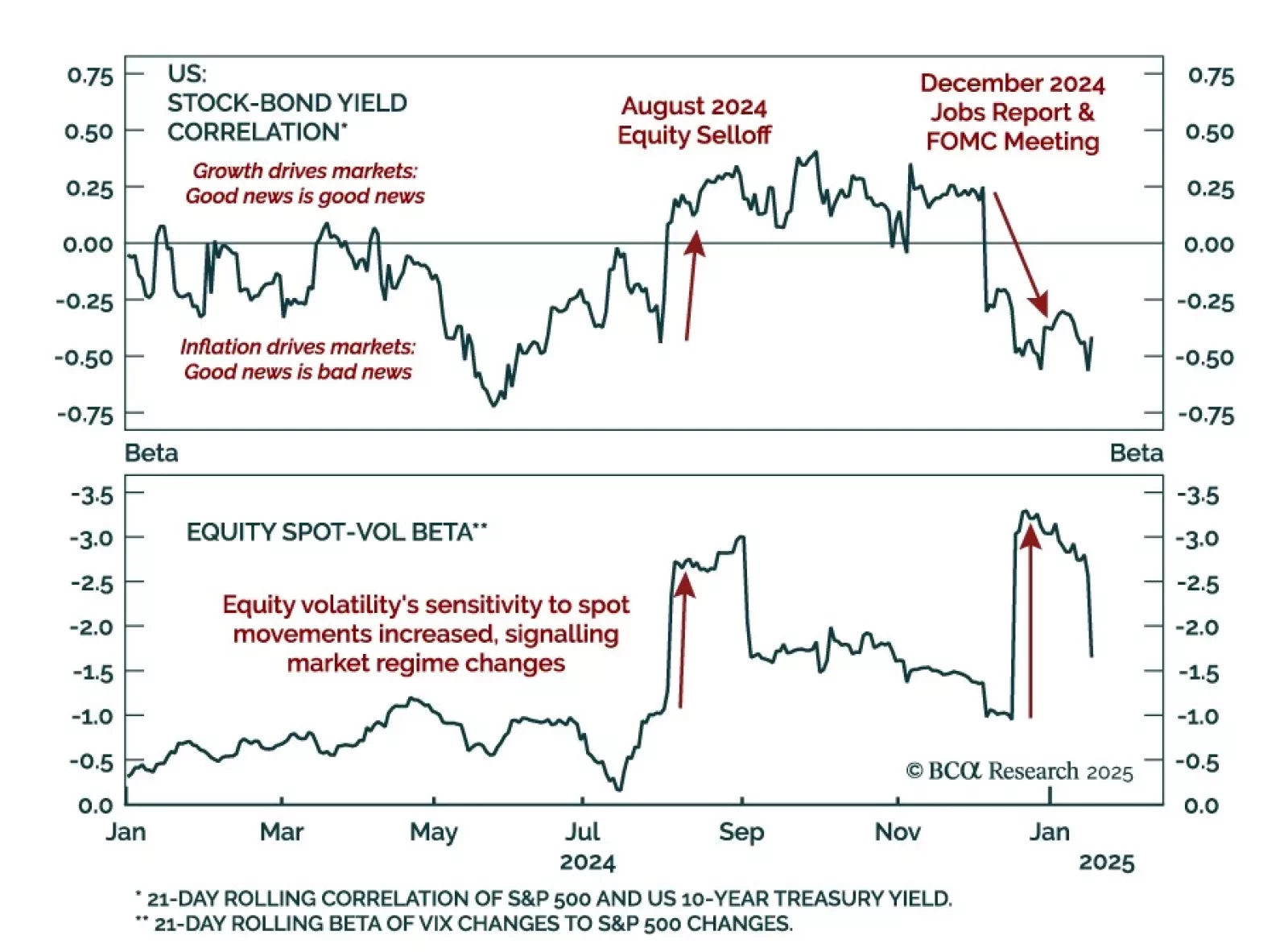

Two main market events defined 2024, highlighting how assets will react to economic data on the tactical horizon. The August 2024 selloff marked a positive shift in the stock-bond yield correlation, as higher odds of a “hard landing…

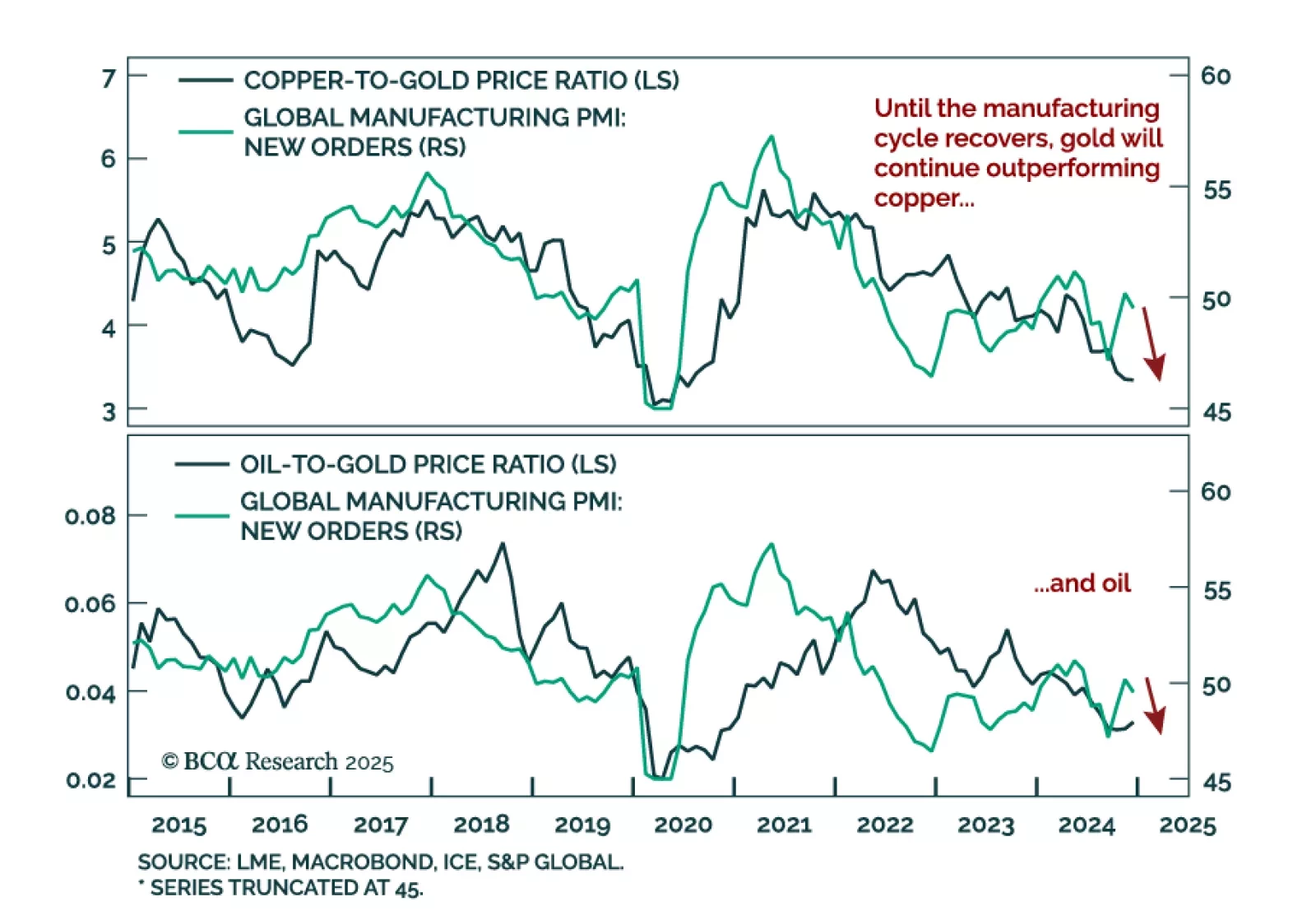

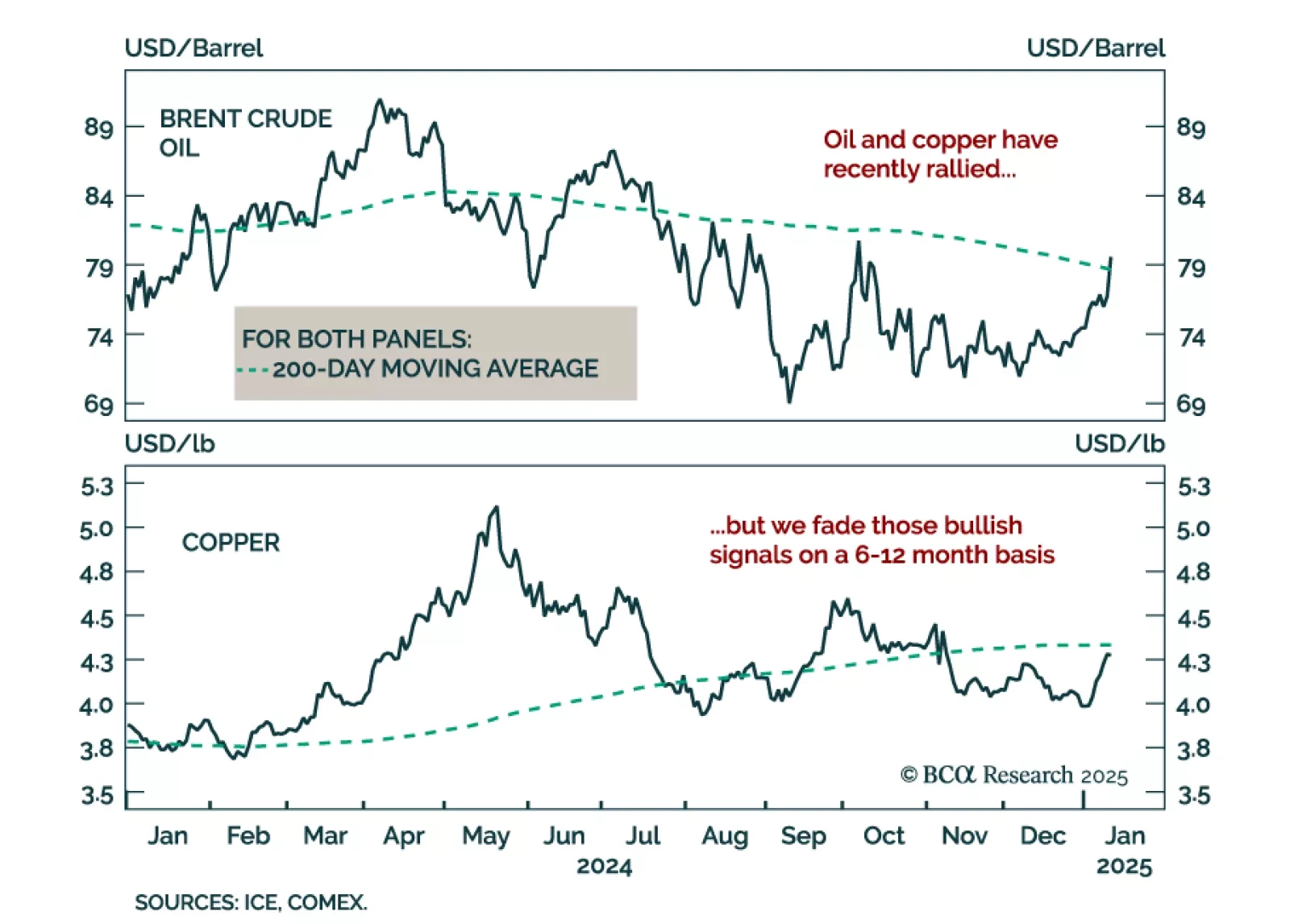

Our Commodities & Energy strategists published a special report outlining three themes they see in the space for 2025. The themes are the following: Sluggish global demand and weak industrial activity will likely weigh…

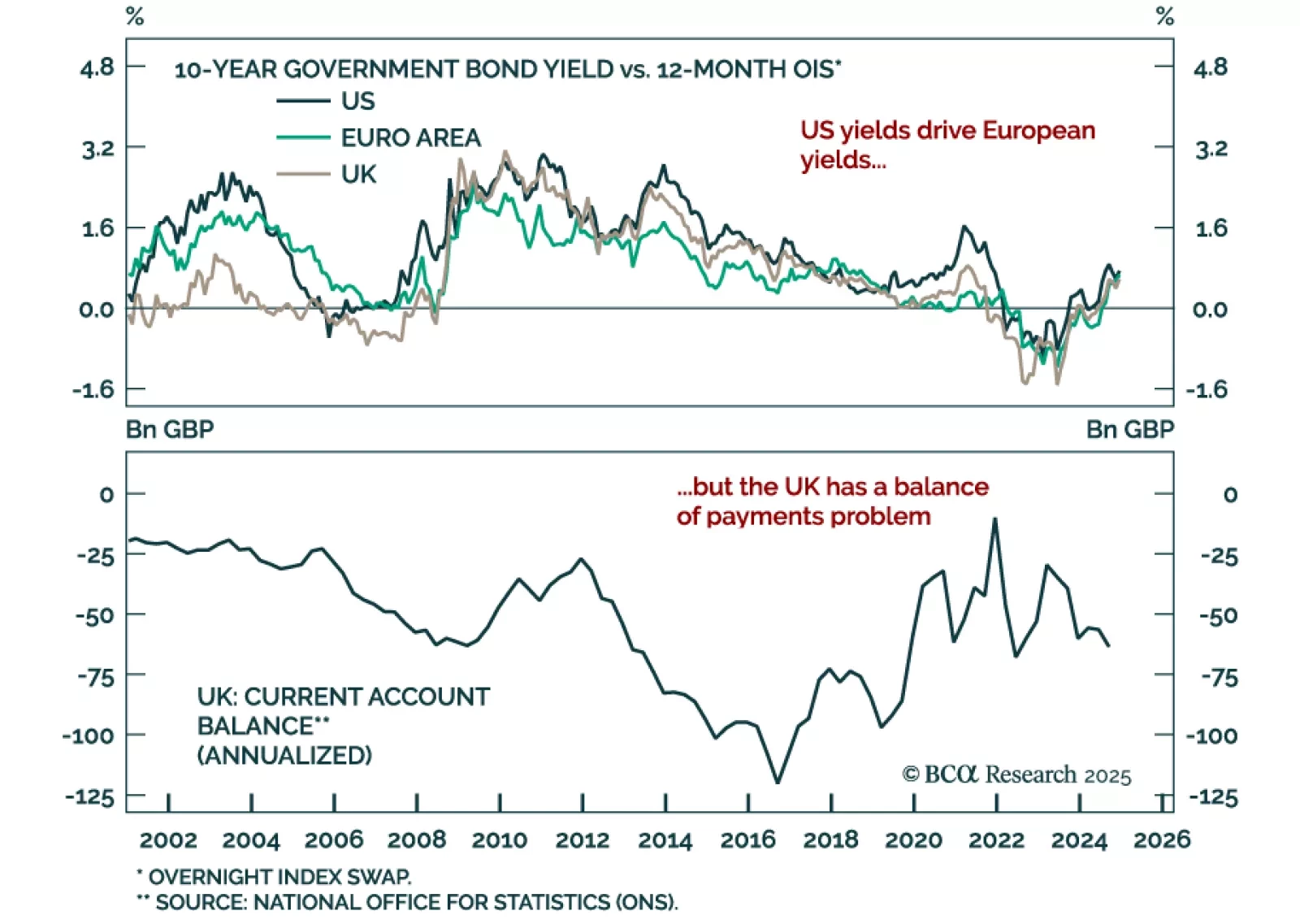

UK inflation surprised to the downside in December. Headline inflation retreated below estimates to 2.5% y/y from an eight-month high of 2.6% in November. Core inflation also decreased below estimates, printing 3.2% vs. 3.5% in…

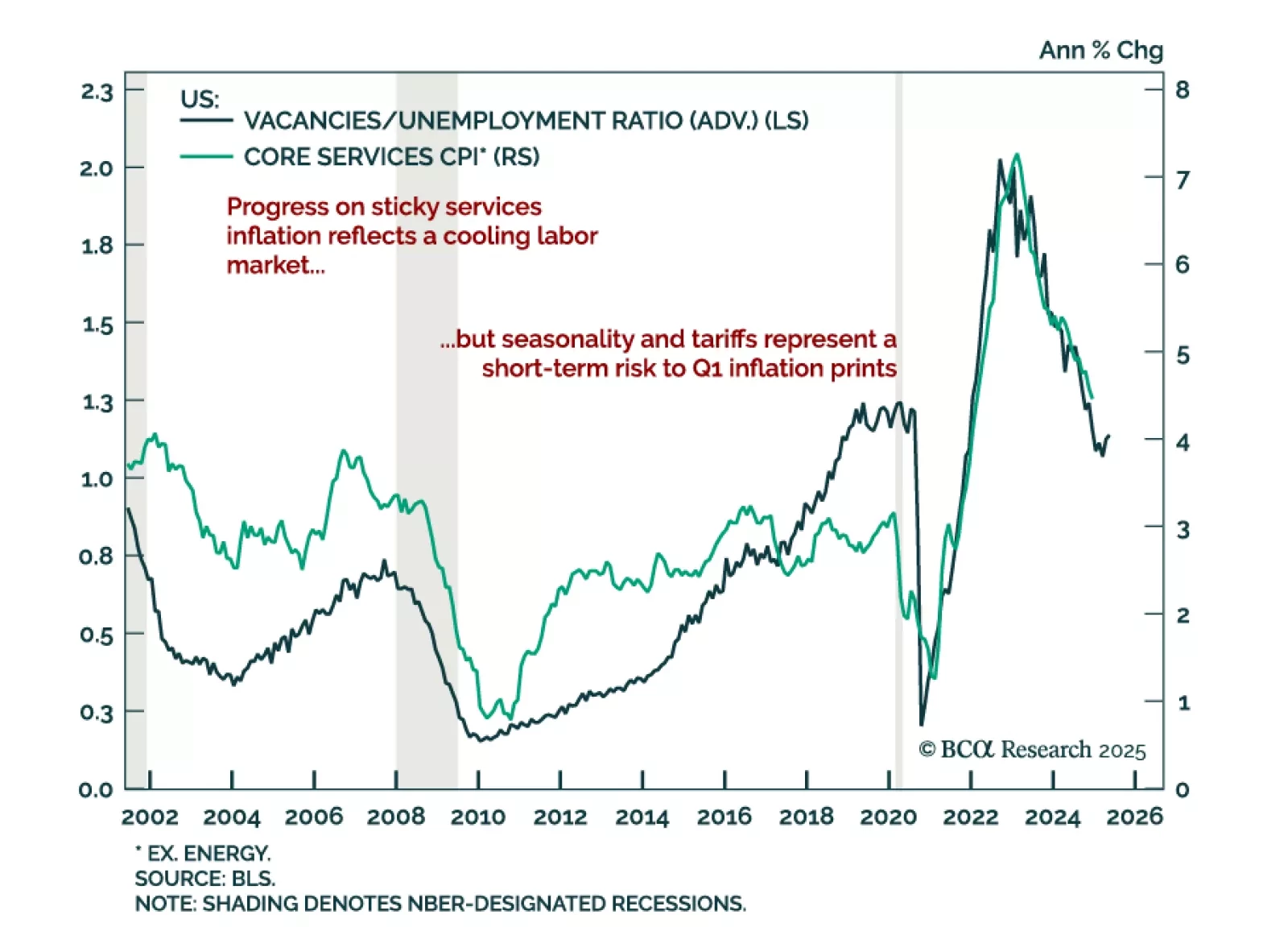

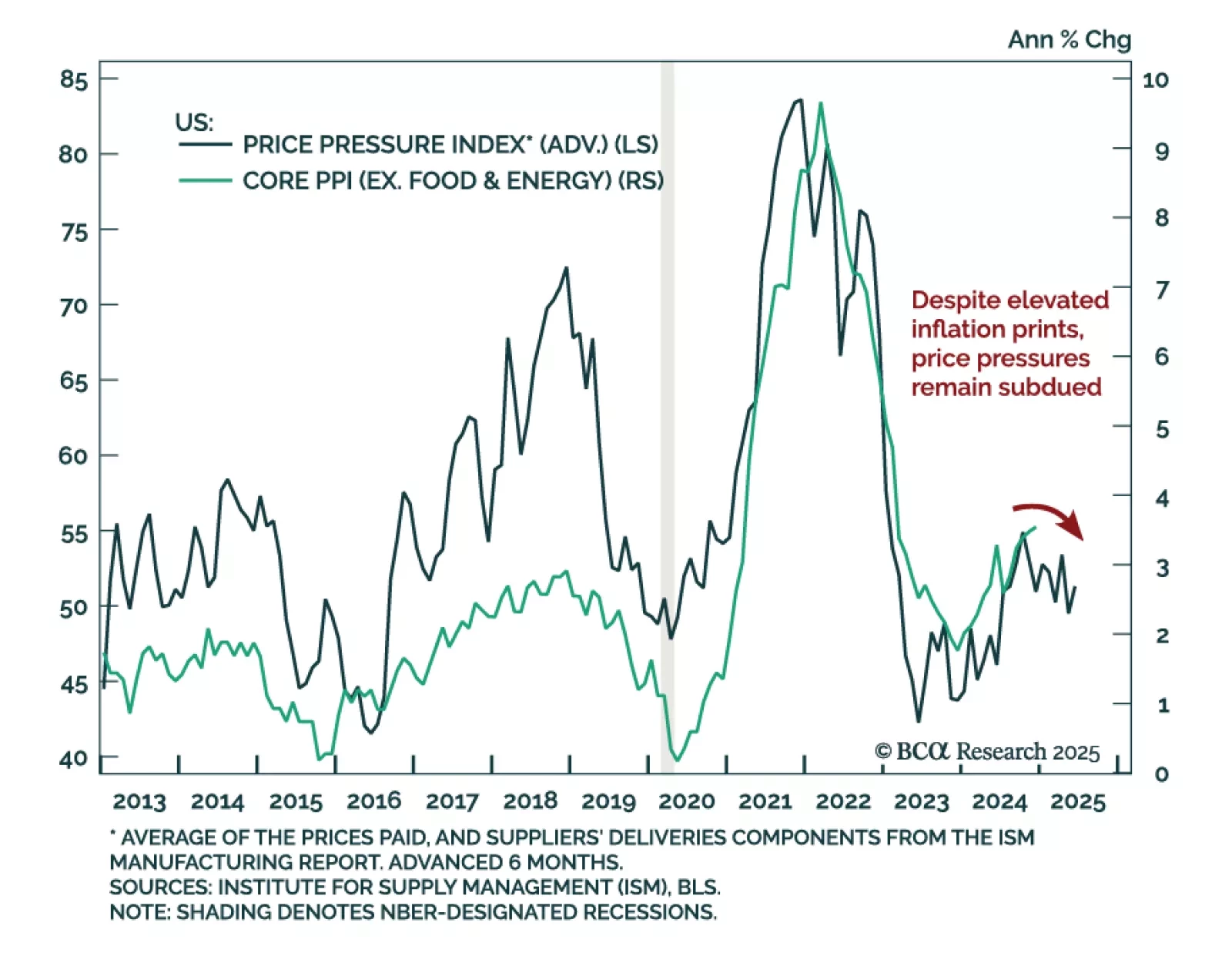

The December US CPI came in better than expected. While headline CPI met estimates of 0.4% m/m (2.9% y/y), core surprised to the downside at 0.2% m/m, decelerating to 3.2% y/y from 3.3%. Moderation in core annual inflation was driven…

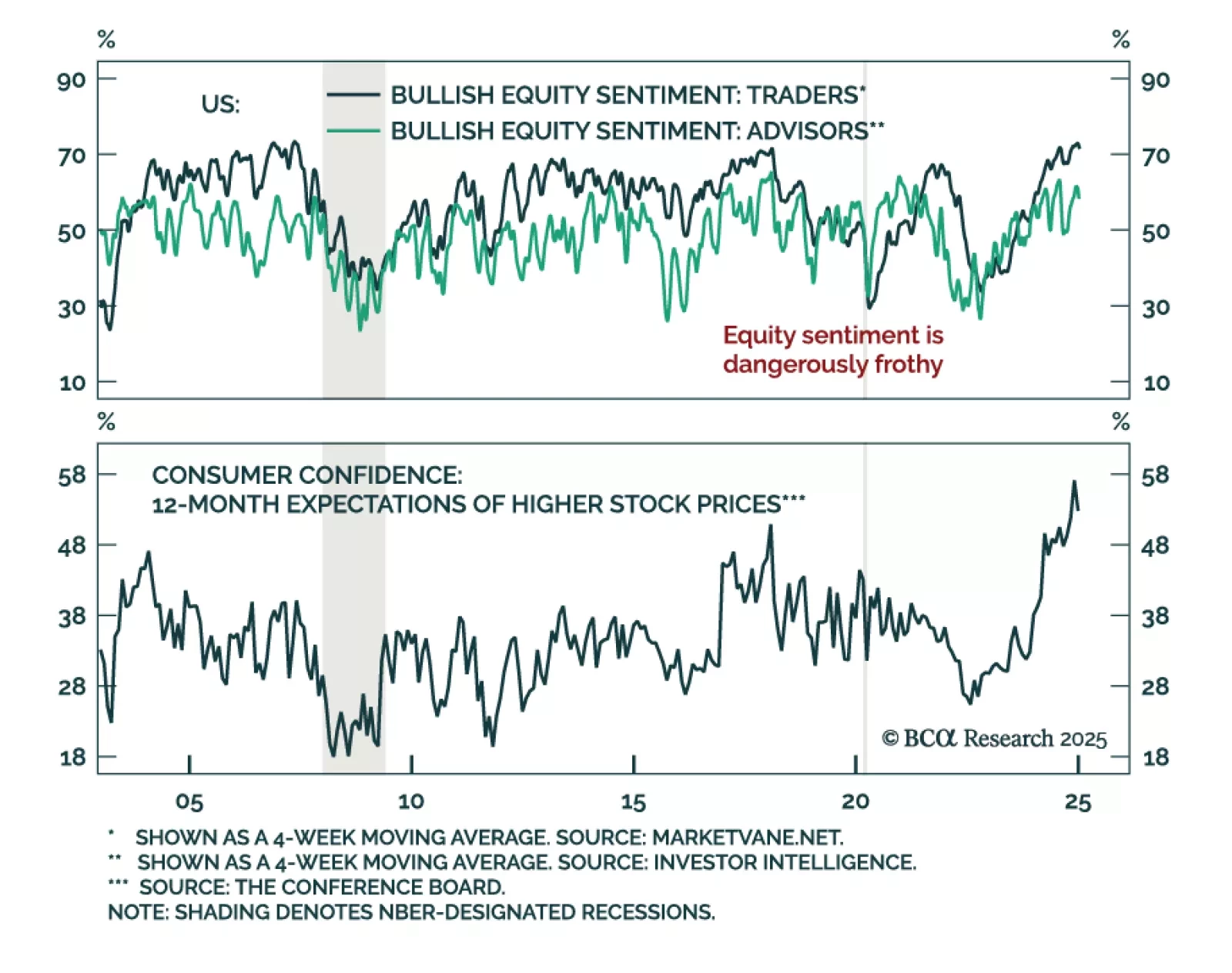

Our Global Investment Strategy (GIS) team believes the US economy is not as strong as commonly believed, and that equity valuations offer little buffer given the risk of incoming macro shocks. The US economy is more fragile than…

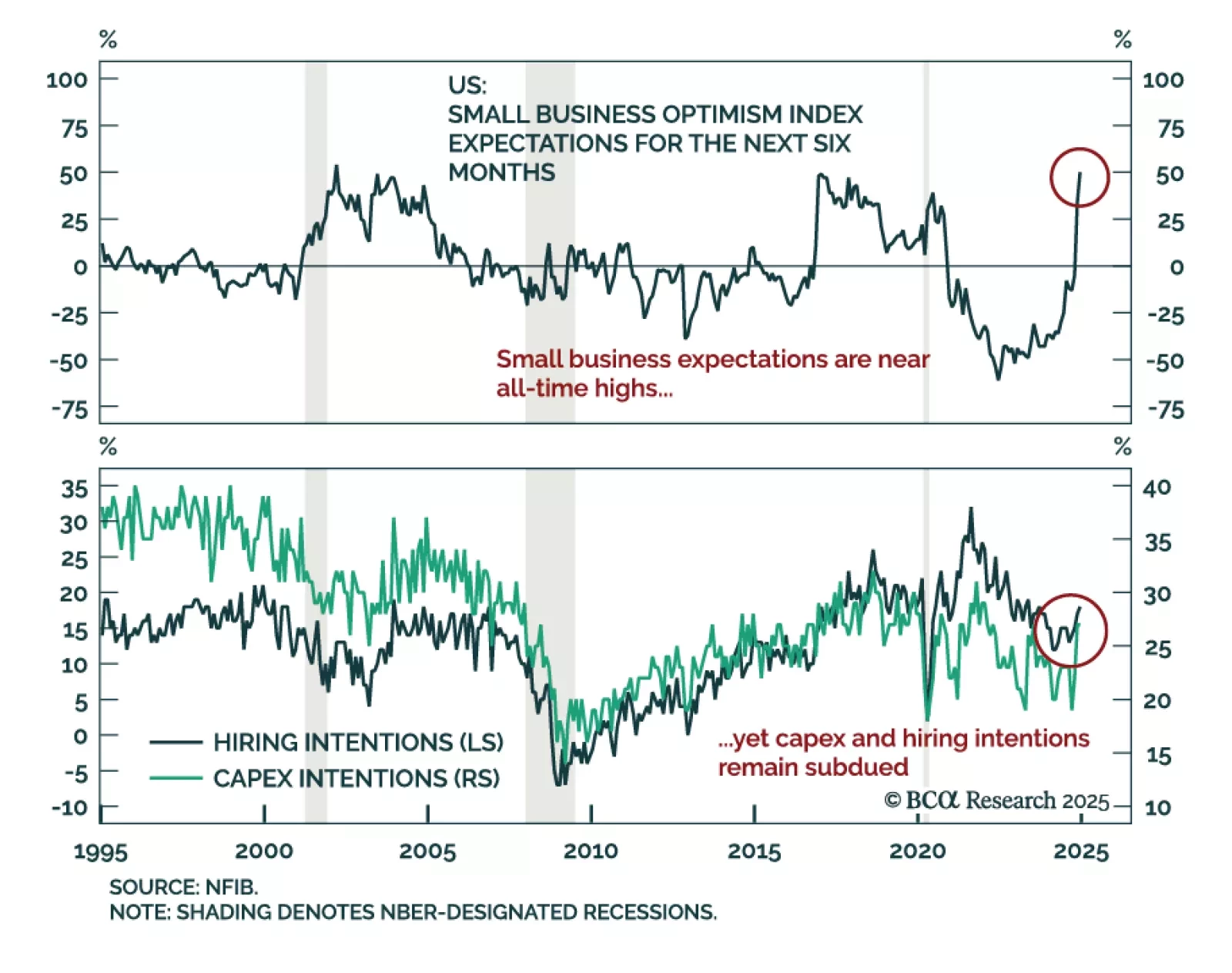

The December NFIB Small Business Optimism Index beat expectations, jumping to 105.1 from 101.7 in November. Most index subcomponents increased, led by measure of expectations, notably for the state of the economy and real sales.…

The December US Producer Price Index came in cooler than expected, increasing 0.2% m/m, a deceleration from 0.4% in November. Core PPI, excluding food and energy, was flat after increasing 0.2% a month prior. Inflation is…

Our European Investment strategists looked at the developed markets bond selloff from a European perspective, focusing on Euro area and UK government bonds and currencies. The recent selloff in European bonds is driven primarily…

Despite a strong dollar, rising yields, and falling equities, oil and copper prices have recently risen. Oil has broken out above its 200-day moving average, while copper is currently testing its own. Oil’s bullish price…