Our Portfolio Allocation Summary for January 2025.

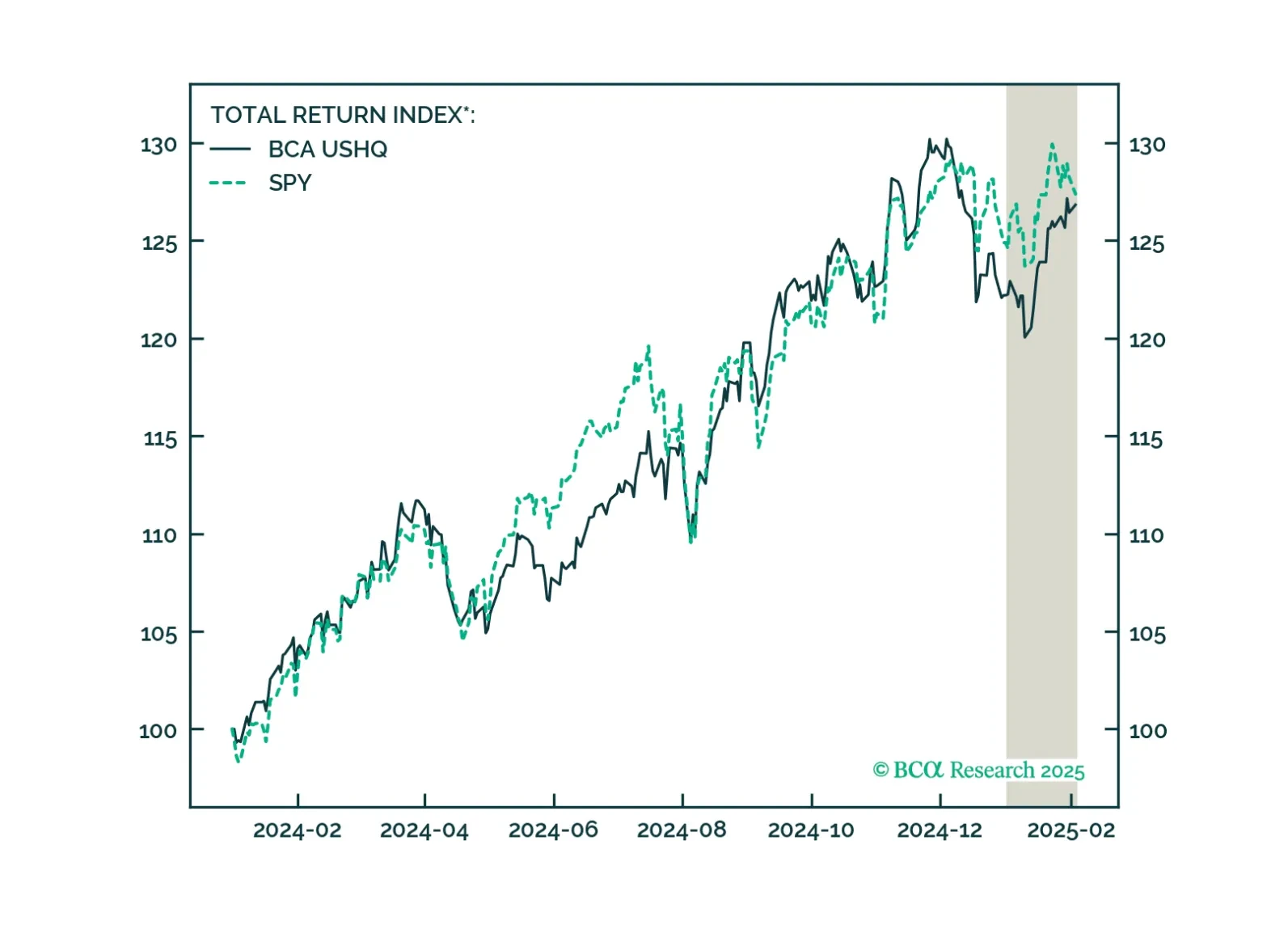

The US High-Quality (USHQ) portfolio slightly outperformed in January, returning 3.4%, whilst its SPY benchmark returned 2.9%. That said, we think the USHQ portfolio will have a solid run through the first half of 2025, benefitting…

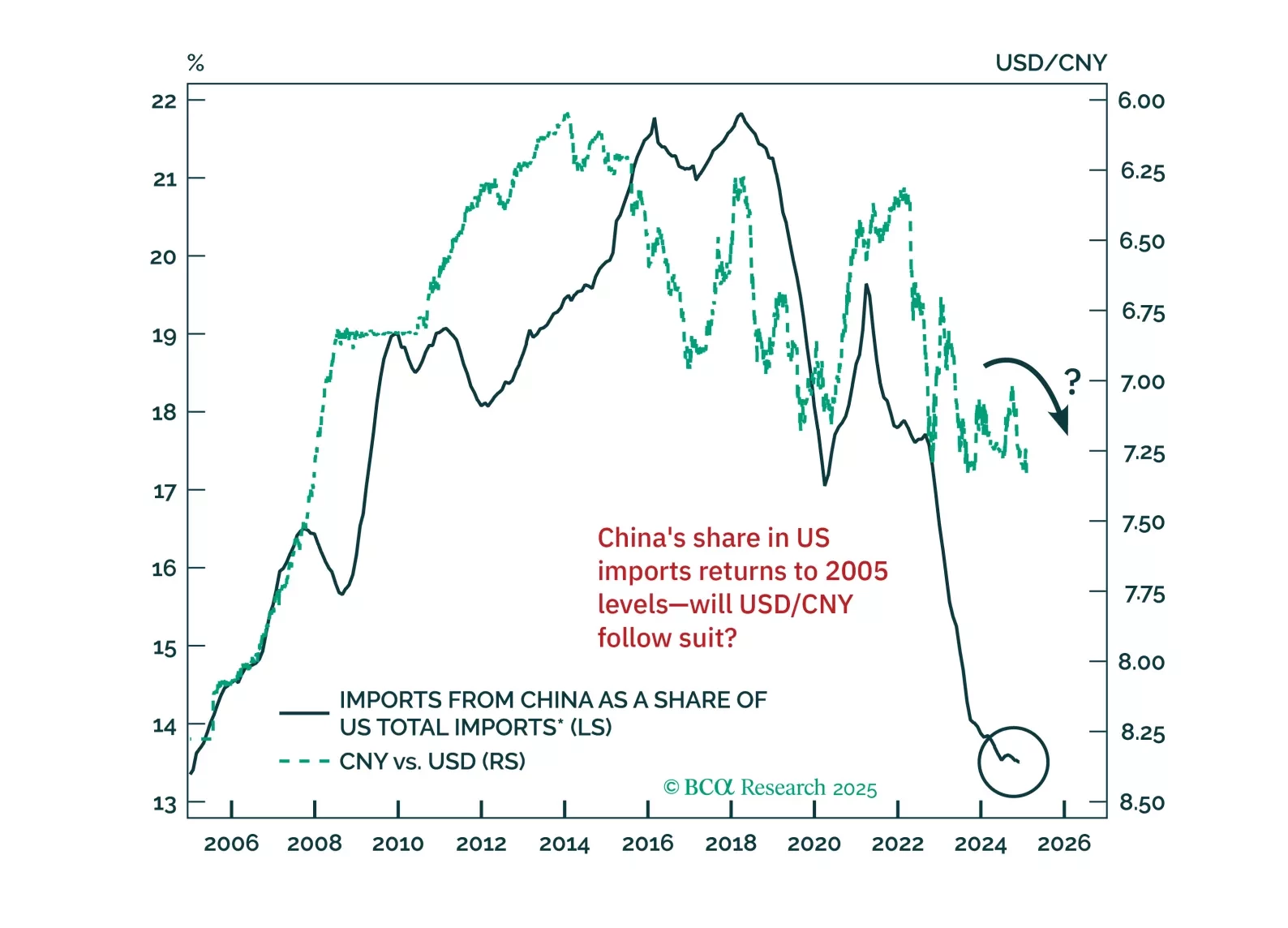

The 10% tariff hike announced on Saturday will likely serve as the opening salvo in a broader wave of protectionist measures. In this report, we assess the increase in US import tariffs on China. While the direct impact on China’s…

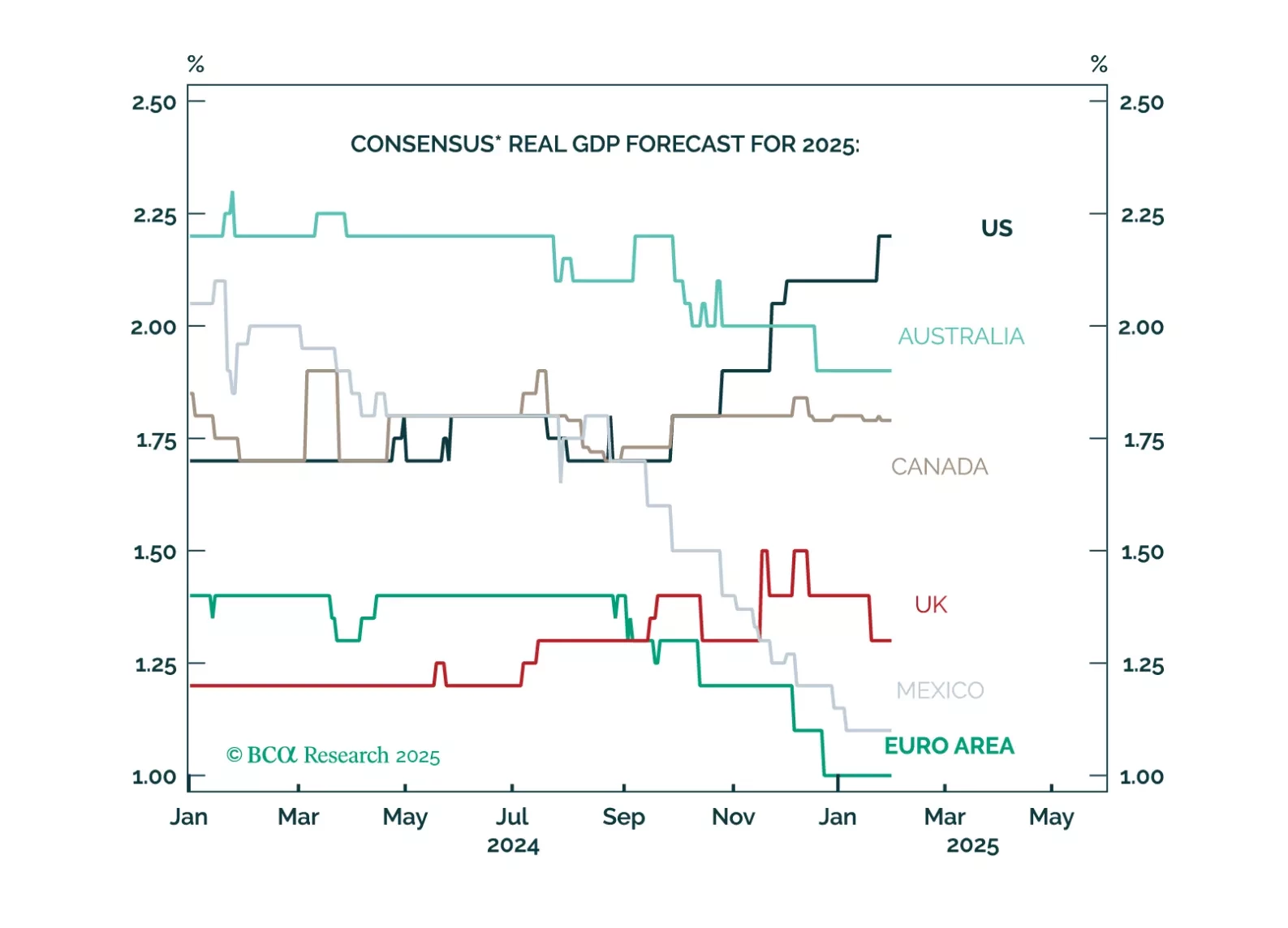

Markets and forecasters anticipate a “Golden Age” for Trump’s America, with US growth expectations soaring while the rest of the world lags. However, this extreme optimism means that there is a lot of room for disappointment. Cooling…

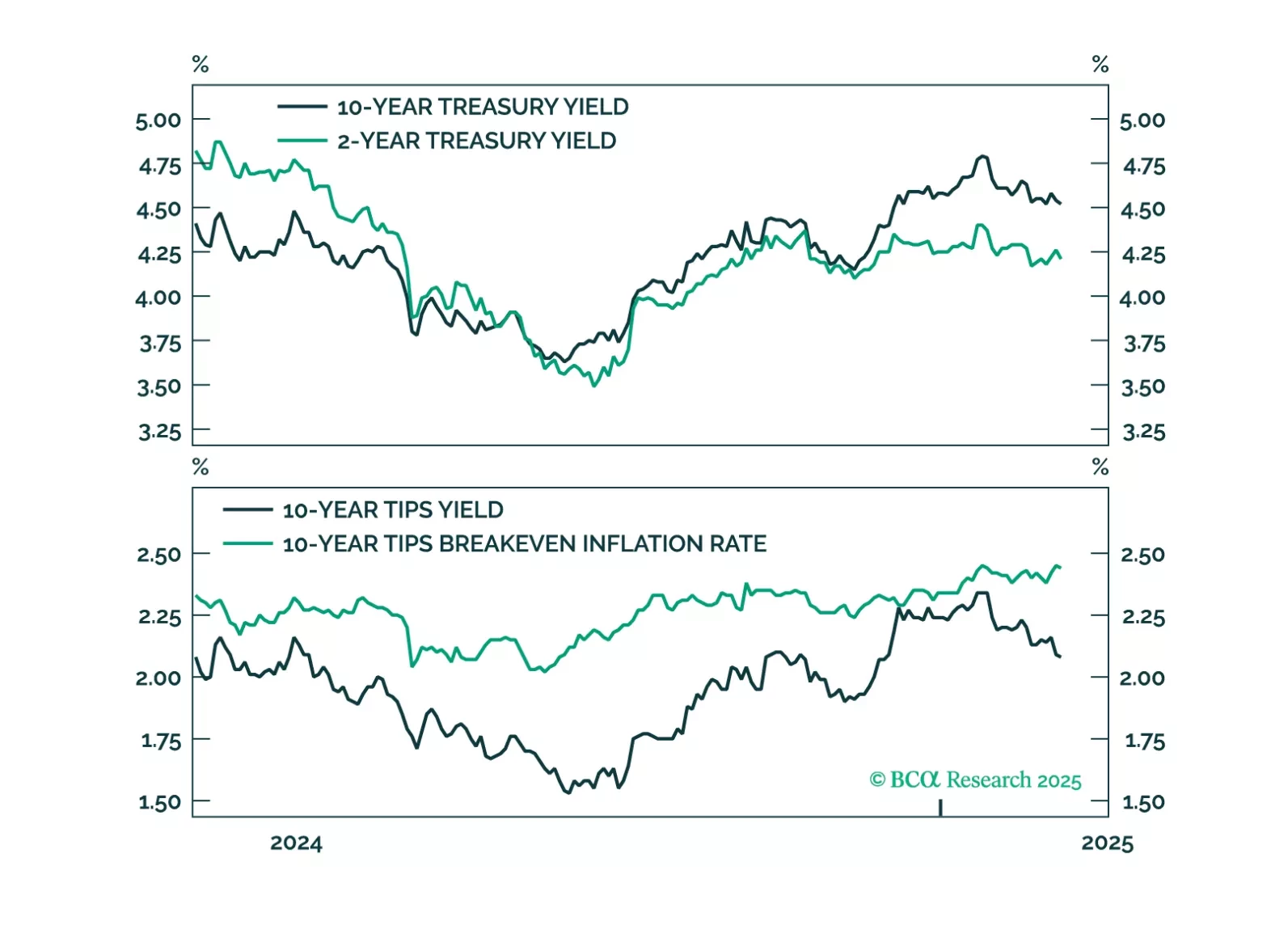

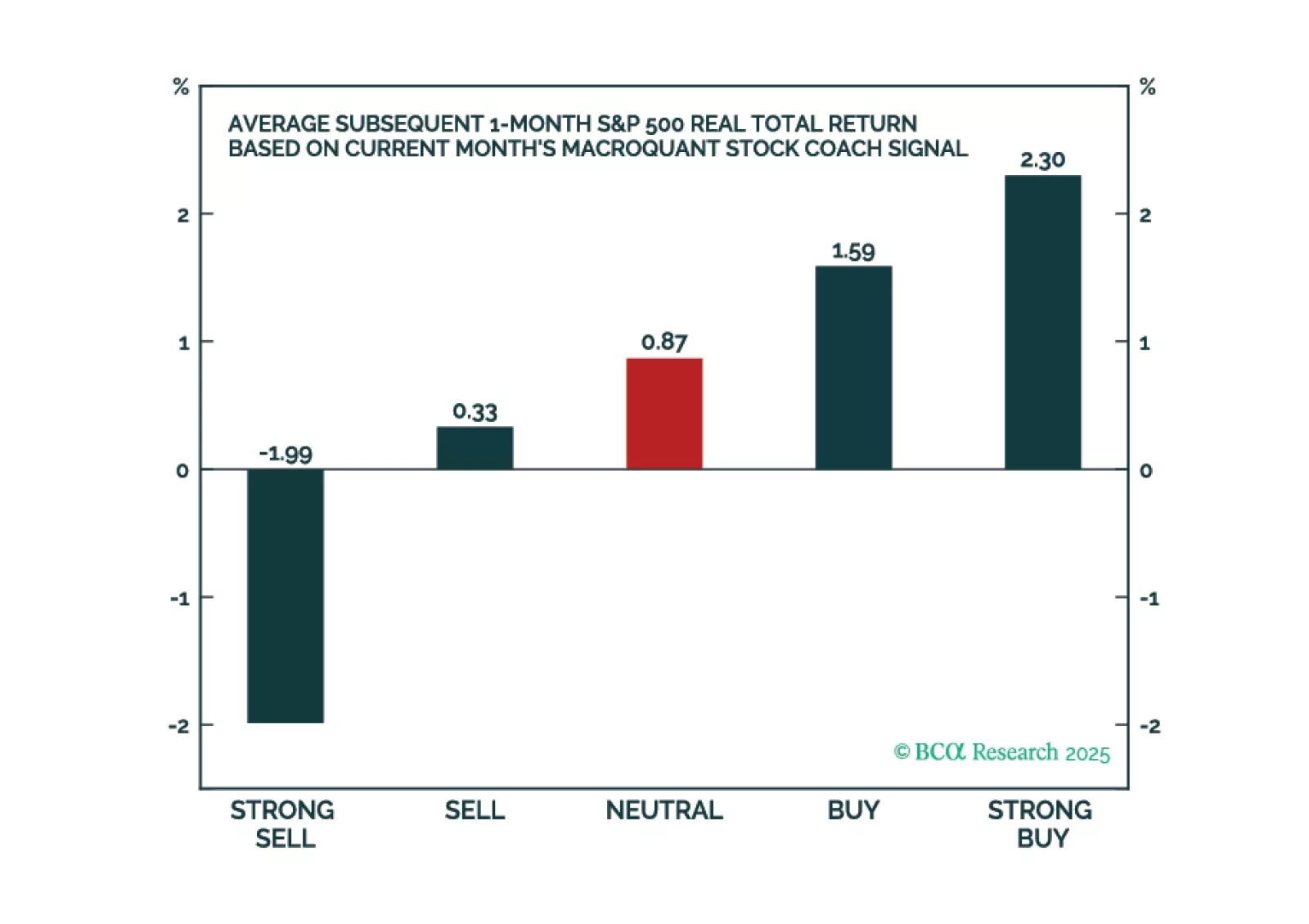

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

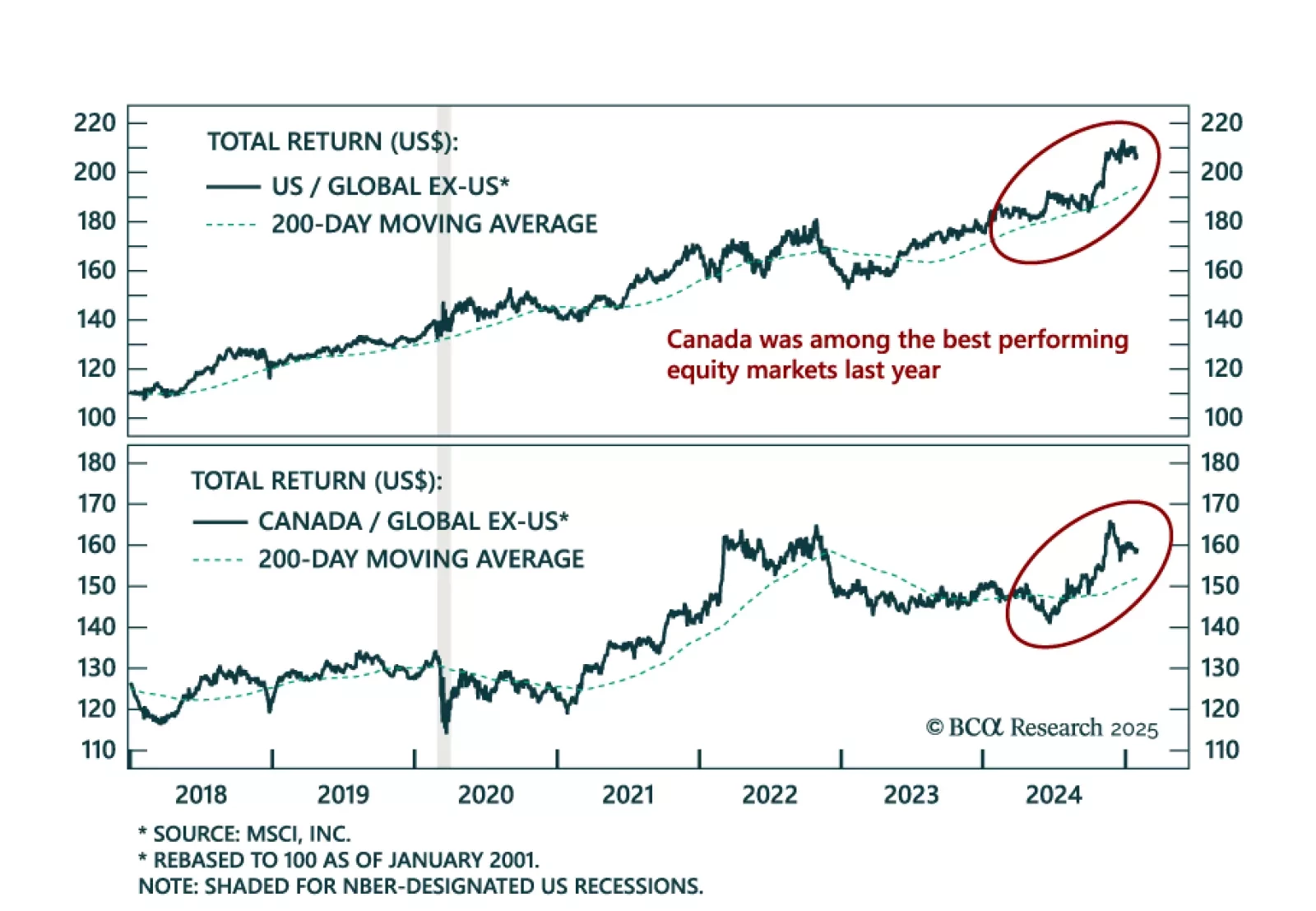

Our colleagues from The Bank Credit Analyst revisited the outlook for Canadian stocks after they outperformed global ex-US stocks in late 2024. The outperformance was driven by financials and tech. While Canadian tech gains were…

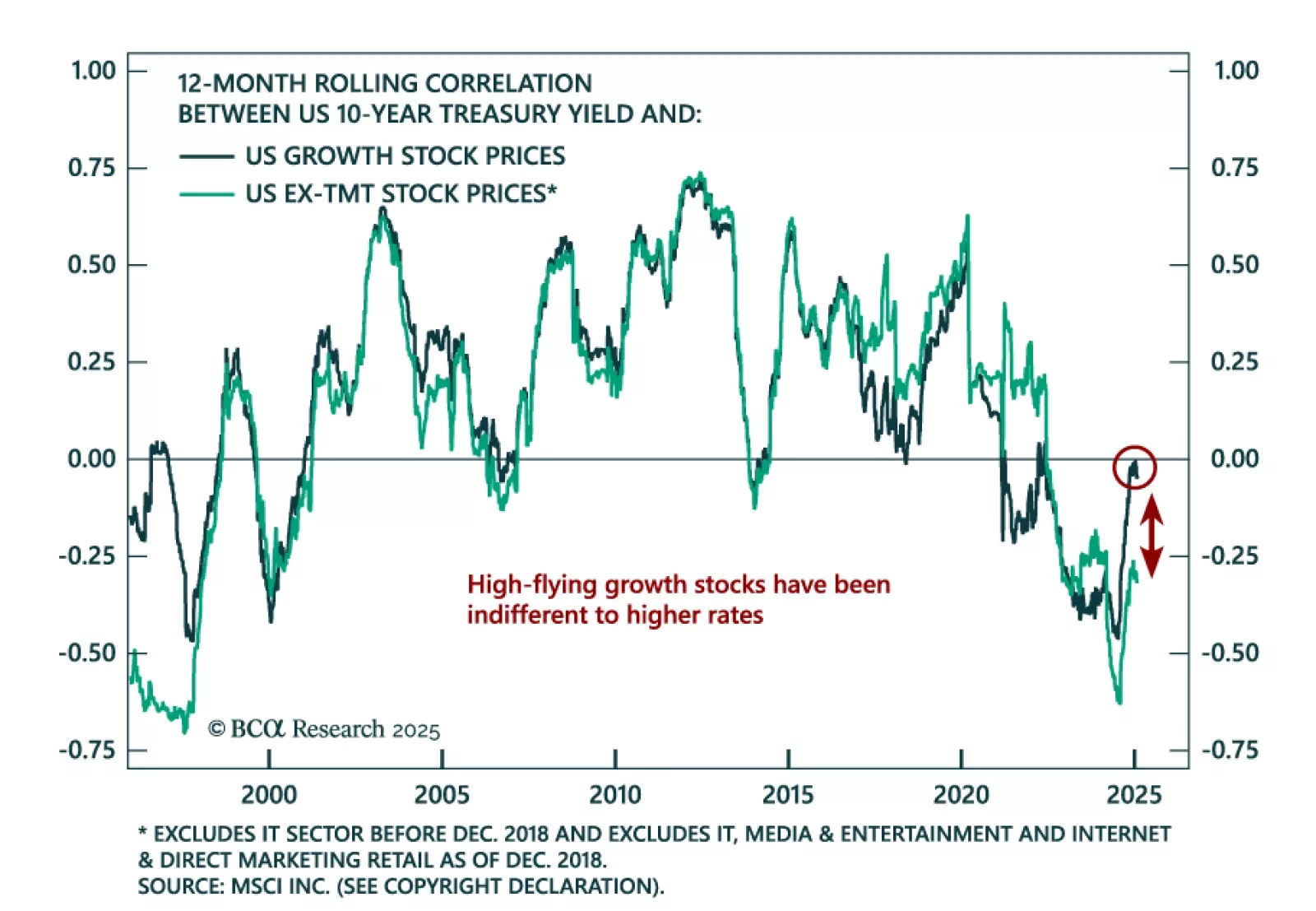

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist of our Emerging Markets and China Investment Strategy services. Arthur highlights an important dichotomy in the US stock-bond yield correlation. In the past 12…

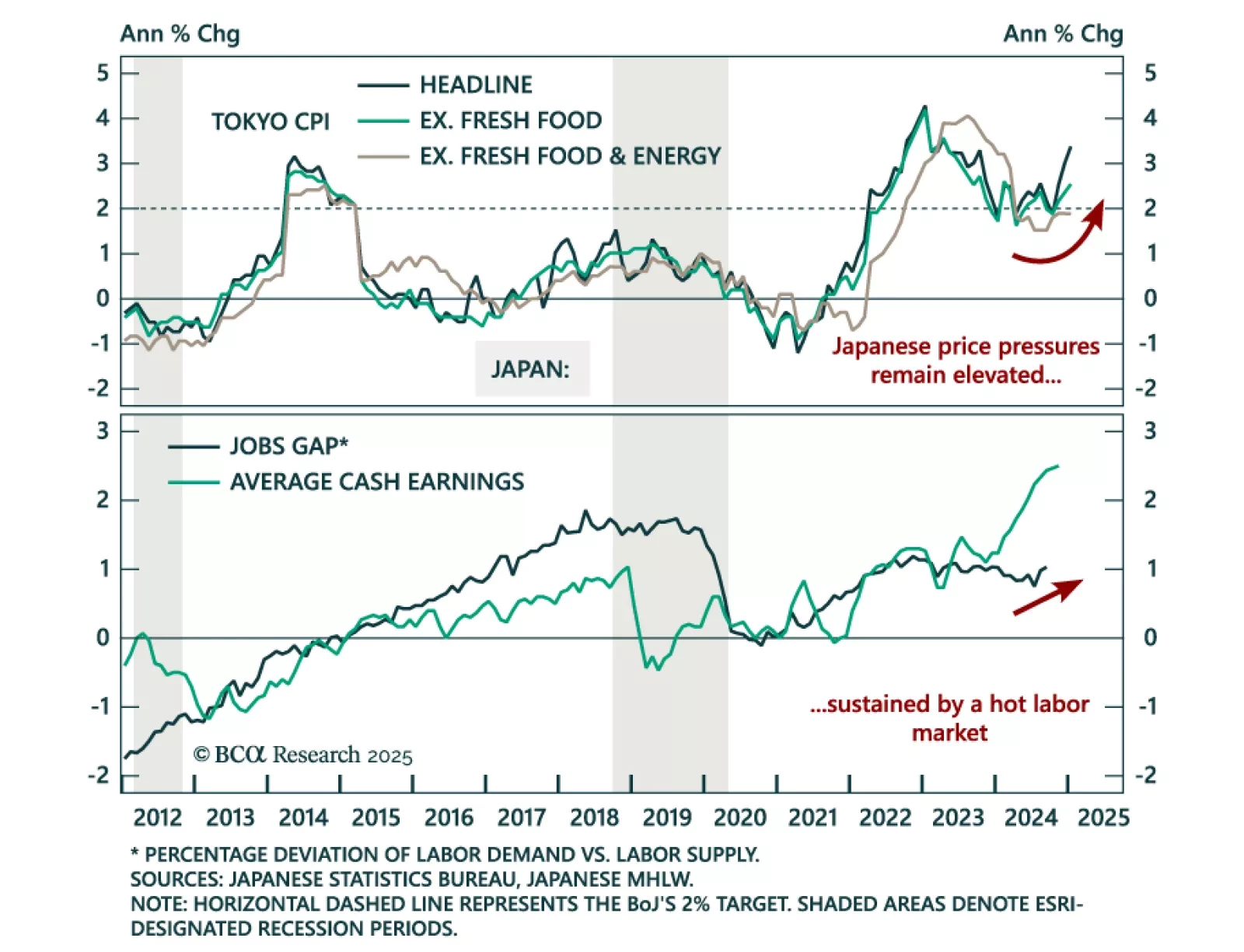

The January Tokyo CPI came in stronger than expected, with headline inflation accelerating to 3.4% y/y from 3.0%, and “core core” (ex. fresh food and energy) accelerating to 1.9% from 1.8%. The jobless rate also decreased 0.1% to 2.4…

December PCE inflation was in line with expectations, with headline inflation at 0.3% m/m (2.6% y/y) and core at 0.2% m/m (2.8% y/y). The Q4 employment cost index also came in line with expectations at 0.9% q/q. Inflation is…